14 Things Entrepreneurs Need to Know

By Rieva Lesonsky

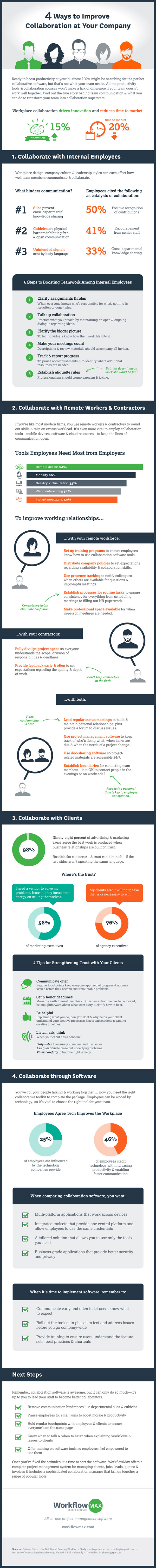

1) Improving Collaboration

Gallup reported only 31 percent of American workers are engaged in their jobs. As a result, the folks at WorkflowMax say business leaders are looking for ways to improve collaboration in the workplace. Check out the infographic below for some tips:

2) Are You Chip-Ready?

Reiterating what we’ve reported before the latest Wells Fargo/Gallup Small Business Index shows only 49 percent of small business owners who accept point-of-sale card payments are aware of upcoming EMV liability shift, the date when a card issuer or merchant that does not support EMV chip card technology will assume liability for any fraudulent point-of-sale card transactions. To meet the October 1 deadline, financial institutions are issuing EMV chip-enabled credit and debit cards, which are designed to protect against fraudulent transactions by encoding cardholder information within an encrypted microchip and data that changes with each transaction, and merchants are converting to new card readers or adding EMV capability to their existing magnetic stripe card reader payment terminals.

Among business owners who report accepting point-of-sale card payments, only 31 percent say that their existing credit card processing system accepts chip-enabled cards. When asked if they plan to upgrade their point-of-sale credit card terminals to accept EMV chip cards, just 29 percent of business owners said they intend to make the change before the Oct. 1 deadline. Another 34 percent of business owners reported they will upgrade at some point in the future after October, and 21 percent say they never plan to upgrade.

In the survey, some of the top reasons business owners said they do not plan to swap their terminals before October include:

- 48 percent feel that upgrading their payment terminal will not impact their business.

- 46 percent do not want to pay for the costs associated with upgrading.

- 41 percent are not concerned about the liability shift in the case of fraud.

3) Getting Chip-Ready

Despite these attitudes it is really critical for small business owners to be ready for the new EMV cards. Sushil da Silva, the co-founder of Highline Software, offers a 5-point checklist to help you prepare.

Credit card fraud is in the US is at epidemic levels. Last year, the U.S. accounted for more fraud than the rest of the world combined. And the fraud rates are accelerating. EMV technology has greatly reduced in-store fraud in Europe.

By the October deadline over 70 percent of cards in consumer hands will be EMV enabled. The retailers Highline has worked with to implement EMV are seeing very high usage of the technology with EMV transactions accounting for more than 40 percent of all transactions. In some stores EMV amount to almost 60 percent of all credit card transactions. Apple pay currently accounts for about 6 percent of transactions but this is a figure that growing.

These are much higher numbers than we expected to see since we installed the first system in New York in April, but it does demonstrates that consumers are armed with the new secure chip cards and are out in stores using them.

With only two months left until the legal liability shift, retailers need to catch up as the public is out there ready and spending. Here are five tips for retailers who are making the change to EMV:

With only two months left until the legal liability shift, retailers need to catch up as the public is out there ready and spending. Here are five tips for retailers who are making the change to EMV:

- If credit card payments are integrated with their POS software call your POS vendor and ask what their specific recommendations are for upgrading. Do they require new hardware for processing EMV cards? Will their software be ready in time for the October deadline? If not, when? Regardless, ask what steps to take in order to become compliant.

- Beware of companies selling “EMV-ready” Ask specifically if the vendor is certified to process EMV transactions today. An EMV-ready terminal is merely capable in principle of accepting EMV cards; it does not mean that the vendor is certified to process EMV transactions now. EMV certification is a complex process that involves the terminal vendors (e.g., Verifone), software running on the terminals, the processing network (e.g., First Data) and the credit card companies. So ask your vendor if they are EMV certified.

- If credit card payments are separate, you can shop around for options. Call your payment processor and ask the same questions as above. If your payment processor isn’t ready or won’t be ready for many months after the deadline you should shop around. Some processors have been ready for a while. You might be able to get the early termination fees waived from your existing processor since they haven’t yet complied with the new requirements for EMV. Ask your processor if they support Apple Pay, which lets customers securely pay with their phones. If you’re going to upgrade hardware now, you may as well get Apple Pay too. Most processors advanced enough to do EMV now also support Apple Pay.

- Treat the EMV requirement as an opportunity. If your existing software vendor or processor isn’t ready, chances are you’re on an obsolete platform. Shop around for a modern, ideally cloud-based mobile system. A cloud-based system dramatically reduces your administration and start-up costs and your data is available from anywhere, and anytime.

- Look for deals. Some new systems offer the latest in cloud/mobile technology but don’t require any investment in hardware. During the EMV shift, Highline, for instance is giving away a mobile EMV reader. The software is free and credit card transactions are a flat 2.95 percent.

We are sitting at the convergence of three major changes that are having a huge impact on in-store retail today. First the introduction of the EMV standard in the U.S. and the liability switch that will happen this October; secondly, the move to the cloud to help retailers innovate rapidly while simplifying their businesses and reducing operating costs; finally, the introduction of mobile technology into the retail space dramatically changing the consumer experience, how they move through a store and what they do when they are there.

4) Tips for Going Global

We all know growing your business internationally is not simple—but it is doable. If you’re looking to conduct cross-continent business, know that you can, but the task is not easy. Here’s some advice from Benoit Gruber, the vice president of Corporate Communications, Sage Enterprise Market & Sage X3:

Managing one location has it’s own challenges like keeping up with all your departments including human resources, sales, marketing and the like. Now, think about doing that, but all over the world where there are different time zones, cultures and expectations. Those of you that already run a multi-location enterprise know how difficult this can be. Again, it might not be simple, but with the right frame of mind and the best practices in place, you’ll be able to grow and strengthen your cross-continental presence and allow your business to truly thrive. The following are some tips that will enable you to conduct your global business successfully.

Create relationships and ask for help

Whether you have an established global business or are looking to expand to new markets, you don’t have the advantage of being everywhere at once to meet and connect with your teams and customers. You’ll have to work hard to maintain your relationships, so you should be setting up regular calls to access the tone and satisfaction of those employees at the location. You can even go the extra mile by making sure you’re present for important events at different global offices or utilize video calls for a more in-person feel. You should also be leveraging your connections in the various continents you’re looking to grow in. If you’re looking to expand in a location where the native language is not in your skillset, have a contact or service in place in order to spread awareness about your products and services.

Stay connected with the cloud

The best advice I can give you is to keep your global business connected. With the development of modern business management solutions, it is easier than ever to stay connected with your teams all over the world. The right software will unite your workforce whether they are in finance, distribution or manufacturing so that everyone is up-to-date on all processes. It will allow employees to access data anywhere, at any time making their working hours match up with yours regardless of time zone. With cloud implementation you’ll be able to go wherever your business takes you by accessing it from different technologies, too. You’ll be able to give the right people the information they need in real time in order to spot anomalies and correct any discrepancies.

Do global business but act local

Conducting global business requires businesses to act like a local. Customs, traditions, and legal compliance vary across geographies. Be aware of the legal compliance needs and requirements in the locations you are conducting business in so you are able to continue doing business legally. By learning the area’s customs and traditions, you are able to relate with locals better and establish a positive reputation.

Communicate often and clearly

We all know that communication is key, but are you taking that to heart when it comes to conducting business across continents? Take a minute to think about how often you have a conversation with your various teams and the way in which those discussions are orchestrated. Can it be improved? The business management solution I suggested should also allow you to cultivate and maintain productive communications with your global business.

Another crucial part of your conversation is being able to use the right language. Barriers in language are detrimental to your productivity and waste time, so it is important to be succinct so your employees and customers can understand you. This is where language localization will be a must for your cloud-based solution. Not only will you be able to clearly communicate with your team, but you’ll also be able to better service your international customers by avoiding miscommunications from suppliers or partners. Being able to clearly communicate strategy to your workforce in all markets will aid your strategic confidence and your business’ ability to stretch.

Remain flexible for growth

As a global business, the ability to maintain control over efficiencies—especially in terms of importing and exporting goods—is a must. You can increase your sales by utilizing an interface that is intuitive regardless of language or device, and is flexible enough to track and make adjustments on the spot. The market in one of your locations can change at any moment, and you’ll want to be agile enough to adapt and change with it. This is where keeping an open dialogue with your location will help, as well, because you’ll be aware of any structural changes you need to make. It’s essential that your global employees have mobile capabilities, and staying connected with cloud-based business management solutions can give you the flexibility you need to move forward.

Expanding to new markets and managing your global business is in your forte. For you business leaders who currently conduct business across continents, you know the unique perspective you gain by maintaining a presence around the world. As long as you create strong relationships, stay connected, communicate frequently, and remain flexible for growth, you’ll have everything you need to take control of your cross-continental business.

5) Meeting Mania

Blue Jeans Network, a leader in cloud-based video collaboration services, recently released its annual State of the Modern Meeting Report, which benchmarks meeting trends. According to the report, today’s meetings increasingly connect global teams and remote workers from anywhere and everywhere, weekend meetings are becoming more frequent and the number of online meetings is also rising.

Some other key findings:

Weekend Warriors: Weekend meetings are on the rise, with an average of 49 percent more meetings on Saturdays and 84 percent more meetings on Sundays than prior years. More weekend meetings take place on the West Coast.

Midwestern Hospitality & Punctuality: Meetings in the Midwest are more likely to start on time, while East Coasters are 4x more likely to be late than people on the West Coast.

Coast to Coast: The New York to Los Angeles corridor is the most traveled business route both physically and virtually. The West Coast also takes more meetings overall than any other US region.

Saving Miles Matter: In 2015 alone, companies using Blue Jeans video conferencing have avoided traveling 7.5 billion miles and saved $3.3 billion in travel costs and 2.7 billion pounds of Co2, the equivalent to planting 322,644 trees.

Winter is Coming: The winter season has double the amount of meeting activity than the rest of the year. And the fewest meetings take place between April and June.

Get a Room: While people join meetings from a wide range of conference room systems, desktops, and mobile devices, when people are in the same location, they prefer to get a room—35 percent of meetings include at least one conference room-system.

Tuesday is now the most popular day of the week for meetings and most meetings take place in the mid afternoon.

Check out the infographic below for more information.

6) What Comes Next After Mobilegeddon?

Moovweb, a mobile optimization company, wanted to see if businesses heeded Google’s call last April to either start delivering mobile-friendly experiences or risk losing their positions in Google search. Using its MoovScore tool, which measures mobile-friendliness, the company tracked the top 3,500 AdWords spenders and found an 83 percent increase in mobile-friendliness between March and June. However, only 33 percent of those sites moved beyond just mobile-friendliness to offer fully optimized mobile experiences.

Digging deeper Moovweb found some variation across industries, with five standing out as having significant levels of mobile optimization: travel & hospitality, auto, retail, manufacturing and insurance.

There’s a lot more to mobile optimization. Moovweb says to best optimize a mobile experience (MEO):

- Your site must load quickly and users must be able to start interacting with it virtually instantly.

- The flow must also be optimized. An example would be shortening the mobile checkout process from five steps to just two.

- And you must also account for context. For example, you might deliver different user interfaces to Android and iOS or differentiate between new and returning users.

7) The Gig Economy

There’s no question the Gig Economy is heating up. Just look at the numbers from Fiverr, the world’s largest online marketplace for creative services. Using services like Fiverr enables small business owners to buy Gigs to take care of everything from graphic design to market research to web work. And Fiverr’s $5 starting point makes it a great way to save money—as well as the time it takes to find the talent and results you need.

Check out these numbers:

- 25,000,000: Number of transactions on Fiverr.com since 2010; 33 percent of that activity took place over the last year

- ~1,000,000: Number of transactions per month

- 4,000,000+: Number of Gigs (services) listed

- 4,000+: Number of Gigs added every day; on average Fiverr sellers add a new Gig every 5 seconds

- 76 percent: Percentage of Fiverr sellers who are Millennials

- 60 percent: Percentage year-over-year growth of the average order value

8) Free Software for Startups

Startups are always looking for ways to cut costs—and getting free software would certainly be helpful. Avast for Business, which has its own free offering for SMBs (see below), has a list of free software you might want to look into:

OpenOffice: Apache OpenOffice is an open source office suite that includes essentials like a word processor, spreadsheet, multimedia, graphics, database and math software. OpenOffice is license-free and can be installed on as many computers as your business needs.

OpenCart: OpenCart is a free and open source shopping cart solution. All you need to do is install OpenCart, select your theme, add your products and you are ready to start selling your products on your website.

Hootsuite: Using social media is a great way to get the word out about your budding business, and a social media manager is, therefore, very helpful to keep track of your social platforms and their effectiveness. Hootsuite offers a free starter package where you can add three social media platforms, get basic analytics reports and schedule posts.

Producteev: Producteev is a task manager that offers unlimited users, projects and tasks in its free version so you can ensure that you and your team stay on top of the most important to-dos to get your business up and running.

Suite CRM: Suite CRM is free, open source software for customer relationship management. It’s based on Sugar CRM and comparable to Salesforce. It gives you a full overview, including products, quotes, contracts, projects, reporting, teams, workflow and much more.

Orange HRM: Orange HRM is a free and open source software for human resource management. It is a full-featured HR management system offering various modules such as system administration, personnel information management, and recruitment.

Wave: Wave offers free cloud-based invoicing, accounting, payroll and payments to businesses with nine people or less. They finance their services by connecting small business owners with vendors of products and services that offer discounts to Wave users.

Fundera: Fundera is a free service that offers you loan options and lets you choose the one best suited for your small business. All you need to do is fill out a short questionnaire and then you are presented with loan products, lenders and rates and can apply to the lenders that fit you best with only one application. [Fundera is a client of GrowBiz Media.]

Avast for Business: Avast not only provides consumers with free security, but we also provide small and medium sized businesses with free cloud-managed protection. Avast for Business is easy to install and can be managed from anywhere and at any time.

9) Finding the Best Employees

PI Worldwide recently announced the results from a recent recruiting and retention trends survey that looked at the way employers find, manage and keep employees. The survey shows employers are struggling to find talent for open positions, with 65 percent of small, 45 percent of medium and 40 percent of large companies saying that it is their biggest problem.

The U.S. Department of Labor estimates the average cost of a bad hire can equal 25-30 percent of that hire’s first year earnings—meaning you can’t afford to make a bad hire.

The survey shows “when looking to bring in new hires, most organizations are focusing on the expected areas of candidates’ skills, experience, and education. However, companies of all sizes are not including ‘soft’ criteria, such as personalities and behaviors, as part of their job descriptions. This means they are often not putting the right emphasis on equally critical areas (such as motivating drives) and an individual’s characteristics that are important for success. As a result, they are inadvertently narrowing their own candidate pools by concentrating on only the “hard” criteria.”

Findings of note include:

Recruitment

When asked why a new hire wasn’t a fit, 47 percent say it’s either because of behavior or inadequate skills.

Small businesses report candidate misrepresentation as the primary reason why new hires don’t work out. However, they rely primarily on interviews and don’t use cognitive assessments and knowledge/skills tests as frequently as larger companies.

Retention

Most companies try to retain and motivate employees through bonuses; however, compensation is cited as the number-one reason for talent turnover.

After compensation, the top reason given for why employees voluntarily left their positions was lack of career development, followed by poor job fit and conflict with a peer or manager.

To download a copy of the full report, visit: 2015 Recruiting and Retention Survey.

10) The Millennial Job Hop

With so many Millennials in the workforce, it’s important for small business owners understand what they are looking for on the job. To get some answers RecruitiFi, a crowdsourced talent acquisition platform, just conducted its first Millennial Outlook Survey.

Key findings include:

- Although 83 percent of Millennials acknowledge that job hopping has the potential to be negatively perceived by prospective employers, 86 percent say it would not prevent them from pursuing their professional or personal passions.

- 77 percent of Millennials work in white-collar jobs, however, 49 percent would consider switching to blue-collar role.

- 57 percent of Millennials don’t think their employers are currently striving to build better programs for their generation.

- Why do Millennials leave their jobs? To pursue a completely different career path (37 percent), take a job with a competitor (25 percent) and/or relocate to a different city (22 percent).

- 53 percent of Millennials have held three or more jobs. And while 33 percent have plans to stay in their current jobs for 3-5 years (33 percent), 20 percent plan to leave after a year or two.

11) Advice for Millennial Entrepreneurs

Speaking of Millennials, they’ve been called (by me and others) the most entrepreneurial generation in American history. If you’re a member of Gen Y, Millennial entrepreneur Ashley Mulcahy, the 25-year-old top-preforming owner of Tutor Doctor in Orange County, CA, has some advice for you. Ashley’s franchise servies 20 cities in nine territories with a network of more than 100 tutors. She started working as a tutor while completing her undergraduate degree and bought her first business owner in her early 20s. Ashley’s advice:

- Write down your goals: We all hold goals and ambitions in our head, but there is something powerful and clarifying about actually writing them out—we commit to them.

- Be willing to take risks but have a plan: Take risks and be sure to track the data to measure ROI. When you fail, learn from the experience and take that knowledge to execute a different approach. Develop a strong business plan and revisit it regularly. You will be faced with a lot of distractions in your 20s, having a plan in writing will keep your drive.

- Take advantage of resources available to you: Accept that you might not always know best. Seek mentors and programs designed specifically to assist young entrepreneurs. For example, the IFA Educational Foundation (IFAEF) recently launched the NextGen initiative, a comprehensive campaign aimed at introducing young entrepreneurs and students to the world of franchising. Even individual franchises are implementing programs to recruit young entrepreneurs such as Tutor Doctor’s YES Program.

- Invest in your employees: The strongest employees result from business owners who show they are willing to invest in their staff. Arm your employees with the same tools and resources you have. You may be young, but demand respect and show how serious you are about this business by investing in your staff’s success.

- Embrace technology: Millennials have been coined the masterminds of technology – use it to your advantage to manage and promote business operations. It is also a great way to maximize your customer-base with online product/service offerings.

12) Donald Trump for President?

After the first Republican presidential on August 6, Manta polled small business owners to find out their reaction to the debate. The business owners polled declared Donald Trump the big winner, saying he’d be “the best Republican candidate” with 41 percent of the vote, leading Jeb Bush who came in second with 14 percent. New Jersey Governor Chris Christie trailed the pack with 3 percent of the vote.

Of everyone running, the business owners polled said Trump would be the best candidate for small business, followed by Hillary Clinton in second place.

The small business owners surveyed said the most important issues to them were:

- The economy (40 percent)

- Taxes (21 percent)

- Health care (9 percent)

Lending and hiring trailed “other” and “religious freedom” in importance.

13) Office Sharing

TheSquareFoot, a commercial real estate brokerage and PivotDesk, an office-sharing marketplace have teamed up, offering TheSquareFoot’s customers to list availability of space across PivotDesk’s network. In addition, PivotDesk customers will gain access to over 5 million square footage of prime real estate.

Jonathan Wasserstrum, CEO and co-founder of TheSquareFoot says they’ve “encountered many companies searching for office space who are not prepared to take on a traditional lease. Partnering with PivotDesk was a natural next step for us to ensure businesses have the flexibility to find the right space for right now.”

David Mandell, CEO of PivotDesk, adds the partnership will help “to ensure businesses at all stages can find a proper home without wasting resources.”

Cool Tool

14) Legal Help

According to LawGeex, 33 percent of Americans last year reported they needed a lawyer but didn’t hire one. Enter LawGeex. The company provides fast and automated feedback on contracts, including: investment term sheets, founders agreements, service agreements, NDAs, leases, and more.

The LawGeex tool reads the contract you upload, compares it to thousands of similar ones, and lets you know how ‘standard’ the contract really is. It shows if there are any missing clauses and calls out what’s important to note, while also explaining what the contract clauses mean.

The company says this knowledge will help you make the right decision on any contracts, whether that’s to sign, negotiate, or find a lawyer for further advice.

As a startup LawGeex is offering access to the contract review tool for free for a limited time.