17 Things Entrepreneurs Should Know to Grow Their Businesses

By Rieva Lesonsky

Editor’s Note: This column is taking two weeks off. We’ll be back December 5th. Happy Thanksgiving!

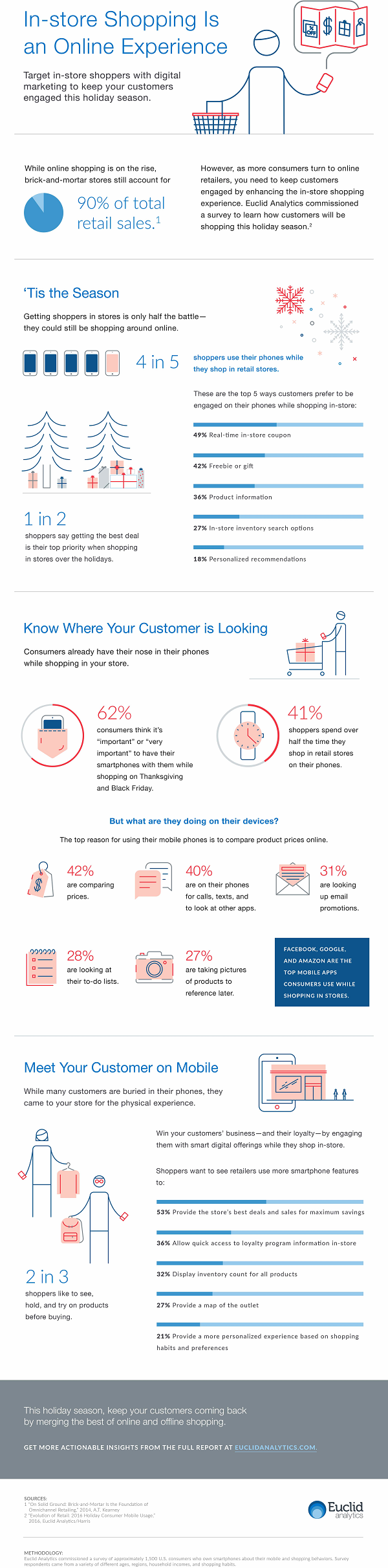

1—Holiday Shopping Behaviors

Euclid Analytics recently released a research report highlighting consumer shopping behaviors.

Key findings include:

- 83% of consumers say their smart devices are central to their shopping experiences

- 47% rely on word-of-mouth to discover cool new products

- 37% rely on Facebook to find new products

- Facebook, Google and Amazon are, respectively, the top smartphone applications consumers are using while shopping

Check the infographic below for more information.

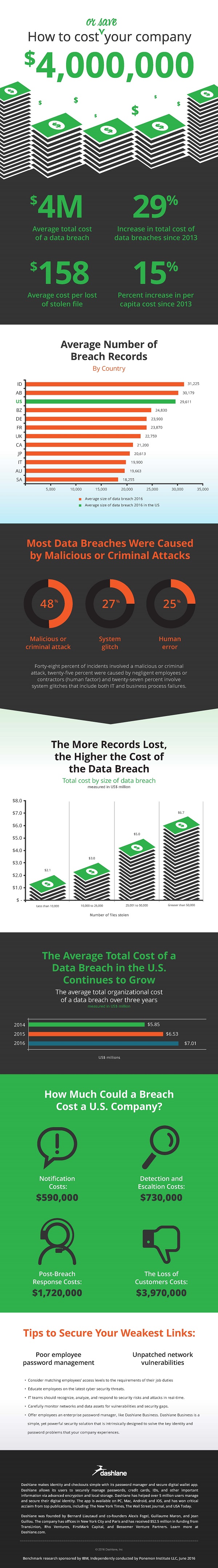

2—Preventing Data Breaches

Data breaches are costly. Luckily, there are ways to prevent these types of losses. Check out the infographic from Dashlane, a popular password manager, as a reminder of how dangerous these breaches can be.

3—5 Tips for Starting a Subscription Box Business

Guest post by Amir Elaguizy, CEO, Cratejoy

1) The tighter the niche and community the better: Many assume it’s better to have the broadest appeal possible, so they start a coffee or a book subscription. We’ve seen it’s far better to have a targeted offering for a niche audience. Subscriptions like OwlCrate which focus on a very specific niche—avid readers of young adult fiction—tend to do much better than a broader subscription, for instance, all fiction fans. There are a few reasons for this:

A targeted niche means built-in early adopters. With OwlCrate, this meant young adult fiction hyper-enthusiasts who were eager to subscribe. There is far less competition from the broad market. For instance, you aren’t up against every other business targeting people who are searching for “books.” Rather, you’re only competing with people who are also targeting fans of “young adult fiction,” which means the costs to acquire customers are much lower.

And product design is easier since it’s easier to design a product that makes a few people incredibly happy than it is to make a product that makes everyone incredibly happy. The latter means you may not have a clear focus and you’ll build a product that leaves many people bored.

You also have the built-in ability to add new products that expand on your customer base’s interest, or sell additional products within this niche.

2) Product decisions and experience trump everything: Subscriptions flourish by maintaining a customer base, and customer value is created after the first purchase. Keeping customers happy with an incredible experience is key to unlocking the power of subscriptions. Additionally, happy customers are delighted with every box. Each enjoyable interaction creates an opportunity to generate additional word of mouth: using your network to grow your network.

Bottom-line, focus on product experience more than anything else.

3) Pricing matters more than you think: In our experience, most first-time subscription founders tend to underprice with the assumption that low prices lure customers. However, these business owners often find that their true costs are higher than expected and it’s much harder to raise prices down the road (after you’ve locked in subscribers at the reduced rate).

The mistake many founders tend to make is assuming they will acquire all customers “for free” using social media. Even when done right, there is a cost for social media—if nothing else, the value of your time.

The average successful subscription box is in the $36.00 price range. I’d suggest pricing of $10-$15 per customer acquisition, and more for a higher priced box. New boxes likely won’t become profitable until the second or third month, giving you even more reason to focus on a high quality product and experience.

Cratejoy offers a calculator to identify initial pricing.

4) KISS (Keep it simple stupid): It’s easy to get caught up in the excitement of starting a new business. Founders want the best tools and best strategies to make the most profit, creating a complex business model. Successful founders take a step back to ask the basics. Start simple and build as the business grows. Explore the topic more at the Cratejoy Subscription School.

5) Lean on community: There are thousands of merchants who lean on each other to get started, provide motivation and share success stories. A great place to start is the Cratejoy Subscription School Facebook Group. Via social, you can also find other entrepreneurs and those passionate about your category, be it books, witchcraft, handcrafted soaps, whatever. Engage with them early and often.

4—Are You Wasting Money on Unnecessary Admin Work?

A new global study from The Workforce Institute at Kronos Incorporated and Coleman Parkes Research shows U.S. businesses waste $687 billion a year on unnecessary administrative work—significantly more than any other country. That equates to about $4,554 per employee, per business being spent on burdensome tasks that are not directly related to employees’ core job roles.

The study, The $687 Billion Question, also found that the U.S. workforce “is hindered by complexity, low productivity, and poor-performing technology.”

Treating employees as an asset rather than a commodity is essential for true workforce engagement. It’s a critical factor in attracting and retaining the best talent possible in a competitive job market. However, manual administrative tasks unrelated to employees’ core job roles creates a time-consuming burden can lead to disengagement. Instead, organizations should re-evaluate these processes to empower employees to deliver their best as part of a broader engagement strategy.

Bridging the engagement gap: Technology can be turned into an advantage, but out-of-date solutions will only add more unnecessary complexity.

- Manual processes are burdensome, with 78% of respondents citing this as a cause of lost productivity.

- 72% of operations/line of business managers report that outdated systems/technology are the biggest workforce management challenge.

- 72% say up-to-date technology would improve employee engagement

Productivity and employee engagement should go hand-in-hand: Employees see themselves as contributors, not liabilities on a balance street.

- 59% believe their CEOs are focused on finances rather than employees.

- 31% of HR professionals rated their people among the top three assets of their organization, despite national discussion about the importance of employee engagement.

- Only 12% rate employee engagement as very strong within their organizations

Stuck in the middle: People are torn between meeting customer needs and manager expectations.

- 65% say it’s difficult to complete all their tasks in a typical work day (mirroring a 2016 Workforce Institute surveyon overtime).

- Management demands, internal politics, unrealistic workloads, lack of staff availability and poor technology support create a perfect storm of complexity that detracts from providing high levels of customer service, according to respondents.

- Respondents believe reducing administration and paperwork, providing the right technology to automate tasks, and improving structure/support within and among departments would allow them to more time to think and plan, address high priority tasks, and focus on customers.

Small changes create big rewards: Reducing just one hour of wasted time per employee adds up to billions of dollars.

- By reducing the burden of admin work by one hour per week, U.S. organizations would save $1,518 per employee, for a total of $229 billion annually.

- According to the study, respondents average 3.1 hours per week on administrative tasks unrelated to their core job roles.

- Just 15% say employee productivity is very strong within their organizations.

Employee motivations are evolving: Monetary rewards are no longer the sole motivator for employees, which is why organizations should focus on communication, collaboration, and culture to keep employees engaged.

- 73% of employees say better communication with management will help them feel more engaged.

- When it comes to reasons to leave their job, compensation is seventh on the list, with respondents stating they are more likely to resign due to lack of direction, lack of focus, not seeing their future role in the company, not feeling valued, not feeling understood, and not getting along with their manager.

- 58% say rewards and incentives would likely increase productivity.

5—Investing in Long Term Growth Strategies: Payroll Services

Guest post by Jay DesMarteau, Head of Small Business Banking at TD Bank

Most entrepreneurs went into business to do what they love. While turning a dream into a career can be fulfilling, it also comes with a lot of responsibilities many small business owners may not have anticipated. When the day-to-day tasks start to add up, it can be difficult to stay focused on the business strategy. However, if a small business owner wants to grow, they’ll need to shift their mindset from being a one-man-show and start thinking like a CEO.

An important part of growth is adding staff who can provide support and allow the business owner to focus on the bigger picture. A TD Bank survey of small businesses in 2015 found that 43% of businesses have at least one employee. While this means an extra set of hands to help out, it also means the small business owner now needs to think about payroll, taxes and regulation.

Payroll services in particular can provide relief. Outsourcing payroll will deliver basic services such as calculating pay, tax withholdings and generating direct deposit or checks each pay period. These areas are governed by strict laws that business owners may not be aware of, and resulting mistakes can lead to sometimes hefty penalties.

“There are nearly 10,000 tax jurisdictions in the U.S. which are changing constantly,” says Jamie Griffiths, vice president of bank partnerships at Paycor, a strategic partner of TD Bank. “It’s very difficult for one person to manage a business and also stay up to date on these laws. Hiring an expert can remove that burden.”

Payroll services ensure that the business complies with complex regulations and that it stays up-to-date with the latest laws. This takes a lot of weight off of a small business owner’s shoulders for a relatively small expense.

An outsourced payroll service can also make the business more attractive to potential employees. These services can provide added perks such as online check stubs, time tracking and apps where employees can view pay information. It also helps level the playing field if a candidate is comparing a small business to a big company.

It also creates long-term stability that can help the SBO transition into retirement smoothly.

It can be difficult for small business owners to break out of their cost-controlling mindset, but it’s important for them to take the time to evaluate which investments will create stability and profitability for their business. While a payroll service is an additional budget line item, business owners need to think of it as a long-term investment that can make the business more attractive to potential investors, buyers and banks. With someone else worries about paystubs.

6—Restaurant Rescue: Avoiding Common Pitfalls

HotSchedules, a leading restaurant technology provider, shares its six tips for restaurant owners to help you avoid needing a “Restaurant Rescue”:

- Tolerating Toxic Employees: You may have an excellent reputation with your customers, but equally important is your reputation for hiring and tolerating toxic employees. You may not always know an employee is toxic. Keep your eyes and ears open and make it known that you have an open door for anyone to discuss real issues that could be causing harm to the overall work environment or to other employees in the workplace.

- Unmanaged Overtime: One of the fastest ways to watch your labor costs creep up is to let overtime get out of control. There is a healthy amount of overtime that is inevitable in a restaurant operation. But, it’s supposed to be the exception, not the rule. Too much overtime could indicate an understaffing problem, not to mention exhausted employees and poor guest experience.

- Ignoring Labor Laws & New Legislation: There’s been a significant uptick in the number of new labor laws impacting the restaurant and hospitality industry. From the Affordable Care Act, to new overtime laws and let’s not forget the wave of wage increases in the “Fight for $15.” There’s been a tendency to want to wait for these laws to come under scrutiny or get hung up in the courts. But that would be a mistake. To avoid penalties and equal opportunity employment lawsuits, the smart, cover-your-ass at all costs employer would heed any and all laws and do their best to comply at all times.

- Not Accepting Responsibility to Train Unskilled Workers: You’re a lucky operator if every employee you hire has previous restaurant experience. The fact is, the industry employs a significant number of unskilled employees. That doesn’t mean they can’t learn the skills necessary to be successful in a restaurant or bar. It would be a mistake to shortchange your restaurant’s investment in training—both in-store and online.

- Communication Management: There is nothing in the universe more important than communication. Restaurants have closed their doors because communication (or the lack of it) was a huge problem. Restaurants that have a method of logging regular shift activities and commit to a regular communication cadence are able to reduce errors, improve compliance and retain happy, engaged team members. One of the best ways to get your team engaged in your vision is to have a way to communicate those values and reinforce them on a regular basis.

- Productivity Shortcuts: Call it laziness, call it unskilled or untrained employees, point your finger at poor management—whatever you call it, productivity shortcuts—especially those that involve food preparation or hygiene—should not be tolerated. Whether you are your own brand, or represent a large franchise, shortcuts could put your guests, your employees, your business and your reputation at risk.

7—New Marketing Tool from LinkedIn

LinkedIn has extended the availability of Sponsored InMail to self-service marketers of any size and budget to engage their target audience on LinkedIn. This is part of LinkedIn’s goal to make sure every customer, regardless of size, budget or experience, can use their products, which is especially relevant to small business marketers.

The challenge: Traditional digital advertising has its challenges. Consumers are bombarded with ads that aren’t relevant, and advertisers are unable to personalize ads at scale. Additionally, as consumers continue to shift their attention to mobile devices, there is an increasing need for effective formats to engage these mobile focused audiences.

LinkedIn says Sponsored InMail solves these challenges by allowing advertisers to create personalized messages while targeting and delivering those messages to their prospects at scale across desktop and mobile.

Additionally, email remains a major channel for marketers. Messages can get buried beneath a mountain of other emails, or blocked by a spam filter. Unlike traditional email marketing, Sponsored InMail is delivered only to members who are actively on LinkedIn, through LinkedIn messenger, with a look and feel that’s consistent whether the user is on mobile or desktop.

Key benefits of Sponsored InMail:

- More flexibility to A/B test and iterate

- Stronger engagement and click-through rates

- Higher-quality leads

- Allows marketers to optimize message for desktop and mobile users

8—5 Tips for Going Global

The second a small business goes online, they become a global company. Bonnie Voldeng, Director of Go-To-Market and Content Strategy at FedEx shares five tips for starting a global business.

- Be prepared to fulfill shipments…quickly. Having demand from customers near and far is promising, but if you cannot get products to them, and in a timely and cost effective manner, you run the risk of damaging relations. To avoid this, speak to your logistics provider about accommodating your growing customer base, as they’ll be able to help you build a strong and healthy supply chain to ensure your products get from A to B without delay.

- Don’t bite off more than you can chew—focus on one country at a time. This may sound counterintuitive, but focusing on one country for starters will ensure your domestic business is kept in order. There’s plenty of time to conquer the rest of the world! You need to speak to your logistics provider to gain their insight into prospective countries, as they can offer guidance on your product’s suitability to a particular market. They’re on site and on the ground, they can identify what’s trending and as economies wax and wane, they can help you determine which countries offer the best opportunities.

- Know your market and be able to adapt to their customs and regulations. You need to be somewhat knowledgeable about how customs is handled in the countries you’re doing business in. If you find yourself overwhelmed by the rules and regulations of a foreign country, you’re not alone. The surge of new exporters has also meant a surge of people looking for export guidance. Luckily, resources are available, and that makes it easier than ever to find answers. You can get information on regulatory requirements and export compliance for overseas markets on gov.

- Evolve your business to sustain international success. The global marketplace is constantly evolving and so it’s wise to continue developing your business to stay ahead. To grow and develop further, put in place clear milestones such as sales targets and invest in training and development for your staff. Ensure you have an overall objective and timeframe you want to achieve that in and then implement smaller targets to get you one step closer. Don’t lose sight of the overall plan but use easily digestible goals to make sure your business growth stays on track. Flexibility and being able to quickly and effectively adapt to the evolving market is crucial. By utilizing technology and ensuring your growing workforce is fully trained you’ll be able to respond quickly to growing demand and go where your customers are.

- Social media can catapult business growth globally. Having a strong presence on social media is a must if you’re becoming a global company. Making the decision to be an online brand can be a defining moment for sales. Social media provides small businesses with an ideal platform that does not require a six figure marketing budget.

9—U.S. Businesses Lag in Mobile Payments

New global research from GfK reveals American shoppers are among the world’s leaders in using mobile devices while shopping in bricks-and-mortar retail outlets. But in-store mobile payments still account for just 2% of all US transactions—which is dramatically lower than China and other mobile-forward regions.

The 2016 FutureBuy® report on digital and in-person shopping trends shows:

- 37% of U.S. shoppers answered “in a store” when asked where they last used a smartphone or tablet to help them shop

- Only 2% made a payment with a mobile device in a store

The most common reasons shoppers use mobile devices (in stores or elsewhere) are to compare prices (25%), search for product information (19%), read online reviews (17%), and check availability of an item (14%).

But making mobile payments is another story:

- 42% believe “mobile payments are more of a gimmick today than a major part of how I pay”

- 24% are “worried about my personal information when using a mobile payment app”

Tim Spenny, Senior Vice President on GfK’s Financial Services team says, “A clear security communication effort coupled with a compelling app or wallet design would help mobile payments become more of a mainstream behavior among U.S. shoppers. The benefits to merchants, in terms of efficiency, loyalty, and additional consumer data, would be huge.”

10—Shopping Apps for Women

Liftoff, a leader in performance-driven mobile user acquisition, recently released its annual Mobile App Engagement Index, highlighting trends in how consumers engage with apps and mobile marketers acquire new users.

The data shows marketers must target women if they are looking to win in mobile and increase profits. According to the report, women are not only more likely to make a purchase in both mcommerce and gaming apps, they are also significantly less expensive to acquire compared to their male counterparts. Liftoff says, “This major shift makes it clear that app marketers need to allocate their dollars and resources towards their female customer base going forward.”

Other findings show:

Women are dominating the mcommerce landscape and wielding all the cash. A year ago, it cost approximately $148 to acquire a user who then went on to complete a first purchase within a shopping app, and according to BI Intelligence, the majority of users making purchases on mobile devices were male. Fast forward to today, and not only has the average cost to acquire a user decreased by about 54.5% from Q2 2015, but the lion’s share of mobile spending has also shifted.

Liftoff found that women were nearly 34% more likely to make a purchase within a mobile app, indicating that females are the driving force behind overall mobile spending. More so, the findings showed that females were 40% less expensive to acquire than their male counterparts.

Female gamers outspend men and rule the mobile gaming market. Games have long been perceived as a ‘male-dominated’ activity, in fact research from Pew Research and Flurry Analytics indicated 60% of Americans assume gaming is a male activity and males are much more likely to download mobile games.

According to Liftoff’s findings, however, female gamers dominate the market and actually outspend men in the space. The data shows that female gamers installed and made a purchase within a gaming app at a rate of 6.7%, compared to males (5.9%). Additionally, the cost to acquire a female gamer who makes an in-app purchase was about 13% less than those for men.

You can download the free report here.

11—Holiday Shipping Strategies

Guest post from Amine Khechfé, co-founder of Endicia and chief strategy officer for the Stamps.com family of companies.

Look at what worked last year and what didn’t. Did you ship items too late last year and they didn’t make it to customers on time? Did you spend time optimizing your website and end up avoiding traffic jams on your site? Did you identify which products sold out faster than others? If you’ve already gone through a holiday season, analyze what worked well and what didn’t to help you gear up for this year’s season and save on spending in the wrong places.

Plan ahead. Anticipate what your holiday demand is going to be so you can have the right amount of inventory in stock and workers on the floor. Additionally, make sure your website is optimized to keep up with holiday web traffic to avoid shopping cart abandonment and high bounce rates.

Manage expectations, but deliver the goods. Make it clear to customers how quickly you can fulfill orders so they know when they need to order it by to get it under the tree in time. As a small business, you obviously don’t have the same capacity as Amazon, so don’t plan your shipping strategy like you do. According to the National Retail Federation’s 2016 Retail Holiday Planning Playbook, 47% of consumers said free shipping was one of the most important factors during the holiday season and 85% of online shoppers will wait 5 days for delivery. Consider offering free shipping if customers get in their holiday orders by a certain (early) date. This way you ensure they get their orders on time, and it gives you additional prep time.

Package properly. Customers don’t want to receive packages that are falling apart or contain damaged items, especially when they’re gifts. Make sure to package everything securely. Having items arrive broken or in poor condition will not only upset customers, but will affect your company’s reputation and reduce the likelihood of future business. This means using new corrugated boxes for heavy/fragile items, avoiding overfilling and underfilling boxes and applying appropriate layering to keep items safe.

Think past the holidays. The holiday season isn’t over once the presents are opened. Make sure you have a solid returns system in place and are providing customers the convenience of easy return shipping labels. Endicia’s Pay-on-Use Returns makes this process seamless. Unlike regular USPS labels, Pay-on-Use Returns aren’t pre-paid, the postage is only deducted from your account if and when the return label is used. This means you can give your customers those easy-to-use return labels in their shipment without having to pay for them before they’re actually used

12—Are You at Risk for Credit Card Fraud?

Most (62%) of small businesses still aren’t using chip-based credit cards—according to a survey from Manta. Read more about why this is risky behavior here.

13—Money for Women

JPMorgan Chase more than doubled the size of its global Small Business Forward program, , by committing $75 million over the next three years to support women, minority and veteran-owned small businesses. This includes a $1.9 million grant to the Association for Enterprise Opportunity (AEO) to support its programs to connect small business owners with alternative funding sources when they are unable to qualify for traditional loans.

The company says small businesses are growing fastest among people of color, particularly Latinas and African American women. Yet, research shows minority-owned businesses rely significantly more on investments of personal or family wealth than on outside debt or equity. And only 16% of conventional small business loans go to women entrepreneurs. Despite the higher startup rate for African-American owned businesses, these businesses received less than two percent of SBA loans in 2013.

14—Now Easier to Transfer Money Internationally

TransferWise, a leading international money transfer platform, just launched TransferWise for Business, a low cost and easy way for businesses to transfer money internationally.

A recent analysis commissioned by TransferWise showed 54% of American small businesses with between 1 to 250 employees have a need to send money abroad at some point. Outside of importing and exporting, these businesses have paid roughly $450 billion to foreign parties (i.e. freelancers, lawyers, satellite offices, etc.) in the last 12 months—spending an estimated $18 billion in fees and charges.

The study also highlighted that 12% of small businesses employ or source talent internationally with a 27% increase in the number of businesses looking to hire foreign talent overseas in the next 12 months.

TransferWise for Business says it makes the experience of making and receiving international payments faster, simpler, and far more convenient than using a bank. Features include:

- Mass Pay tool and API integration: offers an intuitive batch payment solution that lets businesses quickly send and track large numbers of payments, either with a simple file upload or by integrating TransferWise’s API to pay thousands of recipients at once

- Expansive reach: S. businesses can send to 37 currencies in over 50 countries including Canada, Mexico, India, China, South Korea, and Japan

- Easy reporting: new data export function means businesses can download their payment log for accounting purposes

- No middle men: TransferWise sends payments directly into the recipient’s bank account, so there is no additional step or receiving fees demanded from the recipient at the final stage

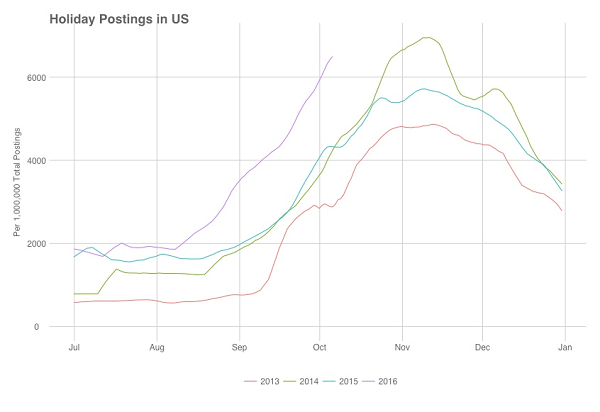

15—Bringing Crowdsourcing Power to Local Jobs

Indeed, a leading job site, recently launched Job Spotter for iOS, the first mobile app designed to bring offline local job postings online, and help businesses of all sizes increase visibility of their local opportunities with the power of crowdsourcing.

Although businesses can post jobs on Indeed for free, a majority of jobs around the world can’t be found online. In many countries, a large percentage of open positions can only be discovered if job seekers walk past a “Help Wanted” or “We’re Hiring” sign. Indeed estimates that, in the U.S. alone, millions of jobs are only advertised in storefront windows.

By downloading the Job Spotter app, anyone can snap pictures of local “Help Wanted” signs and upload them to Indeed. Job seekers gain access to openings they otherwise might not have known about.

For businesses, Job Spotter amplifies their job advertising, increasing their pool of local candidates for locally based positions. In fact, the company says it is already the #2 source of mobile clicks in the U.S. for Indeed.

Job Spotter is currently available in the Apple App Store and Google Play in the U.S. and Australia. Job Spotter users who submit photos of hiring signs from storefronts earn points toward gift cards. To find Job Spotter jobs in your area, simply type “Help Wanted” into Indeed job search.

You can get more information here.

Cool Tools

16—Organize Your Life

It’s important for busy entrepreneurs to have a grip on their schedules, meetings and to-do’s. In this busy holiday season the need is even greater. If you’d like to have all that in one place, so you can see what you need to do at a glance, check out Simpliday, a new iPhone app.

This all-in-one app allows users to:

- Manage all of their phone’s calendars and meetings in one app

- Lists reminders side-by-side with their calendars

- Assign reminders with notes to others who may be attending the same events, etc.

The app is currently free for iOS download here. (I downloaded it and love it.)

17—The Easy Way to Build an App

The App Institute recently issued an App Builder, which allows businesses to build an App without knowing how to code, by using its simple drag and drop system. You can build the app for free and then pay a monthly subscription of $30 or $45 when you’re satisfied with the App you’ve created.

The App Institute describes it as “WordPress for apps.” The system offers a wide range of features that make the app building process easy. You can enter your Facebook page URL to get all the relevant business information, and your website URL to create a color scheme. In addition, there are pre-loaded templates, complete with all the functionalities you’ll need.

If you want to know more, read their case studies here or check out this blog post on the benefits of mobile apps for business. If you don’t want to take the DIY approach, you can hire them to build an app for you, for $1499. There’s more pricing information here.