8 Things Entrepreneurs Need to Know

By Rieva Lesonsky

1) We Feel Good!

The newest Spark Business Barometer from Capital One shows small business owners feel good about financial conditions and their local and national economies. As a result they plan to increase investments in business processes, technology, employee compensation and other areas.

This isn’t a wishy-washy report in any sense. Half the business owners say their current business conditions are either “excellent” or “good”, 63 percent are optimistic about their local economies and 40 percent have already experienced increased sales in the last six months.

The Spark Business Barometer also reports:

As the economy improves, what do business owner plan to do with their money?

- 57 percent of business owners will increase investment in improving business processes and technology

- 55 percent will set aside funds for unexpected emergencies

- 55 percent will save for retirement

- 46 percent plan to give their staff raises

- 35 percent plan to put cash aside for capital investments

Women and Millennial-owned businesses continue to drive optimism.

- 73 percent of Millennial and 56 percent of women-led businesses say current business conditions are good, compared to 46 percent of males

- 42 percent of women say “much better” or “somewhat better” than last year, compared to 31 percent of males.

- 57 percent of Millennials say their businesses are doing better than last year—more than any other generation

How do they measure success? The most popular measures are:

- Customer satisfaction (94 percent)

- Revenues (77 percent)

- Profits (76 percent)

Work/Life Balance

While 69 percent of women define success by “achieving work/life balance”, only 58 percent of men think that way. To achieve the “mythical” balance:

- 43 percent of business owners take vacations

- 33 percent set specific times for arriving and departing the office

- 27 percent limit the amount of work they bring home

Ecommerce: What are you waiting for?

We all know ecommerce is on the raise, but the Barometer indicates small businesses have yet to embrace this sales channel. A mere 25 percent of small business owners report having websites with e-commerce functionality. And of those with ecommerce functionality, 58 percent earn less than 10 percent of their sales from online purchases.

2) On the Road Again

Writing off domestic business travel expenses is not that complicated, but it can get a little tricky when you combine business and personal activities during your business trip. The folks at Deductr, an app that tracks expenses, mileage and time, say, “as a general rule, you can deduct travel expenses incurred when you are away from home while pursuing your business objectives. ‘Travel status’ occurs when your travel circumstances require you to sleep or rest while away from home (generally considered an overnight stay where additional costs for that stay are incurred).”

Here are 7 domestic business travel expense tips from Deductr:

- Calculating travel-related expenses begins by classifying each day away from home as a “workday” or a “personal day.” A workday is one in which you work more than four hours (including travel time or a combination of work and travel).

- If you have at least one workday, you can deduct your food, lodging and incidental costs associated with that workday. (This is for you only. You must exclude the extra costs incurred for family members).

- If you have more workdays than personal days, you can deduct all your costs of transportation to and from the business activity. That includes travel by car, plane, train or boat (except luxury boats).

- All food and entertainment costs are subject to the 50 percent deductible rule.

- Always exclude costs associated with non-employee spouse and/or other family members. You can only deduct the amounts that you would have incurred if you were traveling alone. (If a hotel room is the same for single or double occupancy, you can deduct the entire cost even if your spouse was with you.)

- If you had planned to work more than four hours on a given day but circumstances beyond your control kept you from your business activity, you can still count it as a business day. (Documentation of such circumstances is key to being able to support the deduction).

- Weekend days can count as business days if you must conduct your business the day before and the day after the weekend (including holidays) and it is impractical to incur the costs of returning home and then returning back again to conduct business. (The reasons for the split work days with a weekend in between must be reasonable, documented and within the normal and ordinary course of business.)

We all know how easy it is to neglect tracking and recording business travel and expenses we get back home, but this can lead to lost or forgotten receipts and inaccurate mileage estimates. It’s smarter to track those expenses and miles automatically and on-the-go. The Deductr app helps you document your expenses, so you can make the proper tax deductions. Deductr also allows you to track time spent on your business so you can more easily document your travel workdays.

Consult your tax advisor to make sure your particular circumstances apply. Deductr says there are special rules for foreign travel and luxury boat travel that were not covered in this article.

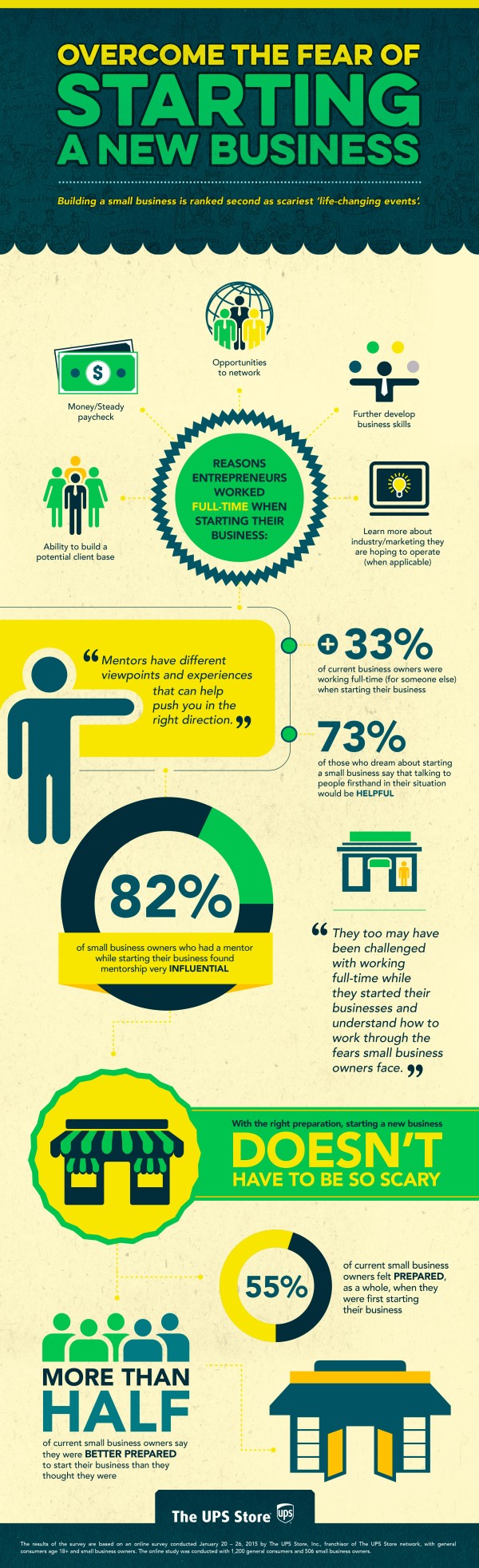

3) Are You Too Scared to Start?

Sure, starting a small business can be intimidating. But I was surprised to see that, according to a survey just released by The UPS Store, starting a small business comes in second, just behind concerns about retirement savings, for the “scariest life-changing event.” This ranks business startup as scarier than getting a divorce, becoming a first-time parent or moving to a new city.

But, having a mentor can make startup a lot less stressful.

- 82 percent of small business owners who worked with a mentor during startup say the experience helped get them through the process.

- About one-third of those who didn’t have a mentor wish they had.

- 73 percent of aspiring business owners say seeking firsthand advice from others in their situation would be helpful.

If you’re wary of getting started, the UPS Store has teamed up with my friends at SCORE to help make your startup dreams a reality.

- Check out the new guide, 16 Steps to Starting a Business While Working Full-Time, on TheUPSStore.com/SCORE.

- Attend the free webinar based on the guide: March 26 at 1 pm ET on SCORE.org.

- Join the Tweetchat on April 23 at 6 pm ET. The UPS Store is teaming up with @BarryMoltz to discuss how to start a business while you’re still working. Follow the hashtag #SmallBizGuide.

- From March 16- April 11, you can get 500 business cards for only $9.99 at The UPS Store.

If you want to see the whole report, you can find it at theupsstore.com/score.

4) 6 Tips for Spring Cleaning Digital Files

It’s spring—officially—ignore the weather outside and think about what spring brings—it’s as if nature pushes the restart button, and everything springs back to life. This is a great time for you to do the same—push the restart button at your business. Start by cleaning up your offices and files. Matt Peterson, the president and CEO of eFileCabinet shares 6 tips for cleaning up your digital files.

1. Markers Keepers: Like any of our possessions, our computer files can be lost in the shuffle of moving files around our desktop, documents folder and other folders. Make sure to mark them with a brief, clear title. Separate personal files from work files and group them in more specific categories.

2. Search for Files: Start by doing an inventory of every file you can find. A good place to start is the My Documents folder. Most likely, your computer also has a shared folder, where other users of your computer might have saved files as well. Double check that there aren’t any files in the shared folder that you would want in your personal folder. Aside from the My Documents folder, look at your hard drive, take out your flash drives, CD’s, and anything else where you may have files you’ve forgotten about. Spring-cleaning can be an excellent opportunity to find files you forgot you had and put them in a place where you won’t forget them again.

3. Sort your Files: Reflect on how you use your computer. Do you have music files? Do you use it for school? How about work? Maybe you do your taxes, or keep a personal journal on your computer. Try to make file groups out of these various categories. It will help immensely if you create your own file naming convention. You might want to use the date as part of your file name, or the topic associated with the file (i.e. ‘Music” or ‘Economics Notes’). You can further simplify by creating folders according to month, then filing documents that were created in that given month. It’s a good idea to keep personal files separated from shared files to avoid confusion.

4. Store (Backup) Everything: Before you begin, back up all of your files. This may seem counter-productive, but it’s an important step you shouldn’t skip. The more places you store identical information, the better. Consider saving your files not only on your internal hard drive, but on a jump drive, a CD, an external hard drive and the Cloud. There’s a good chance there will be files that are built into your system you don’t recognize. If you don’t know what a file is, lean towards caution and don’t delete it. If you delete a critical file, it can negatively impact your computer’s performance.

5. Look to the Cloud: If you’re debating what to do with that digital picture album from the high school reunion and can’t get yourself to click ‘delete,’ upload it to the cloud. However, don’t let it get lost in the cloud. You might want to record where you keep important files in a notebook. Letting the cloud take the weight of your storage will help your computer run smoothly, and create peace of mind knowing that your data won’t be lost if your computer crashes.

6. Throw out the Trash: Once you have your files backed up, begin sorting files starting with the oldest files. When looking through old files, look for the documents you haven’t opened in the last twelve months. If you don’t see any immediate need for them, but may need them down the road, delete that file from your local machine, but leave it backed up (preferably in the cloud). If you see no reason for this file to exist at all, delete it permanently.

This is often the hardest part when doing any kind of cleaning. Human nature makes it difficult for us to part with almost anything we own, even if it’s causing a mess, taking up space, while being completely worthless. If you have multiple drafts of old files, get rid of the outdated ones, and don’t feel guilty about it. It’s safer and more efficient to keep one file in a few different locations (on your computer, in the cloud, on an external hard drive, etc.) than to keep several versions of one file in the same location.

5) Millennial Shoppers

As the first “native tech” generation, Millennials bring that sensibility to their consumer behaviors. A new study from SecureNet, The Way We Pay, shows an “overwhelming majority (85 percent) of shoppers 18-29 years old are more willing to shop at retailers that use their past purchases to deliver targeted coupons.

The Way We Pay also found:

- 68 percent of Millennials have used their mobile phones to research products in-store

- 67 percent shop online, at least 25 percent of the time, including via mobile devices

- 60 percent consider it “important” or “extremely important” to be able to purchase online and return or exchange items in-store

The survey notes that Millennials are an “instant gratification generation,” and actually prefer it when businesses track their preferences—as long as that leads to a more “unique shopping experience.”

For shoppers of all ages, the two most important factors that impact their buying decisions are secure checkout and shipping costs.

6) Teaming Up (part 1)

Yodlee just launched a Small Business PartnerHub to give small business owners access to a suite of tools, including lending, invoicing, and travel and expense management, through a secure financial portal. One of the first partners to sign on is CAN Capital, which offers fast access to funding.

The Yodlee Small Business PartnerHub suite of services includes:

- Loans and Financing

- Expense & Receipt Management

- Invoicing and Collections

- Business Credit Score and Activity Monitoring

- Lead Generation

- Online Accounting Integration

- Payables and Approval Workflows

- Travel Management

Check out Yodlee SmallBusiness to learn more.

7) Teaming Up (part 2)

If you sell online through Bigcommerce, Intuit is offering a seamless integration with QuickBooks Online to make accounting and bookkeeping easier for online businesses. According to the companies, “The direct integration is first available to Bigcommerce merchants, and will automatically update and transfer invoices, expenses and other financial data, freeing time for business owners to focus on growing their business, not managing the technology behind it.”

Online sales are expected to surpass $1.6 trillion globally this year.

Highlights of the integrations include:

- Seamless data updates

- Improved sales transaction accuracy

- Better business performance insights

The QuickBooks Payments integration is available now, and the QuickBooks Online integration will be available soon. You can learn more at bigcommerce.com/quickbooks.

8) Teaming Up (part 3)

Sam’s Club just announced a year-long collaboration with the U.S. Chamber of Commerce Foundation (USCCF) and the Young Entrepreneurs Academy (YEA!), which is a national educational program that helps transform middle and high school students into confident entrepreneurs.

The sponsorship will enable over 8,000 students in grades 6 through 12, in 38 states to participate in YEA!, a 30-week entrepreneurship class teaching kids how to generate business ideas, conduct market research, write business plans, pitch to a panel of investors, and launch their own, legally-registered companies.

As part of the sponsorship, the YEA! program will be able to expand into 30 new communities starting this fall. The U.S. Chamber of Commerce Foundation is now accepting applications from local chambers of commerce that want to start a YEA! program. Local chambers can apply for these “Success Made Simple” startup funds now through May 30 at USChamberFoundation.org/YEA.

Check out the new website, which features stories of YEA! students and alumni and provides access to “Success Made Simple” startup funds applications. To learn more about enrolling in YEA! or starting a program in your community, visit yeausa.org.

Meet the YEA! Graduates

- 99 percent of Academy graduates enroll in college

- 49 percent of YEA! students are female

- 56 percent under-represented minorities

- 100 percent of Academy graduates graduate from high school on time.

- 2,298 YEA! students have launched more than 1,700 real businesses in America

Rieva Lesonsky is CEO of GrowBiz Media, a media and custom content company focusing on small business and entrepreneurship. Email Rieva at rieva@smallbizdaily.com, follow her on Google+ and Twitter.com/Rieva.