When is the Right Time to Raise Money?, Is Your Business at Risk from “Shadow Threats”?, 5 Mistakes to Avoid That Could Kill Your Business and Other Things Entrepreneurs Need to Know

By Rieva Lesonsky

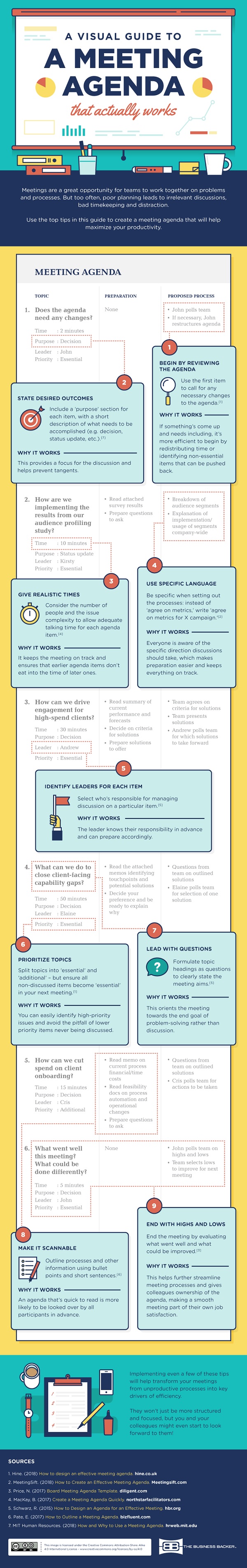

1—End Unproductive Meetings

All business owners experience days crammed with seemingly pointless meetings. In fact, according to data from The Business Backer, 71% of senior managers say meetings are unproductive and inefficient. What’s worse, these meetings have increased in length and frequency over the past 50 years—and executives spend a ridiculous 23 hours per week in them.

Check out the infographic below to learn how to transform unproductive meetings into key drivers of efficiency.

2—10 Common Project Management Mistakes

Even the most well-planned project can run into roadblocks. Here, from Zoe Talent Solutions, is what to look out for.

3—Raising Capital Isn’t Everything

Guest post by Dave Meltzer. Meltzer is featured in the new book “Think and Grow Rich: The Legacy” by James Whittaker. He is the CEO of Sports 1 Marketing which he co-founded with Hall of Fame Quarterback Warren Moon. He is an award-winning humanitarian, an international public speaker, and best-selling author

When is the right time to raise money? That’s probably one of the most common questions I get asked by entrepreneurs. There is a process I go through when deciding whether to spend my time raising capital or making money. This process is typically followed by a series of questions which include:

- When do I decide to take in money?

- How much equity am I actually willing to give away?

- Do I need to take on debt?

It’s very common that people get excited about not using their own money, but a lot of times, as a result of not using their own money, people end up losing control of their entire company—sometimes without realizing their mistake.

Too much, too fast

A prime example of this is the startup Get Satisfaction, which was founded by Lane Becker in 2007. The online customer service enterprise did a fantastic job raising funding, in fact, it did too well. Having turned down offers to buy the company, Get Satisfaction decided to raise a ton of capital. By the time they were finished, they had raised over $20 million (including a $10 million chunk at a $50 million valuation). When people congratulated Becker in 2015 after Get Satisfaction was acquired by the social media company Sprinkler, Becker went on a bit of a rant on Twitter.

Becker pointed out that he was pushed out of the company in 2010, after raising millions upon millions of dollars. He and the early investors got nothing from the sale due to the final amount being lower than the capital they raised, and the current management had done exceptionally well in the sale.

Reflection before cash injection

Why did this entrepreneur and his investors make such a mistake? Their lack of patience caused them to lose control of their business to venture capitalists. They weren’t honest with themselves about their company’s true potential. They took in money too early at too high of a valuation, allowing themselves to be hedged out. They weren’t honest enough with themselves about where their business was in the marketplace before raising a big round of financing with a lofty valuation.

Scale, scale, scale

When you raise $10 million with a $50 million valuation, that’s a serious promise you’re making with your business. You can find bad examples of companies raising capital everywhere, and I have seen the pitfalls firsthand.

If you want to raise capital in an intelligent way, it’s very important to take stock of your company before you decide where you should spend your time and money. It is my belief that, at all costs, you do not take money in until it’s time to scale; which is what I call expansion money. I believe that the time to take outside funding is when you need money to expand on a successful, scalable, model. It’s very, very, difficult to raise money earlier than that.

Not only that, but raising money before you are ready to scale is highly inefficient. Why waste time and ROI for investors when you are not fully ready to make the most of the resources given to you? Make sure you have a scaling plan in place before you consider taking a large amount of capital from an outside source.

Get creative with capital

To boot strap a startup business, utilizing family and friends is an acceptable route, only after you explore traditional loan options for yourself. In fact, a study by the Kauffman Foundation found that nearly three-fourths of companies were funded through personal savings, investments by friends or family, or traditional loans. Only 11% of companies in this study were funded by venture capital or angel investors, which should show you the importance of exploring your options before seeking to raise vast amounts of money. In fact, credit cards were used to fund 6.8% of the companies studied, which is higher than the rate that VCs and angel investors fund businesses, respectively. The fact one of the most expensive mechanisms of financing is used so often should make you even more determined to raise capital without outside investment.

Considerate capital

Take all of this into consideration the next time you’re deciding when to raise capital. Be smart. Be fair. Understand the vibration of your company. Do not take money in until you have a successful, scalable model. Until then, continue to evolve and utilize persistence to find the money necessary to grow that business until you find a successful model to scale. Those are keys when deciding the right time and manner to take in money for your business.

4—5 Mistakes That are Sure to Kill Your Business & How Not to Make Them

Guest post by Harrison Rogers, founder and CEO of HJR Global, a private equity company that has increased at least 200% every year for the past 4 years. A serial entrepreneur and investor, he is passionate about turning ideas into lucrative ventures. Based in Arizona, Harrison has been named Most Influential in Valley Business two years in a row. He’s also been recognized by The Arizona Republic’s 35 under 35, as well as Phoenix Magazine’s 40 under 40.

The experience of bringing a business idea to life, and ensuring its longevity, is full of learning curves. Some slip-ups are par for the course, trial-and-error, and can be happy accidents in the end. Others, however, can be fatal in the life of a business. Without reason, it’s these fatal mistakes that can be most common among new entrepreneurs. To ‘err is human but why not learn from others and avoid these five mistakes that are sure to kill your business:

Mistake 1. “The handshake deal”: In any business, making sales or completing deals is difficult. Sometimes out of urgency or fear of the other party changing their mind, we don’t take the time or effort to formalize the deal in writing. Whether it is a sale with a customer or a deal with a vendor or partner, formalizing it in writing is crucial. This provides the clarity of what is expected from both parties, and the comfort that someone didn’t assume certain items incorrectly. If anyone promotes a deal to not being formalized in writing for any “good reason,” consider that deal too expensive for your business. While legal fees are very undesirable, some upfront fees to prepare agreements can save you and your business. Protect yourself and your business and put everything in writing!

Mistake 2. The false security of social media: While social media is free and SUPER powerful for any company, it has tainted the reality of marketing budgets and given new business owners an incorrect assumption of what vital marketing budgets should be. The average allocation for business’ marketing budgets is 10% of gross sales. While social media is crucial and inexpensive, don’t let it fool you of what you need to allocate towards your marketing budget in order to adequately promote your products or services. It doesn’t matter if you have the best product or services if no one knows about it, and social media is just a small piece of the marketing pie. Get noticed!

Mistake 3. “The impatient businessman”: Being confident in starting ventures, “proving haters wrong”, and having courage to start something before everything’s “perfect” is commendable, but there is a fine line between confidence and recklessness. A business plan is a bare minimum. Without a business plan, it is very easy to get distracted when different challenges or opportunities arise. The time spent on planning and developing your business plan is a fraction of the time that you will save from being wasted on those distractions. Not only will it give you confidence to endure, it gives the team you are leading the assurance that they’re not following a blind leader.

Mistake 4. “The desperate hire”: As our companies grow, new needs and positions become important to fill. Many times, this happens quickly so an urgency or desperation occurs to hire someone. Make sure to give yourself enough time to find the right person for the job. Taking the time to find the right person to bring “on the bus” saves so much time, money, and pain getting the wrong person “off the bus”. Never put your company in a position that is so desperate to fill a need or position that you don’t have the time or resources to find the right person to fill the need. Hire slowly and do your best at getting the wrong people off your bus as quickly as possible. Payroll is usually a company’s biggest expense, but it is always a company’s biggest investment. Make sure to invest in the right people.

Mistake 5. “The Price Beater”: At the beginning we’re always eager to start claiming our share of the market. We want to show our customers and competitors that our products and services are competitive or superior to the market, and sales never lie. So, to get those sales telling a good story, we try and set our prices below our competitors and hope that our margins are sustainable and that we can keep the lights on. As a new business it is very difficult to be able to operate on the margins that large companies operate on, so to always try and set prices lower than our competitors is a dangerous and grueling game plan. Instead, new or smaller businesses need to focus on why your product or service is worth the little extra, and what only your business can provide. Why are you different?

5—5 Ways to Manage Your Business While You Travel

Many entrepreneurs want to go on vacation, but are worried about taking time away from their businesses for a week or two. Ooma Office shares 5 tips for managing your business while on vacation.

#1: Super-stealth call screening

Use a VoIP phone system to forward calls to a virtual receptionist and get voicemails sent to your email. And in case of crisis, you can hack yourself into omnipresence by making your smartphone double as one of your business phones.

#2: Schedule meetings two weeks out

Plan any necessary meetings two weeks before you leave and follow-up meetings two weeks after you get back. Bookending your trip with a one-week window gives you time for heads-down work before you have to circle back with clients.

#3: Automate your tasks

Productivity apps and social media scheduling tools offload your work by automating your daily tasks. Queue your accounts with a week’s worth of posts before you leave—no one will know you’re out of office!

#4: Set quick check-in times

Establish 30 minutes for work in the morning and before dinner—and communicate those times so staff members and clients know when to reach you.

#5: Make your communication guidelines firm

Tell partners and staff what you want to be notified about—and what can wait. Have a staff member send daily roundups to brief you on important updates—because no one wants to field emails on the beach.

6—Most Popular Restaurant Loyalty Apps

Starbucks (no real surprise there) is consumers’ top restaurant app, according to a study conducted by and reported in The Manifest. The Starbucks’ app is lauded for its stickiness, communication and offered value.

Other study highlights:

- 20% of respondents use their preferred food delivery app because it has better restaurant options.

- 50% of smartphone owners use branded restaurant loyalty apps.

- Smartphone owners use restaurant loyalty apps primarily to build up points or “stars” for rewards (72%), such as free drinks and birthday meals.

7—The Power of Shopping Local

A new study released at National Hardware Show, Home Sweet Home: Locals vs. Amazon, examines the positive economic impacts of consumers choosing to support independent building supply, hardware, power equipment and paint dealers instead of purchasing from online retailers like Amazon. It further reinforces the value of the “Local Advantage” when it comes to small independent businesses and shows their rate of return to local communities through labor, profit, procurement and charity is nearly seven times greater than Amazon.

The study shows buying directly through independent businesses whether in-store or online has a great economic impact:

- Sales through local hardware and paint dealers have a local impact nearly seven times greater (676%) than sales through Amazon, even when including all of Amazon’s distribution employment.*

- If Amazon were to capture just 10 percent of the home improvement market from independents, American communities would see a loss of $9.3 billion in local economic activity.

- In addition, because roughly half of Amazon sales come from third-party sellers who collect sales tax on a very limited basis, states and communities would see a substantial loss of revenue.

- When consumers order home improvement products online from an independent business, their money has more than twice (130% higher) the impact on local economies through jobs, taxes, charitable giving and revenue than if they were to buy online from The Home Depot or Lowe’s.

Data in the study shows the hardware, paint and power equipment sectors are somewhat insulated as compared to other industries and supports the broad assertion that home improvement and building materials customers buck the online shopping trend. There appear to be two driving factors:

- Customers want to inspect what they buy before committing and likely visit a trusted retailer for expertise and advice on purchases.

- The big box home center chains have developed sophisticated tools to facilitate hybrid online sales for store pickup.

8—Is Your Business at Risk?

Infoblox Inc., the network control company that provides Actionable Network Intelligence, released new research exposing the significant threat posed by shadow devices on enterprise networks.

The report, What’s Lurking on Your Network: Exposing the Threat of Shadow Devices, found enterprise networks across the U.S., UK and Germany have thousands of shadow personal devices—such as laptops, kindles and mobile phones—and Internet of Things (IoT) devices—such as digital assistants and smart kitchen appliances—connecting to their networks.

Over a third (35%) of companies in the three countries reported more than 5,000 personal devices connecting to the network each day. Employees in the U.S. admitted to connecting to the enterprise network for a number of reasons, including to access social media (39%), as well as to download apps, games and films (24%, 13% and 7% respectively). These practices open organizations up to social engineering hacks, phishing and malware injection.

A third of companies in the U.S., UK and Germany have more than 1,000 shadow IoT devices connected to their network on a typical day.

The most common devices found on enterprise networks included:

- Fitness trackers, such as FitBit or Gear Fit—49%

- Digital assistants, such as Amazon Alexa and Google Home—47%

- Smart TVs—46%

- Smart kitchen devices, such as connected kettles or microwaves—33%

- Games consoles, such as Xbox or PlayStation—30%

Such devices are easily discoverable by cybercriminals online via search engines for internet-connected devices, like Shodan, which provides even lower level criminals with an easy means of identifying a vast number of devices on enterprise networks that can then be targeted for vulnerabilities.

To manage the security threat posed by shadow personal devices and IoT devices in the network, 82% of organizations have introduced a security policy for connected devices. However, IT directors appear misguided in their estimation for how effective these policies are.

While 88% of the IT leaders that responded to the survey believe their security policies are either effective or very effective, 24% of employees surveyed from the U.S. did not know if their organizations had a security policy. And only 20% of employees who worked at a business with a security policy say they follow it by the book.

9—Rebranding Challenges

Millennials are a curious group of consumers. Infamous for the love of brandless brands, lack of brand loyalty and an interest in innovation, aesthetics and company values, this cohort has thrown marketers for a loop. The status quo no longer holds true, and as companies try to figure out how to understand millennials, many are faced with the challenge of rebranding their company to better appeal to this cohort. Simply put 90s kids have a different set of brand values then the generations before them.

While many of the traditional branding efforts must adapt, one thing still remains key, the logo. A good logo is one of the most important steps in creating a brand, especially in the digital age, where it holds more than just a place on business cards, products and billboards.

Millennials see logos on a daily basis, so it’s interesting to see just how well they remember them. So, what is it about a logo that grabs a millennials attention? Why are specific brands trusted more than others, and what makes the design process so crucial? To help answer these questions, this study redesigned the logos of eight iconic food brands that millennials have seen in their parent’s kitchen cabinets since childhood. Based on three factors: color, font and design details, we see which versions were remembered most and what elements of the designs were most impactful. To find out how the results stacked up across each generation, read through this study from Kitchen Cabinet Kings and explore the findings to see how branding plays a role in millennial recognition.

Quick Takes

10—Building an Office?

If you’re planning to build an office, check out this great guide, 13 Mistakes to Avoid When Building Out Your Next Office, from Adam Felson, the director of officemorph, a San Francisco-based project management firm that quarterbacks interior office space build-outs and re-designs.

11—Facebook Messenger Innovations

Last month Facebook introduced new tools to make Facebook Messenger more useful and relevant. The numbers are staggering: More than 8 billion messages are exchanged between people and businesses each month, which is 4x the amount of messages exchanged since just last year. And 1.3 billion (yes, billion) people use Messenger every month.

To learn more, check out this blog post.

12—Are You Stressed?

Try these 15 relaxation techniques from RelaxLikeaBoss.com.

Cool Tools

13—Enhanced Payroll Services for Small Businesses

A few weeks ago, Intuit announced enhanced offerings to complement its existing payroll service solutions. New features include Contractor Direct Deposit, designed for employers in the changing landscape of the gig economy, and Same Day Direct Deposit, enabling small businesses to pay employees faster than ever with QuickBooks Full Service Payroll.

Contractor Direct Deposit is a new feature in QuickBooks Payroll that supports businesses who want to pay their independent contractors the same convenient way they pay their employees—via direct deposit.

Following the launch in January, where Intuit introduced new features that can take the pain out of preparing 1099s for both small business owners and independent contractors, this new payroll service provides the tools and technologies to ensure contractors are paid on time and accurately, giving small business owners confidence in their finances. With each payment, a record is kept up to date in QuickBooks, so when tax time rolls around preparing and filing is lot easier for employers. Contractor Direct Deposit was designed to make the payroll process easier for small business employers and to help save them time.

A smarter way to pay contractors

Intuit estimates 43% of the U.S. workforce will be made up of self-employed contractors by 2020, and many small business owners are taking advantage of this new type of worker. In fact, 30% of U.S. small businesses pay at least one self-employed contractor annually.

New enhanced service offerings

Following the launch of 24-Hour Direct Deposit in 2017, Intuit saw QuickBooks Payroll users experience significant cashflow improvement. Now QuickBooks has sped up this process even more. With Same Day Direct Deposit, small businesses are able to approve direct deposits by 7 a.m. PT and pay employees the same day – for no additional charge. This service is available exclusively for QuickBooks Full Service Payroll customers.

There’s more information here.

14—Motion Detection Advances

Comcast Business recently launched Comcast Business SmartOfficeTM Motion Insights, a new feature of its SmartOfficeTMsolution. The all-new dashboard, featuring advanced motion detection analytics, will provide business managers and owners a comprehensive view of their cameras and quick links to watch live footage and playback video.

This services allows Comcast Business customers to leverage motion detection analytics to make data-driven business decisions. For example, a business owner can assess peak and non-peak hours based on the amount of foot traffic coming through the business and adjust staffing accordingly. The new dashboard will provide customers with a consolidated view of their business activity by pooling data from all of the customer’s SmartOffice cameras, as well as the motion detection analytics for each individual camera.

This upgrade is available immediately, at no additional cost, to all SmartOffice customers. For more information, go here.

15—Point of Sale Financing Platform for Small Business Growth

SuperMoney, a leading financial service comparison site, has launched a new No-Fee Financing Platform that offers affordable point of sale financing opportunities for small businesses across the country.

Built on top of SuperMoney’s consumer loan offer engine technology, the company’s new No-Fee Financing Platform is making point of sale financing available for merchants and service providers across all industries including home improvement, healthcare and specialty retail.

Small businesses can get set up to offer financing in a matter of minutes. SuperMoney is partnering with banks, credit unions, and direct lenders to provide competing financing offers for the consumer.

More information is available here.

16—E-commerce on Google Cloud

Volusion, an e-commerce platform built for SMBs, has migrated its 30,000 e-commerce stores to the Google Cloud Platform (GCP). Advantages to GCP include unsurpassed page speed, greater network reliability, and world-class, site-wide security. The migration has already positively impacted site performance for merchants, which will lead to increased conversion and overall revenue growth.

To date, merchants have seen:

- A 15% average page load time improvement, without having to do site optimization.

- General network latency improvements and reduced CPU usage.

- For larger merchants, every quarter second taken off page load times can increase e-commerce conversion rates.

Volusion says moving to Google Cloud gives it, “the ability to scale any part of its technology within seconds, rather than having to procure and implement hardware over a period of days/weeks when self-hosted. GCP offers Volusion modern and professional tools across network, operations, security, and overall infrastructure, as well as access to Google’s team of professionals to help the company continue to innovate and optimize performance for merchant sites.”