15 Things Entrepreneurs Need to Know

By Rieva Lesonsky

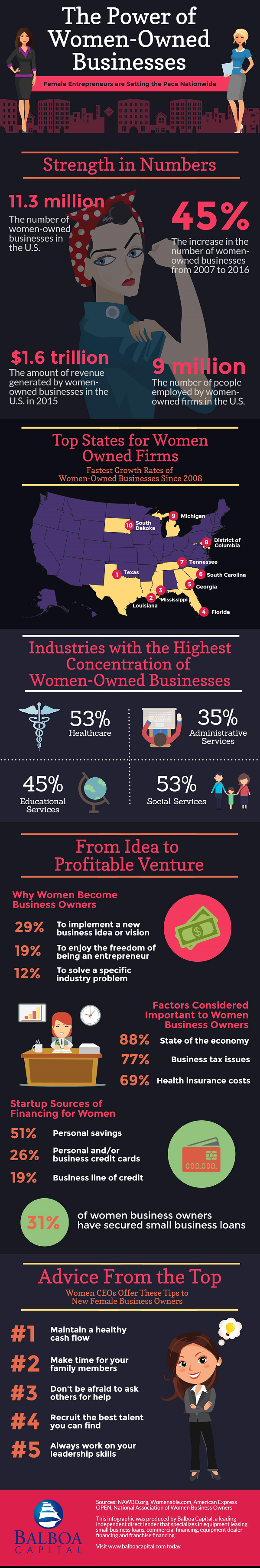

1—Women-Owned Businesses Are Thriving

This is Women’s Small Business Month and Balboa Capital has gathered statistics showing how well women entrepreneurs are doing. Some of the highlights include:

- More than 9.1 million firms are owned by women.

- They generate $1.5 trillion in sales each year.

- 9 million are employed by women-owned businesses in the U.S.

Check out the infographic below for more info.

2—Biggest Email Marketing Mistakes

Email marketing continues to be especially effective for small businesses. And I’m sure you’ve seen your fair share of email best practices. But regular contributor Matt Zajechowski of Digital Third Coast believes “it’s equally important to learn from our email marketing mistakes.” Matt worked with Reachmail to “identify the most egregious behaviors and worst practices exhibited by email marketers.” And then they linked each behavior to a memorable pop culture character to help marketers remember and associate the behavior. Plus, there’s plenty of actionable advice on how to turn bad behavior into a good behavior.

Some of the worst practices they found include:

- Not honoring unsubscribers/making it difficult to unsubscribe

- Over-emailing/sloppy emails

- No clear call-to-action

- Not optimized for mobile

For more, check out the infographic below.

For more, check out the infographic below.

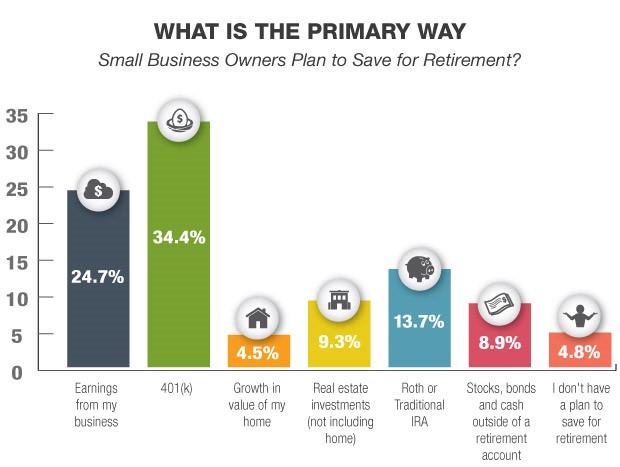

3—Most Small Businesses Don’t Offer 401(k)s

The SurePayroll Small Business Scorecard for August reveals that 66% of small business owner don’t offer a 401(k) plan to their employees and 42% of those who don’t offer one, don’t see the value in it, 35% think the fees are too expensive and 23% say they don’t know how to manage a 401(k).

Most of the small business owners who do offer a 401(k) do so to build retirement savings for themselves and their employees, 6% offer it for tax breaks and 5% offer it to attract new employees. In total, 28% currently offer a plan and another 6% plan to add one soon.

There are more details in the infographic below.

4—How to Make a 5-Hour Workday Work for Your Small Business

Guest post by Stephan Aarstol, author of The Five-Hour Workday: Live Differently, Unlock Productivity, and Find Happiness and CEO and founder of Tower, a holistic beach-lifestyle company. You can connect with Stephan on Twitter @stephanaarstol.

The 9-to-5 grind has created a cult of workaholics. Unfortunately, the 8-hour workday hasn’t budged in 100 years. Never mind that the Information Age represents the biggest shift since the Industrial Revolution and that family structures have changed dramatically since the early 1900s.

Workers still get in their cars every morning and clog up the freeways and do it again at night. Mondays are dreaded. Wednesdays are “hump days.” Friday mornings bring relief because they’re the final push before the weekend.

The idea that workers are expected to endure 70% of their week so they can enjoy the other 30% is collective insanity.

Why My Company Moved to a 5-Hour Workweek

My company decided to do things differently. [My business] sells stand-up paddleboards, so a shorter workday that freed our employees’ afternoons for extraordinary living was a natural fit for our beach lifestyle brand.

We decided to move to a 5-hour workday—everyone works from 8 a.m. to 1 p.m. By eliminating an hour-long lunch, we only reduced our work time by two hours. Our employees don’t get paid less, and I still expect them to be twice as productive as the average worker.

The results have been astounding. Last year, we were named the fastest-growing private company in San Diego. This year, our 9-person team will generate $9 million in revenue.

When I tell people my team only works five hours a day, their response is always, “That’s nice, but it won’t work for me.” The 9-to-5 is so engrained in their minds that they can’t imagine anything else. But you can reduce your hours by 30% and maintain the same level of productivity. Here’s why:

Humans are not machines. Just because you’re at your desk for eight hours doesn’t mean you’re productive. Even the best employees probably only accomplish two to three hours of actual work. The 5-hour day is about managing human energy more efficiently by working in bursts over a shorter period.

Happiness boosts productivity. Studies show that happier workers are more productive, and it makes sense: Having time to pursue your passions, nurture your relationships, and stay active gives you more energy emotionally and physically.

Fewer hours create scarcity. In their book Scarcity: Why Having Too Little Means So Much, Sendhil Mullainathan and Eldar Shafir write that having less time creates periods of heightened productivity called “focus dividends.” A 5-hour workday offers baked-in time management by forcing you to prioritize high-value activities.

How to Implement a 5-Hour Workday

The question I hear most often from people is: “Can a 5-hour day work for everyone?”

Professions that require a 24-hour presence, such as law enforcement, emergency response, and nursing are not good candidates for the 5-hour workday. Nor are jobs that require working in unison with a large number of people (such as film production).

But for the vast majority of knowledge workers, clocking fewer hours that generate higher productivity is very manageable. Here’s how to get started:

- Apply the 80-20 rule. “The 4-Hour Workweek” is required reading for anyone looking to adopt a shorter workday. One of the most important ideas discussed is the Pareto Principle: 80% of production comes from 20% of efforts. Evaluate your [staff’s]workday to identify those 20% activities and eliminate the rest.

- Shift to a production mindset. People who dismiss the 5-hour workday outright usually think it’s impossible because they measure work in hours rather than output. However, most knowledge workers aren’t paid by the hour. They’re paid a flat salary. To help my team shift to a production mindset, I rolled out a profit-sharing plan where 5% of the profits are doled out to employees who demonstrate exemplary productivity.

- Nix the “always available” attitude. One of my biggest objections to moving to a 5-hour workday was reducing our customer service department’s hours. I worried that if we cut our open hours in half, we’d lose half our business. But I realized that we didn’t run a convenience store. Our customers bought new paddleboards maybe once every five years. It didn’t matter when we were open as long as our customers knew our hours.

So we made the switch, and nothing fell apart. We still get roughly the same number of calls each day, and emails are usually answered within hours.

Understand that even in our instant-gratification society, being available all day isn’t necessary. You just need to communicate when you are available.

- Use technology to boost efficiency. One of the unexpected benefits of the 5-hour workday is that it exposed weaknesses in our company that had been hidden by man-hours. To allow our warehouse and customer service employees to work 30% less (without growing our staff), we had to figure out how to serve the same number of customers in less time.

The obvious solution was leveraging automation. In the warehouse, we reduced our packing and shipping time using software. In customer service, we overhauled our frequently asked questions page and created video tutorials to help customers help themselves.

Once you put a time constraint on work, it forces you to consider how you can get technology to do the heavy lifting to increase your output. Make use of email auto responders, set up automatic trigger-based tasks, and learn to use keyboard macros.

- Don’t restrict yourself to a 25-hour week. My employees know they can always walk out of the office guilt-free, but top performers still put in the occasional 12-hour day. Just as with a 9-to-5 job, recognize that there will be times when you want or need to work an extra-long day.

But when you can leave the office at 1 p.m. to go surfing or pick your kids up from school, work isn’t separate from life; it’s all just living. Moving my staff to a 5-hour workday was one of the hardest decisions I’ve ever made, but today my employees are happier, more productive, and invested in the business.

You can make the leap to a 5-hour workday, too. You just have to shift to a production mindset and let go of the fear. You’ll be amazed by the productivity and freedom you can achieve when you stop mindlessly punching the clock.

5—Tips for Planning a Great Holiday Event

As the holiday season rapidly approaches, you may be thinking about staging a holiday event. Marcilene Smith, the onsite event coordinator at the Emerson Resort & Spa in New York’s historic Hudson Valley, offers her expert ideas and tips to help you plan a great event.

Pick a theme. Rather than a generic “holiday” theme, make it more specific and more fun. Try a Mistletoe & Margaritas theme, make them red and green or host a Grinch Party where guests are encouraged to dress up like characters from “Whoville.” Have a Sunday brunch party with pancakes and pajamas and perhaps rosemary eggnog or a cookie exchange.

Know your attendees. As diversity in the population continues to grow, consider having an event with neutral winter décor rather than specific holiday décor especially at corporate holiday parties. Have a “white” party and requests guests to wear winter white to help create a winter wonderland!

Interactive entertainment. Put a holiday spin on the typical photo booth set-up with naughty or nice props, reindeer antlers, a North Pole backdrop, mistletoe, etc. Consider holiday entertainment like a flash mob of carolers. If it’s a small group, try holiday-themed charades or a scavenger hunt.

Unique, useful & seasonal party favors, [depending on your climate]:

- Consider flannel microwavable hand warmers.

- Think seasonal scents and flavors. Give out all-natural peppermint sugar scrub in a Mason jar, peppermint bark bags, local maple syrup or hot chocolate kits.

- If guests aren’t traveling too far, give a [small] pine tree to plant in their own yards.

- Try Mason jar pies to go or banana bread or cranberry bread in a jar.

- Create crafty centerpieces. No need to re-invent the wheel. Use your seasonal décor for a centerpiece. Get creative with ornaments, garland, fresh cut greens, snowflakes, pine cones, lanterns, branches, bows, etc.

Plan ahead and book early. There are only so many days between Thanksgiving and Christmas and prime dates at great venues book up fast.

Consider Mondays through Thursdays for holiday parties. If you’re looking to cut costs, ask if any discounts apply for holiday parties.

6—What are Americans Worried About?

The Travelers Companies recently released the results of the Travelers Risk Index, an annual survey that provides insight into the most pressing concerns of American consumers and business leaders. While fewer respondents believe that the world is becoming riskier, there are shared concerns about cyber threats, the demands of a changing workforce and severe weather.

Here are some topline results:

Consumer worries

Financial security is the top consumer concern for the fourth consecutive year.

- Financial concerns (70%)

- Personal safety concerns (59%)

- Personal privacy loss, identity theft (55%)

- Transportation, travel concerns (54%)

- Cyber, computer, technology risks/data breaches (51%)

Business leaders’ worries

- Medical cost inflation (59%)

- Rising employee benefit costs (56%)

- Cyber, computer, technology risks/data breaches (54%)

- Legal liability (51%)

- Attracting and retaining talent (50%)

Shared Concerns

Cyberattacks are a significant concern among consumers and business leaders as mobile devices, wearable technology, connected workspaces and smart homes become more common. Half of consumers fear someone will gain unauthorized access to their personal information via smart devices. The survey reports that victims of a data breach or cyberattack—nearly 25% of consumers surveyed—say they have not since taken any greater precautions than those who have not experienced a breach.

Among business leaders

- 45% worry about the emerging risks associated with increased automation and internet connectivity

- 13% are very confident they’ve implemented best practices to avoid a cyber incident

- 81% lack confidence in the steps they should take in the event of a cyberbreach

- 32% have a data breach response plan in place

Both consumers and business leaders report worrying about a changing workforce

- 25%+ of consumers are anxious about having the skills to meet workforce demands

- 50% of business leaders report concerns about their ability to attract and retain talent

- 49% of business leaders view aging employees and the influx of Millennials as key disrupters

Severe weather is another shared worry, with a majority of consumers and business leaders believing it is becoming more frequent across the country.

7—Things are “Sunny” on Main Street

According to the Principal Financial Well-Being IndexSM: Business Owners, small business owners are feeling good these days—94% say their businesses are either growing or stable. And 50% of businesses fell into the “growing” category, up 25% from 2015.

Business owners are looking forward to the prospects of tomorrow—50% are optimistic about the economic outlook for 2017, an increase from 45% last year and 36% plan to increase wages, and 36% will add staff.

This year, 87% of business owners say they’re financially healthy, up from 82% last year and 69% have surplus capital on hand. Only 7% are holding on to their capital due to political uncertainty.

Business & politics: Small business owners are split on the best path forward this election year. Half think the government should be doing more to create an environment to drive business growth, while 27% believe the government is doing it right.

The survey shows the most notable political shift in 2016 is in party affiliation: 38% consider themselves to be a Democrat, a significant increase from 26% in 2015. Republicans held steady at roughly one-third of small business owners, and those identifying as Independents dipped to 27% from 36% last year.

8—What Employees Want

O.C. Tanner, an employee recognition and rewards company recently released its 2015 Health and Well-Being Study, which shows:

- Nearly 80% of employees who feel appreciated agree that work is more than just making a living, but only 51% who don¹t feel appreciated feel the same.

- 83% of the employees who feel appreciated believe they have control over their lives, compared to 60% among those who don’t feel appreciated.

- There’s a 44% increase in job satisfaction among employees who feel appreciated.

There’s a ton of great information in the free white paper.

9—Top Tips for Sellers

ORIS Intelligence, has a new platform which helps solve the selling challenges of today’s manufacturers by patrolling and enforcing minimum advertised price (MAP) everywhere their products are sold online, including discovering unknown sellers. As Cyber Monday rapidly approaches, new data from ORIS reveals that pricing violations are most likely to occur in November and December—and on average, violations are priced nearly 18% below the minimum advertised price (MAP) per product.

The ORIS platform actively monitors sellers’ websites, daily—every three hours, to stay ahead of frequent price adjustments made by online retailers and marketplaces. ORIS stores the pricing history indefinitely and sends daily reports, so manufacturers can see every price change, who moved first and note those retailers who have a history of violations.

Now’s a good time for manufacturers to understand where they fall when it comes to MAP and violations. Here are some tips from ORIS to help lead you to sales success:

- Don’t forget the little guy:Monitor big marketplaces as well as smaller, independent websites. Amazon is often blamed for starting price wars, but in reality, they are monitoring other websites and often are the first to match another site.

- Keep a Log:Compile detailed notes of the history of all seller violations and your correspondence to them in one place so it’s easy to find…and easier to identify patterns and repeat offenders.

- No Rest for the Weary:Don’t take a break on weekends. It’s important to monitor nights and weekend. ORIS data shows the most violated day of the week is Sunday followed by Saturday.

- Go Beyond Google:Don’t just rely on shopping comparison engines (CSEs) such as Google Shopping, to monitor your pricing. This is particularly true when analyzing pricing on nights and weekends. CSEs generally acquire their data from data feeds, and it may take hours or days for them to pull a new pricing feed and update their reports. During those after-business hours, be sure to click all the way through to the site to verify the price.

ORIS currently supports brands in a variety of industries including outdoor, consumer electronics, footwear and apparel, housewares, auto-aftermarket and cycling.

10—Employees Struggle to Take Care of Aging Loved Ones

As if they didn’t have enough to contend with, many of the nation’s workers are having to balance their work and personal lives with taking care of aging loved ones. Many, according to a recent survey from Care.com, are struggling to make it all work.

Some survey highlights:

Financial

- 29% of people financially support senior loved ones

- Nearly 1 in 5 people consider themselves a senior care provider.

- Families underestimate the costs for senior care. For example, about 25% think nursing homes cost half of what they actually do ($82,125 to $92,378).

- 67% worry about what senior care options will be available in the future.

64% are not budgeting or saving for their own or their partner’s senior care. 53% of baby boomers aren’t budgeting for their own senior care.

Senior Care Responsibilities Impact the Workplace

- 36% have asked for time off or workplace flexibility to accommodate for senior care

- 36% say worrying about aging loved ones has affected their work performance

- 34% have made work adjustments as a result of caring for aging loved ones.

- 46% would consider quitting to care for an ailing parent or loved one

11—Beware of Scams Targeting Small Business Owners

Local business scams are on the rise. Some scam techniques are fairly sophisticated. Even so, you can still beat them at their own game—as long as you spot the warning signs early on. The folks at YP explain some of the most common scams around today, offering a few tips so you can protect yourself from the swindlers who are trying to take advantage of you and your business.

Clever scammers will fraudulently pretend to be a legitimate company (like YP Marketing Solutions, for example) to earn your trust. They’ll steal logos, trademarks, verbiage, and pretty much anything to make it seem like the business transaction taking place is the real deal.

The Fake Invoice Scam: This scam involves sending a very official-looking invoice asking for payment. Remember, they’ll steal logos and riff off of the look of real invoices to try and sneak it past you. The scammers are counting on you to be too busy to notice any inaccuracies and just send a payment. But if you weren’t expecting to receive an invoice, don’t pay it. Instead, contact the Local Search Association. If you receive a questionable invoice from YP Marketing Solutions, contact your YP Marketing Consultant immediately.

The Walking Fingers Scam: Occasionally, scammers don’t do their homework and use out of date materials. This should provide an immediate red flag. One such scam uses the “Walking Fingers” logo on false invoices and other business correspondence. We at YP no longer use this logo, so if you see it, it’s definitely a fake.

The Refund Scam: Who wouldn’t be excited by an unexpected cash windfall? But, if it comes completely out of the blue and sounds too good to be true, it probably is. Even worse, by cashing a refund or rebate check, you could be held accountable for fraudulent billing practices. Be sure to always read the fine print on the front and back of any check very carefully.

The Listing Scam: Not all scams come in the mail; they could be a friendly voice on the phone. In one such scam, the con artist will call and pretend to verify your information for non-existent directories. Be very careful with what you say on the phone! They will try to get you to say the word “yes” in any way possible. They’ll later edit the call to make it seem like you agreed to pay for a service. A good way to stop this kind of scam is to ask for a call back number and then check its legitimacy with the Local Search Association before providing any additional information. Remember, never say the word “yes.”

The URL Scam: The scammer will send an email that says your URL is going to expire if you don’t pay to renew your registration, hoping that, out of sheer urgency, you’ll pay up without thinking twice. (Though, as you’ve seen as a consistent theme here, don’t pay for anything if you’re unsure of the source!) Here’s a quick and easy way to make sure you’re not falling prey to this kind of scam:

- Visit WHOIS Lookup.

- Type in the URL or domain name of your business.

- Scroll to the bottom of the record to see when your REAL expiration date is.

12—New Fund in Great Lakes Region

Rev1Ventures, a top VC investor in the Great Lakes Region, recently launched Rev1 Fund I, the company’s most significant fund to-date and the largest seed-stage fund in Columbus, Ohio history. The corporate-backed fund is supported by Nationwide, The Ohio State University, Cardinal Health and other top Columbus companies and organizations including The Ohio Third Frontier. Rev1 Ventures also made a significant investment in the fund, leveraging returns from prior successful investments in Columbus start-ups. The Rev1 management team also invested in the fund.

The Rev1 Fund I has tapped the region’s corporate and research partners across disciplines, allowing Rev1 to invest in a broad range of high-growth technology startups, including software, hardware, life sciences, alternative energy, and advanced materials.

Startups in the U.S. raised nearly $60 billion in venture funding last year, according to the National Venture Capital Association. However, early stage investment is on the decline nationally, and the latest Ohio Venture Report found the number of Ohio companies funded is down year over year.

The Rev1 Fund I is dedicated to seed and seed-plus stage companies. With initial investments of up to $1 million, the Rev1 Fund I can lead or co-invest in larger financing rounds, which provide more substantial support to help startups invest in the market development and talent needed to innovate, build and scale their products while also fueling local job growth.

Rev 1 says Columbus is the fastest-growing region for startup activity because of the robust infrastructure and the region’s dedication to fostering business growth. Rev1 invested in 29 companies last year, making it the most active seed fund investor in the Great Lakes Region, as ranked by venture capital industry research firm Pitchbook.

Cool Tools

13—Help for Very Small Businesses

ADP TotalSource recently announced it will now offer its services to very small businesses with as few as two employees. This allows these businesses to be more competitive in the war for talent by providing their employees access to high-caliber HR resources. TotalSource says business owners are increasingly using Professional Employer Organizations (PEO) so they can have more time to devote to larger business objectives.

ADP TotalSource is the largest PEO in the United States, and has traditionally served small businesses with more than 10 employees. ADP TotalSource clients are connected with a professional to help make strategic HR decisions and gain access to an extensive suite of offerings including health benefits, employee growth and development programs, retirement services, and compliance assistance, all accessible in the cloud.

14—Simplified Payroll

Payroll City recently launched its integration with EaseCentral, enabling simplified management of payroll, online benefits enrollment, HR and ACA compliance for small businesses with 2-200 employees.

Payroll City now offers an all-in-one software solution for payroll, employee benefits, HR & compliance. Built for both insurance agents and small employers, the cloud-based combination makes it simple for companies to set up and manage over 50 types of benefits, coordinate payroll and HR, instantly generate employee ID’s and collaborate with employers on new hires, changes and terminations, and deliver completed tax information – all from one location.

15—Data Security for Small Businesses

Druva, a leader in cloud data protection and information management, has joined with Protection 1, a premier full-service business and home security company, to bolster its ability to address data protection needs for small and medium-sized businesses. The addition of Protection 1 to Druva’s PartnerSync program for MSPs comes as the company launches the latest version of its MSP platform, which includes seamless integration between Druva’s multi-tenant MSP management console and customer accounts, new global search capabilities, enhanced MSP administration login credentials, and customer identification improvements.

According to Druva’s VP Corporate and Product Marketing, Dave Packer more than 70% of security breaches specifically target small businesses. “Small businesses are especially vulnerable when it comes to data protection, security defenses, and breaches,” says Packer.

Protection 1 Cyber Security, which includes Druva inSync, provides customized disaster recovery and network, endpoint and wireless security solutions to serve SMBs.

To get more information go here.