By Harold Pine

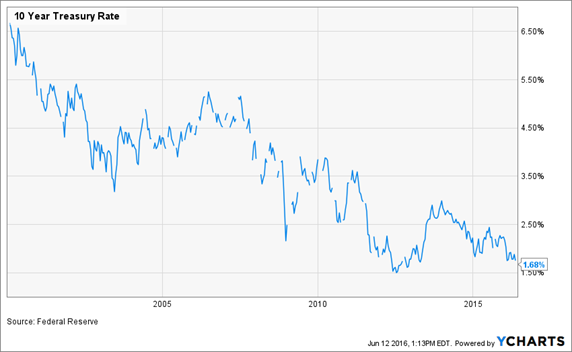

Over the last 16 years plus, equity investors have had some very challenging times. With the S&P 500 returning only about 4% compounded annually over the last 16 years and with close to 20% volatility, it is very tough to have a good feeling about stock returns. Since that time, Treasury yields have come down from about 6.5% to 1.65% today. Putting that in perspective, equities have averaged about 4% compounded annually and the 10-year Treasury bond about 5.7%. This puts a blended portfolio at approximately 4.85% before costs, assuming a 50/50 mix. These are just approximations with some variance around those numbers.

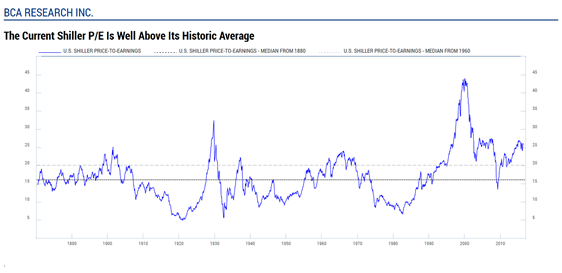

What about going forward for equities? Valuations appear extended, and monetary policy is about as accommodative as it can get. The prospect for higher returns in stocks looks very muted from our point of view. Here is one example of valuation data produced by Robert Shiller and reproduced by BCA Research.

Fixed income looks very challenging in the years ahead with low yields. Your expectations should always be the coupon of yield-to-maturity.

That would put fixed income at, say, 2%, putting you at a blended rate of 3%. I don’t believe 4% is a bad assumption over the next 5 years based on collective valuation metrics and global monetary policy.

Those kinds of prospects are not very appealing, and the longer portfolio returns stay muted the more investors become frustrated. The general inclination is to seek higher returns, which makes portfolio construction more important than ever. A disciplined approach is necessary. Without it, you will be more susceptible to product creation by investment firms that promise higher returns. Complex investment products are meant to be sold. Obfuscation and complexity mask fees and risks. The first step is to outline a clear plan on what you need, not what you want. Create an investment policy statement for you and your family. Include what assets you are willing to own along with how much of each. Understand your utility for additional gains. Utility is just how much better you feel about earning 1% or 2% more versus a large drawdown. As you increase risk/volatility, you may incur much bigger drawdowns. It took three years for a balanced portfolio to recover from 2008-2009 drawdown and seven years for a 100% stock portfolio to recover.

Practical Applications of a Strategy

- Think about returns using data analysis of selected asset classes.

- Rebalance portfolios at least annually or more often as warranted by changes in valuations.

- What are the real risks you face? (Inflation, shortfall etc.) All investors are risk takers when markets are stable and the risk-free rate is low.

- What is your real time horizon?

- Avoid seeking high returns when expected returns are low!

- Reduce friction from taxes and costs.

- When valuations are high, avoid being overly optimistic. Likewise, when valuations are low, avoid being overly pessimistic.

A well-thought-out plan is necessary to be successful. A sufficient condition is to be aware of the risks, be disciplined and stay the course, rebalance, be cost-efficient and reduce taxes where possible. Know your true time horizon and tolerance for variability in your portfolio’s value. Understand the data and its distributions. Know you are not competing against the various markets but all of its participants. All investors together, collectively, must be average.

Harold Pine is the managing director of Chasefield Capital, LLC.