18 Things Small Business Owners Need to Know

By Rieva Lesonsky

1—Favorite Places of the Rich & Famous

Do you have a favorite place? I had a magical, mystical moment at Haleakalā National Park in Maui once, but when I went back, I couldn’t recreate the magic.

Check out the favorite place of Steve Jobs below from Berkeley Build and then click here to see more from Bill Gates, Oprah and others.

Steve Jobs loved Kona Village in Hawaii so much he had a standing retainer on one of the houses there. He would turn up at a moment notice, sometimes flying to the beloved resort from a different holiday location that just ‘wasn’t as good’. Kona Village was very much a serene retreat which provided a much-needed route of escapism from the world of tech for Steve. With no telephones or televisions, and thatched roof bungalows surrounded by clear waters and sandy beaches, it was his preferred haven.

Unfortunately, in 2011 the oceanfront resort was hit by a tsunami that forced closure on the venue. It is expected however to reopen in 2019 following a renovation. Before his death, Steve called the owner of the resort to ensure the hales he loved would be preserved in the same nature.

2—What Color is Right for Your Brand?

When you chose the colors for your logo, did you pick your favorite colors or ones that reflected what your brand stands for? If you’re like most of the entrepreneurs surveyed in research from global creative platform 99designs, you went with colors that reflect your “personal taste and preference” (65% ) and “did not research the potential implications when choosing colors” for their brand (48%).

To help, 99designs just launched an interactive logo color discovery tool to help business owners “identify the right color for their brand personality based on their business goals.”

99designs’ research looks at eight industries: retail, real estate, technology, finance/accounting, legal, marketing/communications, healthcare and agriculture. Some of the key findings include:

Technology: Blue accounts for around 60% of tech logos both on 99designs and within wider industry leaders. Blue is associated with knowledge, security and trust, and it makes sense that companies breaking new ground and shaking up consumer behaviors want to reflect these traits in their branding.

Retail: Overall, attention-grabbing red is the most prevalent color in retail. Characteristically, a loud, playful, youthful and modern hue, red makes particular sense in the context of a storefront enticing customers in the door.

Legal: Logos for law firms tend to be simple and minimalist, and among industry leaders, there is a trend to have one dominant color. Shades of blue lead the color pack, while black and red are also popular choices, as are neutral colors—black, white and gray.

Marketing/Communications: Blue also dominates in marketing and PR, appearing as the dominant hue in nearly half (43%) of logos in this sector created on 99designs. Lighter shades of blue signify friendliness and trust, and darker blues evoke professionalism and security, which reflects the important role these companies play in shaping a client’s public image.

Agriculture: Green dominates both the agriculture logos of industry leaders (60%) as well as 99designs customers in the sector (64%). The top pairing colors are black, white and blue.

There is more info and tips on choosing logo colors in specific industries here.

3—10 Hacks Every iPhone User Should Know About

I’m on my 3rd iPhone and there’s still so much I don’t know about how to get the most out of it. If you’re like me, you’ll want to look at this link from On Stride Financial to learn some hacks.

4—Are Millennials Saving for Retirement?

While the oldest millennials are still in their 30s, it’s never too early to save for retirement. LendEDU did a study on millennial spending and found:

- 37% of millennials aren’t saving for retirement. Those that so save, save an average of $480 per month for retirement.

- 27% spend more on coffee each month than they put away retirement. The average amount spent on coffee was $38, while only 27% of millennials don’t have a monthly coffee expense.

- 49% spend more on restaurants and dining out each month than save for retirement. The average amount spent on restaurants and dining out was $163, while a mere 6% don’t have a monthly restaurant expense.

- 32% spend more money on clothes monthly than they save for retirement. The average amount spent on new clothes was $82, while 21% did not have a clothes expenditure month-to-month.

(There’s more info here.)

If you still think, “I’m young, I don’t have to save for retirement now” LendEDU also surveyed seniors about their biggest financial regrets and learned:

- 6% of older Americans don’t think they’ve saved enough for retirement, while 18.8% aren’t certain if they did

- In terms of their biggest financial regrets from their 20s, 21.4% admit they didn’t save enough for retirement, 17% say they spent too much on nonessential things, 12.3% regret not investing their money, and 10% got into too much debt

- 8% say Social Security benefits are a critical component of their financial strategy, while 29.7% say they are not, and 44.5% are unsure

5—Are Millennials Workaholics?

If you’re working as hard as millennials say they do, you should be saving money for your future years. Most millennials (66%) identify as “workaholics”, according to the Millennial Workaholics Index, from FRESHBOOKS.COM. Other highlights of the report:

- 56% of millennials work more than 40 hours a week. In fact, they’re 8% more likely to work 40+ hours than those older than 45.

- 20% say they work more than 60 hours in a typical week

- 70% say they’ve worked on the weekend

- 32% of millennials have worked in the bathroom

- 27% have invoiced a customer while on a date

6—Small Business Confidence is Up

Every quarter CNBC and SurveyMonkey release a poll of small business owners measuring the vitality of the American economy, and the view from Main Street about jobs, taxes and other relevant topics. Overall, the Small Business Confidence Index (SBCI), for the third quarter of 2018 comes in at 62 (out of 100), which is the highest the SBCI has been since CNBC and SurveyMonkey began polling businesses six quarters ago, tied with Q1 2017.

Other key findings include:

- 58% of the small business owners surveyed say overall business conditions are good, up 39% from the third quarter of 2017.

- 33% plan to increase headcount in the coming year, up from 26% in Q3 2017.

- 16% (but 41% of small businesses with 50 employees or more) have had open positions for at least three months.

- 45% say a lack of education is the biggest reason firms struggle to fill skilled positions.

- 28% believe they are unable to fill skilled positions because large corporations are able to offer better pay and benefits.

- 34% of Republican small business owners expect trade will have a positive effect on their business, while 58% of Democrats expect trade will have a negative effect on their business

- 51% believe free trade agreements help small business.

- 34% say tariffs, like those proposed by President Trump, will hurt their business

- 8% have already made changes, and 21% are planning to make changes, as a result of tariffs.

7—Skills Index

Upwork, the largest global freelancing website, recently released its newest quarterly index of the hottest skills in the U.S. freelance job market. The Upwork Skills Index ranks the site’s 20 fastest-growing skills quarterly. The Index sheds light on new and emerging skills and provides real-time validation of current trends in the labor market and tech industry. According to a recent report, because freelancers are often equipped with the specific skill sets teams require and are well-suited for the increasing volume of project work, 59% of HR managers opted to utilize freelance talent last year. Of these, 57% expect to use even more freelancers in the next 10 years.

The 20 fastest-growing freelance skills in Q2 2018 experienced more than 150% year-over-year growth, while demand for the top 10 skills grew more than 500% compared to the same time period last year (Q2 2017).

The top 20 fastest-growing skills, Q2 2018:

- Blockchain

- Google Cloud Platform

- Volusion

- Risk management

- Product photography

- Rapid prototyping

- Google App Engine API

- SCORM

- GitLab

- Go development

- Apple UIKit

- Enterprise architecture

- Tensorflow

- Atlassian Confluence

- Apple Xcode

- eLearning

- Customer retention

- Articulate storyline

- js

- Scala development

There’s a lot more in-depth information here.

8—Innovation Scholarship

Swiftpage, the provider of Act! CRM software, recently launched its Small Business Idea and Invention Scholarship. The new program will award $2,500 to a student who submits an idea, invention, or app that helps small business owners grow their businesses and run them more efficiently.

“This generation has an acumen for technology and expectations for faster, tailored business transactions,” says H. John Oechsle, CEO at Swiftpage. “Because of the way they experience brands on social media, they also have a more innovative, creative understanding of marketing. We’re very excited to see how students apply those insights toward growth strategies for small businesses.”

The Small Business Idea and Invention Scholarship will acknowledge students who value startup technology and are driven to help small businesses succeed. Currently registered high school, community college or university students are eligible to apply.

Applicants must submit a video less than two minutes in length, explaining an original idea to grow small businesses. Applications are due by December 7th. The winner (to be named in January 2019) will receive $2,500 to be put toward any educational purposes.

Submit an application and video for the Act! Small Business Idea and Invention Scholarship here.

9—Do You Use Checks?

Biz2Credit evaluated check usage of small and medium businesses (SMBs) and found that despite the growing prevalence of online banking, small companies write eight times as many checks as their retail customers. SMBs issued an average of 406 checks per year compared to retail customers, who write around 50 checks per capita per year.

“Small business are true holdouts. Many times, they use checks as a way of controlling cash flow,” says Venkatesh Bala, PhD, Chief Risk Officer for Biz2Credit, who conducted the study. “Issuing checks provides a built-in delay in the payment of vendors and employees, whereas online transfers and direct deposits move the money directly into other bank accounts immediately.”

Check usage varies depending on the size of the business. Companies with less than $250K in annual revenue issued 133 checks per year on average, while firms with more than $5M in revenue issued more than 1,100 per year on average, roughly 4.4 checks each business day.

Younger owners of small businesses (under 35) issue far fewer checks than business owners aged 55 or over (on average, 238 versus 641 per year). However, this partly reflects the fact that younger business owners are less established and have a lower revenue, which is associated with lower check usage.

Check usage also varies widely by industry. The lowest usage is within information technology (IT) and professional services businesses (13% and 19% respectively) while the highest is within the construction industry (47%).

Quick Takes

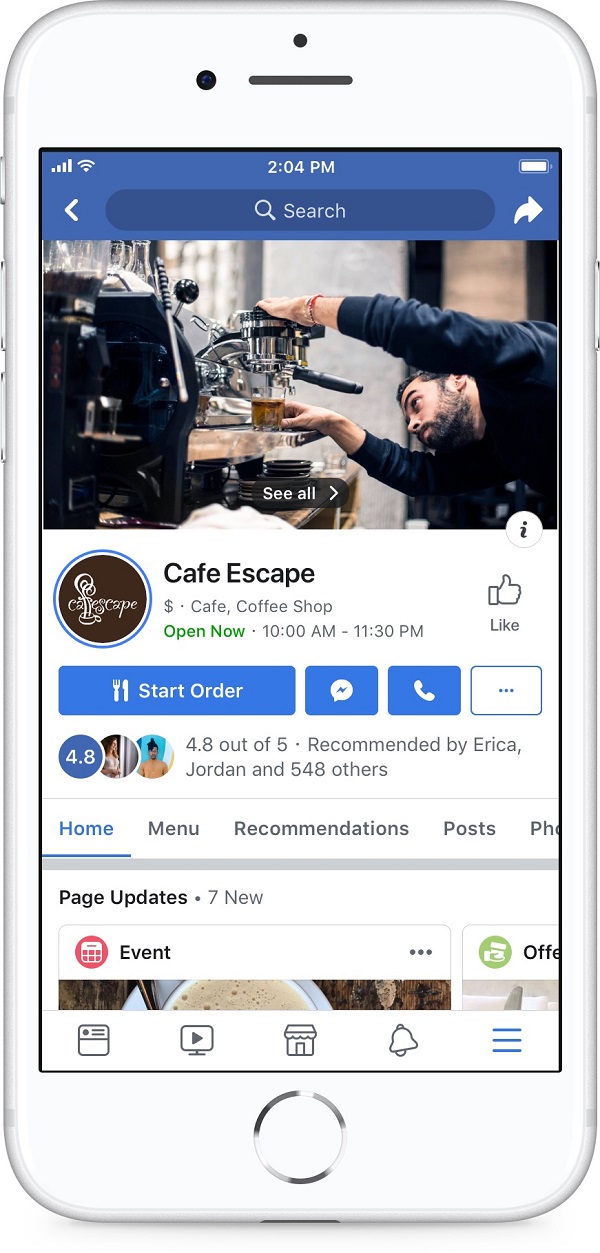

10—Facebook Boosts Local Businesses

Currently, says Alex Himel, VP of Local at Facebook, “1.6 billion people around the world are connected to a small business on Facebook. People and businesses alike have told us they want even easier ways to connect.” Now Facebook has made it even easier for consumers to connect with local businesses. Find out more.

11—Conference for Women

The FUND Conference is a connector of emerging growth stage companies, entrepreneurs, industry pros, and investors with the explicit intention of creating meaningful connections to support deal flow. As we all know, women business owners only receive 2% of VC investments. Even worse, female founders of color receive a fraction of that.

In Chicago on October 24th and 25th the FUND Conference will hold the 2nd Women Investing in Women event so women can discuss, support, and move the needle together.

13—Is Your Staff Sleep Deprived?

Sleep deprivation is serious, and something all business owners should be concerned about. Check out this list of the top 10 hazards affecting sleep deprived employees from the American Safety Council and get tips on how to implement better sleeping habits for a safer and healthier workforce. Some highlights include:

- Sleep deprivation increases the likelihood of a workplace accident by 70%

- Workers are 37% more likely to sustain an injury when working a 12-hour day

- Going 17-19 hours without sleep can drop performance levels to the equivalent of a 0.05% blood alcohol level (~3.5 beers) and cut response speeds in half

- The U.S. incurs a productivity loss of $136.4 billion each year due to sleep deprivation

14—How to Dry Out Your Phone With Rice

In these waning days of summer, there’s still a good chance your smartphone could get wet. If that happens, don’t panic. Check out this guide from ElectroSawHQ about how rice can save your phone.

15—Startup for Young Entrepreneurs

If you’re a young entrepreneur or know one, check out this handy guide from Digital.com.

16—Web Ideas & Inspiration

If you’re looking for inspiration or ideas to help you build an online business, take a look at this article, 30+ Website Ideas that can Help Build a Business from ExtendThemes.

Cool Tools

17—Text Reminders Can Increase Sales

Research shows sending text message reminders can bring a 6:1 return on investment. Text reminder service GoReminders says its users report an average increase of $27,404 per year.

GoReminders is easy to use, but also has advanced features you that scale with your business. It works for businesses switching from a paper appointment book, and yet is powerful enough to use for businesses with multiple locations, staff members and services.

18—The Rise of Digital Lockers

The back-to-school shopping season drives over $27 billion in retail sales, according to a new report from Deloitte. Busy consumers are looking for ways to make shopping as convenient as possible. This has led to the growing popularity of the Buy Online Pickup In-Store (BOPIS) option, which is now responsible for nearly 30% of online retail revenue.

Amazon has a reported 2,000+ digital lockers and it is estimated that by the end of this year, 40% of the U.S. population will have access to a Walmart pick-up locker. Package Concierge, the creator of the leading digital locker management solution, is a big part of that movement, with more than 20 million package transactions processed nationwide.

To help retailers take advantage of the trend, Package Concierge has identified five areas for retailers to focus on when it comes to BOPIS:

Convenience is king: In our world where instant gratification tops all else, today’s consumers expect a new kind of convenience when shopping, so progressive omnichannel retailers must adopt BOPIS to accommodate changing demands. A recent study shows two-thirds of shoppers say multiple fulfillment options influence their willingness to complete a purchase.

Cost cutting: BOPIS allows consumers (and retailers) to save shipping fees, while also expediting last mile fulfillment. Avoiding shipping fees was listed as the top reason customers like BOPIS, so it’s critical for retailers to offer a frictionless customer experience that also helps them save money.

Vision quest: Retailers need to ensure customers can view store-level inventory when making an item selection. Shoppers today want their merchandise ASAP, and they’ll likely only consider items that are in-stock and ready for pickup, otherwise they’ll go to another retailer to find it.

Don’t forget fulfillment: BOPIS doesn’t work if retailers don’t have a clearly stated fulfillment promise that they can consistently deliver on. Many retailers are meeting the expectation of availability within two hours for items in stock. Retailers must make their BOPIS process convenient AND quick. BOPIS falls short if consumers experience friction with fulfillment—standing in line to retrieve an order is a satisfaction killer.

Lock it up: Automated locker system provide simple and secure fulfillment to ensure a positive BOPIS experience for consumers and retailers. During the busy back-to-school season, it’s crucial retailers capitalize on the increased traffic by providing shoppers with a seamless and pleasant transaction process. Research shows nearly 80% of BOPIS shoppers will make an additional purchase while at the store, and a happy customer buys more.

With the Package Concierge system, customers purchase items online and receive a secure authentication code via email and text that confirms the purchase is ready for pick-up. Once at the store, consumers scan their code at the locker system and retrieve their items. It’s simple, and it’s seamless and takes just seconds to complete. Get more information here.

Small business stock photo by Flamingo Images/Shutterstock