11 Things Entrepreneurs Need to Know

By Rieva Lesonsky

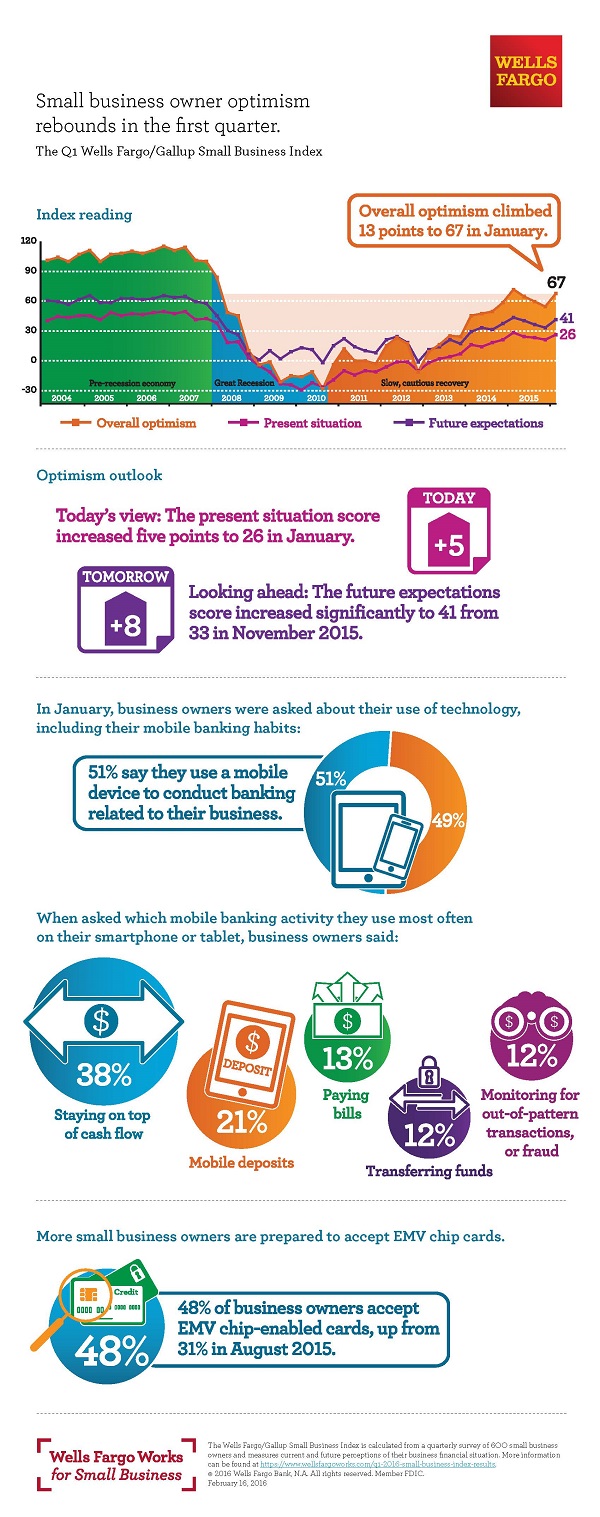

1) Small Business Owners Feeling Optimistic

In the latest Wells Fargo/Gallup Small Business Index, which measures the optimism of small business owners, the Index’s overall score rose to 67, a 13-point gain from November’s survey.

The bounce in optimism benefitted largely from small business owners feeling better about their cash flow, with 60% saying their it was very or somewhat good over the past 12 months—a level not seen since the fourth quarter of 2007. Looking ahead, 66% of business owners expect their cash flow to be very or somewhat good in the next 12 months, compared to 63% in November. Most other Index measures had small increases or were unchanged in the first-quarter survey.

Entrepreneurs reported feeling more positive about the next 12 months, as the survey’s future expectations score rose eight points to 41 in January. The present situation score — how business owners rate current conditions for their business — also improved, climbing five points to 26 in January from November’s score of 21.

Business owners were also asked about the types of payments they accept:

- Cash or check (84%)

- In-person via credit or debit card at a traditional point-of-sale terminal (31%)

- In-person via credit or debit card at a mobile point-of-sale terminal (20%)

- Accepting payments through their website by a variety of methods, including online payment providers (21%) and via credit or debit card (20%)

- Accept payments in person via a digital wallet such as Apple Pay or Android Pay (5%)

Top Challenges

The business owners were asked to identify the most important challenge facing their businesses:

- Attracting customers and finding new business (14%)

- The economy (11%)

- Hiring and retaining quality staff (11%)

- Government regulations (9%)

2) Top Sales Management Software

GetApp, a site with reviews and information on sales management software, released a new report ranking the best programs for small businesses to use. Check the listing out below.

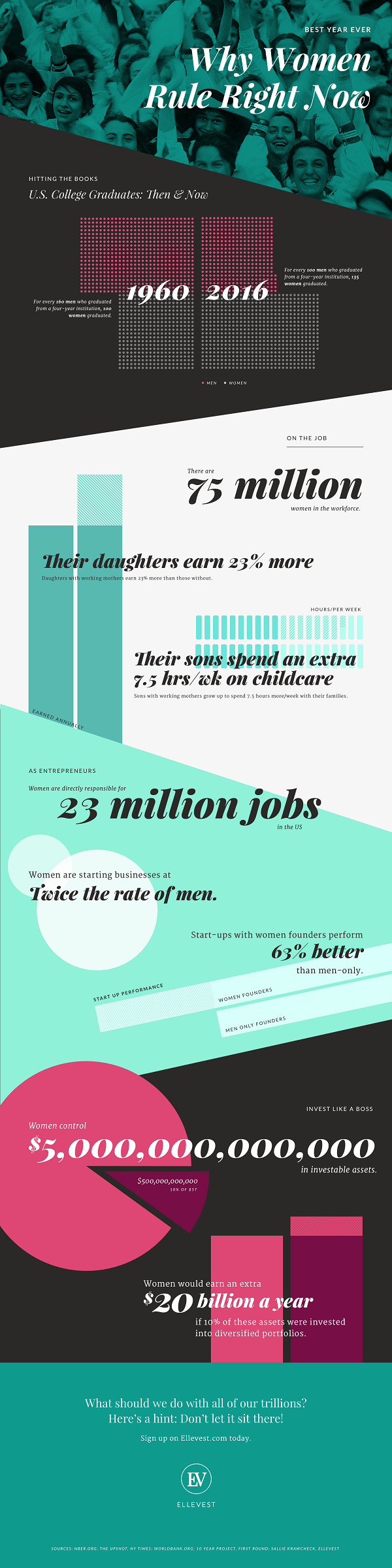

3) Why Women Rule

Overall, it’s been a good year for most American women. They’re dominating higher education, the workforce and entrepreneurship. Ellevest, an investment site dedicated to women, calls out some key highlights:

- There are 75 million women in the work force, and women are directly responsible for creating 23 million jobs in the U.S.

- Start-ups with women founders perform 63% better than men-only start-ups

- Women control $5 TRILLION in investable assets

Check out the infographic below for more information.

4) New Index Reveals Small Businesses’ Most, Least Recommended Brands

Alignable, the social network for small business owners, just released the findings of its first quarterly SMB Trust Index℠, highlighting how more than 6,000 North American small business owners feel about the products and services they are most and least likely to recommend to their peers. This first publicly available Net Promoter Score ® (NPS) report for small business technology brands reveals how they stack up to each other and the competition.

Some notable findings include:

- WordPress, with a NPS of 73, ranks highest among small business owners, followed by Authorize.net and MailChimp.

- Yelp and Groupon are at the bottom of the barrel with scores of -66 and -65, respectively.

- Facebook continues to lose ground, falling out of the top 10.

The number of SMBs adopting cloud-computing services, such as those highlighted in Alignable’s SMB Trust Index, is growing at a staggering rate. According to Compass Intelligence research, the American SMB cloud computing and services market is poised to hit $55 billion in 2016, up 450% from 2011.

“There is certainly huge opportunity for brands in this market, but in selling to small businesses, success revolves around gaining a disproportionate share of the available market,” says Eric Groves, Alignable co-founder and CEO. “To claim this share, brands must be both present and trusted among the small business community. These net promoter scores reflect just how well some brands are—and aren’t—doing that.”

You can see Alignable’s SMB Trust Index here. Additionally, to help understand what makes a brand strong as well as weak, Alignable created word clouds from the comments on four of the more popular brands in this version of the SMB Trust Index. Head to Alignable’s SMB Insights page to see those.

5) State of Small Business: 5 Insights SMBs Want You to Know About 2016

Guest post by Brian Sutter, Director of Marketing, Wasp Barcode Technology

Finding industry-wide metrics specifically for small to medium-sized businesses can be as difficult as, well, running a small to medium-sized business. So our team at Wasp Barcode Technology decided to provide information and insights on some of the trends, concerns and expectations of small business owners in this New Year.

The 2016 State of Small Business Report uses information from over 1,000 small business owners and managers to reveal trends involving everything from expected growth and opinions on the government to trends in marketing and technology tools.

Below are five report findings that should not be overlooked:

1) Now Hiring!

Up 12% from 2015, 50% of small businesses are looking to acquire more talent this year. However, 50% also expect hiring to be one of their biggest challenges of the New Year. This is no easy task according to the November 2015 NFIB Small Business Jobs Report, which reveals that 85% of small business leaders say they can’t find enough qualified applicants.

2) Employee Healthcare: Leading cause of employer headaches

From new mandates to changes in the Oval Office, small businesses predict that 2016 will not provide a remedy to ease the stresses of providing employee healthcare. In fact, new mandates have increased the pressure of providing employee healthcare—43% cite employee healthcare as one of their biggest challenges in 2016—compared to 29% in 2015.

3) So, how about that economy…

The report shows that small businesses as a whole are slightly less confident in the economy than they were in 2015. Specifically, 25% say they’re less confident in the year ahead—compared to 21% in 2015—and only 44% say their confidence for 2016 is higher than the year before—compared to 47% in 2015.

4) Calling all Creatives!

While small business leaders typically outsource a variety of tasks from manufacturing and payroll to accounting services and legal services, it is creative and technical services that are most in demand—54% use outside firms for graphic and web design.

5) What do you mean we can’t be (Facebook) friends?

Despite being one of the top marketing tools, a surprisingly high number of small businesses—20%—don’t use social media. Something we suspect consumers don’t #like.

6) 10 Secrets to Hiring Millennials In 2016

Guest post by Eliot Burdett, CEO, Peak Sales Recruiting

Facebook CEO, Mark Zuckerberg, broke the traditional workplace mold when he made a billion dollars wearing a hoodie. This led to a new era in the workplace and while Silicon Valley quickly mimicked this approach, established companies and seasoned CEO’s had some reservations about changing their company culture.

The problem facing the leaders of Corporate America, who are reluctant to embrace this change, is that Generation Y now makes up the largest sector of the U.S. population with 83 million members, and by 2025 they will make up 75% of the workforce. The bottom line is simple; companies that do not invest in Millennials will become uncompetitive in today’s global and innovative economy.

Given this generation lived through the worst financial crisis since the Great Depression, one might think they would take whatever job they could get. However, Millennials have proven to be a fickle bunch with unique career goals and workplace demands. Business leaders who understand how to position their companies in an appealing way to Millennials will surpass their competition.

As the CEO of Peak Sales Recruiting, here are 10 secrets I have seen world-class companies use to attract Millennials to ensure continued growth and innovation.

1) Highlight commitment to innovation: By now, most companies have embraced technological innovation on some level of the spectrum between having a website and launching a mobile app. Top employers highlight the company’s commitment to innovation and discuss how the candidate will be integral as the company continues to look for new and fresh ideas.

2) Pledge loyalty and stability: The aftermath of the recession has eroded Millennials’ feelings of loyalty towards their employer. In fact, a recent study conducted by PwC found that more and more Millennials expect their total number of lifetime employers to increase—with over 25% of respondents anticipating to work for six or more employers, in comparison to just 10% in 2008. The ability to offer a long-term, stable workplace environment attracts Millennials likes bees to honey.

3) Offer a good work/life balance: The ability to have a good work/life balance is what’s most important for Millennials considering a new opportunity. They are highly attracted to employers that offer flexible hours and remote working environment options. Demonstrating flexibility and genuine concern for meeting Millennial work/life balance standards is an effective tactic to attract the generation’s best candidates.

4) Suggest possibilities for international assignments: Millennials have a strong passion and desire for gaining experience in an international setting. In fact, 71% of Millennials have expressed their eagerness to complete an assignment overseas at some point during their career. The good news is globalization and technological innovations have introduced new markets for companies to build a presence in.

5) Specify opportunities for mentoring: Millennials are known as the ‘Trophy Generation’ because they received positive recognition even when they didn’t win. I am not suggesting you treat them with kid gloves, but this generation responds better to mentors than they do disciplinarians. As a result, they are attracted to careers with the opportunity to learn from a mentor who acts more like an experienced co-worker and less like a disciplining-boss.

6) Communicate with them on social media during the recruiting process: Millennials live in a world that is increasingly virtual. They text, Snapchat, and Tweet. Instead of going out for coffee for a one-on-one meeting, they often prefer meeting online via Skype or on a Google Hangout. This virtual instinct is part of the reason companies, for example, are having a hard time filling a growing number of open sales positions, a profession that requires a great deal of personal, face-to-face connections.

7) Rethink compensation packages: Young people want a financial safety net. They favor a higher base pay with a lower proportion of riskier commission pay. The Wall Street Journal cited that the base pay in sales, for example, has increased 11.7% from 2010 through 2014 while the variable amount has remained steady. While this demonstrates that employers are trying to evolve to appeal to Millennials, it is critical for businesses to double down on this and create compensation packages that suit Millennials’ preferences.

8) Offer tuition incentives: Millennials are the most educated group in American history. Graduate degrees and a thirst for learning is important to them. By offering some form of tuition incentives, your company will become an extremely attractive destination. Additionally, you will encourage your employees to become better educated and equipped to drive your company into the future.

9) Embrace diversity: They are also the largest and most diverse generation in the U.S., made up of 42% minorities, with more women working than any other generation. Diversity in the work place is of great importance to Millennials. That’s why hiring more women and people from different backgrounds, then promoting this in your recruiting, is an effective recruitment tool when targeting Millennials. This will also help eliminate challenges stemming from the gender and diversity gap many companies face, and introduce fresh ideas and valuable contrasting perspectives into the organization.

10) Offer a career, not a Job: Millennials do not want to simply punch the clock. More than any previous generation, they thirst for a sense of purpose and to know they can achieve their own personal goals while working for an employer that cares about doing good things and making the lives of others better.

7) Tips for Finding the Perfect SBA Lender

Guest post by Evan Singer, President, SmartBiz

Although Small Business Administration (SBA) 7(a) loans are inherently similar, the lender you work with can make a world of difference. The right lender can lead to funding in days or weeks rather than causing a borrower to face a months-long, tedious journey that could result in a decline.

Every lender is different and it’s important to gather information before starting the loan process. One SBA lender may say ‘yes’ to you, and another may say ‘no’ to you. Here are four areas to pay attention to so you can find the perfect SBA lender that’s a fit for your small business, and get to a yes!

Determine the size of loan that will fuel growth. Choose a lender that offers the right loan size for your needs. Many SBA lenders aren’t interested in originating a loan less than $250,000, for example. To pin down the correct amount you need for your business, analyze your past and expected future cash flow. Your local Small Business Development Center can help you with this analysis. Find your local branch here.

Research lenders’ credit requirements. Most lenders require specific minimum personal and business credit scores, past and projected business and combined business and personal cash flow, as well as combined business and personal liquid assets. Additionally, most lenders do not allow recent bankruptcies, foreclosures, or judgments, and do not allow open tax liens or collections. Research your lender. Determine if you meet their requirements to qualify to avoid wasting valuable time.

Investigate lenders’ allowable use of proceeds. According to the SBA website, if you are awarded a 7(a) loan, you can use the loan proceeds to help finance a variety of business purposes with a few restrictions. However, each lender has unique use of proceeds parameters that are likely to be much more narrow than what the SBA allows. Make sure the lender you work with allows you to use funds the way you would like to strengthen your business. Examples of use of proceeds include refinancing debt, purchasing real estate, construction, providing long-term working capital to pay operational expenses, etc.

Understand lenders’ collateral requirements. While lenders must meet the minimum SBA threshold for collateral requirements, many lenders add their own additional requirements. Some lenders may ask to take your personal residence as collateral while others may not. Research lenders’ collateral requirements before spending months of back and forth applying for an SBA loan.

You may be able to pre-qualify for an SBA loan. Go here and get an answer in 5 minutes or less, and get funds as fast as 7 days after completing your application.

8) Improve Your Business Skills

EdCast, a fast-growing social knowledge network where users learn from the masters, just added HP’s online Learning Initiative for Entrepreneurs (HP LIFE) to its network. HP LIFE 2.0 will offer 25 interactive micro-courses.

The program’s goal is to provide baseline business skills development for the underserved, helping aspiring entrepreneurs, students and small business owners. Offered in seven languages, HP LIFE 2.0’s self-paced micro-courses cover a wide spectrum of topics including strategic planning, leadership, sales, social media marketing, energy efficiency, funding and finance.

As part of the new EdCast platform, the informal learning offered through micro-courses will be complemented with a personalized feed of bite-sized content that users can consume every day.

Through the EdCast platform, HP LIFE 2.0, which is used by people in more than 200 countries and territories worldwide, now enables users to discover new topics and access additional quality content from a wide variety of thought leaders. HP LIFE 2.0 also provides access to private communities and discussion forums for collaborating partners.

9) Avoid These Common Mistakes

Guest post from Freshbooks.com

Entrepreneurs usually have great ideas and reach for the stars. However, even when closing millions of VC dollars, there still is the nitty-gritty of everyday startup life. We, at Freshbooks have put together a list of mistakes to avoid and not put your burgeoning business at risk. They seem to be simple, but as accounting professionals (and entrepreneurs ourselves), we know the devil’s in the details.

Not staying on top of receivables

Getting paid is fun. Managing who owes you money is usually not. But staying on top of your receivables is critical to ensuring your cash flow is healthy and that you know where you stand financially each month. It also ensures that at tax time, you’re not scrambling to piece together which payments belong to which invoice.

Fortunately, there are more software options than ever before for entrepreneurs to painlessly manage this part of their business. Entrepreneurs should consider taking advantage of cloud accounting tools that allow you to send invoices and update payments from anywhere. Software like FreshBooks, for example, allows you to even automate most of the billing process, including sending out late payment reminders and enabling your clients to pay you online.

Not keeping expense receipts

How many times have you scanned your bank account statement trying to figure out what a charge was for—was it supplies for your office or was it an expense related to a client’s project? Not only is this frustrating, but not having copies of your receipts can land you in trouble at tax time. If you’re unable to accurately report your expenses, you might find yourself getting nailed with costly penalties.

Best practices for keeping organized include:

- Using only your business credit or debit card to cover business related expenses

- Keeping copies of your receipts in one place and reviewing these at least weekly or monthly while they’re fresh in your memory

For entrepreneurs looking to save time, FreshBooks has a feature that allows you to snap a pic of your receipt while you’re on the go so you’ll always have a digital copy when you need it. You can also sync your business bank account or credit card so expenses are automatically imported.

Mixing personal/business finances

When starting your own business, a first step should be to open a separate bank account where you deposit your income and pay your business expenses from. A second step should be getting a credit card that you will only use for this business. These are important signals to the IRS that you’re running a business vs. a hobby. If you’re mixing your finances, the IRS might not grant this important distinction.

Mixing your expenses also prevents you from really knowing how much money you’re actually making vs. spending for your business, which increases your chances of accidentally running up debt or losing track of project profit margins.

Not hiring a professional to handle taxes

In an effort to save money, entrepreneurs might be tempted to do their taxes themselves, but hiring a professional you can trust will pay off in two ways. First, your accountant can apply the most up-to-date tax laws to ensure you’re benefiting from all the deductions you qualify for. For example, not many entrepreneurs realize their bank fees are tax deductible, or that they can claim that professional development course they took a few months back.

Secondly, working with a professional on your taxes means they can help resolve any discrepancies or confusions resulting from guesswork (ex. incorrect tax categories, deductions) that might have otherwise lead to an audit, saving you potentially thousands of dollars in penalties.

Not being on the same wavelength as your accountant

Your CPA can be an ally to you and your business, since they have the skills and training to help guide important business decisions you might face. Is it time to hire your first employee? When’s the right time to make a big purchase for your business, like upgrading your software or buying a new computer? All too often however, creative professionals are uncomfortable with accounting jargon and might be embarrassed or intimidated when trying to communicate with their accountant, resulting in them not asking the questions they have.

It’s important that when you don’t understand, that you ask your accountant to explain things in plain language. Or if you continue to find this tricky, consider finding an accountant who is more on your wavelength and communicates in the style that works best for you. There are more startup- and entrepreneur-friendly accountants than ever before. To find a local accountant, use the accountants map from FreshBooks.

Cool Tool

10) Making Payments Easier for Retailers

Total Merchant Services, a leader in payment services and solutions has made its Groovv Terminal One available on Amazon.com. You can also get Groovv at Staples.com and Apple.com.

Groovv Terminal One, which is free after a $99 rebate from Total Merchant Services, enables acceptance of all payment types including NFC, EMV chip cards and magnetic stripe cards as well as Apple Pay, Android Pay and Samsung Pay. With its EMV capabilities, the device offers the highest level of card protection to its customers while helping merchants avoid credit card fraud liability. With virtually instant activation, merchants can plug in Groovv Terminal One and start accepting payments in minutes.

Groovv Terminal One features no term contracts, no minimums and no hidden fees. New customers also receive up to $10,000 in free Apple Pay transaction processing for the first year.

11) Help for Sales Professionals

PGi recently released a new tool, the iMeet Sales Accelerator, sales productivity software designed to better engage your customers, track the results and close more deals faster. The software lets you create and record video presentations from your full-featured iMeet room, then distribute it to one or multiple prospects, helping you manage your pipeline more effectively.

You can see it in action. Its primary features include:

- Personalized video presentation

- See who opened the presentation, how long they viewed it and if they want to learn more

- Jump from a recorded video to a live meeting