By Jaykishan Panchal

Unless you’ve had your head buried in the sand, you likely heard President Trump’s statement that the United States was poised to hit Mexico with a five percent tariff on all goods this summer. Although the tariff was set to be imposed in June, it has since been “dropped” after the president reached an immigration enforcement deal. Still, many news outlets have reported that the tariff is “indefinitely suspended,” not completely voided.

Despite the fact that we are not currently facing a tariff on Mexican goods, these recent events have begged the question, “what if?” What would life be like if there was suddenly a five percent tariff on all goods imported from Mexico? How would businesses and consumers prepare, then adjust?

Many companies and experts have revealed just how impactful this tariff would be on business, consumer life, and general trade with our neighbor country down south. Let’s take a look at what life would be like under this new tariff, if it were to ever be enacted.

Certain Consumer Goods Would Become More Expensive

Let’s preface this section by saying that many news sources claim the five percent tariff would mostly be absorbed by retailers and manufacturers (in theory). However, if it were to increase by five percent each month until it reached 25 percent, as President Trump claimed, consumers would face a much more significant impact.

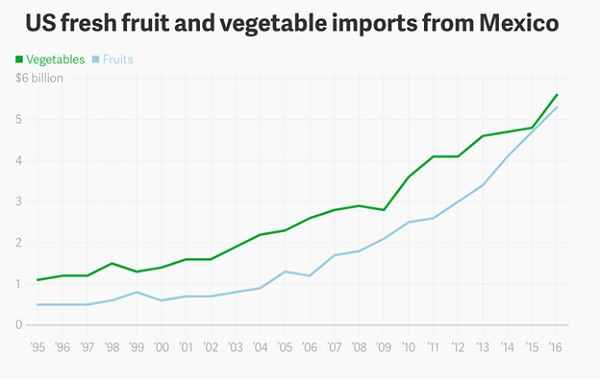

In 2017, Mexico sold U.S. grocers $26.2 billion worth of food, much of which was fruit and vegetables. If you’ve eaten a strawberry recently, there’s a 95 percent chance that it came from Mexico, according to USA Today. All of the warm weather fruits we enjoy, from cucumbers and squash to watermelons and bell peppers, often come from Mexico.

Grocery stores and supermarket chains could attempt to buy from other countries, but transporting perishable produce can be difficult, and the businesses would likely pay higher prices to preserve the imports. Experts such as Lance Jungmeyer, the president of the Fresh Produce Association of the Americas, believe that American grocery store produce aisles would soon start to look relatively scarce under a heavy Mexican tariff.

Image Source: The Atlas

Many people immediately asked, “But what about avocados? Limes? Tequila?” Consumers worried their favorite Mexican imports would vanish, and although that’s not true, there would certainly be a readjustment of pricing to accommodate the tariff. What some consumers don’t understand is that the effect of the tariff would reach far past the grocery store aisles.

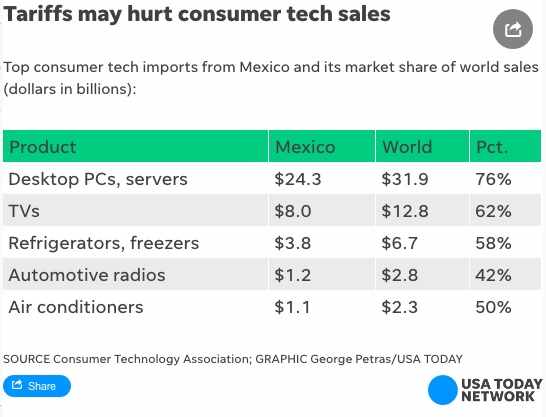

When it comes to electronic products, the water gets a bit murky. It’s unclear to many whether the tariff would apply just to products made in Mexico or products that were assembled elsewhere, then shipped from Mexico. It’s a fine line, but it makes a big difference to technology and appliance companies.

Desktop computers, televisions, and home appliances are often imported from Mexico. Some have predicted that, if the tariff had gone into place over the summer, big events like “Amazon Prime Day” or back-to-school electronic deals might have been canceled. Businesses would need to curb their losses by offering fewer discounts and increasing their prices.

In reality, the companies that would be hit the hardest would most likely be small, local businesses. About 40 percent of the 15,000 U.S. companies that import Mexican goods have less than 50 employees, according to the U.S. Chamber of Commerce. These small businesses would essentially pay an extra tax on all food, electronics, and other products they receive from Mexico.

At a five percent tariff, the Chamber of Commerce estimates that this could cost small businesses as much as $836 million. Although it’s unclear how small businesses would react to this change, it’s safe to say that they would need to limit their inventory and increase prices somewhat to compensate. The impact of the tariff would certainly be felt in communities around the country.

What This Means for Taxes

According to the Tax Foundation model, a tariff like the one proposed by President Trump could reduce long-run GDP by as much as 0.2 percent, or $50.3 million. Additionally, other countries have stated that they intend to impose tariffs on the U.S. in recent months, and if those were imposed, it’s likely that the GDP would fall another 0.09 percent, or $21.53 million.

In general, it’s safe to say that expert economists believe the barrier on trade would reduce economic output and income. Wages and employment could fall, and the burden of the taxes would fall predominantly on the consumer.

Cars Could Increase in Price

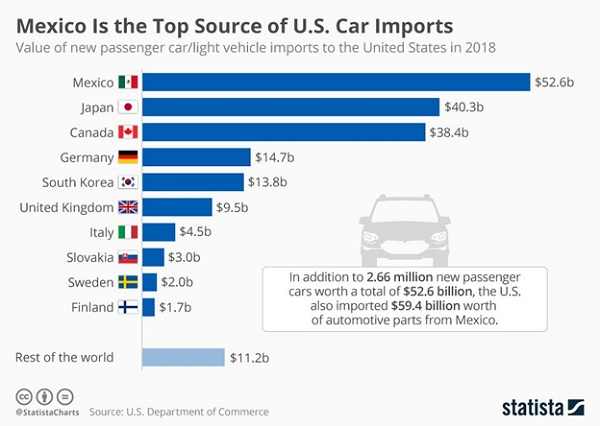

Joseph Hinrichs, president of Ford Automotive, came out and said that a tariff on Mexican auto imports would “have a significant impact on the industry, ourselves included.” As one of the top imports from Mexico, auto parts and vehicles would certainly face changes. The auto-trade with Mexico totaled $93 billion last year, which only supports Hinrichs’ claim that a Mexican-goods tariff would have a big impact on auto manufacturers.

Image Source: Statista

The tariff might not be imposed now, but many U.S. automakers have been forced to think about what they would do if it were to take place. Mexico is the top source of American car imports, almost $13 billion above the next supplier (Japan).

As a result, it’s predicted that U.S. auto production could drop by as much as 3 million cars a year. In an article with CNN, Emmanuel Rosner (an auto analyst at Deutsche Bank) stated that it could drop as much as 18 percent from its current levels.

Brands that currently build parts of their vehicles in Mexico and then export them to the United States include:

- Audi

- Volkswagen

- Toyota

- Nissan

- Ram

- Mercedes-Benz

- Mazda

- Lincoln

- Jeep

- Kia

- Chevrolet

- BMW

The threat of a tariff, as well as the many other shifting trade policies, have kept U.S. trading partners and automakers on their toes. It’s difficult to plan inventory, corporate strategies, and supply chains when these efforts could vary dramatically in price.

Auto manufacturers aren’t the only ones who would feel the repercussions of a tariff on Mexican auto products. Rosner also stated that “We believe the tariffs on vehicles would undoubtedly be passed on to customers.” He estimated that the average price of vehicles sold in the U.S. would increase by about $1,300 if the tariff were to reach 25 percent, which was an original possibility.

However, there are some analysts who believe that tough competition and the current demand for vehicles would actually force manufacturers to consume most of the added expenses. Although consumers would face less of a price hike in vehicles, there would likely be more cost-cutting by auto sector manufacturers.

It’s also possible that we could see a jump in the number of families who rent vehicles, rather than purchase. If the price of a new vehicle were to climb by hundreds (or thousands) of dollars, it’s likely that many auto dealerships would turn to flexible leasing software and more diverse rental agreements to evolve their business model.

What This Means for Taxes

Unless Mexican auto manufacturers were to absorb the tariff in their own costs, the impact of the tariff would likely be felt by retailers, consumers, and importers throughout America. If the tariff were to ever reach 25 percent, the tax would be $86.5 billion annually, the impact would fall most heavily on goods like cars.

Stock Market Unpredictability

When President Trump first announced the five percent tariff, he did so in a brief Tweet. “Given that companies have but a single Tweet to go off, making projections is an exercise in futility given the lack of specific detail,” Canaccord’s Jason Mills stated to CNBC.

If anyone felt they were scrambling to understand the potential impact of the tariff, it was stock market analysts. What would happen to the stock market if the tariff were to go into effect? Which brands and sectors would be hit the hardest?

Most experts seem to agree that retail would be one area that couldn’t avoid the impact. Automakers would be another, but determining how far the influence of the tariff would reach is difficult when details of the tariff and its exemptions/inclusions are unavailable.

When the tariff was still a looming threat, analysts predicted that stocks such as Skyworks Solutions, Constellation Brands, and General Motors would all take a hit. Goldman Sachs even went as far as to say that all investors should “prepare for the worst” if the tariff were to go into effect.

When President Trump stated that the tariff could rise to 25 percent eventually on a Thursday, by the next day, the Dow had plunged 355 points (1.4 percent). The S&P 500 and Nasdaq fell, as well. Investors were agonizing over what the tariff threats could mean, and as a result, the stock market was in turmoil.

Image Source: CNBC

The threat of the tariff has passed for now, but how will investors predict what is to come if another tariff is instated in Mexico?

According to Cliff Hodge, the director of investments at Cornerstone Wealth Group, the United States could be looking at an “earnings recession that could flow through to an economic recession” in the event of an increased tariff. Investors will need to keep their ears to the ground and evaluate what future tariffs, if they come to be, could mean for the economy and their clients.

What This Means for Taxes

If anyone has benefited from the $1.5 trillion in tax cuts imposed by President Trump, those effects would quickly be negated by the effects of the Mexican tariff. Many have admired President Trump’s positive impact on the economy, but if the tariff were to go into effect, would he be able to be re-elected while the economy suffered?

In Conclusion

Currently, consumers and businesses are free from the threat of a tariff on Mexico. However, the sudden, worrisome of its introduction in the first place has left many reeling. Now, we see how directly a Mexican tariff could impact consumer costs and businesses throughout America.

At the end of the day, everyone wants to know how the threat of a tariff could directly impact their own business. Although it’s difficult to say for sure, it’s clear that many in the food industry, electronic productions, auto manufacturing, and investing would face monumental changes.

Jaykishan Panchal is an SEO & Content Marketing Manager at E2M Solutions Inc. Implementing cutting edge SEO strategies to help businesses strengthen their online presence is his forte. Apart from helping small and big businesses, he loves to jot down valuable resources for Entrepreneurs, Start Ups, Technology Geeks with his knowledge and expertise of 9 years in the industry.

Tariff stock photo by gguy/Shutterstock