By Rieva Lesonsky

1—Halloween: Candy, Costumes & More

According to an annual survey from the National Retail Federation (NRF) and Prosper Insights & Analytics, Americans will spend a record $9.1 billion (up 8.3%) on costumes, candy and pumpkins this Halloween.

We’ll spend $410 million on greeting card, $2.7 billion on decorations, another $2.7 billion on candy and a whopping $3.4 billion on costumes.

This year, 2.2 million kids will dress up as an animal, 2.9 million will be their favorite princess, 2.9 million will be Batman and more than 3.7 will don the costume of their favorite action character or superhero.

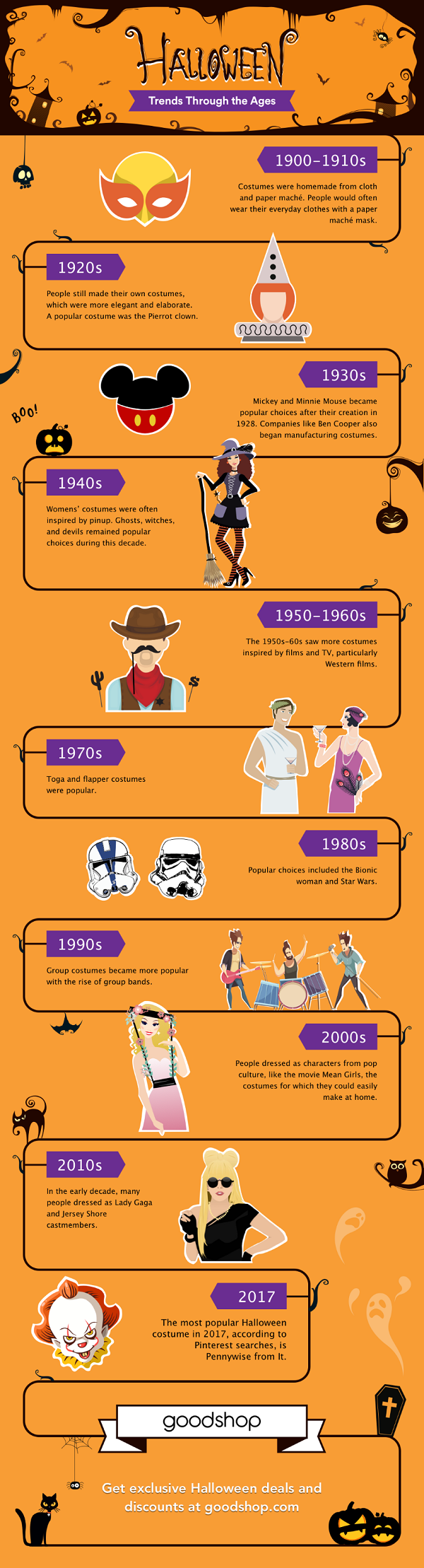

Most consumers buy their costumes—but that wasn’t always the case. Check out the infographic below from my friends at Goodshop—to see how drastically Halloween costumes have changed since 1900. (And if you’re scrambling for Halloween, check out these deals courtesy of Goodshop.)

2—Scary Legal Myths

Rocket Lawyer has compiled some scary legal myths you should be aware of, because if left unheeded the nightmare, like a zombie, will live on…and on…and on…

Scary Myth #1: Businesses will get sued for not providing employee health coverage

- The government will not sue for not supplying health insurance, but you might get dinged in your taxes if you have a large number of part-time employees.

- Actually, 97% of U.S. small businesses are not required to provide health insurance for their workers. The employer mandate under the ACA only applies to businesses with over 50 full-time staff. But, if you are a SMB with a large number of part-time workers you need to calculate the number of hours they worked collectively to figure out the full-time equivalent of part-time employees. You do this by adding up the number of hours worked by part-time employees in a given month and divide the total by 120 (30 hours a week is considered full-time). If the sum of full-time employees, plus the full-time equivalent of the part-time employees is 50 or over, you may be considered applicable.

Scary Legal Myth #2: I do not need to consult a lawyer when it comes to naming my company.

According to the last U.S. Census there are 27.9 million small businesses in the U.S., and the likelihood that one of will have your name could be quite high. A horror story is waiting to happen if you pick a name legally protected by another company. No matter how clever or “different” your company’s or product’s name may be, you should always take preventive measures to ensure they have not been used and then take the steps to legally protect them. Investing in legal counsel to protect your name is far more cost- effective than being sued for trademark infringement.

Scary Legal Myth #3: Small business assets are protected if they incorporate. While this is partially true, there are many situations where this does not apply.

- Don’t be fooled into thinking that just because you own a business you are not personally responsible for the assets you acquire. Most likely you will have to cosign and if you default it’s your personal pocketbook that will feel the pinch.

- Mixing business with pleasure—a dangerous cocktail: Using company funds for pleasure purposes can expose you to the dark side of the IRS.

- Death & taxes: Failing to pay income taxes and employee Social Security and Medicare taxes will likely draw the attention of the IRS.

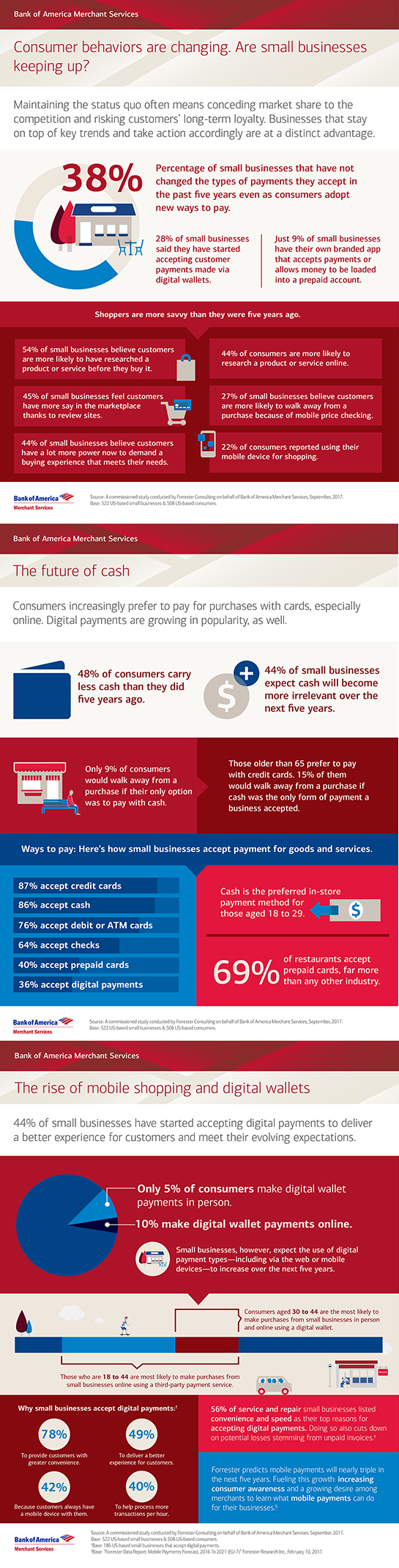

3—Small Business & Payments

Bank of America Merchant Services commissioned Forrester Consulting to conduct a study of payments-focused attitudes and behaviors among U.S. small business owners and consumers. The 2017 report shows that with so much at stake, small businesses must adapt to changes in the ways customers shop and pay.

Some notable findings:

- 48% of consumers carry less cash than they did five years ago, but 38% of small businesses haven’t changed the types of payments they accept in the past five years.

- 53% of consumers are shopping online more than ever, yet only 44% of small businesses operate an e-Commerce website.

- Consumers aged 18 to 29 and over 65 are the most likely to never trust a small business again following a data breach affecting that merchant.

The report says, “small businesses need to adjust quickly to evolving payments trends or risk getting left behind.” While consumers prefer using cards and cash when making purchases, many are becoming more comfortable with “new technologies that enable quick, convenient and secure transactions with businesses at the point of sale and online—not to mention with their peers.”

The report also shows over one-third of merchants now accept digital payments. You can read the report here—and be sure to look at the infographic below for more information.

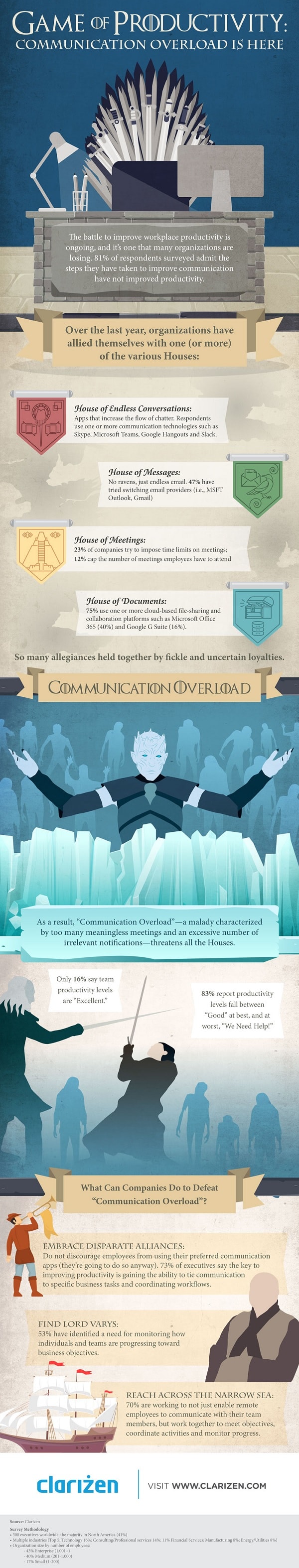

4—Winning at the Game of Productivity

According to the folks at Clarizen, there’s a battle—one that rivals those taking place on TV’s Game of Thrones—going on in businesses nationwide. A recent Clarizen survey shows 81% of respondents say their attempts to improve communication have failed to boost productivity.

Instead, businesses are dealing with:

- Endless communications: where communication apps abound, yet unleash chatter and chaos instead of clarity and collaboration.

- Countless messages: where hordes of emails ravage the countryside, and conversation threads get longer and more tangled by the hour.

- Meetings gone wild: where there is no escape from yet another unnecessary meeting.

- Sea of documents: where version control nightmares unfold, and brave warriors hunt across drives and repositories for essential files that may or may not exist.

Check out the infographic below to see how to win at the Game of Productivity.

5—Is Your Small Business Ready for The Holiday Rush?

Guest post by Chris Francis, VP of Market Development at Worldpay US, a global payments provider for all channels: in-store, online and via mobile.

It’s that time of year again.

Pumpkin spice lattes and apple picking are top of mind, but as fall turns to winter the holiday shopping rush will soon take center stage. Almost a quarter of customers started their holiday shopping research in October and 33% will have already made purchases by the time November hits—which is Wednesday!

Holiday retail sales are expected to increase between 3.6%-4% this year, for an estimated total that may reach $682 billion. The holiday season is a huge opportunity for any SMB, but preparation is key. As customers get ready to flock online and in-store to snatch up what retailers have to offer, there’s plenty SMBs can do to make sure they get a big piece of the holiday shopping pie.

Refresh your tech: With the holiday shopping surge comes increased pressure to deliver the best customer experience—no matter which channel customers are using. Now is the time to make sure you’re meeting the needs of omnichannel shoppers. Consider investing in a mobile POS or solutions that make your customer’s wish lists and shopping carts available both in-store and online. Integrating technology platforms that prioritize customer convenience can pay off when the holidays arrive.

Prioritize training: Prepare your staff for whatever may come their way during the holidays by offering training, and reinforcing important concepts before the shopping rush begins. Whether it’s a confused customer or a complicated return, with the right training your employees will feel confident enough to handle any problems that arise. Having an engaged workforce, especially during the hectic holiday season, is a real competitive advantage. Engaged employees are 17% more productive and tend to have 24%-59% lower turnover.

Increase communication: It’s not ideal, but inventory issues and late deliveries are likely to crop up during the holidays. But establishing clear lines of communication with your suppliers and customers can help. Don’t be afraid to monitor deadlines and reach out to suppliers often to make sure they are staying on top of shipments and deliveries. If it looks like a delivery disaster may impact your customers, make sure they hear it from you first. Try to have a plan to help mitigate the problem and communicate it effectively.

Push local pride: As a small business, your local community is a valuable asset to your business. And the holiday season is a perfect time to show your appreciation. Consider sharing exclusive discounts or limited-time offers with those in your neighborhood as a way to promote your brand and boost sales. By taking part in “Shop Local” campaigns, you can also reach new customers who are looking to support local businesses in your area.

Learn from the past: Don’t let issues you may have faced during previous holiday shopping seasons come back to haunt you. Instead, take a hard look at what did and didn’t work in the past and use those lessons learned to plan for the year ahead. Examine past metrics to measure success and set new goals. From revenue figures to customer engagement surveys, use the data you have to define your goals and make a detailed plan for the strategies needed to reach them.

Establish a backup plan: With e-commerce sales on the rise, it’s important your business is ready to handle the spikes in web traffic and payment processing the holiday shopping season may bring. Make sure you’re prepared for the worst-case scenario by having your hosting provider’s information on hand at all times. If you fall victim to a buggy mobile app or website crash, do your best to alert customers as quickly as possible and apologize for any inconvenience.

Though the holiday season is quickly approaching, there’s still plenty of time to make sure your business is fully prepared for the rush. From making the necessary tech investments to offering engaging training to employees, taking the time to plan now can make a huge difference in the experience customers have while shopping with you all season long.

6—In Business, Collaboration is the Richest Currency

Guest post by Karl Fahrbach, SVP, Global Head of Channels, SAP

As soon as they are old enough to walk and talk, we teach children how to communicate effectively with others. Next, we teach them the importance of sharing; that working on a picture or building a Lego house together with a partner will have a better outcome than going it alone.

Human beings are natural collaborators—from the dawn of time, we’ve worked together to defeat common enemies and achieve shared goals. Our strategy in business shouldn’t be any different—for companies large and small, forging strong partnerships leads to long-term success. To ensure these business relationships withstand the test of time, solution providers and small business owners alike must adopt a few golden rules in forming collaborative partnerships:

All partners are created equal: From alliance partners to channel partners, an unwritten rule in any business agreement should be that egos are left at the door. Placing an equal value on partners large and small creates a cohesive system where all partners feel welcomed, valued and listened to. In nature and in business, an ecosystem is multi-tiered, and each tier has specific needs for success. For small and large businesses alike, the adoption of the cloud has become essential for survival. However, the needs involved in this process will vary based on company size and function. With limited resources and tight budgets, small businesses are best served to start their journey by picking lower-risk, higher-reward deployments initially, and building from there. Seeking feedback from partners who cater to these smaller customers will give solution providers a window into these specific needs, making them better able to provide partners from each and every channel with the tools necessary to facilitate tailored implementations.

Ensuring success for both the business and the partner or solution provider will create a stronger overall ecosystem. And, perhaps most importantly, the melding together of different perspectives opens the door for innovative shifts in partner business models.

Establish an “economy of ideas”: Need an idea for how to grow your ecosystem and or increase your success rates? Why not ask the parties directly involved? As a small business owner, don’t limit communication with your partners to formal email chains and quarterly meetings—make sure conversations are ongoing and open. Showing partners that you value their opinions will make them more inclined to share their aspirations and challenges, allowing for problems to be addressed before they occur. Putting this proactive spin on a business relationship will allow for less time spent on fire drills, and more time on planning for the future—something that’s critically important for small business owners. As the number of ideas shared grows, the more commonplace this practice becomes. The formula is simple: when more smart people are in a room, sharing their smart ideas, everyone learns and your business wins.

Actions speak louder than words: Partner feedback is based on customer response, meaning a win-win-win scenario if all perspectives are taken into account. As such, providers must take action on the suggestions of partners by weaving their ideas into existing and new enablement programs. Transforming partners’ feedback into tangible results will bolster their trust in you, and boost their confidence in the input they provide. This will ensure that partners continue to provide feedback, and that you are able to effectively adjust your partner offerings if and when needed.

Though business partnerships are often thought of as stale, high-level and solely profit driven, the same truths we learned with crayons and blocks still apply. Placing a premium on active, collaborative partnerships is more important now than ever, meaning ideas are as good as dollars.

7—Successful Win-Back Email Campaigns

Email marketing automation platform Klaviyo took a look at what creates high-performing win-back campaigns—and it all comes down to subject lines, number of emails, and content.

Klaviyo analyzed all win-back emails sent in Q2 2017, and found the average open rate among all win-back campaigns was 32.09%. Top performers had the following subject lines:

- “It’s been awhile”—35%

- “We miss you”—30.29%

- “Discount included”—27.9%

One of the trickiest parts of a win-back campaign is deciding how many emails to send. When looking at the top 20 performers (based on revenue per recipient), 16 of them had three or fewer emails in their series. To gain the most out of a win-back series without risking your sending reputation, Klaviyo recommends sending 2-3 emails. According to Phil Weltman, Klaviyo’s Content Marketing Manager, “though you’ll see open rates of over 20% in later emails, you’ll notice your revenue per recipient takes a dip after three emails.”

When it comes to content, win-back emails should incentivize an inactive subscriber to return to your website and make a purchase. While many incentives come in the form of discounts, they don’t always have to—the copy alone can bring customers back to a site. Weltman recommends:

- Updating customers on what’s happened since they last visited your site

- Sharing updates on new products, company policies, or any other important changes that have taken place.

- Prompting inactive recipients to change their preferences or unsubscribe if they no longer want to receive emails.

- Including a promotion or incentive.

8—How to Monetize a Mobile App

More than 60% of app developers recommend a “freemium” model for monetizing a mobile app, according to a new survey from Clutch, a leading research and reviews platform for business services. With the “freemium” model, an app is downloaded for free with the option of in-app purchases and upgrades, appealing to users’ desire to test an app before buying it.

Clutch found that the most successful mobile apps “require a holistic approach that extends beyond development. Companies should focus on strategic internal planning, one signature feature, and a proactive marketing plan that expands their existing brand narrative.”

Nearly 40% of app development firms surveyed cite social media as the leading marketing strategy for driving conversions for mobile apps, showing that social media may outperform in-app advertising for app marketing. Only 8% of developers surveyed recommend in-app advertising due to evolving best practices in user experience and shifting consumer preferences.

Choosing the right development solution is key to launching a successful app. Before selecting a development solution or partner, companies should consider their budget, desired app features, and long-term maintenance costs.

Clutch says nearly 70% of app development firms now require a discovery stage to clarify goals and design requirements, and companies are encouraged to think strategically about the potential costs and opportunities associated with an app.

App development options exist along a spectrum of sophistication and pricing. While DIY App Builder software can be used to produce simple, low cost mobile apps, highly customized projects typically require a boutique or enterprise development firm. Offshore firms can offer a middle ground between affordability and customization.

You can read the complete report here.

9—The Next Generation of Work

Guardian® released The Next Generation of Work, the first set of findings from the 5th Annual Guardian Workplace Benefits Study. The study reveals one-third of businesses and workers anticipate considerable change in the next five years to both the nature of work and required job skills.

Part of that transformation centers around automation. Employers expecting significant revenue and employment growth in the next five years are more likely to look ahead to the impact automation will have on their businesses and their worker. Low-skill, low-wage jobs won’t be the only positions affected by this shift in the workplace. The study shows highly-compensated executives and professionals are not immune to the automation revolution.

Highlights include:

Workers in the Professional/ Financial Services and Construction industries are among the least likely to have taken steps to improve skills for this changing work environment. Surprisingly, these are two industries most likely to be impacted by automation and a drive for efficiency.

38% of businesses expect total employment to increase in the next five years, compared with 16% that anticipate downsizing. Jobs will continue to change, and workers will be re-deployed and require skills in creativity, collaboration and communication.

Millennials are more likely to embrace opportunities to acquire new skills, such as taking on a new role, cross-training, making a career change or returning to school. Gen Xers, who still have 10 to 25 years before retirement, are less likely to have taken steps to improve skills. One in five baby boomers would retire when faced with significant work/job changes.

Nearly four in 10 employers say staffing (including recruiting, hiring and training) is a top business challenge for their companies.

20% of U.S. companies expect an increase in their agile workforce in the coming five years as younger generations lean toward non-traditional employment arrangements, flexible schedules, part-time/contingent and non-permanent positions.

“As jobs are transformed by technology, businesses need to regularly update their workforce strategies to reduce the negative human impact of automation and plan their future workforce,” says Dean Del Vecchio, Executive Vice President, Chief Information Officer and Head of Enterprise Shared Services at Guardian. “Forecasting the skills they need and investing in workforce training will give proactive employers an advantage, while others may face skills gaps—a defining characteristic of the next generation of work.”

Guardian has identified four steps businesses can take now to prepare for a more automated workplace:

- Make recruiting and learning a top priority:Modernize the workforce by implementing non-traditional recruitment strategies to unearth new talent; refresh job training and education methods to include experiential, retraining and cross-training programs, mentoring, e-learning initiatives and college tuition assistance.

- Establish an agile workforce:Anticipate and respond to on-demand talent needs and secure specific skills required to remain competitive in a fast-paced, rapidly changing digital world.

- Prepare for demographic shifts:Adapt workplace strategies for those who embrace a new work paradigm and choose flexible or remote work arrangements and non-traditional career paths.

- Evolve the organization’s culture:Implement a change management strategy that enables the organization to adopt automation and digital solutions that can help overcome barriers such as poor communication and organizational silos, and improve customer centricity.

10—Are American Workers Confused About Their Health Coverage?

Aflac recently announced results from two studies that analyzed the trends, attitudes and use of employee benefits among the U.S. workforce. The 2017 Aflac WorkForces Report (AWR) shows American workers may feel more confident about benefits choices, while admitting a lack of understanding regarding the choices being made. A separate Aflac study found younger workers, who may be making benefits decisions for the first time, also lack knowledge of health insurance coverage but want to branch out and make independent benefits decisions.

American workers may have a false sense of confidence: Benefits enrollment findings from the 2017 Aflac WorkForces Report found that 55% of American workers who receive benefits from their employers agree that completing their annual health benefits enrollment made them feel secure or accomplished. And 67% say they’re confident they understood everything for which they signed up.

However, these results may indicate an underlying false sense of confidence. The survey also shows 76% of workers are making benefits decisions without complete knowledge of the overall plan. When asked specifically about understanding their overall policies, like deductibles, copays and providers in their network, only 24% of these workers admit they understood everything.

“It’s counterintuitive to see that workers are reporting a positive benefits enrollment experience, but so many are still struggling with a good understanding of the various aspects of their health care coverage,” says Matthew Owenby, senior vice president, chief human resources officer at Aflac. “Benefits enrollment is one of the most important decisions a worker can make each year. Ensuring workers are more educated will require a sustained effort by employers and employees alike to better understand all aspects of benefits, including coverage options and costs.”

First-time enrollees looking for independence, yet unprepared: Because millennials and Generation Z are entering the workforce in record numbers, Aflac conducted a separate survey among 20- to 26-year-olds, employed either full or part time. The Aflac WorkForces Report First-Time Enrollees Survey found that 51% of young workers will be choosing their health care benefits for the first time this enrollment season.

When thinking about health care benefits, 22% of those surveyed associate benefits with independence, yet only 19% feel confident, and just 31% feel prepared. Their biggest concern about choosing their own health insurance plan is cost (44%), followed by understanding how health insurance works (36%).

Of those currently on their parents’ plans (35%), 54% are leaving their parents’ plans in the next year to purchase their own benefits for the first time. But 69% of those on their parents’ plans are unaware how much their health insurance coverage costs, even though 41% say they contribute financially to the health insurance plan their parents pay for.

When asked about the benefits young adults are most interested in, voluntary benefits were ranked highest: 32% cited hospital insurance and 29% say accident insurance.

11—Millennials & Financial Advisers

While robo-advisors are surging in popularity and are projected to handle $8 billion of all global AUM by 2020, a new LendEDU poll found millennials still prefer traditional financial advisors.

Key highlights include:

- 4%of millennials are working with a financial advisor; 24.3% have used a robo-advisor

- 6%say robo-advisors are more likely to make a mistake managing their money

- 4%think robo-advisors are more likely to lose their money

- 9%believe human financial advisors are more likely to get a better ROI

- Of the millennials who haven’t used a robo-advisor, 61.58%say they’ve never heard about robo-advisors, suggesting a marketing problem that is holding back the potential for tons of customers

- 5%of millennials haven’t hired a financial advisor because they are worried about falling for a scam

12—America’s Fastest-Growing Cities

WalletHub conducted an in-depth analysis of 2017’s Fastest-Growing Cities in America. To determine where the most rapid local economic growth occurred over seven years, WalletHub’s analysts compared 515 U.S. cities across 15 key metrics. The data set ranges from population growth to college-educated population growth to unemployment rate decrease.

| Fastest-Growing Cities in America | Slowest-Growing Cities in America | ||||

| 1 | Frisco, TX | 506 | Waterbury, CT | ||

| 2 | Kent, WA | 507 | Racine, WI | ||

| 3 | Lehigh Acres, FL | 508 | Fort Smith, AK | ||

| 4 | Meridian, ID | 509 | Davenport, IA | ||

| 5 | Midland, TX | 510 | Baton Rouge, LA | ||

| 6 | McKinney, TX | 511 | Montgomery, AL | ||

| 7 | Fort Myers, FL | 512 | Decatur, IL | ||

| 8 | Bend, OR | 513 | Fayetteville, NC | ||

| 9 | Austin, TX | 514 | Jacksonville, NC | ||

| 10 | Pleasanton, CA | 515 | Shreveport, LA | ||

Quick Takes

13—Record Number of Business Changing Hands

According to BizBuySell.com, the Internet’s largest business-for-sale marketplace, a record number of businesses changed hands in the third quarter of 2017. A total of 2,589 closed transactions were recorded in the third quarter of 2017, setting 2017 up to be a record-breaking year of small business transactions, according to BizBuySell’s Q3 2017 Insights Report. Other significant findings include:

- A jump in median revenue: Businesses sold in Q3 grossed a median revenue of $507,865, an 11.2% increase from last year.

- Softening sale prices: Although the median sale price is up year-over-year, it has softened over the last two quarters. At the start of Q1 of 2017, the median sale price was at a high of $237,000. By Q3, the median sale price fell to $225,000.

- A faster closing rate: The median time to sell a business fell 14.6% since Q3 of 2016, from 171 days to just 146 days, the lowest rate on record.

Check out the full report here.

14—Software for Project Managers

If you’re a project manager, check out this report from GetApp about project management software.

15—HR Disruption

Since 2014, nearly $6 billion has been dedicated to support HR companies in their quest to adopt digital technologies, a younger and multigenerational workforce, continuous performance management and new organizational designs—the foundations for the future.

According to Bersin’s new disruptive trends report, organizations are increasingly restructuring themselves into networks of teams, a concept Bersin, a Deloitte LLP, has dubbed the “Organization of the Future,” and 88% of companies indicate the transition to this structure is a top priority.

If you want to see the report and learn more, you can download it here.