12 Things Entrepreneurs Need to Know

By Rieva Lesonsky

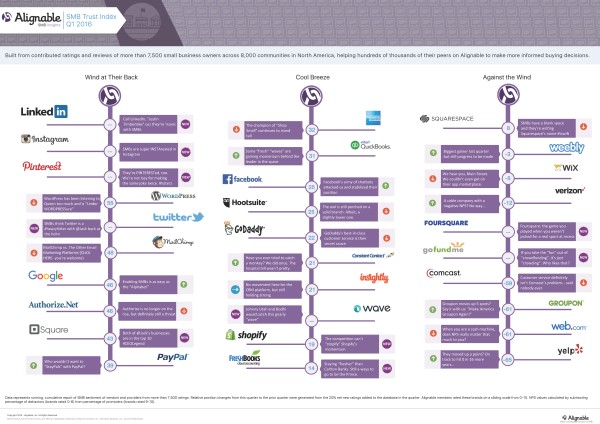

1. Who Do You Trust?

Check out the latest SMB Trust Index from Alignable and see how small entrepreneurs like you rate the big brands you do business with.

2. Shopping Local

There’s lots of good news for small business owners in the new retail research launched by G/O Digital. The research shows 55% of consumers shop local because they love supporting local entrepreneurs. Additionally, 38% shop at small ecommerce retailers over national ones because they prefer to support smaller businesses.

Important influencers include online reviews. In the G/O Study, only 8% of those surveyed say online reviews never factor into their decision to purchase at a local retailer. That makes it a must for business owners to constantly monitor what’s said about you online, so you can “turn negative reviews in to positive opportunities for your business.”

Social media also matters—and it’s not just for complaining. In fact, according to the survey, social media is used to “facilitate positive interactions with local businesses—87% are motivated to engage with a local retailer on social media because of a positive experience with that retailer. Only 13% choose to interact because of a negative experience.”

Want more insights. There’s plenty, such as what deals are most important to local retail shoppers and how mobile affects the in-store experience in the research report, Consumers Love Local: Small Retailers Have the Edge!

3. 7 Ways Startups Can Save Money

You can increase the odds of startup success by spending less on your upfront costs and overhead. CORT, a Berkshire Hathaway company and the nation’s leading provider of transition services, shares seven ways startup entrepreneurs can save revenue.

- Hire Only When Necessary: Hiring full-time, experienced employees early on can use much of a startup’s operational budget. Grow slowly, and only hire employees when it is absolutely necessary. Instead, look to freelance contractors or interns who can help complete tasks. Small business owners may not have the skill-sets or time to manage an SEO-optimized blog, but an intern may be able to lend their expertise from their marketing class, all while building their resume.

- Plan Real Estate Carefully: Startups that plan to open a brick-and-mortar office or storefront should carefully consider their real estate choices. Look for a commercial real estate provider who is focused on your long-term growth, rather than just selling you space. If you anticipate rapid growth, make sure to keep your space flexible. This will allow you to stay in your office long term instead of moving every few years. Another option is to use a co-working space or business incubator. These offer training and networking events for small business owners, a collaborative work environment and no long-term lease commitment.

- Save Money Where You Can: This may seem like a no brainer, but every bit of money you save, is money you can reinvest in your company. Look for ways you can save money by carefully weighing each purchase. Consider if you can rent the products you need or outsource the service to a vendor to conserve capital for growth investments.

- Find Helpful Mentors: Many people have been in your place before. Look to professional organizations or local entrepreneur groups to learn from others experiences. These kinds of mentors can tell you what they did to save money in the start-up phase and how they sustainably grew their companies. The S. Small Business Administration offers a Mentor-Protégé Program for owners of 8(a) businesses. [Or you can find free mentors at SCORE.]

- Negotiate Like an Expert: Negotiating is a key part of success at any stage of business, but especially in the start-up phase. No matter if you are negotiating with future employees, investors or vendors, getting the best deal can save you time and money. You can also consider bartering for services by offering your skills or products in return for professional services.

- Let Your Customers Promote Your Services: While you may think that spending lots of money on a television ad will help drive sales, this may not be the best use of funds for your stage of business. Instead, look to build your reputation on referral sites like Yelp and leverage social media channels to connect with people who fit your customer profile.

- Consider Rental: Paying overhead to buy a full suite of office furniture or other fixed assets can consume valuable resources that you could direct toward other aspects of the business. The rental concept is a low-risk investment to get your office off the ground, ensuring you have flexibility no matter what changes await your business.

CORT offers a variety of workplace collections perfect for small businesses, including the STAKs collection, which offers diverse workplace configurations that promote collaboration, flexibility and mobility.

4. From College Grads to Entrepreneurs

We’re deep in the midst of college graduation season and the Class of 2016 is deciding what’s next. And for many the answer is—business ownership.

The folks at Hiscox, a specialist small business insurer, have some tips for soon-to-be college grads who are thinking about starting their own businesses:

Find your bliss: Starting and running your own business requires a lot of time and energy. The more you enjoy it, the less it’ll feel like “work,” which is important when you’re working long hours. Like when you took certain college courses, you’ll always be learning as a small business owner—the challenge will be more rewarding if you’re passionate about your business.

Network: Soon-to-be college graduates have a built-in network from their time at school. Reach out to older alumni who may now be successful business owners for tips on starting off. Also, don’t forget to target your former classmates or even professors when you’re looking for customers.

Know how to prioritize and when to ask for help: Just because you’re your own boss doesn’t mean you won’t have to put in long hours. It actually may end up being the opposite—since you’ll be wearing many hats as a small business owner, you may find that there aren’t enough hours in the day to get everything done. Did you juggle studying and an internship during college? Be ready to juggle many different things as a business owner. Don’t assume you can do everything, though—know when you have to outsource some of the work.

Take Smart Risks: Starting a small business comes with some risk, but so does anything worth having in life. There will be a lot of long hours and sleepless nights, but it’s worth it to build something great. Protect your new company with small business insurance and you’ll always have the confidence to do more and be more.

5. Get Cash Under Control

Guest post by Jay DesMarteau, Head of Small Business Banking, TD Bank

While having a vision is the first step to being a successful entrepreneur, one of the key focus areas that determine long-term success is effective money management.

Thinking strategically about cash is vital to sustainability. Small business owners need to understand that a business’ ledger is more than just numbers—it shows how the business is performing and impacts salaries and the ability to obtain a loan. Get started with effective money management by following these 4 simple steps:

Focus on Financial Accounts. Gaining a clear view of your business’ assets, profitability and expenses is the first step to maintaining separate finances in a business account. Compared to personal accounts, small business banking products often include tools that are valuable for small business owner, such as payment tools that give insight into cash flow and enhanced security features to protect against fraud.

Small business owners can use these tools to their advantage to monitor cash inflows and outflows to enhance their ability to decide when to buy inventory, make hires, or increase or decrease salaries.

Monitor and Measure Performance. Setting manageable and realistic cash management goals allows small business owners to track their performance against short-term and long-term business objectives. These goals can be categorized based on use: operating budget, short-term liquidity (needed within 30 days but not immediately) or long-term liquidity (needed in 30 or more days). By establishing how cash will be used, small business owners can determine what portion can be stashed in savings for the business.

Invest in Accounting. Most business owners interested in making their businesses a huge success overlook the benefit of having a bookkeeper or accountant to help maintain their financial records. Detailed records provide insights into the business’ inflows and outflows and will help a lender make decisions if a small business owner applies for a loan or line of credit. While hiring an accountant may be an investment, alternative options include: accounting software and upgraded customer payment systems. Newer products such as Clover not only allow business owners to accept credit card or phone payments wherever they do business—from a farmer’s market to a fixed location—they also give insights into daily sales, inventory levels, employee hours and other operational items that impact revenue.

Accelerate the Revenue Cycle. Owning a business comes with an endless stream of costs: employee salaries, suppliers, loan payments. Not staying up-to-date on these expenses could result in account overdrafts, indicating the company’s cash flow is too tight, and the revenue cycle needs to speed up. Through faster receivables, positive pay features and quicker cash deposits, companies can accelerate receivables.

While owning a business can be exciting, effective cash flow management is critical to operating a successful, profitable business. Setting clear goals and using the right tools, you can better position your company to grow and gain equity—and eventually set aside more money for the future.

6. Sales Success Begins and Ends with Engagement

Guest post by Kurt Bilafer, Global Vice President Sales & Success, WePay

My Metric for Success: Engagement: As a sales leader, my professional life is filled with quotas, metrics and dashboards. But if I had to pick just one thing I’m optimizing for, it would be engagement. Why? Because I’ve learned that engagement is the leading indicator for success with whatever else you’re optimizing to achieve.

Early in my career, I was always optimizing for percentage of quota attained, which is a typical sales metric and usually tied to your compensation. Although I wasn’t insightful enough at the time to recognize it, my level of engagement with a prospect was usually a good indicator of the likelihood of making a sale. If a prospect was asking questions, working through their process, showing increased understanding and asking more questions, those were all signs of engagement. It took me a while to see the value of that.

Optimizing to quota: Optimizing to quota worked fine when I was an individual contributor, but as I moved into management and got further removed from the nuts and bolts of the sales cycle and engaging with customers every day, I had to figure out a way to influence the members of my team to make their numbers. So, I focused on optimizing for influence, working one-on-one with people to get them up and running and performing at a high level and hitting their quotas.

That worked fine when I was managing a team reporting directly to me. As I evolved into more of a startup-fixit-turnaround specialist I had to shift gears again. Now I was working in matrixed organizations with distributed teams of hundreds of people who didn’t report directly to me. I had to evangelize new processes and programs, organizational changes and strategy shifts. I had to reach a lot of people I’d never be able to meet personally, let alone learn all of their names. To lead effectively, I had to influence the people who would influence them.

When you’re bringing change to an organization, everyone has to work through his or her process. With big, distributed teams, you don’t get to see people and work with them as often. It could take six to nine months to see whether my influence was having an impact. I needed to know much sooner than that whether my message was getting through, and whether people were buying in and working through their processes. That’s when I started focusing on engagement. I increased my presence on social media and started blogging as a way to amplify myself and stay engaged, even when I couldn’t be there physically. This helped me quickly capture feedback, learn, evolve and improve my message and approach.

Measuring engagement: Engagement can be difficult to measure, but there are ways to do it. One of the ways I’ve done it is by surveying my team. I ask, “On a scale from 1 to 10, how well do you understand the objectives?” Then, “On a scale from 1 to 10, do you understand how you can contribute to these objectives?” and then, “On a scale from 1 to 10, do you think these objectives are achievable objectives?”

Engagement scorecards such as these are a key component of my strategy management efforts, helping me determine where to spend more time reinforcing messages or giving examples.

I also look to see how many people have actually embraced whatever it is we’re doing and are executing on it independently. For example, if I’m implementing a new sales process, one of the ways I measure engagement is how many people are actually leveraging the new sales process.

I do that by doing a deep dive analysis on individual deals to determine if people are actually following all the steps, or they’re just doing it the old way and putting lipstick on a pig to position it differently.

I might also look at how many opportunities the team had to present, what the audience turnout was, the kind of the press or analyst coverage we were getting, and activity on social media.

The loudest actions: Those are all qualitative assessments. But to me, actions speak louder. In sales there’s an expression, “coin operated salespeople.” It speaks to the fact that the most sales people get compensated on achieving their revenue quota, and as long as the “new thing” is tied to their revenue quota, they’ll embrace whatever the message of the day is. But even quota attainment can hide lack of engagement, especially in a larger organization, and eventually lack of engagement becomes a problem.

So, I look for signs of engagement every day. Are people participating in meetings and contributing and asking questions? Are they changing behaviors? Am I hearing success stories? Are they reaching out to me directly to ask clarifying questions, or asking for help on deals?

Beyond that, I know I have engagement when I have people asking to update the sales presentations, taking time to write a blog post, or start being more active on social media. I know I really have it when I hear people evangelizing sharing the message themselves, in their own words.

It’s very rewarding to see that growth, and to know I’m impacting someone’s trajectory. And I know that they’re going to keep executing on the strategy after I leave the room because they’ve worked through their process and made the strategy their own. That’s the level of engagement you need for your team members to be successful, and for you to be successful as a leader.

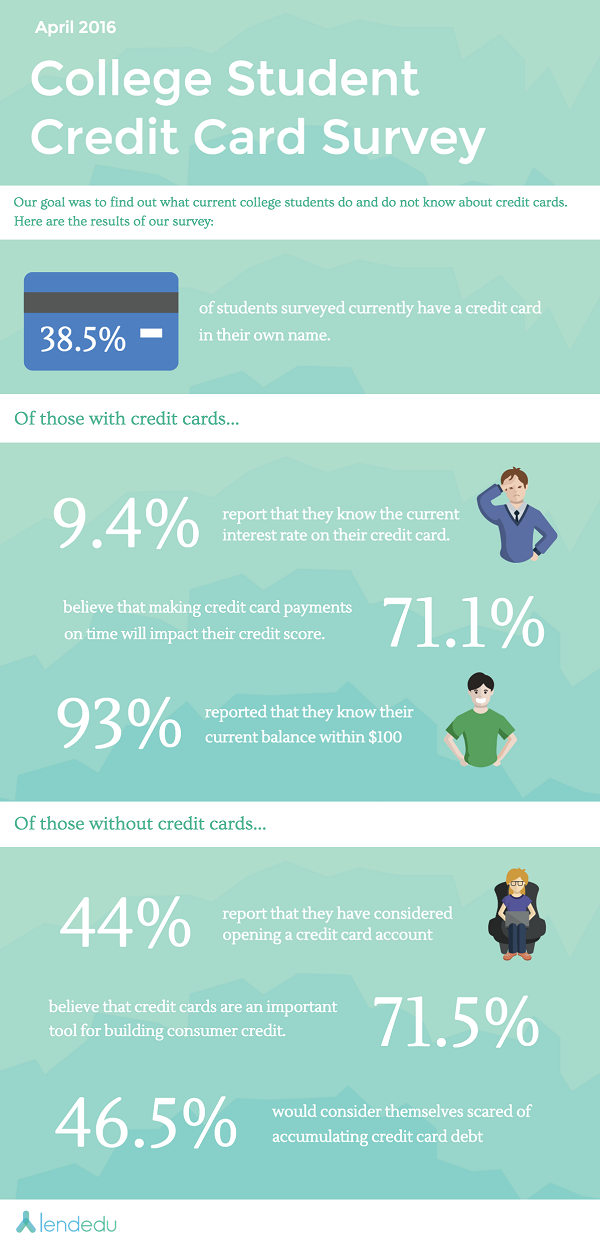

7. Are College Students Abusing Credit Cards?

LendEDU, a student loan marketplace, surveyed college students about their financial literacy and credit card usage. The results:

- 38% of the students surveyed currently had a credit card in their own name

- 9% know the current interest rates on their credit cards

- 21% know the late payment charges on their credit cards & 59% know their balance limits

- 68% carry a credit card balance & 93% kn0w their current balance within $100

- 71% believe paying their credit card bill on time impacts their credit scores

- 23% have more than one credit card account

Check out the infographic below for more information.

8. Help for Retailers in the Omnichannel

The commerce technology landscape is rapidly evolving, and retailers find themselves struggling to both adapt and unify their systems. According to a new survey of U.S. retailers, by Stitch Labs, 27% say disparate systems are the top inhibitor to growth. Perhaps this is the reason inventory management is the top priority for retailers this year, with 27% saying they plan on investing in such solutions. The survey also found that retailers’ biggest fear when it comes to adopting new technology is the time it takes to implement it, while 36% say interoperability is the most important factor to consider when adopting these new solutions.

To help meet these demands, the Stitch Labs introduced a new API enabling mid-market businesses to create custom modifications and additions to the Stitch platform so that it can connect to the existing and future solutions they need to run a successful business. One in five retailers use more than 10 applications to run their business, and the API will help them integrate these apps seamlessly. Sales channels, accounting software, and third party logistics (3PL) providers will all be linked to the heart of omnichannel retail—the inventory.

As retailers further embrace the cloud, APIs will become eve more important. Currently, 49% of retailers say over three-quarters of their solutions are SaaS/cloud-based, and the trend is on the rise; 78% say their most recent technology purchase was of a SaaS/cloud-based product.

The new API is included in Stitch Labs’ Enterprise and Enterprise Plus packages. If you don’t have a developer on staff, Stitch has partnered with a select group of developer partners to assist customers.

More Survey Insights

The survey also shows retailers are feeling positive:

- 53% of retailers are very optimistic and 40% are somewhat optimistic heading into the second half of 2016

- 83% believe industry sales will improve this upcoming holiday season versus last year

If the economy slows down, they plan to maximize sales during the holiday shopping season by offering:

- Free shipping – 36%

- More compelling loyalty rewards – 18%

- Price matching – 13%

- Free returns – 13%

- Buy one, get one – 11%

- Same-day delivery – 3%

- Other – 7%

Where do they plan to invest their money?:

- Inventory management – 27%

- Order fulfillment – 16%

- Supplier management – 12%

- PoS technology – 11%

- Payments & returns – 11%

- None of the above – 23%

What’s inhibiting growth?:

- Capital – 34%

- Inefficient, disparate systems – 27%

- Human resources – 23%

- Communication barriers across teams – 9%

- Other – 8%

Biggest fears (when it comes to adopting new technology):

- Time to implement – 30%

- Interoperability of existing systems – 28%

- Costs – 34%

- (Hidden costs – 17%)

- Employee adoption and buy-in – 8%

- Other – 1%

9. Are Small Businesses Financially Healthy?

Experian teamed with Moody’s Analytics to develop the Experian/Moody’s Analytics Main Street Report. The new quarterly report benchmarks the overall financial health of small businesses, identifies emerging trends and provides insight into what these trends mean for small businesses and the economy as a whole.

The data in the Experian/Moody’s Analytics Main Street Report comes from a combination of business credit data (including credit balances, delinquency rates and utilization rates) and macroeconomic data (including employment rates, income, retail sales and investments).

Results for the first quarter of 2016

- Credit conditions for small businesses have remained relatively stable

- Delinquency and bankruptcy rates hold steady at low levels

- Despite a strong economic performance relative to the rest of the country over the past several years, bankruptcy rates were elevated in the Southwest and the West

- Delinquency rates for the retail industry ticked up slightly during the first quarter of 2016 as a result of weak retail sales

- Small businesses are expanding their credit lines, but aren’t spending the money

If you want to learn more, you can attend a webinar on June 28 at 1 pm ET. You can register for the webinar here.

10. Get Smarter

Manta recently introduced Manta Academy, featuring free in-depth educational courses to help small business owners grow, market and manage their businesses.

Each Academy course is presented in three escalating levels of difficulty—Beginner, Pro, and Expert—so small business owners can learn at their own speeds. Manta says its Academy content is distinguished by its depth and level of detail, rewarding users with specific, actionable knowledge they can use to grow their small businesses.

Lack of resources and business acumen can be significant challenges for small business owners. A recent Manta survey of small business owners found that 26% do not have a business plan, 27% do not have a marketing plan and 23% do not have a sales plan. Of those owners, 49% say they don’t know how to create a business plan. According to the survey less than half of small businesses have market research, succession plans, audience personas, competitive benchmarks or special events plan.

Cool Tools

11. Cost-Efficient Printing

Brother International Corporation has added to its INKvestment line of color inkjet all-in-ones by introducing two, new cost-efficient versions. The MFC-J985DW prints a black & white page for less than a penny and color pages for less than a nickel each, while the MFC-J985DW XL includes 12 INKvestment cartridges, eliminating the need to purchase ink for up to two years. The INKvestment versions are competitively priced at $199 and $299 respectively, without skimping on quality, reliability or business functionality.

A single INKvestment Super High-yield black cartridge delivers approximately 2,400 pages, for less than $251 and a single INKvestment Super High-yield color cartridge delivering 1,200 pages for less than $151.

12. Digital Help for Real Estate Agents

HomeASAP LLC, which provides a full suite of integrated online solutions for real estate professionals, is rolling out its new search technology by first offering it to agents in its 450,000+ member Real Estate Agent Directory on Facebook. The Directory is free to join.

Features of the Homeasap home search include:

- Each IDX website is exclusively branded to the agent

- Active listings are updated as frequently as every 15 minutes

- The search is mobile-friendly and integrated with Facebook

- Cutting-edge map search technology allows users to easily designate areas they wish to search without the arbitrary restrictions of zip codes, although searches can also be conducted by zip code, city or address

- Listings results can be tagged with any keywords, saved to lists and socially shared

- Extensive home details, neighborhood demographics, school and transportation information, etc., are provided. Providing this kind of information on individual agent websites was cost-prohibitive, until now.