21 Things Entrepreneurs Need to Know

[Editor’s note: We’re taking a short hiatus due to lots of business travel. We’ll be back June 18.]

By Rieva Lesonsky

1—Should You Buy or Lease Your Office Space?

Buying or renting an office space is one of the most significant financial decisions your company will make. Whether you’re starting a new business or expanding your organization, you need to carefully weigh the pros and cons before looking for office space for lease or commercial property to purchase. Check out the infographic below from Figari to learn more.

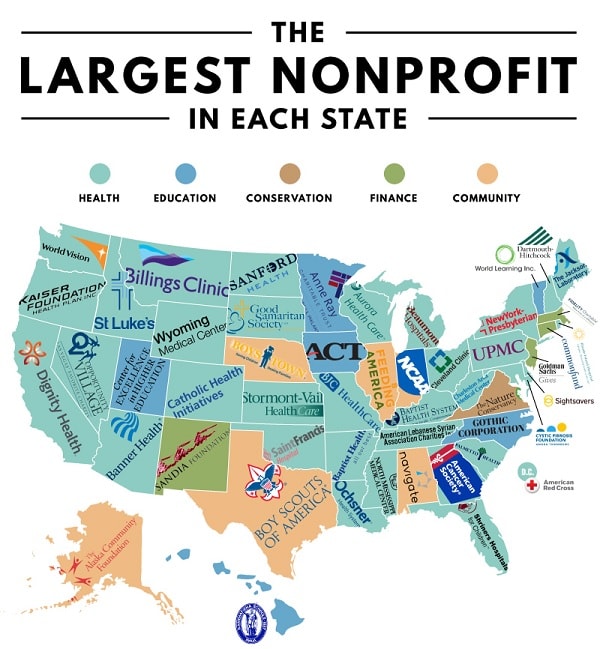

2—Largest Nonprofits in Every State

Many nonprofits are formed to make a change in a local community or for the public benefit. But, nonprofits are also a large force of the American economy, accounting for 11.4 million jobs and 10.3% of all private sector employment according to the Bureau of Labor Statistics.

To show the impact of nonprofits in the U.S., Kittleman, an executive search firm specializing in recruiting for nonprofits, compiled a list of the largest nonprofits in each state, calculated by total receipts and assets.

3—Small Business & Innovation

BMO Wealth Management recently released a report exploring how small business owners view and implement innovation. The report, Creating Wealth through Business Improvements, based on a survey of small business owners across the country, revealed:

- 60% of respondents had never applied for funding to support small business innovation

- The most common reason for not exploring funding options was not wanting to incur debt (36%), they thought they’d be rejected (22%) and the process was too complicated (21%)

- Only 4% ever applied for a government grant

- 44% were aware of government grants but were unsure where to apply; 34% weren’t aware of the availability of grants

The widespread lack of knowledge about capital funding and government grants also extended to another important source of innovation assistance—incubator and accelerator networks:

- 63% weren’t aware of these support systems; only 3% had used them

- Women were less knowledgeable than men, with 72% of women being unaware that incubators and accelerators could be a valuable tool, compared to 54% of men.

When asked to identify the top 3 keys to innovation for a successful entrepreneur, respondents most frequently cited access to funding (66%), followed by access to networking (64%), partnerships with staff, suppliers and customers (61%), and access to mentoring programs (40%). This suggests that business owners know how valuable funding and networking opportunities can be and are, in fact, interested in taking advantage of them. In short, they lack information, not motivation.

BMO offers the following tips for small business owners:

- Join their local Chamber of Commerce and attend monthly events.

- Seek counsel from their local bank to get an overview of potential loan options.

- Read small business blogs which often highlight local, state, and federal funding programs.

To view a copy of the full report, which includes additional survey findings explored in detail as well as tips on how create and implement innovation strategies, go here.

4—Choosing the Right Credit Card

Recent research from Capital One reveals 41% of Americans say they carry cash regularly, while 29% rarely or never have cash on them. As credit becomes more prevalent, it’s important for small business owners to be aware of the money/rewards they risk leaving on the table.

Here are some tips from Capital One Spark Business on how to make the most out of rewards and choose the right credit card, whether for personal or business expenses.

Review the fine print whenever it comes to cash back rewards

Consumers should think about how to earn valuable rewards for what they already spend money on, like travel or dining. For example, all Spark Business credit cards make it simple with unlimited 2% back on all purchases, as opposed to tiered rewards. Overall, this could add up to thousands of dollars back each year to a business’s bottom line.

Use your card for more than travel-related purchases

If you’re only using your business credit card for travel-related purchases, you’re leaving money on the table. Using a business credit card as the primary purchasing solution for larger ticket items (inventory, equipment, software, advertising and shipping) could mean thousands of dollars back to your business.

Consider the tangible and creative ways to utilize rewards

Rewards can be used for introducing programs to help boost employee morale, purchasing new equipment and continuing education for employees.

5—State of the Market: EMV Chip Continues to Spread Throughout the U.S.

The U.S. Payments Forum recently released its spring 2018 market snapshot. In an encouraging report, Visa reported 96% its payment volume at the point-of-sale is made using chip-enabled cards; 59% of U.S. point-of-sale locations accept chip, a 578% growth since its October 2015 liability shift; and there has been a 70% decline in counterfeit card fraud for chip-enabled merchants.

According to the ATM Industry Association, 91% of U.S. ATMs are now EMV-capable; and 86% are accepting chip-on-chip transactions. This represents significant improvement from an estimated 19% at the beginning of 2016 and 58% at the beginning of 2017.

As in-store and ATM chip enablement continue on a positive trend, the industry is focusing on streamlining existing implementations to improve the customer experience and overall efficiency. Another focus is on the future of the chip migration for industry segments with special considerations, like pay-at-the-window and pay-at-the-pump.

Trending topics: considering contactless EMV as a next step

The upward trajectory of the U.S. rollout of contact EMV chip technology has set the stage for a possible next step: contactless EMV payments, including cards and mobile devices.

According to data available from Mastercard, the foundation for contactless payments is already in place. As of Q4 2017, 799,667 unique merchant locations are contactless-enabled, and there has been an 80%growth in contactless transactions year-over-year. But there is work to do to make the infrastructure ubiquitous across the U.S.

“Contactless payments have been a key discussion point for the U.S. Payments Forum, from whom the technology benefits and why implement contactless to when we’ll get there and how,” says Randy Vanderhoof, director of the U.S. Payments Forum. “One of the biggest conversations we’re having now is the need for cross-industry participation to provide education and implementation guidance for issuance and acceptance—all things the Forum has provided for the migration to EMV chip.”

Forum priorities

The U.S. Payments Forum has identified several topics that are top-of-mind for the payments industry, and plans to explore the need for education and guidance in these areas:

Fraud topics. Members identified card-not-present, card-present, person-to-person and faster payments fraud topics as the top areas to explore in 2018.

Payment technology innovations. Contactless, mobile browser and in-app payments were the technology innovations of greatest interest across all stakeholder members. Other topics included IoT payments, biometrics and 3DS.

Resource recap

Over the last quarter, the U.S. Payments Forum has published the following resources on EMV and contactless payments implementation and optimization guidance:

- Merchant and Issuer Error Data Collection Forms. These tools assist merchants, issuers and their partners in gathering information to determine the source of any chip transaction errors

- Mobile and Contactless Payments Requirements and Interactions white paper. This discusses how mobile and contactless payments requirements are collected from payments ecosystem stakeholders

- Mobile and Digital Wallets: U.S. Landscape and Strategic Considerations for Merchants and Financial Institutions white paper. This document provides guidance to merchants and financial institutions on models, technologies and usage drivers for mobile and digital wallets

- Contactless Resources: Implementation Considerations and Clarifications. This document provides a summary of recently-published resources that provide guidance when implementing contactless payments in the U.S.

You can access additional U.S. Payments Forum publications here and get a complete collection of documents, videos, webinars, infographics, and EMV resources.

6—Do You Have Enough Insurance Coverage?

According to a study conducted by Forbes Insights and The Hanover Insurance Group, Inc., a leading property and casualty insurance company, less than 37% of small business owners feel they have adequate insurance protection. The joint 2018 Small Business Risk Report concludes small business owners are concerned about increasing risks including cyber, employment practices liability and crime exposures, yet, often are not spending enough time assessing their insurance needs and ensuring they have the right insurance solutions.

In fact, less than half of small business owners surveyed indicate they are spending sufficient time assessing their insurance needs.

Other key highlights from the 2018 Small Business Risk Report include:

- SBOs overwhelmingly say breadth of coverage, not price, is the number one consideration when buying insurance for their companies.

- While SBOs are aware they face risks, only about half have reviewed their insurance coverage in the past year.

- Of those, just 21% say they leverage recommendations about insurance coverage from outside experts.

- The top three concerns of small business owners include data breaches, loss of employees and business interruption.

“With risks evolving and becoming more complex, it’s more important than ever for small business owners to evaluate their insurance needs to help ensure they are properly protected,” says Michael Keane, president of core commercial at The Hanover. “This presents a tremendous opportunity for independent agents to provide expert counsel to help assess small business owners’ risks, identify solutions, and guide them through the insurance buying process.”

Take a look at the executive summary of the Small Business Risk Report.

7—Small Businesses Plan to Grow

CIT Direct Capital, the national online small business lending unit of CIT Group recentoy released a new survey revealing that 72% of small businesses plan to expand their product and service offerings this year.

Investment priorities, sources and key issues

- When it comes to investing in their businesses, 50% say technology is at the top of the list, followed by equipment upgrades (47%) and hiring staff (36%).

- Over half expect to increase hiring over the next year.

- Small businesses remain focused on a number of key issues. Data security is the top concern for small businesses (68%), followed by continued economic uncertainty (64%) and rising inflation rates (61%).

- The top ways in which small businesses have capitalized their company in the last five years include internal sources of funding (38%), secured bank loan (33%), and leasing/equipment financing (22%).

8—Blockchain Job Opportunities

As the market grows, there will be many lucrative career options for those who are skilled with blockchain technology. In fact, 1,500 blockchain startups are currently looking to hire. The team at BusinessStudent.com compiled The Best Blockchain Careers for the Future:

- Blockchain developer: This is currently the most in-demand job in the industry. Companies across all industries want to develop blockchain platforms to optimize business processes but those programs must be created by developers.

- Blockchain engineer: Last year there were 14 jobs for every one blockchain developer or engineer. Engineers are required to study the technology needs of the companies he works for and create the applications that meet blockchain business needs.

- Blockchain legal consultant or attorney: Lawyers are already overloaded with calls from clients seeking legal advice on how to structure and govern ICOs and how to launch their blockchain projects. The billable hours will be limitless in the future.

- Blockchain project manager: Companies that work with an outside blockchain development firm will need an in-house project manager to be a liaison between the company’s business needs and the technology jargon. An MBA in project management will pop on a resume.

- Blockchain designer: With all of the new blockchain startups and businesses that want to use cryptocurrency, there will be more need for websites and pages to inform customers, clients and platforms of what the company offers in the blockchain space.

Quick Takes

9—50 Social Media Stats You Need to Know

I’m always searching for relevant social media statistics. This post from Holbi is a great place to find them.

10—Building a Website

Need to build a website? Check out this post of the best website builders from WebsiteSetup.org.

11—Local SEO

Local SEO is more important than ever. Check out this Local SEO Guide for Businesses from Caseo.

12—Starting a Photography Business

Do you want to start a photography business? Here’s a great guide from ShootDotEdit to help you get started.

13—Resource Center

Deluxe Corporation launched an online service center offering hundreds of free resources for small business owners, including the new “Small Talks” video series, which features advice from successful entrepreneurs across America.

Deluxe’s Small Business Resource Center is available at Deluxe.com/SBRC. The more than 400 free resources include everything from how-to guides to webinars to educational videos from experts at Deluxe. They cover a wide range of helpful tools for starting a business, marketing your business, managing finances and more. The Small Business Resource Center includes case studies and information from real owners and entrepreneurs.

14—Payment Options

If you sell on e-commerce platform BigCommerce, starting this summer, you’ll be able to accept Chase Pay at your online stores, making it faster for 61 million Chase Visa credit and debit cardholders to complete checkout. BigCommerce also will start enabling immediate merchant onboarding with WePay—a Chase company.

Both Chase offerings will make it easier for both retailers and their customers to transact digitally. Adding Chase Pay as a checkout option will allow retailers to engage with customers through their own loyalty programs while making their mobile and online shops more accessible to Chase customers. With Chase Pay, eligible customers can redeem Chase Ultimate Rewards, giving them more redemption options and greater spending power at checkout.

In addition, WePay will be offered as an integrated payments option to BigCommerce merchants, allowing them to accept payments instantly.

Cool Tools

15—Improving Business Communications

Nextiva has released NextOS, an all-in-one platform that it says will help solve business communications headaches for companies of every size and in every sector. With this launch Nextiva is pivoting from a largely VoIP-focused company to a complete business communications partner entering the SaaS industry (software-as-a-service).

While the company will continue to offer Nextiva Voice products, NextOS elevates Nextiva to a different level. The platform’s multiple products gives users a more holistic view of their customers. Instead of businesses using fragmented technologies from a variety of different companies to communicate—including chat, email, phone, analytics, and surveys—NextOS combines all these important communications tools in one place.

What’s inside NextOS?

Nextiva Service CRM: Nextiva Service CRM offers users multi-channel customer support software to help manage all customer interactions in a single place. Users can connect with customers through chat, email, or phone and they can manage every piece of communication on one screen with automatically created cases.

Nextiva Chat: Live chat is one of the best inventions in business communication, especially in today’s society where we need answers now, now, now. With Nextiva Chat, users can connect with website visitors in real time, thereby helping customers faster and delivering better experiences.

Nextiva Surveys: Businesses need information on each of their customers, but sometimes fret over the sloppiness of survey products. Nextiva’s survey builder offers multiple options for customization, making it the only tool users will need to collect information on customers, prospects, and internal teams.

Why is this launch so important?

Research shows more than 50% of employees have considered leaving their jobs because of fragmented communication overload. Plus, a staggering 63% of employees say they are actually unable to reach their weekly goals because of these challenges.

Click here for more info on NextOS!

16—Top Dell Deals

If you’re looking to upgrade your technology, check out these Memorial Day deals from Dell. Some are available now (check the ones in red).

Top consumer deals

- DellInspiron 11 3000 – $149.99 (Save $50)

o Doorbuster starts May 28, 11:00 a.m. ET

- Dell Inspiron Small Desktop – $199.99(Save $100)

o Doorbuster starts May 28, 5:00 p.m. ET

- DellInspiron 15 3000 – $229.99 (Save $70)

o Doorbuster starts May 28, 5:00 p.m. ET

- Dell Inspiron 11 3000 2-in-1 – $379.99(Save $100)

o Available now until May 29, 7:59 a.m. ET

- Dell Inspiron Desktop + 22″ Dell Monitor – $549.99(Save $280)

o Doorbuster starts May 28, 2:00 p.m. ET

Top small business deals

Deals available via Dell.com/businessdeals

- Dell PowerEdge T30 Tower Server – $329 (Save $408)

- Doorbuster starts May 28 @ 11:00 a.m. ET

- Dell Vostro Small Desktop – $399 (Save $285.29)

- Available now until May 31, 7:59 a.m. ET

- Dell Vostro 15 3000 Laptop – $539 (Save $359.57)

- Available now until May 31, 7:59 a.m. ET

- Dell Latitude 3590 Laptop – $546.93 after SAVE35 coupon (Save $294.50)

- Available now until May 31, 7:59 a.m. ET

- Dell OptiPlex 3050 Small Form Factor – $579 (Save $391.00)

- Available now until May 31, 7:59 a.m. ET

Top electronics and accessories deals

Deals available via http://deals.dell.com/#current-televisions

- Swiss Gear Legacy Backpack + $25 Dell Promo eGift Card – $59.99 (Save $20)

- Available now until May 29, 7:59 a.m. ET

- Dell 22 Monitor – S2218H – $99.99 (Save $100)

- Doorbuster starts May 28 @ 11:00 a.m. ET

- Nest Thermostat 3rd generation – $199.99 (Save $50)

- Available now until June 4, 7:59 a.m. ET

- Alienware 25 Monitor – AW2518HF – $299.99 (Save $200)

- Doorbuster starts May 28 @ 2:00 p.m. ET

- LG 49” 4K Smart HDR Ultra HDTV – 49UJ6300 + $150 Dell Promo eGift Card – $399 (Save $300)

- Available now until May 29, 7:59 a.m. ET

17—PayPal & QuickBooks

Connect to PayPal is an updated PayPal data integration app for QuickBooks. It brings detailed PayPal transaction details into the QuickBooks banking experience. Some of the new updates include:

- Connect to PayPal gives you more visibility into the details of your PayPal transactions. For example, Connect to PayPal will capture line-level detail on sales receipts, such as items sold, discounts, shipping and tax.

- When creating reports, Connect to PayPal will give you more insights and visibility into how your business is doing. This will help you better understand your company’s performance and plan ahead.

There’s a full tutorial online here.

18—Get Matched with a Designer

99designs has just launched a way for customers to search for and be matched directly with the professional designer best suited for their project. The new functionality provides a second method of connecting with freelance design talent in addition to the site’s design contests, in which customers fill out a brief and invite designers to compete for their business by submitting concepts.

With this new functionality, clients can easily sort through 99designs’ global community of freelance designers by style and skill to find designers who are available, affordable and with expertise in a specific design category and/or industry specialization.

19—Automation Saves Time

Tracking data and maintaining records of the many facets of your small business (inventory, orders, customer relationships) is a massively time-consuming process. Using Zapier, a leading automation tool, the average customer saves 2.5 minutes per task. And it automatically shares information between the apps you use daily so you can spend more time focusing on the parts of your businesses that drive the bottom line.

Sample tasks include things like getting a Slack notification every time you receive a gift order request.

Check here for app examples & combinations.

20—IRS Solutions

Canopy, a leading cloud-based practice efficiency platform for tax and accounting professionals, unveiled its Notices solution, giving practitioners a streamlined option for efficiently managing and resolving IRS and state notices for their clients.

More than 200 million IRS notices were sent to taxpayers last year. With more than 150 different types of penalties, managing and understanding each one can be exhausting and costly. Because IRS funding has declined by $2.4B since 2010, cheaper, automated collections continue to have greater prominence in enforcing compliance on a large scale, meaning that even more notices will be sent out in the coming years.

Due to the complexity and time-consuming nature of IRS notices, they can pose a significant challenge for tax practitioners.

“The IRS can cover more ground sending millions of notices than they can by doing traditional audits,” says Nate Barrett, Vice President of Product and Design at Canopy “Now, the average accounting firm is dealing with upwards of 100 notices per year. IRS notices are a huge source of frustration for many firms, as it can take the average practitioner more than three hours to research and respond to a single notice. And this all comes with a sense of anxiety due to the almost certain panic and stress the clients are feeling.”

Canopy’s Notices product enables tax and accounting professionals to quickly identify the type of IRS notice their client received, and then provides comprehensive steps and best practices to quickly resolve the issue.

21—Messaging for Less

Flock, a team messaging and collaboration platform, rolled out new pricing plans.In addition to the standard free plan, customers can now sign up for Flock’s Pro and Enterprise versions and enjoy powerful admin controls, and advanced features such as guest members, unlimited search history, and custom fields. The plans start as low as $3 per user/month, billed annually.

Process automation meets collaboration: Flock’s Process Automation module helps companies automate all processes easily, significantly boosting organizational productivity. In addition, this module is the only such tool that is built within a collaboration platform. The Process Automation module can be used by teams across functions, from IT and HR to sales and marketing, to automate simple processes (reimbursement claims or IT requests), as well as complex workflows where various teams need to work together.

As the module is seamlessly integrated with the Flock ecosystem, users can collaborate and share updates in real-time, in a transparent manner. Ideal for SMBs, the Process Automation module is available now and is free for all. While currently, users need Flock support to set up a customized workflow automation for their team, they should be able to manage this activity independently in about two weeks, once the interface is made live.

Photo by Monkey Business Images/Shutterstock