By Amad Ebrahimi

With all of the recent changes to the tax code, the whole concept of business tax deductions can be confusing and daunting. According to QuickBooks’ recent study, small business owners have mixed feelings about the TCJA tax reform. 32% of business owners think the reform will benefit their business, while 19% said it will poorly affect business — and 22% have heard about the changes to the tax laws but have no idea what the impact will be.

Whether the recent tax reform is for the better or worse, we can shed a little light on what these laws actually mean. Here is a brief overview of the main tax code changes that will affect small businesses and their deductions this tax season.

20% Qualified Business Income Deduction

Certain types of small businesses, such as sole proprietorships, S corporations, and partnerships, may qualify for a 20% income deduction. Since with these types of businesses the business income “passes through” to the individual business owner’s income for tax purposes, the tax reform allows these individuals to deduct 20% from their total income.

There are many rules and regulations about how this tax break works, so talk to your accountant to see if you’re eligible.

Bonus Depreciation

You can now depreciate 100% of certain expenses instead of only 50%. The IRS says:

The new law increases the bonus depreciation percentage from 50 percent to 100 percent for qualified property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023. The bonus depreciation percentage for qualified property that a taxpayer acquired before Sept. 28, 2017, and placed in service before Jan. 1, 2018, remains at 50 percent.

This applies to fixed assets like:

- Vehicles

- Computers

- Software

- Machinery

- Equipment

This law also lets you depreciate farm equipment over five years instead of seven.

No More Entertainment Deduction

In past years, business owners could deduct 50% of entertainment expenses related to their business. Now you can no longer write off entertainment expenses and many people are still unclear on whether or not you can continue deducting meals.

Paid Family/Medical Leave Deduction

For 2018 and 2019, businesses offering paid family leave or paid medical leave to their employees can qualify for a deduction.

While this isn’t an exhaustive look at the TCJA reform by any means, these are some of the most pertinent changes to what your business is potentially allowed to deduct for 2018. You can find a more comprehensive overview of small business tax information and deductions here.

What Is A Deduction?

The one thing that hasn’t change is the nature of deductions. A deduction is a business expense that you can use to reduce your total taxable income. According to the IRS, expenses that qualify for deduction must be “both ordinary and necessary.”

The IRS further explains:

An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.

Small Business Tax Deductions

Here is a partial list of some of the most common tax deductions available for small businesses. Note that not every business will be eligible for every type of deduction.

- Qualified Business Income Deduction: Sole proprietors, S corporations, and partnerships with pass-through income may be eligible for a 20% deduction on their total income.

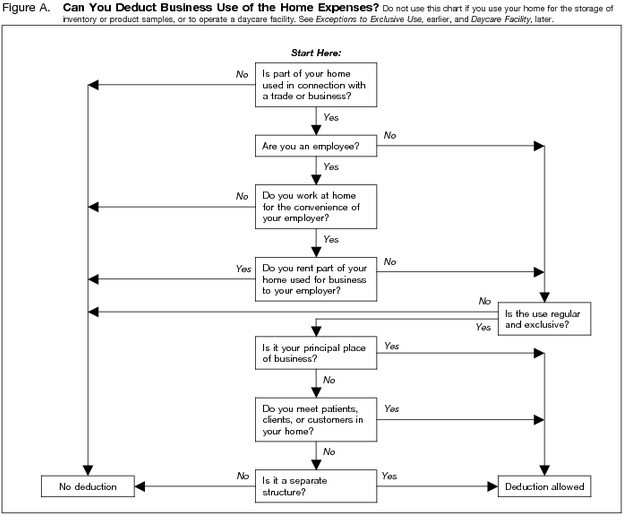

- Home Office: If you have a separate space in your home that is exclusively used for business, then you may be eligible for a home office deduction. This deduction is based on the size of the space and can be calculated via a simplified method or on a supplementary tax form. The simplified method multiplies the square footage of your office by $5 for your total deduction. Or you can use the more complex calculation form. To see if you qualify for a home office deduction, consult the chart below (borrowed from the IRS).

- Car & Truck Expenses: Car and truck expenses can be calculated in two ways: by the standard mileage deduction or by actual expense cost. You can either track your miles and get 54.5 cents per mile (according to the 2018 standard mileage rate), or you can track vehicle expenses (including gas, oil changes, maintenance and repairs, tires, registration, license, insurance, parking fees, garage rent, etc.). Carefully consider how you use your vehicle to ensure you choose the right method to get the most money back. With either option, keeping good records is imperative.

- Travel: In terms of travel, transportation between your home and a business destination can be deducted. Transportation via car, taxi, train, etc., is only covered if you are traveling from your lodging to a business-related destination. Additionally, lodging can be counted as a write-off, as well as baggage, dry cleaning, and business calls. You can even count purchasing your passport as an expense if it is purchased for a business trip. Keep good records of all this information to ensure you get the right deduction amount. In addition, you can write off any travel arranged for job candidates being interviewed.

The list of small business tax deduction goes on covering many things from office supplies to internet services and utilities. To see if you’re eligible for a deduction, double-check IRS regulations and always consult with your accountant.

Amad Ebrahimi is an entrepreneur, business owner and founder of Merchant Maverick, a highly successful business and financial review site which has helped over 1 million business grow since 2009.

Tax deduction stock photo by Rawpixel.com/Shutterstock