11 Things Entrepreneurs Need to Know

By Rieva Lesonsky

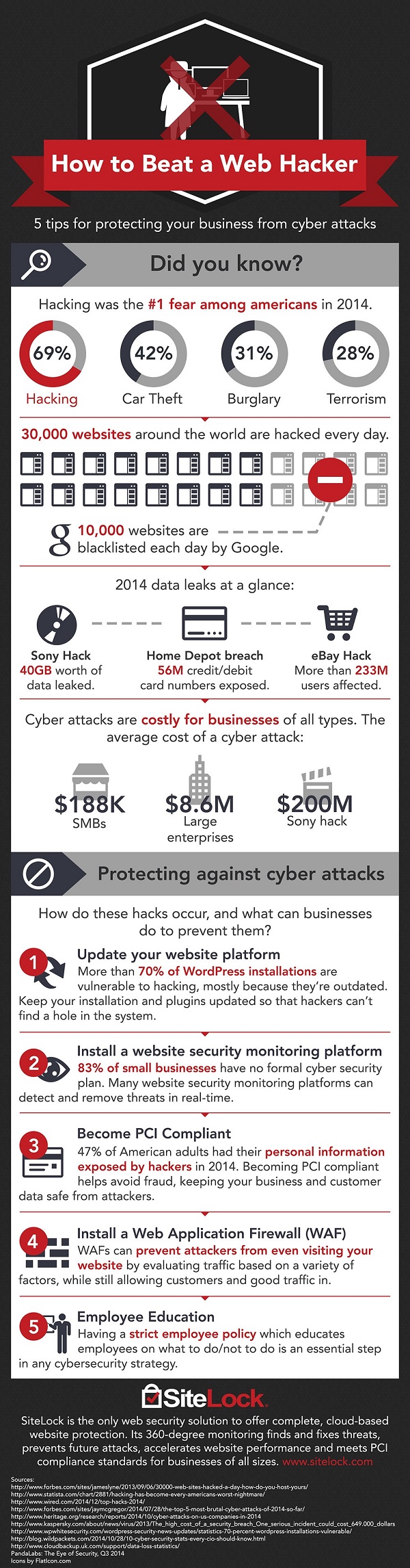

1) 5 Ways to Protect Your Business from Cyberattacks

30,000 websites are hacked every day. Every day? SiteLock shares some tips for how to avoid getting hacked.

2) What does Goldilocks have to do with Your Small Business?

Finding the storage solution that’s just right for your business is a challenge for many small business owners. According to this report from Intermedia, 68 percent of employees use personal cloud storage at work. That may sound innocuous, but that could easily lead to data breaches and worse.

You need to find the balance between IT needs and ease-of-use for you staff. Is your business at risk? Take the quiz to find out.

3) Get Better Email Results

New research from Constant Contactreveals that marketing emails with three or fewer images and approximately 20 lines of text result in the highest click-through rates from email subscribers.

Consumer expectations vary based on the type of business marketing to them, however. The research shows:

- Business product and services companies see the highest click-through rates in emails with between 13 and 16 images, presumably because email subscribers expect to see visuals of the products being offered by the company.

- Restaurants and salons/spas can afford to test more images of menu items/services in their email campaigns: both industries have peak click-through rates in emails with 15 images.

- With listings a focal point of their email marketing campaigns, real estate agents and services see the highest click-through rates at around 35 lines of text.

- Retail businesses have a very small window in terms of the number of lines of text that drive optimal click-through rates. Click-through rates improve over 50 percent between emails with 17 lines of text and 19 lines of text. Click-through rates then drop by 50 percent among emails between 19 lines of text and 21 lines of text.

4) Positive Job Outlook

2014 was a good year for job creation and the trend looks like it will continue this year. In fact, according to the Lucas Group’s newly released SMB Job Generation Outlook, small to mid-sized business leaders are generally optimistic about 2015’s economic and employment opportunities—for the country as a whole and their businesses in particular.

The SMB Job Generation Outlook (compiled quarterly) reports that in Q4, “SMB optimism reached a survey high with 75 percent of respondents reporting feeling optimistic about the economy.” Nearly half (47 percent) plan to hire early this year and 60 percent will add employees sometime in 2015.

The Outlook also identifies and tracks the top concerns of SMBs. In Q4, health-care costs (cited by 32 percent) and talent availability (29 percent) were the top challenges. Thirty-two percent cited health care costs as their #1 concern, followed closely by talent availability, at 29 percent.

A deeper look shows finding qualified talent for open positions has been a growing struggle for SMBs, according to the Outlook. Since early 2013, the survey has tracked a widening in the available talent gap. In Q4, 60 percent said it was difficult to find and hire qualified talent—and 14 percent categorized it as “extremely difficult.” The jobs most difficult to fill include sales, IT, accounting and finance.

To find qualified talent, SMBs are:

- 28 percent: engaging with recruitment firms

- 21 percent: increasing employee salaries and bonuses to attract/retain candidates

- 14 percent: posting online and through social media

- 14 percent: increasing job ads

- 13 percent: working with college and university recruitment offices

There’s a lot more in the Outlook. For one, 46 percent of businesses reported being in a “positive, healthy condition of growth,” compared to 38 percent who said that in 2013.

5) 4 Cool Tools

I know you’re always looking for ways to more effectively run and grow your businesses. Here are some online solutions that might help:

Lessonly training software: Having a simplified training process not only makes hiring easier, but helps your employees feel more confident about you. Studies show employees who participate in solid training programs stay at least three years 69 percent of the time. With an online training platform, companies can build, share and track employee progress quickly and efficiently, and highlight improvement areas immediately.

Stitch Labs selling solution: Looking for a way to manage all your selling processes in one place? This online platform manages inventory, shipping, accounting and more, with top integrations such as Square, eBay, Amazon and Etsy, enabling your business to be wherever shoppers are buying. The real-time syncing capabilities and automated publishing listings take menial day-to-day tasks off a business owner’s “to-do” list for good.

Perch social media monitoring: Hiring a social media management expert isn’t necessary if you use the Perch app. Designed to give a “bird’s-eye view” of reviews, posts and engagement from all the biggest social platforms, Perch will also alert you to what the competition is doing for just a fraction of the cost of a new employee’s salary.

ZenPayroll solutions: Managing employee payroll is usually time consuming, painful and complex, but ZenPayroll is a modern tool that connects payers with payees in a more positive way. With daily digests and employee control over personal information, the platform enables business owners to be much more calm about compensation.

6) Avoid These 6 Common Tax Mistakes

No one want to make tax mistakes—they could end up costing you a whole lot more than you think. Thanks to Terapeak, here are the 6 most common tax mistakes made by online sellers:

- Not filing self-employment schedules with Form 1040. If your online selling earned you more than $400 in profit over the past year, you should complete Form 1040 Schedule C or C-EZ, and Schedule SE, to report your business activity. This is true even if you’re just a part-time seller or consider your business activity to be a “sideline.” Keep in mind: This holds true whether or not you have an actual “business license” from your local municipality.

- Ignoring your Form(s) 1099-K. If you sold more than $20,000 in gross volume or completed more than 200 transactions over the course of the year on any selling channel, you’ll receive a form 1099-K information return that outlines your selling activity. Don’t be tempted to discard or ignore this form. This data has also been provided to the IRS, and you should use it to complete your Schedule C form accurately. Even if you didn’t receive a 1099-K (for example, because your selling was spread out across multiple channels), you should still complete Schedule C or C-EZ, and Schedule SE as outlined above.

- Filing a Schedule C-EZ rather than a Schedule C. The Schedule C-EZ form is available to smaller sellers who meet certain requirements, including having no employees, no inventory and less than $5,000 in expenses. It’s tempting to complete a Schedule C-EZ because the form is much simpler than the Schedule C form, and because it removes the need to file other supporting schedules and forms. However, the simplified form also can impact your ability to take deductions for which you’re eligible, and can enable the sloppy accounting practices that hamstring small businesses as they grow. Though it seems more daunting, Schedule C is usually the right choice for anyone seeking to grow their selling income over time.

- Miscategorizing expenses or taking improper deductions. At the same time, the ability to categorize and deduct based on expenses on the Schedule C and supporting forms can lead to the temptation to “find” as many deductions as you possibly can, at times playing fast and loose with expense categories or actual expenses in order to do so. This is a risky business, as these kinds of deductions are key checkpoints for audit selections, particularly if inconsistencies accumulate on a year-over-year basis. Don’t take deductions that aren’t on the up-and-up here, and don’t try to manage the forms yourself, especially if you don’t understand the categories or accounting practices at issue.

- Failing to remit collected sales tax. Depending on where you sell, and the channels through which you sell, you may be required to collect sales tax from shoppers for some or all of your transactions. States vary in their remittance schedules and requirements, but failure to collect or to remit sales taxes on schedule is a common and costly mistake for many growing businesses.

- Hesitating to get expert help. Small sellers in particular may be accustomed to doing their own income taxes year after year as individuals, and may assume that they can easily carry on doing “their own taxes” as their selling business grows. This is often a mistake—as sales tax collection, profits and expenses accumulate, paperwork can easily become overwhelming. Even for sellers who are able to do it accurately themselves, they’ll often find that the overhead time involved is more costly to them than it would have been to get professional tax and accounting help. In addition, they can miss out on tips and best practices that the professionals can offer to make bookkeeping easier in the long run.

7) Happy Holidays

As expected the 2014 holiday shopping season was a good one—especially for mobile shoppers. A just-released report from Clustrix, show 2014 sales between Black Friday and Cyber Monday rose 15.4 percent from 2013. Many of those purchases were made from mobile devices. Key findings of the survey include:

- 76 percent of consumers shopped via mobile devices over the holiday season

- 48 percent of consumers shopped online instead of in-store on Black Friday, and 62 percent say they prefer to shop online all year long

- 48 percent of consumer experienced website performance issues while shopping

- 74 percent say better shipping rates would influence their purchase decisions on Cyber Monday

8) How Social is Your Small Business?

According to a new survey from Tipbit, which just released a 4.0 version of its iOS app, enhancing the social experience and navigation, 27 percent of survey respondents use social as part of their business workflow.

Tipbit’s 2015 Business Behavior Study shows the top three social networks for business were:

- 72 percent: Facebook

- 56 percent: LinkedIn

- 45 percent: Twitter

Before going to a meeting 61 percent of those that use social as part of their workflow check the social profile of the people they’re meeting with.

Also of interest, when it comes to search:

- 61 percent use Facebook

- 51 percent use LinkedIn

- 42 percent use email

9) 5 Leadership Strategies Every Employer Needs to Know

Are you a good leader? Just because you’re the boss doesn’t make that necessarily so. Rob Wilson, the CEO of Employco, a firm that offers staffing solutions for small to medium-sized businesses, says, “Nothing is more important than knowing how to lead your staff.” Here are his top 5 tips to being a good leader:

- Don’t ask employees to do tasks you aren’t willing to do yourself—whether it’s coming in early or staying late to help finish a big project, a good leader isn’t afraid to roll up his sleeves and get dirty.

- Be kind. You would be surprised how many employers think that being mean will earn them respect. Instead, be pleasant and outgoing. And, when things go wrong, keep it professional.

- Challenge gossip head-on. If you have a negative office culture complete with gossiping and backstabbing, you have to stop the problems at the source. Find out where the gossip problem is coming from, and either help employees see the errors of their ways, or cut them loose. Gossip has to be squashed out quickly and mercilessly.

- Give praise where praise is due. Raises are wonderful, but you can’t always afford to give them out to hard-working staff. Instead, offer weekly appreciations via email and thank people with a kind-hearted and personalized note when they go above and beyond.”

- Offer incentives. If possible, offer unique benefits like summer hours, free coffee, and dedicated lunch hours. Encourage people to get up and leave their desks for lunch, and host office get-togethers at a nearby pub to celebrate a job well done.

10) What’s the Hardest Thing You Deal with Every Day?

GOBankingRates profiled 24 of the richest and most influential entrepreneurs in the U.S. to find out what they believe is the hardest thing they deal with every day. The answers are fascinating.

11) The Advantages of Coworking

Coworking spaces are much in demand these days, especially from startups, small businesses and freelancers. It’s a great way to save money—and be surrounded by like-minded people.

Phil Domenico, the founder of Assemble, an expanding chain of shared offices, says coworking spaces not only offer great space efficiency per person, but also “preserve privacy, security,” abate sound and offer phone booth areas.” Domenico says occupants of coworking spaces usually share resources, such as “cafes, conference rooms, common areas, bathrooms, IT closets, etc. Others, he says, “lease copiers [and] buy paper, coffee, furniture, Internet and more.” The savings are then passed through to the coworking space members.

The advantages to members is, says Domenico, you “avoid all the [usual] leasing costs associated with renting a typical office spaces like broker fees, architectural fees, building permits, security deposits, furniture, IT, cabling and of course the employee costs associated with coordinating all this work.

Rieva Lesonsky is CEO of GrowBiz Media, a media and custom content company focusing on small business and entrepreneurship. Email Rieva at rieva@smallbizdaily.com, follow her on Google+ and Twitter.com/Rieva.