Why do so many small businesses fail to manage cash flow properly?

By Jessica Everitt

No one ever starts a small business expecting it to fail. But the sad fact is that roughly 20% of small businesses don’t even make it through the first year. And only half of the businesses started will still be in existence after five years.

While the number one cause of small business failure is a lack of market need, according to this research, the second most common cause is a lack of cash.

In other words, if you’ve done your homework and know there is a demand for your product or service, the driving reason your business is at risk for failure is poor cash management.

Thankfully, with the use of accounting software, you can master your cash flow and eliminate this risk. In this article, we will walk you through how accounting software can be used to manage your cash flow and why it’s better than the alternative.

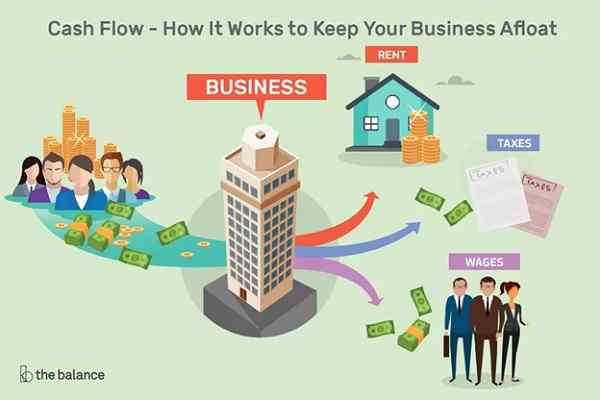

But first, let’s quickly review why cash problems are so disastrous for many businesses.

(Image Source)

Why Poor Cash Flow Is a Leading Cause of Failure

We know that one of the main causes of small business failure is due to a lack of cash. But why is this so fatal, and how do so many businesses fall victim to it?

Why is a shortage of cash fatal?

Most of us have already experienced the pain of a lack of cash at some point in our lives. When you have more expenses due than you have money for, something has to give.

Either expenses have to be paid late, or you have to borrow money to pay them. Borrowing money always comes at a cost. And if you’re forced to get a short-term emergency loan for an unexpected cash shortage, the interest rate can be astronomically high, and you may not be able to stay afloat.

But paying your expenses late comes with its own costs as well. If you pay vendors late, you risk them refusing to deal with you in the future. If employees don’t get paid on time, your best ones will likely quit. And if it’s other expenses such as your credit card bill, then you’re faced with interest charges and damage to your credit score.

Any of these scenarios can quickly lead to a business being forced to close their doors.

Why do so many small businesses struggle with cash flow?

It’s easy to see how important cash flow is. So why do so many small businesses fail to manage it properly?

Here are the four most common reasons:

- A lack of proper cash management. Unless you have a background as an accountant, you’re likely learning cash management as you go. Unfortunately, not knowing how to track, manage, and analyse your cash flows can quickly lead to problems.

- Poor expense tracking. It can be hard to stay on top of expenses and forecast when they need to be paid. Especially costs that are infrequent or fluctuate, such as your electricity bill, overtime labor, or advertising expenses.

- An over-reliance on one source of income. What happens if 60% of your sales come from one customer and they stop paying you on time? Too much dependency on one item, event, or person adds a lot of risk to your business and your cash flow.

- Expanding too fast. In the long run, growth should lead to more sales, profits, and cash. But growth usually means a lot more upfront expenses than income in the short run. If you’re not adequately prepared, your business could fail.

(Image Source)

How Accounting Software Solves the Problem

The problem with using spreadsheets to manage your finances include:

- Manual errors.

- Difficulty forecasting and analyzing possible scenarios.

- A trade-off between enough detail and a simple enough spreadsheet to update.

For instance, it can be difficult to see and forecast overtime labour if all labour costs are grouped together. But, if you have too many line items, you may only update the file once a month or so, which means you can miss issues.

Here is a simple spreadsheet I made, which is similar to a lot of free templates you’ll find online. As you can see, it looks pretty easy to maintain, but it lacks a lot of valuable data.

For instance, you cannot tell the mix of products that made up the cash sales. Or how old the AR accounts were that came through. You also can’t see which portion of payroll is fixed versus hourly or overtime labour. All of which would be useful for forecasting future months.

Fortunately, with accounting software, you can avoid all of these drawbacks. Here’s how:

- Integrate your accounting software with your bank accounts and credit cards, so that expenses are automatically recorded in the system in real-time.

- Categorise all spending within the software. For instance, make sure all material expenses are automatically allocated to inventory costs.

- Track spending as a percentage of revenue both during the period and over time. Any variances should be analysed to understand what’s changed.

- Set industry benchmarks or budgets in your software to compare to your actuals. This will help you quickly identify if your expenses are starting to climb above what you’ve planned for.

- Forecast every week. Every week you can forecast out the next week, month, quarter and year as well as test different possible scenarios over that period. This will allow you to see potential cash flow issues well in advance.

- Use reports to track accounts receivable and accounts payable that are coming due. Then you can send reminders to customers and ensure you don’t incur any interest expenses for missed payments.

- Look at the big picture. With software, you can identify larger trends and build them into your forecast. For instance, you may realize that you have a huge increase in sales every March. Now you can plan inventory and labour accordingly and make sure you have enough cash on hand to cover those costs until the revenue comes in.

No matter what accounting software you use, from a free solution to an enterprise solution such as Netsuite, adopting accounting software will allow you to master your small business cash flow.

An accounting system will walk you through proper management, analysis, and forecasting of your cash flow. It will automatically track your expenses for you, so nothing is missed. And you can use it to predict different possible scenarios, allowing you to see if you’re too reliant on one income source, or if you can afford to expand.

Plus, with its ability to provide real-time data, you can easily see potential issues far in advance. Which gives you enough time to either remedy the problem or secure enough financing to last until your cash flow from operations recovers.

Let me know in the comments if you have any other tips for small businesses trying to keep on top of their cash flow.

Jessica Everitt is a Project Management Professional and change expert. Jessica specializes in project management, risk management, and transformational change. Working with Manager – she is biased on which accounting software you should use and since it’s free recommends you give it a try!@JessicaJEveritt