13 Things Entrepreneurs Need to Know

By Rieva Lesonsky

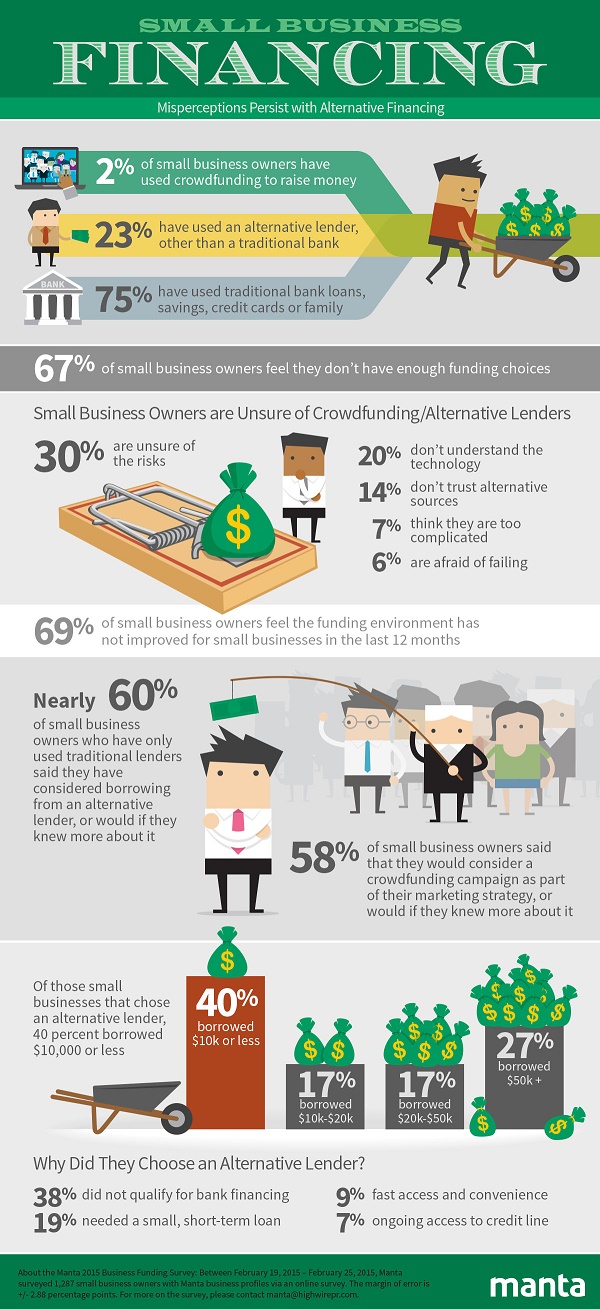

1) In the Dark about Funding Options Despite all the buzz about alternative financing in general and crowdfunding in particular, a new survey from Manta shows small business owners aren’t very aware of these options. According to the survey, about 67 percent of small business owners don’t think they have enough funding options. And 69 percent say the “funding environment hasn’t improved in past 12 months.” Specifically, 23 percent of business owners tapped an alternative lender (meaning, not a bank) to fund a business project, yet a mere 2 percent have used a crowdfunding platform. What’s responsible for the low numbers? Well, 30 percent are unsure of the risks of alternative funding, 20 percent don’t understand the technology associated with these alternative sources and 14 percent simply do not trust them. The Manta survey business owners “overwhelmingly prefer traditional financing options.” Over 70 percent tapped traditional sources for funding (bank loans, savings, credit cards or help from friends and family). Less than 25 percent have gone to an alternative lender. What motivated the entrepreneurs who did use alternative lenders?

- 38 percent didn’t qualify for traditional bank financing

- Almost 20 percent needed small short-term loans

- 9 percent took advantage of the fast access and convenience of alternative lending

- 7 percent wanted ongoing access to a credit line

2) Best Banks for Small Business

Sageworks Bank Information took a look at those traditional lenders and found that as small businesses continue to experience strong revenue growth and profitability, more banks see them as attractive targets for loans. The Sageworks data shows about $12 billion more was lent in 2014 than 2013, the first yearly increase since 2010.

The analysts at Sageworks Bank Information looked at two different ways of measuring U.S. financial institutions’ appetite for small business loans: volume and percentage of total loans to determine the top lenders. If you rank banks by total dollars lent to small businesses in 2014, the five top lenders were:

- Wells Fargo

- Bank of America

- JPMorgan Chase

- US Bank

- Branch Bank & Trust

When looking at the percentage of small business loans to total loans small local banks dominated the rankings. This group was led by: Farmers State Bank in Humphrey, Nebraska; the Bank of Glen Ullin in North Dakota; and The Pitney Bowes Bank in Salt Lake City.

3) Are You Ready to Invest in Your Business?

Brother International Corporation just released its 6th Annual “Brother Small Business Survey,” showing 54 percent of small business owners would rather invest in their businesses instead of stockpiling cash. This is an 18-percent swing in preference since 2010. Other finding show:

- 42 percent are “highly-stressed” about the economy, the same was last year, but down 16 percent from 2013

- 41 percent want to spend money on tech purchases or upgrades—if their revenues increase by 5 percent or more this year. (I’d argue investing in tech will help you grow revenues.)

The cloud is pretty popular right now. Of the 62 percent of business owners who use the cloud, nearly all (95 percent) say the cloud is “beneficial”, 69 percent appreciate the cloud benefits of easier access, storage and analysis of data. And, 34 percent say the cloud has helped them save money. Other wants include:

- 38 percent yearn for new laptops

- 35 percent want to reduce or eliminate their many roles and responsibilities

- 33 percent want to “deploy technology to take better advantage of the ‘Internet of Things’”

- 30 percent want to start accepting mobile payments

- 26 percent want to take more time off

- 20 percent want new mobile devices

- 20 percent want to work on their work/life balance

- 13 percent want new desk phones

4) Emailing It In

Are you making mistakes in you email marketing? Many small businesses are, according to a recent survey, What Consumers Want from Marketing Emails, from TechnologyAdvice Research. Findings include:

- Almost 50 percent of American adults get “irrelevant business emails” daily, 30 percent get them weekly

- 48 percent want better email content

- 43 percent want fewer emails from businesses

- 30 percent of consumers say irrelevant content is the reason they flag business email as spam

The good news is 60 percent of consumers read business emails, however only 16 percent of those readers do so regularly. Promotions and discounts get women to read business emails, while men are looking for news and updates. When asked how businesses could “improve” their email marketing tactics 44 percent want you to email them less often; 24 percent asked for more informative content and 23 percent wanted more personalized offers.

5) 3 Startup Tax Breaks You’ll Want to Know About

With April 15 just around the corner, Matt Straz, the founder and CEO of Namely, an HR, payroll and benefits platform for growing businesses, says it’s time for small business owners to kick it into high gear. “Opportunities abound for startups to cut their tax bills,” Straz says. “The key is to know and understand what’s deductible for your business, and to have a payroll system you can rely on for accurate tax reporting as your business quickly grows.”

Straz says “For many, starting your own business, being your own boss, and earning a living by doing what you love is the American dream. That dream, while exciting, is a costly venture. Fortunately, the Internal Revenue Service (IRS) cuts new business owners a well-deserved break when it comes to taxes.”

To ensure you claim the deductions you deserve as a new business owner, Straz offers three tax breaks you need to know about:

1. Research and experimentation expenses: The long hours and countless dollars you spent conducting investigative research before opening your business? That’s deductible, assuming it resulted in a productive business.

Surveying markets, analyzing products or the labor supply, scouting out locations for your business and any other costs related to creating or investigating a new business can potentially qualify as an investigative expense.

Keep in mind that startup costs up to $5,000 are deductible in full the first year. If your costs exceed that amount, then you can amortize (that is, gradually write off) the remaining costs over a 15-year period, beginning with the month in which your business opens. What’s more, that $5,000 limit has to be reduced dollar for dollar by the amount of startup costs that exceed $50,000. For startup costs greater than $55,000, the $5,000 deduction is no longer an option.

2. Business preparation expenses: Your business likely incurred a number of expenses before it was even “open for business.” As luck would have it, you can write off some of those expenses if your startup expenditures actually resulted in a fully operational business.

These business preparation costs generally include employee training and wages, travel costs associated with finding suppliers, distributors, and customers, advertising costs, and consultant fees. They don’t cover equipment purchases, which are considered assets that are written off through depreciation.

Using a full-service payroll system to integrate payroll with timesheets will ensure you accurately account for wages during the preparatory phase. Keeping up with time management at your growing company is crucial for saving more cash come year’s end.

3. Organizational expenses: If your business is up-and-running as a partnership or corporation before the end of your first year in business, certain organizational structure formation costs can also be deducted.

These expenses include the cost of state incorporation fees and legal fees, organizational meetings, and temporary directors’ salaries.

Small business owners who opt to form a partnership can deduct legal fees, accounting costs, and filing fees related to the development of the partnership agreement.

Moving Forward: How to Maximize Your Tax Benefits

New business owners are often stretched financially, making it even more important to maximize the tax benefits of your startup expenses. Even once those startup expenses become operating expenses (after the planning and development phase of your business), keeping good records is the key to reducing your tax liability and pocketing more of your hard-earned money.

Once your business is fully operational, reliable payroll is a must. Consider investing in an easy-to-use provider that can help with timely calculation, filing, and deposit of employment taxes. It’s worthwhile, and helps you save more come tax time. Also, keep careful track of your expenses and maintain receipts, and consider talking to a tax advisor or accountant to help you make more informed decisions concerning your business.

For more information on how different startup and small business expenses are treated by the IRS, read more at IRS.gov.

What do you think? What other tax-related tips do you have for new business owners? Share your ideas in the comments!

(You can connect with Matt and the Namely team on Twitter, Facebook, and LinkedIn.)

6) Is Your Site Mobile-Friendly?

I’ve been talking about the importance of small business websites being mobile-friendly for quite a while now. If your site isn’t optimized for mobile, not only are you going to lose customers, but Google is (starting April 21) going to “punish” you. The New Design Group has put together a handy guide to what you need to know. Check it out.

7) Let’s Make a Deal

Do shoppers respond to coupons? Should you offer them? How can you make sure you’re doing coupons the “right” way? Valpak has the answers below.

8) 3 Steps to Transform Gossip into Gold for Your Small Business

Most of us are familiar with the downside of gossip, but Deborah Beroset, a communication expert and seminar leader for Landmark, a personal and professional growth, training and development company, reports scientists say it can be positive too—a “sort of glue that binds society.” Beroset cites one study showing more than half of our conversations are gossip-driven. But there’s a cost: In addition to the obvious impacts of wasted time and lowered productivity, gossip can drive a wedge between people, adversely affecting how others view you and sapping your happiness and productivity.

So how can you find the “hidden gold” in gossip in your small business? Beroset recommends seeing gossip as a sign that something needs to change. “It’s not a matter of gossip being bad or a moral issue, it’s the fact that it undermines workability. And without workability, you have no shot at performance,” she says.

Beroset recommends you take three steps to transform “gripe” gossip into an opportunity to improve communications with your staff:

- Notice when you and others are gossiping. Engaging in gossip is a habit, which means people—including you—often do it without thinking. Entrepreneurs and small business owners set the tone for what goes on in their workplaces. Whether the topic is a vendor, a customer, someone within the company or simply someone you know in common, practice asking yourself whether your words, or those of others, are contributing something positive to the conversation or diminishing someone. Simply paying attention to what’s being said is half the battle.

- Identify a complaint. When you hear an employee, business partner or one of your managers gossiping, see if you can gently steer the conversation toward whatever complaint is underneath the gossip. In small businesses, the most common complaints revolve around money, time or responsibilities. If an employee gripes that their workload is too heavy compared with that of other employees, for instance, it may be time to look at how responsibilities can be allocated more fairly and efficiently.

- Take it to the right person. Look to see what request could be made that would address the situation that’s bothering you or the person gossiping, and then identify the best person to take that request to. Practice catching yourself about to say something negative to someone who can do nothing about it—and then follow up with someone who can. With regard to others, if there’s gossipy grumbling in the ranks about a vendor’s performance, for example, look to see what conversation there is to have directly with that vendor as opposed to indulging in or tolerating behind-their-back talk that makes no difference, and either have that conversation yourself or, better yet, request that the person with the complaint addresses the matter with the appropriate party.

What moves mountains in this world is the ability to make powerful requests. People are often amazed at the ease with which a simple request can resolve circumstances that previously seemed like a lost cause. If each time you overhear or learn of gossip you urge the person involved to deal with the matter directly, your efforts contribute to a workplace culture that values direct, powerful communication.

9) On The Road Again…and Again

The American Hotel & Lodging Association wants you to be aware of fraudulent third-party booking sites that “deceive consumers into thinking they are something they are not (like the branded hotel website or other reputable online travel agency) and are able to offer something they can’t (like cancellations, specific rooms and ADA accessibility).” Here are some tips from the American Hotel & Lodging Association:

- Use trusted sites: Although the hotel’s name may be part of the URL, double check the website address to ensure it’s not a third-party vendor.

- Book directly with the hotel either via web or phone to avoid being scammed.

- To ensure you protect your information, your reservation, your points and your credit information, ask the right questions when booking:

- What is the privacy policy? Make sure your personal information isn’t harvested.

- What is the cancellation/trip change policy? Many third party booking sites don’t allow cancellations, changes, or refunds. ü Is the site, in any way, affiliated with the hotel? If its not, your rewards points may not be honored.

- Is it a secure payment site? The URL should have a small lock and should start with https:// as opposed to just http://.

- If a vendor has misrepresented itself to you or if you’ve fallen victim to a hotel booking scam, contact the FTC to alert them to the issue and file a complaint.

10) How Vulnerable Are You?

How many security mistakes do you make every day? If you’re like most of us—lots. And making even just one of them can leave your business—and yourself vulnerable. Check out this article from NextAdvisor.com warning you about common security mistakes and how to avoid making them.

11) Cool Tools, pt. 1

Xero just launched some new features this week to its accounting software. They include:

Inventory. Delivers simple inventory management allowing real-time tracking of the quantity and value of their small business inventory. Items can be easily added to an online quote or invoice, helping small businesses better manage and monitor stock. For customers with complex inventory needs, Xero seamlessly connects to a number of partners in the Add-on Marketplace.

Online Quotes. Small business owners can create online quotes and estimates easily from within Xero, on-the-go, in real-time, and on any device.

Practice Reports. Practice Reports allows accountants to add value to clients through customized reporting on their accounts with real-time data. Initially launching in New Zealand, practice reports will shortly be rolled out in Australia, followed by the U.K. and U.S. later this year.

Side-by-Side Files. Makes it easy for small businesses to enter their financial transactions. Receipts and bills can be uploaded to Xero and viewed on-screen while the transaction is being entered or completed.

Bank Feeds. Building on the existing support for bank feeds, Xero makes it easy for bank transactions to be reconciled with small business accounting. Xero now supports an additional 1,692 bank feeds, connecting to 7,000 bank feeds and over 5,000 financial institutions globally.

12) Cool Tools, pt. 2

Stitch Labs, an inventory control and multichannel selling solution, just announced a new sales forecasting feature which helps simplify operational challenges for retailers and empowers them to make smarter, data-driven business decisions.

Predicting sales is often difficult for retailers. With sales forecasting, retailers can make informed purchasing decisions through reports that help estimate future sales. Stitch’s sales forecasting reports will allow retailers to project sales for the upcoming four and 12-week periods, using order history to predict future demand. The reports will include the mean number of units to be sold in that timeframe. Armed with this information, retailers can determine which pieces of inventory will perform the best, allowing for maximum selling potential.

13) Cool Tools, pt. 3

Kabbage, a leading online provider of small business loans, has licensed its lending platform. In May, Kikka Capital will launch as one of Australia’s leading online consumer lenders, with its new small business lending service powered by technology provided by Kabbage. Kabbage will provide the onboarding, underwriting and monitoring technology platform, while Kikka Capital manages the operations, marketing, funding and loan servicing.

Rieva Lesonsky is CEO of GrowBiz Media, a media and custom content company focusing on small business and entrepreneurship. Email Rieva at rieva@smallbizdaily.com, follow her on Google+ and Twitter.com/Rieva.