Coronavirus Business Update

Programs

Small Business for America’s Future: A New Coalition of SBOs & Leaders Launches

During the biggest small business crisis of our lifetime, a new survey of more than 1,200 small business owners shows they overwhelmingly feel our government leaders don’t understand small business needs and favor big business over small business, and 54% disapprove of the Trump Administration’s handling of the COVID-19 crisis.

Because of this, Small Business for America’s Future, a new coalition of small business owners and leaders, just launched to elevate the voices of small business to ensure policymakers put in place long-term plans that help small businesses recover and create a more equitable economy for all.

Small businesses across the country are suffering. COVID-19 put into stark relief the importance of small businesses to our country and highlighted the inequities that many entrepreneurs of color face. A recent poll of Black and Latino business owners found just 12% of the owners who applied for aid from the Small Business Administration reported receiving what they had asked for and nearly half say they will be permanently out of business by the end of the year. And the recent protests around the murder of George Floyd have placed a spotlight on long-term racial economic disparities.

Small businesses created nearly two-thirds of new jobs following the Great Recession. The chairman of the Federal Reserve recently acknowledged small businesses as the “principal source of job creation—something we will sorely need as people seek to return to work.”

Unfortunately, an online survey of 1,211 small businesses in Small Business for America’s Future’s network found 81% of small businesses don’t think America’s leaders understand the needs of small business, 84% think our leaders favor big business over small business, and 57% believe the Trump Administration’s policies favor big business over small business.

Small Business for America’s Future, a network of small business owners and leaders, will advocate for policies that will facilitate the creation and growth of small businesses while leveling the playing field with big business. The organization evolved from Businesses for Responsible Tax Reform, which launched in 2017 to fight for small businesses during tax reform. Small businesses are facing a crisis and need a strong voice representing their needs.

“We’re committed to ensuring policymakers at every level of government prioritize Main Street by advancing an economic framework that benefits both small businesses and our employees,” says Dr. Erika Gonzalez, co-chair of Small Business for America’s Future, CEO of the South Texas Allergy and Asthma Medical Professionals and Chair of the San Antonio Hispanic Chamber of Commerce. “Reducing the crushing cost of providing healthcare insurance will be important to ensuring small businesses are strong enough financially while maintaining coverage for employees.”

Small Business for America’s Future is asking policymakers to:

Create a fair and equitable COVID-19 recovery plan that supports Main Street. The survey shows 23% of small business owners have considered closing their business permanently and 12% are facing the possibility of having to declare bankruptcy because of COVID-19. Plus, 53% have new debt related to COVID-19—34% have more than $50,000 in new debt.

Of those small businesses that closed due to shelter-in-place orders and now have reopening costs, 40% are using a Paycheck Protection Program loan to finance those costs. However, 3 in 10 small business owners will dip into their personal savings to finance reopening and 20% will use credit cards to do so. Just 12% will use a bank loan, while 52% have no reopening costs because they didn’t have to close their business.

Correct market failures that have resulted in unbearably high healthcare costs and create affordable options for entrepreneurs and their employees. Most (71%) of the small business owners surveyed say lowering healthcare costs is their top concern.

Common-sense tax policies that put small businesses on a level playing field with large corporations and correcting the failures of the 2017 Tax Cuts and Jobs Act. Post crisis, 69% say creating an equitable tax system is a top concern.

Create programs that promote the economic security of small businesses by addressing universal small business problems that make them less competitive with big business. Access to capital in particular was a top concern for 64% of small business owners.

“Small business owners are feeling abandoned by our leaders at the worst possible time. That’s shameful,” says Frank Knapp, Jr., co-chair of Small Business for America’s Future and President and CEO of the South Carolina Small Business Chamber of Commerce. “ They did their part to help prevent the spread of the virus by closing down. It’s time for our leaders to do their part and address critical issues such as access to capital to make sure our small businesses survive, recover and grow.”

Visa: Powering the Digital Revolution

In an effort to get local communities back to business in the wake of the COVID-19 pandemic, Visa recently announced a global commitment to elevate 50 million small and micro businesses globally. They’re introducing a range of locally-designed programs and solutions to enable SMBs to drive efficiency and sales through acceptance of digital payments, building online businesses and incentivizing neighborhood support.

As stay-home orders result in shopping online instead of in-store, COVID-19 is accelerating the use of digital commerce experiences. How much people spend online is also increasing globally, with spend per active card-not-present cardholder up by over 25% in April, compared to January.

Visa is initially focusing on four strategic areas to promote digital commerce and economic growth, with plans to continue to create products and services as the needs of entrepreneurs change over time. These areas include:

Empowering digital-first businesses: Visa has built localized online resource centers in more than 20 countries that provide tools, partner offers and information on how to start, run and grow digital-first small businesses. Visa is expanding its partnership with IFundWomen providing grants and digital training to U.S.-based Black women-owned small businesses.

Encouraging digital payments: Major shifts in consumer behavior have occurred around the globe, including the overarching need for a touchless experience at the point-of-sale as 90% of shoppers are hesitant to shop in-store due to coronavirus. Visa is working with a range of partners to increase the number of locations where consumers can tap their contactless card or mobile phone. Starting in July, Visa street teams will visit merchants to provide “back to business” kits with new point-of-sale materials, branding, educational resources and special offers. The program will kick off in the 50 largest U.S. cities and expand globally to 15 countries.

Incentivizing neighborhood support: Visa partnerships encourage consumers to shop local and remind them that where you shop matters. The Visa Back to Business Project—an online tool that helps consumers identify businesses that may be open in the wake of the pandemic or a natural disaster—is now live. Visa is teaming up with e-commerce platforms like Shopify, and restaurant delivery companies, including Deliveroo, to reward consumers for spending their money locally.

Developing positioning and policy: The company also announced the formation of the Visa Economic Empowerment Institute (VEEI). This new institute comprised of Visa experts and partners will help address underlying problems and provide insights for SMB growth and closing racial/gender gaps. Key projects in the next six months will address topics including post-crisis recovery and resilience, urban mobility, closing equality opportunity gaps and insights into the gig economy.

LinkedIn: New Features for Small Businesses

Here’s a roundup of all the latest features and resources on LinkedIn for small businesses:

Stay connected to your community with LinkedIn Events

LinkedIn recently integrated LinkedIn Events into the Pages experience to help strengthen relationships with customers, colleagues, and communities by being able to easily create and join professional events. For small businesses especially, Events can be used to keep your customers current on how your business is doing and connect with your communities.

Access relevant LinkedIn Learning courses for free

The social platform is offering free LinkedIn Learning courses through the end of August to help SBOs navigate these challenging times. These courses can help you hone your skills in management, sales, marketing, finance—and most importantly, foster well-being. They’re also launching four new courses:

- Pivoting Your Small Business in a Crisis

- Leading a Small Business Through Crisis

- How to Recession Proof Your Small Business

- How to Adapt Your Small Business in a Recession

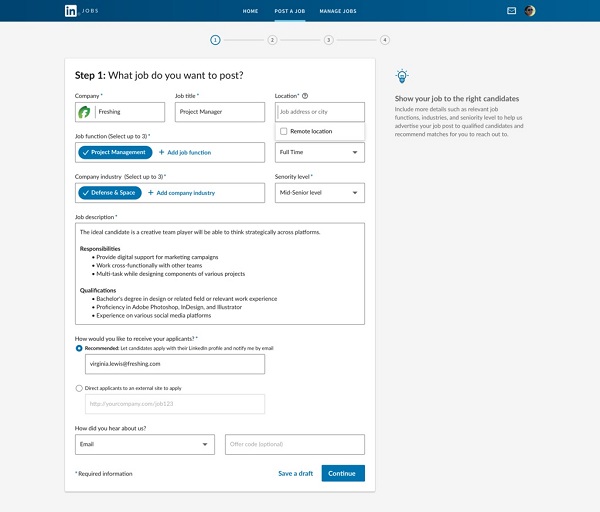

A new way to hire remotely and easily manage job applicants

With the rise of remote work, the location of where you find your next employee(s) may not be as critical of a factor. LinkedIn is rolling out over the next few weeks a new way to be able to set a job post’s location to ‘remote’ with LinkedIn Jobs. This new setting is a quick way to attract job seekers looking for remote work

Plus, they’re introducing a streamlined new candidate management system that’s fully integrated into your familiar member experience on Linkedin.com. If you are actively hiring, you will be able to rate and review job applicants all in one screen to quickly filter down to the most promising candidates. This includes a new video intro feature that helps evaluate a candidate’s communication and soft skills prior to the first live interview. And these hiring tools have been optimized for mobile and built into the LinkedIn app

The redesigned candidate management experience will become available to all LinkedIn Job Posts customers globally over the coming months.

And finally, LinkedIn is offering Talent Hub, their Applicant Tracking System, free of charge for two-years without any additional commitments or requirements.

There’s a lot more information on LinkedIn about resources and tools for small businesses.

Square: On-Demand Delivery for Square Online Store sellers

In this challenging new business environment, it’s more important than ever that sellers have access to the tools they need to sell online quickly, efficiently, and affordably. Square recently announced the availability of on-demand delivery for Square Online Store. Now, with on-demand delivery, Square Online Store sellers can dispatch a courier through delivery partners for orders placed directly on their website.

Traditionally, to enable delivery most sellers list their menu on food delivery platforms because the restaurant doesn’t have its own couriers. This approach is often expensive because these platforms charge a commission to fulfill the delivery. With on-demand delivery for Square Online Store, sellers can take control of their fulfillment process by offering delivery to their loyal customer base directly from their own website.

When an order is placed on the seller’s online store, a courier from the restaurant’s delivery partner is dispatched to the business location, picks up the order, and delivers it to the buyer. The buyer receives text updates with links to live maps to track delivery progress. Sellers pay a flat fee of $1.50 per order to Square, plus a fee to their delivery partner that is calculated in real-time based on distance and other factors. Sellers can pass this fee entirely to the buyer or offer custom delivery promotions. When applied across hundreds of delivery orders each month, sellers can save a significant amount on per-order costs.

Plus, when buyers place an order through Square Online Store, sellers receive their contact information in the Square Customer Directory and are able to maintain sales history for those customers.

Sellers can get started with on-demand delivery powered by Postmates now, with additional delivery partners coming soon. Processing is free on all on-demand delivery orders through July 8, 2020—up to $50,000 in sales.

For additional resources and updates on Square products, see the COVID-19 resource hub.

SHRM Provides Legal Resources

SHRM (Society for Human Resource Management) launched a new product offering for human resource professionals working for small businesses. SHRM LegalNetwork provides businesses with affordable, legal resources during a time when many are especially concerned about legal guidance, compliance, and liability issues. The product will be supported through LegalShield, a long-time provider of legal plans for small businesses.

SHRM LegalNetwork is available to HR professionals representing businesses with 100 or fewer employees. SHRM notes that, “Across the COVID-19 landscape, smaller organizations are the most vulnerable business class, often with little-to-no guidance on managing complex employment laws and liability issues.” SHRM research found that, of the 7 in 10 small businesses seeking outside advice since the start of COVID-19, 86% sought legal help.

“Access to legal protection shouldn’t be a luxury,” says SHRM President and CEO Johnny C. Taylor, Jr., SHRM-SCP. “As businesses reopen, smaller organizations will face many unprecedented scenarios and circumstances—where legal guidance will be needed now more than ever. This service enables HR leaders to fully support their employers on the road to recovery with real-time solutions and dedicated legal protection to manage these important issues.”

To learn more, visit SHRM LegalNetwork.

Facebook: Launches Summer of Support

Facebook just kicked off its Boost With Facebook Summer of Support, a 6-week program that features on-demand training courses, thought leadership lessons and advice from business leaders, small business owners and featured guests. Through the program, Facebook pledges to provide millions of people and small business owners the digital marketing skills and information they need to navigate through this economic crisis and bring their businesses online.

Each week, Boost With Facebook Summer of Support will tackle a new theme with relevant content, for businesses of any size—especially small businesses—and people who are working to get back on track or transition their businesses to digital in this new normal.

Event highlights:

- Inspiring sessions from leading industry executives, celebrities and business owners.

- Launch of the Facebook Online Business Guidea new resource to help small businesses transition online, get discovered and grow their online sales. The step-by-step guide offers instructions to help you set up your business from start to finish with advertising so you can reach new customers and sell your products online. Business owners can visit this page for more details.

- Weekly themed courses to help businesses pivot their business models, build and online brand, connect with customers, and help their community including:

-

- Resilience (June 29-July 5): The businesses that succeed are the ones that can reframe a setback as a new way forward. Find out how to stay resilient in moments of change and make your downturns work for you.

- Reinvention (July 6- 12): These courses will show you how to remake your business to be more open to opportunity.

- Re-Emergence (July 13- 9): Once a crisis ends, how do you enter into the new landscape? Successful re-emergence into the market means understanding which parts of your business to keep and what needs to evolve.

- Customers & Commerce (July 20–26): Learn how to make your business essential, through customer-focused processes and smarter commerce.

- Community (July 27- 1): Learn how to keep your business a vibrant and important member of your community—however you define “community”.

In tandem with Summer of Support, Facebook is premiering Tan France’s Boost My Business” show on Facebook Watch which features Tan, a former small business owner, help business owners grow their businesses online, even if their doors are currently closed using Facebook and Instagram.

Salesforce Care Grants Help Small Business Owners Reimagine Their Businesses

Salesforce recently announced the recipients of its Salesforce Care Small Business Grants to help small business owners get back to business. They partnered with Ureeka, a community that connects small businesses with tools, mentors and resources to help them grow and thrive to fulfill their mission—to provide $10,000 grants to 300 U.S. small businesses, totaling $3 million, to help them adjust to a new normal and adapt their business models.

Equality was one of their core values and 90% of the recipients are businesses led by a person from an underrepresented group, including women, racial minorities, veterans, LGBTQ+ and people with disabilities. All funds have been distributed to grant recipients in hopes of relieving immediate burdens and in some cases, giving business owners the ability to bring staff back on as soon as possible.

There were over 7,000 grant applicants and Salesforce noticed several trends among them, including:

- Most hospitality businesses, especially those tailored to large-scale events, will take much longer to get back to normal, and will need a longer runway to survive.

- Restaurants and bakeries that rely on corporate events and weddings have shifted to offering mini-wedding packages to adapt to a new normal. Other restaurants have tried shifting to offerings like virtual bartending classes, but their take-out and pick-up traffic does not cover high rent costs.

- Professional services are facing decreased business but hope to use this time to reinvest in virtual offerings.

You can meet some of the winners here.

Expensify: Introduces Concierge Travel

Expensify recently introduced Concierge Travel, the first-of-its-kind virtual travel assistant. Concierge Travel puts safety first in a global environment brimming with COVID-19 concerns. Expensify cardholders can book flights, hotels, and rental cars for free by chatting with a Concierge on Expensify’s platform. All bookings include complimentary safety alerts and travel risk services from Global Rescue, as well as safety kits to keep travelers healthy during their journeys.

Those who book with Concierge Travel unlock a full suite of Global Rescue services—such as field rescue, emergency transportation to your hospital of choice, and medical and security advisory—worldwide, around the clock, available by phone or email. International travelers also receive a destination report containing health and security assessments, destination details, and entry and exit requirements for their country of travel.

David Barrett, founder and CEO of Expensify explains, “Concierge Travel just needs to know when and where you’re going, and it takes care of everything else. It learns what airline you like, which seat you prefer, and even automatically re-books canceled or missed flights. [Business owners] worried about compliance and cost can also specify fare classes for flights, star ratings for hotels, and other preferences, then Concierge will book according to company policy.”

To gain access to Concierge Travel, go here.

Tools & Resources

Free Signage

Small business lender, BFS Capital is providing a range of support for their members like a community chat board, articles and the recently-introduced ‘Free Signage’.

After walking neighborhoods in NYC and elsewhere, the CMO and her team came up with attractive signage that anyone can download in a PDF and customize for use in their stores, such as:

- “Yes, we’re back in business, come on in…”

- “Mask or face covering required inside. Thanks for understanding!”

- “We’re taking orders for pickup or delivery…”

New Yelp Features Help Businesses Reopen

Yelp recently introduced new features to help businesses easily communicate health and safety information as part of their reopening efforts. They also launched updates to Yelp Waitlist, an online waitlist management system, to ensure a smoother transition back to dine-in service. There’s more info in this blog post.

Yelp data shows more than 143,000 total business closures from March 1st to June 10th. As businesses reopen, it will be critical for consumers to hear directly from the business if they’re open, what services they’re offering during the pandemic and what their health & safety protocols will be.

To help consumers can find a new COVID-19 section on business pages across all categories, which include:

- Personalized message from the business: A way for consumers to hear directly from the business about if they’re open and how they’re operating during the pandemic.

- Updated Services: Businesses can now share if they offer dine-in service, in-person visits or virtual service offerings. This will also help better surface if a business is offering takeout, delivery and curbside pickup.

- Health & Safety Measures: Businesses can tell consumers if they are enforcing social distancing, sanitizing between customers, mandating staff wear masks and/or gloves, providing hand sanitizer or contactless payment, and more.

For restaurants, new Yelp Waitlist features, include:

- QR code to join the waitlist: This new touchless solution provides consumers with an easy way to join the waitlist for a restaurant when they arrive.

- Manual Wait Controls: Lets restaurants manually adjust wait time estimates during unexpected circumstances so diners have more accurate wait time expectations.

- Capacity Monitor: Allows a host to set their maximum seating capacity and will alert them if they are approaching 90% or have exceeded capacity.

Yelp’s ”Curbside Pickup” attribute is now a search filter and they’ve launched COVID-19 relevant Yelp Collections in select metros on the iOS app.

Polls & Surveys

Remote Working Gap

There’s a gap between employer and employee views about remote work/return to work during COVID-19, according to a recent survey from HR and payroll platform Zenefits.

The survey, conducted by Zenefits’ resource WORKEST, received responses from a mix of HR managers, business owners and active employees at SMBs across the country. Here are some of the findings. For more details check out this blog post.

Employees

- 35% of employees want to return to the office, even though 56% say their company gave them a home office stipend to work from home.

- 34% say their productivity has decreased while working remotely, while another 34% say it’s remained the same. A smaller percentage say their productivity has increased.

- 63% would support a daily test for COVID-19 symptoms.

Business owners/HR managers

- 69% of owners and HR managers plan to require their employees to return to work when the office reopens. Of those who are not, they cited risk of exposure in an open office does not outweigh the benefits, followed by employee preference as the reason to continue remote work.

- Owners and HR Managers say 38% of their workforce has refused to the office, with the majority of this group citing “making more money with unemployment benefits” as the reason why.

Small Businesses are Running Out of Money

The majority of small business owners who received loans from the Paycheck Protection Program (PPP) say it helped save their businesses. However, 43% also say they’re running out of cash and their reserves will last only a month or less.

Even more alarming, 69% of small businesses without PPP funding are worried their cash will run out in July.

These findings are based on the results of an Alignable Pulse Poll, conducted June 12-15.

PPP Loans Helped, But Not Enough: On the positive side, 52% of small business owners who received the PPP loans strongly praised the program and say it not only saved their businesses but helped with their early recovery. Most say they wouldn’t have survived without it.

While the PPP funding helped many small businesses, the majority respondents say they spent much of their federal funding during the first eight weeks of the loan on employee salaries to help ensure loan forgiveness. That’s the big reason they say they need more federal funding.

Most Agree, a New Round of Funding is Required: Though the Flexibility Act helped to loosen earlier PPP loan restrictions, several small business owners noted it came too late for them. Many want the government to create another round of funding for small businesses to keep them going until more business returns.

Minorities & Women-Owned Businesses Need More Help: “It’s clear from this poll the recovery is even slower than many had expected and the damage inflicted by quarantines on our members is widespread and long-lasting,” says Alignable’s President and cofounder Venkat Krishnamurthy. “But minority-owned and women-owned businesses appear to be suffering more than anyone—this problem is getting worse and needs to be addressed quickly.”

Based on poll results, minority and women own businesses are struggling more with cash reserves than other small business owners—whether they received loans or not. These groups of business owners say their cash reserves will last one month or less:

- 52% of minority-owned small businesses that received PPP loans

- 65% of minority-owned businesses that didn’t apply for loans

- 76% of minority-owned businesses rejected by the PPP (and 52% of them already depleted their reserves)

- 55% of all women-owned small businesses

While several nonminority small businesses also expect to be out of funds in a month or less, most of those numbers are less daunting, except for those rejected for PPP funding:

- 40% of nonminority businesses that received PPP loans

- 41% of nonminority firms that didn’t apply

- 65% of nonminority businesses who were rejected for PPP loans

The Rise of E-Commerce

Advertising technology company Viant recently released a whitepaper, Behind the Rise of E-Commerce in America highlighting what e-commerce marketers need to know about lasting online shopping trends in the wake of COVID-19. The whitepaper delves into the marketing tactics e-commerce brands can employ to succeed in such a crowded marketplace, as well as the importance of looking beyond traditional marketing channels.

Prior to COVID-19 closures, consumers were already shopping online more than ever before, with 41% shopping online once a week, and 74% shopping online at least monthly. However, the pandemic further accelerated this trend. According to Viant’s survey, now 59% of consumers shop online at least once a week, and 86% say they are currently shopping online at least once a month. And there are no signs of this trend slowing. Because of this, e-commerce marketers must explore new tactics to reach their target consumers.

“The acceleration of e-commerce adoption in the U.S. is staggering,” says Jon Schulz, CMO at Viant. “Consumer convenience, combined with advertising and transactional efficiency is a strong formula for retail success going forward.”

Viant conducted a survey in May and found:

- Since March 2020, there was a 33% increase in those shopping online 4-6 days a week, a 54% increase in those shopping online 2-3 days a week, and a 39% increase in those shopping online once a week.

- 82% of people who reported shopping online more during the COVID-19 pandemic say they plan to keep shopping online with increased frequency after the pandemic ends.

- More than a third of people say they will be shopping online more in the future because of COVID-19.

- 63% of those who said they bought groceries online since March 2020 said it was their first time doing so, and 69% of those who ordered groceries online during the pandemic said they plan to continue doing so even after the pandemic ends.

- More than half of consumers surveyed who are purchasing goods online that they did not purchase online before the first quarter of 2020 are purchasing preventative health and wellness products and plan to continue doing so after the pandemic ends.

You can download Behind the Rise of Ecommerce in America whitepaper here.

State of Local SEO Report

Moz, Inc., the leader in search engine optimization technology, just released its The State of Local SEO: Industry Report 2020. The report details how marketers deploy local-SEO tactics and offers new insights for agile, future-forward strategies. The data includes current and pre-COVID-19 regulations.

“With many global social distancing orders still in place, new concerns over budget and other unexpected scenarios, many digital marketing professionals may be struggling to manage their local marketing initiatives. But today, connecting communities is paramount, as consumers are seeking new information on things like daycare, food delivery, healthcare and more,” says Sarah Bird, CEO of Moz. “There are new challenges, but there are also new opportunities for success. Brands can synthesize both traditional strategies with new techniques to ensure their businesses stay top-of-mind and accessible.”

Local search maps out real-world communities, connecting residents and travelers to businesses. How those connections happen is a constantly shifting puzzle which local marketers seek to understand and leverage. In this report, Moz uncovered how brands and the agencies that represent them are devoting resources and analyzed how organic search impacts success to deliver key takeaways, including:

- COVID-19 reduced agency and marketing budgets, but companies can still succeed. 81% of agency marketers say marketing budgets have been cut as a result of COVID-19 compared to 62% of non-agency marketers. But 74% of people believe business-as-usual will return within a year of safety orders being lifted.

- Businesses of all sizes know the value of resourcing SEO. 77% of respondents have one or more SEOs on staff—up 8% from last year.

- Local SEO work requires diverse expertise. Executing a local SEO strategy requires collaboration and diverse skill sets, and a full one-third of local marketers feel their companies are not prepared.

- Marketers almost universally agree: Reviews are powerful. 90% of marketers believe customer reviews impact rankings in the local pack.

- Offline local marketing is a growing focus. There has been a 9% YoY increase in survey respondents who are involved in some offline marketing capacity.

- 2020 is the year of the customer. Optimizing for the customer has become this year’s golden rule—whether they’re visiting your website or your flagship store. 71% of respondents say that due to COVID-19 restrictions, new methods have been adopted for getting products and services to customers.

Local search marketing has always existed in a state of rapid and continuous change, and COVID-19 has only amplified this truth. With so many uncertainties on a micro- and macro-level, the report clearly defines strategies and tactics to best serve marketers today, especially as 66% of respondents have their eyes on the true prize: conversions and revenue.

To view the full State of Local SEO: Industry Report 2020, visit Moz.com.

How COVID-19 Affects Retailers—June 2020 Update

The world has changed a lot since this report on the state of small business owners was issued earlier this year. The COVID-19 pandemic impacted almost every facet of how small businesses operate, and even as businesses begin to reopen, there is much uncertainty in what that looks like. CM Commerce recently explored the coronavirus’ impact on small business owners in its report, How COVID-19 Affects Store Owners: June 2020 Update.

Key findings

- IT concerns are playing a much larger role in e-commerce than prior to COVID-19, with IT cited as the highest priority (27%), owners’ biggest key to success (30%) and the number-one task they’re responsible for daily (48%). This is impressive considering in February, 60% of shop owners noted they weren’t utilizing technology to reduce the time they spent on ecommerce tasks.

- More store owners are conducting all of their business online than before. Before COVID-19, most respondents said 26-50% of their business happened online. Now, the majority say 51-70% of their business happens online.

- Surprisingly, stores’ initiatives and goals for the year remain constant despite COVID-19. However, store owners cite addressing COVID-19 concerns as the number one task that’s coming between them and their key priorities (43%).

- Despite everything that’s happened in the course of 2020, store owners’ predominant feeling is hope, with 37% of respondents feeling hopeful, 17% anxious and 12% determined.

Remote Productivity Decreases

Before the coronavirus crisis sent most employees home to work, many reports claimed people working remotely were more productive than those in the office. Apparently that’s changed, according to this report in The Manifest, which says only 30% of workers say they’re more productive working remotely than in an office, while 45% say they’re more productive working from the office and 24% say they are equally productive whether working from home or the office.

The Manifest found the top 6 ways people are staying productive when working from home are:

- Using a designated workspace (43%)

- Structuring their day to resemble normal working hours (36%)

- Taking frequent breaks (34%)

- Setting a schedule (26%)

- Reducing distractions (24%)

- Communicating with colleagues often (23%)

College and the Coronavirus

There are a lot of small businesses located in college towns all across America that are hurting as most college students left school earlier than planned this spring.

Hope were high the students would be returning this fall. But will they? Take a look at the key findings from a survey of incoming college freshmen and current college students by LendEDU:

- Among the just graduated high school seniors who have already committed and sent a deposit to a college, 30% say they would consider not enrolling or try deferring their admission if all learning stays online for the fall 2020 semester.

- Of those just graduated high school seniors who have not yet committed to any college, 43% are considering a gap year, 41% are considering an online college, and 37% are considering a community college for the fall 2020 semester.

- Among current college students 40% are considering transferring to a more affordable college or one closer to home, 34% are considering dropping out and taking time off, 28% are considering dropping out and enrolling in online college, and 26% are considering dropping out and enrolling in community college for the fall 2020 semester.

- 52% of current college students believe the coronavirus will extend the time they originally thought it would take them to graduate from college.

Small Business Support Shifts Amid COVID-19

Cox Business recently released the results of its annual consumer sentiment survey on small and medium-sized businesses. The results center on the impact that COVID-19 has on SMBs and how consumers expect to interact and support them in the future. Additionally, the survey dives into the specific effects from the pandemic on the healthcare industry.

While consumers haven’t forgotten their favorite small business amid the coronavirus pandemic, their visits have dwindled since before the outbreak according to the 2020 Cox Business Consumer Pulse on COVID-19 and Small Businesses.

Key findings

- Before COVID-19, most survey respondents said they frequented small businesses 1 to 3 times each week. During the pandemic, it’s transitioned to only once weekly or not at all.

- 70% of respondents say they plan to increase support of small businesses as the severity of the pandemic in their community lessens. And 68% want to support small businesses in their community to keep their local economy and jobs a float.

- To continue supporting their favorite small businesses during social distancing, respondents have been:

- 76% ordering takeout/delivery from a local restaurant

- 40% increasing the amount tipped at local restaurants

- 30% shopping online with local retailers

- 40% of respondents felt that small businesses were receiving efficient guidance and resources to implement social distancing from their state governments. However, 41% felt that the federal government had not done the same.

- Once re-opened for full service, surveyed consumers feel that these are the top things small businesses can do to make them feel safe amid COVID-19:

- 79% limit the number of patrons inside

- 76% require all staff to wear personal protective equipment

- 45% install protective plastic shields at checkouts

- 45% accept contactless payment

“It’s been an incredibly difficult few months for small businesses across the country,” says Steve Rowley, executive vice president of Cox Business. “Knowing that a vast majority of people are looking for ways to show their support makes the outlook brighter.”

Shopping Apps See Historic Engagement

Liftoff, the leader in mobile app marketing and retargeting, just released its fourth annual report on the rapidly-growing market for mobile app commerce in partnership with the global app marketing platform, Adjust. The study, pulling from the most extensive dataset to-date, shows that mobile shopping apps—the global “go-to”for inspiration and assistance in-store and everywhere—continue to experience significant growth. The report also identifies North America (NAR) as the mobile shopping leader as Asia-Pacific (APAC) struggles with shopping fatigue.

Analyzing more than 53 billion ad impressions across 10 million installs and 2 million first-time events between April 2019 and April 2020, the report found:

It’s never been a better time to be a retail app: Liftoff and Adjust’s analysis points to a golden age for shopping apps. At $19.47, the cost to acquire a user who completes a first purchase has decreased by more than half year-over-year. Meanwhile, engagement has surged 40%, as 14.7% purchase rates tower over last year’s 10.5%. Observe the data over the past two years and the trend is even more apparent, with purchase engagement up 110%.

Plus, with COVID-19 driving stay-at-home orders, consumers seem to be leaning on mobile shopping even more readily: While install costs are relatively stable throughout the year, they drop to their annual low of $2.48 in March 2020—just as shelter-in-place peaked.

“Last year, our analysis found that the rise of sales bonanzas from retail giants like Amazon, Flipkart and Alibaba were tilling the soil for other retailers, priming mobile users to shop year-round, and this trend is only continuing,” explains Mark Ellis, cofounder and CEO of Liftoff. “As consumers adapt to the changing retail landscape, they’re leaning on mobile more than ever. It’s never been a better time to be a retail app marketer.”

In a world where physical touchpoints are reduced, apps position brands to keep driving growth. And according to Adjust, companies have already stepped up their game by focusing on re-engaging and retaining their users.

“The e-commerce industry as a whole got a bit shell-shocked in the first few weeks of March in the wake of COVID-19, with marketers dialing back ad spend,” says Paul H. Müller, cofounder and CTO of Adjust. “But as we saw the vertical start to rebound in April, there’s been a broader push toward re-targeting and re-engagement—in line with bringing customers back into the funnel and keeping their existing ones engaged.”

APAC shows shopping fatigue while North America surges: Last year, the mature markets of APAC and NAR showed similar trends. While users were registering more readily for shopping apps, converting to purchase was a challenge, suggesting that users in these regions were ‘window shopping’ on mobile. However, the data shows a major flip this year, as APAC and NAR usage patterns diverge – with North America coming out in front.

Costs-per-first-purchase in NAR are down 4x (to a low $14.85), while conversion rates are up more than 4x — and 6x higher than that of APAC (27.6% compared to APAC’s 4.7%). Meanwhile, APAC costs have nearly doubled in the past year, up to $54.90. The region finishes last in engagement with purchase rates less than half that of last year, suggesting the region is ripe for a refresh.

You can download the full report.

Get informed—Attend it!

Alibaba.com Virtual Trade Show

While in-person trade shows are on hold, many business owners are looking for new ways to connect with sellers and buyers. Check out the first Alibaba.com US Online Trade Show which starts July 7th. The show offers you a efficient way to expand your network.

Discover new products and services at no cost: You need to register now—time is running out. At the trade show you’ll find new products and U.S. sellers. You’ll also get access to industry insights and trends from expert speakers and meet with the sellers of your choice.

Submit your application here to attend the 4-day event. There is no cost.

Get informed—Read it!

COVID-19 Media Coverage

When did national publications began to cover the coronavirus pandemic? Digital Third Coast did an analysis of Covid-19 media coverage in the early months of 2020 to see.

They studied snapshots of coronavirus-related news and opinion over the first 10 weeks of 2020, across 18 of the nation’s most prominent online publications.

Here’s what they found:

- No sector of the mainstream media was quicker and more vigilant in tracking the emergence of Covid-19 than finance-focused publications. By the end of January, Bloomberg, Reuters and The Wall Street Journal accounted for 46% of all COVID-19 headlines analyzed.

- When looking at coronavirus as the lead story on a publication’s home page, Bloomberg and Reuters had the most COVID-19 related lead stories in January while The New York Times and ABC News had the strongest finishes, each with four consecutive weeks of lead stories heading into mid-March.

- When analyzing total coronavirus headlines over 10 weeks these 10 publications had the most coverage: 1. Bloomberg 2. Reuters 3. Breitbart 4. WSJ NBC News 6. CBS News 7. Politico 8. New York Post 9. ABC News 10. USA Today.

You can read more about.

Need money? Here’s a free e-book from Lighter Capital, Finding the Right Financing for Your Capital Needs. The book “explores the different financing options available to entrepreneurs and will help you make informed decisions.”

Looking to hire. Check out these free job posting sites from the Chamber of Commerce.

From Bank of America’s Small Business Community

Coronavirus Playbook: How to Increase the Value of Your Social Ad Spend

Coronavirus Playbook: How to Share Costs with Other Small Businesses

Defeating Coronavirus Requires a Teamwork Mentality

How to Set Your Business Up for Post-Coronavirus Success

Manufacturers Respond to Coronavirus

Get informed—Advice

Yes, It Will Be Different

Guest post by Wayne Embree, EVP of Venture Acceleration & Investments for Rev1 Ventures, the startup studio that combines capital and strategic services to help startups scale and corporates innovate.

While there are plenty of challenges and opportunities that present themselves within the idea of launching a business during a recession, the only thing for certain right now is uncertainty itself.

We can’t predict what a post-COVID-19 world will look like, but there are a few things that entrepreneurs should expect for their businesses now and once we’re all on the other side of this; things will be different across so many areas of your organization.

Your culture has changed. Not maybe, not might, has. COVID has introduced the most challenging elements to any organization and the team members’ lives: fear, uncertainty, and doubt. Known as FUD, these highly charged emotional states often conflict with what individuals see with their own eyes and fundamentally know in their rational minds. We are all affected by something we cannot see and cannot control. It’s imperative that company leaders provide calm guidance. This doesn’t mean you need to know all the answers. You can’t; not even the experts or political leaders necessarily agree on what’s right, let alone what should happen next. But it is important that your team see that there is a thoughtful, measured approach to decisions that affect them and those around them. Some team members may be personally and emotionally devastated by COVID. They, or family or friends, may have contracted the virus; or they may be caught up in how COVID is affecting the world.

Your current and future employees have changed. Negative associations with uncertainty present a very real challenge for startups, which as a matter of course rely on individuals who are especially well-suited for tolerating perceived, acceptable risks, and uncertainty. Mix fear and doubt into the uncertainty that is always present in a startup, and the totality can become extremely negative and possibly irreversibly damaging to individuals that a startup would employ.

How to address this as a leader? Like most things in small companies, head on. Openly. Honestly. Repeatedly. You will find that some on your team can’t adjust. Their tolerance levels for risk and uncertainty have been reset; quite possibly forever. Some may need to find a different place to work where they perceive less risk to themselves and their families. It may suit others to work in a different part of the business if that is a feasible option ), or work in a different way. Working from home more frequently may smooth their transition. Regardless, it’s imperative that you and your managers carefully monitor your teammates for signs of anxiety and depression and encourage everyone to seek help.

The other side of this coin, however, is opportunity. There are most certainly individuals watching this crisis unfold who do not want to wait any longer to fulfill a dream to work in a startup or to launch a company themselves. These people are emboldened by crises and will bring strength and stability to your organization as the economy recovers, as well as fresh eyes with which to see your customers, product, and market.

Your customer has changed. Your customers are going through very similar issues as your business. Some have no idea what to do; others will try anything once they can get back to business. Take time to really understand what your customers need. This is truer now more than ever, because they may not know. To accomplish this with empathy and intellectual honesty, your team must be aligned on your company’s “why and how” of serving your customers and market.

If your business has sufficient resources or support to act during this part of the market cycle, seize every bit of momentum possible. Those customers and the market share they represent will increase the likelihood your business survives. However, seeking sales requires a united effort from your management team and employees. Some may find it offensive to seek out opportunities and competitive advantages when so many are down and suffering. As long as such tactics are employed ethically and in keeping with a business’ core values, there is no shame in being aggressive during these times to provide solutions to potential customers and thereby sustaining your enterprise.

Entrepreneurs pride themselves on being decisive and leading from the front. This is a time that requires leaders to bring their team together, really understand each person’s concerns, needs and hopes, and then lead from within.

Reopening Smart—How to Cut Costs, Optimize And Increase Cashflow

Guest post by Michael Smythe, VP of Finance, Azlo

First—cut costs. If your revenue has been reduced, some strong cuts may be in your future. Remember to think about:

- Annual, quarterly, and periodic expenses – Be aware of recurring fees that might be coming due before the end of the year. (i.e. vehicle registration for a company car, professional license renewals, association fees, etc.)

- Recurring expenses. Look carefully at your monthly credit card and business checking account statements: Are there subscriptions you have that aren’t essential? High utilities or rent you can negotiate? Maybe move out of an office space entirely?

- New purchases. Investigate and see if it’s possible to set up a payment plan for large purchases instead of paying in one lump sum.

Next—Optimize cashflow. Once you’ve cut unnecessary expenses, you may have to get strategic with how and when you spend the revenue available to you by:

- Assessing your current balance. No one can blame you if you’re weary about checking your current balances, but you must be aware of how much money you have available right now.

- Be diligent about invoicing. In order to have a cashflow, you have to get paid. Be sure to set reminders to double-check on invoices and follow up if they haven’t paid.

- Give less credit. Letting clients pay late is always a risk, but with the state of the economy, it might not be a risk you can take anymore.

- Ask for partial payments or deposits. If your business is about providing a type of service where you’re paid on a per-project basis, it would be totally reasonable to ask for partial payments or deposits before you begin your work.

- Delay payments to vendors. Many businesses are having cash flow issues right now, so think of this as a last resort. Unless there are incentives for paying early, check-in with your vendors to see what’s possible.

Last, increase cashflow. If you’ve made major cuts to your expenses and still can’t attain a positive cashflow, your only choice will be to fill in the gaps or find new sources of revenue by:

- Sell assets – Look at your stockpile of equipment and inventory and see if there’s anything you don’t need or want.

- Apply for loans, grants, and other financial relief. Congress has approved a number of economic disaster relief programs, many available through the Small Business Administration. Information about these programs are constantly being updated, and more are being added. Visit this page for more information.

- Secure a business line of credit. Credit cards are great for handling day-to-day purchases, but loans can bolster your bank accounts while also accruing less interest over time.

- Hustle and pivot. Many small business owners had to make major adaptations to the offerings and structure of their businesses to survive the pandemic and continue generating revenue.

Virus stock photo by eamesBot/Shutterstock