14 Things Entrepreneurs Need to Know

By Rieva Lesonsky

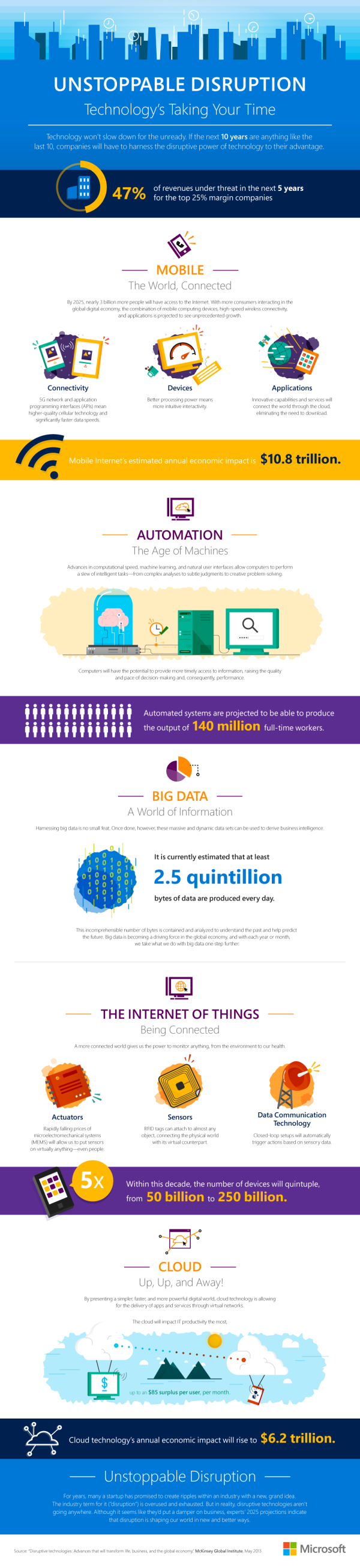

1. 5 Technologies Disrupting Your Business

Digital disruption is a reality. It was a hot topic at Microsoft’s 2015 Global CIO Summit last October. In a survey, CIOs said believe more than 47% of their company’s revenues will be under threat from digital disruption in the next five years.

Microsoft believes numbers like these make digital disruption a “hot topic not just for CIOs, but also CEOs, CMOs and sales leaders. As Michael Alcock, Microsoft’s Director of CIO Executive Programs says: “CIOs are past the point of needing to simply define digital disruption, now the urgency is solve for it, or at least help defend from disruption.”

Check out this interesting infographic below from Microsoft to learn more about the five disruptive technologies that are changing lives, businesses, and global economy: Cloud, Internet of Things, Big Data, Mobile, Automation of Knowledge Work.

2. Marketing Trends

According to a recent survey, 56% of local business owners plan to increase their marketing budgets this year, with a big focus on digital marketing. Social media, email, display, mobile and search (SEO/PPC) will be the marketing channels that will see the biggest investment.

As a result, says Allison Checchi, Chief Marketing Officer at YP, there will be a focus on three core areas:

- Social media: The majority of small business owners now have some kind of social media presence, whether on Facebook, Twitter or other emerging platforms. They’ll become more mature in their use of these platforms. We often see business owners who think it’s a form of marketing to simply post updates about their businesses, regardless of who’s paying attention or interacting with the message being delivered. While the number of “Likes” or “Followers” of a business are important, small business owners need to be engaged in constant conversation with their customers, responding to inquiries, soliciting feedback and creating the perception that the business is accessible and interested. Small business owners must educate themselves on the rudiments of social media measurement to get a basic grasp of whether awareness, likes and site visits correlate with business goals, especially sales.

- CRM: Digital channels such as email, social media, SMS (texts) and POS (point-of-sale) are all conduits for ad retargeting and nurturing your customer relationships. Each time a potential or return customer encounters your brand, incremental data is collected, which you can analyze to make future exposure more meaningful. We’ll see small business owners move toward adopting more robust CRM systems. For example, a local boutique food market with several stores can use a combination of digital and physical communications to manage local customer relationships. They may provide an in-store “guest book” for customers to sign and provide basic information such as email, snail-mail address and birthday. Using that information, the business can start a friendly but unobtrusive correspondence via email with special offers to loyal V.I.P. customers and complement those communications with text reminders about weekend in-store sales or a hand-written birthday card mailed to homes. The store can also remind customers of those sales via social ads, and drive conversation to their Facebook page for additional interaction or promotion of specific pieces clothing to generate more excitement.

- High touch is in, self-service is out: Website, SEO, SEM, Facebook, text, email, Pinterest, Instagram. In 2015, small business owners were overwhelmed with marketing options, all designed to allow them to quickly get online and reach new customers. Spurred on by the introduction of Google AdWords, “DIY” became the approach most marketing vendors pushed—thinking it was the easiest strategy for both the business owner and the vendor. Now, however, we’re starting to see a robust segment of small and medium business proprietors who adopt a “DIFM”—Do It For Me—or “DIWM”—Do it With Me—attitude. They want to understand what’s working and what’s not, and they want help in doing so. Businesses that cater to small businesses by way of consultative, high-touch services will proliferate and prosper, much in line with the maturing of social media use and greater adoption of robust CRM systems.

3. Employee Turnover

You can often judge the “health” of a business by looking at its’ turnover rate. According to the experts, a company’s turnover rate is a reflection of employee engagement at that business. Matt Zajechowski from Digital Third Coast says the average company loses 20-50% of its employee base yearly. And companies with highly-engaged workers have lower turnover rates by roughly 31%.

Does the turnover rate at your small business need some improvement? Zajechowski and HighGround put together a visual guide on how companies with low turnover rates operate effectively. Check it out below.

4. New Small Business Financing Workshop

OnDeck, an online lending leader and SCORE, have teamed for small business, has teamed up with SCORE to offer a small business financing workshop to SCORE’s volunteer mentors across the country.

The workshop, An Insider’s View: Securing Capital to Grow Your Business, created by Ty Kiisel, who heads Small Business Education for OnDeck and a team of SCORE small business mentors, will help SCORE’s small business clients better understand the non-traditional financing options available to them, including: non-profit lending, crowdfunding, invoice financing, online business loans, and loan matching sites. Workshop attendees learn how different types of financing work, who provides them, which financing options make sense for which business needs, how to apply, and what to expect throughout the application process.

The program was introduced last year. But in order to help SCORE chapters implement this workshop in their communities and scale the program across the country, OnDeck has created a workshop-in-a-box kit, enabling every SCORE chapter to offer their own seminars to local small businesses.

Workshop participants will also be guided through OnDeck and SCORE’s interactive Business Fundability Quiz. The quiz helps small business owners assess their current financial standing and evaluate what types of financing they may qualify for. Workshop facilitators will help attendees find ways to improve their profile and increase their odds of successfully funding their business needs. SCORE will also offer participants free one-on-one mentoring to talk through their individual business aspirations and chart a customized pathway to achieve those goals.

If you’re looking to learn more about small business lending options these resources can help:

Visit SCORE’s Financing/Loans Center of Excellence, sponsored by OnDeck and check out some tips and resources for evaluating your small business loan options, applying for small business grants, investigating the process for commercial lending.

Tune into the An Insider’s View: Securing Capital to Grow Your Business webinar online.

Learn more about the world of online lending: For more information about your lending options, visit BusinessLoans.com, OnDeck’s educational website.

And in honor of National Financial Literacy Month join the Tweetchat on April 20 at 1 ET and 10 Pacific. Use the hashtag #AskTy. There’ll be lots of small business lending insights from industry experts, including OnDeck’s Ty Kiisel, SCORE’s David Bobbitt—and me.

5. More Spring Cleaning Tips

We’ve covered spring cleaning tips for the last few weeks. But I’m certain you all are like me and haven’t quite finished (or even started) your spring cleaning yet. To help John Swanciger, CEO at Manta, offers his tips:

Update your computer programs: How many times have you clicked out of an update request on your computer? Selecting “remind me later” may be convenient at the moment, but it leaves your computer susceptible to viruses in the long run. Owners should set aside some time to make sure all the latest programs are running on their computers to guarantee tighter security. For PC users, updates are found in settings under “Update and Security.” For Mac users, open the App Store and select the updates tab.

Go Paperless: According to a tax season Manta poll, 30% of small business owners still track expenses through paper receipts—a “system” that invites error. If you are keeping track of expenses solely through paper receipts, consider going digital. Applications like Expensify and Shoeboxed allow you to scan and sort receipts and store them in a safe, digitized place. This helps clean up cluttered desks and removes the risk of misplacing a receipt.

Clean up your inbox: Still planning to keep that flight information for an old business trip? It’s time to go through and purge irrelevant emails. While deleting, consider creating folders by categories to sort the messages you plan to keep. Folder ideas include “bills,” “customer inquiries” and “appointment confirmations.” If the inbox process feels overwhelming, look into email automation programs to remove the hassle.

Analyze your expenses: Take a step back and reflect on how you spend your money. Is each purchase still matching your current needs? A product or service may not be the best fit for your company now, compared to previous years. Revisit your expenses and analyze what you still need. There may be opportunities to replace current tools with better or more affordable solutions.

Check your backup system: When is the last time you archived your data? Backing up important files can prevent complete loss of data if your computer is compromised. Identify valuable documents and upload them regularly. Also, consider reviewing what you saved the last time, and see if they’re still necessary. If you’re running out of space in your backup system, consider upgrading to higher storage capacities.

Adjust your rates: How much are you spending on taxes, utilities, food and health care compared to last year? If your cost of living has increased and your company’s prices have flatlined, you are earning less money than before. Review your current rates next to your company’s costs and adjust prices accordingly.

6. New Co-working Spaces

Staples and Workbar are teaming up to offer co-working facilities within select Staples retail locations. Co-working spaces are ideal small business owners, independent professionals, startups and the growing mobile workforce.

The first three spaces (2,500-3,500 square-foot custom-designed facilities) will be opening outside of Boston and will “offer a mix of high-end workspaces, conference rooms, private phone rooms, fast and secure Wi-Fi, printers, and bottomless coffee and tea to keep the connectivity and productivity flowing for business customers.”

The idea behind the collaboration is to serve the rising number of mobile professionals, who are not just working in downtown urban environments. Staples and Workbar are “building a hub-and-spoke network that links urban centers and suburban locations” and offers convenient locations, parking and extended hours.

Workbar will be operating the locations within Staples and will offer coworking memberships, pre-scheduled meeting space, use of Workbar’s downtown locations and access to its in-person and online community. And Workbar members will automatically be enrolled in the premier level of Staples Rewards.

7. Women in Tech

In order to better understand what challenges women in technology face in the workplace, and what changes might help solve those problems, Pluralsight, a global leader in online learning for technology professionals, and Women Who Code, a global non-profit dedicated to inspiring women to excel in technology careers, conducted a survey regarding the attitudes of women in technology careers.

The survey showed that women in tech would benefit from having more female role models and that women in tech careers are running into a number of obstacles in climbing the corporate ladder, which may be impacting their salaries and long-term career trajectories.

Survey respondents said lack of opportunities for advancement was the biggest challenge they face in their careers, followed closely by lack of female role models and lack of mentorship at work. More than 60% of female leaders agreed or strongly agreed with the statement that having more women on their teams would be beneficial.

“In the next decade, more than 75% of jobs in the U.S. will require technology skills,” says Alaina Percival, CEO of Women Who Code. “It’s imperative that the industry as a whole become a more welcoming and inclusive place for women who have been drastically underrepresented to date. Providing women every available opportunity and resource to succeed is crucial—both for their well being, and for the stability of the economy.”

Lack of confidence is the biggest issue the women surveyed say is holding them back, followed by male-dominated work environments. While 20% of respondents in their 20s and 30s aspire to a vice president or C-level position, more than 50% felt uncomfortable asking for a raise and nearly 50% felt uncomfortable asking for a promotion.

Other key findings include:

- Women in leadership roles reported being held back by male-dominated work environments at more than twice the rate of women in mid-level positions or below (19% vs. 8%)

- Nearly half of respondents ages 21-49 feel that male colleagues are more likely to get promoted than female

- 50% of all respondents agree that balancing their career and personal life is challenging

- Only 8% of respondents say a startup is the “ideal organization” for them

8. Entrepreneurial Support for the Military

Sage will be sponsoring the upcoming Invictus Games Orlando 2016 as well as enter into a multi-year partnership with the Invictus Games Foundation. The partnership will see the UK’s biggest tech company support the Games, starting with the Orlando event in May 2016.

The Invictus Games, established by Prince Harry in 2014, are an international sporting event for wounded, injured and sick servicemen and women. The Invictus Games use the power of sport to help wounded, injured and sick military service personnel with their recovery and rehabilitation. The inaugural Invictus Games were held in London in September 2014 and attended by over 400 competitors from 13 nations. The Games in 2016 will take place in Orlando, Florida, and will have more than 500 competitors from 14 nations compete in 10 sports.

The Sage Foundation and a team of colleagues from Sage will volunteer at the Games, as part of the annual five days given to its 13,500 colleagues for supporting good causes. Sage will also extend its mentoring and work placement program for former military service personnel to all competitors looking to establish small businesses and learn business skills as they consider their careers beyond competitive sport.

At Sage’s customer event in Chicago 25-28 July, competitors from Invictus Games Orlando 2016 will be invited to join 2,0000 entrepreneurs to inspire them with their stories of determination and success.

This is part of a wide-reaching partnership that will be at the core of the Sage Foundation’s commitment to supporting service people when they leave the military.

Stephen Kelly, CEO, Sage says: “We believe entrepreneurs are the true heroes of the global economy, and supporting them is our passion. Particularly close to our heart is an enduring and treasured relationship with those who have given their service to their country—a special type of hero, so we are proud to pledge our ongoing global support to the Invictus Games.”

9. Entrepreneurs are Cashing Out

BizBuySell.com, the Internet’s largest business-for-sale marketplace, reports the median revenue and median cash flow of sold small businesses in the first quarter of 2016 reached their highest levels since BizBuySell first started tracking data in 2007. This is resulting in higher sale prices for small businesses. The full results are included in BizBuySell’s Q1 2016 Insight Report, which aggregates statistics from business-for-sale transactions reported by participating business brokers nationwide.

A total of 1,840 closed transactions were reported in the first quarter of 2016, a slight increase from the first quarter of 2015, however the businesses that sold this quarter appear to be much healthier. Businesses sold in the first quarter of 2016 grossed a median revenue of $478,000 compared to $442,000 last year, and a median cash flow of $110,000 compared to $104,000. These figures represent the highest median revenue and median cash flow of sold businesses on record at BizBuySell.

As business financials strengthen and sale prices grow accordingly, it appears more owners are deciding now is a good time to sell. The number of businesses listed for-sale grew more than 6.4% from the same time last year. The Q1 2016 listings total marks the highest number of businesses listed for sale on BizBuySell since the first quarter of 2009. The uptick in small business listings this quarter is likely due to a number of factors, including growing small business financial performance and resulting sales prices, as well as the increasing number of Baby Boomers reaching retirement age.

“Overall this quarter’s data confirms that small business listings, transactions and financials are all continuing on a positive trend to start the year,” says Bob House, Group GM of BizBuySell.com and BizQuest.com. “Historically the second quarter of the year has been one of our most active so we expect transactions to continue at a high pace as more buyers step up to take on the growing supply of financially strong listings. In short, all the fundamentals point to a continued strong spring and summer in the business-for-sale market.”

10. Health-Insurance Costs

Health insurance premium renewal rates increased an average of 6.2% for all plans in 2015, up from the previous year’s 5.6% increase, according to new survey data released from United Benefit Advisors (UBA), a leading independent employee benefits advisory organization. Small businesses with fewer than 25 employees, which account for five million U.S. employers, were hit the hardest, according to UBA.

In line with previous years’ findings, UBA finds there are significant regional differences in health plan costs. The Northeast has the highest average annual cost per employee in the country, though Alaska tops the chart with an average annual cost of $12,822 per employee.

On the other end of the spectrum, Hawaii has the lowest average annual cost per employee, which is 24.5% below the national average at $7,610.

Other states that fare better than the national average, and are among the five best states for health plan costs, include Arkansas, New Mexico, Virginia, and Oklahoma at $7,704, $7,793, $7,858, and $7,915, respectively.

Premiums increased the most for singles in Louisiana (23.5%) and California (17.2%), and families saw the biggest premium increase (7.6%) in South Carolina. Connecticut was the only state to see a modest decrease in single premiums (5.1%) and decreases in family premiums were largely nonexistent, according to the survey.

For further information, download UBA’s State-by-State chart. To benchmark your plan costs by industry, size or by plan type, download UBA’s Quick Check Benchmarking Tool.

11. The Importance of CFOs

New results from the Intacct CFO Perspectives Survey reveals that today’s CFOs are more than number crunchers—they are becoming true partners to the business. The survey shows CFOs are focused on a range of strategic initiatives, including managing risk and enhancing customer satisfaction, as well as implementing technology systems that can help the business run more efficiently and achieve greater business sustainability in an uncertain economic environment.

The Survey found that, for 80% of CFOs, business reporting and analytics is one of their top three business initiatives. Additionally, another 60% of CFOs say the automation of financial processes—including the implementation of cloud-based financial systems—is one of their most strategic

According to the survey only 8% of CFOs spend most of their time closing the books each month. In fact, 76% of CFOs spend less than 30% of their time closing the books, while 43% spend less than 20% of their time.

So what are they doing instead? Most (57%) say they manage between three and five different business systems and 12% manage six or more. In fact, just 11% of those surveyed said that the only system they manage is their financial solution.

The survey also found that CFOs are clamoring for easier access to financial and operational data in order to address disruptive business issues. Specifically, 78% of CFOs say better data insights could help them combat rising operational costs, while 63% want data that can help them take action against under-performing business units. An additional 55% said that increased access to data could lead to greater customer profitability.

Cool Tools

12. Help for Real Estate Professionals

N-Play RE, LLC, the leading provider of real estate apps on Facebook, including the 447,000+ member Real Estate Agent Directory, has changed its corporate name and is rebranding as HomeASAP LLC. The move follows the successful introduction of Homeasap, an innovative technology that supports the company’s IDX Home Search solution for real estate professionals.

The new Homeasap technology enables agents and brokers to provide a branded consumer home search experience equal to national portals like Zillow and Realtor.com.

Mark Bloomfield, the founder and CEO of Hameasap, says, “The national portals had set a high bar for what consumers demand in an online home search experience, making it difficult for local agents to compete. Homeasap technology has raised the bar by powering agent websites to the next level in consumer home search. When compared to a leading national portal, consumers favored the Homeasap search experience over 80% of the time. This is what agents have been asking for, and now they have it.”

13. Print On-the-Go

In general mobile printers have either been too bulky to be truly portable, or they’re low-resolution, black-print-only machines utilizing old fax-style thermal paper that fades and scratches. But if mobile printing is important to you, check out the 2.6-lb., book-sized, inkjet Primera Trio All-in-One UltraLight Printer. It claims to be the smallest and lightest printer/scanner/copier on the market, and it’s capable of printing, scanning and copying in full color or grayscale with up to 4800 dpi print resolution on standard A/A4-size paper.

The printer:

- Slips into most laptop bags with room for a laptop.

- Connects to any current computer, laptop or tablet that includes a USB port.

- Comes with a set of power plug adapters for use anywhere on the globe.

- Offers an optional battery pack for the times you have no AC power.

14. Quick Charge

The ASAP Dash says it’s the “fastest smartphone charger” available, taking only five minutes to store the power to charge an iPhone 5. Unlike other rapid charge chargers which have a tiny capacity (under 2,000 mAh), ASAP Dash stores 5,000 mAh, keeping your phone going for more than 48 hrs. ASAP Dash charges up to 16x faster than standard chargers in the market today. ASAP Dash features a slim anodized aluminum shell, giving you one of the thinnest high capacity chargers you’ve ever seen. You can pre-order the ASAP Dash, starting at $89 on Indiegogo.

Some features include:

- Compatible with all USB devices

- Long battery life

- Pocket sized for easy access at any time

- Car charger for on the go charging

- Smart Charge Chip: Inbuilt chip auto detects your USB device and charges at their maximum rate.

- Long lasting battery: Advanced battery technology allows up to 1,200 charge cycles 4x longer than industry standard.