9 Things Entrepreneurs Need to Know

By Rieva Lesonsky

1. If At First You Don’t Succeed…

Rejection is part of most entrepreneurs’ lives. Sure it’s tough to handle—but if you put it in perspective so many of the truly great were rejected at one time or another before they hit it big.

Instead of feeling down when you’re rejected Laura Brothers and ecardshack say rejection can inspire us to work harder. She writes, “Those best remembered were often faced with obstacles that forced them to work harder and show more determination than anyone!”

To help inspire us the next time we get rejected (and you know we will be) they’ve put together a great infographic showing some truly accomplished people who were painfully rejected before making it big.

Laura writes, “Successful entrepreneurs don’t get discouraged by rejection, they use it to help motivate them to reach their goals. So take consolation from these seven famous faces, and understand that sometimes rejection is just the first step towards success.”

2. Understanding U.S. Cross-Border Business

New research from PayPal and Ipsos shows that cross-border business is big business—global sales can drive up to 2x revenue vs. only doing business domestically.

The top three countries that buy from American merchants (by revenue) are Canada (41%), the UK (8%), and Brazil (5%). And 26% of Brazilian cross-border shoppers expect their overall international spending will increase over the next year.

These new commerce opportunities are due to the advancement of technology, which is enabling business to be conducted “across borders, anywhere, anytime and via any device.”

In combination with previous consumer insights work, the new research reveals opportunities for sales growth when compared to shopper demand and attitudes.

Some other key findings include:

The small businesses that are working cross borders “are bullish on the future of international sales.”

- 33% of the merchants surveyed who currently sell only in the U.S. plan to expand their sales cross-border

- 95% of the merchants already selling globally online expect their cross-border operations will lead to steady or increased revenue streams

- 18% of them expect a boost in cross-border sales in the next year

If you want to participate in the global surge, your business must be mobilely optimized. Sadly only 54% of U.S. merchants have a specific mobile version of their website and 17% have websites that don’t offer any kind of mobile optimization

Language can also be an issue. Only 19% of American online merchants surveyed offer language(s) other than English on their business website.

Other insights include:

- Consumers access foreign websites using Search Engine Optimization, but less than 2 in 5 cross-border merchants surveyed invest in SEO and only 14% use search engine marketing

- Being able to shop in their own currency is important to consumers, but less than half the merchants surveyed offer currencies other than their domestic one

- In the top U.S. export markets, 30%-42% of online shoppers say if they were able to pay in their own currency, they’d be more likely to shop cross-border

- 26% of American SMBs plan to offer more currency choices for online shoppers in the future

3. You Can’t Expense That, Or Can You?

According to a Robert Half Management Resources survey, CFOs say they have seen employees ask for reimbursement for everything from rental homes to beef in bulk to toilet paper. Only 11% of executives reported a drop in inappropriate requests over the past few years.

CFOs cited the following examples of unusual items submitted for expense reimbursement:

- New car

- Rental homes

- Vacations

- Flat-screen TV

- Toilet paper

- Doggie day spa

- Loans

- Rent

- 10-cent parking-meter charge

- Medications

- Taxidermy

- Dance classes

There were even a few items that defied categorization:

- “A side of beef—somebody bought half of a cow”

- “A welder”

- “Somebody else’s salary”

You can check out more examples at this blog post.

While the examples appear to be funny, Tim Hird, executive director of Robert Half Management Resources, says, they actually “shed light on what can be a serious problem for businesses. Inappropriate expense reports are costly—both to the company’s bottom line and to the careers of the people who submit them.”

Hird recommends businesses make the expense reporting process as simple as possible and make sure “your policies are clearly communicated and accessible to all employees. Take a big-picture view of the program. Are you using the latest tools available? Removing ambiguity can help reduce the number of problematic requests.”

4. Sunny Days Ahead for Retailers

According to a new survey by Capital Business Credit, 75% of soft goods (clothing and accessories) suppliers expect retail sales to significantly outpace the gross domestic product for the spring and summer shopping season.

The Global Retail Manufacturers and Importers Survey reports that 45.5% of these suppliers believe the spring/summer seasons will be stronger than last year and 38.6% believe it will remain the same, and 75% expect retail sales to grow by 4% or more.

Most (78%) report retailers are ordering more or the same amount of goods. Half say orders have increased between 7-10% (33%) or more than 10% (28.8%).

5. The Power of Influencers

We’ve been hearing lately about influencer marketing. Does it really work? A first-of-its-kind study was recently released examining how micro-influencers drive buying behavior and measuring the volume and impact of their recommendations on consumers. The study, funded by Experticity, the largest network of influential category influencers, was conducted by Dr. Jonah Berger, bestselling author of the book Contagious: Why Things Catch On and a marketing professor at the Wharton School, in partnership with the Keller Fay Group, the leading authority on word of mouth marketing research.

The results show micro-influencers are “a reliable and credible channel that has real impact in swaying consumer behavior. Micro-influencers are not traditional celebrities, but rather individuals who work in their category or are truly knowledgeable, passionate and authentic and are seen as a trusted source when it comes to recommendations for what to buy.”

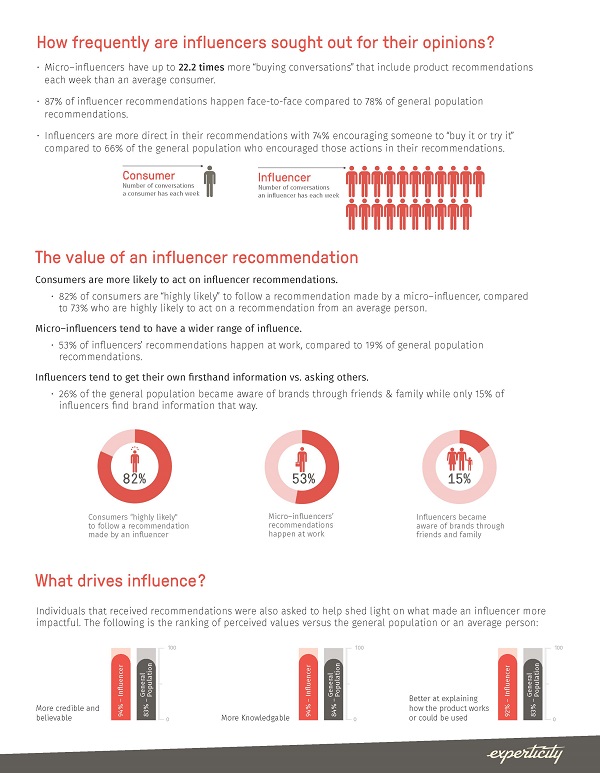

The data shows “these influencers have up to 22.2 times more conversations each week regarding recommendations on what to buy versus an average consumer. Demonstrating the high impact of these recommendations, 82% of the consumers surveyed say they “were highly likely to follow a recommendation made by a micro-influencer.”

Brad Fay, cofounder, COO and lead researcher of the Keller Fay Group, says, “Our research shows that every day people who are passionate about what they are recommending have significantly more buying conversations, and consumers are more likely to act on their recommendations [than that of celebrities].”

Additional key findings from the study included:

- Micro-influencers are more direct in their recommendations with 74% encouraging someone to “buy it or try it” compared to 66% of the general population who encouraged those actions in their recommendations

- 87% of the buying recommendations they make happen face-to-face

- Influencers are seen as more impactful compared to an average person based on the following characteristics: more credible and believable (94% vs. 83%), more knowledgeable (94% vs. 84%) and better at explaining how the product works or could be used (92% vs. 83%)

6. Remote Work Conference

FlexJobs and Remote.co are hosting the first-ever TRaD* Works Conference (*Telecommuting, Remote, and Distributed) in Washington, D.C. on June 8 -10, 2016. Remote.com projects 50% of people will work remotely by 2020, disrupting the traditional brick-and-mortar work model. The Conference will offer businesses “actionable insights into how they can support and optimize remote work programs to maximize the economic, social, health, and environmental benefits of remote work.”

Conference speakers so far include leaders from Dell, ADP, Anthem, Automattic, CNN, SAP and the U.S. Department of Labor. Topics addressed include:

- The ROI for the Economic Benefits of Remote Work

- How Millennials and Future Generations are Shaping Remote Work

- Marketing and Branding your Flex

- Hiring and Recruiting Remote Workers

- How to Build a Case for Remote Work Internally

- Maintaining Culture from a Remote Workforce

- How to Manage Remote Workers Successfully

- Communication and Tools in a Remote Workforce

- Research and Remote Work—What the Numbers Show

The conference will be held at the Fairmont Washington, D.C. Georgetown hotel. You can register for The TRaD Works Conference here.

7. Spring Clean Your Business Strategies

Spring cleaning is not just about organizing your stuff, it’s also about organizing your strategies. John Guy, Executive Vice President and Director of Business Banking, Webster Bank, offers these 5 tips:

- Develop a financing strategy with your banker and accountant: It’s tax season and business owners and their accountants are working on reducing their taxable income. They should however make sure they think about any near-term financing needs they have as well. Since most lenders use tax returns as a way of gauging the cash available to service any new request for credit, the goal of showing little to no income for tax purposes also reduces the funds available to support any debt service.

- Make sure you’ve completed your taxes on time: The timing and payment of taxes is a key red flag for lenders. They generally think, if the business owner isn’t able to pay the government, especially on time, are they going to be to pay me on time?

- Have a thorough understanding of the amount of cash that flows through the business as well as the timing of the inflows relative to the outflows: Cash flow is more important than income in the credit decision and in running a business. We often see businesses with more than adequate receipts but the timing of those receipts may not be in line with the outflows causing a temporary or season shortfall. Doing a cash flow analysis is a great way to assess the needs of a customer and helping the banker determine whether the customer needs a working capital line to meet fluctuating or seasonal needs or a term loan for longer term, obligations.

- Check your personal and business credit scores routinely: We often find that business owners think their scores are better than they are. Credit score is a very important element of the credit decision for lenders because it is a strong barometer of your borrowing history and consistency in not only meeting your obligations, but also on time.

- Be aware of fraud: Fraud continues to be one of the areas where customers underestimate their vulnerability. Banks have the capabilities to help customers assess their exposure from a number of sources of fraud including cyber as well as internal sources or practices. These products can help reduce the chances of fraud occurring, provide early detection and improve the chances of recovery in the event of fraud. Business owners can be reluctant to use these products and services because they don’t think fraud will happen to them, and they think that they have the same level of protection or recovery abilities on the commercial side as they do on the personal side, with their credit cards for example.

8. Tax Time

Friday is April 15th—and Uncle Sam is waiting. You have almost no time left to decide if you’re to prepare and file your small business taxes yourself or if you’re going to hire a professional? Truthfully, you should have already figured this out, but if you haven’t Evan Singer, president of SmartBiz offers some advice:

Complexity: The U.S. Tax Code is complicated. If you don’t pay the correct taxes, you could get hit with penalties and fines. Accountants let you know all filing details early on so that you can comply and avoid trouble.

Speaking of complexity, some small businesses books are intricate. Anne Ross is the owner of a small rental business in Los Angeles. Because of the multifaceted nature of renting and returns, she was more comfortable doing taxes herself. “Nobody understand the business like I do. Doing my own taxes wasn’t fun but it was much less daunting that I thought.” Ross says doing he own taxes had another benefit she didn’t expect. “I felt empowered and I learned more about my business—where we could expand and where we should cut—than I would have if I turned everything over to an accountant.”

Advice: There’s another important reason to hire a professional—advice. Karen Smith owns Fireworx Promotions in Richmond. She says she wouldn’t think of taking on taxes herself. “I use a professional to help me find savings and deductions. He also advises on the advantages of incorporating versus sole proprietorship. The money I save in deductions is well worth the cost of the accountant, plus it gives me peace of mind.”

Time and Costs: You might think you’re saving a ton of money by self-filing. But you need to count in the price of your time and labor. According to the legal website NOLO, the average business tax filing requires 24 hours for small businesses. Those hours can spike as your business grows. If you’re not a one-person show, you might need to get other employees involved to gather documents or crunch numbers. This also counts as labor costs and pulls your employees away from the day-to-day tasks needed to run your business.

Small business owner Smith has advice if you’re searching for an accountant. “It may sound obvious, but be sure you use someone experienced in small businesses. Don’t just go with an accountant a friend used for their taxes. Also, don’t be afraid to ask for references. Go with someone who has a good reputation.”

If you are going the DIY route, make sure you take all of the deductions you’re entitled to as a small business owner.

9. Need a Line of Credit?

BlueVine, an online provider of working capital financing to small businesses, recently announced the general availability of Flex Credit to allow small businesses to obtain a revolving business line of credit.

Flex Credit offers companies a business line of credit between $5,000 and $30,000 with simple, transparent fees and pricing. Using Flex Credit, businesses’ available credit replenishes as they repay their outstanding funds, allowing business to draw additional funds anytime, on-demand. New customers can get approval and funding in as fast as 24 hours. Businesses repay in fixed weekly installments over six months.