20 Things Small Business Owners Need to Know

By Rieva Lesonsky

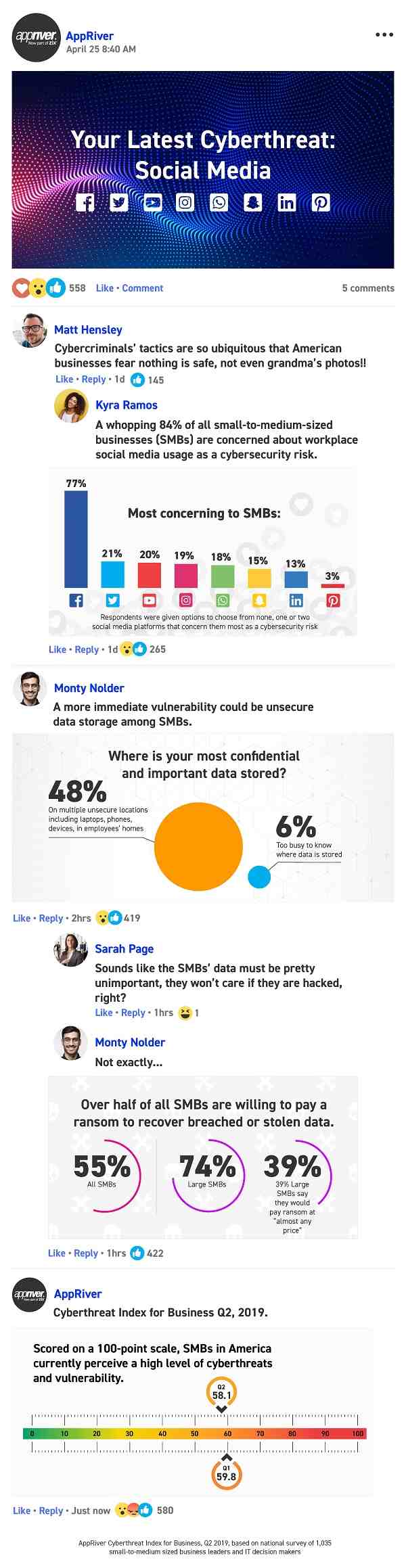

1—Would You Pay Ransom to Cybercriminals?

Are you surprised 55% of SMB executives say they would pay hackers in order to recover their stolen data in ransomware attacks, according to the second quarterly AppRiver Cyberthreat Index for Business Survey. That number jumps to 74% among larger SMBs that employ 150-250 employees, with 39% saying they “definitely would pay ransom at almost any price” to prevent their data from being leaked or lost.

On the flip side, 45% of SMB leaders refuse to give in to cybercriminals, regardless of the ransom amount. Legal services and nonprofit SMBs are least willing to pay ransom in exchange for hacked data, with 67% and 60% respectively saying they will not engage with cybercriminals regardless of the ransom amount or value of the stolen data.

Social media viewed as a threat: 84% of SMB executives and IT decision makers surveyed are concerned about the use of social media apps and websites at the workplace or on a business device. According to these respondents, Facebook poses the most significant liability (77%).

In contrast, SMB leaders say they are concerned about the risks introduced by Twitter (21%) or YouTube (20%), followed by Instagram (19%), WhatsApp (18%), Snapchat (15%), LinkedIn (13%) and Pinterest (3%).

David Wagner, CEO of Zix Corp, the parent company of AppRiver, says, “Cybersecurity is no longer just a technology issue; it amounts to an off-balance sheet liability being carried by every company that isn’t adequately protected. Ransom scenarios, whether initiated through social media apps or any attack vector, have the potential to disrupt or destroy a business overnight. The Q2 AppRiver Cyberthreat Index for Business Survey shows clearly that too many companies are willing to take a significant financial hit to possibly recover their data. Our challenge as cybersecurity leaders is to help them understand how to properly invest fewer dollars on the front end and avoid the problem to start with.”

Compromised data management: Dispersed files and varying security levels may be another reason why businesses are constantly at risk of cyberattacks—48% of AppRiver Index respondents say their confidential business data is scattered across multiple locations, including laptops, smartphones, tablets, as well as on network drives.

While 81% of all small-to-medium-sized business decision makers say they use cloud-based solutions to store their confidential data, 44% of respondents are concerned about the cloud’s security, and another 19% say they don’t believe it offers convenience as a benefit. SMBs in the legal sector, and in the transportation and logistics sector in particular appear skeptical, where over half of decision makers in each say they don’t trust the cloud as a secure storage option. Conversely, leaders in technology, telecom, marketing and financial services sectors report higher confidence in the cloud’s security and convenience.

The AppRiver Q2 Cyberthreat Index for Business surveyed 1,035 cybersecurity decision makers in SMBs (fewer than 250 employees) in April 2019, covering diverse industry sectors and company sizes. The national study had a strong SMB leadership involvement with 80% of those surveyed holding titles of CEO, president, owner, CTO or head of IT.

Take a look at the infographic below.

2—Millennials are Shopping Small

We may be living in the age of Amazon, but millennials are craving the personal touch of small businesses, according to new research conducted by OnePoll for Vistaprint, which found 61% of millennials expect to shop more with small businesses in 2019. Only 15% of consumers aged 55 and older said the same.

Millennial spending habits

- Millennials spend more when shopping small—$s197.32 in an average month, compared to boomers who spend $99.

- 45%of millennials would spend more on a product or service if it meant they were supporting a small business, compared to just 27% of consumers aged 55 and older.

- Why do millennials love to shop small? Supporting the local economy was the top reason (51%), followed by convenience (49%), unique products and services (47%), better customer service (47%) and supporting residents/families (46%).

As millennials continue to drive the shopping small movement, is there a way for small businesses to be more prepared for this opportunity? The answer may be online.

- For millennials, it’s imperativefor small businesses to be online—84% expect businesses to have a website and 80% say they should be active on social media.

- Millennial consumers are also far more likely than boomers to discover small business through online channels, including social media (51% vs 20%), online reviews (41 %vs 15%) and their websites (32% vs 12%).

- If a business doesn’t have an online presence, 34% of millennials and 7% of boomers would be less likely to shop there, which is a concern since 56% of small businesses don’t have a website and 40% don’t use social media.

- The top barrier to building a professional marketing presence is lack of budget, with the average small business spending just $1,533 per year on all marketing activity.

Top 10 reasons millennials prefer small businesses over big businesses

- I like to support the local economy

- They’re more convenient

- Better customer service

- Unique products and services

- I like to support local residents

- I trust them more

- Quality of products and services

- The experience is better

- It feels more personal

- They’re in my neighborhood

3—Cashier-less Shopping Isn’t in Demand on Main Street

Small businesses should keep their cashiers, according to the 2019 Cox Business Consumer Pulse on Small Businesses. The Amazon Go cashier-less shopping model is only of growing interest among respondents ages 18-29, up 8 percentage points from last year. In all, 77% of surveyed consumers prefer to interact with other people at checkout.

The preference for person-to-person interaction likely has to do with the level of service small businesses deliver—53% of surveyed consumers say small businesses provide better customer service than larger businesses.

“While big-box brands are forced to prioritize uniformity across their markets, small businesses can—and should—emphasize what makes them different,” says Steve Rowley, executive vice president of Cox Business.

Although 70% of surveyed consumers think Amazon hurts small businesses, more than half don’t shop less at small businesses because of the e-commerce giant and 71% continue shopping small to support their local communities.

Surveyed consumers also want to continue the conversation with their favorite small businesses online. Nearly 40% of consumers think small businesses should improve customer engagement through social media.

Beyond neighborhood support, consumers want to support “Made in America” products as well. Approximately 70% of surveyed consumers would spend more money at a local shop that sold exclusively American-made goods.

While many surveyed consumers say they do their part to drive the growth of small businesses, most feel the U.S. government is not pulling its weight. When asked if the federal government was doing enough to support small business growth, 69% of surveyed consumers felt that it could be doing more. Specifically, surveyed consumers think the government should offer more tax incentives and support programs for veteran-, minority- and women-owned businesses.

Findings

- 70% would spend more money at a small business that supported a positive social or environmental cause

- Just over half would stop supporting a small business if the causes they supported weren’t in line with your social or environmental views

- Diverse and inclusive hiring was an important factor for 72% of respondents in choosing whether (or not) to frequent small businesses

- Small business segments that are outperforming others in the industry, noted as “above average” by surveyed consumers, are restaurants, food and beverage stores, retailers like florists and novelty shops, and building supply dealers (hardware stores & garden centers)

4—Measuring Shopper Experience

Bazaarvoice, Inc., the provider of user-generated content (UGC) and shopper data solutions, recently released its annual Shopper Experience Index, which explores the influential role of UGC throughout the shopping journey, the importance of authentic, personal connections with consumers, and what e-commerce strategies brands and retailers are focusing on in 2019 and beyond.

Analyzing Bazaarvoice Network data comprised of 5.8 billion monthly product page views and over 66.8 million reviews and 2.2 million photos submitted in 2018, the Shopper Experience Index reveals that best-in-class brands and retailers who make UGC available to shoppers achieved on average 137% conversion lift and 157% lift in revenue per visitor.

Findings:

- The value of reviews extends beyond online sales:63% of Bazaarvoice clients rely on ratings and reviews to boost SEO performance, 53% to improve in-store sales, and 52% to foster brand loyalty.

- From research to purchase, mobile matters:57% of all page views across the Bazaarvoice Network came from mobile in 2018, and; when shoppers engage with UGC on mobile, the conversion lift is 136%, slightly higher than it is for desktop shoppers.

- Seamless social commerce is a priority:Nearly half of Bazaarvoice clients said integrating social media and online shopping experiences will be a top priority or increased area of focus over the next 12-18 months.

With competition across the retail and e-commerce landscapes heightening, brands and retailers are striving to provide engaging, efficient shopping experiences for consumers. Bazaarvoice found that engaging consumers in conversation, including visual UGC across the shopping journey, and partnering to ensure shoppers have the information they need to make informed purchase decisions are key to driving sales and customer loyalty.

Shoppers crave interaction before a transaction: Product pages with Q&A experienced a 447% higher conversion rate compared to those without, regardless of shopper engagement.

Visual content is essential to online shopping: 59% of brands and retailers say featuring photos and videos from customers throughout the shopping experience is standard in e-commerce.

Ratings and reviews syndication is a mutually beneficial partnership between brands and retailers: When brands syndicate reviews to retailers, the median increase in reviews per product is 83% greater than those without syndication; similarly, half of Bazaarvoice retailers source 65% or more of their reviews from brands.

Download the full Shopper Experience Index.

5—College Student Survey

As college graduation season draws to a close, MidAmerica Nazarene University shares some interesting information from its survey of college seniors and recent graduates.

Check out the infographic for more information.

6—Gen Z Enters the Workforce

And now those college graduates are entering the workforce. The 2019 Yello Recruiting Study surveyed hundreds of job candidates, comparing Generation Z, Millennials and Generation X.

Here are some quick facts:

- 2 of 3 Generation Z business majors expect to receive more than one job offer.

- 24% of Gen Zers think they’ll make $60,000 or more in their first job out of school.

- 49% of Gen Z candidates plan to use the current low unemployment rate and strong labor market as leverage for a higher salary, compared to 70% of millennials who would do the same.

- Three-quarters of Gen Z cite being treated unfairly as the top cause of a negative experience, whereas only about half of millennial candidates feel the same.

- 50% of Gen Z computer science & engineering majors expect to receive multiple offers.

- For non-STEM majors like communications or political science, 7 in 10 Gen Zers are worried about finding a job.

- 3 in 4 Generation Z education majors expect to receive at least one job offer.

You can download the survey here.

7—The Pitfalls of A/B Testing and How to Avoid Them

Guest post by Eran Agam and Yuval Ben Zion, Data Science, Fiverr

A/B testing has long been a staple of the online community toolkit. It’s a method to compare two versions of a single variable, typically by testing a subject’s response to variant A against variant B and determining which of the two variants is more effective, in terms of a predetermined KPI. The test groups, A and B, are identical except for one variation that might affect a user’s behavior. Usually, group A reflects the current state (“control” group), while group B will possess the mentioned variation (“treatment” group).

While numerous articles, blog posts and “how to” guides have been written on A/B testing, there are still a few things marketers and data experts seem to get wrong, and if they are not careful, these oversights can negatively impact results. As a cornerstone of product changes and system updates, these kinds of mistakes can lead teams down the wrong path and have significant business repercussions. Below are just a few of the various hiccups we’ve seen across the A/B testing discipline. In an effort to create some practical advice based on the learnings acquired at Fiverr, we’ve created an A/B Testing Protocol, available here.

Introducing a new concept of “disaster sample size” or in short – “disaster N”. While using A/B testing, calculating the test groups’ sample size is an integral part of any test planning procedure. The sample size is affected by the desired significance level, the test’s KPI standard deviation and the margin of error—essentially the effect or change we want to be able to identify.

Usually, people set a relatively small margin of error, as new features are expected to improve KPIs by no more than a few percentages. Our suggestion is to still calculate your test’s sample size, but also calculate a “disaster sample size” where you use a relatively large margin of error. This “disaster sample size” will obviously come out much smaller than the “regular” sample size, but that’s the exact desired effect—to create an early checkpoint per each test to identify very big and significant changes between test groups. Those significant changes should raise a flag for abnormal behavior (even a new bug that’s related to the tested feature). This simple step will make sure you’re not breaking anything, and if you are, you’ll know about it as soon as possible.

Keep track of interactions between different concurrent tests. As the number of tests running in parallel increase, the risk of interactions between different treatments becomes a growing concern. A statistical interaction between two treatments (X and Y) exists if their combined effect is not the same as the sum of the two individual treatment effects. If that’s the case, the two tests are impacting each other. There are two paths forward to tackle this problem:

- Prevention: A series of suggested approaches for preventing and detecting interactions between tests can be found in “Online Controlled Experiments at Large Scale” under section 5.2, by Ron Kohavi, Alex Deng, Brian Frasca, Toby Walker, Ya Xu, Nils Pohlmann. These prevention approaches are recommended for implementation as part of any controlled experiments management tool.

- Detection: This can be implemented as an ongoing detection algorithm, which will send alerts for tests with strong interaction. If tests are being flagged through a detection algorithm, it’s best to stop the concurrent tests.

Predict test groups differences across the lifetime of the sample. In the majority of test analysis, people do so according to relevant KPIs and their performance during the period the test ran. But what if the current trend between group A and group B in the test is going to change in the future? In many cases, one group performs better than the other in the period that the test ran. But if theoretically, you’ll continue running the test, this might become the other way around.

One way to create more certainty is to run a prediction mechanism for a test to evaluate how the differences between the test groups will play out in the future. By doing this, you can flag tests with conflicts between their current analysis and the prediction.

These are just a few of the various hiccups we’ve seen across the A/B testing discipline, but there are certainly more that can be discovered or encountered.

8—Small Business Risk Report Sheds Light on Insurance and Claims Experience

There is a direct correlation between small business owners’ views and confidence in their insurance coverage based on past claims experience and satisfaction, according to the 2019 Small Business Risk Report, conducted by Forbes Insights and The Hanover Insurance Group, Inc. It surveyed small business owners across the country who had experienced a claim in the last five years to evaluate their claims experiences. The study also sought small business owners’ perspectives regarding future vulnerabilities, and the value they place on risk management services.

The 2019 Small Business Risk Report concludes that 36% of respondents were unhappy with how their insurance claims were handled by their carriers. The study found these claims experiences impacted these small business owners’ satisfaction, resulting in less confidence in their insurance program as well as their views on likelihood for future insurance claims.

By contrast, 94% of small business owners who experienced a claim in the last five years and were highly satisfied with the result expressed overwhelming confidence in their overall insurance program.

Key highlights

- Cyber continues to be a growing concern for small business owners. While only 18% of reported facing a data breach incident in the past five years, 67% say they are becoming more vulnerable to cyber and data breach claims as they digitize their businesses.

- 52% believe it is likely their businesses will have a claim in the next five years, with property damage, employee injuries and auto accidents rounding out the top three claims concerns. The type of business insurance claims a small business owner anticipates for the future directly mirrors their prior claims experience.

- The top three aspects of the business insurance claims experience that drive satisfaction for small business owners are fair payment of a claim, quick response and processing time, and knowledgeable claims professionals.

- While small business owners acknowledge the value of risk management services, approximately one-third who work with independent agents reported they were not offered risk management services or were not aware of them.

The study findings suggest an opportunity for independent agents to consistently offer risk management services to help small business owners protect their business operations and get the most benefit from their insurance programs.

“As a leading provider of insurance for small businesses, it is critical for us to understand the evolving risks and exposures for business owners so that, together with our agent partners, we can provide the most comprehensive insurance solutions to meet their needs,” says Michael R. Keane, president, core commercial at The Hanover. “Our annual Small Business Risk Report further validates the importance of claims and risk management and the connection both have to future insurance buying behaviors.”

9—Separating Worktime and Personal Time

Check out this infographic from CashNetUSA for tips about keeping your work life and personal life separate. Of course if you already own your business, that’s likely an impossible task.

10—Small Business Ad Spending

Most small businesses will increase spending on advertising in 2019, according to a survey of small business owners and managers. Businesses will spend more on digital advertising such as social media and Google search, which helps achieve their goal of increasing sales and revenue. Findings

- 37% of small businesses spend less than $10k on advertising, showing businesses don’t have to spend a lot of money to have a successful advertising strategy.

- Millennial-owned small businesses tend to spend more on advertising: 61% of millennials spend more than $50,000 on advertising, compared to 36% of Generation Xers and 15% of baby boomers.

- 91% of small businesses plan to increase their ad spend

- The top advertising mediums small businesses plan to spend more on are social media (56%) and online (41%) such as Google search and banner ads, which offer more targeting opportunities than traditional mediums.

- Millennials are more likely than older generations to increase their ad spend on both digital and traditional mediums, including social media (62%), online (49%), and TV (29%).

- Small businesses’ main goal for advertising is to increase sales and revenue (32%).

- Small businesses say social media (43%) is their most effective medium for achieving their advertising goals, which range from increasing sales and revenue to converting leads to customers to standing out from competitors.

Learn more in this article from The Manifest.

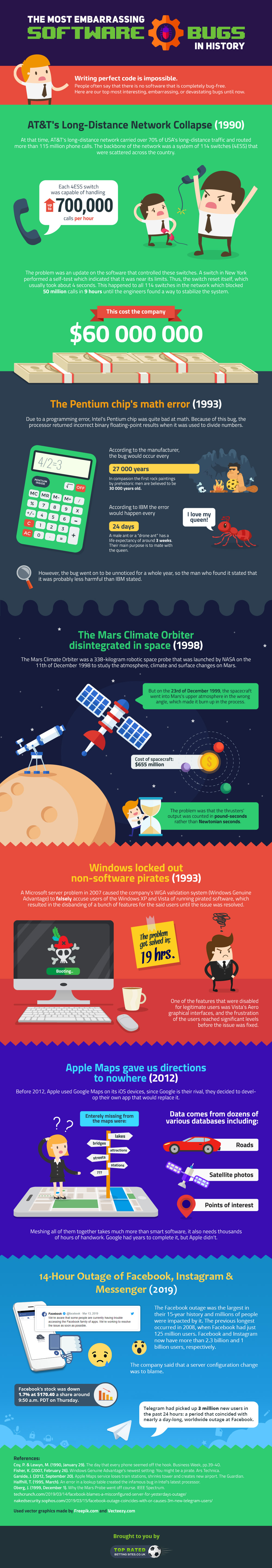

11—The Most Embarrassing Software Bugs

Every business makes mistakes at one point. See the infographic below for some of the most embarrassing mistakes made by the brands we all know.

Click on the infographic to view the interactive version (via TopRatedBettingSites.co.uk)

12—Meet the Winners

In its 7th year, The FedEx Small Business Grant Contest awarded several small U.S. businesses more than $250,500 in grant money and services to help their businesses grow.

The 2019 Grand Prize Winner of the Small Business Grant Contest is LUX Blox—an Illinois- based company that manufactures construction blocks to teach kids (and adults) about nature’s design principles through play. LUX Blox will receive a $50,000 grant, plus $7,500 in FedEx Office® print and business services to help with its mission to develop programs and videos to support STEAM (science, technology, engineering, art and math) learning, and therapeutic exercises for individuals with autism and sensory disorders.

- Manufactured near the inventors’ home in Galesburg, Ill., the LUX Blox story began when Michael and Heather Acerra set out to make a construction system that would build things the same way nature builds itself.

- The cofounders created blocks that could curve, bend, and move, without the limits imposed by stacking or sticking. This unique creation led teachers and students to use LUX Blox blocks as a “hands-on” STEAM learning tool. In fact, the toy was named “2018 Top Toy” by Autism Live.

- LUX Blox are packaged and fulfilled by the skilled hands of people with disabilities through an alliance with Bridgeway Inc., a not-for-profit agency whose mission is to empower people with disabilities through training opportunities and the creation of meaningful employment.

Check out the LUX Blox Submission Video.

Other 2019 prize winners:

- Silver Prize: Qore Performance of McLean, Va. received $30,000 plus $5,000 in FedEx Office print and business services. IcePlate by Qore Performance is a personal cooling/hydrating system for first responders and outdoor workers that helps protect them from heat stroke and hypothermia.

- Bronze Prize: This year, due to the high volume of outstanding entries, FedEx added additional bronze level winners for the first time in the history of the Bronze prize winners can be found here.

Quick Clicks

13—How to empower employees and build trust: Good advice from Achievers

14—Get a list of free stock photo resources (complete with a usability score) from Stock Photo Secrets.

15—The future of work: Get this free guide addressing 10 essentials of employee development from Instructure.

Cool Tools

16—Cash Flow Management Tool

Bench Accounting, North America’s largest bookkeeping service for small businesses, just launched Pulse, a new real-time cash flow management tool. Pulse allows small businesses to monitor every transaction as it happens, enabling you to stay on top of your finances and identify spending trends in real-time.

Pulse is the first real-time financial tool that integrates with a bookkeeping service, supplementing verified monthly financial statements with immediate insights. Pulse lets clients manage their cash and spending by showing them real-time financial reports that combine data from all their institutions in one dashboard. Additional benefits for small business owners include:

- Easy-to-read, actionable reports: Pulse combines all the data needed to manage small business finances and spending into one simple report.

- Stay on top of cash flow and spending: With real-time reporting, clients can monitor every transaction and identify spending trends as they happen.

- One login to rule them all: Pulse brings all accounts and transactions into one place to avoid jumping from app to app or guessing passwords.

17—Easy-to-Use Phone Tech for Small Businesses

In 2018, a team within Google’s internal incubator for experimental ideas, estimated American small businesses receive 400 million calls every day from customers to place to-go orders, book appointments, check open hours or to inquire about inventory. But the team found nearly half of these calls go unanswered because owners are just too busy or assume the caller is a spammer.

So with SMB call volume on the rise, CallJoy is introducing an affordable, yet powerful phone technology solution to give small businesses the same scalable customer service options that typically only large corporations have enjoyed. SMB owners can click here for early access.

“The telephone continues to be a small business’ lifeline. But this volume can easily overwhelm any small business when coupled with other factors such as peak call times and the ever-increasing monsoon of spam callers,” says Bob Summers, founder of CallJoy. “We created CallJoy to help business owners turn the burden of calls into an efficient, delightful experience for their customers that can also give them actionable insights to improve their business.”

With CallJoy, SMB owners receive the following for a monthly flat fee of $39:

- a phone number with a local area code

- an intelligent virtual voice agent and custom greetings

- unlimited call recording and conversation transcripts

- text back functionality

- spam blocking technology

- Google My Business integration

Plus, CallJoy’s virtual phone agent gives small business owners visibility into important metrics, such as what their customers are calling about, the frequency at which they’re calling, and popular call times. Each day, CallJoy categorizes the company’s calls and then compiles the data into an online dashboard and daily insights email.

Learn more about CallJoy on Google’s blog, The Keyword. Small business owners can sign up to receive early access on calljoy.com.

18—Connecting Technology, Software and Data Providers for Better ABM Execution

Demandbase, a leader in Account-Based Marketing (ABM), recently launched the Demandbase ABM Ecosystem, which brings together the Demandbase ABM Platform, CRM, marketing automation and other critical technologies necessary for executing an ABM strategy. The vision of the new ecosystem ensures seamless integration within the ABM tech stack to leverage data, intent and account-based audiences across technologies to deliver consistent cross-channel content, messaging and business outcomes. The current ecosystem includes organizations such as Salesforce, Salesforce Pardot, Marketo, Oracle, SAP, Drift, Uberflip, PathFactory, Folloze, and Sigstr and will continue to expand throughout 2019.

According to Chiefmartech, the marketing technology landscape consists of over 7000 vendors and the rise of platform ecosystems is cited as a key driver in this martech growth.

“ABM has quickly become a core platform for B2B marketers, and the next phase of ABM will require tighter coordination across the ecosystem to integrate applications and data under an account-first architecture,” says Chris Golec, CEO of Demandbase. “As the pioneer of the ABM category, we are spearheading this effort to enable B2B marketers with the ability to deliver a coordinated, consistent message across multiple channels and ultimately increase the effectiveness and ROI of an ABM strategy.”

The Demandbase ABM Ecosystem expands ABM from single-vendor solutions to include marketing automation, CRM, content management systems, direct mail platforms, analytics engines, chat tools, sales orchestration platforms, and more to execute across various channels. At the core is the Demandbase ABM Platform, which allows marketers to identify, manage and segment target account audiences in a single place and measure the results holistically.

19—New E-Commerce Solution from Adobe

Companies across B2C and B2B need to engage their customers wherever they are, react faster to their changing needs and improve the experiences they deliver based on actionable insights. Adobe recently announced an important update to Magento Commerce, the commerce solution in Adobe Experience Cloud for SMBs.

With Amazon Sales Channels and Google Shopping ads Channels, merchants are able to target new audiences and easily reach more customers. These integrated capabilities empower SMBs to better orchestrate the end-to-end experiences they deliver to customers across channels. With PageBuilder merchants can more quickly and easily update the content on their websites. Merchants are now able to tap the broader capabilities of Adobe Analytics, part of Adobe Analytics Cloud in Adobe Experience Cloud through the Adobe Experience Platform connector.

New capabilities in Magento Commerce

- Expand customer reach: With Amazon Sales Channel now generally available, merchants can seamlessly expand their footprint to the Amazon marketplace. Amazon Sales Channel effectively removes the barriers to entry for merchants trying to gain a foothold on Amazon by allowing them to quickly integrate their catalog, establish a bi-directional data flow and start managing listings from their Magento admin. By seamlessly integrating their Magento store with multiple Amazon accounts and regions, merchants can make their Magento Admin the central hub for all their critical Amazon marketplace activities, thereby reducing data silos, removing operational friction, and eliminating additional integration costs. The extension is available today for free download on the Magento Marketplace for Magento Commerce Pro and Magento Open Source 2.2.4 (and later) customers. More info here.

- Target new audiences with a fully integrated, end-to-end Google advertising solution now generally available as a free extension in the Magento Marketplace. Google Shopping Ads Channel for Magento Commerce and Magento Open source 2.2.4 and later, directly integrates with Google Merchant Center and Google Ads to streamline workflow by managing advertising campaigns and reporting across the Google network from the ease of their Magento admin. More info here.

- Launch powerful behavioral analytics: Magento Commerce customers looking to gain a more complete understanding of customer behavior can now easily integrate Adobe Analytics using the Adobe Experience Platform Launch extension. This new development provides brands with the capability to quickly deploy the tag management required to enable the flow of data between Magento Commerce and Adobe Analytics, in just minutes. The extension is one of the first community-driven projects that empowers brands to unlock the potential of bringing the solutions together to drive rich customer behavior insights.

- Accelerate time to market for high conversion mobile experiences: Just months after its release, Progressive Web Applications (PWA) Studio now integrates Braintree (from PayPal) and makes it easier than ever for merchants, partners and developers to get started with debit and credit transactions with a trusted gateway. The integration translates to faster time to market and lower total cost of ownership.

- Expand global inventory management: Magento Order Management brings new capabilities like multi-tender payment workflows, exception management for payments, more granular roles and permissions, full API coverage for omnichannel capabilities, microservices architecture for improved scale and reliability, and fully dedicated staging environment.

- Speed up site content updates: Marketers need to update their online site experience more frequently and more quickly than ever before. The powerful PageBuilder drag-and-drop editing tool for site content, enables merchants to create a best-in-class shopping experience 10 times faster without creative limits or the need for developer support. Now with the new BlueFoot Content Migration tool, merchants who are using BlueFoot on Magento 2.1.x or 2.2.x can quickly upgrade to Magento 2.3.1 with Page Builder 1.0.0 without losing their website content.

20—Receipt Tracking in Southeast Asia

Expensify has teamed up with Grab, Southeast Asia’s leading ridesharing company, to automate expense tracking and reimbursement from rideshares. Mutual customers can now automatically create and submit expense reports, just by connecting Expensify to their Grab Business Profiles. Similar to Expensify’s integrations with Uber and Lyft, Grab customers can book rides in Grab’s mobile app and then receipts are automatically sent to Expensify for a seamless experience.

In a recent Spend Trends report, Expensify analyzed expenses from the past year and reported significant growth in receipt volume from rideshare companies around the world. Grab took the lead for highest growth rate with more than 200% growth in 2018. Much of this growth is attributable to Grab’s investment in Grab for Business, which offers transport management solutions for business travelers.

Business stock photo by Gutesa/Shutterstock