15 Things Entrepreneurs Need to Know

By Rieva Lesonsky

1—Immigrants Impact Entrepreneurship

Yes, the United States truly is the “Land of Opportunity.” We can see it in the fact that more than 40% of Fortune 500 companies were founded by immigrants or children of immigrants. Check out the infographic below from the U.S. Chamber of Commerce and learn more about some of these successful businesses.

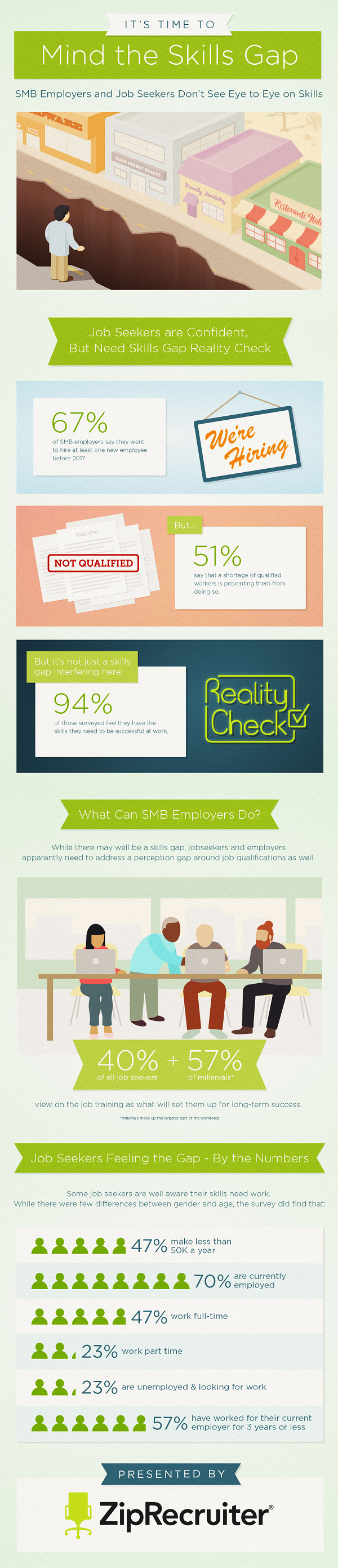

2—The Small Business Employee Skill Gap

In its first SMB Jobs Report ZipRecruiter found there’s a disconnect over the skillset SMB employers are looking for and the ones employees believe they possess. While small businesses employ 77.9% of private sector employees, today’s job seekers don’t have the skills many SMB employers really need. Yet 94% think they do have the right skills to get hired and succeed at work. ZipRecruiter says this “points to how the skills gap might be on the verge of becoming a chasm, as SMB employers and job seekers are on very different pages when it comes down to the skills needed for success.”

According to the report, 67% of SMBs want to hire at least one new employee before 2017, but 52% say a shortage of qualified workers is preventing them from doing so.

How can a small business address the perception gap around job qualifications? ZipRecruiter suggests making on-the-job training part of the hiring plan. In fact, 40% of all job seekers and 57%of millennials view on-the-job training as a crucial part of setting them up for long-term success. To solve the problem ZipRecruiter suggests offering apprenticeships, internships and entry-level training programs, as well as dedicated weekly or monthly training sessions that help employees learn and enhance skills over time.

The infographic below has more details.

3—Top 5 Hiring Bias Busters

Guest post by Katherin Nukk-Freeman & Suzanne Cerra, cofounders of SHIFT HR Compliance Training

Have you ever hired someone because they remind you of someone you know? Did you ever consider that your decision was based on your unconscious bias? Unconscious biases are hidden preferences created over time through socialization, personal experiences and exposure to the views of others. Whether we admit or not, we all have such biases to one extent or another, and they creep into our everyday lives affecting almost every decision we make—especially in the workplace. With such a commonality from workplace to workplace, the question today shouldn’t be “Do we have bias?” but rather, “What can we do about it?”

Here are some tips to combat unconscious bias in the workplace:

Blind Resume Screening: Studies show removing names and addresses from candidates’ resumes can eliminate unconscious bias on gender, race, nationality and/or socioeconomic status. Large companies like Google are starting to use this tactic.

Coordinate Focus Groups to Identify Unconscious Bias in Your Workplace: Select a broad cross section of employees to insure all views are represented. This allows open discussion to raise awareness and identify solutions for unconscious bias so it becomes woven into the fabric of your corporate culture.

Complete Unconscious Bias Training in Your Workforce: A recent EEOC report on anti-harassment and discrimination training recommends training should be thought-provoking and engaging. At SHIFT HR Compliance Training, we’ve developed an anti-harassment and discrimination training course that includes Unconscious Bias awareness. Unconscious Bias awareness training will help your employees uncover their personal and cultural beliefs, which are the root causes of most harassment and discrimination complaints.

Use Metrics to Identify Potential Bias in Hiring and Retention: You can’t improve what you can’t measure. By measuring percentages of diverse candidates who’ve applied, been offered jobs, accepted and have been successful after six months, you will be able to identify the strengths and weakness within your organization.

Use Stereotype-Busting Images in Your Company’s Internal and External Materials: Make sure your company’s website, newsletters, marketing materials, ad campaigns, etc. are reflective of the diverse workforce you have or are trying to achieve.

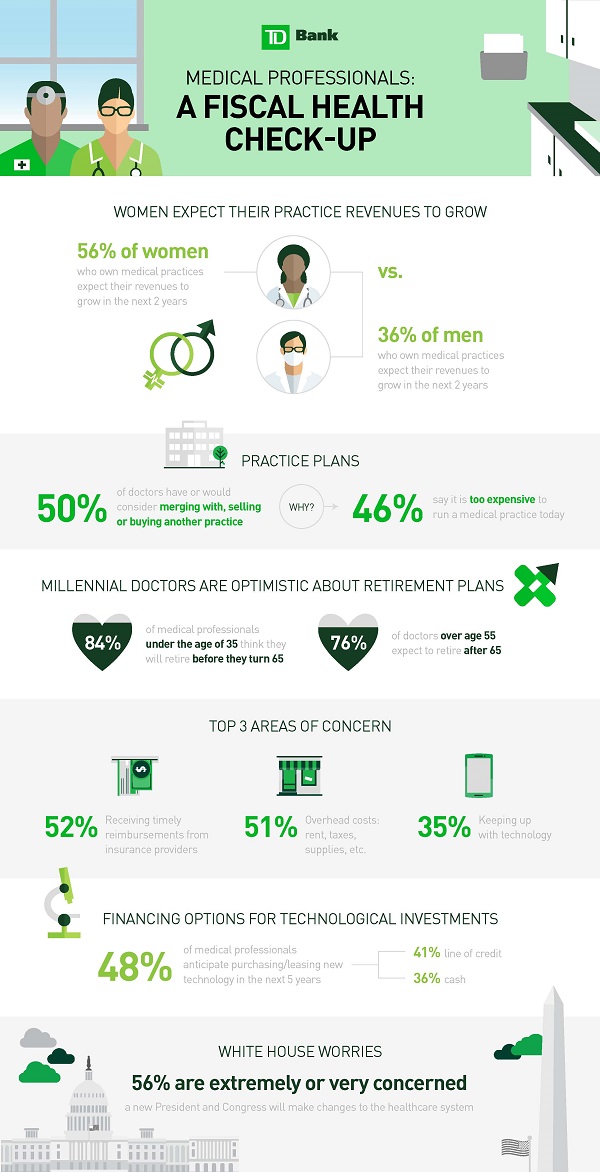

4—Doctors are Entrepreneurs Too

Many physicians are small business owners—just like you—and they share some of the same challenges and concerns you do. Get the scoop in the infographic below from TD Bank.

5—The Small Business Owner Marketing Toolbox

Guest post by Scott Bowen, VP & GM, Vistaprint Digital. You can find him on Twitter @Vistaprintweb.

Small business owners have an endless set of responsibilities, often extending beyond their skillset or area of expertise. This demanding list of duties can create a tug-of-war between time, priorities and comfort zones, preventing these entrepreneurs from focusing on a key aspect of starting a small business: establishing a strong brand identity. Creating brand awareness does not have to be a daunting or time consuming task. Armed with the right tools, small business owners can build a professional brand without sacrificing their most precious resource—time.

When it comes to marketing, it is important to remember that small businesses go through a “crawl, walk, run” progression as they expand in the marketplace. In essence, you can’t run before you crawl, so start with the basics to set a small business up for long-term success. In order to crawl, small business owners must first construct an identity for the business, both online and in the physical world. A well-formed business identity means having the tried-and-true business card, claiming a domain name, building a website and securing a position on search directories.

As a small business matures, it can evolve from identity building tactics into marketing strategy, which incorporates social media, email marketing and lead generation. These avenues provide greater reach, awareness and direct communication with consumers and are the natural next steps for the growing business.

As the brand moves through this process, it is crucial to maintain consistency. A recognizable business image creates loyalty and implies the business is credible and professional. Therefore, it is important to create a common thread throughout all marketing materials, from brochures and banners to websites and email marketing campaigns. Uniformity is ensured by cataloging a preferred suite of fonts, color palette, logos and imagery. This allows small business owners to easily reference brand colors, fonts and images and incorporate them into each marketing piece both online and offline.

Another vital component for brand recognition is having a well-designed website. Our recent Digital Impact Report found that 36% of respondents discover small businesses for the first time online and 45% say they are unlikely to shop at a business with a poorly designed website. Although these findings highlight why a well-designed website is a mandatory component for small businesses, nearly one-third of U.S. small businesses still do not have an established website.

This number is quite staggering, especially considering 81% of consumers research purchases online prior to shopping in store. By not having a website, small businesses miss out on key marketing moments and lose opportunities with potential customers. Their chances of being discovered decrease and hinder their ability to compete in today’s marketplace.

To avoid missing exposure opportunities and gain traction with consumers, it is imperative for small businesses to have a coordinated online and offline presence. There are resources available to help simplify this process and streamline marketing efforts to establish a coordinated and professional brand presence.

So, as small business owners position their businesses for success, they should keep the idea of “crawl, walk, run” in mind. Taking one step at a time when establishing a brand identity lays the foundational identity groundwork before moving on to more sophisticated marketing efforts. Small business owners do not have to be designers, marketers and technologists to be successful at marketing; they just need to find the right tools to make their marketing tactics simple, accessible and affordable.

6—How Risky is the Merchant Cash Advance Industry?

A new special report from the folks at NerdWallet small business says merchant cash advances are the most controversial form of online small business lending. Next year, it reports, the federal Consumer Finance Protection Bureau (CFPB) is expected to turn its attention to small business online lending.

The CFPB moves follow a May U.S. Treasury report calling for vigilance in this space and U.S. House subcommittee hearings in July. Later this year, Illinois legislators will debate a bill that would create the nation’s most stringent rules on alternative business lending; California and New York are studying if they should strengthen regulations on the industry.

The report details:

- How MCAs compare to other forms of business lending on interest rates. (MCA’s effective APR can top triple-digits—far higher than other small business financing).

- While the MCAs officially prohibits multiple “stacking” of loans, in practice the industry perpetuates this debt cycle.

- Like payday loans, minority-owned businesses appear to be targets of this form of predatory lending.

- How the brokers who sell MCAs earn large commissions but are not licensed, so “becoming a broker is as easy as imagining that you are one.”

- Small business owners often don’t understand the terms of onerous repayment schedules, taking on more debt than they can afford.

This special report anchors NerdWallet’s new MCA educational portal, which includes :

- Profiles of small business owners who ran into MCA debt trouble.

- A breakdown of how MCAs work.

- A look at Ondeck as a major player in online small-business lending.

- A calculator to help small business owners determine the real cost of MCAs.

7—Holiday Season Concerns

According to the latest Small Business Index from Office Depot the primary holiday season concerns for SMBs are cash flow (32%) and productivity (23%). The Index also reveals that 30% of business owners think their companies could benefit from hiring temporary employees during the holidays. Of these businesses, 87% plan to hire temporary employees.

Taking time off to recharge is also critical so small business owners don’t burn out during the hectic holiday season. Only 27% of business owners plan to work during the holidays.

Office Depot offers these tips to help you better enjoy the holiday season:

- Develop a plan prior to the start of the holiday season to ensure tasks are completed and business operations stay on schedule. [Given the timing—you need to work on that plan this week.]

- Hire seasonal staff to help with increased business needs and to allow for full-time employees to take time off during the holidays.

- Take time to unplug from work and spend quality time with family and friends.

8—Get a Jump on Your Holiday Email Marketing

Sure it’s the season to market to your customers, but how can your small businesses cut through the noise and optimize for engagement? November 2 marked what GoDaddy calls “Head Start Day”, which it says is the best time to launch your holiday marketing efforts.

While November 2 was a few days ago, don’t worry, the first two weeks of November see the highest engagement for holiday emails. But, warns GoDaddy, you should “be wary of sending holiday emails tomorrow (Tuesday), election day.

Eric Gilbert, the director of GoDaddy Email Marketing, says when it comes to email marketing, “Black Friday and Cyber Monday might seem like the perfect days to send promotional emails, but small businesses should proceed with caution. With higher sending volume comes lower email open rates.” Gilbert also suggests you pay attention to

Snappy subject lines matter—especially on mobile. With mobile device usage on the rise, consumers are scrolling through inboxes and reading email subject lines on-the-go. Recent GoDaddy data shows over a ten-day period, 46% of customers opened marketing emails on a smartphone or tablet. The decision to open an email is made rapidly, so make your first impression count with snappy subject lines and pre-header text.

9—Access to Capital Resources for Small Business Owners in South Florida

The “Connecting Minds” program is bringing together leaders from the Small Business Administration, Accion and small business owners to discuss resources and options available in South Florida. Accion recently received a $250,000 grant from JPMorgan Chase to help increase their capacity to serve more micro and small business owners locally. If you’re in the area you can attend a free breakfast and hear a 2017 Economic Outlook keynote from Chase chief economist Anthony Chan. The event is Thursday November 10th, from 8:00 to 10:30 am at the Rusty Pelican at 3201 Rickenbacker Cwy. In Key Biscayne. You can register here.

10—The Check is No Longer in the Mail

Viewpost, a secure B2B network for invoicing, payments and real-time cash management, recently announced results from its The Check’s No Longer in the Mail Study, which surveyed entrepreneurs and finance professionals in companies between $1 million and $500 million per year in revenue. The survey discovered electronic payments is the preferred method of payment by 51.6% of those surveyed and is close to replacing paper checks as the number one method of payment (paper’s at 37% versus electronic at 35%) for businesses—highlighting a migration that is helping to solve age-old problems with using antiquated payment solutions.

Nearly three out of four executives have embraced some form of electronic payments:

- 30% say they have moved to both electronic payments and electronic invoicing

- 9% have moved to electronic payments.

- 36% are in the planning stages of implementing electronic payment

- 57% claim they would never move to electronic payments

Why Use Electronic Payments?: The most common reason for moving to electronic payments for most surveyed (64%) is that it makes bill payment quicker and more efficient. That was followed by 24/7 access to payment information (16.4%). Less than 5% of entrepreneurs used electronic payments for environmental reasons.

Bank Account Connected to Payables and Receivables: 60% of entrepreneurs admit banks could lure them away with offers on electronic payments and invoicing. For example, 34.8% say they’d consider opening a new bank account if it included the ability to send and receive electronic payments. Plus, 80% believe integrating their bank accounts with invoicing and payments would give them better cash flow management. Electronic invoicing was a lure for 15%. Plus:

- 40% expect to pay nothing extra for an electronic invoicing and payments service

- 2% expect to pay per transaction with no monthly fee

- 13% expect to pay between $1 and $9 monthly for unlimited electronic invoicing and payments.

- Almost 10% expect to pay between $10 to $49 for unlimited electronic invoicing and payment

- 23% expect to pay between $50 to $99 for unlimited electronic invoicing and payments

The Truth About Paper Checks

- 100% write paper checks for their businesses, mostly because (41%) some suppliers don’t accept electronic payments.

- 20% trust paper checks because there are no hidden fees

- 10% say paper checks create a better paper trail.

- Other reasons for sticking to paper included ease (8%), floating checks when short on cash (1.8%) and not trusting technology (1.5%)

When they hear “the check’s in the mail”:

- 6% wish they could digitally track the payment online like a FedEx package

- 4% wish they could call the person’s bluff by requesting a check number and postage date by phone

- 5% ask other suppliers if they’ve had a similar experience

- Others charge interest, stop shipment or withhold services

11—The Future of Retail

In the United States, ecommerce sales during the second quarter of the year grew nearly 16% year-over-year, according to the U.S. Department of Commerce. According to a new survey by ACG New York, the largest association of middle market deal making professionals in New York, that growth is not expected to slow anytime soon. The ACG New York’s Retail Middle Market Survey shows 97% of respondents recognize retail companies need a digital component in order to create a clear path to value creation for private equity firms.

Specifically, 66% believe private equity firms should be investing in user-friendly ecommerce portals to grow their portfolio companies in the retail sector. Richard Baum, ACG New York board member and Managing Partner of Consumer Growth Partner says, “While we recognize the continuously growing digital marketplace and the challenges traditional brick-and-mortar retailers face, the reality is consumer demographics are also changing. Of particular interest is that 33% of those surveyed are concerned about spending habits of Millennials, many of whom prioritize experiences over purchasing material items.”

Unanimously, those surveyed predict loss of market share for traditional retailers due to the rise of ecommerce. Furthermore, 41% indicated that in order to remain relevant, companies need to improve their overall shopping experience for consumers. And 35% believe failure to adapt to the digital marketplace will be the biggest challenge facing traditional brick-and-mortar companies in today’s retail environment.

12—Online Small Business Lending Platforms Unveil SMART Box

The Innovative Lending Platform Association (ILPA)—consisting of the nation’s three largest online small business lending platforms OnDeck, Kabbage and CAN Capital—in partnership with the Association for Enterprise Opportunity (AEO), a leading advocate for microbusiness in the United States, recently launched the SMART (Straightforward Metrics Around Rate and Total cost) Box™, a first-of-its-kind model pricing disclosure and comparison tool focused on empowering small businesses to better assess and compare finance options.

The SMART Box tool was developed in response to a need for common verbiage and standardization in pricing disclosure in small business finance. The SMART Box presents small businesses with a table of standardized pricing comparison tools and explanations, including the total cost of capital (TCC) and annualized percentage rate (APR).

How the SMART Box works:

There are currently three versions of the SMART Box disclosure—for term loans, lines of credit, and merchant cash advances—that take into account the differences between the products, while still utilizing common pricing metrics and calculations, as well as standardized language.

13—Record High Optimism for America’s Small Businesses

The Small Business Growth Survey, conducted by Bizfi, a fintech company, found 87.5% of small business owners are investing more in their businesses in 2016 than 2015. Of those business owners who will be investing, 91.4% plan to borrow funds to do so, 38.3% plan to borrow between $10,000 and $40,000, and 37.5% plan on borrowing more than $40,000.

Alternative Finance is the Most Popular Financing Option: When it comes to accessing growth or working capital, 67.6% of small business owners prefer alternative financing over other available options, including traditional bank loans. In fact, 20.7% plan to access short-term financing, 31.53% borrow funds from a local bank and 27.9% plan to use a credit card or line of credit.

Business Owners are Hiring & Need Capital for Growth: 61.7% are borrowing funds for working capital. Of those, 38.3% will use the money for marketing, 38.3% will invest in inventory and 30.9% will use the funds to hire employees. In addition, 42.9% of business owners plan to expand locations this year, and of those borrowing money, 22.3% are doing so to add locations.

Small business owners are also investing in equipment to grow and improve their companies and operations: 57.8% are investing in vehicles, technology and industry specific equipment. Of those, 82.9% of business owners are opting to purchase the equipment outright, as opposed to leasing. And 53.7% are investing in software.

Cool Tools

14—WordPress Websites

GoDaddy recently released WordPress Websites, an easy way for those looking to build a WordPress website to get up and running quickly. The new offering features an exclusive WordPress Quick Start Wizard that simplifies the website creation process to get people started quickly, plus free, high-quality images for virtually any industry. It also includes professionally built premium themes, and a Visual Page Editor for easy drag and drop customization. Since it’s built on WordPress, the world’s most popular tool for creating websites, businesses have the ability to add new site features using the tens of thousands of free WordPress plugins that are available.

With the Quick Start Wizard, you can quickly get started choosing from various themes and layouts which include essential pages and features (e.g. blog, photo gallery, contact form, social integration with Facebook, Twitter and more) and access to a library of thousands of free images. From here, the Visual Page Editor allows you to edit text, drag and drop columns and rows, and insert images directly onto your page.

During the beta release, more than three times as many customers were successful in publishing a website and the average time to publish a site decreased by 73%.

You can read more about it here.

15—Manage Your Website Mobilely

Wix.com recently launched the Wix App for iOS and Android, which allows users to manage their websites and Wix operating systems on the go, wherever they are, in order to run their businesses in real time. The app reflects customer demand for robust mobile functionality.

Wix App is part of the larger Wix OS solution which enables users to create, manage and market their businesses anytime and anywhere. Wix App is an interface that streamlines the day-to-day mobile management that businesses need to operate ecommerce, marketing, customer service and communications with global customers and visitors. You can use the Wix OS to manage your mobile site, contacts and Wix Stores.

Features include:

- Engage with Visitors: Get real-time notifications when visitors send a message, book an appointment and more. Wix Engage makes it easy to respond right away.

- Start a Live Chat: See when you’ve got a site visitor and start a conversation to help them find exactly what they’re looking for.

- Manage Your Store: Snap a product photo and add it to your online store with just a click.

You can download Wix App for free in Google Play and in the App Store.