10 Things Small Business Owners Really Need to Know

By Rieva Lesonsky

1—Are You Feeling Optimistic?

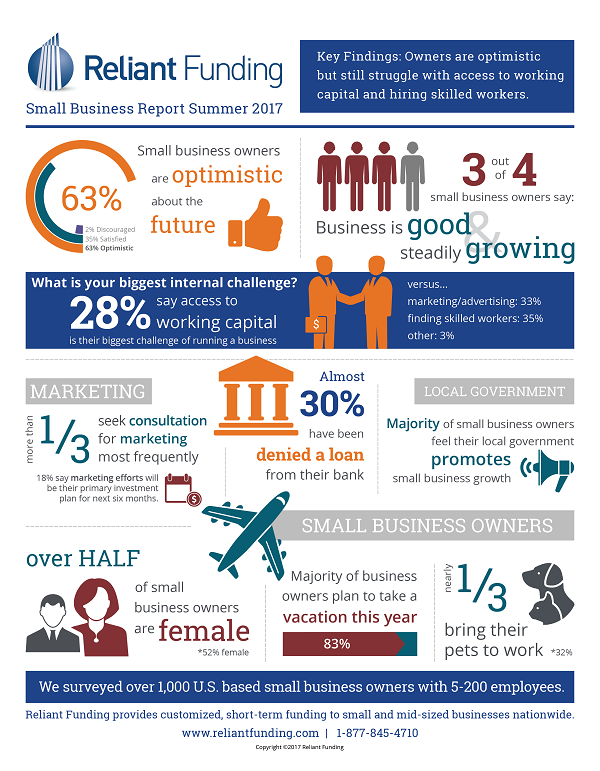

Most small business owners are, according to a new survey of over one thousand small business owners by small business finance company, Reliant Funding.

The survey shows 63% of the business owners surveyed are optimistic about the future, and 76% say their businesses are steadily growing. In another good sign, marketing is high on the business owners’ priorities lists—one-third are already talking to consultants about their marketing efforts, and 18% plan to actually invest in them. Plus, 17% of the small business owners plan to invest in upgrading their facilities.

Adam Stettner, CEO of Reliant Funding, says, “It’s encouraging to see such a positive outlook from America’s small business owners. Tracking these variables offers great insight into how SMB’s are feeling about their businesses and which direction they plan to take for growth.”

Not everything is so sunny, however. Accessing working capital is still a struggle for many small businesses—28% say getting funding for their businesses was a challenge—and 30% had been turned down for a bank loan.

What’s good for the country—a low unemployment rate—is not so good for small businesses, as 35% say finding skilled workers to hire is their biggest challenge.

Check out the infographic below to get the whole scoop.

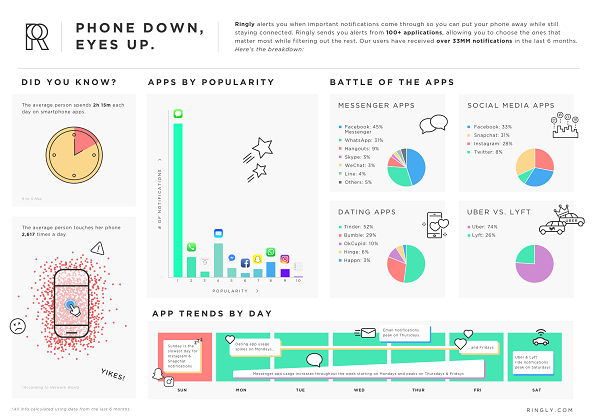

2—How Many Times a Day Do You Touch Your Phone?

100? 500? 1,000? More? I was stunned when I saw how many times a day people touch their phones (take a look at the infographic below). There are plenty of other fun facts and stats—courtesy of smart jewelry brand, RINGLY.

3—5 Ways to Help Manage Your Energy

Guest post by Clara Capano. This article was adapted from Clara Capano’s new guidebook Find Your Focus: 52 Weeks of Clara-ty, now available on Amazon and other major booksellers. For more information on Clara Capano and her work, please visit her website.

In today’s digital era, our pace is rushed and relentless. We’re wired up and connected at all times, and in the same moment, we’re melting down and crashing hard. Time management is no longer a viable solution. How can we keep our energy to endure high performance at work as well as maintain our health, happiness, and overall life balance?

In my coaching sessions, one of the comments I hear most is “I’m tired.” Trust me; I get it. The market is moving fast, and there isn’t much time to get all the items on our lists done—let alone time to rest. At the same time, taking time to rest and recover is critical to success.

In the book The Power of Full Engagement, authors Jim Loehr and Tony Schwartz discuss the concept of managing our energy and not our time. This is quite a different concept for most of us. Many of us believe that time doesn’t change and we can’t control it. Our response and the energy we put into our time is what we can control.

They write: Balancing stress and recovery is critical in all facets of life. When we expend energy, we draw down our reservoir. When we recover energy, we fill it back up. Too much energy expenditure without recovery leads to burnout and breakdown. Too much recovery without use or sufficient stress leads to atrophy and weakness.

There needs to be balance between the two: equal work and recovery. Here are some tips to help you manage your energy:

- Take a time-out each day. Are you asking, “How and when?” This doesn’t have to be a long break—even just 20 to 30 minutes to step away from the phone and computer. You can open a window and breath in the air, listen to music, call a friend for a fun talk. Just step away and shut your mind down. The world will not fall apart in 20 minutes.

- Eat better. It’s true—eating less fast food and a more balanced diet will give you better energy to face the day. If you’re on the run, put a cooler in your car with some fruit, water, and snacks to allow you to grab a quick refuel when you need it.

- Work with the “right” people. You don’t need to work with everyone. Take time to make sure you are choosing to work with the right people—those you can help, who want your help, and who value you. Nothing can drain a battery faster than working with the wrong client.

- Give yourself a break. No one is perfect. Neither is life. You can have the best-laid plans for the day, and they can change in an instant. That’s okay. Try your best. If you get off track, just breathe and get back into your routine as quickly as you can. At the end of the day, review and reflect on your daily activities. If you did your best, celebrate! It isn’t about being perfect; it’s about doing the best with what you have.

- Ask for help. I know this is hard for many—me included. This is a busy and crazy world, and we need to support each other. We can’t be in two places at once, and it isn’t fair to ourselves, our families, or our clients to try to be. If you need help, ask for it. Find a friend, mentor, or guide.

I know all of this seems like common sense, and it’s easy to sit here and give advice. So, I’ll tell you from my heart that I’m working hard to live these tips. It isn’t easy, but every day I get up, get focused, and commit to doing my best. I no longer punish myself if I don’t get it all done. I just do my best.

Give it your all, and take time to celebrate you. You work hard; give yourself some grace.

4—What to Look for in a 401(k)

Guest post from Ubiquity, a premier, flat-fee 401(k) provider for small businesses

- Appropriate cost: Find a plan that fits your budget. But remember, just because it’s a lower cost provider, doesn’t mean it’s the best choice for your business. Complicated plans typically cost more, but small businesses don’t usually need those extra bells and whistles that come with larger companies’ 401(k) plans. It all comes down to how engaged you want to be with your plan. When comparing prices, make sure you consider administrative, investment and upkeep fees, which can drive up the total cost of your plan.

- Flexibility of investments: Depending on the size of your organization, employees may have varying levels of investment savviness. Most 401(k) plans come with a basic fund list you can choose from if you don’t consider yourself the next Warren Buffet. If you’re comfortable with finance and prefer flexible investment choices, ask your 401(k) provider if they have the ability to open a brokerage account. That way, you have the opportunity to invest in all the funds the custodian has to offer. The cost of opening a brokerage account varies, however, so tread carefully.

- Accessibility of an advisor: Often, financial advisors come with your plan; however, their purpose may only be to sell the plan and not to offer support and advice. Determining if your plan does or doesn’t come with an advisor, what their role is and whether you need them can help cut unnecessary costs.

- Adaptable plan design: Make sure you choose a plan designed with businesses like yours in mind! When considering a 401(k) plan, take a look at the eligibility options. Who amongst your employees will be allowed to participate and when are they able to start contributing? Retirement plans are not always one-size-fits-all, especially when it comes to small businesses, so having the ability to customize your plan based on your needs and the needs of your savers is key.

- Fiduciary responsibility: The term fiduciary is tossed around quite a bit these days. To clear up any confusion, a fiduciary is someone who is responsible for acting in good faith when managing someone else’s assets. If your 401(k) plan does not include a financial advisor, you as the company owner will take the full responsibility. If this responsibility is something you’re uncomfortable with, you have the option to hire a financial advisor or find a plan provider who can handle the fiduciary responsibility for you.

- Plan support: When your employees have questions about their 401(k) plan, make sure they have somewhere to turn. Find a provider that offers some support for your employees, whether that’s a call center, online customer service chat or educational meetings. Though shopping for a 401(k) that satisfies your small business can be overwhelming, it’s important to tune out the noise and focus on these six features. Doing so will ensure your employees have a plan that allows them to set sail on the path to successful savings.

5—The Truth About STEM

There’s a STEM (science, technology, engineering and math) talent shortage. Will it last forever? To get some answers, Randstad US conducted a study to uncover key motivations, beliefs and perspectives of STEM-related topics among kids aged 11 to 17. The research shows that despite high interest in STEM studies and confidence in STEM skills at a younger age, as kids get older, their interest fades. Students 11 to 14 years old are 18% more likely than students aged 15 to 17 to consider math one of their favorite subjects. But, 56% of young people also admit knowing how STEM skills relate to the real world would make STEM classes more interesting.

“The term ‘STEM’ needs a rebrand and awareness campaign to get the next generation of talent excited about pursuing these careers,” says Alan Stukalsky, chief digital officer for Randstad North America. “Young people are self-selecting out of higher STEM education classes because they can’t see how these skills apply to different professions and employers they’re excited about. It’s a misperception and a serious economic problem, as a rapidly growing number of jobs now require STEM competencies. If we don’t find a way to guide and prepare the future workforce for these positions, we run the risk of the need for these skills escalating and the hiring gap expanding.”

Practical uses of STEM skills are difficult for students to see: The study also revealed a lack of personal connection to STEM professionals and how STEM jobs are defined.

- 52% of students say they don’t know anyone with a job in STEM, and 27% say they haven’t talked to anyone about jobs in STEM.

- 49% say they don’t know what kind of math jobs exist, and 76% report not knowing a lot about what engineers do.

- 87% think people who study STEM work at companies like NASA; far fewer associate them with mainstream consumer brands like Instagram (40%) and Coca-Cola (26%).

Students interpret STEM too literally: Young people reported high enthusiasm for careers not explicitly defined as STEM, but requiring related skills, suggesting the need for broader education as to how STEM skills can be applied in fields beyond math and science.

- 64% of students rate creating video games for a living as very fun, while 90% rate it somewhat fun.

- 54% think it would be very fun to earn a living working with marine life, with 89 % rating it as at least somewhat fun.

- 47% think it would be very fun to make websites for a living, with 86% saying it would be at least somewhat fun.

There is a lack of confidence in STEM-related skills among young women: Despite significant progress over the past several decades in young women’s participation and performance in STEM subjects, a major gender gap still exists.

- Girls are 34% more likely than boys to say that STEM jobs are hard to understand.

- Only 22% of young women name technology as one of their favorite subjects in school, compared to 46% of boys.

For more information, please download the Randstad STEM Study and Insights Report.

6—What are Small Business Owners Spending Money On?

BizBuySell surveyed 1,200 business owners to understand the costs incurred during the four main phases of ownership—buying, starting, selling and expanding a business.

The results provide an in-depth look at the $42 billion small business owners combine to spend annually during a business transition and why that number has increased from when BizBuySell conducted the same survey five years ago. In the official whitepaper, we break down how much buyers and sellers spend in the year before and after a business is sold, which services account for the highest costs and how spending varies across industry and geographic area.

Some findings:

- Small business owners in the middle of expanding their businesses are more likely to increase their use of existing products, and very few consider switching suppliers. This shows the importance for vendors to establish a relationship with future owners before they buy a business.

- Small business owners were especially loyal to vendors in the utilities (30%), insurance (24%) and office supplies (22%) space.

- Word-of-mouth helps build loyal customers, especially in the financial, insurance, and accounting/payroll fields.

Quick Takes

7—Would You Want to be on Shark Tank?

A survey from Manta reveals:

- While most small business owners have not appeared on Shark Tank (only 3% of the small business owners surveyed have appeared on the show…

- 46% watch it. And 28% say they would apply to appear on the show.

- When asked why don’t want to be on Shark Tank, 39% say they have no desire to be on TV & 38% don’t think their products or services would appeal to the show’s producers.

Cool Tools

8—Never Run Out of Ink & Toner Again

Brother recently introduced Brother Refresh, the only direct from the manufacturer predictive auto-fulfillment service that eliminates the worry about running out of ink or toner. Brother Refresh provides timely delivery of Brother Genuine ink or toner right to your door before you run out. Sign up is simple and there are no contracts or subscription fees.

Smart devices contribute to productivity: More than 70 Brother printers and All-in-Ones are “Refresh-Ready”—equipped with low ink or toner intelligence that automatically triggers a replacement order for the right Brother Genuine ink or toner. This predictive technology delivers a convenient solution that eliminates the time and hassle of running to the store or having to place an order online whenever ink or toner is low.

Simple sign-up & no fees: There are no contracts to sign and no subscription fees for Brother Refresh. Setup is simple—if you already own or purchase Refresh-Ready Brother printers, just register with Brother Refresh, select the correct ink or toner, and provide a shipping address and payment method. From then on, replacement ink or toner will be automatically shipped when you run low.

For a limited time, Brother is offering free shipping for orders over $20.00 along with a 10% discount off Brother Mall prices. To learn more and to sign-up, go here.

9—Customer Engagement Solutions

TimeTrade, a leading provider of intelligent customer engagement and provider of integrated online appointment scheduling for CRM solutions, recently introduced Scheduler for Microsoft Dynamics. This new application will enable businesses to access the full capabilities of TimeTrade right from within Dynamics.

Gartner forecasts the CRM market will exceed $36 billion by the end of this year. That reflects the critical importance of CRM platforms for businesses.

When there are too many moving parts, customer-facing teams can’t deliver optimal results. With Scheduler, teams can schedule meetings with prospects and customers without ever leaving their CRM. This eliminates the need to toggle between calendar applications and the CRM, where details about prospects and customers reside. The result is improved sales, customer success and support results in less time.

Microsoft Dynamics users can use Scheduler to easily arrange multi-person appointments without leaving Dynamics. It lets sales, customer success, support and marketing teams eliminate the calling, chasing and waiting that bog down the process of scheduling meetings with prospects and customers.

TimeTrade also just announced a new, artificial intelligence-driven version of its industry-leading Scheduler for Salesforce product. Building on the AI capabilities of Salesforce Einstein, Scheduler makes it easy for businesses that use Salesforce as their CRM to personalize customer engagement so they can close more deals faster and ensure an exceptional customer experience. Scheduler is available for download on the Salesforce AppExchange.

As the first AI-driven scheduling product available for Salesforce, TimeTrade Scheduler gives sales and customers service teams the information they need to engage with prospects and customers more effectively than ever. Using AI-driven lead-scoring information based on content indicators, Scheduler allows sales teams to take the right action to engage with each prospect, making the process faster and more effective than ever. This helps sales teams focus on the prospects with the highest probability of converting into customers and instantly take action, such as sending a meeting invitation, based on their profile and the unique actions they have taken.

Services teams can use Scheduler to schedule onboarding of new customers quickly.

The company says its “AI strategy helps sales, marketing, service and support teams engage with prospects and customers better than ever by being able to:

- React more effectively to customer needs by using algorithms to capture past behaviors.

- Predict the likelihood of both prospect conversion and customer churn using pattern analysis of previous engagements and demographic data.

- Engage more successfully with customers by using deep learning to predict and improve sales, prevent churn and deliver the next best action for every customer, every time.

- Own the customer relationship by using neuro-linguistic programming and deep learning to deliver virtual assistants, chatbots and other AI-powered capabilities to provide an exceptional customer experience.

10—Selling More to the Government

Onvia, a leading provider of sales intelligence and acceleration technologies for businesses selling to the public sector, recently launched its next generation platform—Onvia 8, which enables companies of all sizes to act on more opportunities and win more government contracts.

With its new interface and mobile interactivity designed for a more engaging, elegant and productive user experience, Onvia 8 helps users take faster action on their leads. The enhanced lead sharing functionality helps sales and marketing teams easily distribute leads across their organizations and channel partners. And streamlined lead management features allow businesses to work efficiently, plan strategically and get ahead of the bid.

Onvia says, “Vendors are challenged to wade through a fragmented, competitive and complex business-to-government marketplace. To succeed in this market, they need accessible data and bid information on their mobile devices, the ability to share that information across organizations and visibility into current and future opportunities.”

And, adds Chris Woerner, SVP of Product, “As a result, we’ve developed Onvia 8 to help users across sales and marketing to work more connected and stay more productive—from getting their hands on the data, to qualifying, distributing and pursuing opportunities.”

To learn more about Onvia 8 request a demonstration or register to attend an “Onvia On Tour” event in one of ten cities across America. You can check out their video here.