8 Things Small Business Owners Need to Know This Week

By Rieva Lesonsky

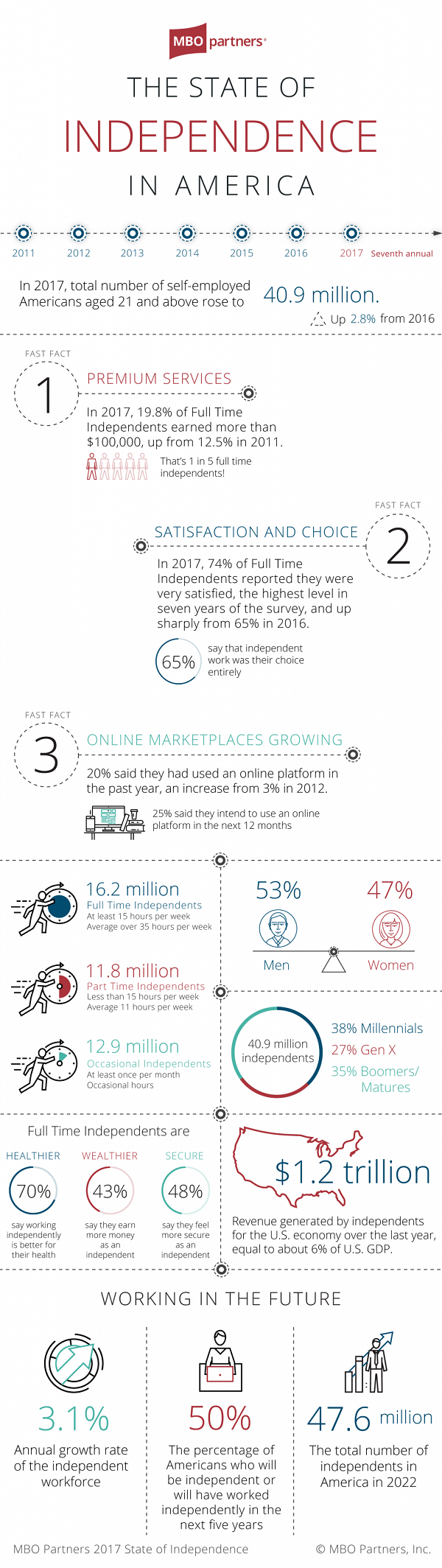

1—The State of Independents

The independent workforce is continuing to grow, according to the 2017 MBO Partners State of Independence In America. There are 41 million Independents, comprising about 31% of the private U.S. workforce, representing every demographic, age, gender, skill and income group.

“Independent work is the way of the future,” says Gene Zaino, CEO of MBO Partners. “Even against a strong economy, independents, particularly in skilled labor markets, choose this path over traditional employment.”

Three key trends emerged in the 2017 study:

1—A strong job market means independents are increasingly able to compete in the War for Talent on their own terms. This strong job market means independents seeking clients have an easier time than ever finding work as jobs open and companies experience a talent shortage. In 2017, for the sixth year in a row, the number of high-earning independents rose. Now, 3.2 million Full-Time Independents make more than $100,000 annually, up 4.9 percent from 2016. This population now represents nearly one in five Full Time Independents.

2—While full time independent work is broadly appealing, it’s not for everyone. A portion of the independent workforce has always been characterized as “reluctant”—people who work independently but would prefer a traditional job yet can’t find one that is better than their independent work option. In 2017, thanks to the strong jobs market, the proportion of Reluctant Independents fell to 24 percent, the lowest in all seven years of the study.

3—More Americans are turning to part-time or occasional independent work to supplement their income. Fueled in part by the growth of the widening array of online platforms, the number of people working as Occasional Independents (those working irregularly or sporadically as independents but at least once per month) soared 23 percent to 12.9 million, up from 10.5 million in 2016.

Check out the details in the infographic below.

2—Workforce Attitudes

The 2017 U.S. Trust Insights on Wealth and Worth survey from U.S. Trust and Bank of America shows the perceptions of different generations about work.

Survey highlights include:

- Americans are choosing to—or needing to—work later in life. With Gen Z coming of age, there are now up to as many as five generations, in some cases, working side by side in the workforce. 47% of those surveyed work on a daily basis with at least three or more generations. One in 10 works with four or more generations.

- 89% agree a diversity of generational perspectives is good for the workplace and leads to better results. But, it also causes some tension…

- Millennials and Gen Xers feel stuck in their careers because older colleagues are working longer. And, nearly half of all generations say they are competing for the same jobs with people who are a generation younger or older than they are. Baby Boomers may feel resentment reporting to a Millennial boss.

- 65% of millennials are still looking for a career they feel passionate about. 67% plan to make a career change in the next 3 years.

- 70% would prefer to own their own business.

- What we want in a career evolves over time and with age. For millennials, making the most money tops the list, but they also want to learn and have a cool experience. For Gen Xers, flexibility in how/where to work trumps money, and they want the ability to lead and make decisions. For boomers, flexibility is also key along with the ability to control their own destinies.

- Age perception plays a big role in the workplace. Millennials say ‘old age’ starts at 59 and youth ends at 40. Their older colleagues disagree—citing 31 as the end of youth.

- What word is most associated with ‘old age’? Experience—while young adults are most viewed as ‘tech savvy’.

3—The Hybrid Cloud

Key strategic business demands—the need for greater business agility, data capabilities, and better customer and user experiences—are compelling companies to embrace cloud systems, according to the Insight-sponsored report by Harvard Business Review Analytic Services.

Respondents are nearly split when it comes to hybrid and private cloud adoption, while total public cloud usage captures only a fraction of the market:

- Hybrid approach with systems hosted in both the public and private clouds (42%)

- Host most of their systems in a private cloud (40%)

- Host most in the public cloud (13%)

The types of systems most likely to reside in the cloud, include:

- Email and communication tools (54%)

- Billing and invoicing (29%)

- Business intelligence (29%)

- Payroll (26%)

- Customer service (24%)

- Project management (24%)

Cloud improves company performance

“A company’s IT environment should work for them by enabling them to both run and innovate. Large and small to mid-sized companies need to focus on managing and modernizing their IT infrastructure, so that it becomes a transformative part of their business that can directly improve results,” says David Lewerke, Director, Hybrid Cloud Consulting Practice at Insight. “While we knew there were a number of benefits, we wanted to better understand from respondents exactly how cloud systems were impacting their business outcomes.”

The benefits of cloud adoption are even more pronounced among small to mid-sized companies:

| Large companies | Small to mid-sized companies | |

| Time to market | 15% | 47% |

| Business/revenue/profit growth | 17% | 38% |

| End customer experience | 32% | 48% |

| Ability to manage security | 26% | 39% |

| Ability to mitigate risk | 28% | 39% |

For all respondents 49% say cloud or hybrid cloud systems have significantly improved collaboration, followed by business agility and flexibility (45%), their ability to manage, analyze, act on and share data (43%) and their ability to empower employees and create a better user experience (42%).

4—High-Performers Take More Vacation Time

Namely, a leading HR platform for mid-sized companies, just announced a new data report, HR Mythbusters 2017, which analyzed data from over 125,000 employees to confirm—or bust—several myths about the modern workplace.

Key findings show that high-performers take ample vacation time, which appears to pay off. Those who received high marks during performance reviews took an average of 19 vacation days each year, versus 14 days on average for low performers. This 5-day gap suggests that time off from work has a dramatic and positive impact on performance. In addition, it appears baby boomers are the new job-hopping generation, with a median tenure of just 2.53 years—busting the notion that millennials are the only ones who frequently change jobs.

Additional insights include:

- Unlimited vacation is under-utilized. Employees with unlimited policies take 13 days a year versus 15 for those with traditional PTO plans.

- Engineers are taking over the workforce. Of employees who started in 2016, “engineer” was far and away the most frequently recurring job title keyword.

- High-growth keeps employees around. For every additional 10% in headcount growth.

You can download the full HR Mythbusters 2017 report here.

5—Buy Online for Your Best Savings

It’s no secret that you can save a lot of money on your new business purchases by shopping online. The bigger question is, how do you know you’re getting the best deals? Plus, we all know that the time it takes to search for coupons, and then cutting and pasting them can be a serious time-suck…time that would be much better spent on developing your new venture.

Our friends at GoodSearch say a great solution is to use a website, browser extension, or even intelligent personal assistant that finds the coupons for you. This is an easy, efficient way to get savings on desks, laptops, computer software, business cards, and many of your other new-business needs.

6—The Consumerization of Benefits: Why Personalization Is Paramount

Guest post by Kristen Appleman, vice president Health and Wealth, ADP TotalSource®

It’s clear everywhere you look: From food to media, entertainment to clothing, there are near-endless options for what we consume and how we consume it. Now more than ever, consumers are inching closer to the buttons and levers that control their choices. And now we’re starting to see employees opt for more choices when making decisions about their benefits and overall health care.

More and more employees of small businesses want their benefits options offered just like other products and services—simple, efficient and tailored to their lifestyles. In fact, a recent ADP® small business client survey found that regardless of whether a company is growing or established, consumerism is the top strategy companies are using to maintain the cost and quality of benefits programs. Forty-two percent of growing companies and 38% of established companies are taking this approach.

By the standard definition of consumerism, that means small business owners are rethinking how they structure the benefits packages they offer to their employees, focusing more on individual preferences and needs rather than defaulting to a “one-size-fits-all” program.

For instance, the survey also found that companies most often consider the different generations and varied incomes within their organizations when designing benefits packages. Businesses that employ millennials, Gen-Xers, and baby boomers are being driven to consider options that will appeal to a diverse set of age groups and lifestyles to drive employee engagement and retention.

Small business owners who are re-evaluating the structure of their employee benefits plans may want to consider these trends:

Amid legislative uncertainties, options are key. With the future of health care reform unclear, many companies are in a holding pattern regarding the future of the health plans they offer. Providing a wider range of benefit options may improve employee engagement and potentially reassure workers that the business owner is sincerely trying to help them meet their health care needs. The Metlife® 14th Annual U.S. Employee Benefits Trends Study shows that workers across all generations place a high value on employee benefits. According to the study, 70% of respondents say personalized benefits are likely to increase their loyalty to their company.

Employees, especially millennials, want the freedom to choose. Different generations have different benefits needs. For instance, the Liazon® 2017 Employee Survey Report found younger employees are most open to the idea of choosing their own health plans from an exchange. According to the Liazon report, 85% of millennials reported high satisfaction in their company’s decision to offer exchanges as a health care option, while 78% of Gen-Xers and 74% of baby boomers felt the same way. Especially amid the ongoing war for talent, offering strong benefits options has become integral to companies trying to keep pace and attract new talent.

Providing options increases employee satisfaction. The health care industry is struggling to educate employees and drive meaningful engagement when it comes to making smart health care decisions. According to the 2016 Benefits Communication Survey by the International Foundation of Employee Benefits Plans, only 19% of employees report having a high level of understanding of their benefits, while almost 50% don’t understand their benefits materials. Providing benefits options and transparency for those options may not only improve employee satisfaction, but may feed employee confidence.

Consumerism is more than just a shift in benefit design—its’ a paradigm shift in how employees will manage their decisions going forward. The world is becoming more complicated and personalized on all fronts, and workers want benefits choice, but don’t always have the right resources. Small business owners can play an important role in giving their employees the tools they need to make their own informed benefits decisions.

Quick Links

7—Small Business Lenders’ Loan Requirements

NextAdvisor has created a useful comparison of the leading small business loan services, including loan amounts offered, APR, terms and origination fees to help entrepreneurs find the right loan for kicking off their small business.

Cool Tools

8—The Easy Way to Manage Your Business Profile

YP, The Real Yellow Pages® just launched ypPresence® Plus, an online presence solution that lets business owners manage their business profile information from a single dashboard and syndicate that information across 60+ leading directory, search, social, and navigation sites.

It’s vital for small businesses to have an accurate online presence—and be in control of their online data. Otherwise, their critical business information, such as a business name, address and phone number, can be listed incorrectly on the sites that consumers visit frequently to search and find local businesses. And apparently research shows, even after a business owner corrects their information, it can be changed without their consent.

To solve this problem, ypPresence Plus locks your core business information on leading sites (so it can’t be changed without consent) and allows you to more easily share content that can both drive engagement with consumers and build on-site SEO.

Key features include:

Lock Listings: Local business owners can lock in critical business information across 60+ leading directories, maps, apps, and social networks.

Be Where Consumers Go: Enables you to increase your visibility by helping you get your business information on more sites where consumers look for information, including leading directory, search, social, and navigation sites.

Build SEO Credibility: When a business’s information is accurate and consistent across multiple sources, a business’s overall SEO rankings get a boost.

Ad-Free Profile: ypPresence Plus clients get access to an enhanced, ad-free profile on yellowpages.com (home to nearly 55 million consumers who are more likely to buy and tend to spend 34% more than all searchers).

Convenient Dashboard: You get access to a central dashboard to update business information, upload photos, monitor reviews, and keep tabs on social activity.