24 Things Entrepreneurs Need to Know—Small Business Week Edition

By Rieva Lesonsky

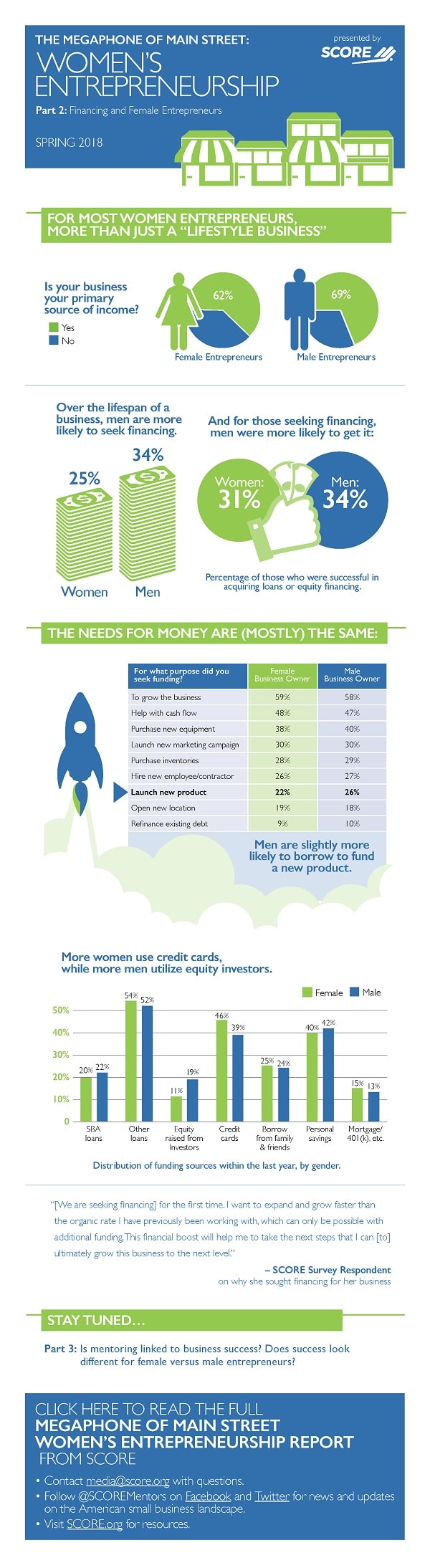

1—Women Entrepreneurs Achieve Success

SCORE, the nation’s largest network of volunteer, expert business mentors, has published original survey data on the state of U.S. women’s entrepreneurship. The data shows women-owned businesses are equally as successful as male-owned businesses across all independent measures of business success, including business starts, revenue growth, job creation and number of years in business.

Key findings include:

- Women are more likely than men to start businesses: 47% of women are in the pre-start or idea phase of business ownership following through on starting a business in the past year, compared to only 44% of men.

- Women-owned businesses reported nearly the same amounts of anticipated revenue growth in 2018: 57% of women entrepreneurs predicted an increase in revenue growth, while 15.5% predicted revenues would stay the same, and 9% predicted a decrease in revenues. In comparison, 59% of male entrepreneurs predicted an increase in revenue growth, while 15.5% predicted revenues would stay the same, and 9.5% predicted a decrease in revenues.

- Women were significantly more likely to launch service businesses: Female-led businesses were more likely to be in professional services, retail, healthcare (10% of women-owned businesses vs. 5% of men-owned businesses) and education (9% of women-owned businesses vs. 5% of men-owned businesses). Male-owned businesses were more likely to be in construction and manufacturing (12% of men-owned businesses vs. 4% of women-owned businesses).

- Both men and women-owned businesses had comparable longevity—with the exception of very established businesses: 17% of male respondents owned a business 20 years or older, compared to only 13% of female respondents.

- Women-owned businesses reported slightly lower levels of employee hiring: 27% of women-owned businesses report an increase in hiring, compared to 30% of men-owned businesses.

There’s more information in the infographic below.

2—Automation & AI Opportunities

Intuit just unveiled Small Business in the Age of AI, a research study examining the uses of cutting edge automation technology now and in the future, as well as entrepreneurs’ attitudes about this emerging tech and the opportunities it presents. The study, conducted with Emergent Research, found that overwhelmingly, small businesses are bullish on the technology and are already leveraging automation tech to manage and grow their businesses, ultimately helping to grow the global economy.

The study shows small businesses view automation technology positively, with 54% saying they view automation technology primarily as an opportunity. While fear of technological innovation is often referenced as the underlying barrier for adoption of machine learning and artificial intelligence (AI), only 5% say they see automation primarily as a threat. In fact, very few small businesses think that automation technology will lead to job losses, with 31% saying automation will allow them to grow their employee base, 59% saying there will be no difference and just 1% saying there will be significant job losses.

The study also found that of those surveyed, 66% were already using automation technologies to help them with a variety of functions, including: finance and billing (29%), marketing (28%), sales (27%), customer service (25%), operations (15%) and production (9%).

The study found small business owners see vital benefits of automation technology, namely freeing up time to get more work done (79%), helping with customer service

(77%), and boosting innovation (74%). These improvements are being driven by leading edge automation tech, including big data analytics (24%), natural language processing (17%), machine learning (12%) and artificial intelligence (11%).

Intuit customers leading with automation: Intuit customers are already leveraging automation technologies, including AI and machine learning, to automate tasks that might otherwise take valuable time and money. In fact, by incorporating automation capabilities into Intuit products, small businesses can easily make their data in QuickBooks work more effectively for them, with benefits ranging from tax savings to categorization of expenses, which can be time-consuming tasks. Through the QuickBooks product vision and the power of the QuickBooks ecosystem, Intuit is transforming how people work for themselves, intelligently anticipating critical turning points and making customers smarter and more confident in the decisions they need to make for their business. Current automation features within the QuickBooks product suite include:

- QuickBooks Auto Categorization

- QuickBooks Payments Automated invoicing

- QuickBooks Self-Employed ExpenseFinder

Small business and automation in the future: In the future, small businesses expect automation to have continued benefits. Over the next five years, respondents said that the top five reasons automation will have a positive impact include business efficiency (73%), productivity (68%), innovation (62%), responsiveness to market changes (60%) and revenue (59%).

For more information on Small Business in the Age of AI, check out SMB Group’s recent report that details how technology trends will influence small businesses.

3—Going from Employee to Employer

How do entrepreneurs go from the aspiring to the operating stage? According to a survey from Paychex:

- 59% worked full time while building their startups on the side

- Men were twice as likely than women to say funding was their greatest challenge

- About 44% of people had help from their family to fund their startup, while nearly 30% were self-funded

The biggest challenge they faced while starting? Maintaining customers or clients was cited by 25% of the small business owners, with more women (29%) than men saying this.

There’s a lot more interesting data in the report. Check it out here.

4—The Future of Work

Upwork released new data showing 58% of small businesses are embracing agile workforces due to ‘greater interest among workers for flexible work arrangements’. The data is a specific cut of results from small business respondents to Upwork’s Future Workforce Report, which explores U.S. business hiring.

“Record low unemployment is putting enormous pressure on businesses to explore new ways to find and engage talent,” said Stephane Kasriel, CEO of Upwork. “As the biggest driver of job growth in the U.S., small businesses are on the leading-edge of workforce innovation. Innovative businesses are realizing that the only sustainable way to grow is by accessing the right talent and technology. As workers seek out more flexible work arrangements, businesses are embracing a flexible workforce to fill skills gaps and scale their teams.”

Top findings include:

Small businesses are embracing flexible talent: 53% are utilizing flexible talent, including freelancers, agency and temp workers, up 16 points from 2017. They anticipate work done by flexible talent will increase by 20% in the next 10 years.

Small businesses plan to increase headcount: 67% plan to increase their worker headcount in 2018, while only 9% expect a decrease. Headcount is expected to increase by 15% in 2018.

Skills have become more specialized: 64% agree that skills have become more specialized compared to three years ago.

Hiring is a challenge: Twice as many small businesses say hiring was harder in 2017 than easier and 63% cite “access to skills” as their top hiring challenge.

Small businesses are embracing a remote workforce: 60% agree remote has become more commonplace compared with three years ago and 67% have someone on their team who works a significant portion of their time remotely, up 13 points from last year.

Remote work is here to stay: Small business were three times more likely to agree than disagree that offices will serve as occasional anchor points rather than daily travel destinations. In the next ten years, small businesses predict that 35% of their employees will work predominantly remotely.

Agile teams will become the new normal: 86% have made progress in developing a more agile, flexible talent strategy.

There’s more information in the infographic below.

5—Want Change? Write Your Congressional Representatives

Small business owners say economic growth and job creation is the number-one issue that will influence their vote in the mid-term election. And hiring qualified workers is their top business concern. This, according to the Q2 2018 Quarterly Index from National Write Your Congressman (NWYC), an organization that gives small businesses a voice in American government. The Index also shows SBOs plan to pay down debt and invest back into their businesses following the new tax law.

The NWYC Index Score, which takes into account six factors measuring small business owners’ trust, hope and satisfaction towards Congress and government, was down slightly from last quarter. The Index found small business owners’ trust in Congress decreased slightly from the previous quarter, but trust is still higher than in Q2 2017.

According to research from the Congressional Management Foundation, 84% of Congressional offices report it would take as few as 25 constituent opinions to consider taking the action requested or changing their stance.

For complete Q2 2018 Index findings, look at the infographic below.

Smart Advice

6—Tips and Tricks for SMBs

Technological innovations are changing how small businesses run. What do you need to know? Several members of the management team at SAP share their valuable insights below.

From Mario Farag, Senior Director, Analytics Marketing for General Business, SAP (@mariofarag):

“In order to be successful, ‘running the numbers’ can no longer be based on a limited set of internal knowledge that results in a report that is skimmed through by a CEO before making a decision. Instead, today’s decision makers need to be engaged with data from all areas of their business in a way that allows them to make informed decisions. This kind of value can only be achieved through the integration of business intelligence systems built around the business’ transactional systems (i.e. ERP).”

“Business Intelligence (BI) solutions are enhancing real-time, smart decision making, and have become the new go-to planning tools for today’s leading businesses. They yield real-time data insights, provide real-time strategy and risk assessments, offer transparency across businesses, streamline reporting and simplify processes across companies. The future has powerful BI tools built into, and not around, the ERP operational systems.”

From Luis Murguia, Global SVP, SAP Business One & SAP Business ByDesign, SAP:

“Business Application software is the biggest enabler of scalability for SMBs. In the early days, a few manual processes (e.g.: order entry or inventory management) could take care of business. But once an SMB grows, adding hundreds of customers, dozens of employees, and newer product lines, things become more complicated. Savvy SMB leaders adopt Business Application software before this breaking point occurs. They have a vision on how great the future will be, managing the present in a proactive way.”

“SMBs need to work with vendors that provide a full digital platform that can be implemented straight from the box. Solutions for CRM, Inventory Management, Accounts Payable, Dashboards, Predictive Analytics, and so on must be fully integrated so that an SMB with little to no IT staff can operate with the same tools that any of their bigger competitors use. Easy and scalable implementation should be one of the main deciding factors for SMBs selecting an ERP platform to start their digital transformation. Though tempting, ‘best of breed’ business applications will only slow down the SMB, distracting critical resources to build ‘in-house’ integrations; instead of driving business outcomes.”

“I always give SMBs Four Tips as they deploy ERP:

- Own it. Implementing an ERP lays the foundation to enable long-term business growth. It will act as a springboard for the next stage of business growth. The SMB owner is ultimately responsible for its success. It cannot be delegated.

- Pick your best people to drive it.ERP touches every aspect of an SMB’s business. However, many of these aspects are not something an SMB owner manages on a daily basis. Chances are that the top performers not only know every aspect of the business, but are also better prepared than anybody else to manage them.

- Work with an implementation partner with Industry expertise.Each SMB, no matter how small, has unique business requirements which may be similar to other businesses in their industry. By working with an industry specialized partner, the SMB owner will reap the benefits of the lessons learned from the people who have already implemented an ERP.

- Engage the individual employees.No matter how well the above points are embraced, nothing will happen if the line operators are skeptical or confused about the implementation. It is the sales people, the support agents, the warehouse manager, the collections agent and so on that actually get things done. Make sure that all employees across all levels are engaged in the implementation.”

7—4 Ways to Get Financial Help for Your Small Business

Guest post by Johannes Endhardt, Vice President, Strategy, Marketing & Analytics, Small Business Bank at Capital One.

Finding the financial assistance to start or grow your small business can be a headache that many entrepreneurs face. Below are four resources that small business owners can easily capitalize on to get financial help for their business.

- Apply for a small business loan:The outlook for small business is optimistic with 62% of small business owners feeling current business conditions are “good” or “excellent” and 51% feeling their financial position will improve six months from now, according to the latest Small Business Growth Index. Therefore, many business owners are looking to secure capital to either start or grow their small businesses. One of the most relevant loans for small businesses is offered through the U.S. Small Business Administration (or SBA) and includes longer payback terms and higher borrowing limits. This can be especially useful when financing necessities for small businesses like real estate and equipment. Entrepreneurs may also consider starting with a microloan, which can help you build financial history that demonstrates you’re worthy of bigger loans in the future.

- Use a business credit card and reinvest your rewards:Businesses who are purchasing at a high volume should look at their business credit card as a purchasing tool. You can capitalize on credit card rewards by setting up automated payments and using your card for payments you wouldn’t normally consider. For example, could you pay your insurance premiums with a business credit card? Most major insurers will take a card and, given insurance is usually a large expense, entrepreneurs can earn significant cash back when they pay for it with their business credit card. Additionally, as you accumulate cash back rewards, you can reinvest the earnings back into your business in the form of new equipment, employee bonuses or even save the money for a rainy day.

- Start saving from day one:When you’re first starting your business, it can be difficult to save while setting aside cash to take care of regular, everyday expenses. However, savings rates (APY) are on the rise, and keeping money in your business savings account, rather than your checking account, can help you build your nest egg. As you start building your savings, be disciplined and you’ll see that it gets easier as your business grows. Start small by setting aside even 1 or 2% of your earnings. As your savings start to grow, slowly increase that%age and focus on what you are saving for. Whether you want to hire your next employee, open a second location in a new neighborhood, or buy that new piece of equipment, having a specific goal for a portion of your business savings will give you clarity and help you focus on the goal.

- Take advantage of tax cuts:There are several provisions within the Tax Cuts and Jobs Act designed to spur small business growth and increase tax savings. While this will primarily affect 2018 returns, you should connect with a financial planner or accountant now to determine how you could benefit from the new tax reform. For example, is your business eligible for the pass-through deduction? Should you invest in new equipment to take advantage of higher deductions and bonus depreciation? Should you accelerate business debt payoff? Every business is going to have different factors to consider, which is why it’s important to discuss how these changes impact your business sooner rather than later.

8—Startup Advice

Dr. Jack Regan formed LexaGene, initially as a one-man show, with the goal of making dangerous pathogens a thing of the past. Very timely given how often we hear about new food outbreaks and flu health scares. His team is developing what will soon be the world’s first on-site, open-access pathogen detection technology that will completely transform the way that organizations all over the world prevent and diagnose diseases.

Jack has a lot of experience as an entrepreneur, and shares some startup lessons below.

- Have conviction.You need to be 100% convinced your company is providing a product or service that is needed by society. Without that level of conviction, you cannot sell the idea to others to raise money, nor will you be able to make it through the rough patches that are inevitable when building a company.

- Be patient.Recognize that Rome wasn’t built in a day, and your company won’t be either. Start small, make steady progress and grow as fast as you can—without being reckless.

- Stay optimistic.Starting a company is not a simple task—and during the hard times, it will be easy to feel disappointed, frustrated, angry and even scared that you’ve made a mistake. This is why it’s extremely important to remain optimistic and remember these low points are only temporary. You’ll soon achieve a high point. Keep going!

- Your endurance will be tested.Entrepreneurship is a lot of hard work and stress. Not only are you constantly working long days in the office, but you also generally need to put your vacations (or other personal things) on hold for long periods of time. This will be tough on you, as well as your family, so it is important to make sure everyone is on board with your journey and make the most of (and appreciate) all of the time you spend together.

- You can’t do it by yourself.You need to find very talented people to surround you, and give all of them a big enough piece of the pie to help you succeed.

9—Improve Your Customer Service & Experience

Eng Tan and Amit Sood are the CEO and CTO respectively of Simplr, a new company using AI and machine learning to offer on-demand and affordable customer service support and business intelligence for small businesses and startups. They share some tips for those who want to improve your company’s customer service and experience.

It’s important to use metrics in your customer support efforts: Metrics are a great way of letting us know how our businesses are doing. Key metrics to successful customer service include: first response time, first revolution time, escalation rate, net promotor system and customer satisfaction.

First response time deals with how quickly a customer receives a response to their question or concern, and first contact resolution factors in the total number of contacts a customer has to make in order to gain a resolution to their query. Studies have found that 46% of customers consider first contact resolution to be the highest priority. Escalation rate reflects the amount of customers who are escalating because they feel they aren’t getting the level of service they expect and net promoter system refers to the likelihood of customer recommending a business to their friends and family. Customer satisfaction provides an overall picture of how satisfied a customer really is in regards to a specific interaction with a company.

Don’t ignore social media—it’s an important channel to communicate with existing and potential customers: With over 3 billion potential customers using social media, it is an imperative that your small business strategy also includes a social media plan. The first step? Grab an available handle across the platforms that your target audiences are most connected on and get started. Keep in mind that managing social media can be a full-time job, so in order to give social media the attention it deserves, you may need to bring on a staff person dedicated to social media or find bandwidth elsewhere on the team. Choose someone who can spend the time personalizing your customer’s social media experience, optimize and engage with customers on a regular basis. Keep in mind that your customer base may change, be sure to keep up with varying trends so you don’t lose any potential customer interactions.

Turn a bad customer interaction into a good one: A negative customer interaction can seem daunting and feel nerve-wracking, as customers have more ways than ever to communicate their frustration with companies online. So how do you respond? First, prioritize the reviews coming from the customers that value your brand first. You don’t need to respond to every bad review unless it is constructive feedback on how you can better your business. Be sure to empathize with disappointed customers as it could change their negative outlook on your business, and always resolve matters quickly and take ownership of your solutions. Choosing a customer support team that understands your customers and can provide empathy while also saving you money is also crucial. Lastly, be sure to tackle the root cause as to make your customer service stronger for the future.

Surveys & Studies

10—Small Business Optimism

U.S. entrepreneurs feel increasingly optimistic about the future, as their confidence in the economy, revenue and long-term growth has reached the highest level since 2015, according to the spring 2018 Bank of America Business Advantage Small Business Owner Report.

The semiannual report finds 54% of entrepreneurs are confident the national economy will continue to climb in 2018, up 2%age points from last year and 25 from two years ago. Similarly, 56% are confident their local economy will improve in 2018 (compared to 50% in spring 2017 and 38% in spring 2016).

This renewed confidence in the economy has translated into an improved business outlook on revenue and long-term growth—60% believe their revenues will increase in 2018 (compared to 48% in spring 2017 and 51% in spring 2016), while 60% plan to grow their business over the next five years (compared to 56% in spring 2017 and 55% in spring 2016). meanwhile, hiring plans have improved since last year, returning to the same level as two years ago (22% in spring 2018 and spring 2016, 18% in 2017).

“Small business owner optimism about the economy and their business outlook has reached the highest levels we’ve seen since 2015,” says Sharon Miller, head of small business, Bank of America. “Many entrepreneurs believe changes to the tax policy and emerging technologies will work to their advantage, and they are seizing the opportunity to invest in their business.”

Tax reform seen as a game-changer, concern over interest rates and commodities pricing on the rise: According to the report, one of the greatest opportunities for small business owners in the near term may be the new tax changes—58% cite the policy as a game-changer for small businesses overall, while 63% say it’s made them more optimistic about their own business’ outlook.

Despite the optimism surrounding the new tax policy, there are several challenges anticipated for the year ahead. For the fifth year in a row, health care costs remain a top economic concern of small business owners (75%). The report also found a variety of mounting economic concerns for 2018, including:

- Interest rates (51%, up 14%age points year over year).

- Commodities pricing (50%, up 14%age points year over year).

- Strength of U.S. dollar (45%, up 9%age points year over year).

- S. and global stock market (43%, up 9%age points year over year).

All-digital payments predicted within the next five years, while smartphone use continues to expand: In exploring entrepreneurs’ adoption of certain technologies, the report found digital payments to be one of the most significant innovations disrupting the small business marketplace—52% of small businesses predict all business payments will be digital within the next five years.

The report also found that mobile use is nearly universal among small business owners, with the overwhelming majority (89%) using smartphones and other mobile devices to manage their business, including:

- Basic tasks (79%)

- Digital banking (41%)

- Social media updates (38%)

- Digital payments (29%)

- Hiring (10%)

Only 59% of entrepreneurs report having a website; 60% of those who have a website say its primary function is to share basic information, while 31% primarily use it to drive sales.

Although there are some risks with the increasing role of new technologies in business, small business owners believe the positives far outweigh the negatives, with 77% believing their future success is dependent on technology as opposed to being threatened by it (23%). In addition, 77% make annual investments in technology, and 34% do so at least once per quarter.

Emerging technologies set to transform the small business landscape, blockchain remains a big question mark: With an eye toward the future, small business owners continue to invest in emerging technologies at a rapid pace—44% report they currently use or are exploring advanced technologies for their business, specifically:

- The Internet of things (24%)

- Data analytics (15%)

- 3-D printing (11%)

- Artificial intelligence (7%)

- Virtual reality (7%)

There is still a lot to learn, they say, about blockchain—65% report they aren’t familiar with distributed ledger technology, and only 13% believe it will be relevant to their business in the near future.

There’s lots more in the inforgraphic below.

11—The American Dream Lives On

According to a recent The UPS Store Inside Small Business Survey, the American dream of opening a small business is still very much alive and well.

Dream big: 66% of those surveyed say they’ve dreamed of opening a small business.

My own boss: 35% say being their own boss was the number-one motivator in opening a small business in 2018, followed by a strong belief in the power of their own product (17%).

Finances and failure: Americans’ top fears in opening a small business are concern regarding their financial security (45%), a fear regarding the financial commitment required to open the business (39%) and the fear of failure (37%).

Food, please: 25% of aspiring small business owners would want to start a restaurant, while the next most popular industries are clothing and fashion (16%) or consumer goods and products (16%).

Tech forward: When thinking of what industries an emerging small business would see the most success in, survey respondents placed technology first (35%), followed by restaurants (22%) and professional services (19%).

The survey also looked at generational and gender optimism, and found:

- Millennials, more than any other generation, say the food industry is where they’d most like to open a small business (30%), followed by clothing (23%) and design/art (20%).

- When comparing men to women and asking how they’d open a small business, men were much more likely to open a brick-and-mortar location than women (34% vs 28%).

- People living in the Northeast were far more optimistic about opening a small business in the next 12 months (52%) compared to other regions. Midwesterners were the least optimistic, with nearly one in three saying they were somewhat or very pessimistic about opening a small business. On the whole, men were more optimistic about opening a small business than women (47% vs 42%).

Check out the infographic below for more information.

12—Consumers and Small Business

The 2018 Cox Business Consumer Pulse on Small Businesses is out from Coxand is chock full of interesting data. It reveals:

Social consciousness is infiltrating consumers’ small business shopping and dining habits.

- 71% of survey respondents would spend more money at a small business if it supported a positive social or environmental cause.

- 68% of consumers think SBOs should openly promote the causes they support, but 59% would stop supporting a small business if the causes they supported weren’t in line with the consumer’s social and/or environmental views.

- More than 70% of consumers say it’s important to them that the small businesses they frequent practice diverse and inclusive hiring.

- 32% says it’s “significantly meaningful” to support women-owned businesses

Consumers love their local businesses, according to the report.

- 83% believe the federal government doesn’t do enough to promote small business growth

- 65% feel the same way about their local government agencies

- 91% of consumers say they visit a local small business at least once a week; 46% shop small two to four times a week and nearly 20% visit a small business more than four times a week.

Consumers back small businesses in their communities because:

- Convenience—61%

- Better customer service than a large business—48%

- Familiarity—41%

- Loyalty—36%

- Greater level of trust than a large business—31%

13—Does Your Business Have a Gender Pay Gap?

Zenefits recently released its SMB Fair Pay study. Check out the results.

The gender pay gap is wider in SMB than other sectors of business—34%

- Women make $0.66 for every dollar for a man. (That’s 14% more than the generally accepted metric in the U.S. of women getting $.80 to the dollar.)

- Women with advanced degrees and <5 years of experience make 56% less than their male counterparts.

- As a woman’s career progresses, the gap tightens but doesn’t disappear. Women in or above director-level positions make 14% less than male counterparts.

- The gap narrows at 20-25 years of industry experience, with women earning the same as men.

92% of employers say they pay employees fairly, yet methods for assuring fairness are inconsistent and even illegal.

- A big contributor to the wage gap is how employers determine salaries.

- The good news: 20-25% use third-party pay data based on role and region.

- The bad news: 33% ask candidates for most recent pay.

- Note: That practice is now illegal in a growing number of states because it penalizes those already behind the pay curve. Even in states where it is illegal (CA and DE, also NYC), 67% of employers reported asking.

- While 79% of employers indicate they take steps to support pay equity, 49% of employees disagree.

- In fact, the better that employers report they are doing, the larger the gap. For example, 91% of employers in the Midwest say they pay fairly, but that’s the region with the widest pay gap for women (43%).

Men and women are equally likely to receive a higher salary when they negotiate, yet only 28% of females report are comfortable doing so.

- Regardless of gender, employees who negotiate earn 43% more than those who don’t.

- The majority of employees (78% of men and 67% of women), discuss salary expectations during the interview process. Yet when an offer is made, 55% of men vs. only 36% of women negotiate.

- The gap widens when it comes to asking for a raise, 62% of men vs. 41% of women feel comfortable asking. Also, twice as many men counter raises they are offered vs. women (17% vs. 8%).

14—Perspectives of Entrepreneurs

There’s a lot of information covered in the 2018 Business Owner Perspectivesreport from Mass Mutual.

For instance, here are the top reasons women entrepreneurs decide to start a business:

- Be their own boss—32%

- Have an independent lifestyle—29%

- To be successful—28%

Also, the report found that women business owners are not prepared for retirement:

- Nearly one-third haven’t given much thought to retirement

- Women business owners will primarily rely on personal savings and retirement accounts once they stop working

- They are more likely to pass their business on to a family member

In general, the study reveals business owners worry the most about their abilities to maintain, grow, and protect their businesses in order to keep their promises, now and in the future. Their top concerns:

- What is my business worth?

- How can I be sure my business will withstand a shock like the death or disability of an owner or key employee?

- How can I keep my employees loyal and productive?

- How can I ensure a fair distribution of my business and assets when I’m gone?

There’s so much more information in the report. You can download it here.

15—Marketing, Strategic Planning & More

A new survey from Constant Contact, an Endurance International Group company, sheds light on how small business owners approach and prioritize operations, marketing, strategic planning and more.

The survey found that small business owners wear many hats and almost all (95%) do some form of marketing for themselves. However, when it comes to marketing and promoting their businesses, most entrepreneurs and small business owners are self-taught (64%) but still don’t consider themselves very marketing savvy, making the vendors and tools they select to support them even more important. In fact, less than half (46%) consider themselves “marketing savvy” and only 9% say they are “extremely marketing savvy.”

But, says Jonathan Kateman, general manager of Constant Contact, “Marketing is key to the success of a small business, but the reality is that most small businesses and entrepreneurs aren’t marketing experts and have limited time and resources available to support marketing activities.”

16—Small Business Perspectives

CNBC and SurveyMonkey recently released the results of their quarterly CNBC/SurveyMonkey Small Business Survey.

Key findings from the Q2 CNBC/SurveyMonkey Small Business Survey include:

- 53%% of small business owners surveyed say overall business conditions are good, up from 47% in the first quarter of 2018 and 38% in the second quarter of 2017.

- 28% expected changes in trade policy to have a negative effect on their businesses, up from 17% in the first quarter of 2018.

- Recent troubles at Facebook, including public outcry over its use of personal data and the threat of government regulation, have not significantly impacted small business owners’ use of the platform

- 25% say they have advertised on Facebook in the past few months. Among this group, 45% plan to keep spending about the same amount on Facebook advertising in the coming months, while 28% plan to spend more and 25% plan to spend less

- Among those who have advertised on Facebook recently, 44% believe social media regulation would “make no difference” in their ads’ effectiveness, while 34% believe it would make their ads less effective and 19% believe it would make their ads more effective.

- Overall, 44% say Amazon is bad for small businesses in general, and 11% say they directly compete with Amazon for customers

- 5% of small business owner respondents have an Amazon storefront

- Only 43% of those who use Amazon Storefront say Amazon helps drive customers to their businesses and 37% of those with an Amazon Storefront say Amazon is bad for small businesses.

- 5% of small business owner respondents have an Amazon storefront

- 25% say they have advertised on Facebook in the past few months. Among this group, 45% plan to keep spending about the same amount on Facebook advertising in the coming months, while 28% plan to spend more and 25% plan to spend less

For more information on the survey including the full results and methodology and in-depth articles, go here.

17—Small Business Forecast

The 4th annual First Citizens Bank Small Business Forecast reveals that most small business owners are positive about 2018 but are less certain about the long-term economy. Overall, 75% of respondents believe their businesses will grow or expand in 2018, with the strongest confidence among millennial small business owners (80%). Meanwhile, 60% are optimistic about the U.S. economy in the next two to three years, but the%age is 8% lower than in 2017. Millennials had the most significant decrease in their economic views, down by 21% from last year.

Other key findings from the study:

The sentiment around the recent tax reform leans positive: 55% of the total respondents expect their own businesses to benefit from the 2018 tax reform and believe small business owners in general will benefit from it.

While 2017 was a good year, 2018 is a good one too: 60% plan to grow their businesses in the next 5-12 months, and 62% are confident about the overall U.S. economic conditions in 2018. Finding different avenues for reaching new leads/prospects is the top sales initiative for 2018, followed by growing the sales pipeline and improving closing rates. Meanwhile, 76% considered their businesses successful in the previous year, including 28% who said it was very successful. This%age is 3% higher compared to the results in 2017.

Social media is still a top tool for small businesses: Social media (54%) and word of mouth (48%) are the most popular resources for learning about small business trends among all respondents. Consistent with the results in 2017, conferences remain one of the top resources for millennial owners to learn about small business trends.

Talent acquisition is a concern: A lack of qualified candidates (25%), fierce competition for talent (24%), and costs for onboarding new hires (21%) are considered the top three talent challenges in 2018.

Millennials are more likely to seek funding: 28% plan to secure funding to expand their business in the next 6-12 months. A larger%age of millennial small business owners (41%) indicate they plan to secure funding.

My state is great for business!: 63% believe the state where their business is located is a great place to start a small business. Among the markets surveyed, Florida had the highest%age of respondents who considered the state to be a great place to start a small business (69%). While millennials had the highest%age of those who think the state where their business is located is a great place to start a small business (65%), the%age is 13% lower than in 2017.

The First Citizens Bank Small Business Forecast is conducted annually in California, Florida, South Carolina and North Carolina to assess the motivations, sentiment and success of U.S. small business owners. There’s more information here.

Cool Tools

18—Dell Computers at a Discount

During Small Business Month, Dell is offering top deals, including up to 40% off select business-ready PC and a free Western Digital hard drive with select PC purchases. The deals are available all month, until 8 am ET on May 30 (or until the supply lasts).

You can find great deals like the ones below:

- Dell Vostro Small Desktop – $399(Save $285)

- Dell Vostro Desktop – $539(Save $360.99)

- Dell Vostro 15 3000 Laptop – $539(Save $359.57)

- Dell OptiPlex 3050 Small Form Factor Desktop with Free Hard Drive – $621.99 after SAVE35 coupon(Save $333.72)

- Dell Precision Tower 3000 Series (3620) – $679(Save $465.99)

- Dell Latitude 3590 Laptop with Free Hard Drive – $704.79 after SAVE35 coupon(Save $449.49)

- Dell Vostro 15 5000 Laptop – $789(Save $538.14)

- Dell Precision 7520 Laptop – $1,499(Save $1,011)

Plus:

- Dell Latitude 5590 Laptop – $1,079(Save $719.57)—Available now until May 13, 8 am ET

- Dell OptiPlex 3050 Micro Desktop – $609(Save $403.86)—Available May 21, 8 am ET until May 30, 8 am ET

19—Trade in Your Apples

Apple’s Trade-in for Business program helps companies receive maximum value for their employees’ current devices by allowing for simple bulk trade-in of smartphones and computers. Apple guarantees 100% data erasure to ensure that no business-related information leaves the company.

This program means businesses can now give their employees the latest technology at a reduced cost by leveraging the value of previous devices.

Trading in devices is simple:

- Requesting a quote consists of submitting a list of devices

- Within a day, you will receive a quote and either accept or decline

- Trade-In for Business then sends the supplies needed to send in the devices (3-5 business days)

- Once sent and received, a payment will be made via eCheck (5-7 business days)

Devices that are eligible for trade-in include:

Macs, PCs, and Displays (2009-2016)

- MacBook

- MacBook Air

- MacBook pro

- iMac

- Mac Mini

- Mac Pro

- Thunderbolt Display

- LG Display

- HP Spectre

- Lenovo Yoga

- & more

Smartphones and Tablets (2011-2017)

- iPads (Pro, Air, Mini, iPad 2)

- iPhone 5-7 Plus

- Non-Apple Tablets and Smartphones

- & more

Apple Trade-In for Business offers free shipping. You can decline any trade value that doesn’t match the original quote you receive. Check you eligibility here.

20—Keeping Track of Data

Check out the Adobe Document Cloud, which uses machine learning to keep everything at the tip of your fingers by:

- Keeping track of business documents all on mobile and desktop devices;

- Editing PDFs and moving around scans throughModify Scan;

- Removing additional technology expenses, like a flatbed scanner, withAdobe Scan;

- Easily sharing and signing business documents withAdobe Sign.

These tools work seamlessly in the background, while you can focus on what’s important—your business.

Best Cities & States

21—Best States for Small Business Lending

Lendio, a leading marketplace for small business loans, recently released its 3rd annual list of top 10 states for small business lending, based on lending data from the Lendio platform, which matches businesses with more than 75 lenders

Key findings:

- Utah and California tied at No. 1.

- In each of the top states, demand for loans increased year-over-year.

- The states with the biggest% increase in demand for loans year-over-year were Texas (119%), Illinois (101%), Florida (95%) and Utah (81%).

- In eight of the top states, the average loan size per borrower increased by 60% or more year-over-year.

- The states with the largest% increase in average loan size year-over-year were Massachusetts (147%), New Jersey (121%), Colorado (100%) and California (91%).

- Utah, California, Washington, Texas and Florida remain stronghold states, ranking on the list three years running.

- New Jersey, Massachusetts and Illinois ranked among the top 10 states for small business lending for the first time.

According to a Federal Reserve Bank of Cleveland report, nearly half of small businesses need additional funding each year; however, since 2008, it’s been a challenge for small business owners to access financial capital. Continued growth and innovation in online lending platforms is transforming the funding landscape.

“Lack of financing makes it hard for small business owners to focus on the big picture,” says Brock Blake, CEO and founder of Lendio. “This list showcases how online lending technology is giving entrepreneurs the freedom to create, innovate and succeed.”

Take a look at the infographic for more information.

22—Best Global Cities for Women Entrepreneurs

Using Dell’s Women Entrepreneur Cities Index, Ecard Shack mapped the global cities with the ability to attract and support high potential women entrepreneurs. The index evaluated cities on their capacity to foster the growth of women-led businesses based on the access they offer to capital, technology, talent, culture and markets.

Some highlights:

- New York City, the Bay Area, and London dominate the top three spots.

- London ranked 3rd for its markets and the capital it offers, and 2nd for its technology, which tied with Austin.

- In the top 10 cities, six are in the U.S., two are in Europe, one is in Canada and one is in Asia.

- Singapore (#8) is the only Asian city that made it to the Top 10.

Check out the interactive infographic by clicking here.

23—Best Cities from WalletHub

WalletHub reports:

Small Cities

The 5 best small cities for startup are:

- Holland, MI

- George, UT

- Aberdeen, SD

- Wilson, NC

- Cheyenne, WY

The 5 top large cities for startup:

- Oklahoma City, OK

- Austin, TX

- Sioux Falls, SD

- Missoula, MT

- Durham, NC

Their top 5 cities for Hispanic entrepreneurs are:

- Laredo, TX

- South Burlington, VT

- Charleston, WV

- Corpus Christi, TX

- Oklahoma City, OK

24—More Best & Worst Cities for Startup

RewardExpert has a different view of the best and worst cities for starting a small business. Their top 3 startup cities are:

- Denver-Aurora-Lakewood, CO: One of the fastest-growing metropolitan areas, with its population projected to grow 1.65% per year, Denver is an attractive location for individuals and businesses alike. Colorado has attracted substantial venture capital investment, with 128 deals worth a total of $670,000,000 made between 2010 and 2016.

- Boston-Cambridge-Newton, Massachusetts: The Boston metro area ranks in the 87th%ile for startup growth and number of startup companies (only 1.7% of all businesses are startups).

- Bridgeport-Stamford-Norwalk, Connecticut: Adjacent to the New York City metropolitan area, this coastal Connecticut strip is a smart choice for businesses that require space to grow. While home values are higher here than anywhere else, office space and housing remains inexpensive for those willing to live and/or work in the city of Bridgeport.

The bottom three places for starting a small business are:

- Charleston-North Charleston, South Carolina: The Charleston, SC metropolitan area comes in as the number-one least-favorable place to start a small business for a number of reasons. The area business ownership rate is below average, in the 8th%ile, with a very low%age of startups (0.89%), and a below average five-year survival rate of 48.32%.

- Florida Panhandle Region (Tallahassee-Pensacola, Florida): The Florida Panhandle region, including both the Tallahassee and Pensacola metropolitan regions, is the second least-favorable location for small businesses — and the absolute least favorable one for startups, which make up only 0.86% of all businesses. Population growth is sluggish, at a 0.875% annual growth rate. Furthermore, median household incomes and net worths are well below average, ranking in the bottom third nationally.

- Inland Empire and Bakersfield, California (Bakersfield-Riverside-San Bernardino-Ontario, California): Outside of the Bay Area and the Los Angeles-San Diego corridor, CA presents a rather inhospitable climate for small businesses and startups alike. Of the three regions that rank third through fifth least propitious, Bakersfield and the Inland Empire region takes the cake. Small business density is below average, and those startups that launch here fail more frequently than average, with a five-year survival rate of only 47.25%.