15 Things Entrepreneurs Need to Know

By Rieva Lesonsky

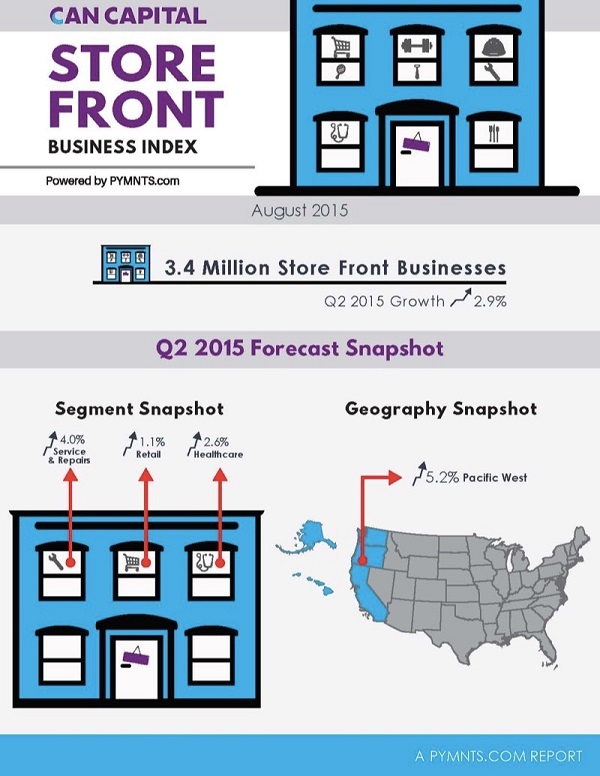

1) Are “Main Street” Businesses Healthy?

We all know America’s small businesses are the backbone of our economy. To find out how Main Street businesses are doing, CAN Capital, a leading alternative provider of capital to small business, and PYMNTS.com teamed up to produce the CAN Capital Store Front Business Index. The companies say they measured the health of the nation’s “Store Fronts and Services”—the businesses that are not just prototypical small businesses, but a subset of them. These are the businesses that “are the backbone of our communities,” the ones we visit regularly.

The Index actually analyzed 3.4 million businesses, representing eight types of small local companies, which include:

- Building Contractors/Remodelers

- Service/Repair

- Eating and Drinking Places

- Retail

- Personal Services

- Professional Services

- Health Care

- Fitness

The CAN Capital Store Front Business Index found:

- Small business wages are the largest driver of growth, increasing 7.9 percent on average in 2014. This growth is projected to slow to 5 percent this year.

- Small business growth was strongest in the Pacific West, where it increased 5.2 percent last year. The Midwest had the lowest growth rate—3 percent.

- Building Contractors and Home Remodelers was the fastest-growing industry, up 7.3 percent in 2014. Fitness had a growth rate of 5.5 percent. Both segments are expected to continue to do well in 2015, with a projected growth rate of 3.9 percent for builders and 5.5 percent for fitness businesses.

CAN Capital and PYMNTS.com plan to measure the state of Store Front Businesses quarterly.

2) Consumer Spending

Perhaps helping explain the health of our “favorite” businesses, Stuart Hoffman, the chief economist for PNC Financial Services Group and Gus Faucher, its senior macroeconomist offer some insights on the latest data around personal income/spending/savings.

They note, “Household income is steadily rising, and consumer spending is rising along with it as noted by solid gains in July for both personal income and consumer spending. Consumers are benefitting from job growth of better than 200,000 per month, modest wage growth, low gasoline prices that have boosted after-inflation incomes, solid balance sheets, and low interest rates. There is also a lot of pent-up demand for purchases; consumers are making up for years of restrained spending following the Great Recession. Households are saving [now, one of] the benefits of lower gasoline prices. But as gas prices decline again with the recent drop in oil prices—the price of a gallon of gasoline will head to around $2.25 by Christmas—they will spend some of the savings. Consumer spending has been leading overall economic growth so far in 2015, and that will remain the case through the rest of this year and into next.

3) 7 Habits of Highly Productive Workers

Productivity at work is a growing issue for many employers. It’s hard to predict what traits to look for when hiring in order to get maximum productivity. Toggl, which offers time-tracking software, recently decided to find out about the habits of productive workers. Of those surveyed 65 percent “found themselves to be productive, while 35 percent evaluated their personalities as unproductive.”

Toggl says the nine most common categories discussed included: time management, good organization and planning, motivation, smart goals, attention to details, self-management, consistency, effective communication and health.

Among freelancers and solo users, factors key to their productivity are:

- 7 percent of solo users say time management is the key

- A nearly identical 24.6 percent say it’s motivation

- 16 percent of freelancers value good organization

- 3 percent say setting smart goals and having a clear step-by-step outline of the work ahead is crucial

- Attention to details was identified as crucial by 7.2 percent

- Effective work communication led to greater productivity for only 3.6 percent

- Only 7 percent think healthy habits (eating well, sleeping well and exercising) are important

For team users the results were similar:

- 7 percent of team users say time management and tracking their time are the keys to their productivity

- 2 percent claim their work engagement and motivation are key factors

- 6 percent value good organization and planning

- 6 percent say its setting smart goals that’s key

- 4 percent say attention to details is crucial for productivity

- Only 3.3 percent say effective work communication leads to greater productivity, despite the fact they work in teams

- A mere 9 percent attribute healthy habits for their productivity

Not surprisingly, most people start thinking about productivity in January and September.

4) Tracking Facebook Changes

Pagemodo, a social marketing suite, offers us a look at the biggest Facebook News Feed updates since August 2014.

5) Beware of Fraud

Bank of the West just released a whitepaper, Fortifying Your Business: Fraud and Security Measures for U.S. Manufacturers, the second Bank of the West manufacturing small business whitepaper, to help guard small manufacturers “against the fraud and security threats they will increasingly face as they become more globalized.”

David Pollino, the fraud prevention officer at Bank of the West, has identified three primary areas of concern when it comes to fraud and security issues affecting small businesses in the manufacturing industry:

Masquerading: This is a payments scheme in which a fraudster impersonates a company executive or outside vendor and requests a phony wire transfer through a phone call or email. In the whitepaper David outlines four steps to take to thwart the growing fraud, starting with developing an approval process for large transactions.

Counterfeiting and Intellectual Property Theft: Vital to manufacturers, intellectual property theft has the potential to break a company (theft of trade secrets ranked 5th on the list of top threats for manufacturers, versus 17th for all industries). The whitepaper discusses the four steps to take to protect against IP theft.

Cybersecurity Breaches: As manufacturing has become increasingly automated and hackers become more sophisticated, companies face heightened risk of cyber attacks. David offers six suggestions for how to minimize cyber vulnerabilities in the whitepaper.

6) Best States & Cities for Small Business

“State and city governments that promote local business training and focus on ease of regulatory compliance are consistently perceived as being friendliest to small business,” reports Thumbtack’s annual Small Business Friendliness Survey.

“Small business owners on Thumbtack have consistently told us that they welcome support from their governments but are frequently frustrated by unnecessary bureaucratic obstacles,” says Jon Lieber, chief economist of Thumbtack.

Some key findings include:

- Business owners in Texas, New Hampshire, Utah, Louisiana, and Colorado gave their states the highest rating for friendliness to small business. Those in Manchester, Dallas, Richmond, Austin, and Knoxville ranked their cities the highest.

- In contrast, small business owners gave California, Connecticut, Illinois, and Rhode Island an “F,” while Massachusetts, Maryland, and New York earned a “D” grade. Providence, New Haven, Buffalo, Albuquerque, and Hartford were the worst-performing cities.

- Entrepreneurs’ perceptions of their tax burdens were among the least important factors in judging governments.

- Investing in a high quality, easy-to-use website that provides useful information and decreases the costs of regulatory compliance improves overall perceptions of a local or state government

7) Seeking Answers

SMB Insights, The Business Journals’ 13th annual survey, reveals that 60 percent of technology decision makers seek advice from other people and sources before they make a purchase. These typical tech decision makers are men in their early 50s who are running well-established moderately sized companies (an average of 24 employees). Those who make technology decisions autonomously are younger and running newer companies. Company size, the decision maker’s age, brand perception and customer experience are some of the factors that influence a small and mid-sized business’s choices, according to latest Technology Decision Making Among SMBs white paper.

Key findings of the survey:

- 96 percent of SMB owners make both technology hardware and software purchase decisions for their companies

- Those running companies with less than 100 employees tend to turn to colleagues and peers. Regardless of company size, the majority of SMBs look to the manufacturer or service provider as well as the Internet for guidance.

Key drivers of brand choice:

- Businesses with fewer than five employees want to work with companies they see as being easy to do business with.

- Those with up to 20 employees are most driven by brands they perceive as industry leaders.

- The largest companies (100+ employees) want an easy business relationship and to work with companies that have momentum.

- Optimization and growth are primary drivers of technology purchases.

- Brands currently used by at least half of decision makers: HP, Adobe, Microsoft and Google. Those used by slightly less than half: Dell, Yahoo, Apple

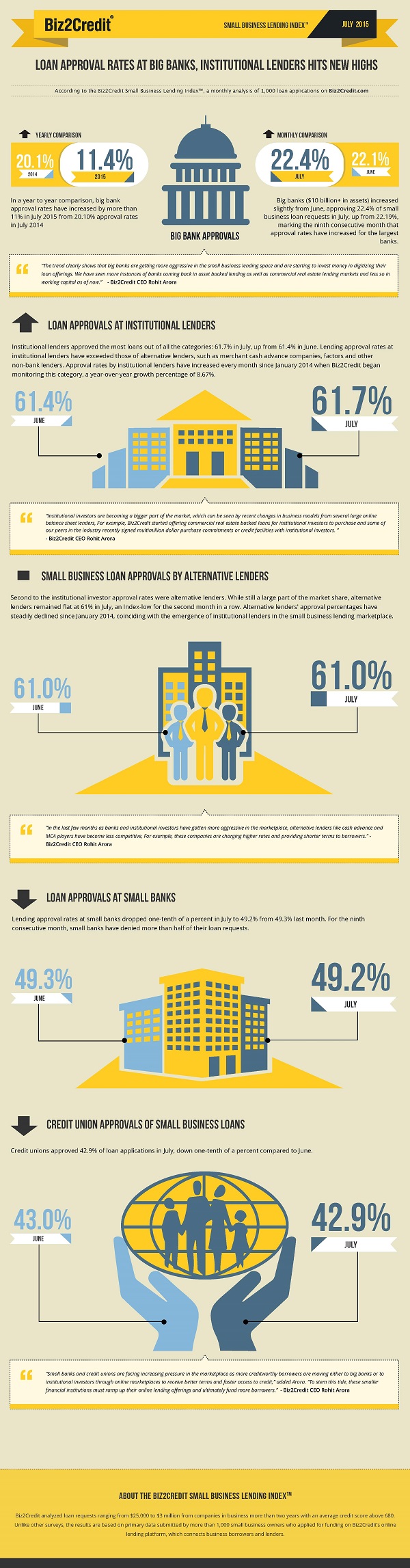

8) Who’s Lending?

Small business loan approval rates through institutional investors and alternative lenders remained higher than any other category in July 2015, according to the Biz2Credit Small Business Lending Index, the monthly analysis of 1,000 loan applications on Biz2Credit.com. Both categories approved approximately 61 percent of Biz2Credit’s total loan requests, surpassing the loans approved through big banks, small banks and credit unions.

Institutional lenders approved the most loans out of all the categories: 61.7 percent in July. Approval rates by institutional lenders have increased every month since January 2014 when Biz2Credit began monitoring this category, a year-over-year growth percentage of 8.7 percent. Alternative lenders came in second at 61 percent in July.

Big banks ($10 billion+ in assets) approved 22.4 percent of small business loan requests in July, while lending approval rates at small banks dropped one-tenth of a percent in July to 49.2 percent and credit unions approved 42.9 percent of loan applications in July.

9) Entrepreneurial Store Debuts

Staples recently announced the debut of the first-of-its-kind retail Entrepreneurial Store, showcasing the products from recent Crowd2Shelf contest winners. The contest, created by Fundable and sponsored by Staples, attracted thousands of contestants with innovative products and companies who competed for a chance to crowdfund their way to Staples.

Some of the items you can find at the store include:

- Folding Bluetooth keyboard

- Remote-controlled recessed LED lighting

- Outlet-mounted Bluetooth music player

- Smartphone-controlled lighting

- Secure tablet holder

The debut of the online store marks the first time a retailer has used crowdfunding to determine market demand and social support in choosing products to carry.

10) VC Confidence

New research from Professor Mark Cannice at the University of San Francisco (USF) about venture capitalists’ confidence levels shows the lowest dip in VC confidence in two years.

The Silicon Valley Venture Capitalist Confidence Index® for the second quarter of 2015, registered 3.73 on a 5 point scale (with 5 indicating high confidence and 1 indicating low confidence).

Overall industry metrics, especially fund-raising and investments by VCs were very strong in Q2. However, concerns over valuations and the cost of doing business in Silicon Valley, as well as concern over macro issues (e.g. China, E.U., and Fed Action) restrained confidence.

This is the 46th consecutive quarterly survey and research report which provides unique quantitative and qualitative trend data and analysis on the confidence of Silicon Valley venture capitalists in the future high-growth entrepreneurial environment.

“While an expectation of a continued strong exit market—both initial public offerings (IPO) and mergers and acquisitions (M&A)—for venture-backed firms remained, along with an abiding confidence in the Silicon Valley ecosystem for new venture creation, increasing concern about high valuations of venture-baked firms restrained sentiment,” says Cannice.

He adds, “While the powerful ecosystem in Silicon Valley for venture creation, innovation, and long-term value creation continues to grow stronger, short to medium-term prospects for positive investment results appear somewhat less certain.”

Cool Tools

11) Popular App Get an Update

Intuit recently announced the Sync with Square app, complete with improved features. The app is one of the most highly requested apps on the QuickBooks App Store. Sync with Square saves SMB owners time by automatically updating sales transactions and invoices directly into QuickBooks Online, which increases accuracy. The app is free to use.

12) QuickBooks Shortcuts

Also new from Intuit is the QuickBooks Online app for Windows, which enhances the experience of small business owners when they access the cloud-based QuickBooks Online ecosystem from their desktop computers.

With the introduction of the free Windows app, QuickBooks Online can work seamlessly across all devices and platforms, including: Windows PC, Mac, iPhone, iPad, Android, and through the web browser.

The QuickBooks Online Windows app includes PC keyboard shortcuts, toolbar, menus, and multiple windows support. It also provides all of the popular QuickBooks Online functions that enable small businesses to easily create invoices, track sales and expenses, and generate reliable records for tax preparation time. And you can access the QuickBooks Online ecosystem directly rather than having to go through a web browser.

13) Eat & Go

If you own a restaurant you should check out Touch Bistro, which is an iPad POS system that enables your servers to quickly process payments at the table. Customers are happy since service is quicker, which helps turn the tables over faster—good news for restaurateurs. The sign on screen option offers an ever quicker—and paperless experience for diners

14) Enhance Your Online Presence

YP, a leading local marketing solutions provider, just introduced ypPresence℠ Starter, a new way for business owners to control the online presence and credibility of their businesses.

Consumers are using multiple sources of information to find detailed information about local businesses before making a decision or a purchase. With ypPresence Starter, business owners can update their business profile pages and share content such as photos, hours of operation, and call-to-action across the web. Key features include:

- Presence Dashboard. A central dashboard makes it easier for business owners to get insight into the online health of listing content, reviews and social activity around their business.

- Online Content Enhancer. Business owners can get listed, create pages and share the most important business information on top sites that account for 90 percent of Internet traffic.

- Online Reputation Awareness: Business owners can monitor online reviews and social mentions in one location, saving the time and hassle of checking multiple sites. Positive reviews and mentions can influence visibility on the major search engines.

You can also manage your online presence anytime, anywhere, via the YP for Business app and get notified every time your business is mentioned in a review, social media or someplace else.

The YP for Business app is free in the App Store and Google Play.

15) Schedule Your Hourly Employees

When I Work helps small business owners schedule their hourly employees. You can send your staff their schedule directly from your Android or iPhone. Employees can also request shift trades and time off through the app. It also includes a built-in time clock with GPS that let’s employers know when their employees clocked in and from where.