With uncertainty roiling the markets and doubt about when our economy will fully re-open in the ways that we are used to, businesses are scrambling, cutting back, and maybe even closing their doors for good. If you’re an entrepreneur, chances are that you’re deeply concerned about what all of this means for you – and wondering how much risk you are willing to take. In fact, the definition of an entrepreneur is “one who initiates and takes risks,” so success comes when you manage risk wisely.

Getting Comfortable With Uncertainty

The first step in managing risk is getting comfortable with uncertainty. As human beings, we feel instinctive motivation to seek safety and survival – so change, unpredictability, and volatility make us uncomfortable. But these are also the precise conditions that present opportunities if we are able to embrace the risks. Some things we know. Others we don’t know, but can find out. And there are still other things that no one knows. That’s uncertainty.

People often think of risk as exposure to injury or loss. But this definition fails to include the benefits of taking risks such as exposure to success, achievement, joy, and meaning. We live in a world that is full of uncertainty, and as much as we want to feel that we are in control of everything, we need to understand the difference between certainty and uncertainty and use that understanding to our advantage. Among the many uncertainties in life are: the weather, the stock market, interest rates, governmental actions, natural disasters, commodity prices, and other people’s thoughts and actions.

Once you understand the things you can control, you then create a plan to deal with the worst-case scenarios. What’s the worst that can happen if you take a risk and it doesn’t work out? If the worst-case scenario is that you are financially ruined, then it’s not a risk worth taking. On the other hand, if the worst-case scenario is that you suffer a tolerable loss, but a gain is a much likelier outcome, then it might be worth taking that risk. After you’ve examined worst-case scenarios and accepted their possibility, risk doesn’t seem so scary. That’s how to get comfortable being uncomfortable.

Mitigating Risk

Several years ago, my family and I were on safari with a young South African guide and his experienced tracker, who sat on the front of the vehicle to look for footprints and other signs of wildlife. Our guide told us this person was one of the best lion trackers in all of South Africa, so I watched him carefully.

When other guides walked out into the bush, they carried their rifles, but this tracker brought only his eyes, ears, and brain. When I asked him how he avoided danger, he said, “When I follow an animal’s tracks, I keep my head up to look and listen for signs of danger, and I keep my head down because I don’t want to find a foot in the track!” This lion tracker had just explained the key to managing risk—you pay attention to the big picture (head up) and the little picture (head down)!

There are five ways that I have learned to mitigate risks:

- Fundamental position

- Diversification

- Ripcord

- Alignment

- Stable and unstable equilibrium

Fundamental Position

As a high school football player, one of the first things I learned was on defense you always had to be prepared for anything. We called this fundamental position, which we defined as follows:

- Both feet solidly on the ground at shoulder width.

- Both legs bent slightly, ready to spring into action in any direction.

- Both arms hanging straight down, hands just above the knees, ready to shed a block or make a tackle.

- Head up and eyes alert.

Fundamental position is another perfect model for managing risk. Like the lion tracker, be alert and ready for anything.

Diversification

Another popular risk-management tool, often applied to portfolio theory, is diversification. The theory here is that different asset classes (e.g., bonds, stocks, real estate, and energy, etc.) are not correlated and move in different directions at different times. The principle of diversification is a good one and can be applied to every aspect of your business and your life. By having more diversity, you are less dependent on any one thing, and your total portfolio is safer.

Ripcord

In business, the best risk managers have an exit plan for each major risk they take. At Amazon, they call it the double-swinging door. What they mean is that for every door they walk through (risks they take), they need the ability to turn around and exit. Amazon takes a lot of large risks, but they always have an exit plan to limit their losses if things go badly. Then they do their best to make it work.

Early in my career, I worked for a major apartment developer, Trammell Crow Residential. We followed a similar strategy to the double-swinging door which we called the “ripcord.” For every investment we made, we limited our liabilities and negotiated an exit strategy. If the deal went poorly, we made sure we had a ripcord (exit plan) that we could pull to minimize our losses and parachute to safety. The real estate developers who didn’t practice this principle ended up being victims of the recession.

Alignment

One of the less-talked-about risk-management principles (which I didn’t really learn until late in my career) is the power and safety of alignment. By alignment, I mean having your goals and values aligned with the people with whom you associate in your business and personal life.

In the homebuilding business, our values were clear—quality, customer service, and profits—so alignment with our trades was usually pretty good. But getting alignment, especially when developing partnerships, isn’t always easy. As they say, the translation of joint venture in Japanese is “same bed, different dreams,” so it’s important to have the same dreams as your partner. I have learned you can take risks with markets but not with people. Dealing with people of integrity is always the first priority.

Friends, Enemies, or Strangers

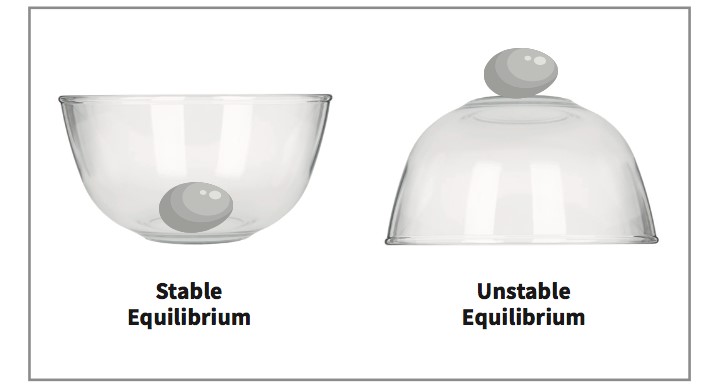

There is one last concept of risk I would like to share with you. This is actually a physics principle that can be applied to business. It is best explained by these two images of an egg and a bowl:

Both images show two stationary objects at rest and in equilibrium. Under stable equilibrium, the egg can be moved, but it returns safely to equilibrium. Under unstable equilibrium, if the egg gets moved, it crashes to the floor and makes a big mess.

Both images show two stationary objects at rest and in equilibrium. Under stable equilibrium, the egg can be moved, but it returns safely to equilibrium. Under unstable equilibrium, if the egg gets moved, it crashes to the floor and makes a big mess.

One way to stay in stable equilibrium is to do business and have relationships with people you know and trust. In life and business, we have three choices: We can interact with friends, enemies, or strangers. If we choose not to interact with friends and people we trust, then we are depending on enemies or strangers, which is essentially unstable equilibrium.

We can all avoid unnecessary risks and are much safer in a stable equilibrium. So try to avoid putting yourself in a vulnerable position where a small vibration could create a large problem.

Always Get Back Up

You can’t be an entrepreneur without taking risks and sometimes failing. I advise you to be the one who strives, who takes smart risks, and gives it your all. And when you lose, as you sometimes will, get right back up and into the arena. That’s not just the best way to succeed in business, but an important way to find happiness and fulfillment in life.

T.W. LEWIS is the founder of T.W. Lewis Company, an award-winning Scottsdale, Arizona based real estate and investment company known for its quality and outstanding customer service. He is a graduate of the University of Kentucky and received his MBA from the University of North Carolina. Lewis received a Lifetime Achievement Award from Professional Builder Magazine and was the first inductee into the National Housing Quality Hall of Fame. In 2002, Lewis and his wife Jan formed T.W. Lewis Foundation to support higher education, children and families in need, youth character education and a variety of local and national non-profits that strengthen Americas’ civil society. In 2015, they created the Lewis Honors College at the University of Kentucky, and in 2019, they established the T.W. Lewis Center for Personal Development at Arizona State University’s Barrett Honors College. For more information, visit: www.solidgroundbook.com.

Managing risk stock photo by Olivier Le Moal/Shutterstock