22 Things Small Business Owners Need to Know

By Rieva Lesonsky

1—6 Spooktacular Branding Ideas for Halloween

Yes, Halloween is only a few days away, so if you’re going to enact some of these ideas, you better act fast. But be sure to keep these tips on hand so next year you can “shake up” your branding in time for the spooky occasion. As Noah Sigman, Creative Director of Moxē , a Florida-based integrated marketing agency, says, “For businesses big and small, branding can make a memorable impression on consumers. “

For companies looking to add an eerie (but fun) touch to their respective brands, here are 6 Spooktacular branding ideas for Halloween.

1—Carve out a custom Halloween logo: When it comes to your brand, there is nothing more set in stone than your logo and your brand colors. Remaining consistent with these elements is what separates a well-managed brand from a weak, utterly forgettable one. However, when it comes to holidays like Halloween, it’s ok to bend the rules a bit. Why not replace the “O” in your name with a jack-o-lantern? Or replace that red and blue with orange and black? If your tagline says “We Are the Experts,” change it to “We Were the Experts.” It’s ok to have some fun with it. Just remember to change it all back on November 1.

2—Get Spooktacular on multiple platforms: Refashioning your company logo for Halloween is a great way to endear your brand to your customers and celebrate the spooky spirit of the holiday, but why not take it a step further? Make sure your Halloween branding carries over to your company’s website and social media pages as well. Remember that branding supports your marketing efforts so get creative. Cisco estimates that video will make up 80% of internet traffic by next year. Try utilizing branded Halloween-themed videos as content for Instagram or Facebook.

3—Create bewitching packaging: Every touchpoint with your customer is an extension of your brand. While you’re at it, expand the holiday theme to your product packaging. If you’re on a budget, try something as simple as printing content on orange paper or using themed packaging tape. Jack-o-lanterns or pumpkins perhaps? And there’s no need to purchase all new boxes and bags. Stickers can be a cost-effective way to add a bit of Halloween fun to all of your items.

4—Create a spellbinding new voice: Your brand already has a voice and it’s usually crucial that it stays consistent in all your writings. But when it comes to Halloween, or any other holiday for that matter, it’s ok to play along. Without getting too creepy, feel free to use your delicious brains and inject a little Halloween humor into your brand voice for the occasion.

5—Offer a Franken-tastic promotion! Contests can be an excellent way to attract customers and entice people to interact with your brand, especially when your promotions tie into special occasions and holidays like Halloween. People just love to win giveaways, discounts, and prizes so even if your budget is limited, there are plenty of fun, low-cost ideas that won’t hurt your wallet while still earning a monster-sized return.

6—“Creep” it real with public art: Consider teaming up with local artists to create fun street art, such as holiday-themed murals or sidewalk chalk art. In the digital age, this is bound to stand out and earn some well-deserved attention from all the walkers.

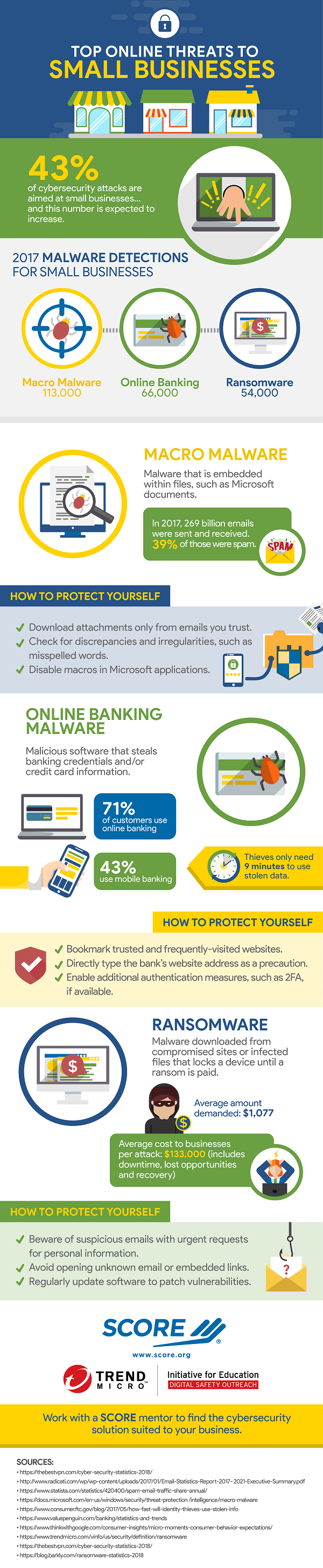

2—Your Small Business is At Risk

As we close out National Cybersecurity Awareness Month, this is a reminder from SCORE that 43% of cyberattacks target small businesses. The infographic below tells you what you need to know.

3—Small Business Happiness

Most (91%) of small business employees are optimistic about the future of small business, though they still believe there’s room for improvement on key areas, such as equal pay. This according to the 2018 Small Business Happiness Survey from voluntary insurance leader Aflac.

Highlights:

- Only 30% of small business employees surveyed think the industry has achieved complete success when it comes to equal pay. Of the same group, 22% say little to no success has been achieved, and 48 % say success has been achieved but there is still room for growth.

- 65% say working at a small business is less stressful than at a larger corporation

- 87% somewhat or strongly agree that working for a small business is more fun than working at a large business

- 91% believe employee happiness is at least somewhat important to their company’s leadership. In fact, 55% say employee happiness is very important to their leadership.

The increasing desire to solve gender issues also aligns with recent findings from the Aflac CSR Survey, which surveyed employees from all businesses. Of that group, 60% of women say paying men and women equally for the same work should be among a company’s top priorities. Additionally, 26% of HR managers surveyed believe their companies pays men more than women for the same work.

4—How to Get People to Like You

It’s a given consumers do business with people they know, like and trust. So, how do you get people to like you? The infographic below from QuickQuid explains all.

5—Small Businesses Selling for Highest Prices on Record

Sale prices of businesses sold in the 3rd-quarter of 2018 reached new highs, according to a report from BizBuySell.com, the internet’s largest business-for-sale marketplace. Sale prices are directly related to stronger business financials which also hit new levels in Q3. With buyers able to offset increasing prices by acquiring healthier businesses, the result is a well-balanced market.

Small businesses sold for a median price of $249,000 in the 3rd quarter, up 10.7% from the same time last year and the highest amount since BizBuySell started collecting data in 2007. The median asking price grew 7.6% to $269,000 which translates to a 93% sales-to-ask ratio, up slightly from the 92% reported in Q3 2017. The strong sales-to-ask ratio likely means that buyers and sellers are seeing eye-to-eye in terms of value. While owners are getting top dollar for their businesses, buyers are inheriting businesses with a better financial footing. Primarily fueled by a healthy economy, businesses sold in Q3 had $530,995 median revenue and $116,229 median cash flow. Those financial totals are up 7.4% and 2.8% respectively y/y.

Businesses added to the market in the 3rd quarter continue to display impressive financials, which should be great news for buyers. The median revenue and cash flow of listed businesses grew 4% and 5% respectively year/. Q3 listing data provides a similarly positive outlook for owners looking to sell. The median asking price of business listed for sale in Q3 reached $279,000, up 3.3% vs. a year ago. Assuming a similar 93% bid-to-ask ratio, business listed in Q3 are on pace for a median sale price of $259,470, which would be the highest amount in BizBuySell history.

BizBuySell’s 2018 Buyer-Seller Confidence Index supports the idea of an equally beneficial market to both buyers and sellers. In fact, buyers are slightly more confident in today’s business-for-sale market than last year. While seller confidence remains unchanged compared to 2017, 60%of owners said they are confident they would receive an acceptable sales price if they exited today.

6—CEOs & Their College Degrees

If you have a senior in high school, there’s a good chance you’ve been spending endless hours going over your kid’s college essays and sending in applications. To help you get through this time (yes, it’s worth it) you should know the top CEO in every state have at least a bachelor’s degree—and 67% have a graduate degree, as well. And:

- Only 6CEOs graduated from Ivy League schools.

- Fewer than half (21) went to private schools.

- Study areas range from accounting to religion, but most majored in business (37%) or engineering (22%).

- Of the CEOs with graduate degrees, 74%received a master’s in business administration and 16% in law

Take a look at the infographic below from Resume.io to see what the nation’s top-earning CEOs majored in in college.

The college degree of the top earning CEO in every US state, courtesy of Resume.io

7—Enter to Win $20,000

AWeber, in celebration of 20 years helping small businesses and nonprofits grow through email marketing, just announced its Small Business, Big Impact Award. Since AWeber introduced email automation to the market in 1998, thousands of small businesses and nonprofits have leveraged the power of its email marketing and automation platform to build stronger relationships with their customers and communities.

Now, as a way to continue that support and celebrate its 20th anniversary, AWeber will award $20,000 to one small business or nonprofit to help them make an even bigger impact for the people they serve.

“Ever since I started AWeber 20 years ago, our main mission has been to help small businesses and nonprofits connect people in remarkable ways,” says Tom Kulzer, AWeber’s founder and CEO.

The Small Business, Big Impact Award is open to all U.S.-based small businesses and nonprofits with 50 or fewer employees. To enter the contest, small businesses and nonprofits must submit an up to 90-second video or 300-word essay describing their small business or nonprofit and answering the questions, “How are you making a big impact, and how would you use $20,000 to make an even bigger impact in the lives of your customers and community?”

The entry period ends January 4, 2019.

A panel of judges, with representatives from AWeber and the contest’s supporting sponsors, including SCORE, the nation’s largest network of volunteer, expert business mentors, will select 20 finalists. The finalists will be presented for public voting from January 21, 2019 through February 8, 2019.

The winner of the award will be announced during a live broadcast on February 21, 2019.

To learn more and to enter the Small Business, Big Impact! Award contest, go here. There’s more information on this blog, and at the contest website.

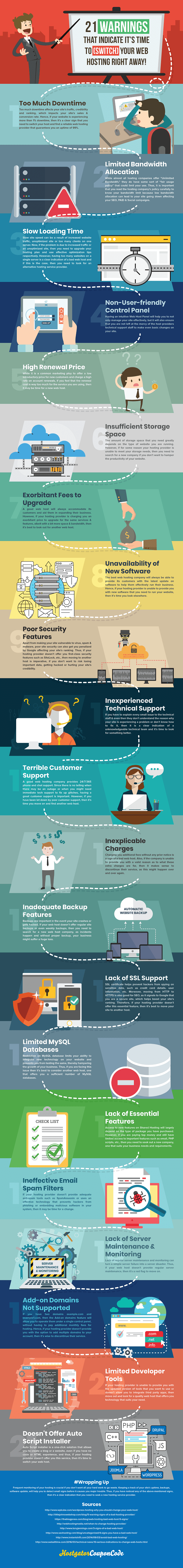

8—21 Warning Signs it’s Time to Switch Your Webhost

Have you outgrown your webhost? Take a look at the infographic below from HostGator to see if you need to immediately find a new webhost.

9—Generational Shopping Behaviors

BigCommerce just released its 3rd annual Omni-Channel Retail Report. The emphasis is on generational differences in shopping behaviors. According to the report, “Gen Z is the new segment for rising brands and apps to capture loyalty.” And Gen Z is different than prior generations—“The ability to touch and try on a product before purchase is less and less of a concern. Instead, brand coverage, social media presence and overall lifestyle affinity wins Gen Z from their one-click purchase on Amazon or through the newest drop app.” Plus, they influence how their older generations shop.

There’s a lot of information here. Want to know where the different generations shop online?

- Gen Z spends 2X-3X more shopping on social channels than the average consumer, with Instagram and Snapchat shopping taking the lead. Gen X skews toward a Facebook shopping

- Only 9.6% of Gen Z reports buying items in a physical store—considerably less than their older generations (millennials at 31.04%, Gen X at 27.5%, and baby boomers at 31.9% respectively).

- Gen Z also spends little on products they find from Facebook—11.8% compared to millennials at 29.39%, Gen X at 34.21% and baby boomers at 24.56%.

- Both millennials and Gen Z spend the majority of their shopping dollars on products they find on Instagram and Snapchat.

There’s a lot more. Check out the blog. And you can download the report for free.

10—Political Talk in the Workplace

We’re living in volatile times. Randstad US just released results of a survey uncovering U.S. employees’ feelings and experiences with political discussions in the workplace, and how an employer’s approach to political issues can influence employee engagement and retention. The data shows 49% of respondents enjoy talking politics with colleagues because it helps them understand other viewpoints, while 53% admit limiting social interactions with coworkers who have differing political beliefs.

“It seems there’s no escaping politics, even on supposedly neutral ground, and unfortunately this can contribute to feelings of alienation as well as deteriorating relationships in the workplace,” says Audra Jenkins, chief diversity and inclusion officer, Randstad North America. “Managers must pay close attention to workplace dynamics and be sure they’re promoting cultures that are inclusive and tolerant of a range of different political perspectives. Without a strategy in place, organizations run the risk of impacting their diversity and inclusion initiatives by creating another barrier that limits the diversity of thought.”

Some employees see the benefits of discussing politics at work, but the risk of negative consequences is high

- 65% say they’re comfortable discussing politics with colleagues, and 38% say they’ve changed their opinions on political issues due to discussions they’ve had with colleagues

- 55% have witnessed heated political discussions or arguments at work, and 38% have been involved in them

- 72% get stressed or anxious when heated arguments occur; 44% say such arguments impact their productivity

Differences in political viewpoints, whether expressed in person or online, can be alienating and damage workplace camaraderie

- 50% have changed their thoughts and feelings about colleagues after discovering their political beliefs

- 43% have at least one colleague whose political views do not align with their own and have felt excluded at work as a result

- 38% believe they’ve experienced negative bias at work due to their political beliefs

- 60% are careful about posting things reflecting their political views on social media networks because they’re afraid their colleagues will see them

- 46% have unfollowed colleagues on social media because of political posts

- 47% feel the need to hide their political beliefs in order to fit in with senior leaders

Political viewpoints can drive employees to quit their jobs, or determine the employment opportunities they seek

- 35% would quit if their direct managers held very different political views than their own and were publicly vocal about them

- 58% would not interview at companies that publicly promoted political beliefs they did not support

- 39% would take pay cuts to move to companies that promoted causes aligned with their political values

Workers are divided on whether employers should take a stance on political issues

- 46% of employees say it’s important for them to work for employers that take stands on controversial political issues

- 56% say it’s important that the charitable and/or corporate social responsibility causes their companies support reflect their own political values

- 53% want their employers to take public stands on LGBTQIA rights

- 54% want their employers to take public stands on immigration policies

- 53% want their employers to take public stands on gun control policies

Politics matter more to millennials than other generations

- 55% of 25–34 year-olds believe they’ve experienced negative bias at work because of their political beliefs, versus just 23% of 50–64 year-olds

- 69% of millennials say their thoughts and feelings about colleagues have changed after they’ve found out their political beliefs, vs. 50% of all workers

- 67% of millennials say they’d quit their jobs over political differences with their bosses, vs. just 15% of 50–64 year-olds

Jenkins says, “Our data shows employees are split on how politically engaged they want their companies to be—but many are hoping their employers will become more politically engaged, especially millennials. As the millennials rise in the ranks in the workplace, I expect we’ll see a shift in how companies manage their charitable and civic actions.”

Employers should foster an open dialogue and put guidelines governing political expression in place. For more information, check out finding the right approach to political expression at work.

11—Encouraging Your Employees to Vote

All that said above, as the business owner, you can encourage your employees to vote, without taking a stand on parties or issues. TriNet explains how on their blog.

12—Parental Leave

Despite having one of the world’s most advanced economies, the United States lags far behind other countries when it comes to paid parental leave. The team from SimplyHired took a closer look at how parental leave policies vary across different industries in the country.

Here are some findings:

- Government and public administration industries offer the greatest number of days of paid parental leave—30 for men and 40 for women.

- New parents working in manufacturing had some of the smallest number of paid leave days—14 for men and 10 for women.

- Mothers earning less than $100k received far less paid maternity days (15-17) than those earning over $100k (25-30).

Here’s the full study from SimplyHired.

13—Retirement Options for Small Business Owners and Employees

Guest post by Chris Duncan, Decisely, a benefits brokerage, retirement solutions and HR services firm

Once upon a time in America, employees could count on an employer to ensure a comfortable retirement. Originally in the form of pension plans these programs helped secure retirement savings for generations.

However, 100% employer-supported retirement options have become nearly extinct with the changing nature of modern work, the move to 401k funded “shared” contribution options, the advent of the “gig” economy, the freezing of most—if not all—traditional benefits plans, and the rising cost of offering plans for small business employers. Consider that while 98% of larger companies offer a retirement plan (typically 401k only), only 53% of companies less than 100 employees offer a retirement savings plan and that number shrinks to 20% for those with less than 50 people.

Small business employ over 40 million in the U.S., which means a significant percentage of the workforce doesn’t have an opportunity to save through work sponsored programs, and if you don’t save through work, you’re likely not to save at all. The result has been catastrophic for employees and their retirement futures. A recent study from Northwestern Mutual found the average retirement savings for an individual is only $84,000, far below the needed level for a well-funded, secure retirement.

Fortunately, the tide is turning for small businesses to reverse this trend and help employers deliver compelling and cost-effective retirement options for employees. Companies must be aware and aggressive in taking advantage of these changes.

Government steps up: A recently announced Executive Order signaled the Federal government’s intent to broaden access to 401k savings options for small businesses. This is similar to the June 2018 change that helped small businesses gain affordable access to employee health plans through the expansion of Association Health Plans; the new order encourages the establishment and expansion of Association Retirement Plans (also known as Multiple Employer Plans or MEP).

An Association Retirement Plan (ARP) would allow small businesses to band together as a group to collectively source more cost-effective 401(k) solutions for its members, bringing large company 401k cost and compliance structures down to the smallest of companies. These plans have the potential to dramatically expand small business based employer-sponsored retirement saving options to millions of employees formerly excluded from doing so. It’s good news for the small business community and great news for workers.

State governments are also joining the fight. In 2017 alone, at least 22 states and cities introduced legislation to address the retirement savings gap among private-sector workers with 11 programs having already launched live.

These states and cities are encouraging the expansion of small business supported savings plans for workers. In general, these efforts revolve around a minimum standard of employee contribution and are typically designed as Roth individual retirement accounts (IRAs). They aim to be low-risk investments that may be mandated for businesses of a certain size, but that allow employees to opt-out. The goal is to extend coverage to more people to improve savings opportunities, while minimizing investment and management costs for businesses.

The future looks bright: Both the Federal Government’s encouragement of collective sourcing of 401k solutions for small businesses through Association Retirement Plans, and state and city efforts to encourage employee savings through IRAs, deliver expanded solutions for small employers to the benefit of their employees for long term savings and retirement preparedness. We expect legislative and regulatory development of required and/or voluntary small business retirement savings options for small business to continue to expand.

As with recent, similar small business AHP health plan changes, small business owners and HR teams should begin planning now to take full advantage of this opportunity. AHPs are already delivering tremendous savings and opportunities to Associations and Franchises nationally. Combined with rapidly emerging Association Retirement Plans, small businesses through their trade and franchise associations are experiencing a renaissance in availability and affordability of medical and other benefits.

Small businesses should begin looking to AHPs for a model of what to expect with ARP. Engage with legal teams and benefits providers now to lay the groundwork for forming an association. By putting in the time and effort today, you can gain a jump on your competition and do right by your workers tomorrow.

14—Sleeping In

Employees who aren’t “excited” about their jobs are more tempted push snooze in the morning and spend some extra minutes in bed. The team from Best Mattress Brand studied over 1,000 people to compare how long they slept in to their early morning productivity and overall satisfaction.

Some findings:

- After the alarm goes off, people who aren’t satisfied with their jobs stay in bed 20% longerthan those who are satisfied

- Those making over $100K a year will spend 40% lesstime in bed after their alarm goes off than those making less than $10K a year

- Even in median salaries, workers making between $35K and $49K a year take 20% longerto get out of bed than those making between $50k & $74k

- People who felt extremely successful in life took an average ofjust 10 mins to get out of bed, 64% less than those who didn’t feel successful

There are so many factors, from room temperature to quality of their mattress that affects sleeping habits. Check out this post to learn lots more.

15—“Small Business, Big Benefits”

The 5th Annual Workplace Benefits Study, Small Business, Big Benefits, by The Guardian Life Insurance Company of America® (Guardian) provides insight into how small businesses (50 employees or less) are enhancing the benefits experience through the use of technology, voluntary benefits and work/life balance policies, including:

- Over the past five years, more small businesses have established flexible work schedules, telecommuting, and wellness programs to help employees improve their work-life balance. For small businesses already applying these practices, the study confirms it makes a difference—55% of workers who feel their employers care about their well-being want to stay at their companies for 10 years or more compared to 33% who don’t believe their companies care.

- Many employees feel their benefits are important to their household’s financial security and higher out-of-pocket medical costs impact workforce well-being. Small businesses are responding by filling the gap and increasing their supplemental health insurance offerings: 38% offering accident insurance (up 15% since 2015), 25% offering critical illness insurance (up 14% since 2015), and 21% offering hospital indemnity insurance (up 24% since 2015).

- Cloud-based software has made human resources and benefits technology more accessible to small businesses. The Guardian study found more than 50% of small businesses have digitalized a majority of their benefits process.

16—Are You Tax Savvy?

Small business owners are not as tax savvy as they think they are, according to a survey from Clutch, the leading B2B research, ratings, and reviews company. In fact, 30% of small businesses believe they overpay their taxes and could claim more deductions and credits. This, despite the fact 93% rate themselves as “very” or “somewhat confident” in their abilities to accurately file taxes.

Clutch surveyed small business owners and managers who are involved in their businesses’ financial decisions to determine how they manage their finances and where they fall short. Small businesses can benefit from seeking outside help for their taxes, even if they think it isn’t worth the cost, say accounting experts.

“It pays to have an actual tax accountant that knows the latest rules, the financial packages, and who has software that is up-to-date with the IRS,” says Wanda Medina, managing partner at Maventri , a full-service digital firm providing accounting, marketing, and administrative support services. “In the long run, it’s going to save a lot of money versus small businesses trying to do it on their own.”

It can also benefit small businesses to seek help for other financial processes. While 95% of small business owners say they are “confident” or “very confident” in the accuracy of their overall financial records, experts say these same small businesses often don’t recognize or understand when mistakes are being made.

“[Small business owners] can think that they’re fine. Then, they have someone skilled look at their balance sheet, their profit & loss, and say, ‘Hey, this is missing or this isn’t categorized correctly,’” Medina said.

Small businesses should keep separate bank accounts: 27% of business don’t keep their personal and business finances in separate bank accounts. While this can work for some businesses, it’s typically not recommended and is potentially risky, say experts.

Separating bank accounts decreases the likelihood of errors, adds Rhett Molitor, co-founder of Basis 365 Accounting, a cloud-based accounting service. This separation can benefit the 23% that have experienced challenges with mixing business and personal finances in the past year.

You can read the full report here.

Watch This!

17—How to Craft a PTO Policy

Paid time off (PTO) has quickly become one of the most popular employee benefits. Learn how to create a PTO policy for your small business at this free one-hour webinar from TSheets and Namely. How to Craft a PTO Policy That Works for Everyone will be presented November 7 at 3pm ET and 12 noon PT.

Employee paid time off experts Robin Wilson (from Intuit), Michael Goldberg (from Namely) and Jessica Greene (also from Intuit) will lead the discussion, which will appeal to anyone with an interest in employee benefits or human resources. Whether you’re a business owner, HR professional or accountant, this is your chance to ask three employee benefits experts about how you can maximize your PTO policy to benefit both the employee and employer.

The free webinar will:

- Highlight best practices to ensure a successful PTO policy that sets your company apart

- Discuss ways your organization can revamp an existing policy

- Share how to measure the success of your PTO policy

Register here.

18—Small Business Revolution

The third season of Small Business Revolution – Main Street, an online series from Deluxe Corporation has debuted. Each season showcases the $500,000 revitalization of one small town and its small businesses.

The third season’s eight episodes chronicle the community and small businesses of Alton, Illinois. For the first time, all of the season’s episodes are being released simultaneously and they’re now streaming at SmallBusinessRevolution.org, Hulu and on YouTube.

Season 3 illustrates how the Deluxe team of small business marketing experts helped revitalize six selected businesses and the Alton community. This year’s small business transformations range from a mother-and-son duo operating a beloved, yet still-struggling soul food restaurant, to a pet groomer who provides exceptional customer service but works around the clock, to young business partners seeking to move their music studio into a larger space.

Each business faced unique challenges—some were on the verge of shuttering entirely—and Deluxe experts helped position them for success. Now, the public is invited to nominate the town they believe should win Deluxe’s next $500,000 Small Business Revolution revitalization.

“We knew Season 3 would have an impact far beyond the businesses that are featured in the show,” says Amanda Brinkman, Chief Brand and Communications Officer at Deluxe. “When watching this season, you’ll find tips that are applicable to entrepreneurs across America—and you will see what is at stake for Season 4 before nominating your favorite small town.”

Deluxe provided a range of marketing services with advice from Deluxe marketing experts, renovation icon Ty Pennington and six female business leaders who are nationally recognized as experts within their respective fields. Working together, the full cast tackles business, cultural and economic challenges facing the unique community of Alton, while providing advice that is applicable to small businesses and communities of all sizes throughout the country.

“My career has focused on helping transform individual people’s homes and lives, and joining Small Business Revolution – Main Street gave me the opportunity to help Deluxe transform an entire community,” says Pennington. In each episode of Season 3, the Deluxe marketing team and Pennington tackle, business and personal issues facing small business owners and community leaders. The series captures the struggle to run a business in a small town and the triumph of a community coming together.

Deluxe, a leading provider of small-business marketing and financial services, launched the Small Business Revolution – Main Street contest in 2016. You can get more information here.

19—Meet Startup Entrepreneurs Across America

START UP, a television docu-series highlighting the struggles and victories of entrepreneurs in six cities across the U.S., returns for its 6th season (check local listings). START UP provides an up-close and personal look into today’s small business success stories. In each episode, the experiences of individuals who have taken ideas and established successful businesses in an uncertain economy.”

The series is distributed nationally to more than 350 PBS stations, Create TV Network and World Channel nationwide and is shown in over 96% of the country.

“The entrepreneurs that we feature on the show are committed to their communities, they have overcome serious hardships to make their dreams happen, and we share their valuable experiences each week on the show,” says show creator and host Gary Bredow. “They embody the spirit of the American entrepreneur and we hope that they will inspire viewers who dream of taking the leap to start their own business.”

As well as shining a spotlight on these entrepreneurs, the creators of START UP are also working with one of the show’s lead sponsors, Vistaprint, to support small businesses and help them look professional across all their marketing. Vistaprint’s design and product teams worked with selected small business owners to provide them with a complete rebrand. The brand transformation of these businesses was captured in four unique episodes that will be distributed via Vistaprint’s social platforms.

In its sixth season, START UP features small business owners in Omaha, Lincoln, Kansas City, Tulsa, Broken Arrow and Fayetteville.

Quick Takes

20—Guide to Nonprofits

Thinking of starting a nonprofit. Here’s a great guide: The Beginner’s Guide: How to Start a Nonprofit Organization.

21—The Truth About Work Friendships

The average worker has five friends at work, according to a survey from Olivet Nazarene University. There’s a lot of information here that’s useful for anyone trying to manage a happy, productive workforce.

Cool Tools

22—New Programs from QuickBooks

Intuit recently announced two new programs for business.

1—QuickBooks® Online Advanced, a cloud-based offering designed for high-growth businesses. By bringing together its 3.4 million online customers, QuickBooks Online Advanced leverages the vast data and information within the QuickBooks ecosystem, applying artificial intelligence and machine learning, to serve up insights and patterns that help growing companies better run their business.

QuickBooks Online Advanced provides an advantage for these growing and more complex businesses at an attractive price point, filling a gap not yet met in the market. Built on an open platform, businesses have access to hundreds of 3rd party applications, such as online bill pay and inventory management, that can easily be added and custom fit to meet their needs. QuickBooks disrupts and innovates by delivering a flexible solution that is tailor-made for businesses at this stage of growth, versus rigid mid-market software that overserve with the wrong functionality.

In addition, QuickBooks Online Advanced includes Intuit’s premium service program, QuickBooks Priority Circle®. This personalized service provides a dedicated Customer Success Manager, a single and consistent point of contact ready to assist small businesses with their technical and product questions.

2—QuickBooks Capital, an innovative lending product that helps millions of QuickBooks small businesses get access to the capital they struggle to get elsewhere. Since launching, Intuit found 60% of QuickBooks Capital customers would likely not get a loan elsewhere, and 46% have never applied for a loan before.

Working capital loans through products like QuickBooks Capital are especially important to underserved, young small businesses who often struggle to get access to traditional loans. Other lenders often rely on manual underwriting processes, which make it unprofitable for the companies providing the loan but more importantly often make the young small business under two years less eligible to apply for the loan. In fact, according to a recent Federal Reserve study, 70% of businesses younger than five years need funding to grow, but only 23% get the funds they need. Additionally, 90% of QuickBooks Capital customers said the funds they received helped them grow their businesses, and 41% say without a loan from QuickBooks Capital, they would not have expanded or improved their business.

Increased loan amount and free access to business credit score and report: When Intuit initially announced QuickBooks Capital in 2017, the product offered loans up to $35,000 for small businesses. QuickBooks Capital now offers loans of up to $100,000 to small businesses with up to 12-month terms. Additionally, QuickBooks Online customers can now access their free business credit score and credit report through a new partnership with Dun & Bradstreet.

Small business stock photo by Nuamfolio/Shutterstock