16 Things Entrepreneurs Need to Know

By Rieva Lesonsky

1) Top 20 POS Software

If you own a store, you know how important Point of Sale (POS) software isyou’re your business. But what one should you use? Capterra, an online tool for business to find the right software, rated the top 20 POS programs, as measured by customers, numbers of users, and social presence.

2) Counting Down to EMV Chip Card Switch

Guest post by Noah Breslow, the CEO of OnDeck.

If you’re not ready for the new EMV-enabled smart credit cards, or are unsure about what I’m referring to, you’re not alone. Wells Fargo recently reported, less than half the business owners they surveyed who accept point-of-sale credit card payments are even aware of the upcoming October 1st liability shift deadline to new card-processing technology aimed at decreasing fraud. More specifically, if you don’t shift to the new card-reader technology, your business would become liable for a fraudulent transaction.

If you’re one of those businesses, there is no law mandating you update your hardware at this point and mass adoption is realistically probably a few years away. So, you aren’t going to be compelled to adopt the new technology immediately. Nevertheless, after the first of next month, if you [don’t switch] your business will assume responsibility for any fraud related to the use of counterfeit credit cards run through your company’s credit card terminals.

Updating to the new technology should be pretty compelling. The financial services research firm Aite Group recently reported credit card fraud losses are expected to hit $3.6 billion this year. That’s up from $1.7 billion in 2011. While the new cards will not completely eliminate the potential for fraud, they are a lot more difficult to counterfeit, which is good for your customers and good for your business.

How to Upgrade to the New Card Readers

- You’ll need a card-reader terminal that accepts chip-based cards and new software that sends the charge through to your payment processor. This can start at $100 for the terminal and head into the thousands of dollars for the software.

- You’ll have to learn your way around the system and train your employees. During the transition period, customers may want to pay with the old swipe cards, newer chip-and-signature cards, or the newest chip-and-pin cards, and you’ll have to know how to deal with each. Set aside time for testing as soon as you can, and create a budget for the process.

- Reach out to your credit card processor to see what they offer and if it fits within your budget. Like most things, you can opt for a simple and inexpensive system or can choose a card reader with all the bells and whistles. While the average cost for the new card readers is between $150 and $600 per terminal, it is possible to find a terminal for around $100.

- For a limited time, Square is offering free terminals and both PayPal and Amazon will be rolling out their own new mobile readers soon. The cost of the technology is coming down with the increased competition from new technology companies entering the space, so you don’t need to break the bank to adopt the new readers.

While there is still some time left to adopt the new technology and purchase the new terminals, this isn’t something you can ignore. The trick will be deciding which hardware and software options are the best fit for your business.

3) How Big is the Gig Economy?

Everyone’s buzzing about the gig economy—but is it actually buzzworthy? In a word, yes. According to stats from invoicing service Due.com, the Gig Economy generates $715 billion annually in the U.S. Here’s some additional info from Due.com’s State of the Freelance Community:

- 53 million: the approximate number of freelancers in America

- 80% of all U.S. workers say they’d do work on the side to earn extra money

- There are 5 primary segments for freelancing

- Independent contractors (40%)

- Moonlighters (27%)

- Diversified workers (18%),

- Temporary workers (10%)

- Freelance business owners (5%)

- 1% of freelancers are women/28.9% are men

Ages of freelancers:

- 26% are in their 30s

- 25% are in their 40s

- 25% are in their 50s

- 12% are teens or in their 20s

- 12% are 60+

Average earnings

- 56% make between $20-$59 per hour

- Writers on average get $58-$82 per blog post written.

- Designers on average earn $52-$90 per hour.

- Programmers on average make $63-$180 per hour

4) The Future of Payments

Next week Samsung will be introducing Samsung Pay to compete with Apple Pay, indicating that new payment methods are a growing opportunity in the tech industry.

The New Jersey Institute of Technology says this technology has created quicker transactions but about 48% of Americans believe virtual currencies could expose them to cyber fraud. Will this fear limit the usability of this technology? Check out the infographic below created by the New Jersey Institute of Technology’s MBA program.

5) How 11 Minutes Could Change Your Trajectory

Guest post by Michelle McQuaid, a speaker, coach and author of 5 Reasons To Tell Your Boss To Go F**k Themselves: How Positive Psychology Can Help You Get What You Want.

Researchers estimate that most businesses spend 80% of their time trying to fix their weaknesses, and only 20% of their time building on their strengths. The problem with this approach is that our brains are actually wired to perform at our best when we’re investing our time and energy in the things that we’re good at and actually enjoy doing; in other words, when we focus on our strengths.

More than a decade of research has found when people develop their strengths at work they feel more confident, engaged, and productive. In particular, Gallup Research reports entrepreneurs who focus on their strengths have a higher probability of building a thriving business that creates millions or even billions of dollars of value, thousands of good jobs and a product or service that impacts the world.

But with so much competing for your attention, how can you ensure that you’re using your strengths each day to help build your business?

Start by ensuring you know what your strengths are. You can discover these by taking this free ten-minute survey, which will identify “how” you like to work at your best. For example, is it when you’re using your strength of “curiosity” to learn new things, using your strength of “kindness” to help others, or your strength of “bravery” to make bold decisions?

Then select one of your higher strengths—one of the behaviors you most value—and start doing a little more of this behavior each day by creating an 11-minute daily strengths habit. Research suggests that our habits run on a simple neurological loop with a cue that triggers off a routine that delivers an emotional or physical reward. As a result, next time the cue is triggered, we willingly repeat the routine – and a habit is established.

Here are some examples you could try:

- When I turn on my computer (cue), then I’ll use my strength of curiosity to spend 10 minutes reading and learning something new (routine), before sharing this idea with a colleague (reward).

- When I start work (cue), then I’ll spend 10 minutes using my strength of creativity to mind-map new ways we can serve our customers (routine), before getting my morning coffee (reward).

- When I go to get my lunch (cue), then I will spend 10 minutes using my strength of kindness to check in with a colleague on what’s working well for them (routine), before getting something to eat (reward).

- When I pack for the day (cue), then I’ll use my strength of honesty to acknowledge failures, fair criticisms and areas for ongoing learning and improvement and make a note of these for tomorrow (routine), before wrapping up for the day.

Exercising this habit creation methodology, you’ll soon find yourself looking forward to doing what it is you do best—and your business is sure to prosper as a result. For more than 70 different ways you can put your strengths to work in just 11 minutes a day visit StrengthsChallenge.

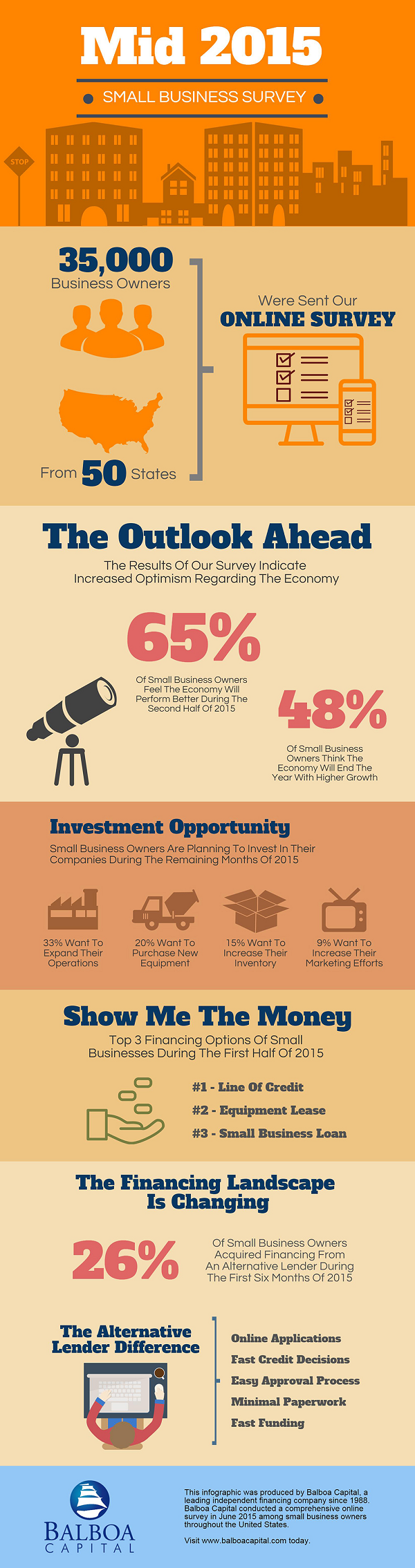

6) Small Business Owners are Optimistic

A recently released survey conducted by small business loan provider and equipment financing company Balboa Capital reveals most business owners (65%) are feeling positive right now, and believe the United States economy is on the right track and will perform well during the rest of 2015.

Key findings include:

- 48% think the economy will end the year with higher growth and as a result:

- 33% want to expand their operations

- 20% want to purchase capital equipment and/or technology

- 15% want to increase their inventories

- 9% want to increase their marketing efforts

- 26% acquired capital from an alternative lender during the first six months of 2015 in the form of:

- Credit lines (16%)

- Equipment leasing (12%)

- Small business loans (8%)

7) Who’s #1?

Once again, Babson College ranks #1 in entrepreneurship in U.S. News & World Report’s college rankings. This is the 19th time Babson has grabbed the top spot. The rest of the top 5 colleges for entrepreneurship are: MIT, University of Southern California (USC), UC Berkeley, and University of Pennsylvania.

The college also was named the top private business school for salary potential of graduates, according to the 2015–2016 PayScale College Salary Report and the No. 2 college in the United States on Money magazine’s Best Colleges list, second only to Stanford.

In other Babson news the Center for Women’s Entrepreneurial Leadership (CWEL) is celebrating 15 years of excellence and is welcoming participants for the 3rd Women Innovating Now (WIN) Lab, a first-of-its kind, yearlong program designed to empower women students and alumnae to build their entrepreneurial ventures. And Babson has joined over 45 business schools in committing to a set of best practices that offer concrete strategies for business schools to help women succeed throughout school and in their careers.

The full results of U.S. News & World Report Best Colleges 2016 are available at www.usnews.com/education.

7) Women Entrepreneurs: Get Your Products in a Holiday Gift Guide

Apply for a spot in the upcoming ‘Resolutions’ Gift Guide from The Story Exchange! The site is looking for a few great woman-made gifts that promote health, wellness, wellbeing and a sustainable environment to share with the world. For more info click here.

8) 5 Questions You Need to Ask Your IT Department About Big Data

Guest post by Lloyd Marino, CEO of Avetta Global and renowned “Tech Whisperer,” who can translate and communicate byzantine technical processes that elude even the savviest business minds into language they can grasp.

Big data is everywhere these days—though it actually has been around for a long time. Any business leader looking to jump into big data and data management needs to be asking the right questions or risk getting lost in a sea technical problems and financial loss. Here’s what you need to know:

- What type of data are we collecting? Big Data has no value alone. As the CEO you need to drive a reason for that data. Have a purpose!

- Can you monetize your results? Don’t let your IT team talk you into Big Data for the sake of being trendy. If you are collecting a fair amount of data, then Big Data might make sense, except when it doesn’t. If you cannot monetize it, why embark on Big Data?

- Who on your team is good with Math? Analytics requires Math! And Big Data is basically useless without analytics. The Best ROI comes from crunching the numbers to predict the data outcome.

- Ask your IT team to start small—is there a small dataset that has inherent value? Think demographics. Figure out where your sales are originating from; then go into action and figure out why. Can you now apply sales efforts elsewhere based on your analytic data?

- Can your team take action? Big Data is a tool not a strategy, its results must be in alignment with your key business objectives, easy for employees to make use of and completely integrated into operational procedures.

9) Marketing is Top Challenge for Small Business

According to a new Spark Business survey only two in five small business owners have executed a marketing campaign in the past six months, despite 70% who say they would if they had the resources and capabilities. To help Capital One Spark Business launched an integrated campaign designed to help its small business customers build awareness, compete and grow their enterprises in today’s increasingly complex and competitive marketplace. The Spark Plug campaign is designed to help small business customers increase awareness and generate new business throughout their local communities.

Keri Gohman, head of small business banking at Capital One says they launched Spark Plug “to recognize and reward small businesses with resources they need to help them reach new customers and grow within their local markets.” Look for the ads from the winning small businesses over the next few months.

10) Marketing Help for Local Businesses

All entrepreneurs know how important digital marketing is to their businesses, but it’s hard to strategize when you’re so busy running your company. To help try SurePulse from Surefire Social is an interactive digital platform that enables local businesses to make informed decisions and gain higher ROI through managing all digital marketing activity in one place. Using SurePulse a business can manage its entire digital footprint: website/mobile, social, reputation, local directories and search engine marketing, measuring their marketing returns, in easy to use dashboards.

Some key functions of SurePulse include the ability to share content across key digital marketing channels, check and monitor listings on maps and directories and publish offers, keep customers engaged and gain new customers through content marketing, discover how customers find a business, monitor conversations about a business and respond to reviews and much more.

11) International Expansion

AFEX, one of the world’s largest non-bank providers of global payment and risk management solutions, recently announced the results of its second annual Currency Risk Outlook Survey, finding that 48% of its clients are expecting to increase their level of international trade in 2015, up from 38% last year. As a result, and against a backdrop of global economic uncertainty, 19% plan to increase hedging activity to mitigate currency risk.

AFEX says, “As opportunities spread across new geographies, a commensurate level of currency risk and volatility follow. Markets expecting to see increased trade include Western Europe (60%), Australasia (13%) and China (10%)—all three of which have seen economic and political turmoil at various times over the past 12 months.”

Asked which global events have most affected their company’s risk mitigation strategy over the last 12 months, clients cited U.S. economic policy (49%), euro-zone issues (44%), the drop in petroleum prices (27%) and European Central Bank quantitative easing (22%) as the drivers.

12) Free Online Courses For Social Change Leaders

Philanthropy University, a new, innovative educational initiative, provides people working in the social sector specialized learning and resources to deepen their impact.

“Philanthropy University offers leaders in the social sector opportunities to strengthen their skills and grow their network of peers and mentors, ultimately increasing collaboration and efficiency and leading to a greater impact in the world,” says Dr. Laura Tyson, Director, Institute for Business & Social Impact at Berkeley-Haas (the Haas School of Business at the University of California Berkeley) and chair of the Philanthropy University Advisory Committee.

Philanthropy University offers classes lasting five to eight weeks that are taught by leading instructors and renowned practitioners. Courses focus on team-based, experiential learning, enabled by the latest social learning technologies from NovoEd.

The seven inaugural courses, which begin September 29th, teach key skills that people need to succeed in the social change sector, including fundraising, strategic planning and scaling for impact. More than 10,000 learners have already registered to be in Philanthropy University’s inaugural session. Instructors include Jessica Jackley, co-founder of Kiva.org, Paul Brest, Professor Emeritus, Stanford University, and Erik Simanis, Cornell University.

Learners can earn recognition from Berkeley-Haas including a Statement of Accomplishment upon completion of any course or a Certificate of Completion in Social Sector Leadership by completing all seven classes.

The initial course offerings and start dates are:

Starting Sept 29, 2015:

Global Social Entrepreneurship

Essential of Nonprofit Strategy

Organizational Capacity: Assessment to Action

Starting Oct 6, 2015:

How to Scale Social Impact

Leadership: 10 Rules for Impact and Meaning

Starting Oct 13, 2015:

Financial Modeling for the Social Sector

Fundraising: How to Connect with Donors

You can register at Philanthropy U.

Cool Tools

13) Making Google Inbox Work for You

Google’s big launch of Inbox earlier this year brought a much-needed refresh to the Gmail-platform. According to Mixmax, a startup company, while “Inbox was a radical new approach to email, focused on triage…a lot of the features that made Gmail a must-have product at work” were no longer viable.

So the company just launched a professional extension for Google Inbox, “making it a useful and viable product to get real work done.” Mixmax says they’re adding “a ton of functionality to Inbox, making it a must-have service to track, automate, and enhance your email.”

Extension features include:

Tracking

Email tracking is a top feature request for Google Apps customers. Mixmax tells you exactly who reads your email and when, even for group emails. The tracking includes clicks and attachment downloads as well as opens.

Automation

The Mixmax email editor allows you to embed your calendar directly into email for scheduling. Rather than wasting time going back and forth to find a common time to meet, you share your free times directly in the email. When a recipient clicks on a time, the meeting is automatically set up.

If you frequently write the same message over and over again (for prospecting, intros, recruiting or marketing), you can save any message as a template to use it again later without typing.

For die-hard Gmail fans, Mixmax resurrects literally hundreds of editor-related features from Gmail: resizing images, signatures, emoji support, keyboard shortcuts, attaching files from Google Drive, and font formatting.

Mixmax for Google Inbox is available for free with paid tiers starting at $9 a month..

14) Put a Whiteboard in Your Pocket

As I’m sure you’re aware Apple just released iOS 9, a powerful update for iPhones and iPads. To take advantage of the update, join.me, LogMeIn, Inc.’s online meeting app, just rolled out an update up its own “that will bring its best features to virtually any iOS device, while bringing the visual collaboration of the whiteboard—physical or virtual—to meeting attendees, regardless of their location.” The update brings the company’s mobile whiteboard, already available on iPad, to the iPhone with plans to support the iPad Pro upon its release later this year. It also gives users the ability to use their mobile cameras to instantly capture and bring physical whiteboards, photos or other visuals into the online meeting experience.

As part of the iOS 9 update, join.me’s new features will now be available for free, with additional, optional upgrades available via in-app and online purchases. New users can download the app from the App Store.

15) Making Appointments Just Got Easier

For entrepreneurs in certain service businesses, such as salons, barbershops, health and wellness providers and others, juggling schedules can be a “a pain point.” To help Square introduced Square Appointments, an online booking system that accepts appointments 24 hours a day — making it convenient for business owners and clients alike.

To make it even easier to manage schedules it has introduced the Appointments app, which allows you to:

- Set up and edit your appointments from anywhere

- Access to your client profiles

- Accept or decline appointments directly through your iPhone notifications screen

- You can check clients out directly on your iPhone seamlessly

The new Appointments app is available for iPhone—even if you don’t process payments with Square.

16) Manual Invoicing for SMBs Without Accounting Software

BlueVine, a leading online provider of working capital financing to small businesses, recently launched a manual invoicing feature which allows small businesses to enter the details of paper invoices into BlueVine’s cloud-based invoice factoring solution, manually creating an online invoice. Without being required to connect accounting software to BlueVine, qualified customers can receive advances on these outstanding invoices within 24 hours.

The company cites a 2015 study from Robert Half and Financial Executives Research Foundation which says 54 percent of U.S. firms rely on manual reconciliation of accounts, underscoring the need for services to create seamless solutions that accommodate these businesses.