10 Things Entrepreneurs Need to Know

By Rieva Lesonsky

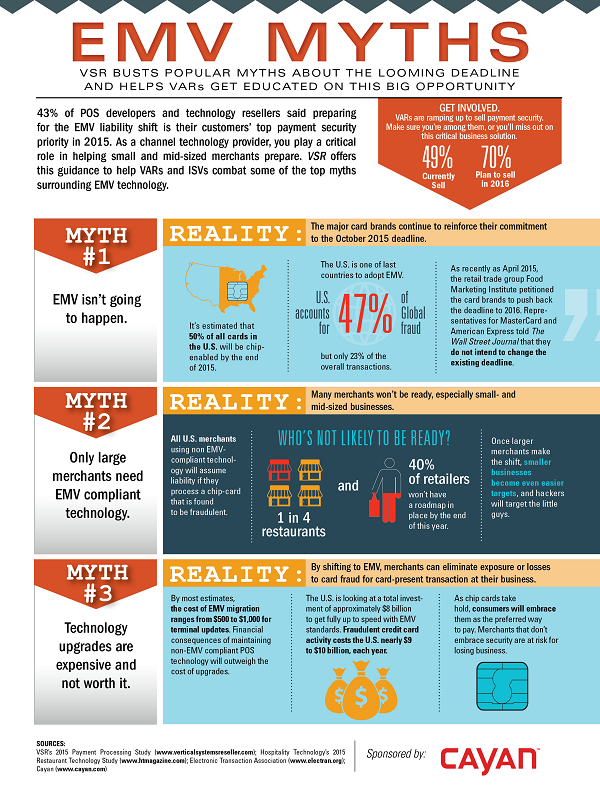

1) The Truth About EMV Conversion

Cayan, a company that connects businesses with payments solutions has created an informative infographic, showing you how very important it is for retailers to get ready to use EMV card readers by the October 1 deadline.

The company found that many business owners remain confused, not only about the deadline, but about what it means for their companies. We’ve told you before—and we will for sure tell you again, if you accept credit cards, you really should make the transition.

2) Celebrating Small Business

By Greg Waldorf, CEO of Invoice2go

This past weekend, most of the buzz around Labor Day had to do with the best weekend getaways or the best furniture sales. Over the years people have lost sight of the true purpose of the holiday—celebrating the American worker. While Labor Day [is still fresh in our minds], let’s take a few minutes to reflect and appreciate the workforce. Small businesses in particular are a huge contributor to the American economy, continuously creating jobs and generating revenue.

Fifty-four percent of all U.S. sales are generated by 28 million small businesses. Since 1990, small businesses have added 8 million new jobs, filling the gap big business has created by eliminating 4 million jobs during the same time. What’s more, small businesses provide 55 percent of all current jobs.

There’s no doubt small business is the backbone of the American economy, however this market is not immune to hurdles. Three out of 10 new small businesses fail to survive more than two years, and half shut down within five years. These businesses are faced with steep challenges—they’re competing with much larger companies and must operate without the deep pockets and large staffing resources of their competitors. It’s difficult to get a business off the ground, but there are tools small business owners can leverage to improve operational efficiencies and maintain a steady cash flow.

Dropbox, for instance, enables you to escape piles of paper and filing cabinets, and easily store, search and share digital documents from any device. Mobile invoicing applications such as Invoice2go help take the stress out of billing customers by allowing you to invoice right when the job is done, directly from your mobile device. This means better cash flow, and fewer hours spent chasing payments. Since poor accounting is one of the top contributors to a small business’ failure, especially during its infancy, improving cash flow is a huge win. If the workload is becoming overwhelming but you can’t commit to hiring a full-time employee, try TaskRabbit to find workers to assist with one-off tasks to help relieve the burden.

The affordability of these apps and many more ensures low overhead with maximum functionality and efficiency. It may seem like a small adjustment to incorporate one or more of these tools into regular business operation, but doing so can give a small business just the boost it needs to thrive and continue supporting the U.S. economy. And as we know, when small businesses win, we all win.

Hope you had a Happy Labor Day!

3) Invoice2go Special Offer—Ends Tomorrow

Invoice2go was selected by Apple for its “Work Smarter, Spend Less” campaign— a program launched by the tech giant in an effort to offer significant discounts on the best mobile apps to help people run a successful business and stay productive. The campaign is focused on making the best business apps more accessible.

The promotion runs through tomorrow, September 9 and offers new users a more than 50 percent discount on their first year of invoicing. Promotional prices for a one-year subscription are:

- STARTER Plan—$4.99

- PRO Plan—$24.99

- ENTERPRISE Plan—$37.99

If you’re an Apple user and want to sign up for Invoice2go at the promotional price, visit the Apple App Store—but do it today.

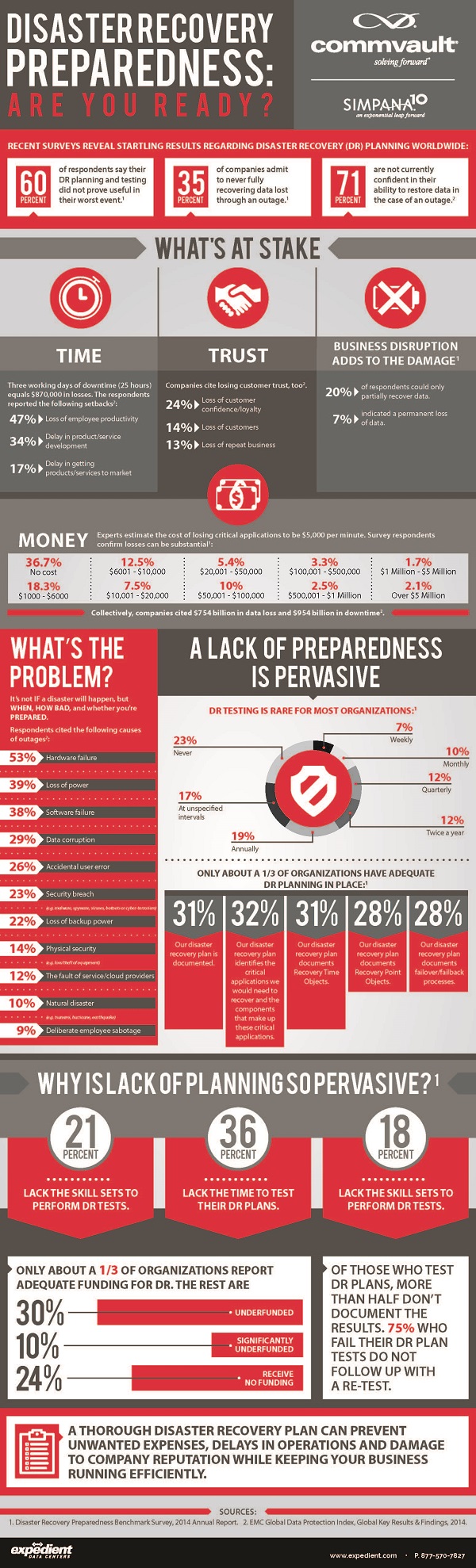

4) If Disaster Strikes—Are You Prepared?

According to a survey from Expedient, 71 percent of businesses are not currently confident in their ability to restore data in the case of an outage. Check out the infographic below, from Expedient’s 6 Steps to Disaster Recovery Preparedness, to learn how your small business can learn to prepare for a disaster before it strikes.

5) What to do in Case of a Data Breach

Speaking of disasters, not all are the “natural” kind. Data breaches for most small businesses would fall into the disaster category. Eduard Goodman, Chief Privacy Officer (CPO) at IDT911 shares his insights and tips for SMBs about data breach notification laws:

“Data breaches are happening with greater frequency, impacting businesses of all sizes. While no company is 100 percent immune from experiencing a breach, SMBs have an increased risk due to financial constraints and limited resources. While Congress debates federal legislation, here are a few tips SMBs should know about data breach notification laws:

Know your state laws. Understanding the ins and outs of your state laws when it comes to data breach notifications is the backbone to developing a business risk management strategy. This means knowing the laws of the states where your customers reside, since the applicable state breach notification law is based on where your impacted employees, customers, patients or clients live and NOT on the location of the business.

Time is of the essence. The time frame to alert consumers of a potential breach varies from state-to-state. For example, Florida requires notification within 30 days, while other states’ vague legal standards are not clear. The best practices over the years have interpreted them as being “as soon as possible” but NO LATER than 45 to 60 days from when a breach is discovered.

Proactive requirements. Some states require proactive measures to be taken in order to reduce the likelihood of a breach. This could include basic encryption of data, or a Written Information Security Program (WISP) like Massachusetts requires.

Avoid data hoarding. [Thinking about] the type of data your company stores will play a part in the type of proactive or reactive measures you take. For example, many of the state bills during the current legislative session are expanding the definition of personal information to include things such as biometric and health data. Many states also are requiring notification of its state attorney general, and several are delving into K-12 student data protection. Having a data retention and destruction plan is key. Knowing what personal information to hold on to and when to delete and destroy it will avoid exposing information that you had no need to keep for a decade in the first place. Personal data can be toxic if you expose it, so if you don’t need it get rid of it (securely) as soon as you can.”

6) Small Business Employees are Working Harder

Intuit just issued its monthly Small Business Employment and Revenue Indexes, which showed U.S. small business employment fell by 5,000 jobs in August, a decline of 0.02 percent for the month. Hourly employees worked an average of 110.1 hours in August, an increase of 20 minutes from July’s revised figure.

The good news was small business employees’ monthly pay increased by 0.3 percent—the equivalent of $8, with average monthly compensation reaching $2,838. Compensation is $44 per month higher than a year ago.

(These findings come from the monthly Intuit Small Business Employment Index and are based on data from Intuit Online Payroll and QuickBooks Online.)

7) Achieving Clarity in an Overwhelming World

I recently reviewed (and liked) the book Find Your Balance Point: Clarify Your Priorities, Simplify Your Life, and Achieve More by leadership authority Brian Tracy and his daughter, Christina Stein, a therapist.

The book provides a list of steps and goals to achieve in order to attain your own personal balance points. One of the key concepts behind this idea is finding clarity in four main areas of life. Developing clarity, the authors say, will provide the tools to create a strong vision, which is essential in finding your balance point. Here’s a short excerpt:

When you ask someone about their day, or even their life in general, the most common answers include: “I’m so busy,” “I’m so tired,” or “I’m overwhelmed.” In this day and age, doing anything and everything you possibly can is promoted as the only way to achieve success. Unfortunately, there isn’t enough time in the day to do anything and everything; these attempts to do so more often produce unsuccessful results, rather than fulfilling ones.

The four areas of life in which we need to achieve clarity:

- Your Professional Identity/Developing Your Business: Ask yourself clarifying questions. Ideally, what do you want your business to look like? What is your product? Who are your customers? Where do you want to be in five years with this business? How much do you want to make per year? Now more personal: What skills do you enjoy? What skills are you good at? What kind of business/product would combine your talents, passions, and experience?

- Your Family and Personal Relationships: Again, look at yourself three to five years from now. Know that 85 percent of your happiness depends on having the right people in your life, and 85 percent of your unhappiness depends on having the wrong people in your life. So, in three to five years, who do you want in your life? What new relationships would you have? Which do you see ending? What kind of lifestyle do you want to engage in? What kind of family values would you have? What kind of house will you live in?

- Your Health: What is your ideal physical condition? In three to five years, what kind of physical condition do you want to be in? What type of exercise do you want to engage in to maintain a healthy lifestyle? What types of food would you eat? What would you have to make happen now in order to achieve that ideal condition in the future?

- Money and Investments: We all want to be free of financial worry and have the ability to make choices without thinking about monetary concerns. However, money (or lack of) is the root of most evils in the world, so you must be very careful in the way you clarify your vision in this category. In three to five years, how much money do you want invested and working for you? How much money do you want saved? How much do you want to be earning? Now, what do you have to do presently to make those visions a reality?

Balancing your life is not an easy task, and it can often be harder to find your own balance point. The balance point is where all things start, and where all things must return to, in order to find peace. Starting with clarity, and creating your vision as a result, is one of the balancing steps [we] believe to be life-changing, and life-enriching.

8) Are Consumers Willing to Share their Personal Information?

Surprisingly, yes, if they get something in return. According to the latest data from [24]7’s Customer Engagement Index, 7 out of every 10 respondents were willing to share some form of data in order to improve their customer service experiences. Other top insights included:

- 24 percent were willing to share their locations

- 18 percent were willing to share the type of devices they use

- Only 6 percent would share more general data such as past purchases

- Customers want a better experience—53 percent believe customer service should be effortless and fast

- 29 percent believe anticipating a customer’s needs is a top attribute for great customer service.

9) Small Business Borrowers’ Bill of Rights – How Will It Affect Small Business Owners?

By Evan Singer, SmartBiz GM

The future of small business lending is undergoing a positive transformation to ensure that small business owners can both secure affordable funds and effectively and transparently compare different loan options. Lenders that fund small businesses have been encouraged to sign The Small Business Borrowers’ Bill of Rights.

A bit of history: During the 2008 financial crisis it became almost impossible for small business owners to secure funding from traditional banks. As a result, a variety of alternative lenders came in to fill the funding gap.

Unfortunately, some of these alternative lenders use non-transparent and unscrupulous lending methods that lock small businesses into expensive short-term loans, hampering financial stability and growth. Small business borrowers can end up paying effective APR’s of more than 50 percent or even 100 percent without realizing it. Even worse, because of the short-term nature of these loans, borrowers are forced or pushed into renewing or taking out a second loan that pays of the first prior to the end of its term. This increases the effective APR to an even higher amount causing cash flow problems that can cripple day-to-day operations.

Small Business Borrowers’ Bill of Rights

To combat these predatory actions, the Responsible Business Lending Coalition has released the Small Business Borrowers’ Bill of Rights. This initiative identifies rights for small-business borrowers that include the right to transparent pricing and terms.

Although our company grew out of the financial crisis as well, SmartBiz approached the funding gap differently. We combined technology and innovation with traditional banking to develop the first streamlined, online SBA lending platform. Since we process SBA loans, which are highly regulated, we’ve always provided the transparent pricing and terms the Borrower’s Bill of Rights has identified. Self-regulation is good for the small business lending industry and good for small businesses. It’s important for the industry as it shows regulators they can police themselves. It’s good for small businesses since they will hopefully find more transparent pricing that can help them better decide the best loan option for their growth.

Loan Cost Transparency

How does this Bill of Rights affect small business owners? Potentially in a big way—loan seekers will now have better access to transparent rates and fees. This hopefully levels the playing field so that loan seekers can compare apples to apples. All key terms are supposed to be presented in an easy-to-understand manner. The loan amount, payment amount and frequency, collateral requirements, and the cost of prepayment should be clearly stated. Those who have signed the Bill of Rights will have to present everything needed for a comparison clearly and prominently, in writing, to the borrower.

How to Compare Apples-to-Apples to Find the Most Affordable Loan

Once borrowers have all of the pertinent numbers related to a loan, it’s important to choose the best loan product that will benefit small business growth. In addition to APR, there’s an easy calculation that will reveal the true cost of the loan so small business owners can make an informed decision—the loan constant. Calculating it is easy. Take the required minimum monthly payment and multiply that amount by 12. Take this result and divide it by the current outstanding loan balance. The lower the loan constant, the better.

The loan constant can be used to compare the true cost of borrowing. Given the choice of two loans, small business owners should opt for the one with the lower loan constant.

Holding alternative lenders accountable to offer similar transparency as banks strengthens the small business lending industry. The economy is strengthened when small businesses have knowledge and transparency necessary to make informed decisions.

Ultimately, we hope the Small Business Borrower’s Bill of Rights sparks job growth, spurs innovation and helps American entrepreneurs flourish. As technology advances and new lenders enter the marketplace, the transparency that the Small Business Borrowers’ Bill of Rights brings will be increasingly important.

10) 5 Top Techniques for Mixing a Successful Sales Cocktail

By Anthony Caliendo

[Anthony Caliendo is an entrepreneur, leadership coach, sales guru and author of the new book, The Sales Assassin: Master Your Black Belt in Sales. Here is his guest post on how to “Mix the Perfect Sales Cocktail.”

Sales can be complicated! Being a good salesperson can be frustrating and complex. Different factors contribute to sales complexity:

- Being able to find the right lucrative opportunity

- Having access to the right resources

- Selling the right product or service that appeals to businesses and consumers

- Developing effective lead generating techniques

- Learning how to navigate through a complex sale

I’ve watched sales professionals expend an enormous amount of energy making sure all these aspects align so they achieve the success and income that they desire and deserve.

One factor in achieving sales success that is the absolute most essential but most frequently ignored is the “human factor.” The two most important and critical components to a successful sales process are you and your customer, no matter what you’re selling. As humans, we have different personalities, tendencies, habits and quirks that can simplify or utterly complicate sales. At the end of the day, [you] must recognize that when you strip away all of the other variables in the sales process, the two constants that will always dictate sales success or failure are who is selling and who is buying. Once you accept this fact, then sales suddenly become less complicated. Why? Because now sales are all about your desire to sell and their desire to buy.

With literally thousands of different sales techniques and philosophies that salespeople attempt to master, we find ourselves using trial and error, sampling and tasting until we think we’ve mixed the right sales cocktail that will increase our closing ratios. However, as a sales leader, coach, and the “Ultimate Sales Assassin”, I know that the most effective sales techniques to produce results and achieve desired outcomes focus on the human factor and the emotions that drive desired behavior:

- Make an impression

- Make connections

- Build relationships and build trust

This requires that salespeople perfect the techniques that get you in front of your potential customer, make you likable and above all, persuasive. Here’s how:

#1: Sell Yourself. My one universal concept that never varies or waivers no matter if your sales business is B2C, B2B, retail, real estate, insurance, technology, securities or manufactured goods: Selling is not about selling your product or service, it’s about selling yourself. That doesn’t mean that you don’t need product knowledge or that you don’t need to create value to influence the close. But consider this: having an A+ product with A+ product knowledge means nothing if you can’t even advance to the presentation.

First and foremost, you have to think of yourself as your product. What attracts consumers to a product? The packaging, its features, price, and guarantees. Manufacturers design and market their goods with consumer appeal uppermost in their mind. As a sales person, you have to market yourself in the same manner. You are the manufacturer of your product: which is you. Dress for success, channel confidence and charisma from within, and attract your buyer to you. You have to make an impression. Be unique. Be distinctive. Be remembered or be forgotten.

At trade shows, I’m known as “The Suit’. Even if the dress code is business casual, I show up in a suit because that’s how I want to be remembered: the guy who always looks professional and is ready to deal with the CEO or the doorman. You know the saying: “You only get one chance to make a first impression.” What first impression are you giving your prospects?

#2: Make Your Prospect Comfortable. Frankly, make them like you. There’s a fine line between confidence and arrogance, persistence and annoyance, being knowledgeable and being a know-it-all. You have to know where and when to draw that line. You have to make your customer want to engage with you and do business with you. Even with today’s online researching and buying trends they will not buy from you if they do not like you and trust you.

#3: Master “The Art of Asking Questions Without Asking.” You must make a connection with your buyer. Learn how to get them off the defense and extract as much information as possible so you can assess their needs—without them even realizing it. The best advice I can give is learn how to open up the dialogue and then learn how to listen. Listening is a skill: not everyone is born with the ability to listen. But if you want to learn how to improve your sales skills, learn and practice your listening skills. Next thing you know you’ve gathered all the info you need for your closing arsenal. Now close.

Remember: LISTEN and SILENT are spelled with the same letters. Think about it.

#4: Isolate Your Buyer’s Hot Spots. Create value, create need and create solutions for your potential buyer. In today’s buying cycle the vast majority of buyers have done their online research before they ever speak to a salesperson. They asked for recommendations, they’ve Googled your company and you, and they have decided that they want to hear your pitch. Don’t waste their time: hone in on what is actually important to them and then be prepared to give them the solutions they are looking for, not the pitch you’ve been preparing for months.

That’s not to say you shouldn’t have your big pitch ready: a Sales Assassin is always prepared to change course to meet the buyer’s needs. They know their problem—but you have the solution. A buyer may be very clear that he needs to purchase ABC, but when you hear the problem a good salesperson is prepared to explain why XYZ is the real solution to their need. Don’t confuse this with upselling: cross selling is solving problems the client may not even realize they have, or known that you could solve. Refer to #3: LISTEN.

#5: Recognize Emotional Drivers and Negotiate Accordingly. Don’t be so preoccupied with your own goal to reach the finish line that you fail to identify your potential buyer’s signals. You are pitching a product to your prospect to solve their problem, not to solve yours. So when your prospect is giving you clues as to what they may be thinking or feeling, you need to recognize that this is what drives them to make their final buying decisions. Once you make your problems the client’s, you’re sure to lose the relationship and the sale. So tune in and negotiate accordingly.

Once you’ve solved the client’s problem, you’re their hero – and you’re their go-to sales rep.

11) Beware of Hotel Booking Scams

AAA, the world’s leading consumer travel advocacy organization, has issued strong warning against hotel booking scams. AAA says, in many cases, sites that look like legitimate travel sites, “will take your money but not actually book your room, flight or car, leaving you without a reservation when you arrive.” According to the American Hotel & Lodging Association, this scam costs consumers more than $220 million a year.

How can you avoid getting scammed? We’ve all heard the adage: “If it sounds too good to be true, it probably is.” That statement applies to booking travel, too. Not all online reviews of online travel agencies are accurate. AAA Travel experts recommend working with a trusted travel agent, especially if you’re unfamiliar with the area. Agents are fonts of knowledge, keeping you informed of changes and have your back when necessary.

Here are some tips from AAA Travel experts to help you avoid travel scams and get the most out of your trip:

Research companies: Book with reputable companies whose names you’ve heard of. Even then, search their name along with “scam” and “review.” If you see a lot of negative reviews for a company, proceed with caution. Try looking them up on the Better Business Bureau website. Ask friends or colleagues for recommendations of online travel agencies.

Take credit: Always pay with a credit card and not a debit card. With debit cards, the money immediately is removed from your bank account, which can make getting it back more difficult. It’s easier to dispute the charges when using a credit card.

Read carefully: Combing through the fine print of travel documents can be tedious, which is why many consumers fail to do this. Even if the site says something like “satisfaction guaranteed,” still read the fine print before booking. This could help prevent things such as being charged a higher room rate when you arrive and understanding your cancellation and revision policies.

Verify reservations: Call the hotels and flights you booked through a third-party site with the hotel or airline itself to make sure that the reservations are correct and ask the company to notify you of changes. Again, use a credit card to book travel, as it offers you more protection.