10 Things Entrepreneurs Really Need to Know

By Rieva Lesonsky

Small Business Week Edition

1—The Evolution of American Industry via the Fortune 500

Regular contributor Matt Zajechowski of Digital Third Coast and the folks at Slant reviewed the top 20 companies of the Fortune 500, from 1965 to 2015. Here’s some of what they found. There’s more in the infographic below and on their web page.

“Industry is always evolving. What works and helps companies thrive in one decade doesn’t guarantee success in the next. Any businessperson or economist will tell you, the ability to adapt to unpredictable factors—market whims, technology, public perception, regulations—will be the surest determinant of success for any company or industry.

“Considering our analysis, confined to the grounds of the top 20 slots in the annual “Fortune 500” list, one initial observation to be made is how many industries have boomed in or around 1995, when the internet became a mainstay in today’s modern culture. The retail industry, especially, exploded, and remains steadily increasing, thanks in part to companies like Amazon (founded in 1994) and Apple, which introduced the first smartphone in 2001. But it wasn’t those companies that drove the boom. It was, of course, Walmart, the king of all brick and mortar business in America.

“As technology and innovation continue to shape how businesses are created and maintained, one thing is for certain…there’s almost no telling where these bubbles will be the next 50 years!”

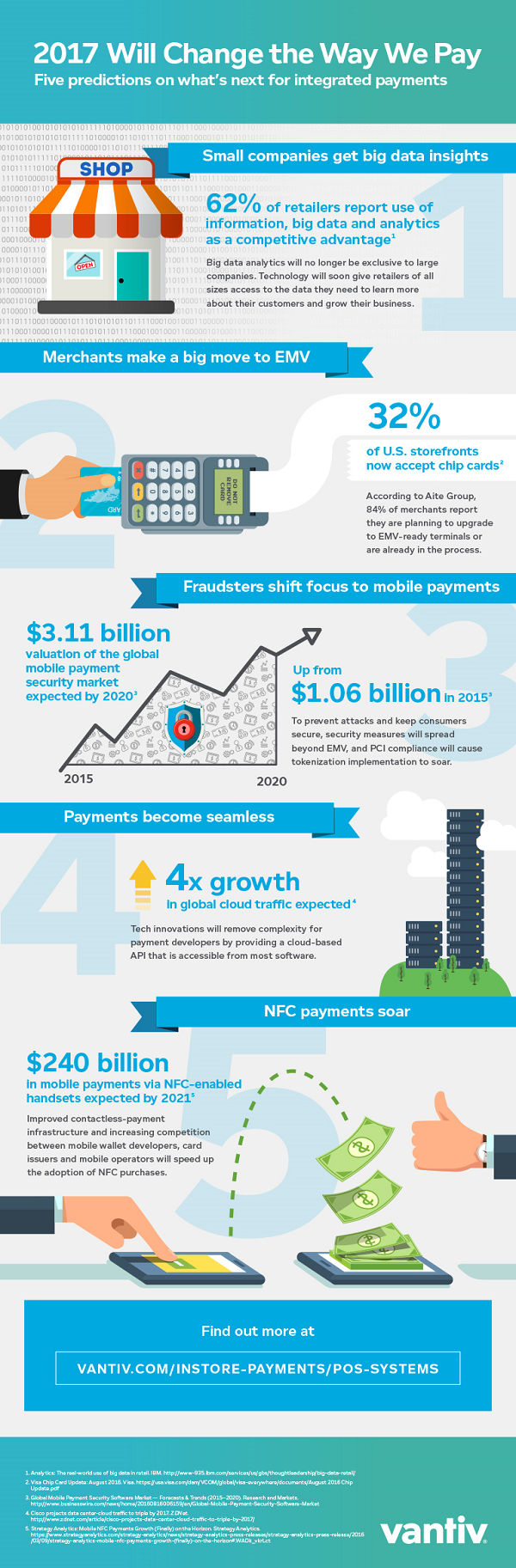

2—Payment Trends 2017

According to Vantiv, the three most important Integrated Payments trends to watch for are:

Merchants Make a Big Move to EMV: With EMV adoption approaching critical mass, 2017 implementation efforts will shift to merchants as they rush to install EMV-enabled terminals.

Fraudsters Shift Focus to Mobile Payments: Now that EMV adoption is inching closer and closer to critical mass in the U.S., and frictionless payments technologies continue to grow, fraudsters will shift their focus to less secure payment options such as mobile payments.

Payments Become Seamless: As invisible payment options continue to take off, the need to make a physical payment is disappearing from the equation. Tech innovations will remove complexity for payment developers by providing a cloud-based API that is accessible from most software.

Check out the infographic below for more details.

3—Small Business Transactions Jump

According to the latest report from BizBuySell.com, the internet’s largest business-for-sale marketplace, there were a record number of sold business transactions in the 1st quarter of 2017. The full results, reported in BizBuySell’s Q1 2017 Insight Report, show a 29% increase from the 1st quarter in 2016. The company attributes part of the spike to “a rush of buyers and sellers looking to close deals around the New Year, a healthy economy, strong small business financials, and access to financing.”

Businesses sold in Q1 grossed a median revenue of $518,159, an 8.4% increase and median cash flow was 6.6% to $117,275. These key financial indicators are the highest totals since BizBuySell first started tracking data in 2007.

High Sale Prices and Listing Numbers Points to a Balanced Market

The strong financials of businesses reported sold resulted in owners receiving higher values for their businesses upon exiting, with the median sale price increasing nearly 8% to $237,000.

Total listings increased 3.8% from last year. BizBuySell says, “These newly-listed businesses boast growing median revenues and cash flows, suggesting there’s still a strong supply of healthy businesses available for interested buyers.”

The restaurant and retail sectors experienced the greatest growth. The number of closed transactions in the restaurant sector increased 29% and the median sale price jumped to $191,250. Higher sale prices were likely a result of improved financials. The median revenue of restaurants increased 33% to $574,679, while cash flows increased 23% to $105,029. Retail business transactions increased 28%.

Looking Ahead

Buyers and sellers entering the market should keep an eye on changing federal and local policies and global market conditions that could impact the business-for-sale environment. According to a survey of small business buyers and owners, they’ll be closely watching healthcare, tax reform and jobs. While all fundamentals point to a stable and robust market, transaction levels for the remainder of the year will likely fall closer to last year’s record highs.

4—SMB Trust Index

Alignable just released its Q1 2017 SMB Trust Index℠, highlighting the 20 brands that have built the greatest trust and loyalty with small and local business owners across North America. Only 44% of the 86 brands in the Index earned positive brand sentiment from business owners.

Highlights of the Index include:

- Amazon, WordPress and Google maintain their Top 3 overall positions from last quarter, while Apple and FedEx enter the Top 5 for the first time.

- The Top 3 brands in the “Social and Digital Marketing” category include Google (#3), LinkedIn (#10), and Twitter (#11).

The Top 20 Most Trusted Brands in Small Business

- Amazon

- WordPress

- Apple

- FedEx

- net

- Stripe

- UPS

- PayPal

- Vistaprint

- Square

- 1&1

- Microsoft

- Dropbox

- MailChimp

- Intuit QuickBooks

5—Is it Time for a Brand Refresh?

Guest post by Brendan Stephens, Global Creative Director at MOO

Get ready for an audit—but don’t call the accountants! Believe it or not, audits aren’t always a bad thing. They help you step back from your day-to-day processes and get a broader look at what your brand is good at, where you may see challenges, and what is going on around you. An audit can provide invaluable insights that can not only inform your brand refresh but also larger business decisions.

Hire a sidekick. When doing a brand refresh, a new perspective can make all the difference. Along with being bogged down by day-to-day work, internal teams are often too close to the brand to see what might or might not be working. Bringing in a partner can help by providing a much needed outside eye.

Look at the big picture. Rebranding involves much more than creating a new logo. As a brand, you want to tell a story through many elements that may at times look unrelated—from the color palette to iconography to tone of voice, many elements affect your look and feel. When rebranding, you should consider each of those elements (and how they work together) and your audience. Make sure things are consistent and harmonious.

Celebrate the rebrand. Your employees are your most important asset and you want them to be as excited about the new brand as you are. Before going public, make sure your employees are in the know. But don’t bore them with slideshow presentations—make the unveiling an event, a celebration. It is a great opportunity for your team to feel energized and part of the new direction.

Spread the word. Your brand is looking mighty fresh. Once you launch the site and recycle the old collateral, send postcards to your valued customers to let them know you’ve rebranded and what the new direction is all about. The personal touch will help them feel involved in the process and strengthen the relationship as you start on the next stage in your brand’s journey.

6—5 Things to Keep in Mind When Shopping for a Digital Marketing Partner

Guest post by Neg Norton, President, Local Search Association, a more than 40-year-old not-for-profit industry association of media companies, agencies and technology providers helping businesses market to local consumers.

Small and medium-sized businesses (SMBs) operate on small budgets and rely heavily on marketing to attract new customers. Therefore, it is essential to have a marketing partner that will deliver a return on investment.

However, finding reliable, trustworthy marketing partners who will consider what’s in the best interest of an SMB can be challenging. The digital marketing marketplace is crowded. On average, SMBs received 24 sales calls a month from someone trying to sell them marketing or advertising services in 2016—a 60% increase from 2015.

The Local Search Association teamed up with Thrive Analytics to produce the “Local Pulse Report” Survey, showing 44% of SMB owners have a hard time finding digital marketing partners who will deliver a return on investment. Furthermore, 38% of SMB owners say they face hurdles in identifying marketing partners they can trust.

When it comes to selecting a digital marketer, the crowded marketplace, ROI and trust aren’t the only challenges facing today’s SMBs. They are often faced with unfamiliar terminology, new products or services, promises they don’t understand and misplaced expectations.

So how can SMBs find a digital marketing partner they can trust? What should they be looking for when seeking and evaluating a provider?

SMBs should seek partners who practice the highest ethical standards. Here are some key business practices SMBs should check to properly vet and evaluate a potential partner.

1—Details regarding fees and/or payments are clearly recorded in an agreement. Thrive Analytics/Local Search Association’s “Local Pulse Report” Survey reveals 56% of SMBs believe finding a reasonably priced service provider is a top challenge, while 26% also struggle with finding a provider who will not hit them with hidden or additional fees.

That’s why SMBs should demand to see details regarding fees and/or payments in the agreement. Make sure contracts include a scope of work or outline of services to be provided, with costs associated with each of the various items.

Additionally, marketing service providers should outline a payment schedule for services and clearly define how payments will be made. Automatic renewal of services or automatic billing must be clearly specified, in addition to instructions for how to terminate auto-renewals.

2—Contracts and terms of agreement are transparent and clear. Transparency in a contract with a marketing partner and any associated terms of agreement is essential. When possible, all contracts should be in written form. Alternatively, if working with a partner via telephone, email or online, make sure that all discussions and agreements are recorded in a retrievable format such as an email confirmation, audio file or via an online dashboard. This goes for any amendments or changes as well—make sure they are confirmed in writing or recorded and retrievable at a later date, in case they need to be referenced.

Contracts or contract discussions should include services to be rendered, associated terms and conditions, and conditions of termination.

3—Project/program goals and objectives are established and agreed upon. Because marketing is an important tool in helping SMBs attract and retain customers and spread the word about their businesses, SMBs seek companies who will deliver a return on investment and work in their best interests.

When working with marketing providers, SMBs and their partners should work together to develop clear goals and objectives that align with your business priorities. The objectives should be reasonable, attainable and most importantly, measurable.

SMBs should also make sure their digital marketing partners disclose the products, services, programs and campaigns they plan to implement to achieve the campaign goals. It is important that SMBs fully understand all the services planned, the value they will add, and all relevant information to confidently make informed marketing decisions.

4—Partner has an established process for communicating client updates. The “Local Pulse Report” Survey shows 35% of SMBs believe getting good customer service after a contract is signed is one of the top challenges when it comes to finding a marketing partner. SMBs want assurance they will receive regular communications from their marketing partners keeping them up to date on performance and accounting.

At a minimum, SMBs should seek partners who provide updates and report on:

- Financial reporting on all monies paid

- Results of the services provided and/or the performance of any marketing campaign

5—Partner has been certified or verified for their ethical business practices. Look for a digital marketing partner who has been certified by a reputable industry organization, such as the LSA Digital Marketer Certification Program. Certification programs help SMBs identify reliable, reputable marketers who they can be confident will work toward their best interests.

Certified providers have gone through a review process to verify they uphold the highest standards and best practices related to their businesses from service agreements, pricing and sales practices to employee hiring and training practices and more.

By working with a certified partner, SMBs can be assured their marketing partners will stand behind representations made during the sales process and follow ethical and trustworthy business practices.

When choosing a digital marketer, SMBs should look for a partner that provides a clear and transparent contract, goals and objectives that align with their business, frequent progress updates and has been verified for ethical business practices.

7—3 Great Resources for Starting a Business

Guest post by Jamie Domenici, Jamie Domenici is the vice president of SMB for Salesforce. Follow her on Twitter @jcdom.

While starting a business may be among the toughest challenges of your lifetime, it’s also a feat that’s among the most rewarding. It starts with deep passion, plenty of know-how and strong determination. But there’s no need to go it alone—every small business needs help to set off on the climb, and fortunately, there are scores of successful small business that can share the resources they depended on early for success. We asked three fast-growing businesses what was most valuable to them as they started and grew. Here’s what they had to say:

1—U.S. Small Business Administration Even when you have a genius idea, it takes a lot to get a business off the ground. Where do you start? What needs to happen first? What are the legal requirements, and do you qualify for government assistance? Start by educating yourself on the SBA site about what you need to do.

“We spent a lot of time on the SBA website. It’s an incredibly comprehensive resource,” says Joe Ellis, Customer Relations Manager at Nady Systems. “The SBA helped us work through all the legalese and requirements involved so we could be sure to start off the right way.”

The Small Business Administration can tell you what’s required, like Social Security and workers’ compensation, and what’s optional, such as health care insurance coverage and retirement benefits, and how this varies from state to state. In addition to vital needs like small business lending and loans, the SBA can help with business plans, business registration, structures and licensing. Watch this video introduction to the SBA to learn more.

2—U.S. Chamber of Commerce “The Chamber of Commerce was a go-to source for us, especially when we had questions about setting up the legal and financial aspects of our model,” says Martin Greenberg, Co-Founder and CEO at Bedly. “Starting small, we felt more confident knowing we had this giant in our corner.”

The world’s largest business organization, the U.S. Chamber of Commerce represents the varied interests of more than 3 million businesses nationwide. The group helps companies of all sizes, sectors and regions—from mom-and-pop shops and local chambers, to leading industry associations and large corporations. Plus, the Chamber and its partners have the tools to save your business money and the solutions to help you run it more efficiently. Shipping, staffing, benefits, lobbyists? They’ve got what you need.

The national Chamber, along with its state and regional branches, advocates for pro-business policies that create jobs and grow our economy; because your growth is key to their success, it’s in their best interest to help you succeed. Issues of expertise range from smart tax policy and regulatory relief to legal reform and trade promotion. What’s more, they’re politically active with professional lobbyists, communicators and policy experts, all in place to advance the interest of the business community’s interests.

Bottom line: it’s a smart community of entrepreneurs that can tackle issues from healthcare and immigration to legal reform and retirement.

3—SCORE Finding a mentor can be invaluable to any business. The best way to find great mentors? Accelerators and agencies like SCORE, a nonprofit association dedicated to helping small businesses get off the ground, grow and achieve their goals through education and mentorship. For 50+ years, SCORE has been connecting small businesses with mentors and other resources, all at little to no cost to the business.

“Mentor connections, insights and support are an invaluable asset to any business,” says Cassidy Tucker, Director of Communications at SPLT, an enterprise carpooling solution founded in 2015. “Mentors continuously help us reimagine and revamp our business.”

SCORE’s vast list of workshops and events can also be extremely helpful. Browse their online list of live and recorded webinars, online courses, and in-person workshops, and you’re sure to find a topic of interest to you—everything from social selling, tax implications and blockers for female entrepreneurs, to global expansion, addressing multicultural audiences and lead generation.

Ready, get set, grow. Starting a business involves planning, strategic decision-making, financial accountability, legal responsibilities and possibly several other steps you haven’t considered—or don’t even know about. That’s why every small business needs dependable resources to get off the ground and running. We hope you’ll use these to grow and thrive.

8—Small Business Week Activities

As an official sponsor of National Small Business Week, Constant Contact is conducting a series of free educational events throughout the country to recognize the critical contributions of America’s entrepreneurs and small business owners and help them enhance their online marketing efforts. The events will explore the benefits of online marketing to engage customers and drive business success, and provide entrepreneurs and small business owners with the knowledge and technical know-how to implement these strategies within their own business.

In addition to these free local events, beginning April 30, Constant Contact is inviting small business owners to share on social media using the hashtag #MySmallBizWhy, sharing why they started their small business. The campaign will run through June and culminate with an interactive digital art display, created by user generated content from small businesses and consumers who support shopping small. Simultaneously, Constant Contact brand ambassadors will hit the streets in major cities across the country to interact with small businesses and the local community, encouraging them to share their #MySmallBizWhy.

Here are some of the events:

Free One-On-One Coaching Sessions will be offered throughout May, as part of educational seminars in several regions of the U.S. The coaching sessions will be offered by local marketing experts who will provide guidance on email marketing strategies and best practices. For more details on these coaching sessions, go to their Small Business Week events page.

Webinar: Email Content in 15 Minutes or Less: On May 4th Bria Sullivan, Constant Contact’s Content Developer, and Dave Charest, Senior Manager of Content and Social Media Marketing at Constant Contact, will present Write Your Email Content in 15 Minutes or Less. The webinar is free, but registration space is limited on a first-come, first-served basis. To sign up for the free webinar, register here.

Cool Tools

9—New Products to Simplify Growth for Any Small Business

At its annual ICON event, Infusionsoft COO, Terry Hicks, announced significant product updates to its established product line and introduced Infusionsoft Propel, a mobile-based solution enabling businesses with no marketing expertise to grow their business more steadily.

Infusionsoft Propel starts by easily organizing customer information in one place, then allows owners to choose from proven marketing campaigns, designed by experts. Once selected, Propel guides owners through an easy, step-by-step experience to personalize and run the campaigns in minutes.

“Many businesses lack the marketing knowledge and technical expertise of the customers we have traditionally served,” says Hicks. “So, we created a solution that simplifies connection and follow-up, reflects their essential needs and works from their smartphone.”

Infusionsoft Propel Key Features and Benefits:

- Organizes Customer Information. Propel collects and organizes customer information wherever it resides, giving users a single, consolidated view and ability to run campaigns

- Guided Experience. A simple, guided Q&A experience with little time commitment that helps users personalize and launch campaigns in just minutes

- Templated, Proven Campaigns. Choose from dozens of proven, templated campaigns that ensures a professional outcome—without forcing owners to develop marketing skills

- Automation Recommendations. Guides users through the automated follow-up steps recommended to improve results and simplify growth

- Automatic Personalized Branding. The tool “scrapes” a business owner’s website for the company logo and color scheme to create a personalized business appearance with no effort

In addition to Infusionsoft Propel, the company unveiled several new products and enhancements to its existing product family, including:

- Landing Pages. Simplifies getting and capturing leads with a best-in-class feature set that enables users to publish beautiful, modern pages that convert, in minutes

- Facebook Advertising Services.A done-for-you advertising service that runs Facebook ads on a customer’s behalf each month, generating leads that are sent to their Infusionsoft accounts

- WordPress Integration. Infusionsoft users who have built their website on the WordPress platform can now easily place a simple opt-in form anywhere on their site and have completed form data automatically submitted into Infusionsoft CRM, campaigns and more.

- Vimeo Business Integration. Users can add an email capture box within a video to capture leads and send them directly to Infusionsoft.

- Automatic translation for International Customers. Customer-facing pages built in Infusionsoft will now be automatically translated into French, Portuguese, Spanish, or German.

10—Global Payment Process for SMBs Made Easy

According to Veem, cross-border payments is a $25 trillion market. SMBs represent $6 trillion of that—but pay $50 billion in fees due to an antiquated wire transfer system that is cumbersome to use and provides little visibility into the status of transfers. These complexities and uncertainties make the international payment experience difficult for busy small businesses.

The company says its platform offers SMBs an end-to-end payment experience that is simple, trackable and integrated into the rest of the businesses’ processes. It allows even the smallest businesses to Veem payments between multiple geographies and in various currencies without worrying about where their money is.

Currently, the global payments industry is a patchwork system that involves multiple financial institutions and currency exchanges, introducing numerous fees and boundless confusion. It’s a struggle to communicate and trade across national boundaries. By intelligently routing payments between different rails, including the increasingly popular blockchain, Veem’s multi-rail technology connects the disparate parts of the international payment process. Veem’s platform brings the simplicity of consumer payments to small businesses by enabling them to send and receive payments using only an email address.

“At Veem, we understand even ‘mom and pop’ businesses must embrace globalization to compete with incumbents, grow their businesses and innovate,” says Marwan Forzley, Veem CEO and founder. “Our platform creates an experience that is simple and frictionless, allowing businesses to easily Veem payments, data and invoices across the globe.”