10 Things Small Business Owners Need to Know

By Rieva Lesonsky

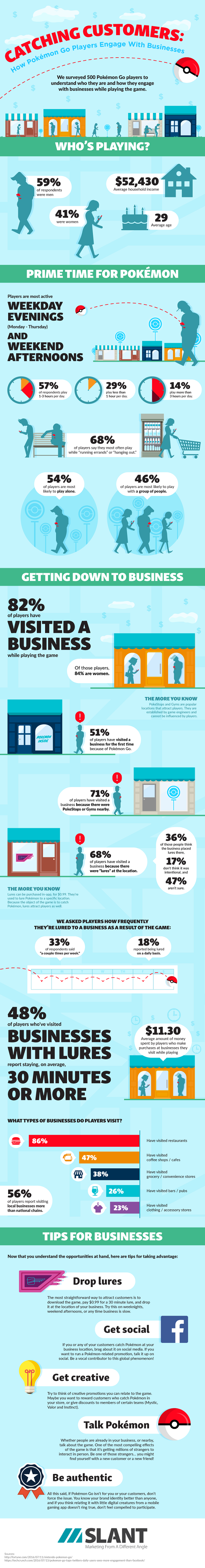

1—Pokémon Go & Your Business

Matt Zajechowski of Digital Third Coast tells us Pokémon Go is already the most popular mobile game in history with more daily users than Twitter and on more Android phones than Tinder. There has been a lot of chatter about Pokémon Go in the business world and how the game has become a remarkable boom for business owners. The one thing that’s been missing from the conversation, Matt says, is an evidence-based look at how Pokémon Go users actually interact with businesses while playing the game.

Matt worked with Slant Marketing to survey Pokémon Go users in an attempt to understand just how they engage with businesses while playing the game.).

Some interesting data from the survey:

- 82% of Pokémon Go players have visited a business while playing the game, and of those players who admit to being directly “lured” there, almost half reported they stayed at the business for over 30 minutes or more.

- 51% of players have visited a business for the first time because of Pokémon Go.

- 71% of players have visited a business because there were PokeStops or Gyms nearby.

- 56% of players report visiting local businesses while playing as opposed to national chains

Check out the infographic below to see how you can take advantage of Pokémon Go.

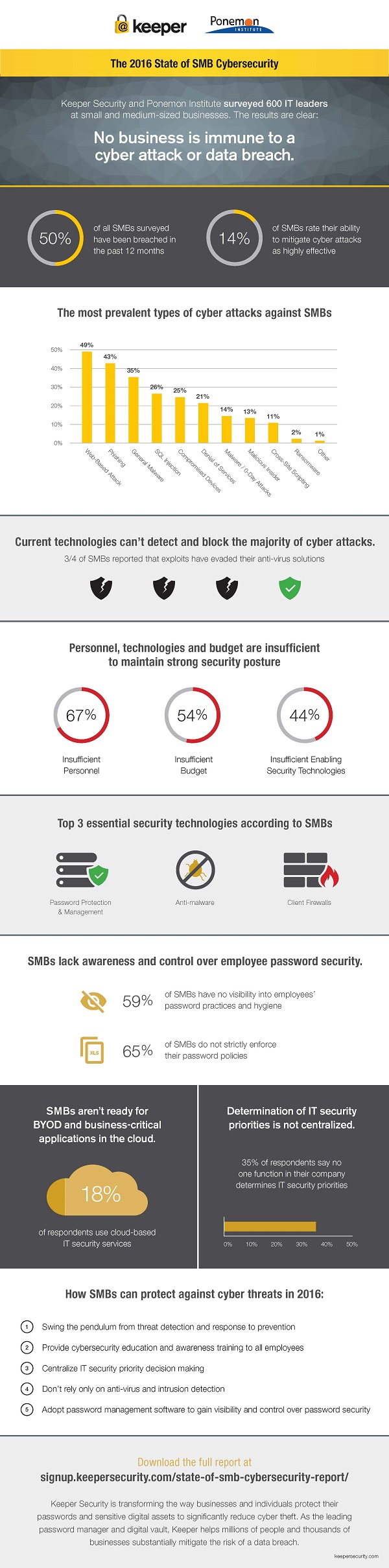

2—Fighting Cyberattacks

Keeper Security, Inc., a leading password manager and secure digital vault, and the Ponemon Institute recently released the results of a North American study analyzing the state of cybersecurity in SMBs, showing more than 50% of SMBs have been breached in the last 12 months.

The study shows no business is too small to evade a cyberattack or data breach and businesses across all industries are impacted by this threat. Only 14% of the companies surveyed rated their ability to mitigate cyberattacks as highly effective. Confidence in SMB cybersecurity posture is so low primarily because personnel, budget and technologies aren’t sufficient. Additionally, IT security priority determination is not centralized to one specific function in a company, therefore reducing accountability and resulting in less informed decision making.

The most prevalent attacks against smaller businesses are web-based and involve phishing and social engineering breaches. The study found that SMBs have a major lack of control and visibility when it comes to employee password security. Strong passwords and biometrics are believed to be an essential part of a security defense, yet 59% of respondents say they have no visibility into employees’ password practices and 65% do not strictly enforce their documented password policies.

Check out the infographic below for more information and you can access the study to learn more.

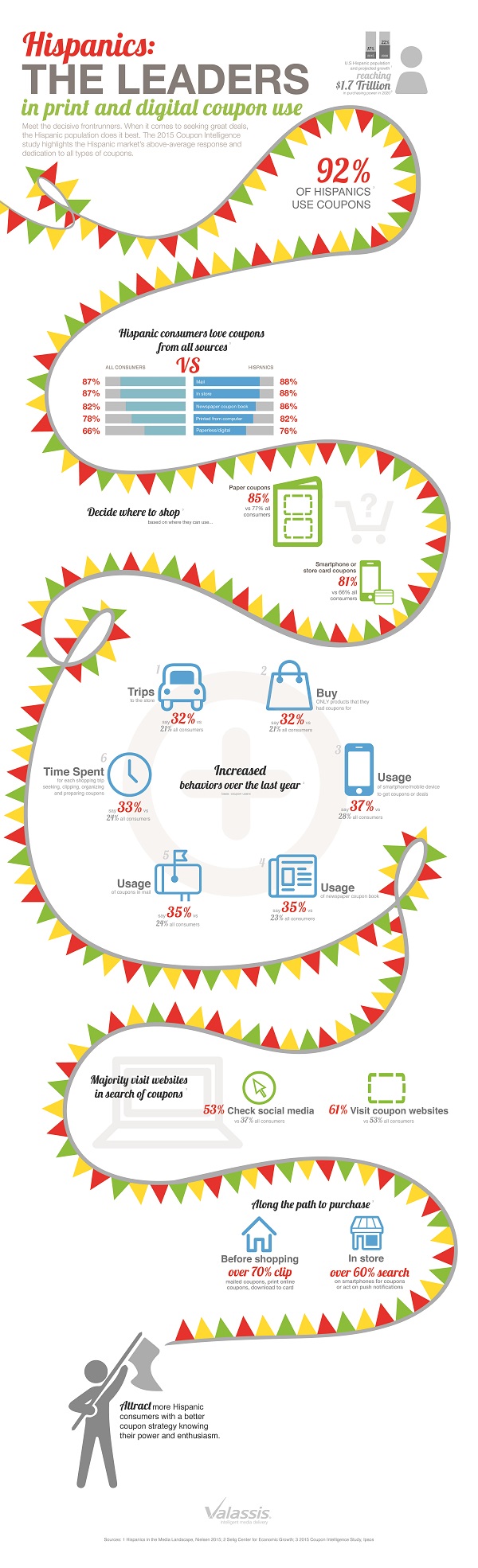

3—Hispanic Shopping Trends

Valassis, a leader in intelligent media delivery, recently looked at Hispanic shopping trends, specifically focusing on how coupons influence this demographics’ buying behavior. With the Selig Center for Economic Growth projecting that the U.S. Hispanic market will reach an annual buying power of $1.7 trillion in 2020, retailers and marketers have a ripe opportunity to drive sales by engaging this important demographic with coupons and offers.

Key research findings include:

- The Hispanic population uses coupons 92% of the time, more frequently than any other demographic

- The Hispanic population’s use of mobile devices for couponing has increased by 37.3% since last year, compared to an average increase of 28% across all other demographics

- The Hispanic population decides where to shop based on paperless discounts delivered via mobile devices 81% of the time, compared to an average of 66% across all other demographics

There’s more in the infographic below.

4—9 Ways to Get the Most Out of Instagram for Your Small Business

Guest post by Kati McGee, Product Marketing Manager, Small Business at Instagram.

- Showcase your passion. Think of Instagram as your virtual shop window where you can demonstrate what makes your business unique. A picture, after all, is worth a thousand words. It’s the perfect place to showcase your passion and inspire existing and future customers.

- Engage your community. Play an active role with your community. Engage with comments and questions on your own posts and use hashtags, location tags and view content your business is tagged in to discover and join the conversation on other community members’ posts. A lot of great small business accounts feature content posted by followers, which helps strengthen the relationship between a business and its most enthusiastic customers.

- Establish your voice. Instagram is where people connect around their passions, so be authentic and create a visual voice that reflects that of your business or band.

- Take your customers behind-the-scenes. People come to Instagram to get a behind-the-scenes look. Use Instagram to tell the world how your business operates, the team that makes it all happen and the effort that it takes to bring your product or service to market.

- Get creative with video. The total time people spent watching video on Instagram has increased 150% over the last six months. That said, lots of people aren’t able to consume sound when on mobile so ensure your video will be engaging with or without sound. And don’t forget to try out our new video tools like Hyperlapse and Boomerang to create simple and engaging videos.

- Choose quality over quantity. Instagram is where people go to connect around their passions and interests. Developing content that is authentic and well-crafted will help businesses stand out by fitting in.

- Search for inspiration. Businesses have been a part of the Instagram community from the beginning. Follow your business partners, advocates, and influencers in the community whose content may relate to your business or inspire you. What do they do well that you can learn from?

- Seek advice and feedback. Your community of fellow entrepreneurs on Instagram domestic and abroad is one of the best resources you can go to for advice. Make sure to also visit our Instagram for Business blog or follow our @instagramforbusiness account, which we created as a source of inspiration for the business community.

- Experiment with advertising. To find new customers, consider experimenting with advertising on the platform. Instagram introduced ads to businesses of all sizes in September, and offers all of the same targeting capabilities as Facebook while utilizing the same simple ad buying interfaces. We also offer many ad formats—landscape, up to 60-second video and multi-image or videos for example. When our new business tools roll out soon, you’ll also be able to promote a post directly from the Instagram app.

5—Back-to-School Shoppers are Price Sensitive

A new survey conducted on behalf of Ebates, a leader and pioneer in cash back shopping, shows 38% of parents will spend between $250-$500 this year on back-to-school shopping.. The survey also discovered that price was the single most influential factor in a parent’s decision whether or not to make a back-to-school purchase.

Wants: For both parents and teens school supplies topped their shopping lists, but teens put a higher priority on stylish clothing. Both parents and teens expect to spend the most money on name brand clothing (53%), followed by clothing essentials (42%) and technology (30%).

Do-not-wants: While teens acknowledged the obvious need for school supplies, that is also what the majority said they were least looking forward to shopping for (36%), followed by off-brand clothing essentials (25%). Parents, on the other hand, are least looking forward to shopping for stylish name brand clothes (34%).

Teens also lamented that each year they are forced to buy school supplies they never use, including: rulers (37%), protractors (36%) and textbook covers (33%).

Spending: Most parents (38%) expect to spend between $250-$500 on back to school shopping, 27% will spend between $100-$250 and 24%they will spend $500-$1,000.

When asked what factor most influences their decision to buy a certain back-to-school item, the resounding response was price, almost to the exclusion of other factors:

- 55%: Price

- 20% Quality of Product:

- 11%: How much the teen wants it

- 7%: Whether it’s on sale

- 4%: Whether it’s made in the U.S.

According to the survey, 60% of parents will do at least some of their back-to-school shopping online.

Ebates has some deals going on through August 31. For details visit Ebates.com. You can download the free Ebates.com app at Google Play and the AppStore.

6—5 Things to Consider When Choosing a Bank for Your Small Business

Guest post by Ryan Himmel, CPA, Head of Financial Partnerships in North America for Xero.

Guest post by Ryan Himmel, CPA, Head of Financial Partnerships in North America for Xero.

Choosing a bank is one of the most important decisions when starting a small business. It’s as important as choosing where you’ll set up a brick-and-mortar store, developing a business strategy or deciding who you’ll partner with.

Choosing a bank should be the start of a long and fruitful business relationship. With so many banks out there claiming to have your business’ needs at the forefront, it can be hard to choose which one is the right choice for your business. Here are five things to consider when making this difficult decision.

- Technology: The financial institutions that embrace technology help small businesses by streamlining core operational functions. In evaluating this factor, it’s important to understand the bank’s basic capabilities—does the prospective bank have an easy-to-use mobile app?—performing the evaluation before making a commitment can save frustration later down the road. The right bank for a small business should easily integrate with crucial third-party applications like your accounting software. Ensuring there is virtual synchronicity between the software you will be using everyday will save time in the future.

- Product Offering: Take stock of all the financial products you will need and ensure your prospective bank has all of them. By simply considering whether you need a large or a small bank, you may narrow your decision quite quickly. Large national and regional banks may be a better fit if your business needs access to a robust suite of financial products such as checking, savings, line of credit, lending, merchant processing and insurance. Smaller banks can have limited product suites, however, a lot of small business loans come from community banks.

- Customer Service: Your local community bank likely prides itself on offering personalized service that is too costly for most of the big banks to provide to all their clients. When interviewing different banks, find out what level of customer service they offer and understand their capabilities. A large bank may be able to offer you round-the-clock customer service over-the-phone and online, but again, most of them don’t have enough relationship managers available to know all the nuances of your business.

- Retail Presence: Branch locations might not be too relevant for most local businesses, but if you want to be able to walk into a branch and deposit a check, then you may need to consider proximity. If this is the case and you have multiple locations across states where your bank does not, then the decision has already been made for you.

- Fee Structure: Sometimes getting advice from someone who really knows numbers is the way to go when choosing a financial institution. Every bank and every product will have different fees. I recommend that the business owner, and their financial advisor, such as an accountant, outline the financial products that are needed over the next three years. Once you understand what you need, it’s easier to comparison shop each of those products and find the banks that meet your needs.

Once you’ve considered all these elements you’ll be in a much stronger position to choose the right bank for your business.

7—5 Ways to Simplify Your Day & Get More Done

Guest post by Johan Gunnars, CEO & Cofounder of Simpliday

Nowadays, most kids—and maybe some adults—probably don’t recognize the old tradition of tying a string around your finger to remind yourself of something important. That’s because reminders, while still as valuable as ever, have evolved with technology (in most cases, for the better). However, even with all the tech options we have to help us remember things today, it can often still feel like daily life isn’t getting any easier or simpler. So where are we going wrong?

The truth is that creating and using reminders is an art—and doing it well is the key to simplifying and empowering your day. Here are five ways to get more out of every reminder you make.

- Write it down: Research shows that just by writing down your goals you are 42% more likely to achieve them. While many of us may have graduated from string tying to long, oftentimes meandering trails of Post-it® notes to take us from task to task, there’s definitely a better way. Put your notes where you’re always bound to see them, on something you carry around with you everywhere and check all the time: your calendar on your phone. That way, you’ll have a timely reference wherever you are, whenever you need it, and you’ll avoid wasting time or energy in the form of missed or duplicated tasks.

- Be specific: How many times have you left yourself a note and been too vague for your own good? You might be trying to simplify things for yourself by taking the shorthand route to your reminders, but after a few days or weeks have gone by, there’s a good chance you won’t remember what an unclear note like “return call” was in reference to. Make things easier on yourself by doing the initial work to be as specific as possible—include location details, links, or attachments to relevant documents so your reminders are as helpful as possible. This tiny extra effort will simplify things for you and pay off in the long run.

- Share the love: Sometimes teamwork is the best way to remember something important and get things done. Indeed, 70% of people who sent weekly updates to a friend reported successful goal achievement—and that’s compared to 35% of those who kept their goals to themselves! Whenever possible, share your reminders with other relevant parties; it will not only help keep your tasks top of mind, it will improve communication and collaboration which, of course, makes everything simpler.

- Don’t be too ambitious: The keyword here is simplicity, and it’s important to be mindful of that when you’re planning your day. I’ve spoken before about the perils of multitasking, and the same is true of trying to pack too many reminders into one day. This is the reason syncing your reminders and calendar together is so important: Having a visual representation of all the things you want or need to stay aware of will also help you to prioritize what’s most important; everything that can wait until another day, should.

- Embrace flexibility: Establishing a routine is a great way to help us prioritize the things in our lives that need our attention. It’s the reason Steve Jobs infamously wore the same outfit every day—one less decision to make in a day full of intensive decision-making. However, we all lead complicated lives that can often blow our cherished routines into little bits. And that’s okay—as long as you’re prepared. Make sure to find a solution that adapts the way your life moves, and empowers you with the ability to easily move things around when you need to. That will help to ensure that you can easily get your routine back on track if it happens to be derailed.

Reminders may seem like the perfect way to simplify and organize our lives, but we often make them ineffective by trying to do too much. After all, anybody who’s downloaded an independent reminder app—to go along with their calendar app, note-taking app, checklist app, and email app—knows the true cost of so-called organization. While these apps may all live on your phone, accessing and coordinating between them all can seem like a full-time job (and there’s nothing less simple or more stressful than that!). When it comes to the life-simplifying powers of reminders, remember this: they should help rather than hinder. These five tips will help ensure that your reminders live up to their potential.

8—Payroll 101

Guest post by Andy Roe, General Manager of SurePayroll, Inc., a Paychex Company. You can follow Andy on Twitter @AndrewSRoe.

Guest post by Andy Roe, General Manager of SurePayroll, Inc., a Paychex Company. You can follow Andy on Twitter @AndrewSRoe.

Small business owners have many responsibilities, with one of the most important being payroll taxes. It doesn’t matter if you tackle this task on your own or hire a payroll provider, avoiding mistakes and making timely payments is of utmost importance.

As complicated as it may sound, the right approach will put you on the path to success.

Here are five lessons to learn:

Lesson 1: Set Up Payroll on Day One: Are you the owner of a new company? If so, there’s no time to waste in regards to setting up a payroll system. This is something you need in place from day one. Here are some basic tips for getting started:

- Request a federal employer identification number.

- Become familiar with both state and local laws.

- Make sure your employees provide you with all the necessary paperwork.

- Select a pay period.

Along with the above, there’s one last thing to do: decide if using a payroll service would be in the best interest of your business (it usually is).

Lesson 2: Choose a Payroll Schedule: This is mentioned above, but it deserves its own section. You don’t have to stick with the same payroll schedule for the life of your business, but it’s best to avoid regular changes. Choosing a payroll schedule will impact both the business and its employees. Generally speaking, you have four options:

- Monthly

- Semi-monthly

- Bi-weekly

- Weekly

Consider the pros and cons of each schedule before making a final choice.

Lesson 3: Understand Payroll Taxes: It’s one thing to understand that you are required to pay payroll taxes. It’s another thing entirely to know much you owe and who will receive the money. In short, payroll taxes consist of federal, state, and local taxes that are withheld from an employee’s paycheck by the company. In addition to income tax, Social Security and Medicare taxes also come into play.

Note: the employer is solely responsible for paying FUTA (Federal Unemployment Tax Act) and SUI (State Unemployment Insurance).

As confusing as this sounds, once you run payroll the first time you’ll better understand your situation and what’s expected of your company.

Lesson 4: Focus on the Cost: There is no denying the fact that the cheapest way to run payroll is to do it yourself. However, this is not something that most companies attempt. Not only is it time consuming, but it can be extremely complex.

As you compare payroll providers, the cost of service is one factor to consider. How much you pay is based on a number of variables, such as:

- Payroll schedule.

- Number of employees.

- The state in which you do business.

- The need for direct deposit.

- If there are employees in more than one state.

- The need for other tax filing and business related services.

Tip: cost is important, but don’t let this overshadow reputation, reliability, and the level of service you’ll receive.

Lesson 5: Stay Current: It’s nice to know that you can rely on the services of a payroll provider. This means you don’t have to waste time figuring out payroll and keeping up with constant changes in tax law. Even so, it’s important to stay current with your payroll process. From time to time you should review:

- Current tax rates.

- Total employee salary payments.

- Cost of your payroll service

When you get serious about payroll it’s much easier to feel confident in the financial decisions you’re making on behalf of your company. Follow these five lessons to ensure that you are on the right track at all times.

Cool Tools

9—Tax Savings for Etsy Entrepreneurs

Intuit just announced it is partnering globally with Etsy to offer Etsy sellers in the U.S. and the U.K. the ability to manage their business finances with QuickBooks Self-Employed.

Like most entrepreneurs, Etsy sellers are responsible for tracking, organizing and reporting their own sales and business expenses. But it is often difficult to capture an accurate snapshot of the financial health of their businesses, and many sellers have questions about what to include as part of their tax filings. In a recent Etsy survey of U.S. sellers, 45% identified tax prep or accounting as very challenging. To simplify this process, Intuit and Etsy are partnering to offer:

Data integration: Etsy sellers’ data will flow seamlessly into QuickBooks Self-Employed, providing instant insights into cash flow by automatically categorizing the data so sellers can see their real income, including total expenses and profit.

Special discounts: Etsy sellers will receive a discount for QuickBooks Self-Employed. Additionally, sellers in the U.S. can take advantage of the QuickBooks Self-Employed Tax Bundle, which provides the ability to pay quarterly and year-end taxes with TurboTax Online with the click of a button.

QuickBooks Self-Employed Saves Users Money: Since launching in January 2015, QuickBooks Self-Employed has helped subscribers identify an average of $4,340 in potential tax savings annually. In fact, QuickBooks Self- Employed subscribers identify an average of $18,967 in potential deductions that could cut their tax bills by 36% each year.

The Rise of the Self-employed Workforce: Full- and part-time freelance workers have grown from 6% of the workforce in 1989 to 34% today. Fueled by platforms like Etsy and others, they are expected to make up 43% of the workforce by 2020. QuickBooks Self-Employed is tailor-made to meet their needs. Key features include:

Separating business and personal finances: Freelancers can import bank and credit card accounts to easily track income and expenses with no data entry required. They can also separate business from personal transactions by simply clicking a button, or swiping a finger across the mobile app.

Delivering easy compliance and tax prep: Expenses such as mileage, phone bill and supplies are auto-categorized into the right Internal Revenue Service Schedule C deductions. And features such as receipt capture make it easy to save all the supporting documentation needed at tax time. A seamless integration with TurboTax allows freelancers to pay quarterly and year-end taxes online with the click of a button.

Improving cash flow with new features: QuickBooks Self-Employed subscribers now have the ability to track mileage automatically via their phone’s GPS, and can take advantage of built-in invoicing which sends a notification when invoices are paid and money is deposited.

Check out more information about QuickBooks Online Self-Employed here.

10—Lead Gen for Real Estate Agents & Brokers

HomeASAP, a leading provider of Internet marketing solutions for real estate professionals, just unveiled Search Alliance™, a first-of-its-kind solution designed to help real estate agents and brokers provide a superior home search experience for consumers, regain market share from the national portals, and lower the cost of lead generation.

Search Alliance™ enables agents serving any market and aligned with any brand to work cooperatively for online lead generation. Agents are provided a full-featured IDX website at no charge to link to the Search Alliance™ network. Once linked, agents are able to aggregate and share consumer web traffic across the network while delivering a national home search experience to prospects and clients on par with the national portals.

Consumers using the Search Alliance™ network start their searches on a participating agent’s website. As the network grows and expands, the agents, in effect, create their own national home search platform to compete with the portals at the local level for consumer traffic.

In addition to the extensive data-sets that are included with every Search Alliance™ agent website, agents are able to personalize their sites with local content, photos and commentary, further enhancing the consumer experience when compared to the big box, ad-based, user-experience of many portals.

If you’re interested in joining the Search Alliance™ go here.