Keep Covid Stress Out of Your Customer Communication

By May Habib

Pandemic stress-related toxic communication can creep into your customer communication. Don’t let it! Set the example, nip toxicity in the bud, protect your team from incoming, build in rest, celebrate the good stuff, and codify that positive voice in your company style guide.

Pandemic stress-related toxic communication can creep into your customer communication. Don’t let it! Set the example, nip toxicity in the bud, protect your team from incoming, build in rest, celebrate the good stuff, and codify that positive voice in your company style guide.This moment finds us with a different kind of anxiety. Pandemic-related stress is at an all-time high, and people are bringing it to work. It can show up in ugly ways, too. In a survey we conducted of 1,000 professionals, 38 percent said they experienced toxic workplace communication since shelter-in-place began. Yikes!

What about when that nastiness starts to seep into your interactions with customers? Even if underneath the surface, unhealthy customer communication can damage your satisfaction scores…and your brand.

Here are 12 steps you can take to help your customer success team stay positive and put all kinds of good vibes out into the universe.

1. Acknowledge the stress

Your customer success team are people, too. They’re dealing with the strain of a deadly pandemic, economic anxiety, and lots of “togetherness” with family members at home. Even if you can’t fix these problems, simply acknowledging the stress they’re under goes a long way for their state of mind.

2. Care for your employees

Maybe it’s quaran-tinis every other Friday. Or a well-timed “wellness day.” Or a cupcake delivery to employees’ homes. Whatever your flavor, invest in ways to remind your employees that you value and care about them. In turn, they’ll value and care for your customers.

3. Be ground zero

As a leader in your company, you set the tone. Consider yourself “ground zero” for the kind of communication you want your customers to experience. The empathetic, upbeat, and kind words and messages you model to employees are the same your employees will use with customers.

4. Know what it sounds like

Know what unhealthy and toxic communication sounds like. Unhealthy communication includes words and turns of phrase that are exclusive, condescending, or passive-aggressive and toxic communication includes comments and writing that are sexually-explicit or suggestive, bullying, racist, or discriminatory.

5. Tool for it

There’s a raft of new tools out there to measure customer interactions, including Gong, Chorus, and Writer. Outfit your teams so you can address unhealthy or toxic communication. But give them a heads up so they know you’re doing it, and approach the oversight with sensitivity.

6. Nip it in the bud

As soon as you see or hear ugliness, call it out immediately. Approach the person in private. They may not be aware of their behavior, so be specific and help them understand the customer impact. Later, anonymize the example and discuss the topic more broadly with the team.

7. Enforce the rules

If the toxic communication persists, take action. Taking a hard line right away sends a clear message and ensures compliance from the rest of the team. Let them know that, even if they are on the receiving end of ugliness, it needs to stop with them – no exceptions.

8. Protect them from toxicity

Any customer-facing team knows what incoming feels like. Equip yours with the appropriate responses and escalation processes to remove themselves from an abusive situation. They need to feel empowered to set boundaries and know that you have their back.

9. Create a pressure valve

Acknowledge the absurd and lower the team’s stress. Bill Gates describes a “Mail Merge couch” from Microsoft’s early days. Team members sat (or laid) on it while taking support calls related to the product’s frustratingly complex feature. The inside joke helped them blow off steam and laugh at their situation.

10. Let them rest

As we learned from Away’s cautionary tale, the stress of being on the front lines is exacerbated by lack of sleep. Prepare and plan for people to get the rest and downtime they need, even if you have to bring in temporary reinforcements or other teams need to chip in.

11. Recognize key moments

Just as you suss out the nastiness, find and recognize the good stuff. Amplify and celebrate examples – large and small – of the behavior you want. Especially call out positive responses in the face of negativity. Create a “good karma” award and make a big hoopla out of it.

12. Make it stick

Make healthy communication a thing in your company culture. Get on the same page with the other executives about the voice, tone, and behavior norms you want to promote internally and externally. Then, make them stick by codifying them in your employee guidelines and brand style guide.

May Habib is co-founder and CEO of Writer, an AI writing assistant for teams.

Cupcake stock photo by Marharyta Kovalenko/Shutterstock

The Pandemic & Recession Could Cause a Huge Tax Debt Spike in 2021

By Mike Brown

Here’s How Small Business Owners Can Prepare

The coronavirus pandemic triggered a global economic crisis, and placed the United States in an official recession as of June 2020.

Hardest hit by this pandemic recession have been American workers; in April 2020, the U.S. unemployment rate skyrocketed to a staggering 14.7% before eventually dropping to a still-high 6.7% in November 2020.

These were the highest unemployment rates since the Great Recession in 2009 and even mirrored jobless rates not seen since the Great Depression in the early 20th century.

After the devastation to the American worker, the next hardest economic blow caused by the coronavirus pandemic and recession was dealt to small business owners.

As of September 2020, the U.S. has lost nearly 100,000 small businesses because of this unprecedented and harrowing pandemic.

For the small businesses that are still alive today, the going has been anything but easy this last year, and they are still not out of the woods yet.

Further, these small businesses face another looming challenge born out of the coronavirus pandemic and recession.

Tax debt

There are a few reasons U.S. small businesses might be facing a tax debt crisis when 2020 taxes are due in April 2021.

First and foremost, the Paycheck Protection Program (PPP) loans that countless small businesses took on to survive the coronavirus pandemic and recession could lead to a surprisingly high tax bill when tax season rolls around this year.

On the federal level, these forgivable loans and the expenses they covered can be written off as tax deductions.

But on the state level, the tax code is not as uniform, and many small business owners will have to pay taxes on their PPP loan, which have gone upwards of $1 million, even if it is forgiven.

A second reason small business owners should be concerned about tax debt in 2021 simply pertains to the drastic declines in revenue that so many of these small businesses have dealt with throughout the pandemic.

With people strapped for cash and stuck in doors, small businesses have struggled mightily to generate revenue, and they very likely will not have the funds to meet their 2020 tax commitment this April.

The third cause for tax debt concern may not apply to as many small business owners, but certainly will for a good number of them. To keep their small businesses afloat, some small business owners had to do things like liquidate their stock holdings or draw from their own personal retirement accounts to meet payroll and keep the doors to their small businesses open.

LendEDU conducted a survey in December that found 78% of adult Americans are concerned about tax debt in 2021 due to drawing from a retirement account to stay afloat during the pandemic.

The LendEDU study on tax debt also found 72% of Americans are worried about tax debt in 2021 after selling stock holdings to bolster their finances during this trying time.

In summation, small business owners are set to face a challenging tax season in 2021 because of the coronavirus pandemic and recession and the actions it forced them to take.

But, there are ways to prepare for what figures to be a harsh tax season when 2020 taxes are due.

First, small business owners need to get an early head start on preparing their 2020 taxes for this April. Seek out professional tax advice now and make them aware of anything financial moves you made during the pandemic to keep your business alive.

If you reach out today, you won’t be rushing to figure out your 2020 taxes right before the filing deadline, which is when tax professionals will become super busy and may not have time for you.

Second, if you do anticipate you are heading towards tax debt because of the pandemic or eventually wind up with tax debt, the worst thing you can do is ignore it and ignore the IRS.

Reach out to see if you can settle your tax debt with the IRS through something like an offer in compromise or installment agreement.

Or, you could employ a tax relief service if you do not want to deal with the IRS directly, and want a team of experts by your side when figuring out how to handle your tax debt.

The coronavirus pandemic and recession has been unimaginably harsh on people and businesses, and the negative impacts it will have on tax season this year is not yet fully known, but figures to be harsh as well.

By getting ahead of the competition and preparing yourself early for the 2021 tax season, you can keep your small business up and running.

In his role at LendEDU, Mike Brown uses data, usually from surveys and publicly-available resources, to identify emerging personal finance trends and tell unique stories. Mike’s work, featured in major outlets like The Wall Street Journal and The Washington Post, provides consumers with a personal finance measuring stick and can help them make informed finance decisions.

CTA: LendEDU helps people compare and learn about student loans, personal loans, mortgages, home equity loans, credit cards, insurance, small business loans, and more. At LendEDU, our goal is to help consumers and business owners make educated decisions when it comes to financial products and strategies without having to do all the legwork themselves.

You can follow LendEDU on Facebook @LendEDU & on Twitter @goLendEDU.

Tax debt stock photo by Rawpixel.com/Shutterstock

How to Talk to an Audience With Pandemic Fatigue

Empathetic marketing is the key to reaching customers sick of pandemic messaging

“Pandemic” was the word of the year for 2020.

And frankly, people are tired of it.

We may be done with COVID-19, but COVID’s not done with us. As small businesses look ahead to their 2021 content plans, one question rises to the fore:

How do you market during a pandemic to an audience that’s tired of hearing about the pandemic?

Customers Are Still Feeling The Pain

COVID-19 rocked the business world. It disrupted supply chains, decimated foot traffic, and decreased income for millions of people.

The virus’ toll on both lives and livelihoods dominated headlines. Misinformation and high-profile debates about COVID’s severity contributed to information overload. A recent study found that COVID-19 news, real or fake, led to months of fear and uncertainty.

People became emotionally exhausted. Depression rates skyrocketed.

This leaves businesses in a delicate situation. Talk about the pandemic too much and people will zone out or switch off. Don’t mention it at all and risk appearing insensitive to people who are suffering.

People don’t want to talk about the pandemic, but they don’t want to ignore it either.

Drop The Phony Empathy

Many of COVID’s impacts on business will fade with time. The shift to empathetic marketing is likely to be one that remains. With so many people feeling afraid and vulnerable, it is vital for brands to come across as human.

The brands that will win in 2021 will be the ones that connect with their customers on an emotional level. Lip-service sentiments like “we’re all in this together” felt phony last spring and are downright stale now. Be real. Look at your brand’s personality and the messages your customers need to hear and connect the dots.

Your audience wants your understanding, not your platitudes.

Verizon was a great example of this early in the pandemic. In April 2020, with lockdowns in full swing, the telecom company offered free access to e-learning resources. This went beyond recognizing the pain of parents thrust into the role of homeschool teachers. Verizon acknowledged its customers’ needs and offered help.

Empathy is listening and responding from a place of compassion. For businesses, that means understanding what your customers are going through. How has the virus affected them, if at all? Examine your analytics to understand your audience’s journey. Reference what you know about your audience against your content and SEO strategy.

When the virus pushed the holiday shopping season out of malls and onto laptops, Tommy Hilfiger recognized that for many of its customers, Christmas shopping isn’t just about buying gifts – it’s a beloved experience. In response, the brand launched an interactive online store that went far beyond the typical ecommerce site.

Navigation inspired by choose-your-own-adventure games led visitors through the virtual departments. As they explored the store, shoppers discovered digital versions of the little bonuses one would expect in a store at Christmas, like hot chocolate recipes and tutorials for DIY gift wrap.

Regularly take the pulse of your customers’ priorities. As interest in the pandemic wanes, so should your COVID-focused content. But you can’t go back to the same messaging you used in 2019. The world is not the same. Even as the virus fades to the background, your content should still be sensitive to its long-term effects on your audience.

Help Customers Move On

Audiences will respond positively to companies that help them move past the pandemic without pretending it never happened.

In May, as KFC began reopening restaurants in the U.K., it launched a humorous social media and ad campaign. The ads reassured customers that they no longer had to figure out how to recreate the Colonel’s fried chicken at home. At a time when hopeful, inspirational pandemic ads were still the norm, KFC reaffirmed its tongue-in-cheek brand voice even as it acknowledged the lockdown.

Focus your 2021 strategy on being customer-centric. Recognize where your customers are in their lives and point the way forward. If you strayed from your brand voice during the pandemic, now is the time to reassert it in a sensitive, human-first way.

Dana Herra is a copywriter and strategic content marketer. Her company, Herra Communications, specializes in helping small businesses express the unique edge that sets them apart. Before turning to marketing, Dana spent 10 years as an award-winning journalist. Connect with her on Twitter @DanaHerra. Learn more at her website, danaherra.com.

Pandemic stock photo by Tomas Ragina/Shutterstock

The Small Business Lessons We’ll Take With Us Into 2021

By Jasen Stine

As we close the book on 2020, there are a lot of takeaways and lessons to be learned from this challengig year. But, there are also a lot of inspiring stories, especially within the small business community, to be proud of. All over the country, small businesses adapted to the pandemic and made appropriate shifts in business models, products, accessibility, and more to best meet their customers’ needs.

As we head into 2021 and look at the road to recovery, it is important to take these hardships with us, but also not forget about the millions of ways small business owners stepped up and adapted to new, constantly changing circumstances.

Intuit Quickbooks conducted a recent study on what’s next for small businesses, surveying current and future small business owners. The most promising statistic? Almost 1 in 3 (29%) small business owners surveyed said the current state of the economy has had a “positive” or “very positive” impact on their company’s innovation, demonstrating that small business owners are embracing the challenges of the year and are confident in their products and services moving into 2021.

So, as we look head to the new year, it’s important to embrace new technologies and trends we predict to see in the next 12 months. Including:

- Increase in online accommodations, with 28% of small businesses selling more products and services online this year.

- Small businesses continue to adapt with changing environments, in fact 86% of small businesses that have developed new products and services this year have done so as a result of COVID-19.

- Growing industries, as the fastest growing industries for small businesses over the next 12 months are predicted to be: accommodation and food services, arts and recreation, and retail.

It’s also essential to take advice and learnings from people who have been there. 69% of people who own a small business recommend writing a business plan. They also agree that the top priorities for small businesses they wished they invested in sooner include expense tracking, inventory, and invoicing. According to small business owners, the first thing new businesses should get help with is setting up financial systems correctly. This is a great opportunity to ask your tax and accounting professional about their advisory services offerings so you can work in tandem to set business goals and create a path to achieve them, on top of advice about the financials.

If this year has taught us anything, it’s that small businesses are resilient and can adapt to their environment to help benefit their customers and communities.

Jasen Stine has worked in the tax and accounting profession for more than 20 years, and is currently Intuit’s Tax & Accounting Education Leader, implementing strategy and education on the tax and accounting industries. He is a thought leader on the Fourth Industrial Revolution, and recently worked on a team to implement natural language processing technology, currently patent pending, in educational programs.

Employee Engagement Solutions, Safety Signage and More Tools and Resources

By Rieva Lesonsky

Tools & Resources

Safety Signage

As businesses reopen and businesses, there is now a heavy focus on safety, hygiene, and distancing protocols. A great way to deliver those messages is with eye-catching and affordable COVID-19 safety signage from Indiesigns.

The colorful, upbeat signage follows the latest safety regulations from the Centers for Disease Control and are designed by independent artists. They can be customized to include logos, company language and titles.

The colorful, upbeat signage follows the latest safety regulations from the Centers for Disease Control and are designed by independent artists. They can be customized to include logos, company language and titles.

Two Employee Engagement Solutions

1—From Zenefits:

Zenefits, the HR, benefits and payroll platform, recently added to its product suite with the launch of People Hub and Employee Engagement Surveys. These powerful people-enablement tools offer enterprise-grade HR technology solutions built for SMBs.

The drastic changes in the world of work since March has put a spotlight on a company’s ability to understand the sentiment of its workforce and to effectively communicate with them. Under normal circumstances, employee engagement and workforce communication are tough challenges for SMBs. But effectively addressing these issues when employees are working from home and adhering to social distancing recommendations is seemingly impossible. It’s no surprise that a June 2020 Gallup poll showed the largest decline in U.S. employee engagement in the 20 years they have been tracking the metric.

The new tools help businesses centralize communications with a distributed workforce, easily gather and analyze employee sentiment, and support employee well-being. And they help level the playing field for small businesses via tools that were previously only available to large companies.

Small businesses can now access:

- People Hub: People Hub is a company collaboration tool that helps organize and centralize HR activities. Employees and admins can efficiently communicate and collaborate directly from one system, which even sends push notifications to mobile. It’s easy to manage communications for key HR activities such as open enrollment, broadcast important company information and critical updates like new safety procedures or location openings/closings, and automate announcements for company milestones like new hire announcements, birthdays and anniversaries, holidays, and more.

Testament to the changing work landscape, some early users of the People Hub have used it to share information on new company processes around wearing masks and supporting customers as they reopen their businesses.

- Employee Engagement Surveys: With the massive upheaval across work, home and family in 2020, understanding and adjusting for employee sentiment is crucial.

The engagement survey tool comes with a variety of preconfigured survey types to gauge worker satisfaction, collect a pulse check on employee net promoter score, or even conduct a full review of the employee engagement. The tool also helps easily visualize areas for improvement across departments, teams, locations, and more so employers can share results —and planned actions—with managers and employees while safeguarding worker anonymity and promoting inclusivity.

The new tools are now available to existing customers in the Zen HR package. A comprehensive suite of helpful tools for navigating a remote workforce, including COVID testing integrations, distributed compliance training and helpful COVID documentation, can be found here.

2—From Paycor

Human Capital Management (HCM) company Paycor recently launched Paycor Pulse, an employee engagement solution that utilizes Natural Language Processing (NLP Artificial Intelligence) to immediately turn written data into valuable insights around Employee Sentiment, enabling leaders to get ahead of potential problems like turnover and low morale and giving them the tools they need to navigate the new reality of work.

As COVID-19 continues to sweep the nation, there are new distractions, stressors and fears employees and employers are facing. This has also led to new concerns HR and business leaders are having to address surrounding the employee experience, engagement and workforce management. Today, it is critical for HR and business leaders to have a pulse on their workforce to understand the overall sentiment of their employees to plan and build a strategy that addresses their needs.

Occasional employee satisfaction surveys are lagging indicators of persistent concerns. According to a recent Gartner poll, only 16% of leaders are satisfied with the way they currently measure the employee experience. Antiquated processes like annual reviews can be long and cumbersome for the managers and employees and often times response quality can be low. To better understand the employee experience, it’s important to continuously gather employee-centric data that analyzes factors such as engagement levels, satisfaction with career/personal growth and relationships with management.

Paycor Pulse allows HR and business leaders to:

- Build trust and action plans based on the employee sentiment

- Analyze what employees are thinking and feeling in real time

- Go beyond average employee engagement and help team members process their experiences

- Build a comprehensive HR strategy that builds trust in leadership and drives business performance

- Cultivates leaders who listen and promotes accountability

- Allows leaders to make data-driven decisions so employees feel empowered and valued

Paycor Pulse is available for prospects and current clients. For more information, please click here.

Market Research Tool that Boosts Economic Recovery

Market research tool expert RavenCSI, has pledged to help organizations of any size, in any industry, anywhere to chart their course to economic recovery by offering its solution free of charge to the end of 2020.

The tool helps you find out how factors such as social distancing and travel may have impacted your markets. It uses drag and drop survey functionality to help you quickly design branded research questions to gauge market expectations.

Check out this video for more information.

Polls & Surveys

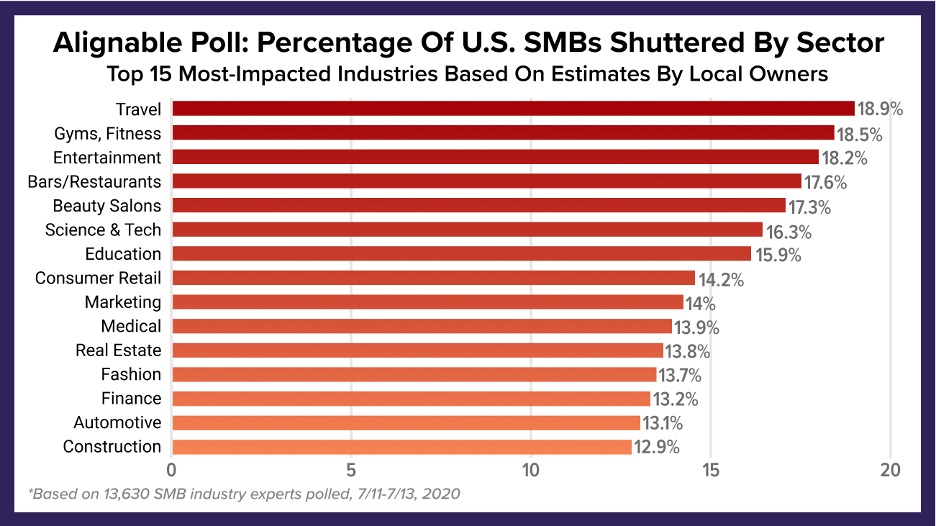

How Many Small Businesses Have Shuttered So Far?

At this point determining the breadth and depth of the COVID-19’s impact on small businesses continues to be a challenge. It’s particularly difficult to accurately gauge exactly how many small businesses have closed, because once they shut their doors for good, the owners can be hard to reach.

According to Alignable’s July State Of Small Business Report, in which small business owners self-reported the status of their own businesses, 16% haven’t reopened yet and 3% had closed for good. Based on these statistics alone, as many as 900,000 small businesses could have shuttered so far.

A recent Alignable Opinion Poll asked small business owners for their views on SMB closures. Specifically, Alignable asked: “In your estimation, what percentage of the local businesses in your industry have already permanently closed?”

The results were striking—the average estimate is that 15% of businesses have shuttered nationally. Results vary by state and industry, but the numbers are quite high nearly everywhere.

Here’s a snapshot of their perspectives on specific industries, with travel, gyms, entertainment, and bars/restaurants topping their list of categories that they believe are really hurting.

“Unfortunately, it’s no surprise to see many of these industries on this list,” says Eric Groves, Alignable’s CEO and cofounder. “But these estimates need to be a call to action for business owners, community leaders, and influencers in these industries. While consumer perceptions around personal safety will enable many of these industries to start down a path towards recovery, we’re also going to need a concerted effort to encourage a shift back to purchasing from local businesses for real recovery to begin.”

“Unfortunately, it’s no surprise to see many of these industries on this list,” says Eric Groves, Alignable’s CEO and cofounder. “But these estimates need to be a call to action for business owners, community leaders, and influencers in these industries. While consumer perceptions around personal safety will enable many of these industries to start down a path towards recovery, we’re also going to need a concerted effort to encourage a shift back to purchasing from local businesses for real recovery to begin.”

73% Of Small Businesses Call For Federal Funding Beyond PPP

With the threat of more business closures on the horizon, short-term relief provided by the PPP program, and the significant amount of time needed to change consumer perceptions, the focus may soon shift towards another round of financial relief.

In fact, in this poll, 40% of small business owners say they’ll be out of cash reserves in a month or less.

When asked if they believe the federal government needs to launch another major funding effort for small businesses, a whopping 73% of those polled say, “Yes.”

Many also note the crisis has continued longer than they originally anticipated, and resurgences have set them back. And 54% say their communities have experienced a new round of outbreaks.

Remote Work

JDP recently surveyed Americans who typically work in offices but are now working from home full-time to try and learn more about this pandemic-spurred era of remote work.

Findings

- 77% say they are working different hours from home than they would at the office. 66% say they are more likely to work nights and weekends than before

- 67% say their productivity is the same or better when working from home, although 54% report more distractions working from home

- 42% say they are working less than usual from home.; 33% report working more and 25% report working the same

- Those who are working more say it’s hard to keep boundaries between work and home life as the main reason. Those working less report having less work to do

- A whopping 92% of respondents say they believe their boss trusts them working from home…and 86% say they’ve taken advantage of their freedom while working remotely.

Take a look at the full report.

The Impact of “Paused” Travel on Small Businesses

SAP Concur recently released new survey data revealing 90% of U.S. SMB travelers believe their companies will experience negative outcomes due to pausing travel during COVID-19.

Key findings

- Globally, SMB travelers recognize that travel is important to success, and while they expect to experience a mix of emotions during their next trip, many are excited to get back on the road (31%). U.S. SMB travelers are the most likely to be excited (45%), followed by those from France (34%) and the UK (32%).

- However, 72% of U.S. SMB travelers plan to take action if businesses do not implement long-term safety measures. In fact, 23% will look for a new position, within or outside the company, that does not require travel.

- U.S. SMB travelers feel they’d most benefit from trainings about protecting their health and safety (55%), maintaining healthy habits (47%), and travel preparation best practices (26%).

- 98% of U.S.SMB travel managers were not fully prepared to manage travel during COVID-19.

- When compared to U.S. enterprise travel managers, they were less prepared to get travelers home safely while following quarantine rules (64% versus 49%), provide safety guidelines (64% versus 38%), and determine if it is safe to travel in the absence of government guidelines (60% versus 32%).

- The good news is SMB travel managers are quickly catching up.

- More U.S. SMB travel managers report their companies will implement mandatory travel safety trainings (60% versus 53%), mandatory personal health screenings for travelers (55% versus 36%) and required pre-trip approvals for business trips (53% versus 36%) in the near term.

- 98% of U.S. SMB travel managers expect their companies to implement long-term safety measures for traveling employees, including easier access to personal protective equipment like gloves or masks (49%), travel safety information (49%), and tighter monitoring of individual itineraries (49%).

Also, to help travelers make informed decisions for their trips, TripIt (an SAP Concur travel app) has launched several new features and resources with health and safety in mind:

- Nearby Places: Search feature that makes it easy to find places close to travelers’ hotel, rental car, activity, or restaurant. Starting this month, the tool will also make it easy to find nearby hospitals, clinics, and pharmacies.

- Traveler Resource Center: Online resource that provides public health and safety advisories, booking cancellation and travel policies, and more to help travelers make the best decisions for their next trips.

- Neighborhood Safety Scores: Safety feature that scores neighborhoods from 1 to 100, representing low to high risk, including a Health and Medical score that factors in COVID-19 data.

You can find more information in this blog post.

Customer Experience Drives Brand Loyalty Through the Pandemic

Prior to COVID-19, 54% of consumers say they had a better experience shopping online; however, after enduring nearly three months of COVID-19, 76% of consumers moved to online shopping for items they would typically buy in store. And, 57% of those consumers plan to continue shopping online after the pandemic ends, signaling a potential for permanent change in consumer shopping behaviors. All this according to Sitel Group’s COVID-19: the CX Impact study, which analyzes consumer sentiment toward customer experiences, both before and during the COVID-19 pandemic.

Shopping is not the only area where consumers have increased their desire for digital customer experience (CX) throughout the pandemic. When experiencing difficulty with a product or service, 35% of consumers would now rather find the solution themselves online than reach out to customer service, up 7% since early March. Plus, 43% of both Gen Zers and millennials are nearly twice as likely as baby boomers (27%) to want to find the solution themselves. Additionally, 14% of consumers feel a digital company representative (e.g. chatbot, IVR, etc.) would best understand their request and assist them properly during the COVID-19 pandemic, up 6% since early March, proving tech is key to CX through a crisis.

“The last three months have challenged consumers and brands like never before, and we are all faced with understanding a new reality: How do we shift from adapting to the crisis to driving a success strategy in this future world?” says Martin Wilkinson-Brown, Global CMO at Sitel Group. “In this quickly changing world, customer experience is truly one of the only ways for brands to stay competitive within their industries and now more than ever it’s critical to meet consumers where they want to interact with brands. Our COVID-19: the CX Impact study reveals that brands have a short window of time to construct their plan for the future, and consumers are rewarding innovation over passive action.”

The COVID-19 pandemic has turned the CX industry on its head leaving brands questioning how to move forward and struggling to keep up with consumer demand. While consumers have been more forgiving of brands during the pandemic—only 14% have submitted a complaint, down 18% since early March. And when asked how long it took for the company to get back to them and resolve the issue, 22% never had their issue resolved, up 6% since early March.

Additional findings:

Consumers are Sensitive to the Current Climate When Leaving Negative Reviews

- Just 10% consumers have left a negative review for a brand/company during the COVID-19 pandemic, a dramatic decrease of 30% since early March

- 63% of consumers spoke with a customer service representative (e.g., a human being or digital representative) about the problem they were having before leaving a negative review

- 37% of consumers left a negative review during the pandemic because the product/service didn’t meet their expectations

- 43% consumers would stop doing business with a company during the COVID-19 pandemic if they received poor customer experience, down 30% since early March

Consumers Appreciate the Need to Implement Policies That Negatively Impact Their CX

- 36% view brands more positively because of policies the brand implemented (e.g., longer shipping times, limited hours of operation, etc.) due to COVID-19 that may negatively impact their experience

- 49% have not changed their opinion of brands for implementing these policies, and just 9% view brands more negatively for implementing these policies

Retail Has Been Hit Hard by the Pandemic and Economic Downturn, But Consumers Applaud Their Innovation to Create Better Experiences

- 27% think the retail industry has been the most innovative when it comes to using emerging technology to provide positive customer experiences, up 12% since early March, compared to:

- Banking and financial services (16%), down 11% since early March; telecommunications (15%), down 4% since early March; travel and hospitality (8%), down 6% since early March; and insurance (3%), no change since early March

- The majority of consumers think that order online, pick-up curbside (48%) has most improved their customer experience with brands/companies during the pandemic, compared to virtual experiences (13%), membership freezes or discounts (13%) or corporate social responsibility initiatives (6%).

To learn more about Sitel Group’s COVID-19: the CX Impact study and view additional findings, download the full white paper and supporting reports here.

Americans are Shopping Small

Seven in 10 Americans have experienced a wake-up call to avoid big corporations and shop small during the COVID-19 pandemic, according to new research from OnePoll for Canva.

The study asked Americans how they’ve handled the coronavirus’s impact on their local communities and how they’re supporting each other in this difficult time.

Findings

- 71% of those surveyed say they’re now shifting their shopping habits to supporting small and local businesses rather than big corporations or chains

- 79% says the COVID-19 pandemic has changed their perspective on just how important small businesses are to their communities

During their time sheltering in place, respondents shared they’ve supported an average of 10 small businesses

- 43% say they’ve mostly been supporting local businesses by ordering take-out and delivery

- Over half of those surveyed also say they’re tipping their delivery drivers more than they normally would—up to 28% of their bill

- 40% say they’ve been supporting their local businesses by shopping online

- 38% have been donating money

- 30% are writing online reviews and sharing their local businesses’ social media posts to support them during this time.

Despite their individual support of local businesses, 74% of those polled are worried their favorite local spot may not financially survive the pandemic. And perhaps because of this worry, 77% say they plan on supporting more local businesses once things return to normal.

“Recent months have stressed the importance of acting with kindness and compassion – especially when it comes to supporting our local communities in a time where small businesses are struggling to break even and keep their employees,” says Canva’s Trends and Data Analytics Lead, Dr. Tim O’Keefe.

For most (58%) the business they can’t wait to visit again after the pandemic is their local coffee shop. Another 51% can’t wait to book a reservation at their favorite restaurant and 31% can’t wait to sit down and have a drink at their local bar.

Other top stops after COVID-19 included paying a visit to the hair salon, nail salon and local clothing store or boutique.

O’Keefe adds, “Around the world, we’re seeing millions of small businesses quickly adapt so they can continue operations. We’ve also seen a surge in the use of Canva’s free small business templates, with the creation of takeout menus growing by 66% as restaurants pivot to offering delivery-only, new marketing material to promote how distilleries are now producing hand sanitizer, and the adoption of personalized Zoom background designs for personal trainers running virtual classes. It’s incredibly inspiring to see this positive trend towards innovation, determination and camaraderie across the globe.”

Top ways to support local businesses during COVID-19

Ordering delivery/take-out – 43%

Shop online – 39%

Donating money – 38%

Buying gift cards – 34%

Writing reviews online – 31%

Sharing their social media posts – 30%

Posting about them on my social media – 26%

Top businesses Americans are most excited to visit again after COVID-19

Coffee shop/cafe – 58%

Restaurant – 51%

Hair salon – 37%

Gym/fitness studio – 36%

Local clothing store/boutique – 33%

Bar – 31%

Nail salon – 23%

Are Gen Z & Millennials Able to Save Money?

Travis Credit Union recently surveyed Millennials and Gen Zers to learn more about their money-saving habits and how Covid-19 and the looming recession has impacted their savings.

Findings

- 39% of young Americans have dipped into their savings during Covid-19, using on average 1/3 of their total savings

- The top reasons for using savings during Covid-19:

- Food (70%)

- Utilities (48%)

- Mortgage or rent payments (41%)

- Credit card debt (25%)

- Student loans (22%)

- Car payments(22%)

- Health care costs (19%)

- 73% of respondents say Covid-19 will shape their financial habits moving forward.

- Young Americans plan to improve their financial habits by:

- Curbing their spending (45%)

- Contributing more to savings (43%)

- Building an emergency fund (39%)

- Contributing more to 401K (28%)

Check out the full report.

Small Businesses Relying on Personal Funds During Pandemic

Over one-third of small business decision makers (35%) say they or the business owners have dipped into their personal funds to keep their businesses afloat during the COVID-19 pandemic, according to a new CreditCards.com report. That includes 24% who say they or the owners used a personal credit card and 21% who say they or the owners tapped a personal savings account since March (10% did both).

In addition, 30% of small businesses received Paycheck Protection Program loans from the Small Business Administration, 24% accessed cash from a business savings account, 20% used a business credit card for financing and 9% took out another type of loan. That means 70% of small businesses depended on at least one of the aforementioned funding sources over the past five months.

Unfortunately, it’s not enough to guarantee their continued survival—53% of small business decision makers say they’ll require an increase in sales and/or some manner of assistance to remain in business through the end of the year. Examples include increased sales (32%), government assistance (19%), a loan (13%) and something else (8%).

To meet their growth targets, 64% of small business decision makers say they’ll need at least one of those factors. In this case, 44% are banking on increased sales, 15% are looking for more government assistance, 10% are hoping for a loan and 9% said something else.

“It’s such a tough time for small businesses,” laments Ted Rossman, industry analyst at CreditCards.com. “It’s commendable how far these dedicated business owners are willing to go in search of their dreams. I worry, however, about the debt they’re taking on, and how they’re potentially putting their personal finances at risk.”

The survey found 70% of small businesses have small business credit cards. Among them, the most popular benefit is rewards (45%, including 28% who said cash back and 18% who said travel), followed by convenience (23%) and a low interest rate (10%).

Get informed—Advice

The ‘Musts’ To Make Meetings Safer in the Age Of COVID-19

Guest post by Dr. Richard Arriviello, Chief Medical Officer, InHouse Physicians

Corporate meetings and industry events, so much a part of the American business ecosystem, remain on hold, have been postponed, or have been cancelled altogether. When they will happen again is anybody’s guess.

COVID-19’s spikes in many states have prompted pauses and rollbacks to business re-openings and put large gatherings farther into the future. But at the same time, the uncertainty gives event planners and business leaders more time to learn how they can protect and monitor the health of large numbers of people when it is deemed safer to hold such events.

By nature, travel and mass gatherings at conference centers or hotels are high-risk for getting sick. The ultra-contagious coronavirus, resulting in a world-wide pandemic that now finds the U.S. as the epicenter, continually reminds us that there is no definitive playbook to combat it. And there is a palpable anxiety and outright fear people have now, and will continue to have, until an effective vaccine is approved.

So, whenever meetings finally resume, planners will need to have a plan in place for protecting their attendees, reducing the risk of infection spread, and providing every stakeholder with the resources they need without fearing for their health. Essentially, we need to re-establish health security in the meetings industry and doing so means applying three main principles from which a sound plan can be formed.

Prevention. There are certain things you must do to prevent illness at a meeting. They include seating configurations that allow for social distancing, sending out communications about all the protocols, encouraging frequent breaks for hand washing, and disinfecting surfaces more frequently in heavy-traffic rooms. Hotel staff should guarantee the cleaning of each meeting room between each meeting, including the cleaning of all chair/table surfaces and spraying the room before the next group arrives. Also, you need the ability to provide PPE or work with a vendor to procure masks and gloves for those who will still be on edge about attending.

Detection. If you’re a forward-thinking company that’s going to hold meetings this fall or in the winter of 2021, you will have to deal with sick attendees. They may have the seasonal flu, a cold, or they may have COVID-19, and you need to plan accordingly. It starts with giving temperature checks at the beginning of each day, temperature checks at general sessions, and temperature checks when people are registering at the conference.

If there are people at the meeting showing flu-like symptoms, it’s a must to find out whether they have COVID-19 and providing access to rapid COVID-19 testing. The testing doesn’t necessarily have to be on site; if not, find a local resource to do the testing.

Response. If some attendees are sick, meeting organizers need to know how they will handle that. It’s advisable to come up with a strong sick-attendee policy that’s enforceable and that can be monitored. That means if one is sick, they don’t attend the meeting, or if at the meeting they must go back to their room. If testing is positive for COVID, they have to be quarantined. Who did they come into close contact with while at the meeting? Those people, too, will need to be tested.

Remember, communication is extraordinarily important at a large meeting – now more than ever. You may want to have somebody dedicated to that role, putting informative and honest content together. Attendees must be told the facts, such as what the COVID situation is at that time in the U.S. and in the city where the meeting is held. Give people the opportunity to ask questions and address them. Conference planners are not medical experts, so it’s helpful to guide attendees to appropriate websites that can update them on the virus and safety precautions.

What the meetings industry needs to start accepting is that pandemics now happen more frequently – we’ve had two in the first two decades of the 21st century. It’s an industry always vulnerable to illness. Therefore, the industry should adhere to the principles above and develop consistent strategies to reduce that vulnerability, and in future pandemics we won’t have such a decimation as we’ve seen with the industry in the past few months. It will take an industry-wide effort of getting leaders to work together and create standards.

How Long til “Normalcy” Returns?, The Impact of PPP, Challenges of the Lockdown

By Rieva Lesonsky

Coronavirus Business Update

Programs

Micro-Grants for Women of Color Small Business Owners

Women on the Rise NY, Inc. dba HerSuiteSpot in partnership with the Yva Jourdan Foundation, Inc. have provided micro-grants to women of color entrepreneurs since 2017 as a way to assist them in starting or growing a business.

Now they’re helping the HerSuiteSpot community with a micro-grant fund called HerRise Micro-Grant. HerRise Micro-Grants will award 20 cash grants at $500 each to qualifying women of color owned small businesses experiencing financial hardships due to COVID-19 in a three round micro-grant giving event.

Applications are open through August 31, 2020. See the website for a full list of eligibility criteria and more details on the application process.

The 7th Annual Women on the Rise Forum & Expo is now going virtual and is scheduled for 10/10/20.

The Yva Jourdan Foundation is seeking to raise funds for the micro-grants totaling $50,000. For donations and sponsorship please contact Marsha Guerrier.

Tools & Resources

Check out the Small Business Booster Kit from AdRoll. It’s full of free tools, resources and content.

Reports, Polls & Surveys

BizBuySell Insight Report

Small business transactions dropped 39% in the 2nd quarter of 2020 according to BizBuySell’s Insight Report—the largest year-over-year decline since the Great Recession, when transactions dropped 50% in the 2nd quarter of 2009.

According to the Report, “The second quarter of 2020 began with government mandated shutdowns postponing deals as owners focused on maintaining operations while buyers waited for the dust to settle. Lack of clarity over which businesses were ‘essential’ versus which were required to close and for how long made for an especially challenging market.”

During the first week of July, BizBuySell surveyed thousands of small business owners and buyers to learn how the pandemic had impacted their business or buying decisions. According to the survey, 20% of business owners closed their doors as a result of the pandemic and another 32% suspended partial operations.

Fearing the worst, many buyers paused their search. Others who wanted to move forward couldn’t because lenders froze loan approvals. BizBuySell says, “This dynamic combined with dried up cash flow for impacted businesses complicated short-term exit plans and resulted in some owners pulling their businesses off the market.”

Jay Offerdahl, President of Charlotte based Viking Mergers & Acquisitions, described the situation as a “giant pause”, with fear of the unknown paralyzing all parties. “Buyers and lenders didn’t want to close, while sellers would panic at any hesitancy and immediately want to find another buyer,” says Offerdahl.

By July 71% of the surveyed owners who were forced to close have resumed operations. BizBuySell says, “Entrepreneurs are pivoting, adapting, and seeking opportunity amidst the disruption brought on by the pandemic, and as a result, acquisitions are steadily bouncing back from April lows.”

After a 51% year-over-year decrease in April transactions, consecutive 12-point gains in May and June shrank the deficit to 39% and 27% respectively. Over the same period, the number of buyers searching and inquiring about businesses on BizBuySell recovered then eclipsed pre-pandemic levels.

“The panic changed toward the end of May. At that point, we understood what we were dealing with, and the appropriate way to view financials in light of it,” says Offerdahl. “Demand recovered, listings started to return, and deals were happening again.”

There’s a ton of great info in this report. You can read the whole report here.

For Many Businesses Normalcy is a Ways Off

More than half of business leaders (53%) expect their companies to return to normal in the next 12 months, according to JPMorgan Chase’s Business Leaders Outlook Pulse Survey. They remain hopeful even though most (83%) are running at a reduced capacity, 68% are confident their businesses will thrive and only 2% are concerned their businesses may not survive.

Looking ahead to the next six months, 56% are optimistic about their companies, but confidence dwindles on broader levels. They’re optimistic about their local economies (33%) and the national economy (35%). But their confidence in the global economy is considerably lower at 17%.

According to the survey, as a result of this year’s disruptions, these are the top five actions business leaders are taking:

- Conserving capital for unforeseen needs:87% of business leaders have already built up their cash reserves or plan to do so in the next three months. Not surprisingly, 71% have either reduced their spending on capital expenditures or are planning to do so.

- Learning from the crisis:With continued uncertainty around economic conditions and a potential second wave of COVID-19, 82% have already prepared or are planning to prepare for a similar event in the future.

- Managing business finances digitally:59% have either already increased or plan to increase their use of digital banking and treasury management tools to manage cash flow, send and receive payments, and streamline operations.

- Implementing permanent changes to operating models:As a result of turning to remote working solutions, 56% have already made permanent changes to their operating models or plan to do so in the next three months.

- Shifting the business online:54% have also shifted more of their operating models to be online or plan to do so, as a result of pandemic-related closures and shifting consumer habits.

While many business leaders are cautiously optimistic about the future, they’re faced with the realities of an unpredictable operating environment. Their top three challenges are:

- Uncertain economic conditions:70% of business leasers cited economic uncertainty—both domestically and globally—as the leading challenge facing their business operations.

- Revenue and sales growth:59% of business leaders are concerned about growing sales, though with certain industries seeing an uptick in demand, 47% reported that they’re expecting an increase in revenue and sales within the next six months.

- Shifting consumer habits due to COVID-19:The pandemic saw more consumers turning to e-commerce technology for purchasing, in addition to spending more conservatively overall. Changing consumer habits is a leading concern for 33% of business leaders.

Businesses should keep the following top-of-mind when navigating the rest of 2020:

- Harness the power of workplace technology.COVID-19 has accelerated the evolution of remote working, and now is the time for businesses to implement digital tools to enhance productivity. Learn more here.

- Enhance digital security protocols.Business email compromise (BEC) is among the most serious threats that face businesses—particularly in times of crisis. Learn how to prevent BEC and other types of fraud here.

- Proactively prepare for future disruption.Recent events have reinforced that businesses across industries and of all sizes should have solid business resiliency plans in place before crises happen. Learn more here.

Read more about the 2020 Business Leaders Outlook Pulse Survey.

State of Small Business

Alignable’s State of Small Business Report for July was released earlier this month.

Here are a few highlights:

National Fear Of Re-Closing Up 41%: The fear of needing to re-close again due to outbreaks has skyrocketed to 41%, up from 17% in May to 24% in late June. And while that fear is higher in FL & TX, those small business owners are even more worried about customers being too afraid to return.

Impending July Cash Crunch: Though fears about re-closing and apprehensive customers are pervasive, the No. 1 worry among SMBs is running out of cash.

- 43% of PPP loan recipients say they’re almost out of money.

- Worse yet, a whopping 69% of small businesses that never got federal funding say their cash reserves could be gone by July’s end.

- For many minorities, those numbers are even higher.

Hiring’s Up, But Revenues Grow More Slowly

- 77% of small business staffers are back on the payroll (up 19% from May). That’s a great sign.

- But 49% of the owners say they have less than half of the revenue they had prior to the pandemic.

Those are just a few insights shared in the July report. Read the rest here.

Top 50 Cities Seeing the Most E-Commerce Adoption

Square recently released the Rise of eCommerce report, exploring how sellers in cities large and small embraced e-commerce in an effort to continue serving their customers in recent months. The report lists the top 50 cities that saw the largest percentage increase in new ecommerce sellers, includes insights from businesses on the front lines of this transition, and shares predictions about the road ahead from Square’s head of eCommerce, David Rusenko. The key takeaway—e-commerce is here to stay.

To see which cities made the list (the #1 city surprised me), and learn more about how online selling is helping sellers of all sizes adapt to COVID-19, click here.

Impact of PPP

Gusto released an initial impact of PPP on small business in America (the analyzes hiring trends through mid-June).

Key Report Findings from Gusto’s PPP Report:

- Hiring rates are ramping up: Hiring and rehiring rates in late April through early June were nearly twice as high for companies that reported receiving PPP loans compared to those that did not (34.2% versus 18.4% hired at least one employee during this period).

- Bridging the gap: Federal loan programs helped small businesses with their April and May hiring efforts, but not enough to make up for the deep job cuts they made in March. Businesses that reported receiving a PPP loan were more than twice as likely (+139%) to rehire at least one employee from the last week of April through mid-May than businesses that did not. However, these companies were also still 65% more likely to terminate at least one employee during that same period.

- The first cut is the deepest: Businesses that received PPP loans were those that made the deepest job cuts before the CARES Act passed in late March ‘20. Despite higher rehiring rates for employees that were terminated between the onset of the COVID crisis and the beginning of PPP loan payouts, the percentage of employees that were out of work is still higher for PPP-receiving companies (86.9% of employees were still employed as of mid-May versus 89.6% for companies that did not report receiving a PPP loan).

Summary of Report: In their analysis of the report Gusto says that PPP aid has helped to provide stabilization from the initial free fall in March, with strong increases in hiring and rehiring beginning in the second half of April.

But the report also shows PPP aid has not yet been enough to create a return to pre-COVID-19 employment levels. New legislation passed by Congress extends the timeline and eases restrictions on how funds are used, which may help to speed up initial recovery efforts.

Even with these changes, small businesses remain in a race against the clock to set up shop, rehire employees, and take care of fixed costs beyond payroll. And they still must navigate varying timelines for full reopening. In addition, most of the businesses that received PPP funding will have spent their PPP funds within the next few weeks while many of these businesses are still only able to partially operate.

Other recent Gusto data of interest:

- Wages are being cut at a high rate. According to specific data they shared with the Washington Post, (see this article on wage cuts): “Pay and hours have been cut in nearly every sector, according to payroll processor Gusto, but white-collar industries such as finance, tech and law have seen things turn south most rapidly….Both small and large companies have been cutting pay. In data shared with The Post, Gusto found almost a third of small businesses had cut some workers’ pay or hours by at least 10 percent in May. That includes 9.5 percent that reduced pay for at least one employee, and 22 percent that cut hours.”

Effects of Lockdown

Tech.co surveyed small businesses about how they’ve managed during the lockdown. As the initially started to ease they were interested in investigating the challenges small businesses have faced due to the Covid-19 pandemic.

Findings:

- 80% of small business owners said Covid-19 has had a negative impact on their business, yet 55% are feeling very positive for the future

- 100% of respondents have been using lockdown to build their businesses, with the majority focusing on marketing, connecting with customers, and upskilling.

- 76% have upskilled during the lockdown—with SEO, social media, learning a new language, and data analytics as the most common new skills to learn.

The businesses surveyed were from a mixture of industries, but the most common sectors were B2B services (28%), beauty, health & wellbeing (18%), retail (18%), software/ tech (7%), and travel (5%).

Challenges faced

The most common challenges to businesses were fewer sales (54%), followed by having to reschedule product launches and events (54%), struggling to pay staff and business costs (18%), and affecting investment opportunities (18%).

Business activities

All respondents surveyed say they had used their time under lockdown productively to grow their business.

Most have focused on what they can offer online, and building up their digital marketing strategies, with creating new content (88%) and online offers (60%), holding or attending online events (60%), connecting with customers (57%), and upskilling (55%) as the most common things to do over lockdown.

Some had positive outcomes as a result of COVID-19, including an increase in online sales, having more time to focus on marketing, growth in their mailing list, learning new things, new product launches, and getting to know their customers better.

The most common new skills for people to develop were learning SEO (25%), social media (13%), learning a new language (3.2%), data skills (3.2%), and PR (3.2%).

Using technology

Technology has played a crucial role in business success over this time. Zoom, WhatsApp, and email were the most common ways to communicate with staff, and social media marketing, email marketing, web conferencing, and having an online website or store were the most beneficial forms of technology. The majority have used lockdown to update their website, with 60% tweaking their current site and 25% building a new one.

For advice from some business owners, see Advice section below.

Financial Consequences for Businesses Suffering COVID-19 Related Data Breaches

Since the onset of COVID-19, the FBI’s Internet Crime Complaint Center, the IC3, reported a significant uptick in cybercrime targeted at individuals, businesses and government agencies. To better understand consumer sentiment around data security amid the pandemic, PCI Pal®, the global provider of secure payment solutions, recently conducted a survey of North American consumers. The research found that a staggering 64% of Americans and 68% of Canadians would avoid buying from a company that had suffered a COVID-19 related data breach for up to several years. Another 17% of Americans and 24% of Canadians said they would never return to the business.

“Cybercriminals are shamelessly opportunistic and growing alarmingly sophisticated. Capitalizing on the remote working situation and growing consumer fears around the pandemic, hackers are working around the clock to steal data for profit. With North American consumers rightfully holding businesses accountable for lax data security practices, businesses must meet the highest compliance and security standards if they want to build and maintain customer loyalty,” says Geoff Forsyth, Chief Information Security Officer, PCI Pal.

Surprisingly, only 38% of Americans and 40% of Canadians expressed more concern about companies handling their personal data securely since COVID-19. And 57% of Americans and 56% of Canadians report having the same level of concern around data security as they did before the pandemic hit. With the Identity Theft Resource Center reporting a 17% spike in data breaches in 2019 from 2018, these figures suggest that North American consumers are experiencing data breach fatigue.

When it comes to shopping with businesses operating remotely as a result of COVID-19, 76% of Americans and 83% of Canadians expressed concerns around sharing payment details or conducting financial transactions. As COVID-19 related scams proliferate, these figures suggest that businesses must be vigilant in protecting consumer data, in particular, bank account details and credit card numbers—further evidenced by data from Experian which found that 31% of data breach victims have their identity stolen.

“As organizations continue to adapt to the changing business and threat landscape, it’ll be crucial to prioritize data security,” says Forsyth. “This will include adjusting business models to meet the highest standards of security and compliance across all customer engagement channels.”

Are You Future Ready?

While the COVID-19 pandemic has had an enormous effect on companies globally, today’s leading businesses (of all sizes) are adaptable and people and purpose focused, according to a major new study from Vodafone Business. The Future Ready Report identifies the attributes of the most resilient ‘future ready’ organizations and their responses to common business challenges before, during and beyond the COVID-19 crisis.

For example, while nearly half of all businesses studied report profits are down now compared to last year, 30% of “future ready” businesses report an increase.

“Future ready” businesses (FRBs) can be identified by six unifying characteristics, including adaptability, an openness to technology, and clear transformation goals. The report also found:

- Employees have taken center stage, particularly for FRBs:

- 44% of all businesses now prioritize employee wellness and mental health, up 10 percentage points since before Covid-19, but for FRBs this is 77%.

- 90% of FRBs reported supporting their employees further during the pandemic.

- Societal attitudes and consumer expectations have changed, and businesses have moved to focus on ethical behaviors or to find a purpose beyond their core offering:

- During COVID-19, 81% of organizations reported taking some form of action to support those outside their business, compared to 94% of FRBs.

As businesses continue to adapt to new challenges, Vodafone Business also recently launched V-Hub, a resource service for SMEs looking to digitalize, to support small and medium businesses as they rebuild. The service offers SMEs access to articles, guides and live help covering topics such as website construction, cyber security, remote working and digital marketing.

You can read the full report here.

Consumers Upbeat About Travel Post COVID-19

Flywire recently released new research showing very strong consumer demand for travel post coronavirus crisis. The interactive report, Bouncing Back: Consumer Views on Traveling Again, is based on an independent survey of adult leisure travelers from the United States, Canada, United Kingdom and Japan. The research looks at the impact of the coronavirus crisis on consumer travel plans and their expectations of travel providers to encourage more travel.

Few industries have been hurt by the coronavirus crisis as much as travel. Worldwide GDP loss could be as much as $2.7 trillion in 2020 according to the World Travel & Tourism Council. Direct travel spending in the U.S. alone is expected to decline by $519 billion.

Despite a bleak financial outlook, travelers are optimistic about the industry, according to Flywire’s new survey. This suggests a resurgence of the industry when travel options return; 93% of respondents are confident the industry will still be here after the pandemic is over and 69% plan to travel again when it does. For 74%, just thinking of traveling again while they are self-isolating is keeping them going.

Additional findings from the report include:

Consumers are ready to spend on travel again. Over half of the travelers surveyed say they will spend the same on travel for the remainder of this year/next year as they did last year, while one in five will increase their budget. 55% plan to stay in their own country for their first trips. The types of vacations planned include the beach (38%), visiting family and friends (36%) and city vacations (23%).

Adventure travelers are looking for more adventure. Of those consumers who have traveled for adventure in the past 12 months, nearly half say their first trip will be another adventure experience. Specific preferences vary widely—from exotic (13%), camping (13%), hiking (11%) and general adventure (7%) to skiing (4%), safari (3%) and biking (1%).

The payment experience matters to consumers. 88% of those surveyed say ease of payment is important to their overall travel experience with almost half (48%) saying it is very important. 66% said that the payment experience impacts their choice of travel agent or tour operator. This suggests that ensuring a seamless payment experience can directly impact revenue for travel agents and operators as they try to bounce back.

Travel correlates closely to well-being. 73% of travelers across all countries had a negative feeling as a result of not being able to travel, and 70% say not traveling means they are not able to make new and/or special memories. Being stuck at home is taking an emotional toll. Over one-third (35%) of consumers surveyed say not traveling now makes them feel sad and/or depressed while one-quarter said it makes them feel isolated and/or anxious.

On the positive side, over four in five (82%) say traveling is a way to calm their soul and 72% say the opportunity to travel again gives them something to look forward to.

Consumers are pleased with the travel industry’s response, but they also expect more.

Overall, consumers feel the industry has responded well with 77% saying the industry is doing a great job considering the circumstances. On the flip side, 88% of those surveyed say the travel industry needs to be more flexible in dealing with changes and cancellations. Hotels received the highest grades for their response while cruises and airlines were viewed as the least responsive.

How Tech Leaders are Handling Leadership and Influence

Americans are now spending an additional 30% of their day online, according to a study from Search Engine Land, (up from 25% of their day in 2019, per Pew) and CEOs need to adapt to reach them,.

Sutherlandgold tracked 10 influential CEOs from Fortune’s 40 Under 40 list to see how they went about raising their visibility and engaging their digital audiences (both before and after the pandemic).

Here are 5 major insights:

- Event cancelations hit CEOs hard: They found 7 of the 10 leaders shared their thought leadership primarily by speaking at events. Once the pandemic hit, 50% of the CEOs tracked embraced virtual events but did not significantly increase the visibility of their original thinking via byline articles, blog posts, videos, or podcasts.

- Twitter was immediately leveraged: As soon as the pandemic was announced, 70% of the 10 high growth CEOs with Twitter accounts increased both their follower count and added to their total number of tweets. Having an active social media presence is an invaluable advantage in times of crisis. Leaders who transparently and consistently communicate the state of their business are able to build trust, loyalty, and visibility for their employees and brand.

- Yet LinkedIn was forgotten: Surprisingly, only 2 out of the 10 CEOs tracked contributed articles or engaged audiences via LinkedIn. This is an open opportunity, as LinkedIn is the #1 professional network for B2B companies, and approximately 80% of the 100+ CEOs surveyed preferred LinkedIn for engagement and reaching investors.

- Social media? CEOs do it themselves: Engagement on social media is mission-critical to CEOs at startup companies. More than 80% of CEOs from their online survey say they manage their own social media presence, while 18% say an employee or outside agency manages their social media engagement.

Get informed—Read it!

Will Americans Sue Small Businesses if Exposed to COVID-19?

A Yahoo-Finance Harris poll from Yahoo Finance shows less than a third of Americans say they would sue a business if they were exposed to COVID-19 while visiting the establishment, according to a new Yahoo Finance-Harris poll.

Almost one-third (30%) of those surveyed earlier this month say they would be likely to sue the business—18% say they’d be “somewhat likely” and 12% of people say they would be “very likely” to file a lawsuit. And 70% of respondents said they would not be likely to sue.

Americans are a little more likely to sue their employers: 34% of respondents say they would be likely to sue their employer if they were exposed to COVID-19 at work.

Read the report.

Battle Over Vacation Time

The Wall Street Journal covered the current battle between employers who want their employees to take their vacation time and workers who don’t want to take the time since they can’t really go anywhere.

Zenefits vacation data used in the report—it showed requests from 3,000 companies for vacation in April and May were significantly down compared to the same period last year—63,000, compared to 120,000 in 2019.

The Future of Sales and AI

A few stats from the Selling Forward: The Future of Sales & Marketing Research Report were interesting:

- 84% of respondents feel that teams are as productive or even more productive when selling remotely as they were in the office

- 22% report there will “never be a complete return to in-office working”

- More than 75% feel optimistic about their economic outlook in the future

- 70% expect a rebound in 2020 or have not taken any hit to their revenue

Read the report from ringDNA.

What Gen Z Expects from Business During the Coronavirus Pandemic

There are a lot of reports worth reading from The Ambassadors Company, including one about what Gen Z wants from businesses in the age of COVID-19.

Get informed—Advice

Hotel Industry Releases Top 5 Requirements to Travel Safely

The American Hotel & Lodging Association (AHLA) today released the “Safe Stay Guest Checklist” for guests on how to travel safely while also creating a standardized safety experience nationwide. This checklist is part of AHLA’s Safe Stay guidelines, an industry-wide, enhanced set of health and safety protocols designed to provide a safe and clean environment for all hotel guests and employees.

The Safe Stay Guest Checklist includes:

- Require face coverings in all indoor public spaces and practice social distancing in all common areas.

- Choose contactless options, where available, including online reservations, check-ins, and payments.

- Consider daily room cleaning, only if necessary. Ask the hotel about your options.

- Request contactless room service delivery.

- Refrain from traveling if you have, or recently had, any symptoms of COVID-19 or contact with anyone diagnosed with COVID-19.

To further expand the hotel industry’s Safe Stay initiative, AHLA also recently launched COVID-19 Precautions for Hotels, an online course developed in partnership with the American Hotel & Lodging Educational Institute(AHLEI) to help hotels train their staffs on the enhanced safety and cleanliness guidelines.

Advice for Small Businesses

In the Tech.co report mentioned above, many small business owners offered advice to other entrepreneurs. Check it out below:

Pivot and prioritize: Prioritizing what you are good at and knowing what works was mentioned by several respondents:

Joseph Hagen, Streamline PR: “Use this time to sharpen what you are already good at”.

Dennis Vu, Ringblaze: “Focus on your strengths, don’t experiment too much. Do more of what works for you in terms of customer acquisition and focus on that. For us, that has been email marketing and we’ve doubled down on it.”

Sara Price, Coaching Service Actually: “Get the balance right between cutting costs and investing in the future. See this as an opportunity to engage, build trust and loyalty.”

Test new things & be agile: Others says now is the best time to be agile, and develop and test new things on your audience, particularly in a time of uncertainty.

Lottie Boreham, BOOST&Co: “Agility is key, things are moving so quickly all the time that you need to keep an eye on the news and trends and respond fast.”

Michaela Thomas, The Thomas Connection: “Take a step back and strategize, to use your time wisely. Test out new offers on your existing customer base, tweak them, and then do an imperfect first round.”

Kim Allcott, Allcott Associates LLP: “Look for opportunities that are unique to the situation. We’re making the most of the lockdown period by providing free building advice from the company partners”

Reach out and get to know your customers. The importance of knowing and understanding your customers and their needs cropped up a lot in the advice given by businesses. Use the lockdown to really focus on building customer retention strategies.

Kim-Adele Platts, Executive Coaching: “It might seem counterintuitive but really lock down your niche, define your absolute ideal customer the one you are perfect for. Think about them and their current challenge. If you were in their shoes what would you be looking for right now? Then make sure your product or service clearly talks to that solution. We make the mistake of talking about us when we need to be talking about and to our customers.”

Jon Davis, Medius: “From a B2B perspective, I think it’s important to maintain contact with your customers and let them understand that you’re there to help and support them through this challenging period. So whether that’s producing helpful content to navigate the crisis, or reassuring clients services are at their disposal to help cope, it’s important to open dialogue early and to continue talking to your client.”

Calypso Rose, Indytute: “Talk and make connections with your customers. Find out what they want you to do to help their situation. Use this time to create content that is good for now and for the future as this period of time won’t be forever.”

Focus on Marketing. In times of economic downturns, companies often have to make cuts. Often, it’s the marketing and advertising budget that is cut. However, many respondents pointed to the continued importance of getting your marketing right.