8 Things Entrepreneurs Need to Know

By Rieva Lesonsky

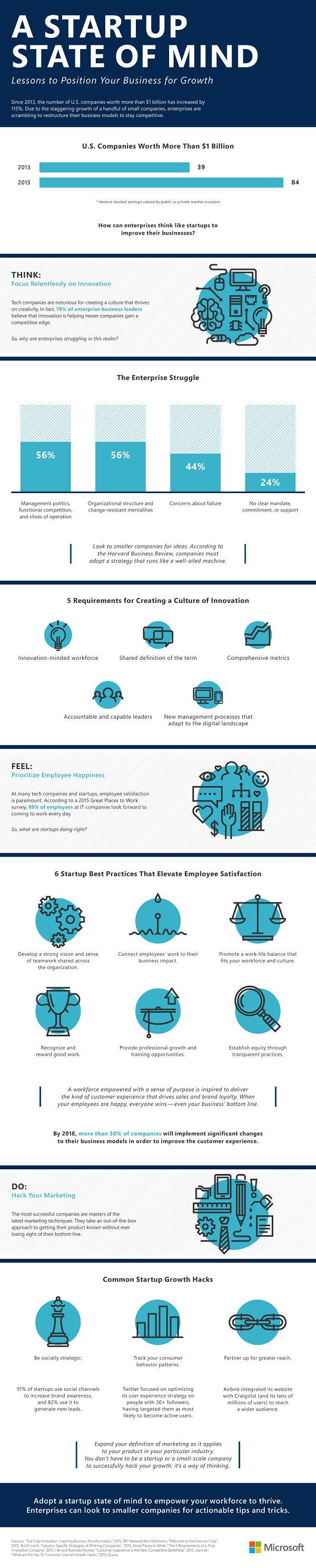

1. Startup State of Mind

Since I started covering small business and entrepreneurship all those years ago many things have changed. One in particular—back then most businesses, large and small, had a corporate mindset. Today, many of those businesses are thinking small. Check out the infographic below from Microsoft to see how—and why so many businesses today have a startup state of mind.

2. Best Small Cities for Startup

Don’t want to live in a major metropolitan area? That doesn’t mean you can be a successful small business owner. Check out the best small cities for startups, courtesy of WalletHub. Here’s the top 10:

- Holland, MI

- North Chicago, IL

- Brighton, NY

- Jefferson City, MO

- La Vergne, TN

- Inver Grove Heights, MN

- Clearfield, UT

- Dothan, AL

- Cheyenne, WY

- Deerfield Beach, FL

3. More Bests

In honor of National Small Business Week, WalletHub released several more “best” reports, including:

Best Cities for Hispanic Entrepreneurs (my home city—Irvine, CA, ranks 16th)

Best Business Credit Cards

Most Small Business Friendly Credit Card Companies

Best Bank Accounts for Small Business

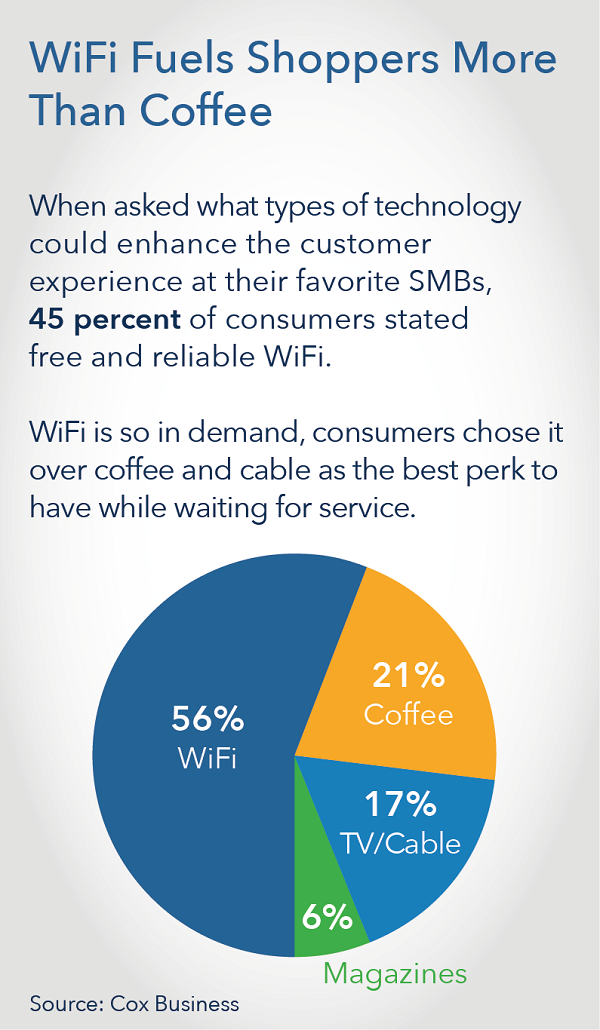

4. What Consumers Want

Do you really know what your customers want? The Cox 2016 Consumer Pulse on Small Businesses revealed what brings consumers to your businesses. One amazing fact: 90% of U.S. consumers shop small at least once a week.

And while they’re in your store, restaurant or other business, they want free Wi-Fi. In fact 45% of consumers name that as their number-one perk while they wait at your business, ranking ahead of a cup of coffee.

You can check out the entire survey here.

5. New Retirement Savings Account

The U.S. Treasury has announced a new retirement savings account made available they say is “simple, safe, and affordable”—the myRA. Highlight of the myRA include:

- It costs nothing to open an account—and there are no fees

- You can contribute any amount you choose ($2, $20, $200—whatever fits your budget)

- There’s no risk of losing money

- There are no complicated investment options

- Your account earns interest

- You can withdraw the money you put in without tax or penalties

If you don’t have access to an employer-sponsored retirement account, the myRA is a great option.

6. Are You Making More Happen?

In honor of National Small Business Week Staples is cutting prices on a wide selection of ink and toner cartridges and offering a new in-stock guarantee. The new prices for the ink and toner extend beyond NSBW. If you go to your local Staples to buy ink and toner—and if a particular cartridge is out of stock, a Staples associate will order that item at an onsite kiosk for you, plus you get a $10 discount and free shipping. If you buy online, you can pick up your cartridges in-store within one hour of purchase.

The company is price matching cartridges sold and shipped by Amazone.com or other retailers that sells cartridges in retail stores and online under the same brand.

Staples also launched the Make More Happen Contest, highlighting the small business owners from around the country. You can enter the contest between now and May 21. Just go to the Make More Happen Contest page and describe in 200 words or less how your business is “making more happen.” Five winners will receive on-location production of a 30-second spotlight video of their businesses to be featured nationally on Staples’ social media channels and a $1,000 Staples Print & Marketing Services package to help market the business.

7. How Small Business Owners Get Funded

In another “Pulse” report, The Alternative Board (TAB)’s quarterly Small Business Pulse Survey, which focused on how business owners acquired funding and how they would do it differently if they were given a second chance. Some highlights include:

- 63% of small business owners say banks are their primary source of getting a loan

- 37% turn to loans against personal assets

- 34%) get loans from friends/family

- 15% turn to government grant programs

- 9% get money from angel investors or venture capital firms

The most important lessons entrepreneurs learned from securing external funding:

- Borrow at the right time (34%)

- Borrow from the right source (34%)

- Borrow the right amount (19%)

- Borrow with the right advisor at your side (13%)

Looking back, 29% of business owners wished they had borrowed more money, while 11% would rather have borrowed less.

8. Access to Capital

We all know how hard it is for small businesses to get access to capital. To help,

Sam’s Club and Sam’s Club Giving just announced $8.8 million in new grants for small business owners—especially women, minorities and veterans. These grants were awarded to organizations dedicated to borrower education initiatives easing access to capital.

Among the groups getting funding are:

- Accion

- Community Reinvestment Fund

- Small Business Majority Foundation

- Grameen America

- Lift Fund

- SCORE

- Enactus

- University of New Hampshire research