11 Things Small Business Owners Need to Know

By Rieva Lesonsky

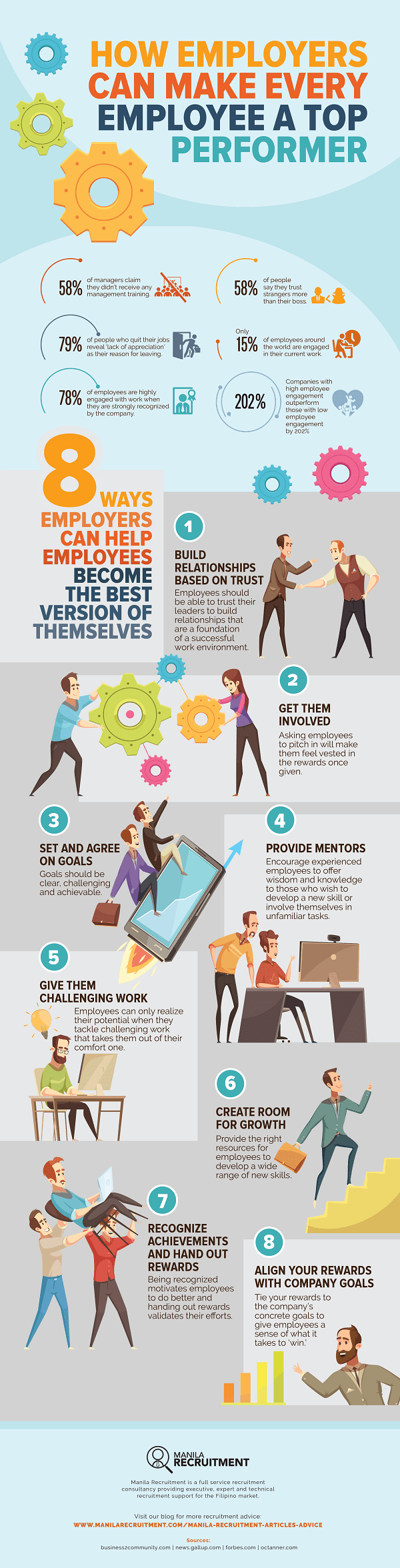

1—Help Your Employees Become Top Performers

For many small business owners these days finding and keeping qualified employees can be a struggle. Once you hire high-potential employees, you have to continually invest in their success.

Check out the infographic below from Manila Recruitment to learn how to groom top-performing employees.

2—Helping American Businesses Go Global

Kabbage, Inc., a global financial services, technology and data platform serving small businesses, has teamed up with Alibaba.com, Alibaba Group’s online platform for global B2B trade to power the Pay Later program offered to U.S. buyers. Pay Later allows small businesses on Alibaba.com to obtain up to $150,000 of financing for their orders.

To apply, go to Alibaba.com or the Alibaba.com mobile app, and connect your verified, real-time business data, such as a bank account, accounting software, payment processors and more, for a fast and paperless funding decision during the checkout process. Each purchase financed via Pay Later creates a six-month term loan with rates as low as 1.25% per month—a competitively lower rate than most traditional loans. There are no fees to apply, no fees to maintain the line of credit, no order transaction fees and no early repayment fees.

Since its beta launch in June 2018, The Pay Later program has simplified and strengthened payments for small businesses using Alibaba.com. A poll of Pay Later customers shows 81% say it’s easier to apply with Pay Later than other business financing options, and 68% say Pay Later has allowed them to increase order sizes on the site. Pay Later financing also better accommodates the around-the-clock nature of small business owners as more than 60% of loans to-date have been accessed outside of normal banking hours.

3—The Largest Online Network for SMBs in North America

Alignable.com, The Small Business Network, just hit a major milestone—membership passed the 3 million mark, making it the largest online network of SMBs in the U.S. and Canada. While membership momentum has been rapid, engagement across the platform also has seen dramatic increases.

Alignable’s CEO and cofounder Eric Groves says, “Today, over 10% of the small businesses in North America have a presence on Alignable. And we’re helping those members gain access to vital tools and resources that will fuel their success. Ultimately, we want to expand our services, so all small business owners see Alignable as their most-trusted business resource.”

To date, a whopping 42 million+ connections have been made across the U.S. and Canada on Alignable, up 40% over the past three months. Plus, millions of members have exchanged referrals and recommendations.

To keep driving the growth of member businesses, the company has many new campaigns, partnerships, and product features launching in 2019, including the search for each community’s Small Businessperson of the Year, which has attracted thousands of nominations. For any small business owners who are not part of Alignable yet, but want to benefit from the know-how shared by its three million members, click here to join for free.

Alignable also has established the Alignable Trust Index, which collects and presents ratings and reviews for more than 100 national brands, showcasing the brands most recommended from one small business to another.

Alignable just polled its members asking if the government shutdown affected their businesses. More than 3,600 people responded—and a whopping 84% said it wasn’t affecting their businesses. You can read the comments here. Several business owners want to learn how they can help other small businesses who are struggling due to the shutdown.

4—The State of Global Entrepreneurship

Nearly 20% of the world’s entrepreneurs work with family members, according to the 20th anniversary edition of the 2018/19 Global Entrepreneurship Monitor (GEM) Global Report, sponsored by Babson College, Universidad Del Desarrollo and Korea Entrepreneurship Foundation.

“The Global Entrepreneurship Monitor Global Report shows that the global economy nourishes entrepreneurs of all kinds. There is a lot of media attention for innovative startups, however entrepreneurial employees, family business entrepreneurs, and small-scale established entrepreneurs also play a key role in national and local economies,” says coauthor and Utrecht University Entrepreneurship Associate Professor Niels Bosma. “This year, GEM results also confirmed that entrepreneurial activity in the gig and sharing economy is substantial in all parts of the world.”

In fact, 6% of people ages 18-64 in 27 countries are part of the gig and sharing economy.

“It might not be a surprise that many businesses are family owned, particularly when we see them every day in our communities and read about large family-owned corporations in the news. Nevertheless, to our knowledge, this is the first global study of family involvement in the startup phase. The results illustrate the extent entrepreneurs rely on family members to get their businesses off the ground,” says coauthor and Babson College Entrepreneurship Professor Donna Kelley.

Global GEM highlights

Nearly one in five entrepreneurs are starting businesses that will be owned and/or managed with family members, in the 47 economies assessing family business activity. Colombia, the United Arab Emirates, and Uruguay report the highest level of family-based entrepreneurship.

The highest rate of involvement in gig/sharing economy activities, measured in 27 economies, is in the Republic of Korea. Israel, Chile, Ireland and the United States also report high rates of involvement in the gig and sharing economy.

The report examines societal attitudes about entrepreneurship, which can indicate the extent there are potential entrepreneurs and support for this activity. In the Netherlands, Poland, and Sweden about three-fourths of adults say it is easy to start a business, the highest of the 49 economies studied. In Netherlands and Poland, in addition to Turkey, Thailand, Guatemala and Madagascar, over 80% of people think entrepreneurship is a good choice of career. Thailand also shows the highest level of media attention for entrepreneurs with 87% of adults stating that entrepreneurs are represented positively in the media. In Sweden, 82% of adults believe there are many opportunities around them for starting businesses, the highest level across the entire sample.

Key findings

Demographic profile of entrepreneurs

Total early-stage Entrepreneurial Activity (TEA) Rates. The highest TEA rates can be found in Angola (41%), a low-income economy. However, high rates can also be found at higher income levels with middle-income Guatemala reporting 28% TEA and high-income Chile reporting a level of 25%.

Gender. Of 48 economies surveyed by GEM in 2018, six show roughly equal TEA rates between women and men. Those are Indonesia, Thailand, Panama, Qatar, Madagascar and Angola.

Impactful entrepreneurship

Improvement-Driven Opportunity (IDO) Motives. The proportion of entrepreneurs who are opportunity-motivated and improvement-driven, in terms of seeking higher income or greater independence, accounts for an average of 37% of entrepreneurs in the low-income economies. This increases to 42% on average among the middle-income economies and 51% in the high-income economies.

Growth Expectations. The highest proportions of entrepreneurs projecting to create six or more jobs in the next five years are in the United Arab Emirates (UAE) and Colombia.

Innovation. Innovation among entrepreneurs is most prevalent in India (47%), and Luxembourg and Chile (both 48%), where entrepreneurs are introducing products or services that are new to customers and not generally offered by competitors.

Industry. The most noticeable industry trend in the movement from low to high-income groups is the decline in wholesale/retail activity, which is taken up by the increase in services and technology. In every low-income economy, wholesale/retail businesses account for more than half of their entrepreneurs, while only four of the 31 high-income economies report this level. In contrast, in over half of the high-income economies, 20% or more of the startup activity is in finance/real estate/business services, while few entrepreneurs in the low-income economies are starting in this sector.

Entrepreneurship of all kinds

Solo entrepreneurship. In Brazil, 53% of entrepreneurs operate on their own, with no co-founders or employees, and projecting no hiring. The next highest level on this indicator is in Madagascar, where 30% of entrepreneurs are operating on their own and plan to continue doing so.

Entrepreneurial employee activity. Entrepreneurship among employees of existing organizations is most prevalent in Europe. In Sweden, Germany and Cyprus, entrepreneurship is at least as likely to occur in organizations as it is in independent startups. In other countries, like the Netherlands and Canada, high levels of employee entrepreneurship complement high TEA rates.

Family-based entrepreneurship. Family-based start-ups contribute substantially to entrepreneurship in many economies. In Angola, Lebanon, Guatemala, Chile, Colombia and Thailand, 10% or more of the adult population are starting businesses involving family members.

Gig economy and sharing economy. The highest rate of involvement in such activities by far is in the Republic of Korea (over 20% of the adult population).

Sustaining entrepreneurship

Established business ownership. The East and South Asia group is distinct in showing a relatively high level of established business activity relative to TEA. In Thailand, where TEA rates of 20% are highest in the region, an equal number of people (20%) run mature businesses. In Latin America, and in the Middle East and Africa, most economies show higher startup levels than established business activity.

Discontinuance. In most cases, discontinuance follows TEA. For example, in Thailand, Chile, Guatemala, and Lebanon, discontinuance rates are high, but so is TEA. Conversely, discontinuance is low in many European countries, as are TEA rates. Among various reasons cited for discontinuing a business, the most common was a lack of either profitability or capital, accounting for an average of 45% of exits, unweighted across the sample.

Entrepreneurial potential and support

Ease of starting a business. About three-fourths of adults in the Netherlands, Poland, and Sweden say it is easy to start a business in their countries.

Media attention for entrepreneurship. Media attention is high in East and South Asia, particularly in Thailand (87%), Indonesia (80%), and Taiwan (76%).

Opportunity and capability perceptions. High levels on both of these indicators occur in three Middle East and African countries, where over 70% of adults in Saudi Arabia, Angola and Sudan see many entrepreneurial opportunities around them, and over 75% of adults believe they have the ability to start a business.

Fear of failure. Latin America boasts a low fear of failure rate.

Affiliations with entrepreneurs. The highest and lowest personal affiliations with entrepreneurs in the entire sample are found in the Middle East and Africa. People are most likely to know an entrepreneur in Saudi Arabia (79%) but least likely to know one in its neighboring country of Egypt (12%).

Entrepreneurial intentions. Entrepreneurial intentions are higher than TEA in every economy in Latin America and the Caribbean, in the Middle East and Africa, and, with the exception of Japan, in East and South Asia. The largest gap in these indicators across the entire sample is found in Morocco and Egypt, where for every person starting a business, six intend to start in the next three years.

5—Best Practices—When Video and Email Cross Paths

Guest post by Sean Gordon, CEO, HIRENAMI & vidREACH.io & Executive VP, ITC Holdings

Every business today, no matter the industry, has someone working with video. Whether marketing, or a startup, video is always an integral part of how you conduct business.

That said, in many ways digital video production and distribution remain in its infancy. While programs with exciting new features pop up on a weekly basis, existing tools like email are playing catch-up to the video revolution.

Besides hardware taking steps forward, we’re still adapting to the production of video, as well as the etiquette when it comes to distribution. Etiquette is equally important; when to send, whom to send what, and what accompanies a video, are crucial considerations.

How can we ensure our video will reach the widest intended audience? Let’s look at some best practices for sending videos through email to prospects, customers and for internal communications.

Treat your subject line as a film studio treats their movie titles: Put thought into it! Be creative, draw their eyes, make them want to open and view. Be forthcoming but clever, not misleading. What are some subject line strategies? First and foremost, let your recipient know a video is embedded.

Another strategy is to be self-referential of the video, stating something like, “INSERT CONTACT NAME, I created this quick 30-second video to introduce you to our INSERT PRODUCT”. The benefit here is that it personalizes and even includes stakes; this title is obviously predicated on an earlier outreach, so you’re delivering specific information for the recipient that they may have requested.

Words are your friend: The video is the key to your email, the reason you’re sending it in the first place. However, don’t ignore the power of text to augment your message!

Don’t use your email to reiterate what was said in the video; summarize, add personalized caveats to strengthen the message.

Don’t forget to follow-up: Include a call-to-action at the conclusion of the email. What would be the next step you’d like to see taken?

A final though—don’t be afraid to show some personality! You can be a little bit goofy or a little bit eccentric. Personalize and humanize, those two words should be your guiding creed.

6—How to Plan a Memorable Business Meeting or Event

Thousands of meetings and events are planned every year with the hope that attendees will learn something new and put that into action. The best way to get those ideas implemented, according to BCD Meetings & Events is to create a memorable attendee journey because when attendees leave an event excited they are more likely to apply what they’ve learned.

Here are some of their tips for creating that type of experience:

- Identity the core of the meeting. Understanding each attendee’s needs and desires is vital in guiding event creation, from beginning to end. With that knowledge, you can set attainable goals, ensuring a successful attendee experience.

- Cultivate interest early. Launch the registration site earlier to connect sooner with attendees (send a save-the-dates, blogs to get people excited, etc.) The earlier the attendee journey begins, the more time you have to build up anticipation.

- Be audience-centric. Deliver memorable, in-person experiences and dynamic content that resonates with attendees. Building your meeting around your audience drives engagement, while also provides the WOW needed for maximum impact.

- Leverage technology wisely. Use technology to enhance the attendee experience—AKA NOT to keep their eyes looking down on their phones. A well-balanced use of technology keeps attendees engaged, and helps you understand their experience from data collected after-the-fact.

7—Most People Receive One or More Robocalls Per Day

Did you receive a robocall today? Chances are you did—52% of us receive at least one robocall per day, according to a new survey from Clutch, a leading B2B research, ratings, and reviews firm. And almost 40% of survey respondents, say they receive multiple robocalls per day.

Robocalls are common because:

- Ease of operating a robocall scam

- Low cost of making phone calls

- Ability to place calls from anywhere

These factors make tracking and apprehending robocall scammers challenging for authorities. “I can go to a website, upload an audio file, put in a range of phone numbers, use a prepaid debit card, and annoy San Francisco for $400 to $500,” says Alex Quilici, CEO of YouMail, a service for blocking robocalls. “When it’s that easy to commit a crime, criminals will commit it.”

Revealing private information to a robocall: 21% of people have either accidentally or intentionally given their private information to a robocall scammer. Robocallers use a variety of tactics to increase the success of their scams. The most troubling is known as “neighbor spoofing,” or tricking a caller ID to display a local number to the person being called, even if the call is placed from far away.

Indeed, 44% say they receive a robocall with an area code matching their personal phone number at least once a day. When people see a call from a local number, they are more likely to pick up, assuming a neighbor or local business is calling them.

Robocalls often spoof real phone numbers to conduct this scam. If the robocall recipient calls the number back, it can confuse or undermine the individual or business that owns the real phone number.

8—4 Financial Resolutions Every Freelancer Needs to Make

How do we prevent business failure? According to FreshBooks part of the reason freelance businesses fail is that the average freelancer doesn’t follow best financial practices.

Here are the financial resolutions top freelance earners follow—and that every freelancer needs to make in 2019:

Resolution 1: Don’t mix business with pleasure: 74% of top earners keep business and personal accounts separate

Small businesses can get into trouble fast by not putting a bright line between personal and business finances. Your company should not be a personal slush fund for that trip to Ibiza.

Resolution 2: Don’t go it alone: 73% of top earners use professional resources to maximize deductions

Unless you run a Mom & Pop CPA shop, accounting is likely not your area of expertise. Seek out resources on best practices and ask for help from professionals if you get stuck.

Resolution 3: use accounting software: 61% of top earners rely on accounting software

Technology is nothing to fear, especially in the accounting space. There are plenty of reliable high-tech tools that will help you manage your cash flow, receivables, billing, and taxes.

Resolution 4: budget, budget, budget: The budgets of top earners account for both their short and long-term financial goals.

It’s pretty obvious every small business needs a budget. They can keep you from overspending and help you set realistic objectives. They are also great at helping you to visualize your company’s goals in the short, medium, and long terms.

For more common accounting mistakes putting small businesses at risk you can check out this FreshBooks blog post.

9—Smart Stores for Small Business

Big box retailers often have lots of tools and money at their disposal to create a “smart” environment for their customers, including Wi-Fi, content streaming, and targeted advertising. Of course, we all know this isn’t always the case when it comes to smaller retailers. Veea, Inc. is changing this through its VeeaHub Smart Store. The VeeaHub Smart Store is a complete hardware and software solution, replacing existing Wi-Fi access points and other on-premise point solutions, through a single convergence device.

Through VeeaHub Smart Store, stores are able to connect all “smart” systems through their hybrid mesh, while providing bandwidth management and enhancing internet connectivity, all at a lower operational cost.

Quick Takes

10—According to a 2017 survey from the American Pet Products Association,11% of pet owners now enjoy a pet friendly workplace, up from 8% in 2014. If you’d like to be a pet-friendly office, check out this great guide, The Office Dog: An Ultimate Guide to Dogs in The Workplace.

11—WorkSmart Systems, an Indianapolis-based Professional Employer Organization (PEO), has attained official designation as an IRS certified professional employer organization (CPEO), one of only 6% of nationwide CPEOs to offer safer federal eligibility.

Business stock photo by GaudiLab/Shutterstock