12 Things Entrepreneurs Need to Know

By Rieva Lesonsky

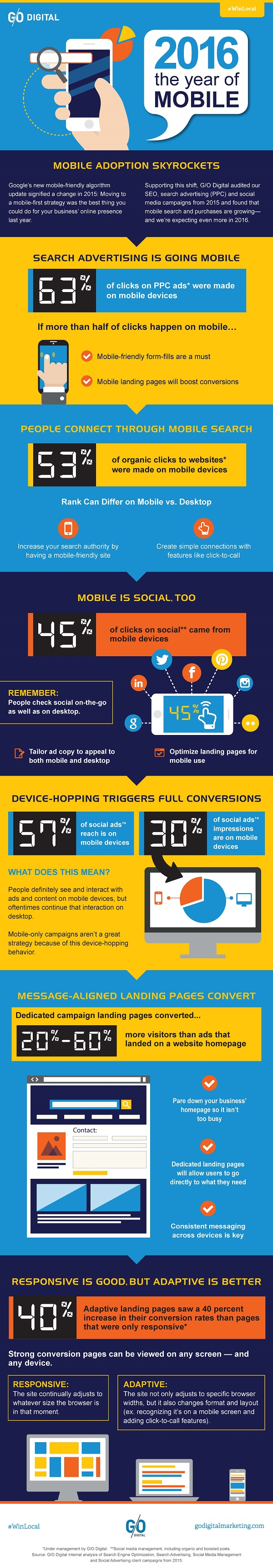

1. 2016: The Year of Mobile

Are you a mobile-friendly small business? I sure hope so—because that’s increasingly what consumers expect.

G/O Digital released some data about what people are actually doing on mobile—and how your digital marketing strategy can take advantage of it.

The data shows that on average, 63% of clicks on PPC ads run by G/O Digital were made on mobile devices, and 53% of organic clicks to websites under management by G/O Digital were made on mobile devices. An average of 45% of clicks on social come from mobile devices. But G/O Digital adds other data indicates consumers “definitely see and interact with ads and content on mobile devices, but concurrently, see and interact on mobile and continue that interaction on their desktop.

When planning your digital marketing strategy, G/O Digital says, “A mobile-only focus will not generally give you the best results. It could, in fact, deliver the opposite, as consumers who find you first on mobile, but finish the buying cycle on desktop are unable to find you, then ultimately buy from your competitor instead.”

Here are the top things G/O Digital recommends you do to ensure you’re taking advantage of the rise of mobile?

- Ensure your website is mobile-friendly.

- Responsive is good, but adaptive is better.

- Ensure your campaigns run across and include consistent branding on all device types.

- Use campaign-specific landing pages.

For more information, check out the infographic below.

2. EMV Chip Card Update

The EMV chip card mandate is almost six months old and according to the PYMNTS.com SMB Technology Adoption Index, powered by Sage, for first quarter of 2016 only 39% of small and medium businesses have implemented the required technology to accept Europay, Mastercard and Visa (EMV).

The Index also found 49% of businesses that don’t yet accept EMV chip cards don’t plan to accept them in the future. Most of the these businesses are B2B companies that either see no benefit to initiating the process of EMV integration or do not have enough volume to make implementation worthwhile.

Paul Bridgewater, CEO of Sage Payment Solutions, the payments division for Sage North America says, “I think what we’re really seeing with this research is a gap in understanding just what the EMV mandate means for businesses. It’s on industry leaders to make sure small businesses can access all of the tools they need to get educated and stay current on EMV in a way that works for them.”

Other key takeaways from SMB Technology Adoption Index include:

- An overwhelming majority of SMBs say they implemented EMV technology either because it is required by a processor or because of safety concerns.

- While SMBs say their biggest concern is getting paid on time, only 19% of them have a completely or very automated invoice process.

- Mobile pay adoption remains low, as Apple Pay and/or Android Pay are accepted by only 1% of SMBs.

One problem this quarter’s Index shows is a lack of awareness by small businesses of how much ground they have to make up when it comes to adopting technology. In fact, 56% of B2C businesses rate themselves between 7 and 10 (on a scale of 10) when it comes to how integrated their company is in terms of using technology to manage their cash flow.

Sage and PYMNTS.com will cohost a live webcast Wednesday, March 30, at 1 pm ET to discuss the Index and how SMBs can grow by tapping into existing and emerging technologies. You can register here.

For more information about EMV you can go here.

3. State of Minority-Owned Businesses

Experian just released a new study offering insight into the health of minority-owned small businesses in America.

The study shows that, compared with the overall small-business population, minority-owned small businesses are slightly behind when it comes to credit management. For example, the average business credit score (based on a scale of 1 to 100—with 100 being least risky; predicts the likelihood of severe delinquency—more than 91 days past due—within the next 12 months) for a minority-owned small business is 49.7, nearly five points lower than the average for the general small-business population. As a consumer, the average credit score for a minority small-business owner is 707, 15 points lower than the overall average for small-business owners.

In terms of payment behavior, 1.2% of minority small-business owners have at least one business credit card account that is severely delinquent (91-plus days), while 8.3% have at least one consumer credit card account that is severely delinquent (90-plus days). Comparatively, 1.1% of the general small-business owners have at least one severely delinquent business credit card account and 6.8% have at least one severely delinquent consumer account.

Other findings:

- Approximately 7% of all minority-owned businesses are based out of the home, while more than 10% of the general small-business population are home-based

- More than 31% of minority small-business owners are women

- Nearly 45% of all minority-owned small businesses come from three states: California (23.4%), Florida (11.4%) and Texas (10.1%)

- Minority small-business owners have an average outstanding business balance of $8,759, while the general small-business owner population has an average outstanding balance of $9,066

Experian is having a webinar no this topic April 5 at 1 pm Eastern time, 10 am Pacific. You can register here.

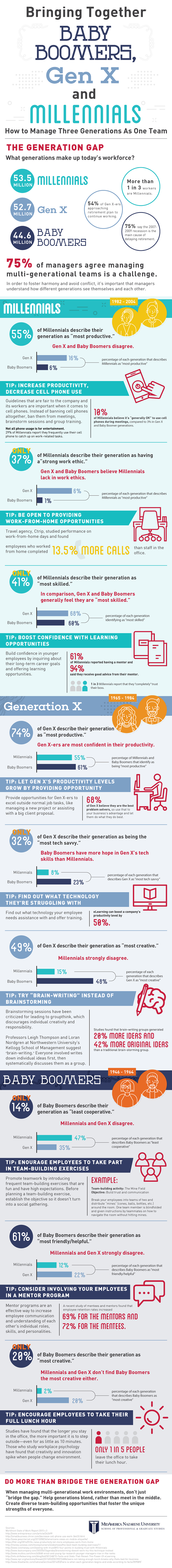

4. Multi-Generational Workplaces

Today’s workplaces are more multi-generational than ever. While a workplace that blends experience and youthful exuberance can be beneficial, it can also create an environment with a disconnect between people of different age groups, leaving many managers with the challenge of managing teams made of employees from distinctly different generations, each with unique strengths, needs, weaknesses and attitudes.

Our friend Matt Zajechowski of Digital Third Coast and Yorton Clark Jr., a professor and chair of the business administration department at MidAmerica Nazreen University developed a visual guide for managers on how to manage different generations in the workplace effectively.

The guide covers the three most active generations in the workforce (Millennials, Gen X, & Baby Boomers), how each age group views themselves as well as how they view one another, tips for increasing production with each group as well as actionable advice on to bridge the gap between each generation in the workplace.

Check out the infographic below.

5. Get in on the Trade Show Action

About 13,000 trade shows and conferences are held annually. According to the Center for Exhibition Industry Research, 77% of executive decision makers found at least one new supplier at the last show they attended. And Exhibit Surveys says in 2015, 51% of show goers planned to buy within 12 months after attending a show.

To get the most out of exhibiting at a trade show Justin Hersh, founder and CEO of experience creation shop Group Delphi (which is responsible for experiential work for companies like Apple and SAP) shares some best practices from the show floor.

- Figure out why before you go.We see it all the time. Companies’ first order of business is booth build and design. We encourage companies to back up and figure out why they want to exhibit in the first place. This leads to a more relevant and effective design—and sometimes even the discovery that they should be pursuing another marketing channel all together. When you are clear on your purpose, you can also be clear on your success once the show is over.

- Sales people are great, but bring on the subject matter experts! People want to converse and immerse, not be sold to. Unlike 10 years ago, attendees can get all the sales info they need about you from your website. So use the trade show to give them something they can’t get online: a dynamic conversation—and a sensory experience.

- Apply technology with purpose.Don’t reach for the latest tech, often expensive, just for the sake of keeping up. Make sure technology used in your exhibit is purposeful. Even the biggest exhibit houses in the world applied technology sparingly at ExhibitorLIVE; in our case, virtual reality was used to reveal a mystic jungle, representing both the beauty and clutter of the experiential landscape today.

- Create opportunities for conversation.Be it comfortable couches, an inviting coffee shop set up or a wine bar, offer a place where attendees are happy to stay for a while. This also means ensuring your booth doesn’t look like a fortress, surrounded by barriers that make it tough to see, or step, inside.

6. Digital Marketing & Small Business

The majority of small businesses in the U.S. do not engage in digital marketing, according to a new survey conducted by Clutch, a leading B2B research firm. The results suggest that potentially thousands of small businesses are negatively impacting their success, limiting their growth, and making it easier for competitors to capture and convert potential customers.

Two reasons shape small businesses’ decisions to hold back on digital marketing: (1) the cost and (2) inexperience with the required tools and strategies.

Digital marketing is more accessible than ever for small business owners and managers. There are plenty of services that offer easy-to-use software and tools for creating and managing email newsletters, building websites and mobile apps, scheduling social media posts, and tracking relevant metrics.

The good news is the survey shows small businesses are starting to pay more attention to digital marketing: over 80% acknowledge that digital marketing is imperative to business success and 70% plan to implement a digital marketing plan by 2017 or later.

For the small businesses that do take the leap into digital marketing, social media is their preferred jumping off point. Nearly 60% currently engage in social media and nearly 75% say they plan to implement some type of social media marketing strategy by 2017 or later.

Of those that currently have a social media presence, Facebook (89%), Twitter (49%), and LinkedIn (42%) are the most popular platforms.

7. Spring Clean Your Email Marketing

Spring is here and while you have spring cleaning on your brain, now is also the perfect time for small businesses to give their email marketing practices a refresh.

The email marketing experts at GoDaddy put together some tips on how to optimize your email marketing which could lead to better customer engagement:

Scrub your subscriber list: Make sure you’re sharing your content with people who are really interested. By adopting some healthy opt-in practices for your email lists, you’ll be sure you’re getting in front of the right potential customers. If someone subscribes to your newsletter through your website—or has recently purchased something from your company—they are going to be more receptive to your content. Never purchase an email list, and keep your lists fresh instead of continuing to send emails to someone who bought a product from you five years ago.

Don’t lump everyone together: Email marketing is still a great way to get your content in front of both new and returning customers, but they’re not going to want to see the same messages. By taking some time to segment your email marketing lists, you can send recipients the content most relevant for them. Segmentation may increase open rates by 25% and click-thru rates by 9%!

Dust off your best content: You don’t want to regurgitate the same information to your customers year over year. Take a look at your best content from 2015. Did your sales spike following a certain holiday sale? Did your website traffic go up following a specific announcement made over email? Use your company’s email marketing stats to draw some conclusions about what kind of content works best for your customers.

8. Business Expansion Loans

Credibly, an online lending platform, is offering its first extended term loan offering—the Business Expansion Loan, which offers rates ranging from 9.99% to 36%, terms of 18 and 24 months and multiple payment options.

The Credibly Business Expansion Loan can be approved and accessed within one day, in amounts from $10,000 to $250,000. You have to be in business for six months or more to apply. This loan is designed for businesses whose needs extend beyond short-term working capital to include longer-term growth capital.

To date Credibly has provided more than $250 million in funding for over 6,000 businesses.

9. How to Catch a Shark

Do you watch the hit TV show Shark Tank and dream of actually hooking one of the sharks for a joint business venture? Well, the reality is most of the show’s participants walk away empty handed. So how do you catch a shark?

Anthony Amos (who never appeared on the show) and Kevin Harrington, one of the original Shark Tank sharks have written a new book, How To Catch A Shark. Amos and Harrington have partnered on a number of projects.

How did Amos “catch” Harrington? Here are his recommendations for catching your own shark:

Know what kind of shark will benefit you the most: Is it a great white, for example, who will invest money but take more equity, or a hammerhead who has a large celebrity or social presence? Is it a whale shark, one who will be more methodical and follow a strict business plan? Determine which shark could benefit your business and growth strategy the most.

Find your shark’s sweet spot: Yes, sharks have sweet spots. If you were pitching a kitchen product, for example, that would be a great pitch to a shark like Kevin Harrington because kitchen products are his sweet spot. A shark like Kevin O’Leary, on the other hand, is known for saying products aren’t a business, so that wouldn’t be a good pitch for him.

Create the perfect bait to catch your shark: Start your pitch with something dramatic to make sure they are listening. Demonstrate how your business or product is a mass-market proposition. How does it solve a problem or benefit the customer? Show the shark how the product or business is unique. What kind of testimonials and endorsements do you have? What is your track record? And of course, what is the money-making potential?

It’s all about adding value: Many people get caught up in their own stories and forget that all the shark or customer really wants to know is, “What’s in it for me?” Always focus more on the value you offer rather than the history of what you have done or what the company has achieved in the past. These are indeed important details, but the value you bring to the shark is more important.

Do the opposite of what most people do: Do you know how many people come up to Kevin and other sharks at events and try to take a photo with them and pitch them a deal? A shark is more open to listening to your offer through a personal introduction or something that sets you apart. In order to capture a shark, you need them to see you as a peer and not a fan. Don’t put them on a pedestal. Treat them like a person.

10. Happy Birthday Twitter

Twitter just turned 10 and to celebrate Free Enterprise from the U.S. Chamber of Commerce created a round-up of first tweets from famouse business leaders and entrepreneurs. Check it out here.

11. Strengthening Entrepreneurship in Minority Communities

The 3rd annual Color of Wealth Summit, themed The Inclusion Revolution: Race, Economic Mobility, and the Future of America, will focus on strengthening entrepreneurship in communities of color. The Summit will take place in the U.S. Capitol Complex in Washington, D.C. on April 21, 2016 from 9 am to 3:15 pm and is open to the public.

A roundtable will explore case studies and research on economic development in low-income communities and will discuss strategies to maintain and strengthen community wellbeing, improve health outcomes, provide equal opportunities, and improve neighborhood safety.

The summit also includes a Shark-a-Thon session, in which innovators will present ideas to bring low-income communities into the financial mainstream. A panel of business-savvy professionals will critique the concepts and offer feedback. The winner will receive a $10,000 planning grant from the JPMorgan Chase Foundation.

You can register here.

Cool Tool

12. Hiring Made Easy

HireArt has launched a mobile app, making the job-hunting and hiring processes even easier. The app allows job applicants to showcase their skills and personality with an application process that combines written and video responses making it easier for business owners to fill openings.

HireArt serves as the equivalent to a phone interview in the application process. And job applicants can receive feedback from HireArt graders on how they can improve, which again takes some stress out of the hiring process.

HireArt’s speciality is entry-level, non-technical jobs.