20 Things Small Business Owners Need to Know

By Rieva Lesonsky

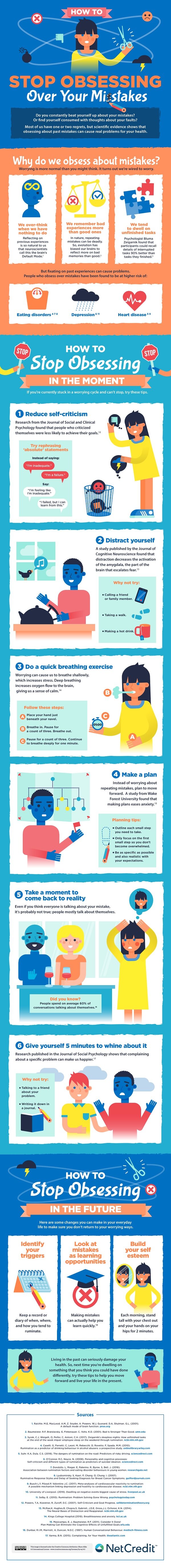

1—How to Stop Worrying About Mistakes

Worrying about mistakes is natural. In fact, we humans are wired to worry. But, constantly worrying about mistakes is not healthy, and can take a serious toll on your personal and professional wellbeing.

It’s important to know how to process your mistakes quickly and learn from them, so you can avoid making the same mistake again.

Check out the infographic below from NetCredit and learn how to stop worrying about your mistakes and learn from them instead.

2—Have an “Event-full” September

Events can be educational—and fun. Here are 7 worth considering attending (and some tips you can apply to your own small business), courtesy of Eventbrite.

- New York Fashion Week (September 6-14, 2019) is already underway: Be prepared for models, designers, and influencers to flock the city! It’s not just about the runway shows—popups and retail store experiences as simple as providing champagne while people browse the store can enhance the customer’s brand experience.

- Beer: Despite the meteoric rise of hard seltzers this summer, beer remains steady when it comes to events. In fact, Eventbrite powered 9k+ beer-related events in the U.S. in 2018 alone, and we saw a 20% increase in beer-related events on our platform between 2017 and 2018. There are hundreds of beer festivals in the U.S. this month, including the LA Beer Fest, The Lagunitas Beer Circus in Petaluma, CA, and the Michigan Brewers Guild’s Fall Beer Festival. The success behind these festivals lies in the variety of beers attendees can try in one place. Take a page from these beer festivals by considering how your business can offer various samples of your product or solution.

- Pickles: And do you know what goes well with beer? Pickles. We’re seeing some extra love for pickles: InAPickle Festival in Houston will host a pickling contest and pickle juice drinking contest and the Fried Pickle Festival in Loudon, Tennessee features family-friendly activities like arts & crafts and petting zoos. What sorts of quirky trends can you pick up on to surprise your customers?

- Vegan: Food is always trendy, but we’re seeing an increasing number of people getting curious about vegan & plant-based lifestyles. Consumers have been introduced to a huge number of plant-based food alternatives like cauliflower pizza bases and broccoli rice. If you have a food business, consider how you can capitalize on this trend by offering plant-based alternatives and considering the diverse range of dietary restrictions.

- Health and wellness: After a summer of indulgence with beer and apparently pickles, people are also starting to turn their attention back to their health. We’re seeing 5K’s, yoga retreats, and essential oils workshops throughout the month. Health & wellness has been a huge trend for more than just September—2 in 5 American adults plan to attend a workshop or event related to their health and wellness this year according to our recent survey. How can your next customer touchpoint incorporate a health-related element?

- Back to School: School is back in session, and so are the events like back-to-school meetings, bashes, and family movie nights. Businesses can take advantage of this season by enticing parents with back-to-school deals or simply noting that working parents may be busier juggling events & meetings.

- Pairings: Two are better than one, and that’s what we’re seeing with experiences that pair unexpected things like 5K’s and wine (Run Now Wine Later) or expected combos like Avocado & Margarita. Hybridization is key to creating memorable experiences—how can you enhance your offering by pairing with something else?

3—Small Business Payment Trends

There’s a lot to learn about the latest payments-focused trends and behaviors from the Bank of America Merchant Services third annual Small Business Payments Spotlight, conducted with Forrester Consulting. The Spotlight surveyed both small business owners and consumers throughout the U.S.

1—Consumers continue to hunt for convenience at check-out. Key finding: Digital wallets and third-party payments services both doubled in two years, proving that increased convenience and services are starting to attract more consumers beyond the typical early adopters.

When shopping in-person at small businesses, the number of consumers choosing to pay with digital wallets like Apple Pay and Google Pay doubled in the past two years—topping out at 10%. When it comes to online shopping, third-party payment methods, like PayPal, are gaining even more popularity, with usage jumping from 11% in 2017 to 27% in 2019.

“Today’s consumers are constantly looking for easier, faster and safer ways to shop—both in-store and online,” says Sydney Ivey, general manager for small business at Bank of America Merchant Services.

2—The cost of data breaches continues to grow more costly—for both a small business’s bottom line and customer loyalty. Key finding: Nearly 30% of consumers say they wouldn’t shop at a small business that had experienced a data breach.

Since Bank of America Merchant Services’ first Small Business Payments Spotlight report in 2017, the number of small businesses paying over $50,000 to resolve issues related to data breaches has jumped from 31 to 41%.

But small business owners are taking steps to secure cardholder data. EMV chip card acceptance has reached an all-time high of 80 percent among small businesses.

3—Small businesses continue to embrace eCommerce to stay competitive and grow sales. Key finding: 44% of consumers younger than 30 use their mobile devices while shopping more often today than five years ago.

With 70% of small businesses engaging in e-commerce through a website, app or third-party market, small businesses are recognizing the need to take their businesses online. Unfortunately, they have to contend with increasingly stringent consumer demands. Top consumer concerns? Shipping costs and speed.

Some small businesses are also disconnected from the way consumers use the internet to research products and services. Since half of consumers say they won’t shop at a small business if they have negative online reviews, not considering the role reviews have in driving sales can be disastrous.

“When you compare the data from our last three Small Business Payments Spotlight reports, it’s plain to see that business owners are increasingly tech savvy and attuned to their customers’ changing expectations to stay competitive,” says Bank of America Merchant Services’ Chief Executive Officer Tim Tynan.

For more small business tips, go to Bank of America Merchant Services. You can follow them on Facebook or LinkedIn.

4—Average Student Loan Debt

Student loan debt continues to be a growing issue in the U.S. and at nearly all schools in the country as the cost of college continues to rise. This according to the 4th annual Student Loan Debt by School by State Report, from LendEDU. The report is an in-depth analysis of student loan debt figures at nearly 1,000 four-year private and public higher education institutions across the United States.

While the figures change each year, the narrative certainly does not: Nationally, outstanding student loan debt sits at $1.52 trillion, making it the second largest form of consumer debt trailing only mortgages.

Key observations

- For the Class of 2018, the average debt per borrower was $28,565. This is up $277 from the Class of 2017 ($28,288).

- When including those with no student loans, the average graduate in the Class of 2018 had $16,649 in debt. This is up $329 from the Class of 2017 ($16,320).

- 99% of graduates from the Class of 2018 at non-profit 4-year public and private colleges had student loan debt. This is slightly down from 57.96% from the Class of 2017.

- For the Class of 2018, borrowers from private institutions left with $38,186 in student debt on average (56.86% of grads were borrowers), whereas borrowers from public institutions left with $27,524 in student debt (57.04% of grads were borrowers).

- On the school-level basis in the Class of 2018, the average student debt per borrower ranged from a low of $3,043 at Appalachian Bible College to a high of $54,067 at Bryant University.

- On the state level basis in the Class of 2018, the average student debt per borrower ranged from a low of $19,742 in Utah to a high of $38,776 in Connecticut.

- For the Class of 2018, of the 250 colleges with the highest amount of student loan debt per borrower, 81.2% of the institutions were private, while 18.8% were public.

- For the Class of 2018, of the 250 colleges with the lowest amount of student loan debt per borrower, 57.2% of the institutions were public, while 42.8% were private

These eye-popping numbers have elevated the issue of student loan debt to the national scale.

5—State of Small Business Lending: Is the Gender Gap in Funding Closing?

Women entrepreneurs are making waves in the small business world. According to historical and projected data from the U.S. Census Bureau, the number of women-owned businesses increased by 58% between 2007 and 2018, at a rate nearly five times higher than the overall average. During this time period, women-owned businesses also displayed growth in hiring and revenue.

Despite this progress, women entrepreneurs still face obstacles when starting a small business. Clients and vendors often don’t take female business leaders as seriously as their male peers. Women have more pressure to balance family and business obligations. They also face more challenges in accessing funding. In Fundera’s State of Small Business Lending report, they dug deeper into the availability and cost of small business loans for women-owned businesses.

Fundera has looked at this topic in previous years. In their first report on women and small business lending, which covered data from February 2014 to June 2016, they found women business owners requested less funding, got approved less often, received smaller loan amounts, and paid more for financing than men. In the next report, covering June 2016 to September 2017, some statistics had improved in favor of women. In certain product categories, women entrepreneurs received similar loan amounts and lower interest rates than men.

This time, they took a “more nuanced look at female entrepreneurship,” focusing on 1,158 small business owners who successfully secured funding through Fundera’s marketplace in the second quarter of 2019. The results show continued gains for women entrepreneurs in terms of loan amounts and cost of financing, this time across all of Fundera’s loan categories. That said, there are still specific areas that call for improvement, including women’s access to funding.

Key takeaways from this year’s report

- The gender gap in funding amounts and cost is closing. In the second quarter of 2019, both men and women received an average loan size of approximately $42,000, despite women requesting less funding. Across all loan categories, women business owners received interest rates on average three percentage points lower than men.

- Women still have less access to funding and report lower financials. Despite the fact that women secured similar funding amounts as men, men entrepreneurs were 20% more likely to receive a loan. Women entrepreneurs also reported lower business revenues and profits compared to men.

- Women and men use funding for different purposes. Women were more likely to use financing for debt refinancing/consolidation and business expansion, whereas men were more likely to finance the purchase of equipment. Female loan recipients were more active in industries that have lower profit margins.

Where do we go from here?

Fundera says, “This State of Small Business Lending report brings good news for current and prospective women small business owners. Women who are approved for funding receive similar funding amounts as men and lower interest rates. They also qualify in larger percentages than men for loans with longer repayment terms. That said, women still report lower business revenue and profit, and the biggest obstacle of all continues to be access to funding. Fewer women apply for funding, women ask for less money, and men are 20% more likely to be approved for a loan than women.

“Fortunately, there are clear ways to increase funding access for women entrepreneurs. Women should try to secure funding at the earliest possible moments for their business, in order to jumpstart growth. They can also diversify into industries with higher revenue and profit margins. They should stay focused on building and retaining good credit. And in-person lenders, particularly banks, can do a better job of protecting loan approval and underwriting processes from bias.”

Read the full report to learn exactly how men and women entrepreneurs fared in the second quarter of 2019.

6—Audio Out-of-Home Advertising Marketplace

Vibenomics, which offers a solution for managing audio experiences combining cloud technology with full-service audio programming and content production capabilities, reaching over 150 million unique visitors annually with a mix of licensed background music, professionally recorded voice messaging, and live announcements, just launched the Vibenomics Audio Out-of-Home Ad Marketplace, offering advertisers access to 150 million on-the-go consumers in the places where they shop, work, travel, and play.

The Out of Home Advertising Association of America reports that the out-of-home (OOH) industry is experiencing growth not seen in more than a decade. Revenue grew 7.7% to nearly $2.7 billion for the second quarter of 2019 compared to the same period in 2018, marking the sector’s highest quarterly growth since 2007. For the first half of the year, revenue was up 7%. The strong quarterly growth occurred across all four major OOH channels: billboards, street furniture, transit and place-based.

Some key highlights of the new Vibenomics Out-of-Home Advertising Marketplace include:

- 100% uninterrupted share of voice in places where other ad channels can’t reach

- Endemic advertisers reach consumers right at the point of sale

- Non-endemic advertisers gain new context addressing audiences on-the-go

- Brand-safe placements immune to ad fraud

- Dynamic, in-stream, programmatic digital audio ad insertion

- Full-service in-house audio production team can turn around IAB-standard digital audio creative in hours

To shepherd the launch of the Marketplace, Vibenomics brought on visionary broadcast and technology veteran Paul Brenner, a former president of NextRadio/TagStation and SVP of Emmis Communications, to serve as Chief Strategy Officer.

If you want to use the power of music in your small business, Brenner offers these tips:

Fit: Does the music you selected fit with how you want to present your brand? For example, energetic music will work better with a gym than a spa. Lyrics can certainly impact how your patrons view your business, but the tone, tempo, and composition have a substantial, subconscious effect on how your business is perceived. Picking music for your store or advertising that matches your brand identity can improve customers’ ability to remember your establishment through their emotional attachment. The subconscious effect of music is called the “halo effect,” in which sound and other cues like smell and lighting are not assessed separately, but collectively as one experience.

Function: Sound has a huge impact on the pleasure center of the brain along with its stress-regulation ability. People listening to energetic music will want to move more because they experience an increase in arousal mechanisms in their brain and body. Soothing music can slow breathing and heart rate as well as lower blood pressure. Do you want your patrons to feel more relaxed in your space? Or, should they move faster and feel more excited? This is tied into your brand and the products or services you offer.

Semantics: This refers to the deeper meaning and purpose of specific song choices. For example, Coca-Cola has included the hiss from opening a can in its advertising jingles for a long time. Certain keys or harmonies are associated with certain emotional experiences in the western world, so this can be used when you create a playlist for your business or have a company design music for your advertising.

Learn more about Vibenomics here.

7—Final Deadline Stevie Awards

The Stevie Awards for Women in Business honor the achievements of working women in more than 90 categories, including Entrepreneur of the Year, Executive of the Year, Mentor or Coach of the Year, Lifetime Achievement Award, Achievement in Equal Pay, Women Helping Women, Employee of the Year, Woman-Owned or -Run Company of the Year, and Innovator of the Year. All female entrepreneurs, executives, employees and the organizations they run, worldwide, are eligible to be nominated.

Final deadline to enter the 2019 (16th annual) Stevie Awards for Women in Business is Wednesday, September 18.

Go here for entry kits and complete details on the competition. The awards are produced by the creators of the prestigious American Business Awards® and International Business Awards®.

Finalists will be announced on October 2, and the Gold, Silver and Bronze Stevie winners will be revealed at a gala awards dinner at the Marriott Marquis Hotel in New York on November 15, 2019.

The second annual Women|Future Conference will be held in conjunction with the Stevie Awards on November 14-15. The full agenda and list of speakers is available here. The two-day conference addresses the most pressing business issues of tomorrow. From robotics and international trade, to the future of work and artificial intelligence, the conference will provide information on these topics from the perspectives of women in those fields and how they will affect professional women in all industries—their careers and businesses.

Sheryl Connelly, corporate futurist with Ford Motor Company, will be opening the first day with her keynote, “Coming Trends That Will Revolutionize Your Business.”

Early-bird registration rates are available now through September 13. The first 100 paid registrants will be entered into a drawing from which 20 will be randomly selected for a private breakfast with Sheryl Connelly before her keynote address.

8—Should You Allow Dogs in Your Office?

It’s a fact dogs help humans relax, de-stress and feel happier. Better still, according to Headway Capital, introducing a dog into the office can build trust and a sense of community within teams.

Check out their infographic below offering 15 reasons why you should allow dogs to come to work.

Cool Tools

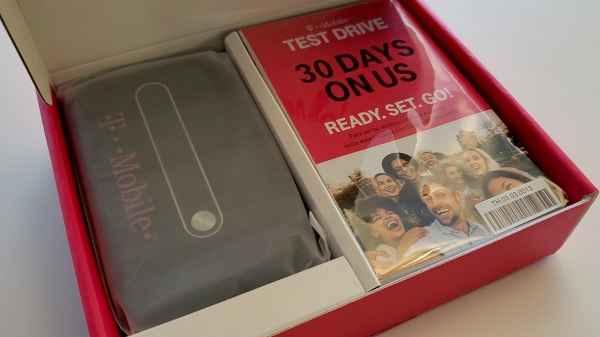

9—T-Mobile Offers Try Before You Buy Options

T-Mobile has just launched a program where you can try the network—before you buy. You can try the network free on any carrier’s phone, and see how their “newest, most powerful signal—600 MHz—goes farther than ever before.”

Why it matters: 84% of people want to try a wireless network before they switch carriers. Yet, wireless is one of the only industries in the world that forces customers to buy before they try.

T-Mobile CEO John Legere made the announcement in a video blog. With Test Drive, carrier customers can snag a free hotspot that connects to the network, including the “Un-carrier’s” newest, most powerful signal—600 MHz—and try the network for up to 30 days—while keeping their own phones, phone numbers and apps. At no cost!

The company says wireless is one of the only industries that forces consumers to buy before they try. “Of course, the carriers can’t even get something as simple as ‘try before you buy’ right. They want you to trade in your phone, transfer your life to a new one and burn an entire day switching … just to hope their network works for you. It’s arrogant, it’s broken and it’s time for backwards-buying to end,” says Legere. “Our network is open for anyone to try because we have nothing to hide. At T-Mobile, the strength of our network speaks for itself … we’re so confident in it, we’re giving people a free 30-day test drive.”

The company says wireless is one of the only industries that forces consumers to buy before they try. “Of course, the carriers can’t even get something as simple as ‘try before you buy’ right. They want you to trade in your phone, transfer your life to a new one and burn an entire day switching … just to hope their network works for you. It’s arrogant, it’s broken and it’s time for backwards-buying to end,” says Legere. “Our network is open for anyone to try because we have nothing to hide. At T-Mobile, the strength of our network speaks for itself … we’re so confident in it, we’re giving people a free 30-day test drive.”

And the Un-carrier network is expanding every day, powered by 600 MHz, which is only available from T-Mobile. 600 MHz signals go twice as far from the tower and work four times better in buildings than mid-band signals. So, T-Mobile can provide better coverage in rural areas, hard-to-reach places and deep inside buildings. This is the same signal that will form the foundation for T-Mobile’s future nationwide 5G network.

Here’s how Test Drive works:

- Sign up for T-Mobile Test Drive. T-Mobile will send carrier customers a Coolpad Surf Device hotspot. For free.

- Turn on the hotspot, and it’ll connect to T-Mobile’s LTE network, and connect your Verizon, AT&T, Sprint, Xfinity Mobile or any carrier smartphone to it via Wi-Fi.

- Experience T-Mobile’s data coverage for up to 30 days or 30 GB, whichever comes first.

- After the trial, drop the hotspot off at any T-Mobile store or hand it off to a friend.

Check out more information on Test Drive. If you want to join the conversation on Twitter, tweet @T-Mobile and use the hashtag #TryBeforeYouBuy.

10—1 Million Verified Software Reviews to Help You Make Better Purchasing Decisions

One million verified software product reviews, across more than 700 software categories ranging from accounting software to website optimization tools, are now available on Capterra.com.

Capterra’s reviews coverage has nearly doubled since 2018 and is by far the broadest and most comprehensive set of software reviews available to the public. This valuable, free resource is supported by Capterra’s robust quality assurance process, which ensures that all site visitors benefit from the lived experience of other human buyers—not faked reviews.

Capterra says B2B consumers are eager to find quality-assured user reviews to help identify the technology, vendors and solutions that best match their specific needs. And that people are using reviews earlier in their evaluation process, significantly reducing the time and energy required to find the right solution.

Key insights from Capterra’s 1 million reviews data1

- Reviews Accelerate Adoption of New Technologies: Software reviews decrease the time buyers spent in the software purchase cycle by nearly six months, allowing buyers to focus more time on innovating and driving their business forward.

- Reviews Impact Buyer Decisions: When learning about software, 4% of SMBs surveyed use websites with user reviews, while 13% use these websites as their first source of information.

- Negative Reviews Matter: 57% of respondents with less than 20 employees say negative user reviews were one of their top three reasons for disqualifying a service provider from consideration during their software purchase search.

To go beyond star ratings, Capterra’s reviews insights team leverages artificial intelligence to perform a detailed sentiment analysis to determine how positive or negative a user’s comments are related to key product attributes such as performance, customizability, integration, ease of use and customer support. Based on this analysis, the company is able to assign a sentiment score of 1-10, with ten being the most positive. The company uses this data to create content that provides buyers with a more complete view on how a specific software ranks in these key areas.

[1] Capterra Small Business Software Buying Trends Survey, 2018

11—LinkedIn Expands the Marketing Partner Program With New Engagement Insights

Guest post by Amita Paul, Senior Product Manager, LinkedIn Marketing Solutions

Reaching and engaging the right audiences at scale is one of the key challenges that you’ve shared with us. While we’re seeing record levels of engagement in the feed and content shared across the platform, we understand that it can be difficult to identify the audiences you should be targeting and the kinds of content they’re likely to engage with.

We’re excited to announce a new category to the LinkedIn Partner Program—Audience Engagement. Launch partners including Amobee, Annalect, Hootsuite, Ogilvy, and Sprinklr have integrated the LinkedIn Audience Engagement API to create offerings that enable customers and clients to discover new audiences, better understand the types of content those audiences are engaging with and see how your content is performing against industry benchmarks.

With these insights, you can better refine your content strategy and make smarter marketing decisions to help deliver better ROI for your LinkedIn ad campaigns and organic posts. This new partner category provides three key benefits, including:

Audience discovery. With more than 645M members on LinkedIn, it can be hard to keep track of who you should be engaging with on the platform. Our integration partners enable you to discover new audiences who have high engagement with topics and articles related to your industry. This also helps you discover new groups you can engage with for your next marketing campaign.

Content recommendations. We’ve also made it easier to discover trending topics and content that your key audiences are engaging with. These insights can help inform your content marketing strategy, helping you know what to post (and whom to target) on LinkedIn.

Industry benchmarking. Sometimes it’s helpful to know how your content is performing against others in your industry. Now you can better understand the kinds of content your competitors are posting and how their engagement compares against your own. These insights can help optimize your targeting and content strategy.

This new category is the next step in our journey to bring enhanced partner capabilities to help you grow your business on LinkedIn.

To protect our members’ privacy, we only provide aggregated insights that do not identify our members. Also, access to the Linkedin Audience Engagement API is currently limited to a small subset of partners. For more information visit our partner page.

12—Sage Intacct Comes to Australia

Sage, a market leader in cloud business management solutions, recently launched its financial management platform Sage Intacct in Australia. New research by Sage, highlights how the role of a CFO has changed from managing compliance and accounting activities to providing strategic leadership and driving digital transformation as many CFOs assume responsibility for choosing business technology.

Sage Intacct provides finance professionals with:

- A platform designed for and by CFOs and Finance Professionals: Sage Intacct is a powerful cloud financial management platform, designed for finance professionals, providing deep multi-dimensional accounting, automation for efficient financial operations and sophisticated visibility for real-time decision making

- Best of Breed Integration: Sage Intacct’s technology uses open APIs, making it easy to connect with third party cloud applications, including Salesforce, providing a highly extensible and scalable platform

- Lower cost of ownership: Sage Intacct is a highly modular solution where customers pay for what they need, get more efficient and cost-effective implementations, world-class security backups and disaster recovery delivering a lower total cost of ownership

Commenting on the local availability of Sage Intacct, Kerry Agiasotis, Managing Director & Executive Vice President, Sage, Asia Pacific, says “We are strongly committed to addressing the pain points of Australian businesses with technology that helps their organizations to thrive. That’s why we have invested in bringing Sage Intacct to Australia, with which we believe we can set a new standard for Australian finance leaders on their journey to drive digital transformation.”

Sage Intacct will be sold and implemented through value added resellers, with certified Australian business partners at the time of launch being Akuna Solutions, Alphasys, Aptus, Forpoint Solutions, Guintabell, Microchannel, Progressive Business Technologies and Resonant Software Solutions. Sage Intacct also offers customers increased functionality through the Sage Intacct marketplace.

Sage has shared new, nationwide research which identifies the top pain points for finance functions in their quest to grow and maintain a competitive advantage. Specific to the Australian market, this study gauges the impact of digital transformation on mid-sized organizations, showing how the role of the CFO moves from ‘historian’ to ‘visionary’, whilst playing a larger role in leading the digitalization of growing businesses. As CFOs cross the chasm towards a more automated future, this research highlights the performance gap between traditionalists and early adopters, including the opportunity to propel digital transformation beyond the finance function into wider business transformation.

Learn more in this blog.

Quick Clicks

13—New Podcast Launches Today

The That Made All The Difference podcast from Bank of America is launching today. In this series, Bank of America Executive Alicia Burke hosts interviews with influential guests to learn about the moments that inspired in them the power to move forward and make a positive impact on the world. The episodes include the moment former war correspondent and ABC TV anchor, Dan Harris, discovered meditation and mindfulness, and the moment award-winning filmmaker, Ken Burns, followed his passion of creating documentaries.

You can check out the podcast trailer below:

- Apple Podcast Trailer Link

- Google Podcast Trailer Link

- Spotify Podcast Trailer Link

- Stitcher Podcast Trailer Link

The full series is available on The New York Times and other major platforms. The episodes will roll out on a weekly basis. To stay up to date on all the content from That Made All The Difference, follow @BofANews.

14—Get More Productive

Want to increase your productivity? Then make plans to attend the Productivity Summit, a remote conference with over 40 expert speakers presenting in real-time about personal productivity, technology, organization and business development.

The Productivity Summit has four tracks:

- Productivity: how to be more productive using principles, strategies and techniques.

- Technology: what and how to use specific technologies to get things done.

- Organization: how to get your home or office more organized, and dealing with clutter and disorganization.

- Business Development: for those looking to build or grow their businesses more effectively and efficiently.

Summit host, Ray Sidney-Smith, Google Small Business Advisor for Productivity, will be moderating a panel discussion, “The Future of Productivity Technology,” with productivity technology experts from leading companies in the industry on Friday, October 4.

On Saturday, October 5, Demir Bentley, of Lifehack Bootcamp and Lifehack Tribe, will be keynoting the Summit with his presentation, “The Biggest Cover Up In Productivity History. There will be a Digital Interactives area where speakers will be placing learning quizzes, polls and more to engage with what you learn at the Summit. And, each day ends with live, virtual networking events for summit attendees.

The Productivity Summit is free to attend live. Register and get complimentary replays of the sessions through Sunday evening, October 6, 2019, ET, so you can watch missed sessions or rewatch sessions you found especially helpful.

You can buy access to the 2019 Summit video replay library. It’s available now in early bird pricing (until 9/13/19 4:59 PM ET). The price goes up as the Summit date approaches and again after the summit replays end…so grab the replay package before the price increases!

15—Content is King

Creating fresh content is an important component of a business website, helping drive traffic and increasing your organic rankings. But how do you develop content? Almost everything you need to know is here—in this blog from ROI Foundry.

16—The Benefits of Telecommuting

Telecommuting is rising in popularity, both here in the U.S. and in the UK. Check out this great guide to telecommuting from RingCentral.

17—The Rise of Self-Employment

More and more American workers (24 million in fact) are thinking about self-employment, according to FreshBooks’ 3rd annual self-employment report.

But only a fraction will take the leap. FreshBooks wondered why and issued a report showing:

- 58% say that finding talent is a challenge

- 51% find it challenging to find customers

- 35% worry about inconsistent income

- 27% lack a complete business plan

18—Stop Job Hopping

Do people work for a passion for what they do, or for the money? According to the Signs.com: Love What You Do survey:

- Both men and women are more likely to quit a job they’re not passionate about, than one where they have a bad relationship with their boss

- People making between $75k and $99k who work at a job they are passionate about wouldn’t consider job hopping until they reached the 3.5-year mark

- People who made less than $50k were the most eager to find a new job, regardless of their reasons why

- Insufficient pay, lack of growth opportunities and lack of passion are the top 3 reasons employees would quit a job in the next 5 years

19—Do Employees See the Good in Others?

According to the Seeing the Good in Others report from 1800Contacts Connect:

- 93% of people have great personal relationships with their co-workers

- Although people can feel animosity toward their boss, over 90% believe their bosses are good people with good intentions

- Those who believe people are fundamentally bad make an average of $5,000 less ($40,296) compared to those who see the good in others ($45,078)

- Of those who believe people are fundamentally good, 73% are satisfied with their careers while 63% received a raise in the past year

20—Telling Lies at Work

SimplyHired looked at Work White Lies and found:

- 60% of employees admitted to lying about being sick or not feeling well, but only 28% considered it a harmless lie

- Managers told white lies more frequently than entry-level employees—37% admitted to lying once a week or more

- Unhappy employees told lies more than twice as often as satisfied employees (41% vs 17%)

Business stock photo by pixelheadphoto digitalskillet/Shutterstock