16 Things Small Business Owners Need to Know

By Rieva Lesonsky

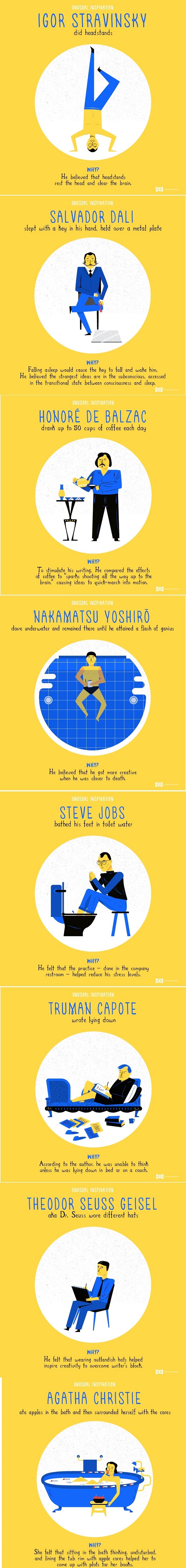

1—Sparking Creativity

We all have our own favorite tricks, tips and hacks for how we spark creativity. Check the infographic below from The Business Backer for how 9 of the world’s most creative minds got their ideas.

2—Creating a More Secure Internet

Worried about the update of Google Chrome 68 and its increased focus on security? To help, Endurance International Group, a leading provider of platform solutions designed to help small and medium-sized businesses succeed online, just announced it is offering free SSL Certificates for customers of its Bluehost, HostGator, Domain.com and iPage brands to ensure customer data and transactions are secure for themselves and their visitors.

Google’s updated web browser Chrome 68 now alerts users if a site does not use a secure HTTPS connection, making an SSL Certificate, an important aspect of any website, even more critical. Google’s updated browser displays a “Not Secure” message in the URL of any website that does not have a secure HTTPS connection, making visitors less likely to engage and reducing visibility in Google search results.

“Many of our customers are entrepreneurs, focused on running their businesses, not web developers adept at reacting to the ever-changing world of technology,” says Suhaib Zaheer, senior vice president and general manager, hosting brands at Endurance. “In this day and age, a secure website is no longer optional and SSL certification is now a ‘must-have’ for any website, which is why we’re proud to offer this to Bluehost, HostGator, Domain.com and iPage customers free of charge in light of Google’s browser update.”

Why Encryption is Critical

A “Not Secure” notice could have a dramatic impact on millions of small businesses. Without a SSL Certificate encrypting the data passing between them and the visitors to their sites, both parties could be at risk, and without dedicated resources for site security, small businesses may be even more vulnerable to attacks.

A simple SSL Certificate can help to protect small businesses by:

- Authenticating your presence: Validates that customers are talking to your servers and not someone pretending to be you.

- Retaining data integrity: Prevents bad actors from modifying the communications between visitors’ computer and business servers, or even injecting unwanted content into sites.

- Encrypting data: Keeps the data passing between a site and its visitors private.

- Boosting SEO rank: Improves search optimization since Google will give a boost in the ranking of websites that use an SSL Certificate.

Bluehost, HostGator, Domain.com and iPage customers will receive free basic SSL to help ensure their sites are secure, allowing their customers to interact with them with confidence. Paid options are also available for customers looking for additional SSL features, such as warranty and TrustLogo Site Seal to display on their websites to show their customers that data is secure.

You can get more information by going to: Bluehost, HostGator, Domain.com and iPage.

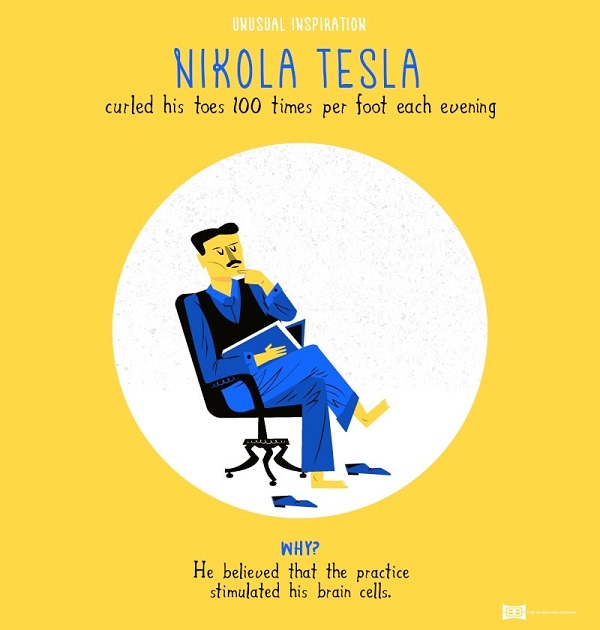

3—Are Your Payment Options Outdated?

Likely yes, since 38% of small businesses have not updated their payment options in the last 5 years, according to research from SCORE. This is particularly problematic because consumers have changed their behaviors, with 46% saying they rarely or never use cash and more and more embracing mobile payments.

The infographic below explains more.

4—Small Business in the Digital Era: Reaching the Connected Consumer

Visa and a consortium of key industry organizations recently announced Digital Transformation of SMBs: The Future of Commerce, a first-of-its-kind look at the opportunities and challenges SMB owners face in an increasingly digital world. The report shows how SMBs can capture revenue opportunities and move to more technology-focused processes.

“For small and medium size business owners, the perceived cost, time and tech-proficiency required for building a digital presence can feel like an insurmountable obstacle. But it doesn’t have to be”, says Jack Forestell, chief product officer, Visa Inc. “Through this report, we hope to help SMBs navigate the complexities of today’s technology-first consumer.”

Based on survey responses, Visa estimates that the SMBs’ average cost of processing digital payments, inclusive of direct expenses and labor costs, is 57% less than that of non-digital payments. And, 65% of SMBs say customers spend more when they use cards versus cash. Plus 78% of consumers rank a digital payment method, such as paying with a card or mobile device, as their number one preferred payment option. (Also noted in the infographic in #3)

Digital presence for SMBs: According to the report, consumer purchasing behavior is driven in part by websites and online experiences.

- 51% of consumers wish they could shop exclusively online. This has big implications for SMBs, given only 46% of SMBs surveyed have an online presence.

- 38% of consumers’ retail purchases are made online, but 61% of consumers plan to increase their online purchases in the next 5 years.

- As online purchases continue to increase, it could exacerbate a widening gap, given only 15% of SMBs’ sales are conducted through digital channels.

Offers & loyalty: Only one in five SMBs surveyed offer a loyalty program, yet rewards drive consumer preference and digital programs can offer instant value and gratification.

- 78% of consumers are more likely to choose a business that offers a loyalty program and 65% say they examine loyalty programs prior to shopping at a store, visiting a restaurant, or trying out a service.

- 90% of consumers prefer a digitally based loyalty program compared to a paper-based stamp or punch card.

- Nearly 80% of businesses say loyalty programs have a positive impact on average ticket size, repeat customers and revenue.

5—Financial Challenges for Gig Economy Workers

BMO Wealth Management (U.S.) recently released a report about the challenges and opportunities faced by participants in the rapidly growing “gig economy.” The report, The Gig Economy: Achieving Financial Wellness with Confidence, reveals that while gig workers of all ages share some common benefits—and barriers to success—the generations also display some distinct outlooks.

Key survey findings show:

- The three primary reasons to take on gig work, according to respondents, were to make extra money on the side (55%),balance career and family needs (48%) and have greater autonomy and control (48%).

- Millennials were much more likely than boomers to gig to make extra money (58% vs. 49%, with gen-Xers falling in the middle), and more than half of gen-Xers and boomers (55% and 52% respectively) did it to achieve greater life balance, compared to just 40% of millennials.

- Boomers face challenges in finding employment, with 34% reporting gig work was the only way to make an income, while just 20% of millennials expressed the same.

- Across generations, similar proportions of respondents pointed to a lack of benefits (medical, dental and disability) as one of the biggest downsides (cited by 69% of all respondents), along with not earning enough (43%), lack of profitability (41%), and accumulating debt (27%).

“The growth and popularity of the gig economy among employers and workers alike is resulting in a sea of change in how gig workers manage daily finances and retirement planning,” says Tania Slade, National Head of Wealth Planning, BMO Wealth Management (U.S.). “There are obviously tremendous advantages for gig workers of all ages, from flexibility, personal growth and providing supplemental income, but giving up a steady paycheck and employer-based retirement plans for less consistent income requires additional time and planning in order to achieve financial health.”

Tips for gig workers:

Make a business plan: A business plan documents what gig workers will do to make money, outlining their expertise, services, products, clientele, marketing plan, fees, location, hours, and expenses. Addressing these at the outset will help manage some of the challenges of gig work, and should be developed in tandem with a financial plan to help achieve important longer-term financial goals.

Have a spending plan (or budget): A gig worker’s business and personal finances will become intertwined, but it’s best to try and keep them separate. They should consider an “essentials only” budget that focuses on minimizing expenses such as food, travel and entertainment to help manage fluctuating monthly income.

Be organized: Self-employed workers must report all income to the appropriate tax authorities and submit income taxes and self-employment taxes that include both the employer and employee portion of Social Security and Medicare Taxes. It is advisable to work with a tax professional to help address income taxes and reporting requirements.

Have a financial plan: A flexible financial plan is a must in the gig economy, when income is often variable. A financial professional can help monitor and assess spending and saving on a regular basis to stay on budget and achieve short- and long-term financial goals.

Save for other goals: Payments to retirement accounts like solo 401(k)s, IRAs, SEP-IRAs and Roth IRAs can be automated to develop consistent savings habits and adjusted as monthly income fluctuates. Gig workers should plan to assess finances and adjust savings plans on a quarterly or semi-annual basis.

You can check out the full report here.

6—The Eye-Opening Truth About Data-Driven Marketing

Marketers who actively seek out and chase after data are already at an advantage. Data holds the power to understanding your customers, making better marketing decisions, and offer more personalized experiences for your audience.

But if data is so important, why is it so hard to implement a data-driven strategy?

Even though data is so important to marketers, there are major obstacles in the way of integrating data across platforms. The inability to see all your data in one place continues to be a plight for many marketing teams. However, the future holds good news when it comes to data-driven marketing.

Despite the struggle, 97% of marketers are getting more effective at collecting data. And data is becoming easier to collect, which might mean it takes less work and energy for you to achieve your data-collecting goals than you thought.

Start by taking a look at all your systems and platforms collecting data. Audit every touchpoint and see what can be consolidated, what you can learn, and what can be improved. You might find connecting points to be easier than you thought.

No matter the relationship status between you and the data you’d love to have, the biggest takeaway is to begin inserting data into your marketing strategy now. Don’t wait for someone else on your team to collect data or for a specific system to “fix all your struggles”. Take strides now so you can acquire more customers and inspire more loyalty.

Check out the infographic below from Campaign Monitor and Ascend2 to get more insider perspectives about data-driven marketing.

7—Free, Online Ecommerce Conference

BigCommere is having a BIG conference. The Make It Big Conference is a free, 5-day online ecommerce conference August 6-10, featuring experts like:

- Steve Case, co-founder of AOL

- Pauline Brown, the former North American Chairman of LVMH Moet Hennessy Louis Vuitton

- Ezra Firestone,the marketing marketing mastermind behind multiple multi-million dollar brands

- Richard Lindner, the co-founder and president of DigitalMarketer

- Melanie Travis, the founder of Andie Swim, the fastest growing DNVB swimwear line for women

- Web Smith, the founder of 2PM and the co-founding team of Mizzen & Main

- & 25+ more!

Register here.

8—Business Transactions Continue to Rise

2018 is poised to be another record-breaking year when it comes to small business transactions, which are up 6.7% since Q2 2017, according to the Q2 2018 Insight Report, from BizBuySell. Overall, stable selling conditions and an increasingly diverse marketplace have pushed many boomers to begin to sell.

This positive news follows a record-breaking 2017. And, asking and selling prices are still rising as well. Notably:

- 5,383 businesses have been reported sold in the first two quarters of 2018, putting the year on pace to surpass 2017’s record-high

- Median revenue was $526,048 in Q2, a 7.4% increase from last year and the highest media revenue mark since BizBuySell started tracking data in 2007

- Median sale price increased 4.4%, from $229,000 in Q2 2017 to $239,000

- Median asking price for closed transactions increased 4% to $260,000

9—Business Travel Expense Report

Certify just released its Q2 2018 SpendSmart™ report, which tracks the most popular airlines, ground transportation services, lodging and restaurants used by business travelers in North America. According to the report, Lyft gained 8% in market share over Q2 2017 while Uber declined 3% and taxi use dropped 5% during the same period. Uber is still dominating business travel ride-hailing according to Certify’s data, with 74% of the overall market compared to 19% for Lyft and 7 for taxis.

Tipping the scales: Uber vs. Lyft: Despite the Q2 year-over-year decline in market share as measured by Certify, business travelers are spending more money on Uber rides than with Lyft—business travelers spent $26 on average per Uber ride compared to $22.37 for Lyft.

Business travelers embrace other digital services: Ride-hailing isn’t the only digital service enjoying the attention of business travelers. With time at a premium, business travelers are stepping-up use of apps that help them find parking spots. SpotHero was the most popular parking app among business travelers in Q2 2018, increasing 216% from Q2 2017.

Business travelers are also embracing food delivery services. Grubhub gobbled up 35% of all food delivery service transactions in Q2 2018—a 10% drop from Q2 2017—compared to 25% for Uber Eats (up 11% over Q2 2017), 20% for DoorDash and 11% for Postmates. Grubhub was also the highest rated food delivery service among business travelers in Q2 2018, earning 4.74 out of a possible 5 stars, compared to 4.67 for DoorDash and 4.6 for Uber Eats. Meanwhile, DoorDash had the highest average transaction cost among business travelers in Q2 2018, at $75.21. Uber Eats had the lowest average transaction cost in Q2 2018, at $34.30.

Leading the way: the most expensed vendors by category and overall: Starbucks topped the list of the most expensed restaurants by business travelers in Q2 2018, with over 5% of all transactions and an average expense amount of $12.47. McDonald’s was second at nearly 3% of all restaurant transactions. Chick-fil-A was the top-rated restaurant in the 2nd quarter, earning 4.6 out of a possible five stars compared to 4.4 for Chipotle and 4.4 for Panera Bread.

Hampton Inn topped all lodging vendors, totaling 9.3% of all lodging transactions and an average expense amount of $245.88 per transaction. Marriott was second with 8.4% of lodging transactions. Hyatt, Marriott and Westin Hotels were the top rated hotels, each earning an average rating of 4.4 out of a possible five stars.

Meanwhile, National Car Rental was the most expensed car rental company among business travelers, with 26.9% of all category expenses, and an average expensed amount of $185.02. Enterprise Rent-A-Car came in second with 16.1% of car rental expenses and an average amount of $203.42 per transaction. Enterprise Rent-A-Car and National Car Rental tied with an average rating of 4.4 stars.

Delta was the most expensed airline with 20.2% of all category expenses and an average expense amount of $430.67. American Airlines grabbed 18.8% of airline transactions, followed by Southwest Airlines at 15.2% of all transactions. JetBlue (4.6 stars) and Southwest Airlines (4.5 stars) were the top rated airlines.

And finally, Uber was the most expensed of all business travel services, accounting for 11% of all transactions—up from 7% Q2 2017. Amazon, Delta and Starbucks tied for second in Q2 2018, each earning 4% of all business travel receipts and expenses in the quarter. American Airlines rounded out the top five with 3% of transactions.

“What the data tells us is that business travelers are embracing digital services like never before because convenience on the road is foremost,” says Robert Neveu, CEO of Certify. “Two of the top five most expensed services by business travelers in Q2 2018 were digital—Amazon and Uber—and apps for food delivery, parking and lodging are quickly establishing themselves as worthy competitors in their markets. [So], it’s not such a stretch to imagine services like Grubhub, DoorDash, Uber Eats and Postmates coming to dominate traditional eating options like Starbucks, McDonald’s and Panera Bread over the next five years, just as Uber and Lyft have taken down taxis.”

10—Watch Out Workforce—The Touchscreen Generation is Merging Tech and Creativity

Guest post by Jag Vootku, founder and CEO of KudosWall, a social platform designed for students to track academic achievements through an online portfolio and build a professional resume, all in one place. Follow KudosWall on Facebook, Twitter, and Linkedin.

These days, younger people are referred to as the “touchscreen generation”—and for good reason. Most of them were practically born with tablets and smartphones in their hands.

A 2018 Pew Research Center survey reveals 92% of 18- to 29-year-olds own a smartphone. What’s more, in a 2016 poll by Adestra, 87% of 14- to 18-year-olds said they own and use a smartphone, meaning those young adults have been swiping and surfing mobilely for years.

With the advent of the internet and technology, the human experience has radically transformed, opening people up to more information now than ever before. Technology is a major part of this generation’s experience. It’s enabled them to learn and connect with others’ perspectives in a way that stimulates a higher level of creativity.

It’s not only a tool that inspires creativity, it’s also used to share that creativity. This generation is joining what American economist and social scientist Richard Florida calls the “creative class”—a class of workers who are tasked with developing new ideas and creative content.

Here’s how creativity and technology are being merged by the touchscreen generation:

Building supportive networks: Cyberbullying consistently makes the headlines, but there are actually several benefits to our connected world for younger generations that are ignored. For instance, a June 2012 report by Common Sense Media found that one in five teens said social media makes them feel more confident, compared with just 4% who said it makes them feel less so.

What’s more, tech has had a much different impact on how they relate to others than is commonly thought—52% said social media made their friendships better, compared to just 4% who said it negatively affected those relationships. And 57% of teens even said they met a new friend online, according to a 2015 survey from Pew Research Center.

Technology makes building a network more efficient. It’s important to connect and build a rapport with peers at any age. Being immersed in a community that inspires creativity and ignites new ideas, encourages people to keep growing and developing.

For example, social media gives students the chance to learn and join specific groups in order to pursue passions and interests. This actually helps them gain traction in their academic pursuits leading into their careers.

In fact, KudosWall conducted a survey and found social group memberships are among the most valued aspects of a college application. What’s more, 61% of admissions professionals say applicants with large networks prove they’re a strong cultural fit.

Younger generations are using technology to build their networks and creatively establish social capital early in their lives. They’re also leveraging social media to bolster their confidence and strengthen relationships. These skills and experiences will give them an advantage as they merge into the professional world.

Merging digital presence and authenticity: There are many facets to building an online presence, including social media accounts, websites, and blogs. Fortunately, given the ubiquity of smartphone ownership and social media usage among the touchscreen generation, they are particularly tech savvy. When they merge that with creativity, they can establish an authentic, positive online presence.

Having a strong online presence that is revealing of who you genuinely are has become increasingly important. Our survey found that creativity, thoroughness, and reflection are the top personality traits college admissions professionals look for in an online presence.

However, the value of an online presence extends beyond academics. It also helps you network and showcase your skills, interests, and abilities to potential employers.

By presenting an authentic representation of themselves in creative ways, this generation is set up for success. For example, they can share videos, art projects, and even create online courses to teach their skills to others. In fact, many of them are learning new technology skills to build a career.

Fueling the tech boom: Coding and other technology skills are becoming second nature to this generation set to enter the workforce in the next decade. It’s not surprising that most of them are considering joining the technology industry. In fact, seven in 10 teenagers surveyed for the CompTIA report, Youth Opinions of Careers in Information Technology, say they are open to the possibility of a career in the technology arena.

The future workforce is currently exploring their creativity through technology. For example, there are several coding games aimed at teens and younger children. For instance, CodeMonkey teaches kids how to use CoffeeScript, a programming language, to build their own games in HTML5.

These games merge recreation and education. The technology industry continues to grow, and with the influx of educated, creative young talent, the landscape will see even more growth.

11—Achieving the American Dream

Do you believe you’ve achieved the “American dream”? According to Kabbage, Inc., a global financial services, technology and data platform serving small businesses, 85% of small business owners believe being your own boss and owning a business is achieving the American Dream. And they’re so satisfied with business ownership, 84% hope their children one day become small business owners.

When asked why they wish their children become business owners, the top responses included:

- Turning their passion into a career (38%)

- Being their own boss allows them to control their schedule (24%)

- Starting and building a company is rewarding (22%)

To recognize the dream that parents have for their children, Kabbage is giving away “Future Small Business Owner” baby onesies to any parent in the United States.

“As an entrepreneur, I’m grateful for the unique opportunity we have to turn passions into businesses,” says Kabbage President Kathryn Petralia. “Kabbage is committed to removing financial friction from small business owners’ daily lives, allowing them to focus on their dream and build incredible businesses. The onesies are our small way to highlight a goal that we hope all parents have for our youngest generation.”

12—Fashion & Beauty Conference

SIMPLY and Who What Wear are having the 7th annual SIMPLY LA conference, the premier business focused event for fashion and beauty insiders, entrepreneurs, industry leaders and influencers. SIMPLY LA takes place at The Americana at Brand on August 11 from 8am-6pm.

SIMPLY LA has one main goal: to connect individuals (in a kind way) and give them the tools they need to succeed in the fashion & beauty industry. “The ever-changing fashion & beauty industry is much about who you know, which is why I created the SIMPLY conference 7 years ago. To become an influencer, stylist or many other jobs in the industry, you need to meet the right people to get your foot in the door. SIMPLY is a kind place to make those important connections that could change your career path forever,” says Sarah Boyd, SIMPLY’s founder.

Expert speakers will be featured on one of two tracks: The Influencer Track or The Digital Marketing Track so guests can choose the one that best fits their interests—both groups include access to the Keynote conversation with Kat Graham, the face of Foster Grant.

The Influencer Track is for those who want to learn about how to grow your audience, monetize your influence, and turn your blogging hobby into a career. The Digital Marketing Track is for those who want to learn about the latest in marketing tools and techniques, understand how to run successful influencer campaigns, and hear from the brands that are killing the social media game. For those who really just want to get to know the latest and greatest brands in fashion, beauty & lifestyle, connect one-on-one with brand representatives, and socialize with industry insiders, there’s a special lower-priced Brand Experience option to join the excitement.

For the $350.00 ticket price, guests will receive access to the Brand Experience, meals including breakfast and lunch, cocktails, a VIP gift bag, and access to the invite-only SIMPLY LA Facebook group for post-event networking and other exclusive opportunities.

For ticket information and to reserve a spot at SIMPLY LA, go here.

Quick Takes

13—Women and Investing

Statistically, women are less likely to invest. To help with this issue, The Simple Dollar created a guide on Why Women Should Invest and How to Get Started. Many women assume that investing either requires expertise, a lot of time and large amounts of money, but that’s not the case! The article highlights reasons why investing is important and more profitable than traditional savings alone, as well as helping women craft a strategy and find an investment platform that works well for them and their current finances.

14—The Journey to Success—as Told by Entrepreneurs

Often we learn the most from our peers—people who’ve also built small businesses. Paychex interviewed 31 entrepreneurs about their triumphs and the mistakes they made. The most common roadblocks were: making poor team choices/putting trust in the wrong people, followed by failing to ask for help. Overall, most of the entrepreneurs said their greatest achievement were making an impact.

You can check out their advice here: Memorable Mistakes and Treasured Triumphs.

Cool Tools

15—The “Uber” of IT

One of the biggest challenges for small businesses is getting IT support. Help is at hand. EVAN® is on a mission “to eliminate the traditional IT support system.”

The company says it’s developed the first immediate, real-time IT support platform that is secure, transparent, and reliable. (Think Uber for IT.) This is ideal for SMBs: you get high-quality IT support, whenever you need it, but only pay for what you use.

16—Introducing Copper: a New CRM

ProsperWorks, a Google-recommended CRM for today’s digital workplace, recently rebranded. The company, now called Copper, says, “The rebrand comes at a time of an industry need for new solutions that match today’s digital customer. Today’s existing CRM solutions are outdated, but since their creation in the 1990s, customers have changed the way they work, as have the tasks customers are trying to accomplish.”

A recent survey commissioned by Copper shows nearly half of respondents think the innovation of CRM should be quicker. The form of communication between teams and customers has shifted from in-person meetings to informal chat apps and mobile conversations. According to the survey, 44% of respondents use chat and Slack and 67% say more than 40% of their customer communications happen over email. Today’s workforce wants tools that make their lives easier, deliver a tailored experience and fit within the way they live and work.

In addition, today’s customer relationship is no longer the sole priority of the sales team—63% of survey respondents say three or more teammates are involved in fostering customer relationships. Copper is catering to the modern workforce that demands automated, easy-to-use and design-first tools so that they can focus more on fostering relationships instead of manual data entry like the legacy CRM systems of the past.

Copper also just announced Data Studio, a native integration with Google Cloud Platform (GCP). Data Studio is a free tool that makes vital data accessible and useful, allowing customers to create charts and reports with easy drag-and-drop features for quick visualization of business information. Copper is moving to GCP and this new feature within Copper CRM enables customers to apply Data Studios’ powerful analytics software to their relationship data at the press of a button.

Copper customers are leveraging GCP and the Data Studio and Copper integration to quickly visualize critical business data including sales summaries, lead conversion rates, win rates, average sale prices and more. By eliminating the manual data entry that has plagued legacy CRM offerings of the past, Copper’s native integration in G Suite allows users to automate workflows and complete business tasks without interruption.

You can find out more here and here and follow them on Twitter: @CopperInc.

Small business owner stock photo by Makistock/Shutterstock