By Dixie Somers

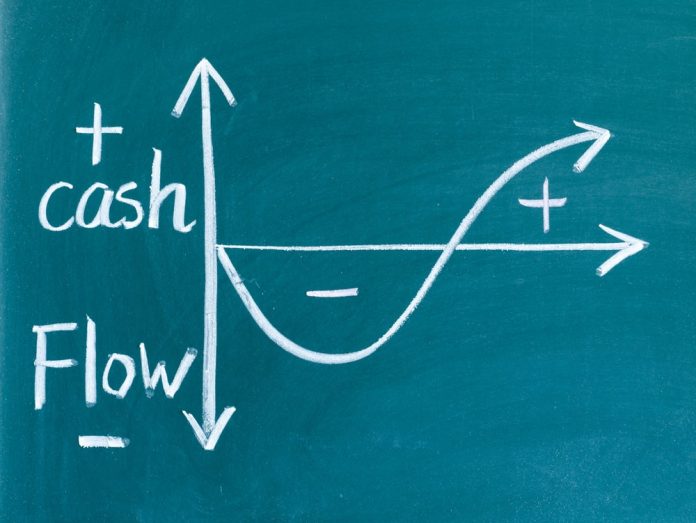

Cash flow is the lifeblood of your businesses. Healthy cash flow equals a healthy business. It allows you to modernize your marketing, offer stellar customer service, and keep inventory on hand to meet your customer’s needs.

Cash flow is a simple concept. You use cash when creating the services or goods you give your customers. Your customers give you more cash than you invested in your product when they purchase it from you. Then the cycle repeats. Here are some tips on how to handle cash flow like a professional.

Use a Cash Flow Budget

A cash flow budget allows you to see the inflow and outflow of cash over a specific time frame. With it, you can prepare a sales forecast for your business. Most cash flow budgets are designed to predict the receipts and disbursements your business should expect every month.

Depending on how your business operates, you may want your cash flow budget to predict inflows and outflows daily, weekly, monthly, or yearly. Business is ripe with uncertainty. Attempting to predict too far ahead could be self-defeating. However, if your budget does not look far enough ahead, you may fail to take the corrective action to keep your cash flow healthy.

Hire an Accountant

You would not attempt to diagnose or treat problems with your cardiovascular system yourself. You lack the needed experience. Most business owners lack the needed experience to diagnose and correct issues with their cash flow. This is why it is recommended that they use the services of an accountant.

Accountants are there to provide accuracy and stability. Businesses like Aggregated Spend ID can be beneficial in helping maintain organized records. Accountants have training that allows them to detect potential cash flow problems and to devise proactive ways of addressing them. Your accountant may be able to help you find solutions before the downside of negative cash flow can be felt.

Proper Record-Keeping and Cash Flow

Proper record-keeping gives you the financial data that allows your business to operate efficiently, thereby increasing profitability. Increased profitability means increased cash flow. When your business has accurate records, with help from HCP expense and invoice integration, both you and your accountant can quickly identify income, expenses, assets, and liabilities. That information can be used when preparing financial statements, including a cash flow projection. These records will give you a clearer picture of how your business is operating, which will benefit you in the long run.

It is good to periodically review how the cash flow of your businesses is doing. No matter how well your business is doing, it would be shortsighted to think that cash flow challenges will not arise in the near future. Keeping a budget, hiring an accountant, and keeping proper records will help you maintain the cash flow needed so that you can move forward with business.

Dixie Somers is an Arizona-based freelance writer. Follow her @DixieSomers.

Cash Flow stock photo by Perfect Gui/Shutterstock