In the lifetime of small- to medium-sized businesses in the U.S., economic disruption is inevitable. While leadership may prepare for unknown risks and potential problems within their business models, oftentimes unforeseen crises can take a heavy toll.

The severity of economic disruptions caused by the COVID-19 pandemic has created a unique demand for financial assistance in such businesses. Impacts to sales and cash flow, along with maintaining functions running under the “new normal,” is at the forefront of interest for business leaders.

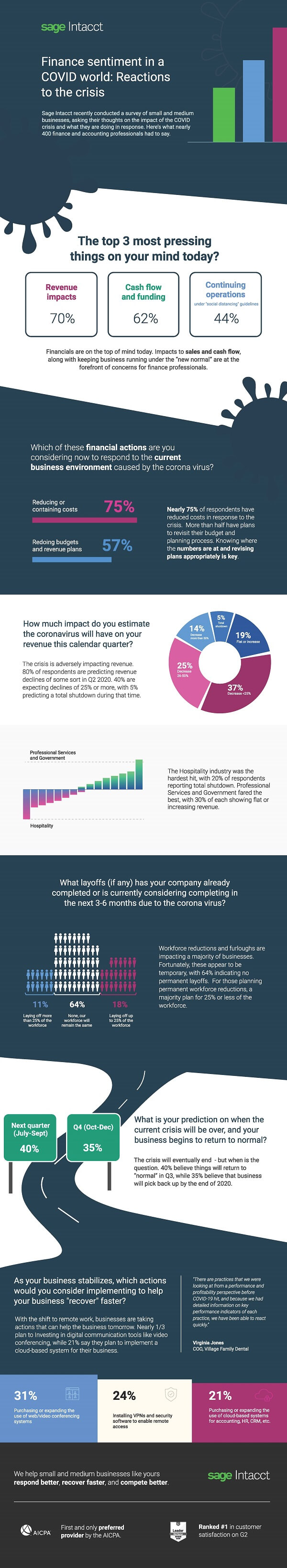

Sage Intacct surveyed nearly 400 finance and accounting professionals for insights on the impact of COVID-19 on SMBs and how they are responding to the crisis. While responses across industries differed slightly, all are working to take measures that protect themselves and their employees.

Financial Planning Around the Current Reality

Proper planning for what’s to come requires finance professionals in small- and medium-sized businesses to look at initial losses and anticipate where more losses may occur in the long-term. Within Sage Intacct’s survey, more than a third (37%) of finance leaders predicted a decrease of up to 25% of their revenue, with one-fifth of business professionals expecting revenue hits of more than 50% – and the possibility of a complete shutdown.

Managing these potential losses and avoiding a complete hemorrhage of funds is one of the main focal areas right now for finance teams. As such, many are looking to reduce costs within their business (75%) or revising wider revenue protections (57%), while focusing on budget planning for the future.

For finance teams, staff retention is especially important since hiring new talent in the aftermath of this crisis may be more burdensome than protecting loyal employees, due to the inherent cost of onboarding. Nearly 64% of respondents expressed they are hopeful they will not have to lay off staff permanently over the next 3-6 months. Of course, employees are essential to business functions at the most basic level, so furloughing and laying off staff has naturally become a last resort.

Utilizing the Paycheck Protection Program (PPP) to Assist with Immediate Cashflow

Government intervention, while not always the first option to be pursued, has become a necessary solution during COVID-19 – with most resorting to the federal Paycheck Protection Program. As bottom lines are disrupted, the loan, designed to mitigate the economic impact on companies with 500 employees or less, has become increasingly important for SMBs to utilize.

The PPP helps companies by providing them with a safety net of funds beyond emergency savings. Most significantly, these loans will be forgiven if they are used to keep employees on staff or for rent, mortgage interest or utilities. Due to the extent of the crisis, the program is reworking to provide more flexibility in how companies can spend the money, and the timeframe in which they can use it.

Of all industries, construction/real estate and hospitality were among the most likely to apply for this program, with financial services and government the least likely to apply. Not surprisingly, as one of the hardest hit industries, nearly one-third of the hospitality firms responding to the survey had requested PPP loans in excess of $5 million.

Planning for the Future

Small businesses can take this time to plan for the future, and further secure themselves when revenue picks back up again. While it may be challenging to look ahead when so much is left unknown, there are several factors that can be acknowledged and used for small businesses to thrive in what will become the “new normal.” As a result, many small- and medium-sized business finance professionals are largely preparing to invest in technological solutions to enable greater productivity and security for a more remote and diverse workforce.

Almost one third (31%) of finance and accounting professionals are looking to increase online conferencing options, while 24% are planning on installing VPN and other remote working security enhancements, and 21% plan to increase the use of cloud-based accounting solutions. Cloud-based accounting solutions can help small businesses manage monetary expectations while providing improved data accessibility, viewability and instantaneous updates.

These technological advancements provide professionals with real-time information on key performance indicators, allowing executives deeper and more integrated knowledge that helps them to react quickly and effectively during a crisis.

Although the ongoing crisis seems unyielding, mitigating the impact of an economic downturn through planning, reducing business costs, revising revenue protections, utilizing loans, and investing in the future can help businesses overcome their struggles.

Rich Reimer is Vice President of Industry Marketing for Sage Intacct, an award-winning cloud accounting and financial management solution that is part of Sage Business Cloud. Rich has more than 20 years of management and marketing experience with startups to Fortune 500 companies, including consumer, enterprise SaaS, and enterprise infrastructure businesses. In his current role, he helps finance leaders at small- and medium-sized businesses across various industries leverage technology to be more agile and drive improved decisions

Business stock photo by Preechar Bowonkitwanchai/Shutterstock