10 Things Entrepreneurs Need to Know

By Rieva Lesonsky

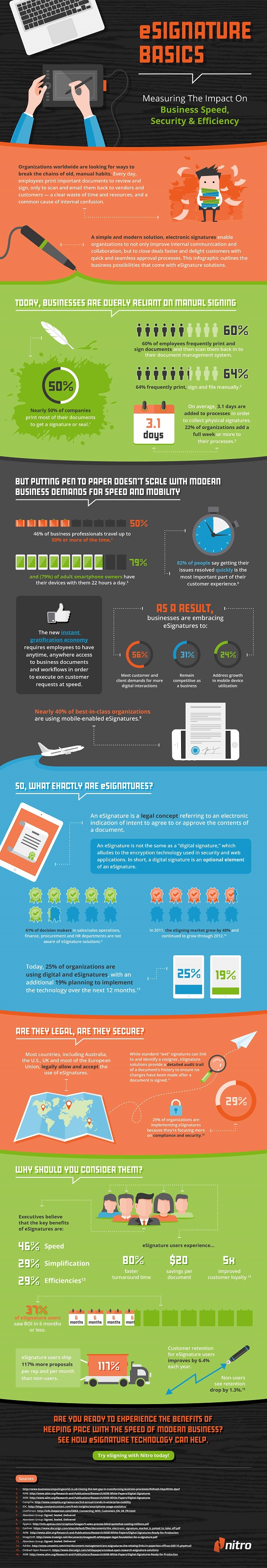

1) Sign Up for eSignatures

While the paperless office is still not a reality, we are making progress towards achieving that goal. One technology that’s helped us go paperless is the number of digital signature tools available to us.

However, despite all these options, according to the folks at Nitro, “employees are still spending valuable time and resources to print and sign documents of all types.”

Nitro reports:

- 60 percent of employees often print and sign documents and then scan them back into their document management system.

- 64 percent typically print, sign and file paperwork manually.

However, Nitro says, there are a lot of benefits to using eSignatures. Users experienced:

- 80 percent faster turnaround time, $20 savings per document and 5x improved customer loyalty

- 37 percent of users got a ROI within 6 months of using eSignatures

- 117 percent more proposals were sent

- 6.4 percent customer retention rate, compare to a 1.3 percent retention drop by non-users.

2) Small Businesses Keep Getting Stronger

The 1st quarter report from the ShopKeep Small Business Index (SSBI) shows “small businesses are growing and are the strongest they’ve been in recent years. Overall confidence in small businesses has increased significantly this quarter from 64 percent to 96 percent.

ShopKeep, an iPad, cloud-based POS system issues a report every quarter, drawn from same-store sales data and customer survey results.

Still, this quarter’s findings show business owners have concerns, including:

- 61 percent are concerned about tax and regulatory policies

- 44 percent worry about economic uncertainty

- 42 percent are concerned about finding/retaining a quality workforce

- 27 percent worry about the cost and availability of employee health insurance

Overall, these ShopKeep merchants had a very strong quarter, following a much improved holiday season. An overwhelming majority (96 percent) are “confident about the current state of their businesses (which is well above the current U.S. average of 65 percent) and 97 percent are optimistic their businesses will be successful one year from now. In the last six months, 75 percent of merchants saw revenues rise, 90 percent expect sales increases in the next six months and 68 percent reported an increase in net profits over the last six months.

Who do small business owners rely on to help them run their businesses?

- Accountants, bookkeepers or financial advisors: 60 percent

- Family and friends: 54 percent

- Online resources: 55 percent

- Other small businesses owners: 43 percent

To learn more, read the full report.

3) We Feel Good!

A PNC survey underscores the optimism among small and mid-sized business owners. The latest PNC Economic Outlook Survey shows 83 percent of business owners are optimistic about their company’s overall prospects and 70 percent (the most since 2007!) are optimistic about the U.S. economy. Plus, 57 percent expect sales to increase and 51 percent anticipate profits will climb during the next six months. As a result of this 40 percent plan to give their employees a raise and 22 percent expect to hire more staff.

Most of the business owners don’t plan to seek outside financing,

Although expectations for business prospects are promising, loan and credit demand continue on a slow path upward. While the majority doesn’t plan to seek outside financing, 22 percent say they probably or definitely will take out a new loan or line of credit in the next six months.

Other key findings include:

- 53 percent plan to pay down existing debt

- 43 percent expect their cash flow to increase in the next six months

- 55 percent are aware of their cash flow on a daily basis

- 70 percent maintain an emergency or cash reserve fund

- 45 percent are concerned about information security and 9 percent have been impacted by a security breach

4) Job Growth

ZipRecruiter, an employment service for small and mid-size businesses, just released their third monthly National Jobs Report showing that last month there was “strong growth in insurance, financial services and educational services” jobs, while demand slowed in the health care, employment services and retail sectors.

This month, job demand in the insurance, construction, accommodations and food services industries is expected to increase.

ZipRecruiter also measures the largest change in relative demand for hiring by city (MSA’s). In March job demand was highest in:

- New York

- San Francisco

- Los Angeles

- Seattle

- Riverside, CA

5) Sourcing Simplified

Sourcing products has long been a big challenge for many small business owners. To help Alibaba and Bigcommerce just announced a new way for business owners to get merchandise.

Alibaba.com is collaborating with Bigcommerce to “deliver an integrated shopping experience for sourcing products from Alibaba.com’s extensive network of Chinese wholesale suppliers.” Jointly developed by Alibab.com and Bigcommerce, the custom-built Wholesale application provides a unique catalog of wholesale suppliers in a secure and familiar interface so merchants can quickly find and select new products to sell online. At launch, Bigcommerce’s 70,000 merchants will have access to about 300 Gold Suppliers on Alibaba.com, hand-selected for meeting strict quality and customer support standards

As Michael Lee, International Business Development and Marketing Director for Alibaba.com explains, “This new application provides Bigcommerce merchants with direct access to Alibaba.com wholesale suppliers, offering competitive prices to realize better profit margins.”

Bigcommerce merchants receive:

- Integrated search, customized for ecommerce merchants

- Transparent purchasing from suppliers

- Customized pricing with lower order minimums. Merchants can select wholesale pricing based on fastest delivery time or lowest possible price.

- Payment protection

There’s more information, including resources on how to build a business, source products and find suppliers, available on this new website.

6) Tax Savings in the Cloud

With taxes on everyone’s mind Peak 10, an IT solutions provider says many business owners are “unaware their business’ cloud strategy might qualify for a tax credit.” An unbelievable 92 percent of surveyed business executives have not taken advantage of existing statutory credits for cloud investment.

To help you figure it all out (take advantage of the cloud, keep your data safe and save money), Peak 10 offers these 4 tips:

- Educate your staff. Look up the federal and state cloud tax regulations that affect your business. For example, Section 199 provides a tax deduction for domestic production if taxpayers meet certain requirements.

- Create a holistic approach. Your accounting department or tax consultants are there to help. Include them in the cloud strategy process

- Be aware of international laws. The cloud is neither a one-size-fits-all model, nor is it confined to borders. If you do business internationally, consider the cross-border provisions and implications of your tailored cloud strategy.

- Understand compliance regulations. Export controls also apply to virtual technology elements. Consider software encryption, and server location and choose an IT partner with strict regulation adherence to avoid penalties.

Peak 10 says, “By heeding these steps and partnering with a service provider that is open and invested in all levels of the cloud solution, businesses can properly source long-term IT needs, improve the bottom lines and ensure proper tax credits are received.

7) Beware These 4 Top Investment Scams

Securities attorney Andrew Stoltmann, the CEO of Stoltmann Law Offices, says that even though most of us are aware of pyramid schemes, many of us wouldn’t be able to detect one if we were pitched by a smooth salesperson. “They say that a fool and his money are soon parted,” Stoltmann says, “but the reality is that intelligent people are also susceptible to investment scams.”

Stoltmann explains the top 4 investment scams (according to the Huffington Post) we should watch out for:

1. Ponzi schemes. These are schemes that encourage you to get your friends and family involved. You get excited about the possibilities and start inviting everyone you know to join in. Whole families (even communities) can be affected by Ponzi schemes.

2. Promissory notes. With promissory notes, people are promised little risk with big returns. High interest rates lure in investors, especially those who are elderly and need funds quickly and simply. Sadly, many vulnerable people lose thousands and thousands of dollars this way.

3. Gold and precious metals. There is such an allure to precious metals. It feels very exciting to invest in a diamond mine. Yet the reality is that you are investing in nothing more than scam.

4. Investment Seminars. Have you ever heard you have to spend money to make money? That is the crux of these investment seminars where people pony up a lot of cash for nothing but empty promises and wasted hours in a hotel ballroom.

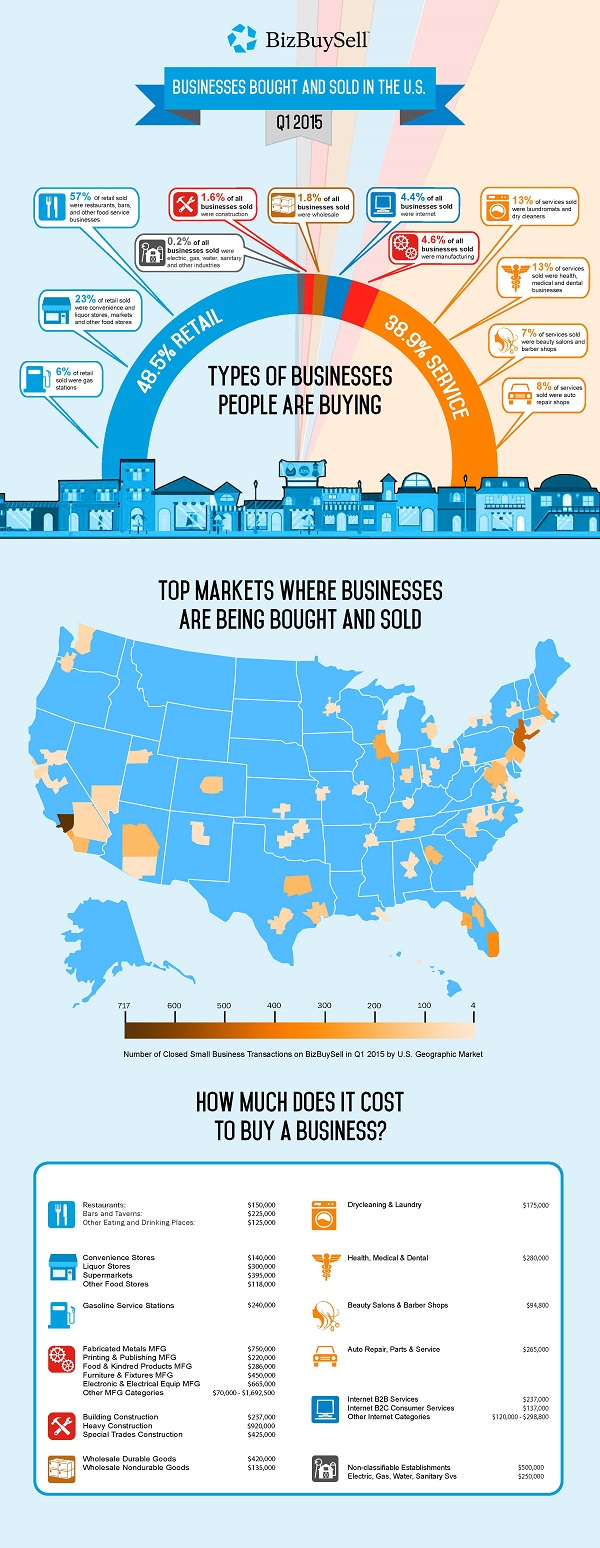

8) More Businesses Sold

BizBuySell.com just released its quarterly Insight Report, showing a 6 percent increase in small business transactions compared to the same time last year. A few highlights from this quarter’s data:

- The median revenue of small business sold in Q1 rose from $400,000 last year to $442,000 in 2015.

- The improving financial performance of small businesses allowed sellers to both ask—and get more money. The median asking price of a business grew to $225,000, up from $199,000 a year ago and the median sale price increased to $200,000, up $25,000 from last year.

- Retail business financials were particularly high as growth in both revenue and cash flow led to higher sales and asking prices.

BizBuySell reports businesses in the service industry appear to have fueled transaction growth in the 1st quarter—these sales increased 18 percent from the 1st quarter of 2014. Businesses transactions were most popular in the Midwest.

Small retailers saw the biggest gains in financial performance in early 2015. The median revenue of a retail business sold in 2015 was $537,500, up from $437,783 in 2014.

9) Cool Tool

ClearSlide, a leading sales engagement platform, just released the ClearSlide Presenter, a new iOS app, allowing sellers and marketers to access content, conduct in-person or remote meetings, and capture real-time analytics on viewer engagement. The app is available for download in the iTunes App store.

Clearside set out to eliminate some common challenges that impeded the presentation process, such as not having access to Wi-Fi or a projector, or discovering you are presenting to both face-to-face and remote participants.

Raj Gossain, VP of Product at ClearSlide, says the “ClearSlide Presenter is the first sales presentation tool that is ‘ready to pitch from anywhere’ while automatically capturing and syncing engagement data essential to optimizing the sales process.”

Users can present from their iPhones or iPads, sharing content directly on the device or broadcasting content via a ClearSlide Viewer Link. The ClearSlide Presenter can access your sales and marketing materials, including videos and web slides, and can also sync key content directly to the app to present even when offline.

10) The Canadians are Coming, The Canadians are Coming

Small business is big in Canada and the recently released annual report from Economic Development Canada (EDC) shows Canadian exports rose 5.7 percent over 2014, despite the fact that only 4 percent of Canadian companies actually export their goods and services.

To grow this even more Jim Shenkman, the CEO of Bivio Events and a serial entrepreneur in America, Canada and global markets, is organizing an Expand in the USA conference to “empower Canadians [small business owners] to up their game south of the border.”

The conference will be held June 16 and 17 at The International Centre in Mississauga, Ontario. You can register and get more information on the Expand in the USA website.

Rieva Lesonsky is CEO of GrowBiz Media, a media and custom content company focusing on small business and entrepreneurship. Email Rieva at rieva@smallbizdaily.com, follow her on Google+ and Twitter.com/Rieva.