22 Things Small Business Owners Need to Know

By Rieva Lesonsky

1—11 Things Managers Should Never Say

Check out this great infographic of things managers should never say to employee from Headway Capital.

2—Jobs Report

ADP has released the June ADP National Employment Report®, showing the U.S. Economy lost 23,000 small business jobs. In total, the total employment change in U.S nonfarm private business sector from May to June showed a job uptick of 102,000. See the infographic below for more info.

3—Surviving a Summer Slowdown

Guest post by Jay DesMarteau, Head ogf Commercial Specialty Segments, TD Bank.

What resources SBOs can take advantage of during their slower seasons in order to prepare for busier times (when to hire ahead or increase/reduce inventory)

Throughout the year, SBOs should monitor their capital inflows and outflows, sales revenue and inventory turnover (if applicable) to get a sense of the business’s revenue cycle, including any peak and slower times. Understanding the business’s profitability, assets and expenses year-round can help SBOs better forecast cash flow and establish goals and processes for both slow and busy seasons. For example, if revenue typically declines during the summer, owners may consider taking a lower or no salary for themselves or reducing inventory orders to continue to meet financial obligations such as employee salaries and debt payments during those months. Business owners should also staff for their needs, perhaps reducing hours during the off season while planning to “hire ahead” and secure part- or full-time workers in advance of their busy season, when competition may increase for talent.

Why cash management goals should be synced to the seasonal nature of the business

It’s important to align cash performance with short-term and long-term objectives as well as allocate cash on hand into buckets based on use: operating budget, short-term liquidity (needed within 30 days) or long-term liquidity (needed longer than 30 days). Once SBOs have determined their goals, it’s imperative to re-examine the business’s revenue cycle and capital to see if any funds can be transferred to a business savings vehicle during peak revenue times that can then be drawn on during slower seasons or if a better strategy is to retain cash-on-hand to meet demand during busier times.

How to accelerate cash collections when running a seasonal business:

Any SBO knows that owning a business comes with a plethora of expenses ranging from employee salaries to suppliers and loan payments. These can pile up or result in account overdrafts if an SBO doesn’t monitor them regularly. Running a seasonal business can pose a challenge for paying these bills on time as assets, profitability and liquidity fluctuate throughout the year.

To ensure an SBO has enough capital on hand to take care of bills, the business’s revenue cycle needs to accelerate. Cash collection can accelerate through use of automated receivables; mobile check deposit (remote deposit capture); positive pay for checks or ACH (this speeds up clearing time by matching payment information to a list of known payers); or a ‘smart safe’ (this electronically counts cash deposits and credits the business account prior to the physical cash reaching the bank). Accelerated time frames help seasonal SBOs who need to tackle a changing list of expenses. It’s a great idea to speak with a small business banker to best understand how each of these products work and can help the business.

4—Summertime Consumer Shopping and Dining Habits

Lightspeed, a leading provider of omnichannel point of sale software, solutions and support systems for over 49,000 independent retailers and restaurants, recently revealed several key discoveries regarding consumer shopping and dining habits for the summer season. One insight—physical retail is still the most prevalent form for both Americans (36%) and Canadians (47%), even amidst the growing popularity of online shopping and food ordering.

Since July is Independent Retailer Month, Lightspeed developed the 2019 Summer Shopping Habits Survey and 2019 Summer Dining Habits Survey.

Key findings

- Over half of North Americans spend up to $250 per summer shopping trip:52% of Canadians and 53% of Americans spend between $50 to $250 per shopping excursion

- Food quality is the most important factor to a positive dining experience:Nearly 60% of North Americans say food quality is their most important consideration for a positive dining experience, followed by customer service for Americans, and price for Canadians

- North Americans spend most of their summer money on food:Both Canadians (41%) and Americans (42%) spend the most money on food during the summer, followed by clothing and apparel, supplies for hobbies and home furnishings

- Americans spend more in the winter, Canadians spend more in the summer:Over 36% of Canadians spend the most money on shopping and dining in the summer; over 36% of Americans spend the most in the winter

- The majority of North Americans anticipate spending hundreds of dollars per summer month on eating out:28% of both Canadians and Americans believe they will spend between $100-$300 at foodservice establishments per month between June and August

With this summer data, Lightspeed provides retailers and restaurateurs key insights such as consumer spending tendencies, where they like to shop and dine, factors affecting their choices, and more. These results help inventory-rich businesses with complex verticals create customer experiences that drive brand loyalty, complementing Lightspeed’s extensive suite of product offerings with solutions such as Lightspeed Loyalty, Lightspeed Analytics and Lightspeed Payments.

5—Are you Prepared for a Possible Recession?

New data released by Kabbage, Inc., a data and technology company offering automated cash flow solutions to small businesses, reveals 80% of entrepreneurs are confident their small businesses are well positioned to outlast a market downturn. The Kabbage survey demonstrates the differences in how companies will approach and plan for an economic slowdown.

Even with a high rate of confidence in the stability of their companies, all small business owners still anticipate a slowdown and are taking the necessary steps for their businesses. While 10% of respondents were unsure how to prepare for a recession, the majority of entrepreneurs are pursuing investment opportunities to increase their cash flow.

Actions to increase cash flow

33% are growing their customer bases, securing more contracts or expanding sales

21% are launching new products or services in an effort to increase revenues

13% are pursuing business partnerships to sell to a wider customer base

Actions to reduce costs:

8% are reducing operational expenses where possible to increase cash reserves

8% are postponing an expansion

7% are postponing hiring

“The grit and resilience of small business owners is admirable. Despite the growing fears of economists and Wall Street, entrepreneurs are ready to rise to the challenge,” says Kabbage Chief Revenue Officer, Laura Goldberg. “The data demonstrates how every small business is unique and how market shifts impact them individually. The constant among them is their confidence to build their business and pursue their passion despite any hurdle.”

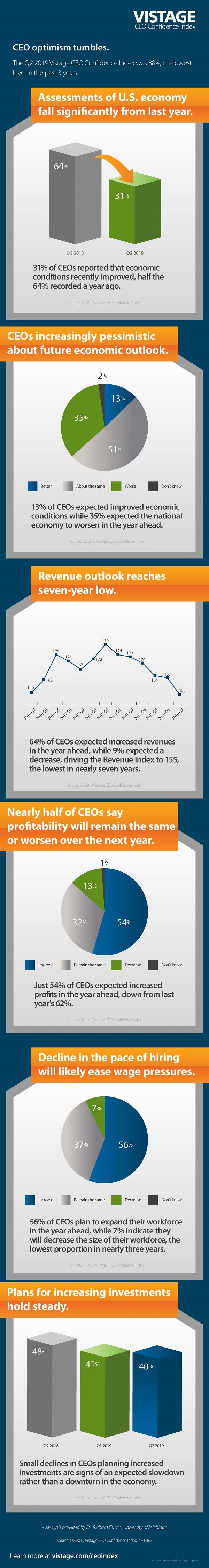

6—Economic Optimism Among SMBs Falls to Lowest Point Since 2008

Confidence in the economy among small and midsize business CEOs continues to decline, falling to 88.4 in Vistage’s Q2 2019 CEO Confidence Index. The CEO Confidence Index was 88.4 in Q2 2019, down from 91.6 in the prior quarter and last year’s 104.1. This represents the lowest CEO confidence level in the past three years, since the 88 recorded in Q2 2016. However, one of the components of the index – CEO sentiment about future economic conditions – is at the lowest level since Q4 2008.

“Damage done to the economy from the tariffs, the slowdown in job growth as well as heightened economic uncertainty has been substantial,” says Dr. Richard Curtin, research associate professor at the University of Michigan, who analyzed the data. “Despite these concerns, firms still held net favorable views that the Trump administration has helped their business [42% versus 26%].”

“Despite concerns about the economy and slowing business expansion, [SMBs] still report favorable prospects for their business, with nearly two-thirds — 64% — of CEOs expecting revenue gains and more than half anticipating profits to increase over the next 12 months,” says Joe Galvin, Vistage’s chief research officer.

Survey highlights include:

Pessimistic economic prospects

- Only 31% reported economic conditions had recently improved, half of the 64% recorded a year ago.

- Firms have expressed even greater pessimism about the outlook for the economy in the year ahead: Just 13% of CEOs expected improved conditions, unchanged from the prior two quarters and well below last year’s 32%.

- While the majority [51%] expected the economy to remain stable, the proportion that actually anticipated a downturn rose to 35% in the latest survey, twice last year’s 17% and the highest level since late 2008, when negative prospects for the economy peaked at 60%.

- While most of the Q2 survey data was collected before the threat of Mexican tariffs vanished, tariffs of 25% on nearly half of all imports from China remained in force.

- When directly asked about the expected impact of tariffs on their firms, 40% of all CEOs indicated negative consequences for their own businesses, compared with just 4% who reported positive impact.

Revenue and profit outlook

- Increased revenues were expected by 64% of all firms in Q2, down from 70% last quarter and 78% last year, and the lowest percentage in nearly seven years.

- Profit increases were anticipated by 54%, down from last quarter’s 58% and last year’s 62%, and the lowest since Trump entered office.

- The impact of tariffs on profits may partially erase the benefits of Trump’s tax cuts for some firms.

Hiring and investment plans

- 56% anticipated adding new employees to their workforce. Although only marginally below last quarter’s 59%, it was the lowest in nearly three years.

- 64% plan to boost wages to attract qualified talent.

- The anticipated decline in the pace of hiring will slightly ease these Importantly, 13% of firms planned cutbacks in investment spending, with 46% keeping the level of investment expenditures largely unchanged.

- These small declines in planned investments and hiring are consistent with an expected slowdown in the pace of economic growth.

Check out the full results and take a look at the infographic below.

7—America’s Financial Goals

Our friends at LendEDU recently released a survey about the financial goals of Americans.

Key findings:

- 19% of Americans listed “having enough saved so I can finally retire” as their number-one financial goal, but 39% of those respondents believe they will never achieve that goal

- 14% listed “paying off credit card debt” as their top goal but 7% don’t believe that will happen, while 20% listed “buying my own house or apartment” as their top goal but 17% don’t believe they will achieve that goal

- 1% of baby boomers listed “paying off student loan debt” as their top goal, while 6% of Generation Xers, 11% of millennials, and 15% of post-millennials answered the same

- 4% of post-millennials named “investing in real estate” as their top goal, more than any other generation, but no post-millennials listed “investing in the stock market” or “creating a retirement” account as their goal

- 12% of baby boomers don’t believe they will ever hit their financial goals

- 33% of respondents say a bill from an emergency like an accident would destroy their savings and derail their goals

- Out of the single respondents, 72% say reaching their financial goals is more important than finding the love of their life, which was selected by 23% of those surveyed

- 39% of those who listed retirement as their top goal don’t think they’ll be able to retire

8—Tips for Keeping Up with Changing Employment Regulations

Guest post by Danielle Jones, manager of HR services, Insperity

Updates to employment law can be tricky for business owners to navigate, and this year may only add to the confusion. Legislatures at the federal, state and local levels have turned their attention to a number of employment issues, such as paid sick leave, minimum wage increases and pay equity, and any resulting changes may have the potential to significantly impact small and medium-sized businesses across the country.

However, while new legislation can feel overwhelming, it is vital for companies to remain compliant with changes to avoid potentially costly consequences. With that in mind, here are some tips on how business leaders can prepare for legislative changes that may impact their organization.

Note the fine print: It may sound simple, but some of the most pressing questions about new regulations may be answered by carefully reading the full text of the document. Since changes can vary by city, county and state, company leaders should pay close attention to the details of new legislation, such as whether the law allows exemptions based on workforce size or which employees will be directly impacted by the changes. Paying attention to the specifics of any new legislation can help ensure businesses remain compliant and allow leaders to fully understand any impacts to their company and employees.

Take a conservative approach: Even after carefully reading and researching a new piece of legislation, business owners may still be unsure how it will impact their organization. In these cases, a conservative approach may be the safest way forward. For instance, if company leaders are unsure whether or not a new regulation will impact a specific team member, it is often best to assume it does. This approach can help to avoid costly mistakes and ensure each worker has access to the benefits they are legally entitled to receive.

Prioritize communication: New legislation can create confusion or concern among employees, particularly when workers could be directly impacted by the changes. To help ease these concerns, leaders should clearly communicate how the changes may impact the business and its employees, while being transparent about any changes to company policy. Managers may even consider holding feedback sessions with staff to ensure everyone understands new legislation and answer any questions they may have. Prioritizing open and thoughtful communication can help eliminate confusion among employees and create a sense of trust in company leaders.

Make a plan: When faced with new regulations, employers should consider developing a plan and timeline for how and when the changes will be implemented across their organizations. As part of this process, leaders should pay close attention to legislative deadlines and required changes to allow ample time for the new rules to go into effect. After creating the plan, company leaders should share the draft with all relevant members of the leadership team and managers of impacted employees to ensure everyone is aware of the strategy and process for implementation.

Legislative changes are inevitable, whether small business owners like them or not. However, business leaders can save both time and money by preparing for these changes and creating a plan to thoughtfully integrate new regulations across their organization.

9—What’s New with LinkedIn Pages: Engage your Community

Guest post by Rishi Jobanputra, Product Management, LinkedIn

Engaging with your community can be hard for organizations of all sizes. Whether you’re a small business looking for topics to spark a discussion, or a larger organization trying to foster authentic conversation, interacting with your community means strengthening ties with your existing network.

Last year, we unveiled the new Linkedin Pages to help organizations of all sizes join in meaningful conversations with LinkedIn’s community of more than 630 million professionals and 34 million Pages.

Now, we’re excited to announce new features for LinkedIn Pages that make it easier to engage your community and participate in the conversations that matter most to your business. LinkedIn Pages provides you with an indispensable hub to connect with your employees, customers and prospects who support your brand and want to stay in the know with your organization.

Going forward, we plan to release new features once a quarter, so you can keep track of all the important updates that allow you to make the most of your LinkedIn Page.

Custom Call to Action (CTA) and Analytics—A new way to drive leads and measure impact

As a Page Admin, you’ve told us you wanted the ability to customize the way you engage with your Page followers and visitors. Beyond the primary “Follow” button, we’ve now added the ability to select a custom CTA button for your Page. Five new options make it easy to turn your Page visitors into potential leads, and new analytics provide deeper insight into how many visitors are engaging and converting.

CTA button options include:

- Contact us

- Learn more

- Register

- Sign up

- Visit website

You can find the click-through analytics for your custom CTA button in two places: Either the Dashboard on the left-hand side of your Page Admin home or at the top of your Visitor Analytics tab.

Community Hashtags—Join the right conversations

We’re also introducing Community Hashtags, so you can associate your Page with relevant hashtags and join important conversations that members and organizations are having on those topics. From #AdvertisingWeek to #Blockchain, it’s easy to jump in and participate from the perspective of your organization.

Mobile Admin Editing—Update your Page from anywhere

With more members using LinkedIn on mobile, you need the ability to post, respond and edit your Page on the go. Now, you can update key Page details and edit posts you’ve already published from your mobile device.

To learn more about the updates, visit LinkedIn’s Pages Best Practices site here.

(Note: Community Hashtags and Custom CTAs are available on desktop only.)

10—The Small Business Wellness Index

KeyBank recently launched the Small Business Wellness Index, which measures the drivers, challenges, payment trends and financing needs of small business owners across the country. Data is drawn from KeyBank’s proprietary Small Business Wellness Review, a first-of-its-kind program driven by artificial intelligence, which guides small business owners through a comprehensive conversation about their businesses to identify their needs and offers industry-specific guidance and customized cash flow recommendations.

“Not only does the AI-driven program supply business owners with the industry intel they need to stay competitive, it also helps us better understand our clients and offer personalized expertise,” says Kip Clarke, head of KeyBank’s Business Banking.

Since launching the Small Business Wellness Review in 2018, KeyBank has taken the pulse of more than 38,000 American small business owners across the bank’s 15-state footprint. The data provides a real-time perspective on small business sentiment and behaviors in the United States.

“With this significant critical mass of data, we have the unique opportunity to spot macro trends among small business owners that will offer meaningful insights and inform a more holistic banking experience in today’s digital-first world,” continues Clarke.

The first Small Business Wellness Index from KeyBank, to be released on a quarterly basis, analyzed responses from more than 38,000 small business owners and found that cash flow is the top challenge for small businesses in Q1 2019, but business owners remain passionate and resilient.

Top findings

- An entrepreneurial spirit drove most owners to start their own small businesses: 21% wanted to be their own boss; 20% were motivated by passion for their business or by their entrepreneurial spirit—16%

- Money concerns rise to the top of small business challenges: Cash flow (43%), operating costs (24%) and financial control (14%) remain the biggest challenges for small businesses owners across all markets and company ages in Q1 2019, aligning with business owner responses in Q3-Q4 2018.

- 51% of small businesses have financing needs to keep their businesses operating: This includes increasing working capital (16%), purchasing equipment, vehicles or inventory (13%), as well as expanding products, services or locations (12%).

11—How to Attract Creative Class Talent

Guest post by Rana Florida, Chief Executive Officer of the Creative Class Group

In the international best-seller The Rise of the Creative Class, my husband, Professor Richard Florida, described the tectonic forces that are reshaping our economy, our geography, the work we do, and our whole way of life. Just as our economy shifted from an agricultural basis to an industrial one in the late eighteenth century, we are entering a new epoch, in which the most significant driver of economic growth is human creativity.

Leading this transformation are the 42 million Americans who use their minds and their creativity to earn their livelihoods: the creative class. These are the people who produce new designs, new ways of thinking, new discoveries that are readily transferable and widely useful. They work in a wide range of knowledge-intensive industries, including high-tech, financial services, law and medicine, business management, design, the arts, academia, and more.

So how do we attract and retain the most creative of these highly individualistic people to our organizations? Here are seven easy ways:

- First, they value intrinsic rewards over financial ones. Don’t get me wrong, everyone, including creatives, likes a bonus or a raise, but creatives expect their work to be rewarding in and of itself. They want to feel valued for what they do. Build in positive feedback and recognition with projects and initiatives.

- Give them the tools they need to grow and thrive at their jobs. Whether that’s professional development or on-the-job training, they need to keep their minds active and engaged. Once they get bored and stop growing, they move on. Providing them with ladders to opportunity is important for your next round of leaders and to their personal growth and happiness.

- All of us are spending more time at work than we used to. Make being at work as easy for them as possible. Reduce the number of status reports they have to file, and all the other bureaucratic processes and procedures that no one has the time for anymore. Let them concentrate on the work that really inspires them—and that produces value for your firm.

- Make it as easy as possible for them to get to work. Locate your offices close to public transportation. Not only is commuting among life’s least enjoyable activities, but Creative Class workers don’t want to waste their valuable time sitting in traffic. The productivity costs of this deadtime has huge implications on their mental well-being. Locating in downtowns that are walkable and have easy access are key to attracting and retaining such workers. Also offer satellite locations which gives them the geographical choice of working from offers an added amenity.

- Give them the freedom and flexibility they need. If they have to come in late or leave early or work from home due to an illness, a personal issue, or a sick child, allow them. Don’t hold them accountable to hours; make them responsible for results and empower them to manage their own workload during hours that work for them.

- Make your workplace a healthy place, a place where they can take breaks and recharge. If you can afford to provide amenities such as massages, yoga classes, a gym, a lunch room with multiple healthy options, an outdoor nature trail, do so. If you can’t, make sure such services are accessible nearby. Making your employees healthy not only saves on healthcare costs but resets a Creative Class mind for the next working cycle.

Stimulate, engage and inspire them—the more they share your vision of the organization, the more excited they will be to stay on board and contribute to its success. Despite the talented engineers and techies at Apple, there was no question that Steve Jobs vision inspired some of the world’s biggest innovations. New discoveries and innovation require a team of passionate employees, but without a compelling vision, the path will not be easily navigated. Make sure to offer a simple and powerful vision for others to follow.

12—Installment Payment Capabilities Give Shoppers Simple and Flexible Way to Pay

Visa just introduced a suite of Visa’s installment solutions APIs, making it easier to provide shoppers the ability to choose how they pay before, during or after purchase. Through a pilot program, participating issuers and merchants will be able to offer their customers an installment payment experience at checkout using a Visa card they already have in their wallets.

With Visa’s installment solutions, Visa cardholders will have the option to divide their total purchase amount into smaller, equal payments over a defined time period on qualifying purchases, in-store, online or while traveling abroad[1].

“Visa’s installment capabilities are changing the game by allowing issuers to leverage an existing payment account consumers already have and are familiar with, instead of asking them to submit to a credit check, download an app or open another line of credit,” says Sam Shrauger, senior vice president, global head of issuer and consumer solutions, Visa. “We expect installments to become a foundational method of payment at checkout for both domestic and cross-border commerce payment transactions.”

Visa is partnering with clients around the world to pilot a variety of installment use cases. The goal of Visa’s installment solutions is to simplify today’s friction-filled and time-consuming installment process at checkout for buyers and sellers. Online shoppers today are typically presented with an installment offer at the final checkout screen. Consumers are then required to sign up with a designated provider, apply for a line of credit and—if approved—use their funds toward a given purchase. Each time a consumer shops with a different merchant who offers a different installment capability, they need to complete the same process again to obtain a new line of credit.

Now, merchants can leverage cardholders’ existing relationships with financial institutions to provide Visa’s installment solutions at the point of sale –online or in-store—through a single API-based integration. This will ultimately help merchants enhance sales, improve customer loyalty and overall cash flow, while offering their shoppers a friction-free payment experience at checkout.

Globally, installments represented $1.2 trillion in payment volume in 2017 and have been growing 15% year-over-year, twice as fast as credit cards. A recent study found 74% of U.S. cardholders think installments are helpful for budgeting and alleviating the stress of making large purchases (70%). In addition, 60% of millennials say they are interested in point of sale financing for large online purchases.

13—The Cost of Natural Disasters

In 2018, 14 natural disasters cost the U.S. $91 billion in 2018 according to FundRocket.

- Louisiana, Texas, and Florida are the most vulnerable states to natural disasters—they topped the list for most financial losses with over $5 billion each

- Hurricanes were the second-costliest disaster in terms of median losses per business ($98.5k) but accumulated the greatest total loss at $25.9 billion

- SBA loans covered 35% of the $6 billion in verified losses caused by Hurricane Katrina in 2005

- The 2018 California wildfires were the only non-hurricane natural disaster to make the list for costliest disasters, approved loans only covered 8.2% of losses

Learn more.

14—Are Your Phone Habits Causing You to Lose Customers?

One third of small businesses are losing customers because they fail to answer the phone, according to Charleston’s Moneypenny, the world’s leading outsourced communications provider. In fact, relying on voice mail to do the job customers expect humans to do only leaves customers irritated and businesses appearing less than professional.

About 26.6 million of the 28 million businesses in the U.S. have only one to nine employees, meaning full-time dedicated phone staff is likely not available. Most of these small businesses realize incoming calls are vital to their success, but cannot answer literally every call, leaving around 33% unanswered. Of these, 71% go to voicemail and 29% simply ring out. Approximately 69% of the customers that go to voicemail will not leave a message.

“Calls are becoming increasingly valuable to small businesses,” says Joanna Swash, Global CEO/Robbie van Adibé, Global Chairman of Moneypenny. “Handled correctly, they can transform the way a business communicates with and relates to customers, which subsequently can be seen in their bottom line. Not handled correctly, if at all, means the loss of valuable leads. Today’s customers expect to be able to communicate with businesses immediately, and proper call answering is vital to making that first impression positive.”

When the phone is answered, Moneypenny adds the person answering the call should be friendly, clear and easily understandable, an active and attentive listener, and convey a positive attitude that isn’t dismissive. One study showed 19% of surveyed callers wouldn’t do business with a company based on their first phone call impressions, and that 31% of callers felt their call wasn’t valued by the small business.

To show businesses what their answering gap is costing them Moneypenny launched a new online Call Calculator, which can show how many calls they are missing a week, and how much it could be costing them. The tool helps businesses gain insight into what their dedicated receptionists could do to help fill their answering gap.

15—Digital Business Entertainment

Last month Mailchimp officially launched Mailchimp Presents, a new digital business entertainment platform. Mailchimp Presents features original short-form series, films, and podcasts made to support and inspire small businesses and entrepreneurs. The platform is launching with over 50 pieces of content, with dozens more set to release this year.

This is a major investment for Mailchimp in producing original, high-quality content. They’ve hired an internal team to create and build out the platform, and are working with several award-winning directors and producers, including Jason Woliner and Hrishikesh Hirway, and talent like Jay Duplass, Samin Nosrat, and Big Boi.

On the heels of their all-in-one marketing platform launch in May, Mailchimp Presents gives Mailchimp a new, unique way to connect with small businesses. Mailchimp’s goal for the platform is to support the entrepreneurial journey by creating and sharing entertainment that is practical, heartfelt, and fun.

No login is required to access the entertainment and it is available at no cost.

You can watch a trailer here.

16—Sleeping Pays Off

There are benefits to getting a good night’s sleep, according to the Success and Satisfactory Sleep report from HealthySleep

- Those who get good sleep earn an average of $6,500 more than those who sleep poorly

- Good sleepers confess to having $10,000 in savings—6X more than those who sleep poorly

- 60% of bad sleepers feel stuck in their current careers and 56% have significant career regrets

- 63% of bad sleepers feel depressed at work at least once a week and 74% feel anxious—2X more than people who consider themselves good sleepers

17—Appearances Counts

Look Good, Work Good, a report from NVISION, shows:

- 52% of employees think a formally dressed co-worker is more productive than a casually dressed co-worker in the same position

- Over 60% judge their co-workers based on their work attire

- Hiring managers are more likely to prioritize an applicant’s groomed appearance (87%) over education (84%) and professional recommendations (75%)

- 76% of hiring managers say attractiveness matters at their company

Quick Clicks

18—5 social media strategies to boost sales for your startup—great info from AeroLeads.

19—Test your internet speed. BroadbandSearch says these are the top 7 sites for testing your internet speed and explains why it matters.

20—The Senior List looked at the monetary habits and mistakes of seniors and millennials. Check out what they learned.

21—Best cities for professional women to work in from GetResponse.

22—How adopting a dog led to a best-selling children’s book and a new mission.

Business stock photo by nd3000/Shutterstock