11 Things Entrepreneurs Need to Know

By Rieva Lesonsky

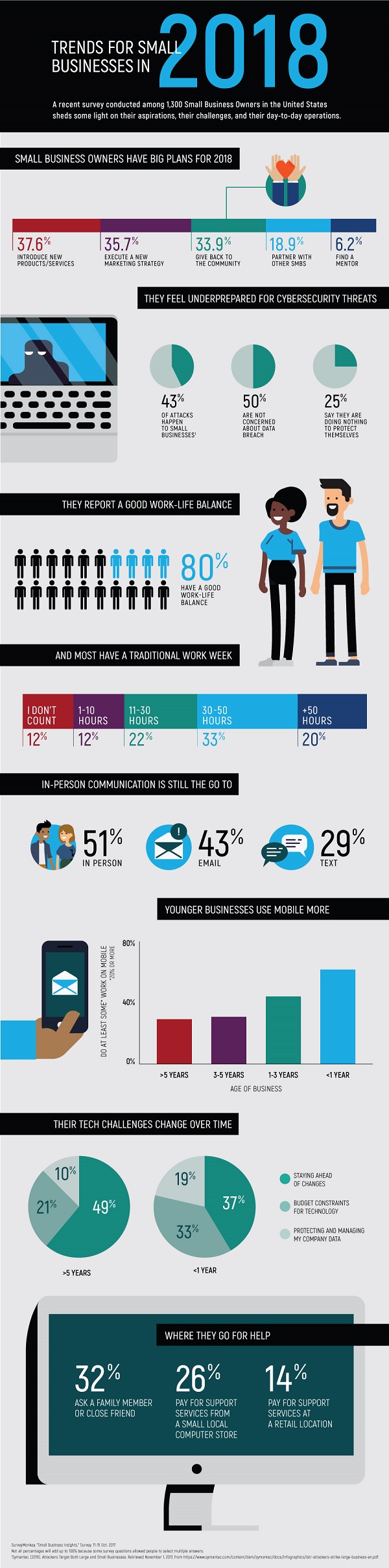

1—Small Business Expectations

Last fall, Microsoft Store surveyed small business owners and entrepreneurs and learned they were looking forward to 2018. Most expect to grow by:

- Introducing a new product or service

- Executing a new marketing strategy

- Giving back to their community

- 90% plan to hire 1-2 new employees

Check out the infographic below for more information.

2—Introvert’s Guide to Speaking Up

Even if you’re the boss, being an introvert can hold you back. Here, courtesy of OnStride Financial, a UK-based financial services firm.

3—Is This the Year of the Side Hustle?

A study of 2,000 American workers by TSheets, which offers an employee time tracking app, shows 10% of your employees might be headed to a new job this year. While this might be good news for the nation’s recruiters, it’s not so great for you. You might have to sweeten the pot to keep them.

Another possible concern for business owners is staff productivity. Their attention might be diverted because they’re working on their own businesses. According to the study, 19% of workers will start or continue a side hustle this year, to supplement their income.

- 5% of the American workforce (around 7.5 million people) will start a new side hustle, while keeping their current jobs

- 14% (around 21 million people) will keep their current side hustle, and stay at their jobs

- 3% intend to quit their jobs this year to focus on their side hustle full time.

- 9% will continue to work for themselves in 2018

4—A Key Provision of the Tax Reform Act: New 20% Deduction for Small Business Owners

Guest post by Mike D’Avolio, CPA, a senior tax analyst with the Intuit ProConnect. D’Avolio has been a small-business tax expert for more than 20 years and serves as the primary liaison with the Internal Revenue Service for tax law interpretation matters, manages all technical tax information, and supports tax development and other groups by providing them with current tax law developments, analysis of tax legislation and in-depth product testing.

The Tax Cuts and Jobs Act was signed into law on December 22, 2017. One of the key measures provides a 20% deduction beginning in Tax Year 2018 on pass-through income from sole proprietors, limited liability companies, partnerships and S corporations.

The 20% deduction applies to Qualified Business Income (QBI) which includes the net amount of income, gains, deductions and losses associated with a trade or business, but not investment-related items, such as capital gains or losses, dividends and interest income. The new deduction is taken below the line, which means it reduces taxable income not adjusted gross income.

Two limitations on high-income earners

The Act sets limits on how much people with high incomes can deduct.

- Professional service industries

The new rules deter high-income taxpayers from trying to convert wages or other compensation from personal services into income that qualifies for the deduction. For people in the professional service industries, such as health, law, consulting, athletics and financial, the 20% deduction would begin to be phased out for those who earn more than $315,000 (for couples) and $157,500 (for singles). The deduction is fully phased out when income reaches $415,000 (for couples) and $207,500 (for singles).

- All industries

For high-earners in all industries, the new Tax Act uses another calculation to limit the deduction. The limit would be set to whichever is higher: 50% of total wages paid or 25% of wages plus 2.5% of the cost of tangible depreciable property. This means pass-through entities that pay a large amount of employee wages or are in capital-intensive industries can take more of the deduction.

Tax savings and planning opportunities

Small business owners may consider doing some scenario planning to optimize the 20% deduction. Here are some tax planning opportunities:

- Because of the phase-outs and threshold amounts, married taxpayers may want to compare married filing jointly versus married filing separately to see which status yields the higher benefit.

- Generally, it’s advantageous to reduce W-2 wages to minimize self-employment taxes. However, increasing W-2 salaries to a certain level may be necessary to optimize the 20% deduction. Thus, converting a 1099 contractor to a W-2 employee could be beneficial.

- Small businesses qualifying for the 20% tax deduction could see their effective marginal tax rate reduced to 29.6%. Under the new law, the top income tax rate for C corporations is reduced to 21%. C corporations are taxed twice (once on the income and then on the returns to investors), so it may not make sense to convert an S corporation to a C corporation.

The rules surrounding the new tax deduction can be complex, especially for high-income taxpayers. Please consider engaging the services of a tax professional to help you determine the impact to your small business.

5—Top SEO Priorities

Social media marketing is the leading SEO priority among U.S. businesses in 2018, according to new research from Clutch and Ignite Visibility. Over 90% of businesses that invest in SEO also invest in social media. The survey of marketing decision-makers reveals most tend to shape their SEO strategy based on the SEO services they prioritize and the challenges they face.

Two factors impact the direction of a business’s SEO strategy: The shifting customer journey and whether the business focuses on paid search or organic SEO services.

Organic SEO services include:

- On-site optimization: web design, site infrastructure, blogging

- Off-site optimization: content marketing, social media marketing

Over 40% of businesses that invest in SEO focus on organic services, compared to 19% that focus on paid search. And 55% of businesses partner with an expert firm for SEO services.

Businesses that focus on organic SEO are more likely to use in-house staff for general marketing, such as content marketing and social media—76% do this. Businesses that focus on paid search are more likely to hire an SEO company—68% do this, compared to just 37% that rely on in-house staff.

Paid search complements organic SEO by providing feedback on keyword research, audience targeting, and effective ad copy, says Eythor Westman, head of paid media at Ignite Visibility.

How businesses adapt to shifts in the customer buying journey is another factor that shapes SEO strategy. The rise of mobile search drives changes to the customer buying journey. SEO experts agree customers use their mobile devices to learn about a company through social media and site content before converting to make a purchase.

Today, says John Lincoln, CEO of Ignite Visibility, “somebody Googles a keyword. Then they click on a top ranking term like, ‘SEO company.’ They read your blog and click around [your] social media [platforms]. Then, they convert three weeks later after they feel comfortable with you.”

In response, businesses prioritize SEO services that facilitate the customer journey. Along with social media (20%), businesses rate creating content to earn links (15%), and mobile search optimization (14%) as their top SEO priorities.

You should check out the full report.

6—Strange Employment Laws

If you think employment laws are weird here in the U.S. (and some surely are), check out some even odder laws from around the world, courtesy of Legacy Citizenship.

7—5 Finalists Named for Small Business Revolution – Main Street

Deluxe Corporation just announced the five finalists in a nationwide search for one inspiring small town to receive a $500,000 transformation and to be featured in Season 3 of Deluxe’s hit show Small Business Revolution – Main Street.

Deluxe received thousands of nominations for Season 3. The public will now decide the winner, which will receive a $500,000 revitalization for its small businesses and downtown area and be featured in an eight-episode series that will stream on Hulu and SmallBusinessRevolution.org. Small business owners in the winning town will receive marketing support and business advice from a team of Deluxe small-business marketing experts, including Deluxe’s chief brand and communications officer Amanda Brinkman.

Deluxe has also enlisted TV star Ty Pennington, who will join Deluxe experts in the winning town and serve as celebrity spokesperson of the popular online series.

After narrowing the Season 3 nominations to a short list of 10 towns, Deluxe visited each of the towns and identified five finalists:

Alton, IL: A riverfront community separated from Missouri and the St. Louis metro by the Mighty Mississippi, this bustling town once boasted more millionaires per capita than anywhere in the U.S. Now, Alton is transitioning out of its heavily industrial past and is in the midst of an entrepreneurial reinvention.

Amesbury, MA: A historic New England town once famous for manufacturing everything from ships to carriages. Nestled on the Merrimack River, Amesbury now features a picturesque downtown that is filled with inspiring small businesses.

Bastrop, TX: A small community outside Austin that has weathered challenges that include a massive forest fire. Its downtown, which feels plucked from a classic Western film, features everything from a moonshine distiller to an arts bazaar selling high-end Persian rugs.

Martinez, CA: The town is home to both Joe DiMaggio and the martini, Martinez sits on the outskirts of San Francisco’s East Bay. Its downtown is experiencing a revival amid the renovation of beautiful historic buildings.

Siloam Springs, AR: Located in the northwestern corner of the state on the Oklahoma border, Siloam Springs blends a wealth of natural beauty with a youthful entrepreneurial enthusiasm and a robust Hispanic community.

VOTE NOW! Deadline for voting is Tuesday, February 20th. Visit SmallBusinessRevolution.org to watch a brief video about each finalist and vote for your favorite. The town’s story will be told in Season 3 of Small Business Revolution – Main Street, which will air in the fall of 2018. The winner will be announced on February 27.

8—Kabbage Expands Credit Line Sizes

Kabbage, Inc., a global financial services, technology and data platform serving small businesses, now offers lines of credit of up to $250,000. The expanded Kabbage® product provides larger businesses with access to greater purchasing power for longer-term investments. $250,000 is the largest credit line available from any online lender and will allow Kabbage to expand its customer base to serve larger businesses.

In a recent survey of small businesses, Kabbage learned more than 73% of businesses expect to increase their revenues by more than 20% this year—a goal that requires simple, flexible access to large amounts of working capital.

The Kabbage survey also found respondents intend to invest in:

- Mobile technologies, such as apps, advertising or text automation to acquire new customers and deepen their relationship with existing ones (51%)

- Technologies to reduce manual process and paperwork (59%)

- Social advertising, increasing spend by 20% across Yelp, Facebook, Twitter, Pinterest and others (49%)

- Cybersecurity tools and software to protect company and customer data (46%)

9—Entrepreneurs of Color Fund Expands to South Bronx and San Francisco

Building on the success of Detroit’s Entrepreneurs of Color Fund, JPMorgan Chase recently announced it will expand the fund’s model and create two new funds to help minority entrepreneurs in San Francisco and the South Bronx. They’re committing more than $5 million across the two cities to provide minority entrepreneurs with critical access to capital, while also recruiting additional investors to the new funds.

As part of JPMorgan Chase’s $150 million Small Business Forward program to help women, minority and veteran entrepreneurs, the firm will invest $3.1 million in San Francisco and $2 million in the South Bronx, with the goal of helping local minority-owned small business share in the growth of these two cities. The firm recently doubled the size of Small Business Forward from $75 million as part of a $20 billion, five-year U.S. investment that includes increasing the firm’s small business lending commitment and community investments to drive inclusive economic growth.

Applying Insights from Detroit

Since its launch two years ago, the Detroit fund has lent or approved $4.7 million to 45 minority small businesses, resulting in more than 600 new or preserved jobs. Fifty-three percent of the loans have supported minority women-owned businesses and 70% have supported small businesses based in Detroit neighborhoods.

The new funds will provide underlying capital for community lending partners to make loans and provide technical assistance and personalized servicing. Many entrepreneurs will be in the start-up stage of their business, but the funds will also support existing, legacy businesses—allowing more businesses to stay local despite threats like rising rents and higher operating costs. These entrepreneurs are typically unable to qualify for traditional loans, often due to previous credit challenges, limited financial collateral, short business history or informal businesses practices.

Small businesses are key drivers of growth, and that growth is fastest among minority and women entrepreneurs. A 2016 study by the Institute for a Competitive Inner City shows that small businesses in large cities account for a majority of jobs, but that number is even bigger in inner city areas. In Detroit, small businesses accounted for half of jobs within city limits—that number jumps to two-thirds of jobs in Detroit’s inner city neighborhoods. That same report also found a modest increase in the number of jobs created by existing small businesses could create enough employment opportunities for all currently unemployed inner city residents.

San Francisco Entrepreneurs of Color Fund

JPMorgan Chase is bringing together Working Solutions, ICA Fund Good Jobs and Pacific Community Ventures to help San Francisco entrepreneurs of color start, stay and grow in the city. The collaborative, which won JPMorgan Chase’s PRO Neighborhoods competition, will provide loans and technical assistance, with loans starting from $5,000 for start-ups and larger loans for more developed small businesses.

The fund will also work closely with the new Chase Center in Mission Bay to generate business opportunities and local economic growth.

South Bronx Entrepreneurs of Color Fund

In the Bronx, 80% of small businesses are owned by entrepreneurs of color, and many struggle with being able to afford the space and resources they need to run and grow their businesses.

JPMorgan Chase is partnering with Excelsior Growth Fund and Accion East, two recent winners of JPMorgan Chase’s PRO Neighborhoods competition. The PRO Neighborhoods investment facilitated the development of a loan management infrastructure that the collaborative will leverage to create tailored solutions, including flexible small business loan products. The Entrepreneurs of Color Fund will also offer technical assistance and education to businesses. CommonWise Education, a network of grassroots local leaders, labor leaders, and anchor institutions whose mission is to end generational poverty in the Bronx will help to inform the design of the fund.

If you have questions about investing in the funds, contact Excelsior Growth Fund (South Bronx) at 646-465-818 or Working Solutions (San Francisco) at (415) 655-5442.

If you want to apply for funds:

- In the South Bronx, go to ExcelsiorGrowthFund.org

- In San Francisco, go toentrepreneursofcolorfundsf.org.

Quick Takes

10—Overcoming Social Media Challenges

The smart folks at Clutch, a B2B research, ratings and review company, just launched The Manifest, a business news and how-to website. Take a look at their first report on overcoming social media challenges.

11—Travel Alerts

If you travel overseas, you need to stay current on any travel warnings and advisories from the U.S. State Department. This page from Insure My Trip will help you do just that.