22 Things Entrepreneurs Need to Know

By Rieva Lesonsky

1—9 Ways to Focus a Wandering Mind

It’s probably no surprise that the human mind has a tendency to wander. But there are scientific reasons it’s so easy for us to lose focus. Next time you’re feeling a little distracted, try out some of these techniques in the infographic from On Stride Financial to learn more.

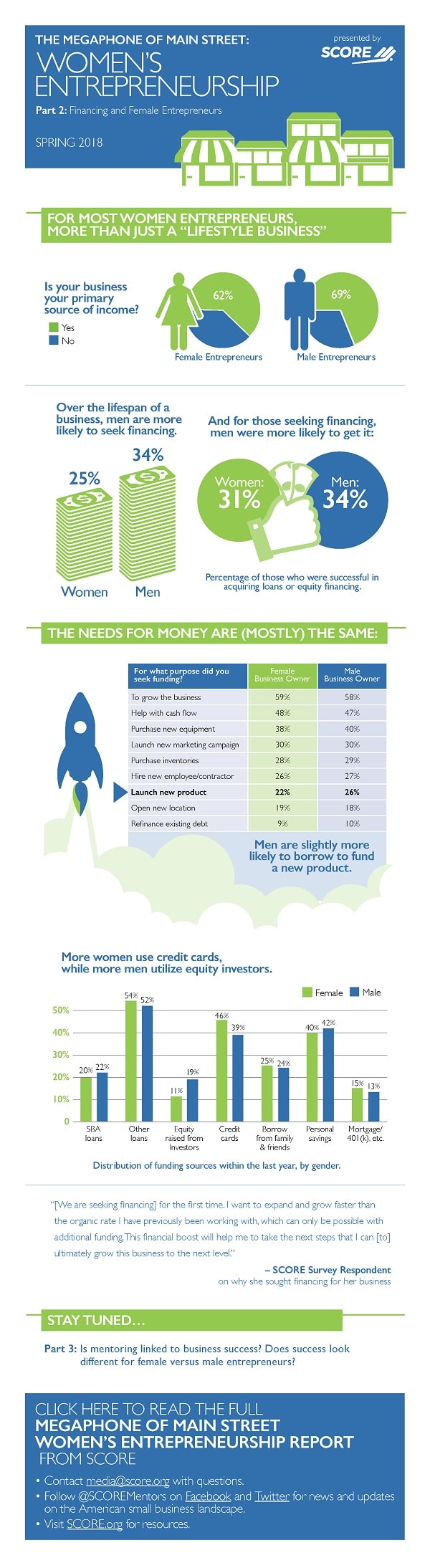

2—Entrepreneurial Women Face Financial Obstacles

According to a new report from SCORE, mentors to America’s small businesses, women entrepreneurs are less likely than men to seek and obtain financing, even though they are starting businesses faster than men, and their businesses are just as successful in terms of business starts, revenue growth, job creation and longevity. This difficult financial climate for women entrepreneurs makes them more likely than men to rely on credit cards as a source of business funding.

Key findings:

- 62% of women entrepreneurs depend on their businesses as their primary source of income, challenging the assumption that women entrepreneurs are more likely to run “lifestyle businesses”

- Over the lifespan of their businesses, men are more likely to seek financing (34% of men; 25% of women)

- Among all business owners seeking financing, male entrepreneurs were more likely to receive it (34% of men got loans or equity financing in the past year, compared to 31% of women)

- Reasons for seeking financing were similar across genders, with one exception: Men were more likely to seek financing to launch a new product (26% of men vs. 22% of women)

For more information, download The Megaphone of Main Street: Report on Women’s Entrepreneurship and check out the infographic below.

3—Women in the Independent Workforce Report

Speaking of women entrepreneurs, the Women in the Independent Workforce Report, from FreshBooks shows self-employed women earn 29% less than males—compared to 22% less for full-time employees. Here are some highlights:

Up to 13 million women plan to become self-employed by 2020

52% of women say they can’t reach their full potential as employees and 63% believe self-employment will help advance their careers faster—proving women turn to self-employment as a form of empowerment.

Yet, self-employed women earn 29% less than men

On average, male freelancers earn $77,540, while the women earn $56,184. That 29% wage gap could pay for two and a half years of food and groceries for the average American.

20% of women are forced to charge less than men

Women freelancers say, to keep clients they have to charge less than their male equivalents. Another 30% say they have to work harder than men who do the same work.

33% of self-employed women have experienced discrimination

Another 30% say they’re not taken as seriously as their male peers—meaning self-employment doesn’t bring an end to gender discrimination.

FreshBooks will also be releasing a Wage Gap Calculator in the coming weeks to further empower self-employed women with data to charge their full worth.

4—How to Make Your Infographic Stand Out

Infographics are still effective ways to communicate your message. (Notice we always lead this column with one.) But do you know the latest infographic trends? The infographic specialists at Visme say we should know about :

- The new square infographictrend on Instagram

- Isometric infographics have 3D elements in them

- Infographics with real-life objects

For more, check out their infographic (naturally) below.

Created with Visme

Read more at http://blog.visme.co/cool-infographics/#7L0BBLk8LLeo1iFL.99

5—How Businesses Use Content Marketing & Social Media

The Manifest recently reported on two important marketing topics. First, they looked at how businesses use content marketing. They discovered:

- 53% of businesses spend time and money on content marketing

- 51% of the businesses that invest in content marketing, publish content daily

- The most popular content: videos (72%), blog posts (69%), and research and original data (60%).

- Marketers identify creating more original content (22%) and making content more visual (22%) as the top ways to improve content.

They also looked at how small businesses plan to invest in social media in 2018. They learned:

- 92% of small businesses plan to invest more time and money in social media in 2018

- Most small businesses want to increase their investment in Facebook (58%), and the recent Cambridge Analytica scandal isn’t slowing them down.

- The most important metric for tracking the success of a small business’s social media efforts is engagement (20%).

- 46% of small businesses use paid social media advertising and are shifting their budgets from more traditional forms of marketing

- Small businesses use a variety of resources for help with their social media efforts, including in-house staff (53%), social media management software (33%), freelancers/consultants (33%), and digital marketing or social media marketing agencies (24%).

6—Small Businesses Have Major Growth Plans

Expansion is on the agenda for small business owners (SBOs) in 2018, with more than half anticipating revenue growth and 22% planning to hire staff, according to the 2018 Small Business Survey conducted by TD Bank, America’s Most Convenient Bank®. This is considerably better than last year, when 46% of business owners expected to increase revenue and just 9% had plans to hire.

But, to help fuel this growth, 46% of the SBOs surveyed say they either have or will apply for credit in the next 12 months, compared with 21% in 2017. Federal Reserve interest rate hikes may be affecting SBO’s credit plans, however, with 27% stating rate changes are spurring them to seek credit sooner or to refinance current debt.

“It is encouraging that a large portion of SBOs plan to seek credit this year and expand,” says Jay DesMarteau, Head of Commercial Specialty Segments, TD Bank. “Banks can work with business owners on solutions that make sense for their needs and provide insights into how business and personal credit and income can impact their financial future.”

Tax reform may not be a major boon to small businesses, with nearly half of respondents saying the Tax Cuts and Jobs Act provisions will not benefit their businesses. Among those who do plan changes in business investments due to tax reform:

- 15% expect higher earnings

- 14% will use extra capital to pay down debt

- 13% plan to integrate new technology

- 13% will purchase new equipment.

Although SBO optimism is high, they do face some challenges: the health of the national economy (27%); tax reform (20%); inflation (14%); and rising interest rates (13%).

Another challenge is what to do at the end of their entrepreneurial lives—52% don’t have a retirement or succession plan for their businesses, up from 47% in 2015, a number that rises to 63% for business owners 55 and older.

7—State of Customer Management

ProsperWorks, the CRM recommended and used by Google, just announced a new study that measured the attitudes of sales and marketing professionals toward the state of customer management and the state of CRM innovation. The new report, The State of Customer Management in the Relationship Era, shows today’s digital workforce isn’t satisfied with the rate at which CRM technology is evolving to align with fast-growing technology advancements and user demands. The survey also shows more teammates are involved in managing customer relationships than ever before and communication between sales teams and customers has grown less formal with the rise of chat apps and mobile technology.

The findings show the way companies interact with customers is changing, but CRM technology is too manual, has not evolved and is not focused enough on fostering relationships. It’s no surprise nearly 50% of respondents think innovation of CRM should be quicker. The survey also found that:

Customer communication has grown less formal and more collaborative: The sales relationship is no longer a one-to-one interaction. According to the survey, 63% of survey respondents say three or more teammates are involved in customer relationships, proving it’s a more collaborative, relationship-focused effort. The form of communication between sales teams and customers has also shifted from in-person meetings to informal chat apps and mobile technology with 44% using chat and Slack. However, there is still heavy reliance on email to communicate—66% of respondents say 40% or more of their customer communications happen via email.

CRM technology isn’t keeping pace: 77% of respondents still use spreadsheets to track customer data—a reflection that CRMs are not addressing the needs of today’s users. Furthermore, data entry (48%) and keeping data up to date (52%) are the biggest problems today’s workforce faces with CRM systems because it is still a very manual task. These time-consuming, manual tasks are stopping sales teams from focusing on what matters most: fostering the relationship and closing the deal.

Sales teams are looking for automation: The lack of automated tools are dictating processes and 80% of respondents still manually enter and update contact and account info. Users are spending too much time in CRM systems, with 57% using it all day, every day. It’s no surprise that organizations are still looking for the right fit—more than 56% say they’ve used three or more CRM tools in their careers.

“Today’s business users want tools that make their lives easier, deliver a consumer-like experience and fit within the way they live and work. Current CRM tools are clearly a burden of admin-ridden tasks that are negatively affecting customer success, customer support, marketing, finance and operations and more,” says Jon Lee, cofounder and CEO of ProsperWorks. “We’re in an age where automation and collaboration can help team members be more customer-centric and focus their time on nurturing the customer relationship, all while bringing more value to the organization.”

8—B2B Buying Disconnect

For the latest version of the B2B Buying Disconnect, TrustRadius surveyed technology buyers and vendors to get deeper insights into the B2B purchasing process. It found there is still a significant trust gap between buyers and vendors, especially when it comes to understanding what a product really can—and can’t—do.

Key findings include:

- 85% of vendors believe they are open and honest about their product’s limitations—only 37% of buyers agree

- 23% of buyers say their vendors were highly influential in their purchasing decisions. Those vendors were twice as likely to embrace authenticity than the rest. Of the buyers who worked with a very influential vendor:

- 56% say the vendor was upfront about product limitations, vs. 31% of buyers with less influential vendors

- 50% say the vendor provided customer evidence like reviews and case studies, vs. 27%

- 42% say they were connected with customer references, vs. 20%

- 84% of buyers say they are willing to share their perspectives with prospects. There is potential for 2x participation in advocacy programs, but vendors need to ask.

9—Top Tech Uses for Small Businesses

Capterra, a leading online resource for business software buyers, recently released its findings from a survey across 14 industries on what software small business owners should invest in now and what software they can put on the back-burner. Designed to help SMBs set their purchasing priorities, a key takeaway from the Capterra survey shows SMBs need to invest in data security—right away.

Customer relationship management (CRM) software is essential to most businesses, but depending on the company, blockchain and business intelligence may not be a significant option—at least not immediately. While small business investments are determined by a complex combination of factors that are unique to a company’s goals and circumstances, the survey results and analysis are a “pulse checker” on the SMB market in general and vital to small business owners.

The landscape now: security and cloud technologies drive today’s small businesses

Among the technologies already implemented in SMBs, the survey shows small business owners need to invest in data management or information security solutions with only 68% currently using data and information security technologies. “The SMB community must commit to 100% participation in security management in order to stop data breaches,” says Tirena Dingeldein, senior analyst and content manager, at Capterra. “Hackers are increasingly sophisticated in their attacks,” says Dingeldein. The implementation of policies to increase oversight of data and information security—such as the General Data Protection Act (GDPR)—also pose a serious risk to small businesses that risk losing money, on top of any potential hacks, if they do not protect their data correctly.

The survey also shows 59% of respondents currently use cloud computing for their businesses. For businesses that have yet to implement cloud strategies into their technology objectives, Capterra advises to watch for these indicators as a sign that it’s time to transition to a cloud solution:

- Budget for maintaining systems in-house is increasing

- More time is spent waiting for data to populate than using it for work

- The existing data filing system has outgrown what its in-house solution can handle

CRM tools needed to scale business growth

Most respondents (73%) say CRM software is critical to their organization, yet only 56% currently use a CRM tool. “After data and information security management tools, SMBs should make CRM technology their next tech investment,” says Dingeldein. “CRM software is the way successful businesses nurture their customers and open up their sales funnels. Without CRM, small businesses risk time and resources used to build customer relationships.”

For business owners who have yet to adopt a CRM tool, “the survey shows while a majority of business owners are interested in CRM tools, delay in adoption is often a result of not yet finding the right tool that fits their needs,” says Dingeldein. Dingeldein also suggests SMBs explore free or open source CRM if their budgets don’t allow for paid versions.

Blockchain is the hype but not necessary—yet

Surprises in the survey include much talked-about blockchain: 54% of the respondents currently using, planning or evaluating blockchain say it’s beneficial but not necessary for conducting business. “Blockchain may not be a necessary requirement right now, but it should also not be discounted for future consideration,” says Dingeldein. “It is predicted that blockchain will have a significant impact on small businesses in the next ten years.”

Results also show 28% of respondents currently using, planning or evaluating chatbots don’t think they’re necessary to conduct business. However, as businesses scale, owners may need to reconsider the value and efficiency chatbots bring.

To learn more about the finding, check out Tirena Dingeldein’s blog, “Tech for Small Businesses: What Your Peers Are Using.”

10—State of Black America

The National Urban League’s annual State of Black America report, which evaluates the social and economic status of African Americans using an Equality Index, this year includes a Digital Inclusion Index that quantifies Black America’s participation in the digital revolution.

Fortunately, the digital revolution is still in its youth and ripe with potential for Black Americans. While it has positioned itself such that the barriers of entry are few and low, the findings of the National Urban League’s 2018 Digital Inclusion Index are unambiguous: We must separate the signal from the noise, says National Urban League President and CEO Marc H. Morial.

The Digital Inclusion Index answers the question: Are the new job, business and educational opportunities created by the increased digitization of our world being equally shared? It is calculated based on three values: digital skills and occupations (35%), digital access (35%) and digital policy (30%). The report found African Americans are far less likely than whites to be employed at social media and technology companies—less than 5% of the workforce vs. more than 50% for whites. Less than 6% of total Black employment in 2017 was in the tech industry, vs. 8.5% for whites.

Technology is a study in contrasts for Black America, Morial says. Black families continue to remain less likely than white families to have dedicated internet access at home, yet African Americans are the second-largest multicultural group, after Asian Americans, for mobile device ownership, with 91% owning smartphones. Black millennials are influential, leading users of mobile technology and platforms, and voracious consumers and creators of digital content, but lag behind in tech employment.

Quick Takes

11— If a Natural Disaster Strikes

I am always surprised, despite all the warnings, how many small businesses are not prepared in case a natural disaster strikes. According to CoverWallet, the Federal Reserve Banks of Dallas, San Francisco, New York, and Richmond recently released a report about the effects of natural disasters on small businesses.

The report shows in FEMA-designated areas, 40% of businesses reported natural-disaster related losses, and 35% reported losing more than $25,000 in revenue. Unfortunately, 27% of small businesses in these areas with natural disaster-related losses had no insurance coverage. Additionally, 65% of affected businesses lost power or utilities, but only 17% of affected firms had business disruption insurance at the time of the disaster.

Obviously, a natural disaster can also destroy your business, so make sure you’re covered—just in case.

12—Facebook Ads

If you need helping making sure your Facebook ads will deliver, check out Connectio’s, E-Commerce Facebook Ads Done Right: Why Hustling Is Key (With Case Studies!), which features actionable tips and case studies.

13—Gift Cards & Registries

If you offer gift cards at your business, check at these tips for leveraging gift cards, prepaid programs and subscription services to help build brand loyalty from First Data:

Rethink the traditional gift registry: What can you get for the couple that has everything? Businesses can help wedding guests find the perfect present by offering prepaid experiential gifts, like the Domino’s wedding registry, which provide unique options for couples more interested in food or experiences than the classic gravy boat gift.

Go beyond the single sale: Prepaid gift options that provide an unlimited amount of goods or services over a specific time, such as Olive Garden’s Never Ending Pasta Pass, are marketing tools that help increase foot-traffic while building loyalty to a specific brand.

Offer product or service subscriptions: Product or service subscriptions are a hassle-free, personalized gift option that’s easy to send from far away or in-person. Businesses can customize their offerings to create a fun subscription package, offering everything from food and entertainment packages to flowers and beauty items. The commitment of a subscription service also greatly reduces the chance a subscriber will turn to one of your competitors for the same product or service.

14—Online Marketplace

Shopping can be a worthwhile activity. It can help better our communities, the environment and society. Did you know 70% of our economy is made up of consumer spending? And $73 of every $100 spent at a local business stays in that community.

Meet Spendindie, an online marketplace where consumers can shop with independent and local businesses, helping keep money in our local communities. The company, which launched at SXSW in March, features businesses from across the country, and rewards shoppers for discovering and promoting their favorite local finds. The platform enables consumers to shop by cause if a topic is especially close to them.

15—Need Help Growing Your Tech Startup?

If your company (especially if you’re a startup) needs some help developing brand growth strategies, you might want to check out SourceCode Communications, which provides brand growth communications programs. SourceCode can help drive thought leadership and support customer acquisition strategies.

- Strategy & counsel

- Media relations

- Media training

- Content & amplification

- Messaging & positioning

- Crisis communication

- Issues management

- Influencer relationships

- Research & insights

- Measurement & analytics

Cool Tools

16—DIY Your Logo

Logomaster.ai, a DIY logo maker has built an AI tool to generate logo packages on demand. They say they’ve “discovered the underlying attributes of different fonts, icons and shapes,” which helps you create a more effective logo.

Packages start at $20, far cheaper than hiring a designer. Since the company launched last year, they’ve already helped more than 3,000 founders create logos, using their collection of over one million icons and 800 fonts.

Up till now, all logos have been designed by AI. However they’re introducing the option to have the logos retouched and refined by their human design team.

17—Creating Content Campaigns

Content is key to success in email marketing, but, as Campaigner says, it’s often easier said than done. To make it easier, they’ve just launched an “Articles” feature, so marketers can craft brand consistent campaigns with customizable elements within Campaigner’s platform, in tandem with their templates and Landing Pages.

Articles gives you the ability to create your own design elements in HTML while ensuring your code remains dynamic and adaptable across all campaigns. Instead of building components like headers and footers with each message, Articles allow marketers to easily customize these elements in HTML and save them for reuse in upcoming messages and campaigns.

With Articles, marketers are able to spend more time curating, rather than developing, content. Instead of editing complex blocks of code each time they create a new campaign, marketers can now browse their library for Articles to insert seamlessly into existing content.

18—Outsourcing Customer Service

We all know how important reliable and responsive customer service is a necessary element of any successful business. And yet, according to a 2018 Customer Service Benchmark Report, 62% of companies (mostly small businesses) don’t respond to customer inquiries in a timely manner.

If you own an e-commerce business, and are looking for a customer service solution, check out Simplr, which was incubated and funded by Asurion, a global leader in customer service.

The premise behind Simplr is simple: “rapidly expand the customer service capacities of e-commerce businesses with speed, empathy and precision. Simplr developed a simple formula that combines knowledgeable, on-demand customer service manpower with machine learning and customized client dashboards that give businesses the ability to invest in a customer service solution that’s high quality, affordable and scalable.”

How Simplr works

First, the Simplr team analyzes and evaluates a company’s customer service approach, history and messaging to get a complete understanding of the brand’s needs and voice. Next, it trains and supports a screened and on-demand team to respond to customer inquiries; the expert staff capacity is augmented with Simplr’s unique blend of machine learning and intelligent platforms that vet inquiries and give experts the resources they need while helping each customer.

19—Pinterest and Hootsuite

Hootsuite just announced a partnership with Pinterest resulting in the native integration of Pinterest into the Hootsuite platform. As shown in Hootsuite’s 2018 Social Trends Report, using images to engage customers and followers is vital to social engagement. Now, all Hootsuite customers can schedule and publish content directly to Pinterest.

More information regarding Hootsuite’s integration with Pinterest can be found here.

20—Social Media Subscription

If you want to keep current on social media check out the newest offering from full-service social media agency McLernon & Co. They just launched the & Co. Collective, which is four live and recorded workshops and consulting services, available for $37 per month to subscribers.

McLernon & Co. saw a gap in training solutions for marketing managers. & Co. Collective will offer updated information on the ever changing social media algorithms and landscapes. The Collective is open to anyone who wants to learn more about social media, and is at the 101, 201 or 301 levels. Business owners, marketing professionals and bloggers are encouraged to enroll.

21—Online Banking & Budgeting Tool

Simple, an online budgeting and banking tool, just created what it calls “the ultimate financial de-stresser: the Simple Emergency Fund for when #LifeHappens.” Simple says 72% of Americans say they were stressed about money at some point during the past month (APA). Their goal is for people to “add ‘financial self-care’ to their list of to-do’s.” Simple’s Emergency Fund feature is designed to set aside money for you each month in case you ever find yourself in a sticky situation.

22—Preventing Data Breaches

Intersections Inc., provider of Identity Guard®, the industry pioneer in identity theft protection services, recently launched Data Breach Readiness, the first comprehensive data breach preparedness solution for SMBs.

“The most devastating impacts of a data breach can only be avoided by both working to prevent a breach and by planning and preparing a response before an incident occurs,” says Jerry Thompson, Senior Vice President, of Intersections. “Identity Guard has helped companies manage data breaches for more than a decade, and we’ve distilled that experience into a robust package that helps businesses prevent or—in the worst case scenario—manage a breach.”

Businesses of all sizes face challenges in safeguarding their critical information. SMBs often lack the internal resources to dedicate towards preparedness, making them attractive targets for hackers. According to Small Business Trends, 43% of cyberattacks are aimed at small businesses.

Smart organizations are increasingly focusing on proactively identifying data breaches and preparing to efficiently react to them in advance of a data breach crisis. Identity Guard’s Data Breach Readiness service includes direct access to Delta Risk LLC, a Chertoff Group organization, which provides ongoing network assessments to identify potential vulnerabilities. Monthly scans help ensure early detection and resolution of developing security concerns.

For more information about Identity Guard’s Breach Readiness, go here.