Getting Your Business Prepared for Hurricane Season

By Jim Goss, Senior Vice President, Risk Management, Stephens Insurance

Hurricane season is once again in full swing, but is your business ready should a catastrophe strike? Economic losses from Hurricane Sandy reached an estimated $50 billion, and 30 percent of small businesses will be impacted by a natural disaster at some point, according to the National Federation of Independent Businesses. Four years later, the physical damage from Sandy has largely been repaired but the financial impact lingers. Even today, the effects of the storm continue to inform how businesses in high impact regions protect their offices, equipment, manufacturing facilities, and employees.

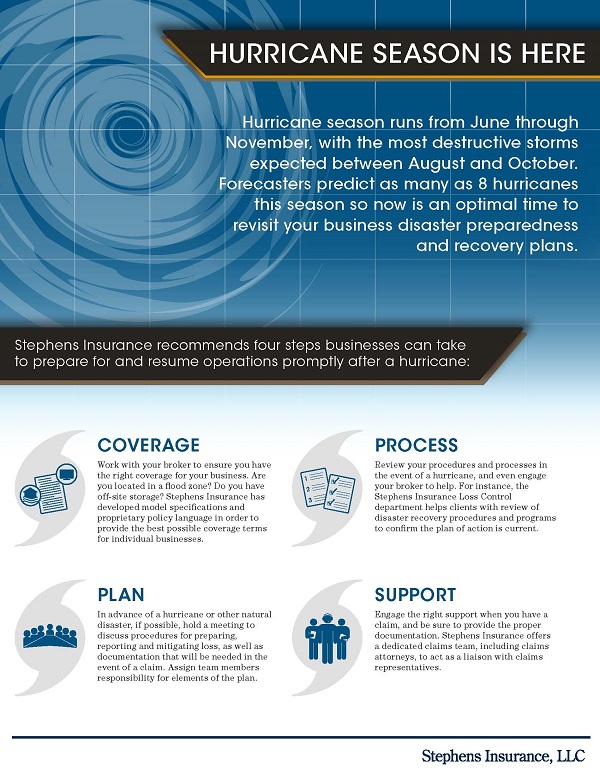

Hurricane season officially began on June 1st, and, while the season lasts through November, the most destructive storms are expected between August and October. With forecasters predicting as many as 3 major hurricanes this season, now is an optimal time for small business owners to revisit and update disaster preparedness and recovery plans.

Hurricane season officially began on June 1st, and, while the season lasts through November, the most destructive storms are expected between August and October. With forecasters predicting as many as 3 major hurricanes this season, now is an optimal time for small business owners to revisit and update disaster preparedness and recovery plans.

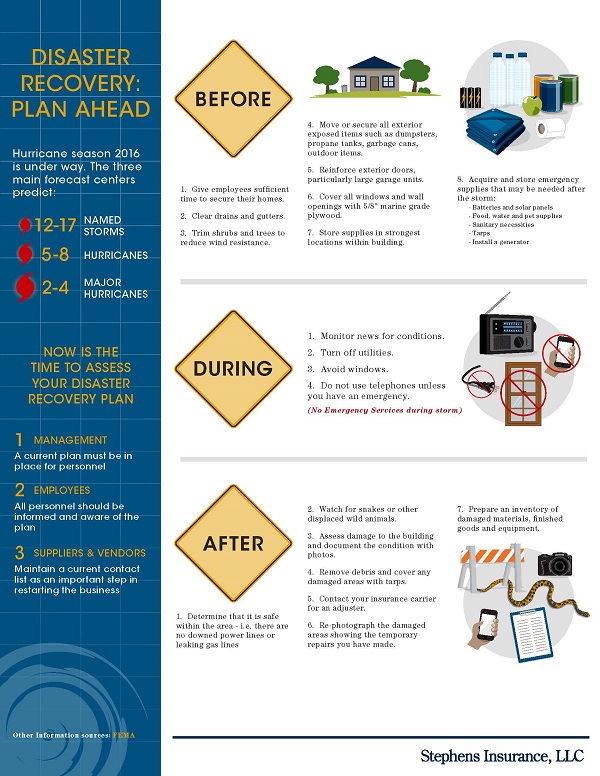

Importantly, business should prepare contingencies not only for a direct hit from a major storm, but also to weather lingering disruptions to supply chains and distribution networks as a result of storms farther afield. Transit disruptions, power failures and storms impacting suppliers and vendors can all have trickle-down impacts on small businesses that can close the doors. And, according to the Federal Emergency Management Agency, almost 40 percent of small businesses that close during a disaster never reopen. Owners and managers can get ahead of these disruptive forces by giving close consideration to four key areas:

Planning: As the hurricane season nears its peak, meet with your staff to discuss safety procedures and contingency plans in the event of a storm. Ensure key personnel know and understand the procedures for preparing, reporting and mitigating any potential losses from storms, as well as documentation that will be needed in the event of a claim. Assign specific responsibilities to staff members as needed. Remember, partial “proofs-of-loss” will be critical to getting the doors open again when submitting claims after a storm.

Planning: As the hurricane season nears its peak, meet with your staff to discuss safety procedures and contingency plans in the event of a storm. Ensure key personnel know and understand the procedures for preparing, reporting and mitigating any potential losses from storms, as well as documentation that will be needed in the event of a claim. Assign specific responsibilities to staff members as needed. Remember, partial “proofs-of-loss” will be critical to getting the doors open again when submitting claims after a storm.

- Process: Review disaster recovery procedures and processes in the event of a hurricane – how to communicate, keep employees safe and keep (or get) the lights on. If you’ve changed anything about your business recently, be sure to take those changes into account and update your plan accordingly. Remember to take advantage of services from your insurance provider when possible. For example, some providers will review disaster plans and provide suggestions to clients to maximize the plan’s impact.

- Coverage: Stay current with your insurance coverage. Is your business located in a flood zone? Does your policy include coverage for destructive wind-driven rain? Do you have off-site storage that might be impacted by a storm? Has anything significant changed with your business operations that might increase your exposure to storm risk? Ensure that your insurance properly covers your business for today.

- Support: Understand what resources are available to you in the event you need to submit a claim, and keep primary contact numbers close at hand. In the event of a storm, be sure to engage the right support for your claim, and be sure to provide the proper documentation.

To ensure the continuity of your business after a major weather event, it’s critical that your management and staff are prepared beforehand. This includes both providing proper guidelines for what to do before, during and after a storm, as well as understanding your insurance coverage and preparing contingencies for what recovery looks like, should a storm hit. Building a plan in advance of storm season will help to significantly ease the process of coping with a storm if it occurs, and will help you to understand how best to reduce risks to your business.

Jim Goss, is the senior vice president of risk management at Stephens Insurance.

For further information from Stephens Insurance on how to prepare for hurricane season and ensure you and your employees stay safe during a storm, see our full infographic here.