Getting a business off the ground is hard work and using personal credit isn’t always a good idea. While it might be easy, business credit offers more benefits and it’s easier to get financing assistance for a business. A good credit score will increase your chances of qualifying for a business loan or line of credit at agreeable terms. There are many benefits to having a good business credit score and getting there isn’t as tricky as some might think.

What Is a Business Credit Score?

A business credit score is not very different from a personal credit score. It indicates your business’s creditworthiness and is represented in a number.

The higher your credit score, the clearer it is that you pay your bills timely and responsibly.

Business lenders use credit scores to determine if it’s worth the risk of loaning money to you. If your score is low, you’re less likely to obtain financial assistance.

Why Is It Important to Have a Good Credit Score?

A good business credit score shows lenders that you are a low-risk borrower who will pay back the money you obtain. It gives you and your business a good, reliable reputation.

Here are a few more benefits to having a good credit score:

- Easier to negotiate favorable terms with suppliers

- The business’s borrowing power increases

- Higher chance of property rent approval

- Lower interest rates on loans

- Lines of credit are obtained easier

- Avoid paying security deposits on utilities

- Better vehicle insurance rates

Overall, a good business credit score shows that a business is growing and prospering.

What Factors Affect a Business Credit Score?

There are several elements that influence the health of your business credit score. Each of them is important and it’s wise to take them all into consideration in your business plans.

- Assets: The assets owned by your business, such as property, can improve your business credit score.

- Public Record: Reports such as judgments against the business owner, liens, and UCC filings can negatively affect your credit score.

- Credit and Loan History: Your personal credit and loan history, as well as the history of your business, is important. The kind of loans you had, their value, and how quickly they were paid are taken into consideration.

- Business Longevity: The age of your business is a factor that influences your credit score. Whether your business has been operating for a few months or a few years is important for your score.

- Revenues: Your annual revenues can negatively or positively affect your credit score.

- Outstanding Debts: Loans that need to be paid or credit cards that are not paid off yet will influence your business credit score. Paying on time and using credit responsibly will have a positive effect.

- Industry Risk: Some businesses are at higher risks than others, such as restaurants and bars.

How Does Business Credit Work?

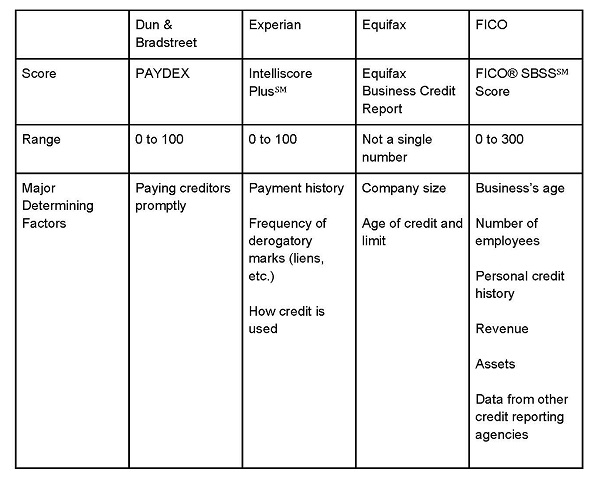

There are three main business credit scores and reporting agencies. They are:

- Dun & Bradstreet

- Experian

- Equifax

There is also a FICO Small Business Scoring Service, which uses information from the above-mentioned agencies to generate a credit score for small businesses.

Dun & Bradstreet awards a score between 0 and 100. It also provides a ‘financial stress score’ and a ‘commercial credit score’ that will help lenders decide how much you can loan.

Equifax has three assessments for businesses: the ‘business failure score’, the ‘payment index’, and the ‘credit risk score’. The agency also businesses a credit score between 0 and 100.

Experian gives businesses a CreditScore report that includes account histories and payment trends. A score between 0 and 100 is awarded to the business to indicate its risk factor.

How to Check Your Business Credit Score

Here’s how you can check your business credit score:

- Dun & Bradstreet: Create a free D-U-N-S® Number and begin to monitor your score by signing up for CreditSignal®. You will have to pay for a full report.

- Equifax: Create a myEquifax account and enroll in Equifax Core Credit™ to get a free monthly credit report.

- Experian: Experian has four business credit report products. You can get one-time access at $39.95 for a CreditScore Report and services can go up to $49.95.

- FICO: A credit report from FICO will require paying for a Basic, Advanced, or Premier service.

Conclusion

A business credit score can open doors to your business that were previously closed or unavailable. Having a good score will financially boost what you can do with your business and it’s easier to get some help if you fall on difficult times or just need some extra money.

Eddie Segal is an experienced web analytics specialist and technology writer. In his writing, He covers subjects ranging from finance, cloud computing to agile development to cybersecurity and deep learning. He also specializes in SEO, link building, and content strategies for technology brands. Eddie also contributes to a number of blogs like DZone, Dataversity, and IBM.

Business credit score stock photo by garagestock/Shutterstock