11 Things Busy Entrepreneurs Need to Know

By Rieva Lesonsky

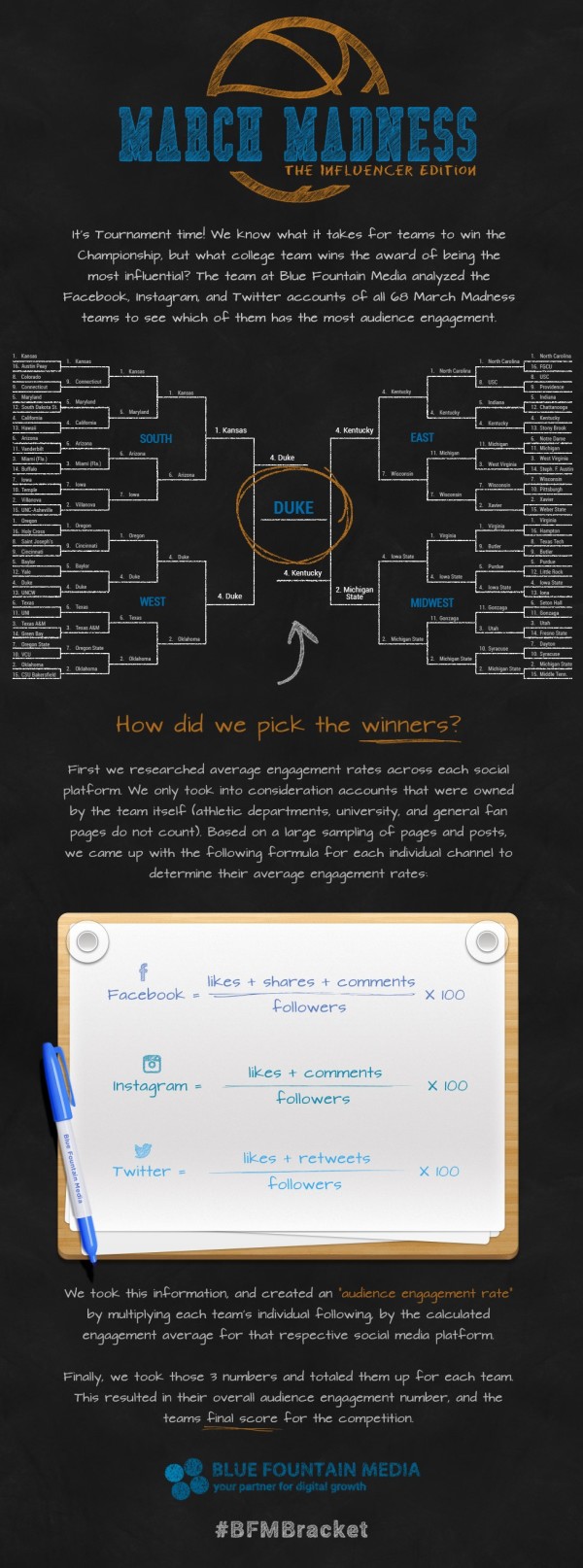

1) March Madness & Social Engagement

The uber-creative folks at Blue Fountain Media descended deeper into March Madness to uncover which college basketball team in the tournament scores best at social media engagement. Considering the state of everyone’s brackets, this might have been a more lucrative criterion to bet on.

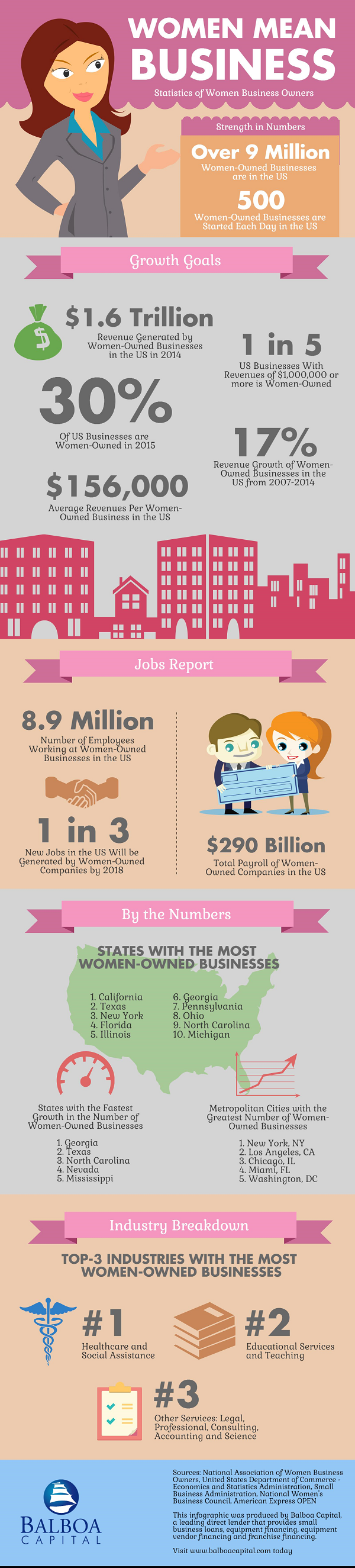

2) Women Entrepreneurs: By The Numbers

Women-owned businesses are thriving. Check out these stats, courtesy of Balboa Capital:

- 30% of U.S. businesses are owned by women

- California and New York are among the Top 10 states with the most women-owned businesses

- 500 women-owned businesses are started every day in the U.S.

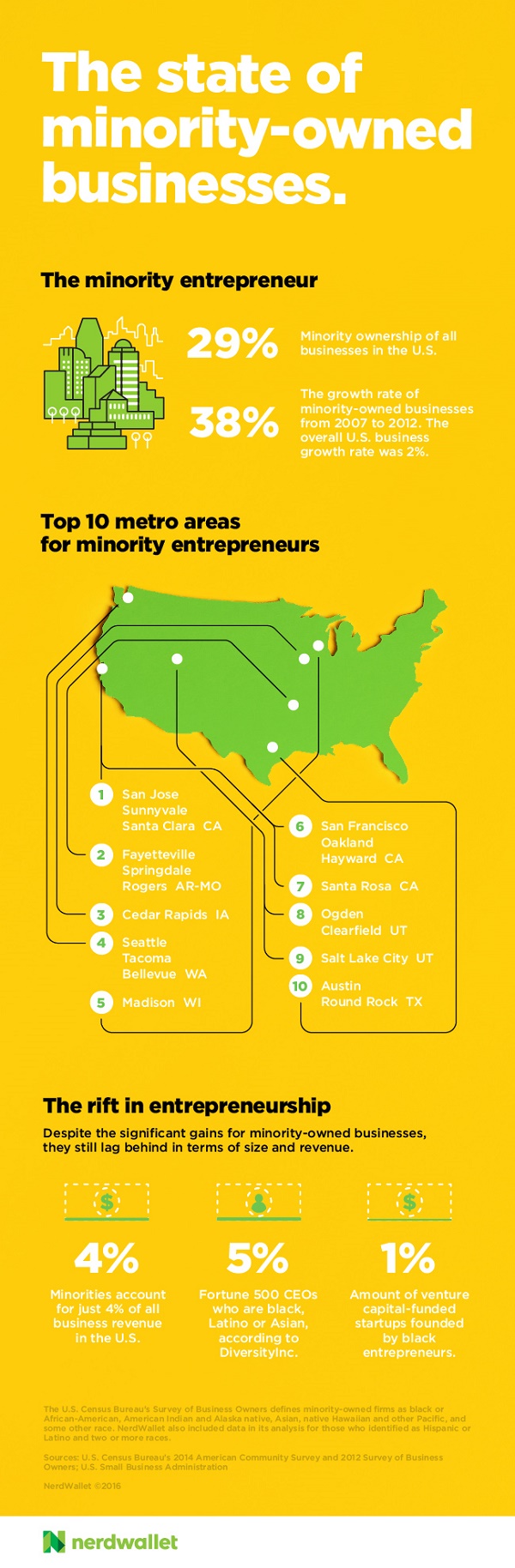

3) Best Cities for Minority Entrepreneurs

According to NerdWallet, the number of black, Hispanic, Asian and other minority-founded small businesses surged 38% in recent years, a growth rate three times higher than population gains, making them a rising (and powerful) force in the American economy

But are some parts of the country more startup friendly for minority entrepreneurs? Actually, yes—look below for the cities NerdWallet identifies as the places to launch a business if you’re a minority entrepreneur.

Based on data from the U.S. Census Bureau and the Small Business Administration, here are some highlights:

- California’s Bay Area (in and around San Francisco) is home to three of the top 10 metros to start a minority-owned business.

- With its fast-growing Hispanic population, Utah has three spots in the top 25 metros.

- One common element of the top 10 cities: All ranked in the top 25% in number of SBA loans by population.

4) Are You Overpaying Your Business Taxes?

According to Sage, most businesses overpay their taxes. Check out the infographic below.

5) 3 Smart Ways to Use Your Tax Refund

Guest post by David Hufnagel, Hispanic market director, MassMutual

The average tax refund in 2015 was approximately $2,800 according to the IRS, and similar refunds are expected in 2016. For those getting a refund, there are many options to consider for what to do with this unexpected income. The big question is what is the smartest option?

While you may want to splurge with your refund, carefully managing the majority of your refund is a smart financial move. A tax refund or any unexpected income can be used to help reach your financial goals without impacting your current standard of living.

Massachusetts Mutual Life Insurance Company (MassMutual) suggests three things to consider for this year’s tax refund:

- Pay down debt. Take a look at your current debt. Find out which have the highest interest rates and consider paying those down first to help prevent interest from continuing to add up. Another common strategy is to pay off your smallest debt first, and then work your way up to the larger ones.

- Build an emergency fund. Consider using at least a portion of your tax refund to give your emergency fund a boost. Make a goal to stash away three to six months’ worth of expenses in cash in an emergency fund that you can easily access if you need to, such as a savings account, and use your refund to work towards that goal. Interestingly, a study commissioned by MassMutual in 2015 showed that almost half (45%) of Latinos rely on their savings accounts in moments of need.

- Pay the future forward. The positive news is that Americans are living longer—and are now faced with saving for a retirement period of up to 30 years. So if you haven’t started to save or want to boost your retirement savings, consider putting your refund in a retirement savings plan. You may also consider using a portion of your refund for higher education—for yourself, a child or grandchild. If you haven’t considered buying life insurance or disability income insurance yet, or need to revisit your plans, now’s a good time to talk to a financial professional.

A tax refund is money that you’ve worked hard for, and it is ok to do something fun with it, as well. Just make sure you consider committing at least a portion towards your short-term and long-term financial needs and goals.

To learn more about establishing healthy financial goals or to locate a financial professional near you, visit massmutual.com/Latino.

6) When is a Holiday Not a Holiday?

With Easter Sunday less than a week away, the data team at Invoice2go took a look at whether business owners actually take holidays off. The answer is mixed:

Easter is the most worked holiday. Last year on Easter Sunday (April 5, 2015), the work output of the country’s smallest business dropped by a mere 19%, compared to Christmas and Thanksgiving, where work dropped 85% and 86% respectively.

Here are the holidays that American small business owners take off the most:

- Thanksgiving: work output drops 86%

- Christmas: work output drops 85%

- July 4th: work output drops 34%

- Labor Day: work output drops 23%

- Easter: work output drops 19%

7) “Wellth” is the New Wealth

Guest post by Nick Goode, VP of Cloud Product Management, Sage & Sage One. You can contact him on Twitter @nickgoode.

Wealth has historically been viewed as financial success in business that translates to success in life. Money, real estate, investments, and “stuff” like cars and expensive vacations—if you’ve got these things, you’re doing well for yourself…right?

Perhaps it’s time we recognized the wealth game is changing. While money does matter, it’s no longer the foremost defining attribute of personal or professional achievement. Instead, a new focus on happiness and purpose is driving the common consciousness. This shift is due in part to the influence of Millennials, whose priorities about work and life are reshaping everything from world economies to the business landscape as a whole.

The Millennial mind looks at something like the price of real estate—the financial Everest they would need to climb to achieve some conventional form of “wealth”—and realizes that maybe there are more important things within their reach. Indeed, 53% of Millennials say they value health more than any other priority besides family. Additionally, 90% say they pursue health in order to be successful in other areas of life. It’s clear, that rather than wealth, this next generation of leaders prioritizes what I like to call “wellth”.

What is wellth? Wellth is the combination of physical, mental, and financial wellbeing that provides a foundation for each of us to strive toward success by living our best lives. Wellth redefines what it means to “arrive” by focusing instead on the journey; it’s about not being a slave to the daily grind; it’s making a conscious decision to live well. And while wellth may seem like some kind of New Age idealism, it’s not limited to vegan yoga students, boot camp evangelists, or spin bike enthusiasts queuing up to find inner strength at studios all over the world. In fact, there is a definite growing awareness among middle-aged professionals and corporate leaders that seeking wellness will help to accomplish larger goals.

Here are three trends that showcase how Millennial-minded workers and businesses are switching their focus from wealth to wellth.

- Fueling an Appetite for Ambition: It’s true: green is the new black. Just take a look at the many healthy-eating gurus who are dominating Instagramfeeds and building entrepreneurial empires on the foundation of wellness. Beyond the trendiness, though, this new focus on eating right underscores an emerging understanding and appreciation of how food affects all aspects of our lives.

The healthy food/happy employees connection has not gone unrecognized by most forward-thinking businesses. Research shows that employees with unhealthy diets are 66% more likely to experience a loss in productivity than those who regularly eat whole grains, fruits, and vegetables. This is something most people realize from personal experience without even needing the science to back it up. There are foods that increase focus, concentration, and alertness, just as there are foods that make you feel sluggish, uninterested, and tired—it’s the reason we all silently chide ourselves for reaching for that bag of chips when we’re stressed.

Not surprisingly, Google has spared no expense to ensure their cafeteria nurtures employees from the inside out. That’s because they realize that there’s an integral correlation between health, employee happiness, and the combined effect of both on business success. They value wellth!

- Finding Focus in Action: Increasing your heart rate and physically pushing your body isn’t only good for your muscles and bones, it’s also great for your brain. This relationship is why many of the world’s most successful business leaders turn to fitness to help them stay centered. In fact, Sir Richard Branson cites daily exerciseas his number-one secret to staying healthy and productive.

But it’s not only physical action that makes a difference. In addition to building fitness and wellness programs into their cultures, top companies are also recognizing the impact of purpose on the emotional wellbeing of their employees (and, ultimately, their bottom lines). Those that prioritize action in the form of corporate social responsibility and embrace the power of giving back are finding success, both in terms of profitability and in terms of employee motivation, retention, and engagement.

- Taking Mindfulness to Work: Balance in life is necessary, and burnout at work can often tip the scales in the wrong direction. Burnout manifests as a lack of interest or motivation, depression, or even physical illness—and 69% of employees cite burnout as a key contributing factor to poor productivity.

Along with eating right and staying fit, being mindful of burnout is essential for keeping your wellth account full. This can be as simple as scheduling time to unplug or learn new skills. Even technology—the supposed enemy of peace and quiet—can help. For example, apps like Headspace can act as a personal trainer for your mind and help you achieve your daily 10 minutes of mindfulness.

Businesses that want to help their employees avoid burnout can provide unique experiences, such as sponsoring a company cycling team or organizing regular outdoor retreats. Oftentimes, just getting outside is enough to reset the balance, as research shows that time spent in nature can increase happiness and attentiveness.

Journeying Toward Wellth

These three trends represent the tip of the iceberg for the wellth movement. As the Millennial mindset continues to shift wellness from a mere fad into the mainstream, traditional constructs of personal/professional achievement are actively being replaced with a new appreciation of life goals (and how we reach them). The basic tenets of wellth may focus on diet, fitness, and mindfulness, but this movement is about more than just working out and eating berries and kale; it’s a conscious choice to live well.

As motivational philosopher (and friend) Jay Shetty notes, “We are human beings but act more like human doings. Instead of a ‘to do’ list we need a ‘to be’ list. Rather than thinking what we should we do in situations we should think about who we want to be in situations.”

Wellth is how many of us are bringing the act of being back into everything we do. It provides a holistic vision of what it takes for each of us to reach higher and go farther, which empowers us to build a solid foundation for attaining success in all aspects of life—including work.

So, how wellthy are you?

8) Choosing the Best Health Plans

One of the hardest responsibilities small business owners have is selecting the best health care plan for their employees. To gain some insight, take a look at the latest findings from the United Benefit Advisors Health Plan Survey, the nation’s most comprehensive health plan survey, related to how Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs) are being used by businesses.

So which is faring better in the industry, HRAs or HSAs? And who offers the best and worst plans? The answers depend on where you are located in the country, what industry you’re in, and how many employees you have.

You can get a free copy of UBA’s special report here. And if you want more information you can contact a UBA partner firm or utilize the UBA resources center online.

Cool Tools

9) Creating Visuals

It’s more important than ever for small businesses to be able to create strong visuals. And with the newly released SmartDraw 2016 from SmartDraw Software, it’s easier than ever to do just that. SmartDraw, a popular drawing software with more than 1 million users worldwide, now includes SmartDraw Cloud, allowing users to easily create powerful visuals from any platform, including PCs, Macs and mobile devices, anywhere.

SmartDraw 2016 includes an updated user interface, improved sharing, new and improved templates, themes and symbols.

The new version has been under development for over five years. “Most cloud apps are hobbled versions of their desktop counterparts,” says Paul Stannard, founder and CEO of SmartDraw Software. “Instead, we took five years and recreated almost every feature of our popular SmartDraw business edition.”

SmartDraw is power-packed, offering 4,500 smart templates for more than 70 different kinds of visuals such as flowcharts, mind maps, org charts, floor plans and more. With 34,000 professionally designed symbols, SmartDraw makes it easy to quickly create complex, powerful visuals.

There’s special introductory pricing available right now:

- Standard Edition (includes 1-year of SmartDraw Cloud)………..$197

- Business Edition (includes 1-year of SmartDraw Cloud)………..$297

- Enterprise Edition (includes 1-year of SmartDraw Cloud)………$497

- SmartDraw Cloud Stand-alone………..$12.95 per month (payable annually)

For More Information:

Try SmartDraw Cloud

10) Freelancers: Get Help Managing Your Finances

QuickBooks Self-Employed has added six new partners (eBay, FlexJobs, Incorporate.com, Kelly Services, Moonlighting and NAHREP). Users now have access to discounts on both QuickBooks Self-Employed and the QuickBooks Self-Employed Tax Bundle.

QB Self-Employed also added automatic mileage tracking, which is particularly important for those in the driving/delivery space. The feature eliminates the need to manually enter data about every mile driven. Instead, every trip is automatically tracked, and users simply need to swipe to see the deductions they’ve earned. Every 1,000 miles driven can produce up to $500 in deductions, but the IRS wants proof of all trips, both business and personal. Automatic mileage tracking is an accurate and easy to use tool. Already, QuickBooks Self-Employed has helped users track more than 40 million miles, delivering more than $23 million in savings.

11) Help for Those Who Help Small Businesses

GoDaddy just announced an expansion of its hosting services to offer Cloud Servers and Bitnami-powered Cloud Applications, designed to help individual developers, tech entrepreneurs and IT professionals quickly build, test and scale cloud solutions.

With 54-second or less provisioning, virtual instances can be built, tested, cloned and re-provisioned almost instantly. Powered by a simple, yet powerful API and easy-to-use user interface, Cloud Servers provide developers complete control over their virtual instances and include concise in-app documentation.

Some additional features include:

- Automatically backup your data without downtime to keep Cloud Server user data and configuration covered for piece of mind; 99.9% uptime is guaranteed.

- Keep user servers in constant contact with each other with private networking will maintain secure communication and protocols.

- Flexibly assign permanent IPs and multiple IP addresses to a single server with as many available as required.

- Supported distributions offered are Ubuntu 14.04, CentOS 6 & 7, Fedora 23, Debian 8, FreeBSD, CoreOS and Arch Linux. At launch, GoDaddy Cloud Servers are in US Datacenters only.

GoDaddy Cloud Servers are integrated with GoDaddy products such as Domains and DNS, which allows customers to manage and maintain new and existing domains and subdomains. Additionally, Cloud Server customers have full access to multiple, public facing APIs. The new cloud offering from GoDaddy is available in 26 languages in 44 countries/territories and 53 markets.

GoDaddy’s Cloud Applications are powered byBitnami, the leading library for open source server application deployments.