10 Things Entrepreneurs Need to Know

By Rieva Lesonsky

1) Milestone

Congratulations go out to Linksys, which announced last week, after 15 years in business, it sold its 100 millionth router worldwide. Amazing!

2) Social Slackers

Are small businesses ignoring social media? Some evidence says yes—and I think that’s a BIG mistake.

3) Marketing Automation Best Practices

Software Advice, a company that helps buyers choose marketing systems, has issued an eye-opening (to me anyway) report about the use—or lack thereof—of marketing automation software.

Some key findings:

- 98 percent of buyers are looking for dedicated marketing automation software for the first time

- 47 percent are still using manual methods (such as pen and paper, spreadsheets and one-off emails)

- 17 percent use industry-specific software

- 15 percent use customer relationship management (CRM) software

- 9 percent use nothing (Nothing!)

It’s no wonder then that 27 percent of buyers say they’re overwhelmed with managing clients, contacts and leads and want software to improve lead management. Another 15 percent are dissatisfied with their current systems and that’s why they’re in the market for new software.

What functionality do prospective buyers want in a new system?

- 74 percent want contact management software

- 73 percent want email marketing and/or drip campaign functionality only

- 4 percent request social media marketing functionality

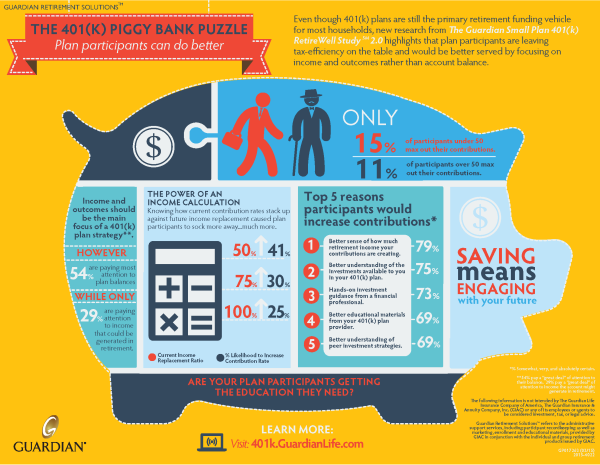

4) Not Ready for Retirement

The Guardian Insurance & Annuity Company, a wholly-owned subsidiary of The Guardian Life Insurance Company of America, just released the results of a comprehensive national survey (The Guardian Small Plan 401(k) RetireWell Study 2.0: What’s Working and Not Working for Small Plan Participants) showing that even people who participate and are satisfied with their 401(k)s don’t understand basic investment concepts, which likely contributes to lower plan engagement and less successful retirement outcomes.

Some key findings include:

- 92 percent of participants are very or somewhat satisfied with their 401(k) plans

- 79 percent of participants say knowing how much income they have in retirement would lead them to increase their contributions

- In general, larger plan participants have access to more investment and plan features

- Participants feel better overall about their 401(k)s when working with a financial professional

5) Working from Home Tips

Do you run a virtual business out of your home? Sure there are a lot of advantages, but for many entrepreneurs it’s not as easy as you’d think (I don’t love it). Xander Schultz, CEO of Complete, an online community where people help each other complete tasks and goals, shares some really useful work-at-home tips.

- Use airplane mode. Unless you’re waiting on something, there’s no reason you can’t go 25 minutes without responding to a phone call. During your focus period, hit that airplane icon and enjoy a life without rings, dings and other intrusive notifications.

- Maintain your morning routine. Productivity can be as much about the attitude as the strategy. You should still get out of bed, visit your cafe, hit the gym and get dressed as if you were going to work (or maybe one notch more casual, but just one). The W in WFH stands for working, not hanging out. Make sure you still give your day the focus it deserves.

- Use the Pomodoro technique. Essentially, the technique requires that you alternate periods of pure focus with short breaks. Different people advocate for different time segmentations, but it seems 25 minutes of focus time partnered with 5-minute breaks is the most common measure of one Pomodoro. On the third or fourth Pomodoro, take a full 25-minute break.

6) Small Business Perspectives

Manta just released their spring 2015 survey offering the perspectives of small business owners on a variety of “timely topics”. See if you agree or disagree:

Timely Topic: Marijuana Legalization

Question: Would the legalization of marijuana in your state be a boon for new small businesses?

- Not sure: 39 percent

- No: 32 percent

- Yes: 29 percent

Keep in mind that, in this scenario, 59 percent of consumers say they wouldn’t patronize a small business that didn’t drug test their employees. However 29 percent of business owners say they wouldn’t drug test their employees, while 27 percent say they would.

Timely Topic: Retirement

Question: What’s you biggest fear about retirement?

- Not enough savings: 39 percent

- I’ll never be able to retire: 25 percent

- My health will decline: 15 percent

- Lost sense of purpose: 12 percent

- Watching my business fail after I leave it: 9 percent

Timely Topic: Success Factors

Question: What is the #1 thing your small business couldn’t succeed without?

- Passion and determination: 35 percent

- Cash flow: 24 percent

- My network of other small business owners: 18 percent

- My employees: 16 percent

- The latest technology: 7 percent

One word of caution: 62 percent of consumers say they do not trust a small business if it doesn’t have a strong online presence.

7) Build a Website for Less

Speaking of not having a strong online presence, Web.com (disclosure: a client) and Sam’s Club just announced a new collaboration. If you’re a Sam’s Club Business member, you can grow your business and save money by using Web.com’s Online Marketing Solutions, available now.

Sam’s Club members can get access to exclusive Do-It-Yourself and Build-It-For-Me business bundles for creating custom websites, local online advertising, social marketing and email marketing among other marketing services. These solutions are specifically designed to help Sam’s Club Business members successfully build or improve their online presence, reach and engagement with prospects and customers, while saving money and time.

According to a survey conducted by Web.com, 50 percent of small businesses do not have an online presence, although 97 percent of consumers search for products and services online.

This exclusive offer was one of several small business solutions Sam’s Club is introducing for its members.

8) Made in the USA

Bank of the West’s Chief Economist Scott Anderson just released a whitepaper: Made Here: The Business Outlook for U.S. Manufacturing, which looks at the “bright economic outlook for small to midsized U.S. manufacturers and how their proximity to the customer is fueling the American manufacturing revival.”

According to the paper, the small businesses manufacturers say their long-term health is driven by customer proximity, which they leverage to deliver: “superior service, quality & customization; speed & inventory management; iterative new product development and effective reputation management.

In other words, while a “Made in the USA” label carries an implicit trust globally, the paper shows that for small- and medium-size manufacturing companies, being close to the customer is a powerful advantage, helping them consistently provide faster and more responsive service and better products than overseas competitors. And the paper adds, as American consumers and businesses demand more customization and faster delivery, this advantage is likely to intensify.

9) Keep Track of Your Accounting

We all know time is money–especially when you’re a small business owner. Chance are accounting is one of the tasks that takes up a lot of your time—think of the time it takes to track inventory, sales leads/results, payroll and so forth. It’s no wonder more than 40 percent of small business owners say accounting is the worst part of owning a business.

Now ONE UP, a new mobile app for small businesses with 1-20 employees, takes those routine accounting tasks that take hours and reduces them to a couple of minutes a month. ONE UP automatically synchronizes with your bank’s and provides suggested entries that can be validated with one click. In addition to the “hands-free” accounting, the ONE UP suite includes automatic inventory, CRM and invoicing.

Francois Nadal, ONE UP’s CEO, says, “It’s as if you had a CPA on your shoulder. ONE UP is the killer app providing automatic bookkeeping to small businesses worldwide.”

ONE UP was developed for mobile first, so users can run and manage all key aspects of their businesses from anywhere.

Other features include ONE UP Inventory and ONE UP CRM. ONE UP Accounting also allows your accountant to log in remotely to audit your books or export your financial records to their locations.

ONE UP prices start at $9 per month for one user. There’s a 30 day free trial available at oneup.com.

10) Charge It

Which credit cards are small-business friendly and which may be costing you more to use? Credit card comparison website CardHub just released its 2015 Small Business Credit Card Report. According to CardHub, all the major credit card companies hold customers personally liable for business credit card use. Also, every major issuer uses personal credit data to determine business credit card eligibility.

Rieva Lesonsky is CEO of GrowBiz Media, a media and custom content company focusing on small business and entrepreneurship. Email Rieva at rieva@smallbizdaily.com, follow her on Google+ and Twitter.com/Rieva.