6 Things Small Business Owners Need to Know

By Rieva Lesonsky

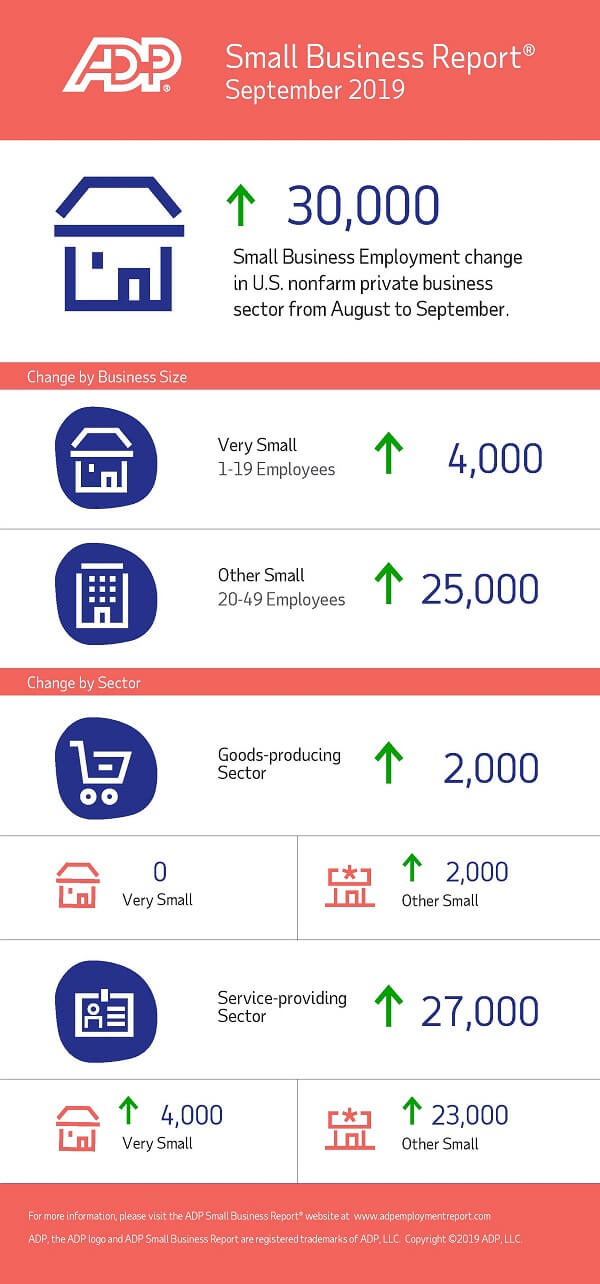

1—Small Business Job Creation Increased in September

Private sector small business employment increased by 30,000 jobs from August to September according to the September ADP Small Business Report.

Check out the infographic below from ADP.

2—Create Customized Email Templates in Second

Wouldn’t it be easier to create email campaigns if you had a design assistant at the ready? Well, now you do—AWeber just launched AWeber Smart Designer—an intelligent design assistant that automatically (and quickly) generates customized email templates from a website or social media profile.

This game-changing email marketing feature gathers logos, images, brand colors and text from websites, Facebook or Instagram pages, and YouTube channels to create ready-to-send email templates. It enables you to automate email template design—one of the most time-consuming and complex elements of the email marketing process—by leveraging your existing branding and content.

“Small business owners no longer need to think about spending hours on email design,” says Rob Patterson, AWeber’s Chief Marketing & Growth Officer. “AWeber Smart Designer uses advanced intelligence to accurately classify content from a website so that the right images, logos and content end up in the right place within a template. This powerfully-simple tool saves our customers time so they can focus on their passions and grow their businesses.”

AWeber Smart Designer automatically distinguishes logos from other images and places them throughout a variety of template options appropriately, in roughly 5 seconds. It can also analyze websites, blogs, social media profiles and e-commerce web storefronts and produce proper template results.

I highly recommend “playing” with the tool. I did—and was stunned by how quickly the Smart Designer created several beautiful newsletter themes. Check it out and create your own email template at AWeber Smart Designer.

To learn even more register for AWeber’s webinar, The Email Design Myths Hurting your Business (And How to Fix Them), on October 15 at 2 pm EDT.

3—New Website Design Service Fuels Small Business Growth

Regular readers know I believe every small business needs a website. But I know it can be difficult in today’s competitive business climate, to build and manage a website, while you’re also trying to focus on running and growing your business.

Help is at hand—Yahoo Small Business just launched an “easy and affordable website service using the popular WordPress platform.” Website Design Service helps you establish and maximize a strong online presence by providing the design, engineering, copywriting and support services required to create, build, launch and manage a website, with little “time and effort” required from you. You end up with a professional and productive website without having to invest in the skills, knowledge, time or resources to design and maintain it.

And, as your business evolves, your website will too, due to the continued support and updates included as part of Website Design Service. Yahoo Small Business says, “Clients can regularly request content updates and additions to their site to keep it fresh and accurate. Through the service, the site will be closely monitored to ensure it continues operating efficiently and securely, including proactively updating security plug-ins. In addition, all website content is reviewed for SEO optimization before and after launch, which can help the site get higher page rankings and increased organic traffic—which means more customers.

“Our mission is to help small businesses thrive, and a high performing, fully updated website is one of the most important keys to success,” says Kush Shrivastava, managing director of Yahoo Small Business. “We know that many small business owners don’t have the time or the experience to design and build a professional website, let alone to handle the ongoing management of the site and updating of content. With Website Design Service, small business owners don’t need to spend extensive time or money learning how to code or optimize for search rankings. Yahoo Small Business will handle the heavy-lifting to deliver the world-class website they need to effectively connect with their customers.”

Website Design Service includes two offerings:

1—Standard: focused on delivering an elegant, professional site with basic functionality and light content updates.

2—Premium: ideal for more sophisticated websites with advanced features and capabilities, including accepting reservations or appointments, issuing quotes, customer login and more.

Both offerings include SEO, reporting and regular content updates to arm small business owners with the tools they need to grow their online presence. Additionally, all websites are optimized for mobile.

Want to get started? Yahoo Small Business offers an easy step-by-step process that includes consultations with an expert designer to discuss a business’ brand and goals, along with its website production, content assets, regular monitoring and maintenance.

4—Help for Entrepreneurs in Underserved Communities

This morning Google.org announced a $10 million pledge to support businesses in underserved communities. The first $2 million will go to the American Library Association (ALA) to support entrepreneurship centers at libraries in 10 states and help libraries across the country develop new offerings for small business creators.

The pledge is intended to help low-income and minority entrepreneurs start new businesses via access to training and capital. The grant to the ALA, says Google, “will enable libraries across the country to double down on their support to low income and minority entrepreneurs. Libraries will be able to develop new partnerships with community-based organizations, test new models to bring support to entrepreneurs in their community and track their impact. This is important because libraries are one of the largest platforms for supporting aspiring low-income and underrepresented entrepreneurs.” And, in fact, Google reports almost half of all libraries in the U.S. provide assistance to startup entrepreneurs.

In a blog post Google pointed out how small businesses don’t only benefit the business owner, but also the local community the business is based in—“67 cents out of every dollar spent at a local business stays in the local economy.”

Google believes “being online is the way to win.” They also just released a report showing the new ways American search for local businesses. They’ve seen “350 times more search interest in ‘local’ + ‘near me’ than there was 10 years ago.

The grant also supports the ALA’s efforts to develop a guide for libraries to building their own entrepreneurship programs, including recommendations for better serving entrepreneurs from diverse communities and underrepresented backgrounds. Google says this grant builds on their ongoing support for libraries, including the $1 million in funding that Grow with Google gave the ALA earlier this year to help libraries. The collaboration has already supported 130 libraries across 18 states and will continue to all 50 states.

Other efforts launched this year include the June launch of Google for Small Business—a website that offers free personalized plans for small businesses so they know which Google tools will help them reach more customers and work more efficiently.

5—Economic Optimism among SMBs Continues to Decline

Confidence in the economy among CEOs of SMBs continues its downward trend—falling to 85.0 in the Q3 2019 VistageCEO Confidence Index. This is down from 88.4 in the previous quarter, and the current reading is at the lowest level since Q3 2011 when the Index was recorded at 83.5. Vistage says the falloff “continues to be driven by less favorable assessments of the national economy.” And, while they add, the decline doesn’t mean the CEOs think a recession is coming, “leaders have expressed even greater pessimism about the outlook for the economy in the year ahead, with 39% expecting the economy to worsen, the highest proportion since the closing quarter of 2008.”

“There are a number of domestic and international issues, like tariffs, whose favorable resolution could push confidence higher in the months ahead. At present, however, uncertainty about how and when these issues will be resolved will continue to erode confidence,” says Dr. Richard Curtin, research associate professor at the University of Michigan, who analyzed the data. “With the continued decreased confidence in the economy, firms have embraced a precautionary outlook which will make their forward planning more defensive rather than expansive.”

Pessimism is at an all-time high with only 12% of all CEOs surveyed expecting improved conditions in the year ahead. In addition, just 21% indicated that economic conditions have recently improved, down from 31% last quarter, and a mere one-third of the 64% recorded a year ago. These negative views affects how the CEOs view their own companies’ outlook—61% of those surveyed expect increased revenues—the lowest response since 2009 and well below last year’s 75%.

On the brighter side, hiring plans remain strong and workforce expansion was the only factor in the Index that posted an increase in the Q3 survey, with 57% of all firms planning to add new employees to their workforce, and 76% said retaining existing talent was “very important,” an increase from last quarter’s 70%.

“Uncertainty continues to impact small and midsize businesses, yet the fact that hiring and retaining top talent continues to be a priority is an indicator of cautious confidence,” says Joe Galvin, Vistage’s chief research officer

Survey highlights

Revenue and profit outlook

- Just 10% anticipated revenue declines, which was held down in part due to the 44% who expected to raise prices for their products or services.

- Profit increases were anticipated by 51%, just below last quarter’s 54% but below last year’s 61%.

- 14% of all firms anticipated outright declines in profits during the year ahead.

- 41% noted that tariffs are having a negative effect on their business, with 33% saying they were directly affected by the new tariffs put in place on September 1.

Hiring and investment plans

Just 5% expect to reduce their workforce, down from 7% last quarter. Although workforce expansion plans are still below last year’s level, the current levels indicate that firms have only marginally reduced their efforts to increase personnel, despite having to offer higher competitive wages (37%), cost of living increases (17%), performance-based raises (15%) and steps to increase retention (21%).

Adding new employees to their total workforce was anticipated by 57% of all firms. While only marginally above last quarter’s 56%, this was the only component to post an increase in the Q3 survey.

- 37% say wage increases were implemented to attract qualified talent.

- 37% of CEOs are planning increases in expenditures for new fixed investments, down from 40% last quarter.

- Few firms planned cutbacks in investment spending (12%), with most firms keeping the level of investment expenditures largely unchanged (50%).

6—How Americans Spend Their Money

There’s a lot of fascinating information in a new report from LendEDU about how different generations of Americans spend their money. For example, when it comes to making credit card payments, baby boomers use 17% of their monthly income, Gene X uses 9%, and millennials only use 7%.

Key findings

Student loan debt: Millennials have the biggest financial commitment contributing (month to month) 3% of their income to student loan payments compared to Generation X (1%) and baby boomers (0%)

Retirement contributions: Both millennials and Gen X were putting 4% of their monthly income, while boomers were putting 2%.

In general, all three generations stick close to the 28 part of the 28/36 rule which calls for committing a maximum of 28% of income to housing costs. Millennials committed 33%, compared to baby boomers (29%) and Gen X (32%).

But, sticking with the 28/36 rule, all generations paid much more than 36% maximum proportion of their income to all debt payments. Boomers had the largest month-to-month debt commitment (51%), while both Gen X and millennials were at 50%.

On average millennials were proportionally putting the most towards active investments other than those made for retirement accounts (4%), compared to baby boomers (2%) and Gen X (2%).

Across the board, living expenses accounted for the second largest month-to-month expense. Millennials dedicated 24%, compared to 25% from Gen X and 22% from baby boomers.

Baby boomers had the largest insurance commitment in terms of percentages (9%), while Gen X (8%) and millennials (6%) were not far behind.

Business stock photo by Jacob Lund/Shutterstock