Corporate taxes in America can be confusing, to say the least. Businesses pay a variety of state and federal taxes. These differ both according to the type of tax and how it’s calculated. Some states don’t charge corporate taxes at all, but make up the revenue in other ways.

This can make it very confusing for those wanting to start a business in the United States. But sit back and relax—we’re about to make things a lot simpler for you. We’ll look at which states offer the best tax breaks for business and where the best place to start your business in 2020 is.

The Best States to Start a Business In

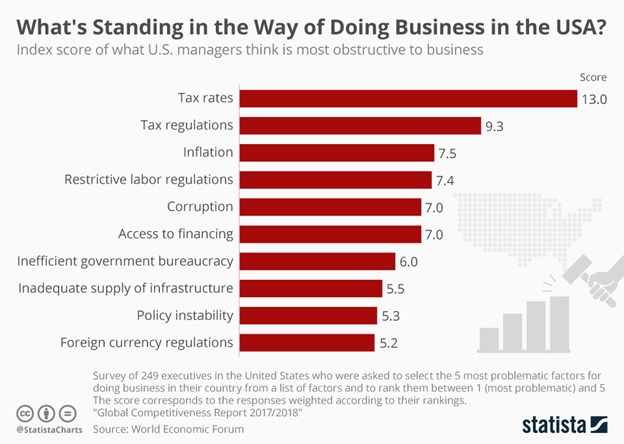

According to Statista, businesses in the United States feel that tax rates in the United States are the biggest obstacle to businesses. You can see this for yourself in the chart below.

Source: Statista

As a business owner, it clearly makes sense to look for the best deals on taxes. Wyoming and South Dakota are two states with favorable corporate tax policies. They don’t charge corporate or income tax at all. Instead, they raise revenues by levying a sales tax on items sold. That isn’t great for the consumer, but it does make for favorable conditions for startups.

Be Wary of 0% Corporate Tax States

Remember when we said corporate taxes in America were confusing? Here’s one of the reasons—you don’t pay corporate income tax in Ohio, for example. What you do pay in Ohio is commercial activity tax.

What’s the difference?

The difference is in the details. Commercial activity tax (CAT) is charged on the gross sales made by the company. Let that sink in for a minute. The state of Ohio takes its cut based on what you sell an item for before any deductions come into play.

That might not sound too bad, but it can make a significant difference in how much tax you pay.

Say, for example, that you sell 100 water filters for $10 each. You’d make a gross profit of $1,000. Now, let’s work out how the different taxes would apply. We’ll use Iowa’s maximum corporate tax rate of 12% in both cases just to simplify matters.

CIT Calculation

With CIT, you’d note your gross profit. You’d then work out the expenses that got you to that point. Say, for example, it costs you $5 to produce and market a filter.

Your net profit would be $500.

12% of $500 will be $60.

CAT Calculation

With CAT, you’re taxed on your gross profit—your net profit doesn’t enter the equation.

Your gross profit is $1,000.

12% of $1000 is $120.

The 0% corporate tax rate in Ohio looks attractive compared to Iowa. If you look at Tax Foundation in Iowa, your corporate tax is 12% as opposed to 0%. Iowa works on a CIT system rather than a CAT system, so Iowa could be the better bet.

Is That All There Is to It?

When considering where to start your business, you must ask where the state derives its revenue from. Texas, for example, doesn’t charge corporate income tax. Where then does the state get its revenue from?

According to Dallas News, it’s mostly from a range of 60 other taxes. If you’re a small business owner, this isn’t going to make as much of an impact. But what happens if you want to set up a massive manufacturing plant? Or if you’re going to open a chain of stores?

It’s also worth considering how vital tax income is to the running of the state. How well funded the state is impacts things like business stimulus programs and infrastructural development. You can probably find a cheap spot to set up a factory in Wyoming, but will you be able to staff it? Is the infrastructure in place to support it?

Final Notes

As you can see, there’s a lot more to consider than taxes when it comes to setting up your new business. Before choosing one state over another, it’s best to conduct extensive research. What taxes and other expenses will you pay? What support will you get for your money? Are the market conditions favorable?

The extra work is a chore, but could well mean the difference between you becoming the next billionaire or your business going bust.

Kristina Laova, tech blogger and contributor at SpendMeNot.com and various media. When I’m not writing at my desk, I’m devoted to ESL teaching and doing certified court translation. A vivid writer, keen traveler and an adventurous soul as curious as humanity.

The world is my oyster.

Image by Steve Buissinne from Pixabay