13 Things Small Business Owners Need to Know

By Rieva Lesonsky

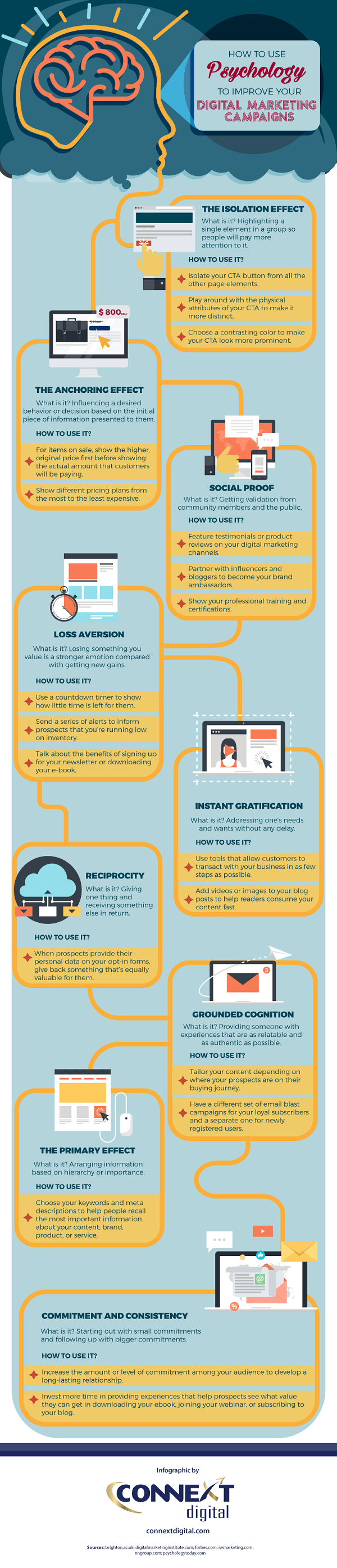

1—Using Psychology to Improve Your Digital Marketing Campaigns

When it comes to digital marketing marketers, say the folks at Connext Digital have to wear the hat of a sales person—and of a psychologist, meaning they use psychological principles to persuade customers to their desired action.

It may take a lot of training to understand how the brain works or how to best appeal to one’s emotions, but there’s a way for marketers to know these things without taking a psychology class. To get started, check out the infographic below from Connext Digital that shows how you can apply the science of human psychology in digital marketing.

2—Are You Confident Your Digital Marketing Works for You?

Speaking of digital marketing, according to a new survey from Clutch, businesses are confident their digital marketing efforts are successful. In fact, more than 80% of digital marketers believe their digital marketing is effective in increasing sales and revenue.

“That number is high because digital marketing is where customers are,” says Flynn Zaiger, CEO of digital marketing agency Online Optimism. “Walking down the street, people aren’t looking at billboards or checking newspapers—they’re staring at their phones.”

The survey shows businesses believe digital marketing is effective because it’s a more direct way to reach consumers compared to traditional marketing and advertising.

Businesses rely on a combination of digital marketing channels to achieve goals: Businesses invest in a variety of digital marketing channels but prefer social media marketing (81%), a website (78%), and email marketing (69%) because they’re the most popular among consumers. All three channels provide businesses the opportunity to give voice to their brand—especially when used in combination.

SEO least popular channel, requires too much effort: Only 44% of the businesses surveyed invest in SEO. Failure to invest in SEO, however, can undermine the effectiveness of a website and other digital marketing channels. But says Jon Borg-Breen, cofounder and head of sales at B2B lead generation agency Symbiont Group, “Businesses have a harder time with SEO. It’s not as immediately impactful as having a brand-new design on your website that people can say, ‘Wow, that looks cool.’”

However, the experts agree SEO is still an essential digital marketing channel.

Businesses use digital marketing to increase sales and revenue: Businesses invest in digital marketing to increase their sales and revenue—28% identify driving profits as their primary goal. And many businesses depend on digital marketing to make a sale.

You can read the full report here.

3—7 Hand Gestures Guaranteed to Get People to Listen to You

I talk with my hands. And apparently that’s a good thing—psychologists say hand gestures are a critical part of human communication. In fact, behavioral researcher Vanessa Van Edwards discovered speakers whose TED Talks went viral used an average of 465 hand gestures, versus the 272 used by speakers whose talks weren’t as popular. So, no matter what they’re talking about, the best speakers have one thing in common: they use hand gestures. And they do it in a controlled, yet natural way.

The next time you want to make sure your audience is engaged, throw in a few of the tried-and-true gestures in the infographic below from PoundPlace. If you want to see the animated version, go here.

4—Women-Owned Businesses

In 1972 the U.S. Census Bureau provided data on minority- and women-owned businesses for the very first time. The 2018 State of Women-Owned Businesses report examines trends in women-owned businesses since 1972 and found the number of businesses owned by women increased 31 times since 1972—from 402,000 to 12.3 million in 2018. Employment for these firms grew 40-fold from 230,000 to 9.2 million, and revenues rose from $8.1 billion to $1.8 trillion—217 times greater.

Key findings:

- 1,821 women-owned businesses were created over the last year, and women of color account for47% of those businesses.

- Since 2007, the number of firms owned by women of color grew at nearly three times the rate(163%) than women-owned businesses overall (58%).

- Businesses owned by Latinas and African American women grew even faster:172% and 164%

- The top-ranking states (including DC) where women-owned businesses most increased their economic clout (a measure of combined growth rates in number of firms, employment and revenues) since 2007 are:South Dakota, Texas/Utah (tied for 2nd place), Delaware and North Dakota/Tennessee (tied for 5th place).

- The top five-ranking states (including the DC) showing the highest employment vitality (a measure of employment growth rate from 2007 to 2018 and average number of employees at women-owned firms) are:Minnesota, Maine/North Dakota (tied for 2nd place), Iowa and Delaware/Virginia (tied for 5th place).

- The industries that saw the most growth in the number of women-owned firms since 2007 are: utilities(151%), other services (126%), construction (94%), accommodations and food services (85%) and administrative, support and waste management services (70%).

The release and full report, are available here.

5— The 5 Best Accounting Tools for Improving Your Payment Workflow

Guest post by Ralph Perdomo is a research analyst and writer at Nvoicepay, a leader in payment automation software for the enterprise.

Many organizations may be unable to “go all in” with AP automation. Either it’s pricing that keeps them at a distance, outdated infrastructure, or just plain old unwillingness to change (if it ain’t broke, why fix it, after all).

Which is fine.

But, there are still ways to reap the benefits of an improved accounts payable workflow without going all in with automation. On a hamburger budget, you can enjoy the steak dinner of automation—even if it’s à la carte.

These are some of the accounting tools that’ll get you to a better way of doing things—a better payment workflow in AP.

1—Supplier portals: Many organizations like HP, IBM, and Google—any Fortune 500 organization, really—use vendor portals for both invoice submission and payment status inquiry. Thanks to the downstream nature of technology, what was once the domain for large organizations, is now accessible to organizations of all sizes.

Supplier portals free accounts payable clerks from performing the more distracting tasks such as answering payment inquiry calls by allowing them to focus on their primary duty—paying suppliers on time. Best of all, supplier portals are the gateway to document management, which is the first step to going paperless.

2—External check printing: Try as you might, you can never escape the paper check—as is the case when issuing one-offs or paying smaller suppliers’ invoices.

External check printing and mailing services have emerged as an electronic-friendly alternative to conventional paper checks. This tool is helpful for organizations that want to automate part of their payments process while still providing the touch of paper checks.

And when paired with APIs (as many of the higher-end external printing/mailing services offer) accountants need not leave their accounting platform—ever. Issuing and sending payment from a checking account is as simple as clicking a button.

3—T&E services: Payables performs a delicate balancing act when processing employee’s T&Es. Accountants, here, must keep an ever-watchful eye for fraud and malintent, all the while processing reimbursements for their peers’ business expenses. These competing priorities can prove a challenge even for the most experienced professional accountant.

Unsurprising, then, third-party T&E services have emerged within the past few years to address this pain—Expensify and Concur come to mind.

Organizations outsource the specifics of T&E, allowing payables to focus less on the “internal customer” and more on the “external” one; certainly making for a more palatable watercooler conversation.

4—Sharing data: Although not necessarily “just one tool,” the sharing of data across departments provides a whole toolbox of resources for accountants throughout an organization.

When non-siloed data (siloing is the term used to describe data that’s stuck in one application or organizational department) is shared, analytics and intelligence are used to make better decisions about business finances. For example, purchasing and procurement can use unobstructed data from payables to better negotiate rates from future suppliers. How? With the intelligence gleaned from knowing which suppliers already accept lowered invoice rates in exchange for faster payment. Purchasing and procurement can then work deals with this past payment behavior.

The only limitation in sharing data is a business analyst’s imagination.

5—Paperless: But the very best tool to improving any workflow in AP may very well be no tool at all. By ditching paper—going paperless—AP gains time, a more secure process, and best of all, rebates.

Eliminating the need to transpose paper invoices into an accounting system saves countless hours and removes the risk of error in the transcription process. And since there’s no need for accountants to walk around the office, securing payment authorization is an almost immediate process.

What’s more, this efficient paperless workflow gives organizations the leverage needed to request invoice discounts in exchange for faster online payment. That’s why going paperless is the domain for rebates.

So how much will you have off the automation menu? An appetizer or the four-course meal of automation? Whatever you order, it’ll taste great!

6—Key Ways to Make Your Small Business More Transparent

No matter what business you’re in, you want customers to have faith in your ability to meet their needs. That’s at the very core of being successful. The key to creating and fostering trust in customers often comes down to transparency. You want your customers to feel as though your business is an open book, and that they’ll always know what to expect from you. Transparency is something that’s both simple and complicated for businesses to achieve. It’s simple because it’s a matter of living up to the expectations customers have for your business. Yet it’s also complicated because it involves helping to set those expectations that customers have in the first place. Building a more transparent organization involves creating an internal culture that encourages honesty and transparency as well as building stronger relationships with customers.

Check out the infographic below from Track Your Truck to learn more.

Key Ways to Make Your Business More Transparent created by Track Your Truck.

7—35% of U.S. Workers Say They’ve Been Harassed in the Workplace

Perhaps not so startling today, a new study released by Hiscox, shows that 35% of employees feel they’ve experienced workplace harassment, and 50% of those say it’s on account of their gender or sex. These findings are according to the 2018 Hiscox Workplace Harassment Study™

“As the spotlight on workplace harassment intensifies, companies must be aware of the peril they face by ignoring this issue,” says Patrick Mitchell, Management Liability Product Head at Hiscox USA. “Businesses of all sizes face steep financial, reputational, and workforce consequences if they fail to take steps to prevent, detect and mitigate inappropriate behavior in the workplace.”

Gender and seniority are key factors, but they’re not the only ones: While it’s important to not overlook any potential incidents of harassment, 78% of those who were harassed say it was perpetrated by a male, and 73% say their harassers were in senior positions. But, there were also instances where the harassment was committed by women against men, by members of the same sex and by non-company employees, such as customers or vendors. All of these scenarios represent incidents in which a company could be subject to liability and financial loss if they fail to appropriately protect their employees.

Harassment often goes unreported: 40% of those who report being harassed never reported the harassment to company management or the police because (the top reason cited) they feared the allegations would create a hostile work environment (53%). Of those who did report it, 37% did not believe the incident was handled properly by their employers. For women who reported harassment, this number climbed to 49%. And while 45% of all respondents have witnessed harassment in the workplace, 42% of them did not report it.

Harassment happens at companies of any size, but reactions vary: The percentage of respondents who indicated they had been harassed was the same (32%) at companies with fewer than 200 employees as it was at those with over 1,000 employees. However, how companies approach harassment varies. At companies with fewer than 200 employees, 54% say their firms don’t offer anti-harassment training compared to only 21% of those at firms with more than 1,000 employees. And only 39% of those at smaller firms say their companies had implemented new workplace harassment policies within the past 12 months versus 57% of their larger counterparts.

The changing mindset around harassment: In an era of increased transparency and social movements such as #MeToo and #TimesUp, employers are taking a more proactive approach to prevention with 85% of respondents saying they believe people are more likely to report incidents due to these social movements.

Millennials were the most likely to say they were harassed (46%), compared to 35% of Gen Xers. Millennials were also more likely to report harassment to company management or the police (76%).

8—2nd Annual “Grow Your Biz Contest” Deadline Approaches

If you’re one of the 60% of U.S. small businesses that are planning to grow over the next five years Mastercard and Bank of America want to help you. Enter the 2nd annual Grow Your Biz contest, where you can pitch your business for the opportunity to win $25k and business consultation with industry experts.

Sharon Miller, head of small business at Bank of America, says, “Grow your Biz is a great opportunity to consult an expert and access capital for your business. Every minute matters when you run a business, so we’ve made participation as simple as possible.”

To enter the Grow Your Biz Contest, just answer this simple question, “How will you grow your small business?” by submitting a short video (up to 1 minute) online.

From the submissions, four finalists will be identified for their creativity and business strategy to receive a $1,000 Mastercard prepaid card, one-on-one business consultation with industry experts and the opportunity to pitch their businesses to the Grow Your Biz Panel during the finale event in New York City on November 8, 2018.

A panel of expert judges will provide all finalists with individual consultation sessions and select one grand-prize winner who will receive $25,000 to pursue their business plan.

Last year’s Grow Your Biz Contest focused on the Boston market where four finalists demonstrated great enthusiasm the desire to grow and grow smart. From Intriguing Hair’s beautifully styled hair, Birch Baby’s organic baby products, Paddy Wagon’s inflatable pubs, and the Grow Your Biz Contest winner More to Love’s inspiring mindfulness, each finalist showed their unique value and how they planned to take their business to the next level – all they needed was a jump start with the proper tools and resources.

Mastercard and Bank of America continue to make it a priority to deliver the right resources that help give small business owners the competitive advantage to grow smart and expand successfully, including small business rewards and benefits as seen through the recently introduced Bank of America Relationship Rewards.

About the Grow Your Biz Contest: You don’t need to make a purchase to enter the contest (and it’s void where prohibited.) The contest is open to small business owners in the 50 U.S. states and Washington DC. You must be 18+ to enter.

Don’t wait—contest deadline is 9/30/18. Restrictions apply. Click here for Official Rules.

9—How to Save Up to $600 a Year on Your Cell Phone Plans

Guest post by CEO & founder of MoneySavingPro.com, one of the leading cell phone price comparison sites in the U.S. You can contact him on LinkedIn and Twitter: @_robwebber

It’s important for businesses—both big and small—to keep a sharp eye on their finances. But while larger expenses such as rent and salaries can be an annoyance to large companies, they can be a real burden on smaller ones.

Budgeting can make or break any business so small business owners should always be looking for savvy ways to save money. This allows for money to be put back into the business for the company to invest in other things.

You may find that a lot of these smaller expenses are actually costing you a lot more than they should be. Take your phone bill for example. There’s a way to keep the same quality coverage as you would have with one of the “Big Four” (Verizon, AT&T, T-Mobile and Sprint), for a fraction of the price. You can save up to $600 a year on your cell phone bill by switching to a Mobile Virtual Network Operator (MVNO).

A saving of $600 on just one cell phone is a lot to a small business. If you’re apprehensive about switching, here are some questions you should ask when looking for a new cell phone provider:

- Which networks offer coverage in your area?

- Which MVNOs operate on your network?

- How many lines do you need for your business?

- Is unlimited data a necessity?

- Do you need unlimited calls and texts?

- Are you going to keep your phone or buy a new one?

The average U.S. cell phone bill is around $80 a month, meanwhile, our UK counterparts are only paying an average $30 a month. How is this possible? The UK has embraced the idea of MVNOs.

MVNOs are smaller carriers that lease service and tower storage from the “Big Four” in bulk and sell it to consumers at a lower monthly cost. You’ve probably heard of a few more popular MVNOs such as Cricket Wireless, and MetroPCS.

There’s a reason they can do this—they have lower overheads, spend much less on marketing, and don’t have a lot of brick-and-mortar stores to operate. In fact, you can sign up for most MVNOs online without ever setting foot in a store.

This means switching to an MVNO could potentially save your business thousands of dollars. Imagine what that could mean for your small business. To ensure you find the best deal compare cell phone plans from multiple carriers before making a decision.

Benefits of MVNOs

Besides the huge price cut, there are other major benefits of switching to an MVNO.

- The same 4G LTE mobile network you already enjoy

- No contracts or credit checks, most operate as prepaid carriers

- Customized plans—only pay for what you actually need

- High customer service ratings

- A simple online sign-up process, just swap SIM cards

- Keep your existing number and phone

Where do you begin?

If you’re currently with a “Big Four” carrier and want to save money by switching to an MVNO, it will be easier for you to switch to one that is on the same major carrier network.

So if you’re with Sprint right now, you’ll want to switch to a Sprint or Verizon MVNO as they are both on the CDMA network (While AT&T & T-Mobile are GSM). If you’d prefer to cross over, you’ll have to get a phone compatible with that network.

To leave the “Big Four” you must own your phone outright. So if you still have payments left on your phone and wish to keep it you’ll have to pay the difference before they will allow you to take it. If that price tag is a little overwhelming don’t fret, look into buying a refurbished smartphone on the same network.

Once you own your phone outright be sure to unlock it so it can be used with any carrier. This allows you the freedom to switch to whichever MVNO gives you the best deal. Be advised though, if you have a GSM phone on a CDMA network and your service drops down from 4G, your phone will basically become a paperweight until 4G is restored. So it may be best to switch to an MVNO that operates on the same network or purchase a phone compatible with the network you choose.

10—Choosing an HR Solution

Guest post by Michael Fauscette, Chief Research Officer, G2 Crowd.

Before you choose a Core HR solution, here are some tips.

- Self-service/mobile user options: Employee self-service, or maybe more appropriately full mobile access, is an expected part of Core HR products, allowing users to manage and access their employee information, control benefits, record and track paid time off (PTO), and access and update performance management records. The mobile approach needs to be full featured and support employee and manager activities. Mobile access benefits employees, supporting their preferred style of work and helps them take ownership of their information. In addition administrators reduce time spent on non-essential duties and employee data accuracy improves.

- Payroll manipulation and tax compliance: Company needs for support of payroll processes and tax compliance can vary widely based on location and number of sites. It is particularly important for companies with sites located in areas with separate tax rates, tax laws, and workers’ rights that the system meet all of the business requirements. Some HR systems comply with local rates and laws automatically based on the location information of the office or employee, while others require manual setup and maintenance. The bottom line is to carefully define your complete payroll needs before selecting a Core HR product to find the best fit and meet all of your business needs.

- Business requirements: Perhaps the most frequent piece of advice provided by reviewers in regards to the implementation of Core HR software is to provide a detailed description of business needs and requirements, including desired functionality and business processes, to the vendor’s representative or implementation consultant, as opposed to simply choosing a product based on a free trial or demonstration.

- Fit and implementation: Most implementation experts will encourage you to adopt the processes as implemented in your chosen solution, which is one reason that determining fit and ensuring that the solution meets your specific business requirements is critical. All solutions will have some ability to change configuration options to adapt the system to your needs, but many cloud based solutions will have limitations on customizations. It is important to understand those, and to assess the overall fit while staying open to some process improvement and change. Responsive vendor customer service and tech support may help make up for features and help the business adjust to the new solution.

- Reporting features: Due to the breadth of data included in Core HR software and the potential complexity of meeting regulations and compliance requirements, HR administrators often require robust reporting and analysis tools. When evaluating Core HR software solutions, you should take care to choose one with reporting features that are robust, flexible and configurable enough to meet your specific needs.

- Compensation flexibility: Regardless of the size of your business, your Core HR software should provide easy-to-use compensation management features that are able to support a variety of salary structures and compliance needs. These include pay-for-performance policies, step-and-grade progressions, and bonus structures in addition to federal, state, and corporate policies and mandates. When you choose a Core HR software solution, make sure that the product contains easy-to-use, flexible employee compensation management features.

- Ease of benefits management: Core HR software is designed to provide a unified and complete solution for HR administration. With benefit options representing an increasingly larger and more important part of employee compensation packages, the system should provide the features and functions to easily manage a diverse set of benefits. The solution should accommodate the selection and management of multiple and diverse benefits plans and brokers. Fully compliant open enrollment should be supported within the product according to government guidelines.

Quick Takes

11—Need Money?

TD Bank just launched an online application process for lines of credit, term loans, leases and CREM loans up to $100,000. This application process takes less than 15 minutes to complete and small business owners receive a decision on their applications within two business days. The form can be submitted for a single or multi-owner entity and are fully ADA accessible. The online application service also is available for new and existing customers. In addition, TD is adding 25 more small business specialists to its stores due to increased need across its Maine-to-Florida footprint.

12—Building a Website

If you’re in the “it’s-time-to-build-a-website” stage, check out these two guides from Pedestal.

- The Definitive Guide: How to Choose The Right Website Maker

- How to Make Your Own Website For Your Small Business

Cool Tools

13—New Easy-To-Use Employee Management Tool

North American Bancard Holdings, LLC. (NAB), a payment solutions provider and Homebase, leading provider of team management solutions to local business, are partnering to offer small businesses a robust and easy-to-use employee management tool. The Homebase software is being offered through NAB’s PayAnywhere technology platform.

NAB added a time clock feature into its PayAnywhere application, so, through an integration with Homebase, employees can easily clock in and out not only through PayAnywhere but also through the Homebase platform, which can turn tablets, smart phones, and a computer browser into a sophisticated time clock. In addition to recording hours worked, the Homebase integration enables business owners to download timesheets for payroll, broadcast team communications, and access employee scheduling capabilities, allowing merchants to manage labor costs in real-time.

The time clock integration and basic timesheet management and scheduling capabilities through Homebase are provided free to all PayAnywhere merchants. These merchants also have the option to upgrade to even more advanced employee management capabilities available from Homebase, such as predictive scheduling, GPS-enabled time clock, robust time-keeping features, and powerful reporting tools.

NAB’s PayAnywhere technology platform also provides merchants access to a wide array of capabilities to efficiently run their business, including inventory management, in-depth reporting, dispute and chargeback management, account and equipment maintenance, invoice management, and a virtual terminal to accept phone, mail and online payments.

Business woman stock photo by Dean Drobot/Shutterstock